Professional Documents

Culture Documents

Answer Ni Chat GPT HAAHAHA

Uploaded by

jevocab120 ratings0% found this document useful (0 votes)

13 views3 pagesOriginal Title

Answer Ni Chat Gpt HAAHAHA

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views3 pagesAnswer Ni Chat GPT HAAHAHA

Uploaded by

jevocab12Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

To prepare the adjusting entries and adjusted trial balance, we need to consider the given information.

Here are the adjusting entries based on the provided information:

1. Adjusting entry for doubtful accounts:

Debit: Bad Debt Expense - P4,900 (10% of P49,000)

Credit: Allowance for Doubtful Accounts - P4,900

2. Adjusting entry for prepaid insurance:

Debit: Insurance Expense - P3,000 (P15,000 / 5 months)

Credit: Prepaid Insurance - P3,000

3. Adjusting entry for cash on hand:

Debit: Cash on Hand - P300

Credit: Cash - P300

4. Adjusting entry for accrued interest on notes receivable:

Debit: Interest Receivable - P500 (P30,000 × 10% × 60/365)

Credit: Interest Income - P500

5. Adjusting entry for depreciation of machinery and equipment:

Debit: Depreciation Expense - P15,000 [P150,000 / 10 years]

Credit: Accumulated Depreciation - P15,000

6. Adjusting entry for depreciation of furniture and fixtures:

Debit: Depreciation Expense - P3,250 [P25,000 / 5 years]

Credit: Accumulated Depreciation - P3,250

7. Adjusting entry for accrued interest on notes payable:

Debit: Interest Expense - P1,250 (P50,000 × 15% × 60/360)

Credit: Interest Payable - P1,250

8. Adjusting entry for percentage tax on gross receipts:

Debit: Percentage Tax Expense - P6,000 (P60,000 × 10%)

Credit: Percentage Tax Payable - P6,000

Now, let's prepare the adjusted trial balance:

Account Titles Debit Credit

-----------------------------------------------

Cash (on hand) P 24,700

Cash (in bank) P 45,000

Accounts receivables P 44,100

Notes receivables P 29,500

Office supplies P 600

Prepaid insurance P 12,000

Furnitures and Fixtures P 21,750

Equipment and Machineries P 135,000

Accounts Payable P 26,000

Notes Payable P 50,000

Ortega. Capital P 138,850

Ortega. Drawings P 500

Repair and enhancement Income P 290,000

Salaries expense P 55,000

Rent expense P 45,000

Interest P 1,000

License expense P 7,250

Miscellaneous expense P 46,750

Bad Debt Expense P 4,900

Allowance for Doubtful Accounts P 4,900

Insurance Expense P 3,000

Cash on Hand P 300

Interest Receivable P 500

Depreciation Expense P 18,250

Accumulated Depreciation P 18,250

Interest Expense P 1,250

Interest Payable P 1,250

Percentage Tax Expense P 6,000

Percentage Tax Payable P 6,000

----------------------------------------------------------

TOTAL P 569,800 P 569,800

The adjusted trial balance shows the balances of all accounts after considering the adjusting entries. The

debit and credit totals should match to ensure the accounts are in balance.

You might also like

- Practical Accounting 2 Review: Partnership and Business CombinationDocument32 pagesPractical Accounting 2 Review: Partnership and Business CombinationJason Bautista100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- AFAR-01 (Partnership Formation & Operation)Document6 pagesAFAR-01 (Partnership Formation & Operation)Jezzie Santos100% (1)

- Chap 3 AssignmentDocument7 pagesChap 3 AssignmentsadiaNo ratings yet

- PLDT Home Application FormDocument2 pagesPLDT Home Application FormBernardo GalupeNo ratings yet

- Quizzer - Financial Accounting ProcessDocument8 pagesQuizzer - Financial Accounting ProcessLuisitoNo ratings yet

- Mongan, Katrina L. Excess Lot Batuhan Dasmariñas City, CaviteDocument1 pageMongan, Katrina L. Excess Lot Batuhan Dasmariñas City, Cavitema.chrislyn viloriaNo ratings yet

- Error in Recording & Posting: Fabm 2Document17 pagesError in Recording & Posting: Fabm 2Earl Hyannis Elauria0% (1)

- Partnership Formation and Operations GuideDocument6 pagesPartnership Formation and Operations GuideMaricris Alilin100% (1)

- Sample/practice Exam 29 March 2019, Answers Sample/practice Exam 29 March 2019, AnswersDocument8 pagesSample/practice Exam 29 March 2019, Answers Sample/practice Exam 29 March 2019, AnswersRachel Green0% (1)

- AFAR 01 Partnership Formation OperationsDocument6 pagesAFAR 01 Partnership Formation OperationsMichelle GubatonNo ratings yet

- Audit of Cash Basis, Single Entry and Correction of Errors (Q)Document4 pagesAudit of Cash Basis, Single Entry and Correction of Errors (Q)Lesley Pascual Cortez100% (1)

- P2 QuizDocument7 pagesP2 QuizJay Mark DimaanoNo ratings yet

- Exercise 2-5,6, and 7Document7 pagesExercise 2-5,6, and 7Nhel AlvaroNo ratings yet

- AFAR-01 (Partnership Formation & Operations)Document7 pagesAFAR-01 (Partnership Formation & Operations)Jennelyn CapenditNo ratings yet

- Advac2 MidtermDocument5 pagesAdvac2 MidtermgeminailnaNo ratings yet

- Convert Off Ledger Account Funds To On Ledger Account FundsDocument3 pagesConvert Off Ledger Account Funds To On Ledger Account FundsAidzeel Iskandar AhmadNo ratings yet

- Reviewer Midterm Accounting Exercises in Financial and Accouting ReportingDocument20 pagesReviewer Midterm Accounting Exercises in Financial and Accouting ReportingFiel Marie SateraNo ratings yet

- AFAR-01 (Partnership Formation and Operations)Document6 pagesAFAR-01 (Partnership Formation and Operations)Ruth RodriguezNo ratings yet

- Ed-138 FullDocument230 pagesEd-138 FulljuananpspNo ratings yet

- Capter 9, Problem 7Document8 pagesCapter 9, Problem 7John JosephNo ratings yet

- Pa2 M-1415Document4 pagesPa2 M-1415Ronnelson PascualNo ratings yet

- Income Statement, Oener's Equity, PositionDocument4 pagesIncome Statement, Oener's Equity, PositionMaDine 19No ratings yet

- Chapter 4 SOLUTIONDocument18 pagesChapter 4 SOLUTIONEarl Joseph ColloNo ratings yet

- Salvador's business transactionsDocument3 pagesSalvador's business transactionsangelica joyce caballesNo ratings yet

- Steady Answering Service Adjusting Entries Date Particulars Debit CreditDocument5 pagesSteady Answering Service Adjusting Entries Date Particulars Debit Creditnicka nocheNo ratings yet

- Acc7 q1Document2 pagesAcc7 q1Jao FloresNo ratings yet

- JournalizingDocument5 pagesJournalizingMikee ChoiNo ratings yet

- Exercise 3-9 - Multiple Choice-Determine The Balances (Huang, Aaron)Document11 pagesExercise 3-9 - Multiple Choice-Determine The Balances (Huang, Aaron)Aaron HuangNo ratings yet

- CORPORATE LIQUIDATION AND JOINT VENTURE SETTLEMENTSDocument5 pagesCORPORATE LIQUIDATION AND JOINT VENTURE SETTLEMENTSjjjjjjjjjjjjjjjNo ratings yet

- CHAPTER 4: DO IT! 1 Worksheet: Blessie, Capital Jan. 1, 2019 961,900Document3 pagesCHAPTER 4: DO IT! 1 Worksheet: Blessie, Capital Jan. 1, 2019 961,900CacjungoyNo ratings yet

- Act. 16-19Document4 pagesAct. 16-19ジェフ ァーソンNo ratings yet

- Explore ACTIVITY 1. Fill Me In: Current AssetsDocument4 pagesExplore ACTIVITY 1. Fill Me In: Current AssetsCOD CODNo ratings yet

- AcctngDocument6 pagesAcctngJiezel ChiNo ratings yet

- Sample Practice Exam 29 March 2019 Answers - CompressDocument7 pagesSample Practice Exam 29 March 2019 Answers - CompressShevina Maghari shsnohsNo ratings yet

- Journal Entries for Actual and Normal Cost SystemsDocument7 pagesJournal Entries for Actual and Normal Cost SystemsNhel AlvaroNo ratings yet

- Icb 1Document9 pagesIcb 1Diana GallardoNo ratings yet

- I. Adjustments Ii. WorksheetDocument11 pagesI. Adjustments Ii. WorksheetDarwyn MendozaNo ratings yet

- Far AssignmentDocument12 pagesFar AssignmentisadizeNo ratings yet

- AFAR 01 - Partnership FormationDocument2 pagesAFAR 01 - Partnership FormationSamantha Alice LysanderNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Trial BalanceDocument1 pageTrial BalanceCusucusu Poutry Pak HAjiNo ratings yet

- ReSA CPA Review Batch 43 Week 1 Partnership FormationDocument6 pagesReSA CPA Review Batch 43 Week 1 Partnership FormationNathalie Shien DagaragaNo ratings yet

- Assignment No 4Document3 pagesAssignment No 4analyngrace1No ratings yet

- Activity 1 PartnershipDocument4 pagesActivity 1 PartnershipJanet AnotdeNo ratings yet

- Trial BalanceDocument1 pageTrial BalanceDian Novia PurwandariNo ratings yet

- Rui Company FS FINALDocument20 pagesRui Company FS FINALNikkiNo ratings yet

- Financial Statements SummaryDocument27 pagesFinancial Statements SummaryRina KusumaNo ratings yet

- Chapter 4Document17 pagesChapter 4RBNo ratings yet

- Date NO Description REF DebetDocument21 pagesDate NO Description REF Debetmohamad arifinNo ratings yet

- Activity: Cash & Accrual BasisDocument8 pagesActivity: Cash & Accrual BasismoreNo ratings yet

- Partnership Accounting Practical Accounting 2Document13 pagesPartnership Accounting Practical Accounting 2random17341No ratings yet

- Final BASIC AcctgDocument3 pagesFinal BASIC AcctgFiona Concepcion100% (1)

- Main 3 - Claveria, Jenny PDFDocument18 pagesMain 3 - Claveria, Jenny PDFSheena marie ClaveriaNo ratings yet

- Name: Jeth A. Mahusay Course: BSA-3 Schedule: TTH-4:00-5:30 PM Subject: Accounting For Business Combinations Instructor: Ms. Ana Mae Magbanua, CPADocument2 pagesName: Jeth A. Mahusay Course: BSA-3 Schedule: TTH-4:00-5:30 PM Subject: Accounting For Business Combinations Instructor: Ms. Ana Mae Magbanua, CPAJeth MahusayNo ratings yet

- Jawab-Latihan - Siklus AkuntansiDocument26 pagesJawab-Latihan - Siklus AkuntansiSumarsono Booming FotocopyNo ratings yet

- Cup - Basic ParcorDocument8 pagesCup - Basic ParcorJerauld BucolNo ratings yet

- Cash Flow Statements Notes and Practical ExercisesDocument9 pagesCash Flow Statements Notes and Practical ExercisesRNo ratings yet

- This Is RealDocument17 pagesThis Is RealCheemee LiuNo ratings yet

- This Is RealDocument17 pagesThis Is RealCheemee LiuNo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Correcting The Trial Balance 2022Document3 pagesCorrecting The Trial Balance 2022Charlemagne Jared RobielosNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Case Study The Smith GroupDocument2 pagesCase Study The Smith Groupminisaggu0% (1)

- Philips VisicuDocument8 pagesPhilips Visicupreeti jhaNo ratings yet

- Accounting cycle for merchandising businessesDocument17 pagesAccounting cycle for merchandising businessesseneshaw tibebuNo ratings yet

- ACCOUNTING PRINCIPLESDocument12 pagesACCOUNTING PRINCIPLESshashusheelaNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHiten AhirNo ratings yet

- IoT Architecture and Protocols Course StructureDocument2 pagesIoT Architecture and Protocols Course StructureDonthu GamingNo ratings yet

- Paypoint Retailer Guide v8Document43 pagesPaypoint Retailer Guide v8fopag70359No ratings yet

- Up DistributrorDocument15 pagesUp DistributrorOFC accountNo ratings yet

- Nov2010 Paper2 Q1 OlevelDocument3 pagesNov2010 Paper2 Q1 OlevelAbid faisal AhmedNo ratings yet

- MITC CCDocument13 pagesMITC CCShauryaNo ratings yet

- JJJDocument6 pagesJJJDevesh0% (1)

- E-Commerce: Instructor: Yakub Ahmed YakubDocument33 pagesE-Commerce: Instructor: Yakub Ahmed YakubFaaiso LajecleeyNo ratings yet

- Cash Composition, Bank Reconciliation Statement, Increasing The Base Fund PDFDocument3 pagesCash Composition, Bank Reconciliation Statement, Increasing The Base Fund PDFIrish OccenoNo ratings yet

- AaronshivhiranandresumeDocument3 pagesAaronshivhiranandresumeapi-246245951No ratings yet

- Review of The Accounting Process PDFDocument3 pagesReview of The Accounting Process PDFShiela Marie Sta AnaNo ratings yet

- Tally Module 1 Assignment SolutionDocument6 pagesTally Module 1 Assignment Solutioncharu bishtNo ratings yet

- USDOS ASPE Health Plan Contact and Claims InfoDocument1 pageUSDOS ASPE Health Plan Contact and Claims InfoEstrella Cotrina RojasNo ratings yet

- British Car Auctions March 2010Document52 pagesBritish Car Auctions March 2010krountreeNo ratings yet

- Book train ticket ERS titleDocument1 pageBook train ticket ERS titleKrishna PrasadNo ratings yet

- Internship Report on Soneri BankDocument37 pagesInternship Report on Soneri BankAnoshKhanNo ratings yet

- Vallabhi 2018 PDFDocument196 pagesVallabhi 2018 PDFSateesh KotyadaNo ratings yet

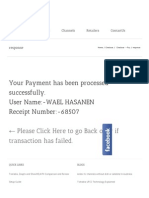

- Your Payment Has Been Processed Successfully. User Name:-WAEL HASANEN Receipt Number:-68507Document1 pageYour Payment Has Been Processed Successfully. User Name:-WAEL HASANEN Receipt Number:-68507Meshoo ZakyNo ratings yet

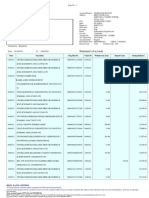

- e-BILL Details - Customer Id: 578632, Date: 2021-08-24Document1 pagee-BILL Details - Customer Id: 578632, Date: 2021-08-24mayurNo ratings yet

- B2B E-ticketing GuideDocument4 pagesB2B E-ticketing Guidesuneel kumarNo ratings yet

- Dem at ClosureDocument1 pageDem at ClosureShadow GamingNo ratings yet