Professional Documents

Culture Documents

Accounting GR 11 MEMO P2

Uploaded by

nkatekodawn72Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting GR 11 MEMO P2

Uploaded by

nkatekodawn72Copyright:

Available Formats

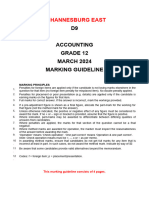

Accounting Grade 11-Memorandum NW/June 2019

PROVINCIAL ASSESSMENT

GRADE 11

ACCOUNTING:

PAPER 2

JUNE 2019: MEMORANDUM

MARKS: 150

MARKING PRINCIPLES:

1. Penalties for foreign items are applied only if the candidate is not losing marks elsewhere in

the question for that item (no penalty for misplaced item). No double penalty applied.

2. Penalties for placement or poor presentation (e.g. details) are applied only if the candidate is

earning marks on the figures for that item.

3. Full marks for correct answer. If answer incorrect, mark the workings provided.

4. If a pre-adjustment figure is shown as a final figure, allocate the part-mark for the working for

that figure (not the method mark for the answer).

5. Unless otherwise indicated, the positive or negative effect of any figure must be considered

to award the mark. If no + or – sign or bracket is provided, assume that the figure is positive.

6. Where indicated, part-marks may be awarded to differentiate between differing qualities of

answers from candidates.

7. Where penalties are applied, the marks for that section of the question cannot be a final

negative.

8. Where method marks are awarded for operation, the marker must inspect the reasonableness

of the answer and at least one part must be correct before awarding the mark.

9. In awarding method marks, ensure that candidates do not get full marks for any item that is

incorrect at least in part.

10. Be aware of candidates who provide valid alternatives beyond the marking guideline.

11. Codes: f = foreign item; p = placement/presentation.

This marking guideline consists of 11 pages.

Demo

NW/JUNE/ACCNG/ EMIS/6******* Page 1 of 11

Accounting Grade 11-Memorandum NW/June 2019

QUESTION 1 COST ACCOUNTING - MANUFACTURING

1.1 Match the concepts

1.1.1 E

1.1.2 A

1.1.3 D

1.1.4 C

1.1.5 B

5

1.2 BACHUM BUILDERS

1.2.1 Calculate:

Direct labour cost

5 x 1 840 x R45,60 = 419 520 *

385 x 5 x R68,40 = 131 670 * 551 190 – 4 marks

419 520 x 10% = 41 952 * (37 756,80 + 4 195,20) - both

for 1 mark

Total = 593 142 * *One part correct

7

GENERAL LEDGER OF BACHUM BUILDERS

(a) RAW MATERIAL ACCOUNT

2018 23 500 2019

1 Balance b/d 28 Creditors control 8 600

Mar Feb

2019 Creditors Work-in-

488 400 483 000

28

Feb control progress acc.

14 230 34 530

Bank Balance c/d

526 130

One part correct 526 130

2019

1 Balance b/d 34 530

Mar

7

Demo

NW/JUNE/ACCNG/ EMIS/6******* Page 2 of 11

Accounting Grade 11-Memorandum NW/June 2019

(b) FACTORY OVERHEAD ACCOUNT

Consumable

2019 stores / Factory 2019 Work-in-progress 447

28 21 914 28

Feb indirect Feb acc. 988*

material

Indirect labour 81 000

Rent expense 174

278 400 x 5/8 000

Water and

101

electricity

175

134 900 x .75

Insurance 31

46 800 x 2/3 200

Sundry

38 699

expenses

447 988 447 988

10

(c) WORK-IN-PROCESS STOCK ACCOUNT

20

201 Finished goods

b/ 19 2 1 524 80

8 1 Balance 27 270 stock

d Fe 8 0

Mar Balancing figure

b

483 000

201

2 Direct material * c/

9 Balance 26 600

8 cost See 1.2.1 d

Feb

(a)

Direct labour 593 142*

cost See 1.2.1

Factory 447 988*

overhead See 1.2.1

cost (b)

1 551 1 551

one part correct

400 400

201

b/

9 1 Balance 26 600

d

Mar

Demo

NW/JUNE/ACCNG/ EMIS/6******* Page 3 of 11

Accounting Grade 11-Memorandum NW/June 2019

1.2.3 GROSS PROFIT CALCULATION

see 1.2.2.3

Cost of sales : 40 026 + 1 524 800 – 45 744 = 1 519 082 *

Sales (units) 210 + 8 000 – 240 = 7 970 x R250 = 1 992 500 *

one part correct

Gross profit : 1 992 500 – 1 519 082 = 473 418 * one part correct

OR

2 marks 2 marks 1 marks 2 marks 1 work with

250 – 190,60 = 59,40 x 7 970 = 473 418

1.3 MABE MANUFACTURERS

1.3.1 (a) 12 480 x R7,00 = 87 360

(b) 374 400/12 480 = R30 4

1.3.2 Do a calculation to verify the break-even number of units for the

financial year ended 30 June 2019

see 1.3.1 a

25 x 12 480 or (224 640 + 87 360)

312 000 One part correct in workings. = 12 000

R92,50 – (28 + 30 + 8,50)

66,50

1.3.3 Comment on the break-even point and the level of production for

both years. Quote relevant figures in your comment.

Valid comment quoting figures

Comparing BEP to level of production – the business produced 12 480

units which is 480 units more than the BEP. Making low profit. Need to

increase productivity to increase profits

Or

Compare production 2018 to 2019 – the business produced 680 units more

than last year.

Or

BEP increased from 11 800 to 12 000 units. The business did not make a

profit last year (broke even) but managed to increase the production levels

this year.

4

Demo

NW/JUNE/ACCNG/ EMIS/6******* Page 4 of 11

Accounting Grade 11-Memorandum NW/June 2019

1.3.4 Provide a valid reason for the change in direct material cost per unit.

Any valid reason see to calculation (b)

Could be additional transport costs.

Shortage of stock from suppliers pushed the price up (supply and

demand)

Wastage in the factory.

Poorly trained workers.

Stock theft.

Inflation

Injudicious buying (not comparing prices, looking for alternative

suppliers, etc. care-free kind of buying)

2

1.3.5 Give ONE suggestion that the business can use to improve

production and profitability. Quote figures.

Reduce costs – 20% increase in direct materials.

Control use of raw material. Train workers to be more efficient (25,00

30,00)

Look for cheaper suppliers, local to reduce transport costs. (25,00

30,00)

Provide incentives to workers to produce more – only 680 units more

than last year and 480 more than the BEP. Workers increase is 9%.

Spend more money on advertising to improve sales – there was a

decrease in selling and distribution costs from 8,90 to 8,50 per unit.

Only a 14% increase in price of desks – could use a bigger mark-up.

(40% mark-up presently being used)

60

60

Demo

NW/JUNE/ACCNG/ EMIS/6******* Page 5 of 11

Accounting Grade 11-Memorandum NW/June 2019

QUESTION 2:

2.1 Write only the term next to the question number

2.1.1 Stale cheque

2.1.2 Debit order

2.1.3 Bank charges

2.1.4 Dishonoured cheque

2.1.5 Bank overdraft 5

2.1.2 Cash Receipts Journal – 30 November 2018

Sundry Accounts

Day Details Bank Amount Details

Total 174 890 174 890

T Tlou 4 400 4 400 Rent income

BWK Hospice 550 550 Donation

CJ Motors 2 360 2 360 Repairs

182 200 182 200

* Details and the amount must both be correct and correspond for candidates to earn a mark or marks, i.e. details and amounts

must not be marked independently from one another.

Demo

NW/JUNE/ACCNG/ EMIS/6******* Page 6 of 11

Accounting Grade 11-Memorandum NW/June 2019

2.2.1 Cash Payments Journal – 30 November 2018

Sundry Accounts

Day Details Bank Amount Details

Total 124 760 124 760

Allsure Insurers 980 980 Insurance

L Lebona 266 266 Debtors Control

ABC Bank 1 494 843 Bank charges

Can be split

651 Interest on overdraft

Venter Stationers 545 545 Stationery

CJ Motors 2 360 2 360 Repairs

130 405 130 405

* Details and the amount must both be correct and correspond for candidates to earn a mark or marks, i.e. details and amounts

must not be marked independently from one another.

13

2.2.2 Dr Bank Cr

2018 Sundry accounts / 2017

NOV Total Receipts 182 200 OCT Balance 32 649

30 1

2018 Sundry account

NOV Total Payments 130 405

30

Balance 19 146

182 200 182 200

2018

OCT Balance 19 146

1

5

Demo

NW/JUNE/ACCNG/ EMIS/6******* Page 7 of 11

Accounting Grade 11-Memorandum NW/June 2019

2.2.3 Bank Reconciliation Statement on 30 November 2018

Details Debit Credit

Balance as per Bank Statement 23 014

Outstanding deposit 19 870

Debit erroneously credited deposit 5 800

Debit outstanding cheques: 3013 12 348

3102 3 230

3132 2 360

Debit balance as per Bank Account 19 146

Both totals 42 884 42 884

2.3.1 As the internal auditor, explain TWO concerns you have over

Keneilwe’s duties

Any TWO 2 marks

Lack of division of duties negatively affects internal control

Lindi is the only person dealing with invoicing and receipt of cash

Nobody is checking Lindi’s work

For 1 mark:

Division of duties

Internal Control 6

Demo

NW/JUNE/ACCNG/ EMIS/6******* Page 8 of 11

Accounting Grade 11-Memorandum NW/June 2019

2.3.2 Identify TWO problems with the cash slip and give advices to solve

them.

PROBLEM WITH EVIDENCE ADVICE

Problem Evidence figures not Specific advice required based on

required evidence Division of duties must

not be mentioned twice Award 1

mark for an incomplete advice

Theft / Fraud / Error / Internal Check that the total of cash slips

control measures are lacking. agrees to the total of the cash

Some of the cash slips (7 000) deposit slip.

have not been deposited / The person receiving cash must

recorded. not be the same person

depositing it. Division of duties.

Rolling of Cash / The deposit Cash collected must be deposited

occurs much later after receipt of immediately

cash (15 days). 8

50

50

QUESTION 3:

3.1 Dr Asset Disposal Account N6 Cr

2018 2018 Accumulated

July 1 Vehicles 100 000 July 1 depreciation on

vehicles 42 400

20000+16000+64

00

Creditors Control

55 000

Loss on sale of

asset 2 600

100 000 100 000

10

Demo

NW/JUNE/ACCNG/ EMIS/6******* Page 9 of 11

Accounting Grade 11-Memorandum NW/June 2019

Land and

3.2 Fixed/Tangible Assets Vehicles Equipment

Buildings

Carrying value at the beginning of

400 000 224 000 60 000

the year

Cost 400 000 300 000 80 000

Accumulated Depreciation (0) (76 000) (20 000)

Movements

Additions at cost 120 000 150 000 48 000

(57 600)

Disposals at carrying value 0

See 3.1

Depreciation

Vehicles 6 400 + 15 000+ 32

* ( 53 400) * ( 9 200)

000

Equipment (8 000 + 1 200

Carrying value at the end of the

520 000 263 000 98 800

year

Cost 520 000 350 000 128 000

Accumulated Depreciation (0) (87 000) *29 200

* - any figure

20

3.3 The Land and Buildings were revalued on 1 March 2015 and the

market value is R700 000, the financial records of are reflecting

R400 000.Which GAAP Principle is applicable?

Historical Cost

1

Demo

NW/JUNE/ACCNG/ EMIS/6******* Page 10 of 11

Accounting Grade 11-Memorandum NW/June 2019

3.4 Identify ONE problem in relation to each branch, quoting figures to support

the problem. In each case, offer Wilson Bafana advice on how to solve the

problem.

BRANCH COMMENT ADVICE

There is 10 motor bikes Take regular stock and

missing / stolen (57 – 47). compare it with the stock

OR records.

Naledi

Loss of income of R180 000. OR

Figures

OR Improve internal control and

Comment install security cameras.

Loss on profit on R60 000

OR

Advice

Annel must pay in the

shortage.

Kagisano Money stolen/not all the Control the deposit slips.

money banked. Shortage of

Figures R400 000. OR

Comment Division of duties. Not the

same person must receive

and deposit the money.

Advice

Not a lot of motor bikes is Must not pay the manager a

sold. Only 125 of 425./ Sold fixed monthly salary. Let him

Taung only 29% of the stock. work on a commission basis.

Figures OR OR

Comment Her advertising is not The manager must revise the

effective. Use R20 000 more advertisement strategy.

as Kagisano and R40 000

Advice more as Naledi. OR

Take stock to other branches.

09

40

40

TOTAL: 150

Demo

NW/JUNE/ACCNG/ EMIS/6******* Page 11 of 11

You might also like

- Aircraft Hourly Operating Cost CalculatorDocument33 pagesAircraft Hourly Operating Cost CalculatorhenryNo ratings yet

- Chapter 10 AnswersDocument3 pagesChapter 10 AnswersThe Nightwatchmen100% (1)

- Gr10 t2 Maths Exam Paper 1 and Paper 2 Questions Answer SeriesDocument5 pagesGr10 t2 Maths Exam Paper 1 and Paper 2 Questions Answer Seriesnkatekodawn72No ratings yet

- Scantlings Rev01 ISO125Document3 pagesScantlings Rev01 ISO125Jesse Garcia OlmosNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Suggested Solutions (RBCPB RSPFCPB - 1st Quarter) PDFDocument5 pagesSuggested Solutions (RBCPB RSPFCPB - 1st Quarter) PDFJogie BonNo ratings yet

- 2023 Grade 11 Written Report MGDocument5 pages2023 Grade 11 Written Report MGfiercestallionofficial0% (2)

- rh400 PDFDocument4 pagesrh400 PDFIvanNo ratings yet

- Memorandum and Articles of Association SHARE COMPANY Tentatively DraftedDocument9 pagesMemorandum and Articles of Association SHARE COMPANY Tentatively DraftedAbenezer A Gebremedhin100% (12)

- Depreciation Expense - Asset A 3,900Document4 pagesDepreciation Expense - Asset A 3,900ZeeNo ratings yet

- My Wife's BossDocument1,589 pagesMy Wife's Bossnkatekodawn72100% (1)

- ACCN GR 11 P2 NOVEMBER 2020 MG FINAL - DeJDocument9 pagesACCN GR 11 P2 NOVEMBER 2020 MG FINAL - DeJlindort00No ratings yet

- Accounting Nov 2020 Memo EngDocument15 pagesAccounting Nov 2020 Memo Engivanoganne36No ratings yet

- Acc 2018 MemoDocument12 pagesAcc 2018 Memokyle.govender2004No ratings yet

- Acc G11 Ec Nov 2022 P2 MGDocument8 pagesAcc G11 Ec Nov 2022 P2 MGTshenoloNo ratings yet

- Grade 10 Provincial Exam Accounting P1 (English) November 2019 Possible Answers - 050305Document6 pagesGrade 10 Provincial Exam Accounting P1 (English) November 2019 Possible Answers - 050305hobyanevisionNo ratings yet

- ACC-March-QP & Memo-2020-Gr11Document21 pagesACC-March-QP & Memo-2020-Gr11Kabelo SefaliNo ratings yet

- Accounting NSC P1 Memo Nov 2022 EngDocument12 pagesAccounting NSC P1 Memo Nov 2022 EngItumeleng MogoleNo ratings yet

- Accounting P1 Nov 2022 MG EngDocument11 pagesAccounting P1 Nov 2022 MG Engmthethwathando422No ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/23Document20 pagesCambridge International AS & A Level: ACCOUNTING 9706/23sleepNo ratings yet

- Accounting Nov 2019 Nov 2019 Memo EngDocument17 pagesAccounting Nov 2019 Nov 2019 Memo Engkekedieketseng561No ratings yet

- Assignment 3 - Depreciation and Adjusting Entries: Year Calculation Depreciation Accumulated Expense DepreciationDocument14 pagesAssignment 3 - Depreciation and Adjusting Entries: Year Calculation Depreciation Accumulated Expense DepreciationMohammad MustafaNo ratings yet

- FAC3761 - Exam Prep - Mock Question Paper - Suggested SolutionDocument9 pagesFAC3761 - Exam Prep - Mock Question Paper - Suggested SolutionRene EngelbrechtNo ratings yet

- Accounting GR 11 Paper 2Document10 pagesAccounting GR 11 Paper 2nkatekodawn72No ratings yet

- Accounting Feb-March 2016 Memo EngDocument16 pagesAccounting Feb-March 2016 Memo Engmanganyiforget58No ratings yet

- Accounting P2 May-June 2023 EngDocument14 pagesAccounting P2 May-June 2023 EngZNo ratings yet

- Accounting P2 May-June 2023 MG EngDocument10 pagesAccounting P2 May-June 2023 MG EngZNo ratings yet

- National Senior Certificate: Grade 12Document9 pagesNational Senior Certificate: Grade 12Raeesa SNo ratings yet

- Senior Certificate Examinations: Accounting 2018 Marking GuidelinesDocument16 pagesSenior Certificate Examinations: Accounting 2018 Marking GuidelinesmozizNo ratings yet

- Grade 10 Provincial Exam Accounting P2 (English) November 2018 Possible Answers - 050034Document11 pagesGrade 10 Provincial Exam Accounting P2 (English) November 2018 Possible Answers - 050034hobyanevisionNo ratings yet

- Accounting P1 May-June 2023 EngDocument12 pagesAccounting P1 May-June 2023 EngKaren ErasmusNo ratings yet

- National Senior Certificate: Grade 12Document10 pagesNational Senior Certificate: Grade 12Roseline SibekoNo ratings yet

- Ia 2 AssignmentDocument8 pagesIa 2 AssignmentJotaro KujoNo ratings yet

- Internal Memo Calloff Orders Sultan Eng KaggaDocument1 pageInternal Memo Calloff Orders Sultan Eng KaggaGerald ObalimNo ratings yet

- AFRMar2019 NELCO PDFDocument15 pagesAFRMar2019 NELCO PDFSriram RanganathanNo ratings yet

- Accounting P1 Nov 2023 Eng 2Document14 pagesAccounting P1 Nov 2023 Eng 2sliyama06No ratings yet

- 412 - Subs - STF - 2019-New Accounting CodeDocument24 pages412 - Subs - STF - 2019-New Accounting CodeMiss_AccountantNo ratings yet

- Jockey Club Ti-I College F.4 Business, Accounting and Financial Studies Second Term Examination (2020-2021)Document5 pagesJockey Club Ti-I College F.4 Business, Accounting and Financial Studies Second Term Examination (2020-2021)ouo So方No ratings yet

- 72034bos57955 p1 6Document12 pages72034bos57955 p1 6Fs printNo ratings yet

- Accounting P2 Nov 2020 Memo EngDocument10 pagesAccounting P2 Nov 2020 Memo EngBurning PhenomNo ratings yet

- Grade 12 NSC Accounting P1 (English) September 2022 Preparatory Examination Possible AnswersDocument13 pagesGrade 12 NSC Accounting P1 (English) September 2022 Preparatory Examination Possible Answersseemaneletlhogonolo30No ratings yet

- 7707 XC Mye 20-21 PDFDocument10 pages7707 XC Mye 20-21 PDFSaeed MahmoodNo ratings yet

- .HksaesproposalpolicypolicyDetails&Policy No 000012551578&agent CD 00918003&branch CD &user Id 009Document8 pages.HksaesproposalpolicypolicyDetails&Policy No 000012551578&agent CD 00918003&branch CD &user Id 009YAN YAN TSOINo ratings yet

- Dea Aul - QuizDocument5 pagesDea Aul - QuizDea Aulia AmanahNo ratings yet

- Degree - Swe - Acc - Resit Session - Marking GuideDocument2 pagesDegree - Swe - Acc - Resit Session - Marking GuideDidier ChautyNo ratings yet

- AOM 2023-001 - MaljoDocument17 pagesAOM 2023-001 - MaljoKen BocsNo ratings yet

- Form WP Modul 6 Aktiva TetapDocument11 pagesForm WP Modul 6 Aktiva Tetapuri doieNo ratings yet

- The Following Transactions Occurred During 201G:: Property of STIDocument2 pagesThe Following Transactions Occurred During 201G:: Property of STILunaNo ratings yet

- Accounting NSC P1 MG Sept 2022 Eng GautengDocument13 pagesAccounting NSC P1 MG Sept 2022 Eng GautengSweetness MakaLuthando LeocardiaNo ratings yet

- Acc GR 10 P2 (A) Exemplar Nov 2018 Eng MemoDocument12 pagesAcc GR 10 P2 (A) Exemplar Nov 2018 Eng Memomishomabunda20No ratings yet

- Accounting P2 GR11 Ansbook Nov2019 - Eng DDocument16 pagesAccounting P2 GR11 Ansbook Nov2019 - Eng DSmangaliso KhumaloNo ratings yet

- Cambridge O Level: Accounting 7707/23 October/November 2020Document14 pagesCambridge O Level: Accounting 7707/23 October/November 2020ImanNo ratings yet

- NSC Accounting Grade 12 May June 2023 P1 and MemoDocument32 pagesNSC Accounting Grade 12 May June 2023 P1 and Memozondoowethu5No ratings yet

- Gr11 April P2 2020 Marking SchemeDocument10 pagesGr11 April P2 2020 Marking SchemeMartha AntonNo ratings yet

- Ledger 609Document36 pagesLedger 609krani TRA BPENo ratings yet

- RBCPB MooeDocument12 pagesRBCPB MooePacifico HernandezNo ratings yet

- Official GR 12 Accounting P2 Eng MemoDocument13 pagesOfficial GR 12 Accounting P2 Eng MemoLISA LUFUSONo ratings yet

- Accounting P1 NSC Nov 2020 EngDocument11 pagesAccounting P1 NSC Nov 2020 EngSweetness MakaLuthando LeocardiaNo ratings yet

- Grade 11 Accn June 2023 P2 MGDocument9 pagesGrade 11 Accn June 2023 P2 MGKwakhanya StemelaNo ratings yet

- Grade 10 Provincial Exam Accounting P2 (English) November 2019 Answer Book - 050044Document10 pagesGrade 10 Provincial Exam Accounting P2 (English) November 2019 Answer Book - 050044hobyanevisionNo ratings yet

- 2024 Grade 12 Controlled Test MG 1 2Document4 pages2024 Grade 12 Controlled Test MG 1 2Zenzele100% (1)

- Gr11 Acc P1 (English) June 2019 Question PaperDocument12 pagesGr11 Acc P1 (English) June 2019 Question PaperShriddhi MaharajNo ratings yet

- Lecturer Name: A.Jeya Santhini Email: Jeyasanthini@utar - Edu.myDocument33 pagesLecturer Name: A.Jeya Santhini Email: Jeyasanthini@utar - Edu.myWen Xin GanNo ratings yet

- Accounting Nov 2016 Memo EngDocument16 pagesAccounting Nov 2016 Memo Engsiyandamabuza789No ratings yet

- FC0PR003 Procedure (Original)Document30 pagesFC0PR003 Procedure (Original)hasan sohailNo ratings yet

- Faf Tutorial 3 Ifrs 16Document4 pagesFaf Tutorial 3 Ifrs 16嘉慧No ratings yet

- J Grade 11 2018 June Maths Paper 2Document8 pagesJ Grade 11 2018 June Maths Paper 2nkatekodawn72No ratings yet

- FS Maths Grade 12 June 2022 P2 and MemoDocument26 pagesFS Maths Grade 12 June 2022 P2 and Memonkatekodawn72No ratings yet

- Physical Science Grade 12 SEPT 2022 P1 and MemoDocument33 pagesPhysical Science Grade 12 SEPT 2022 P1 and Memonkatekodawn72No ratings yet

- Grade 11 Year Note - 2024Document116 pagesGrade 11 Year Note - 2024nkatekodawn72No ratings yet

- 2019 NAT PhySci GR 10 Nov Exam P2 MemoDocument10 pages2019 NAT PhySci GR 10 Nov Exam P2 Memonkatekodawn72No ratings yet

- NW NSC GR 10 Life Sciences P2 Eng Nov 2019Document13 pagesNW NSC GR 10 Life Sciences P2 Eng Nov 2019nkatekodawn72No ratings yet

- G10 - History of Life On Earth - DR RossDocument14 pagesG10 - History of Life On Earth - DR Rossnkatekodawn72No ratings yet

- Chandigarh BillsDocument35 pagesChandigarh BillsDarshit VyasNo ratings yet

- Mcdonald's Case StudyDocument26 pagesMcdonald's Case StudyClaude EbennaNo ratings yet

- CRO Nomination List Form - Rev2Document1 pageCRO Nomination List Form - Rev2kolli.99995891No ratings yet

- Real Advice On How To Cheat Turnitin in 2022Document1 pageReal Advice On How To Cheat Turnitin in 2022YandiNo ratings yet

- AKG CS3 Discussion SystemDocument6 pagesAKG CS3 Discussion SystemSound Technology LtdNo ratings yet

- Special Power of Attorney: Full Name and Full Residential and Office Address of NRI Borrower(s)Document5 pagesSpecial Power of Attorney: Full Name and Full Residential and Office Address of NRI Borrower(s)Rushikesh BhongadeNo ratings yet

- Price Comparison TemplateDocument1 pagePrice Comparison TemplateAqeel RashNo ratings yet

- Free Movie Streaming Sites: Amazon Prime VideoDocument2 pagesFree Movie Streaming Sites: Amazon Prime VideoZakir AliNo ratings yet

- Gujarat Technological University: Project EmpathyDocument7 pagesGujarat Technological University: Project EmpathyKaval PatelNo ratings yet

- Resolution No. 001 S. 2023Document4 pagesResolution No. 001 S. 2023Chad Laurence Vinson CandelonNo ratings yet

- Articles Continuation VMVDocument3 pagesArticles Continuation VMVScott Adkins100% (2)

- Week 1 QuizDocument20 pagesWeek 1 QuizEduardo GomezNo ratings yet

- Research and Consideratio Ns For: Conor Timmons Juan Garelli Iris LichnovskáDocument23 pagesResearch and Consideratio Ns For: Conor Timmons Juan Garelli Iris LichnovskáAmal HameedNo ratings yet

- Interrupts in Atmega16Document3 pagesInterrupts in Atmega16Anoop S PillaiNo ratings yet

- Υπόθεση (engl)Document10 pagesΥπόθεση (engl)coolmandia13No ratings yet

- Datasheet Módulos Talesun 530-550W TP7F72M (H)Document2 pagesDatasheet Módulos Talesun 530-550W TP7F72M (H)Vitor BenicioNo ratings yet

- IMCDocument45 pagesIMCAsaf RajputNo ratings yet

- CasesDocument11 pagesCasesMitchi BarrancoNo ratings yet

- ST - Mary's Engineering College: Part-A Unit Wise Question Bank Unit 1Document26 pagesST - Mary's Engineering College: Part-A Unit Wise Question Bank Unit 1Israel VenkatNo ratings yet

- E826 Service Quick GuideDocument1 pageE826 Service Quick GuideTxarlyHidalgoNo ratings yet

- List of Tables: Scheduled Castes, Scheduled Tribes and General Population in Andhra Pradesh From 1961-2001 CensusDocument5 pagesList of Tables: Scheduled Castes, Scheduled Tribes and General Population in Andhra Pradesh From 1961-2001 CensusYeshWaNthNo ratings yet

- Statement Weighted Mean Verbal Interpretation RankDocument2 pagesStatement Weighted Mean Verbal Interpretation RankRobelyn Merquita HaoNo ratings yet

- API and ISO Gas-Lift Recommended Practices PDFDocument47 pagesAPI and ISO Gas-Lift Recommended Practices PDFcarlosNo ratings yet

- International Standard 2671: Environmental Tests For Aircraft Equipment - Part 3.4: Acoustic VibrationDocument12 pagesInternational Standard 2671: Environmental Tests For Aircraft Equipment - Part 3.4: Acoustic VibrationfgnestorNo ratings yet

- Amir Adnan Retain StoreDocument25 pagesAmir Adnan Retain StoreWaqas Mazhar100% (1)

- Experiment4 DoxDocument9 pagesExperiment4 Doxsajith100% (1)