0% found this document useful (0 votes)

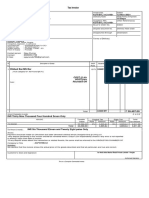

56 views6 pages(To Be Filled Out by BIR) DLN

This document outlines the documentary requirements for various transactions and registrations with the Bureau of Internal Revenue (BIR) in the Philippines. It lists requirements for TIN card issuance, registration of books of accounts, changes in civil status or business details, transfer of registration, and cancellation of registration. The requirements include government-issued identification documents, affidavits, board resolutions, permits, and certifications depending on the type of taxpayer and transaction. Special documentation is needed if representing another taxpayer.

Uploaded by

glaika04Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

56 views6 pages(To Be Filled Out by BIR) DLN

This document outlines the documentary requirements for various transactions and registrations with the Bureau of Internal Revenue (BIR) in the Philippines. It lists requirements for TIN card issuance, registration of books of accounts, changes in civil status or business details, transfer of registration, and cancellation of registration. The requirements include government-issued identification documents, affidavits, board resolutions, permits, and certifications depending on the type of taxpayer and transaction. Special documentation is needed if representing another taxpayer.

Uploaded by

glaika04Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd