Professional Documents

Culture Documents

AfB1 Tutorial Questions For Week 3

Uploaded by

zhaok0610Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AfB1 Tutorial Questions For Week 3

Uploaded by

zhaok0610Copyright:

Available Formats

ACCOUNTING FOR BUSINESS 1

SEMESTER 1

Tutorial questions for tutorial to be held in week 3

1. Outline some key differences between a Sole Trader and a Limited Company if considering forming a

new business

2. Prepare a Balance Sheet/(Statement of Financial Position) from the following list of assets and

liabilities, using the accounting equation to deduce the owner’s capital as the missing item.

£

Amounts due from customers (trade receivables) 5,000

Cash in hand 800

Inventory (stock of goods held for resale) 20,000

Plant and machinery 65,400

Amounts due to suppliers but not paid 3,500

Vehicles 4,000

Three-year loan from a local authority 40,000

Explain how the Balance Sheet prepared above would change for each of the following transactions:

(not required to prepare new Income Statement/Balance Sheet)

(a) The full amounts of £5,000 due from customers are received

(b) The principal on the local authority loan of £1,000 is repaid

(c) Amounts of £2,000 due to suppliers are paid

(d) Office furniture is purchased on credit amounting to £5,000

(e) The owner inherits £10,000 from his grandmother and invests this in the business

3. The following information has been gathered from the accounting records of Jonathan's Hair Stylists.

Assets and liabilities at 30 September Year 8

£

Cash in till register 55

Overdraft with the bank 684

Borrowings from a relative 12,000

Trade receivables (amounts due from credit customers) 100

Hairdressing supplies (shampoos, conditioners, etc.) 450

Buildings, furniture, equipment 66,000

Revenue and expenses for the year ended 30 September Year 8

Amounts charged for hairdressing services 40,400

Wages to employees 16,500

Interest on borrowings 1,080

Interest on overdraft 123

Hairdressing supplies used in period 5,400

Costs of administration 2,060

Costs of advertising 950

From the information above prepare an Income Statement for the year ended 30 th September year

8 and Balance Sheet/(SOFP) as at 30th September Year 8 and calculate:

(a) the amount of net profit for the year at 30 September Year 8;

(b) the amount of owners capital at 30th September year 8

(c) the amount of the owners capital at 1st October Year 7

4. Classify each of the items in the following list as an asset, a liability, or neither an asset nor a

liability. Explain whether each item identified as an asset or a liability would meet the conditions for

recognition of the item in the Balance Sheet.

(a) An advance in salary paid to an employee.

(b) Cash held in the cash register of a shop.

(c) A customer (trade debtor) who has recently been declared bankrupt by the courts.

(d) Items of inventory (stock) of finished goods that have been returned from a customer as

being below the quality expected.

(e) A dollar loan made to a business by a US bank.

(f) The cost of providing management training for key personnel.

(g) An amount spent on undertaking market research to determine the best marketing strategy

for a new product.

(h) A guarantee given by a company to a bank that it will meet the overdraft of a senior employee of

the company if that employee defaults on the payments to the bank.

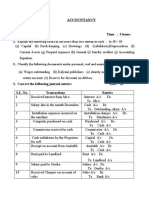

5. Explain how the following transactions would affect the Accounting equation through changes in the

Income Statement/Balance sheet and prepare the Income Statement and Balance Sheet/(SOFP) at

the year end. (Note that there is a blank worksheet provided to assist in preparing the IS/BS)

Month ended October 20XX

1 Mohamed sets up a plumbing business. He calls the business Mo’s Plumbers. He pays £3,000 into the

business bank account

2 The business gets a bank loan of £1,000 to be repaid in 2 years time

3 Mo’s Plumbers buys a set of plumbing tools from Harry paying by bank transfer £1,600.

4 Mo’s Plumbers buys a small van from Motor Trader for £2,000. Mo’s Plumbers pays £500 by bank transfer

and the balance is on credit payable over two months

5 Mo’s Plumbers provides plumbing services for £1,600 and receive £900 by bank transfer from one customer

with the remaining customers owing the amounts due.

6 Mo’s Plumbers pays electricity bills £50

7 Mo’s Plumbers pays rent of £150

8 Mo’s plumbers pay Motorvan Trader £1,000 for the amount due to them in respect of the van purchased

previously

9 Customers pay £500 by bank transfer for plumbing services received in (5) above.

ASSETS = LIABILITIES Total OWNERS CAPITAL

No Van Tools Trade Cash at bank = Motor Bank Revenue Expenses Owner’s

receivable Trader loan (I.S) (I.S) capital

s

1

2

3

4

5

6

7

8

9

Total

You might also like

- Mock-Iv AccountsDocument6 pagesMock-Iv AccountsAnsh UdainiaNo ratings yet

- Accounting Principles Pilot TestDocument6 pagesAccounting Principles Pilot TestNguyễn Thị Ngọc AnhNo ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- 15-Mca-Or-Accounting and Financial ManagementDocument4 pages15-Mca-Or-Accounting and Financial ManagementSRINIVASA RAO GANTANo ratings yet

- Accounting For Finance: Eric Cauvin Exercises 2Document6 pagesAccounting For Finance: Eric Cauvin Exercises 2ddd huangNo ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- Finacial Accountig1Document7 pagesFinacial Accountig1Prashanth PendyalaNo ratings yet

- Paper - 1: Accounting: © The Institute of Chartered Accountants of IndiaDocument31 pagesPaper - 1: Accounting: © The Institute of Chartered Accountants of Indiakunal akhadeNo ratings yet

- Caf 5 Far1 Spring 2019xsxDocument5 pagesCaf 5 Far1 Spring 2019xsxMustafa ZaheerNo ratings yet

- CK Shah VUAPURWATA Mid-Semester Exam Q&ADocument26 pagesCK Shah VUAPURWATA Mid-Semester Exam Q&Aangel100% (1)

- SP - XI - AccountancyDocument3 pagesSP - XI - AccountancyPriyankadevi PrabuNo ratings yet

- Assignment Help Journal Ledger and MyodDocument9 pagesAssignment Help Journal Ledger and MyodrajeshNo ratings yet

- Financial Accounting Punjab University: Question Paper 2010Document4 pagesFinancial Accounting Punjab University: Question Paper 2010ZeeShan IqbalNo ratings yet

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- Cash Accrual Single EntryDocument3 pagesCash Accrual Single EntryJustine GuilingNo ratings yet

- Test 5Document4 pagesTest 5suzalaggarwalllNo ratings yet

- Accounts Home Test 2Document7 pagesAccounts Home Test 2Ashish RaiNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument4 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- 04 Accounts Receivable - (PS)Document2 pages04 Accounts Receivable - (PS)kyle mandaresioNo ratings yet

- Extra Exercises ErrorsDocument6 pagesExtra Exercises ErrorsMohd Rafi Jasman100% (1)

- Illustrative Examples - Trade and Other ReceivablesDocument2 pagesIllustrative Examples - Trade and Other ReceivablesMelrose Eugenio ErasgaNo ratings yet

- Accounting document analysisDocument3 pagesAccounting document analysisRazib Das RaazNo ratings yet

- FARAP-4518Document3 pagesFARAP-4518Accounting StuffNo ratings yet

- 11 Com Pre-ExamDocument4 pages11 Com Pre-ExamObaid Khan50% (2)

- Time Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationDocument3 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationKashifNo ratings yet

- Corporate Accounting Ii-1Document4 pagesCorporate Accounting Ii-1ARAVIND V KNo ratings yet

- FYJC Book Keeping and Accuntancy Topic Final AccountDocument4 pagesFYJC Book Keeping and Accuntancy Topic Final AccountRavichandraNo ratings yet

- Institute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartDocument3 pagesInstitute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartSafi SheikhNo ratings yet

- Financial Accounting Punjab University: Question Paper 2009Document5 pagesFinancial Accounting Punjab University: Question Paper 2009Abrar AliNo ratings yet

- Accounting Assignment 04A 207Document10 pagesAccounting Assignment 04A 207Aniyah's RanticsNo ratings yet

- Mca Accounts Model QuestionDocument2 pagesMca Accounts Model QuestionAnonymous 1ClGHbiT0JNo ratings yet

- FUFA Question Paper_Compre_FOFA(ECON F212) 1st Sem 2018-19 (1) (1) (1)Document2 pagesFUFA Question Paper_Compre_FOFA(ECON F212) 1st Sem 2018-19 (1) (1) (1)vineetchahar0210No ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- Govt & NFP Accounting - Ch7Document23 pagesGovt & NFP Accounting - Ch7Bikila MalasaNo ratings yet

- ASSIGNMENT (30 Marks) Task 1 (8) : Mics To TheDocument5 pagesASSIGNMENT (30 Marks) Task 1 (8) : Mics To TheJiaXinLimNo ratings yet

- Co 2101Document3 pagesCo 2101PRIYA LAKSHMANNo ratings yet

- AFA IP.l II QuestionDec 2019Document4 pagesAFA IP.l II QuestionDec 2019HossainNo ratings yet

- Student financial accounts portfolioDocument5 pagesStudent financial accounts portfolioKevin PhạmNo ratings yet

- Poa 01 - 1.2223Document3 pagesPoa 01 - 1.2223Phương Anh HàNo ratings yet

- ACC 281 SEMINAR QUESTIONS Version 2Document8 pagesACC 281 SEMINAR QUESTIONS Version 2Joel SimonNo ratings yet

- Lesson 1 Partnership FormationDocument21 pagesLesson 1 Partnership FormationDan Gabrielle SalacNo ratings yet

- Individual Assignment.123Document5 pagesIndividual Assignment.123Tsegaye BubamoNo ratings yet

- MIDTERM LESSON 1 Accounting EquationDocument2 pagesMIDTERM LESSON 1 Accounting EquationJomar Villena100% (3)

- CA Inter Accounts Q MTP 1 Nov 2022Document7 pagesCA Inter Accounts Q MTP 1 Nov 2022smartshivenduNo ratings yet

- Accounts Mega ModelDocument8 pagesAccounts Mega Modellekha ram100% (1)

- Topic 3 TutorialDocument10 pagesTopic 3 TutorialMimi ArniNo ratings yet

- Problems - Cash FlowDocument5 pagesProblems - Cash FlowKevin JoyNo ratings yet

- FinAccUnit 1 (B) - Incomplete Records Lecture Notes PDFDocument10 pagesFinAccUnit 1 (B) - Incomplete Records Lecture Notes PDFSherona ReidNo ratings yet

- Explain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Document4 pagesExplain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Anita PanigrahiNo ratings yet

- IMT 57 Financial Accounting M1Document4 pagesIMT 57 Financial Accounting M1solvedcareNo ratings yet

- MCS-035 ACCOUNTANCY EXAM QUESTIONSDocument3 pagesMCS-035 ACCOUNTANCY EXAM QUESTIONSNerdy FellaNo ratings yet

- Taxation-Ii: (A) What Do You Mean by "Arm's Length Price" and What Are The Methods To Be Used For TheDocument4 pagesTaxation-Ii: (A) What Do You Mean by "Arm's Length Price" and What Are The Methods To Be Used For Theswarna dasNo ratings yet

- B. Com I All PapersnDocument14 pagesB. Com I All Papersnrahim Abbas aliNo ratings yet

- Fin Mang 2020Document3 pagesFin Mang 2020vinayakraj jamreNo ratings yet

- GULF BOARD EXAMINATION-February-2022 Class: XI AccountancyDocument6 pagesGULF BOARD EXAMINATION-February-2022 Class: XI Accountancyneemthas761No ratings yet

- B.Com Degree Examination December 2014 Advanced Financial Accounting Question PaperDocument7 pagesB.Com Degree Examination December 2014 Advanced Financial Accounting Question PaperEmind Annamalai JPNagarNo ratings yet

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Management AccountingDocument375 pagesManagement Accountingpri123123100% (2)

- Corporate Reporting Paper 3.1march 2023Document28 pagesCorporate Reporting Paper 3.1march 2023JAMAN SOUTH MUNICIPAL HEALTH DIRECTORATENo ratings yet

- Assignment 2Document25 pagesAssignment 2Jiaxi WNo ratings yet

- Practice Question On Group AccountsDocument12 pagesPractice Question On Group Accountsemerald75% (4)

- Vadero Inc Accounting ExerciseDocument3 pagesVadero Inc Accounting ExerciseMalik Afzaal AwanNo ratings yet

- April May 2023 - H11FM - en GBDocument15 pagesApril May 2023 - H11FM - en GBRatul GoswamiNo ratings yet

- Cfas Problem 8 3 PDFDocument3 pagesCfas Problem 8 3 PDFAzuh ShiNo ratings yet

- Verdant Eco Delights - Accounting AspectDocument14 pagesVerdant Eco Delights - Accounting Aspectspades46No ratings yet

- Bankable Project of Roller Flour Mill: Subject: New Enterprise ManagementDocument26 pagesBankable Project of Roller Flour Mill: Subject: New Enterprise ManagementRaajan BrahmbhattNo ratings yet

- AcumaticaERP OrganizationStructureDocument44 pagesAcumaticaERP OrganizationStructurecrudbugNo ratings yet

- ACT2111 Fall 2019 Ch1 - Lecture 1&2 - StudentDocument57 pagesACT2111 Fall 2019 Ch1 - Lecture 1&2 - StudentKevinNo ratings yet

- VOL 3 18. Book Value Per ShareDocument15 pagesVOL 3 18. Book Value Per ShareJohn Vincent CruzNo ratings yet

- FM For CA Intermediate 6-11-20Document45 pagesFM For CA Intermediate 6-11-20Lakshay Singh BhandariNo ratings yet

- (AFAR) (S05) - PFRS 15, Installment Sales, and Consignment SalesDocument6 pages(AFAR) (S05) - PFRS 15, Installment Sales, and Consignment SalesPolinar Paul MarbenNo ratings yet

- PCAB Requirements: A. LegalDocument6 pagesPCAB Requirements: A. LegalGilianne Kathryn Layco Gantuangco-CabilingNo ratings yet

- FS ExerciseDocument30 pagesFS Exercisesaiful2522No ratings yet

- SHE Equity Contributed.Document18 pagesSHE Equity Contributed.Maketh.ManNo ratings yet

- Chapter 10 in Class Problems DAY 2 SolutionsDocument2 pagesChapter 10 in Class Problems DAY 2 SolutionsAbdullah alhamaadNo ratings yet

- Problem set on partnership liquidation and distribution of assetsDocument5 pagesProblem set on partnership liquidation and distribution of assetsHoney OrdoñoNo ratings yet

- Financial Statement Analysis: MGT-537 Dr. Hafiz Muhammad Ishaq 32Document77 pagesFinancial Statement Analysis: MGT-537 Dr. Hafiz Muhammad Ishaq 32gazmeerNo ratings yet

- Goat Project NewDocument15 pagesGoat Project NewmrigendrarimalNo ratings yet

- N5 Financial Accounting November 2016Document10 pagesN5 Financial Accounting November 2016TsholofeloNo ratings yet

- Corporations Issuance of StocksDocument8 pagesCorporations Issuance of StocksYoussef NabilNo ratings yet

- Bankruptcy AccountingDocument13 pagesBankruptcy AccountingTarun SinghNo ratings yet

- Financial Management PolicyDocument12 pagesFinancial Management PolicyMuhammad Salman AhmedNo ratings yet

- Audit Responsibilities and ObjectivesDocument25 pagesAudit Responsibilities and ObjectivesNisa sudinkebudayaan100% (1)

- Capital Structure Analysis of Hero Honda, For The Year 2005 To 2010Document8 pagesCapital Structure Analysis of Hero Honda, For The Year 2005 To 2010shrutiNo ratings yet

- Alpha Holds Investments in Two Other Entities Beta and GammaDocument2 pagesAlpha Holds Investments in Two Other Entities Beta and GammaFreelance WorkerNo ratings yet

- Green EatsDocument6 pagesGreen EatsDhruv tyagiNo ratings yet

- Mod 4 - Credit Risk Analysis and InterpretationDocument45 pagesMod 4 - Credit Risk Analysis and InterpretationbobdoleNo ratings yet