Professional Documents

Culture Documents

Banks

Uploaded by

Muhammad Asif KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banks

Uploaded by

Muhammad Asif KhanCopyright:

Available Formats

THE SECOND SCHEDULE TO THE BANKING COMPANIES ORDINANCE, 1962

(See Section 34)

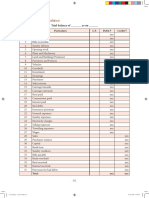

STATEMENT OF FINANCIAL POSITION AS AT ____________

Note (Current Year) (Prior Year)

Rupees in '000

ASSETS

Cash and balances with treasury banks 5 xxxxxxxx xxxxxxxx

Balances with other banks 6 xxxxxxxx xxxxxxxx

Lendings to financial institutions 7 xxxxxxxx xxxxxxxx

Investments 8 xxxxxxxx xxxxxxxx

Advances 9 xxxxxxxx xxxxxxxx

Fixed assets 10 xxxxxxxx xxxxxxxx

Intangible assets 11 xxxxxxxx xxxxxxxx

Deferred tax assets 12 xxxxxxxx xxxxxxxx

Other assets 13 xxxxxxxx xxxxxxxx

xxxxxxxx xxxxxxxx

LIABILITIES

Bills payable 15 xxxxxxxx xxxxxxxx

Borrowings 16 xxxxxxxx xxxxxxxx

Deposits and other accounts 17 xxxxxxxx xxxxxxxx

Liabilities against assets subject to finance lease 18 xxxxxxxx xxxxxxxx

Subordinated debt 19 xxxxxxxx xxxxxxxx

Deferred tax liabilities 20 xxxxxxxx xxxxxxxx

Other liabilities 21 xxxxxxxx xxxxxxxx

xxxxxxxx xxxxxxxx

NET ASSETS xxxxxxxx xxxxxxxx

REPRESENTED BY

Share capital/ Head office capital account - net 22 xxxxxxxx xxxxxxxx

Reserves xxxxxxxx xxxxxxxx

Surplus/ (Deficit) on revaluation of assets 23 xxxxxxxx xxxxxxxx

Unappropriated/ Unremitted profit xxxxxxxx xxxxxxxx

xxxxxxxx xxxxxxxx

CONTINGENCIES AND COMMITMENTS 24

The annexed notes 1 to 48 and annexures I and II form an integral part of these financial statements.

________________________ ___________________ ___________ ___________ ___________

President/Chief Executive Chief Financial Officer Director Director Director

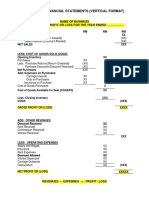

Format of Annual Financial Statements

PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED _________

Note (Current Year) (Prior Year)

Rupees in ‘000

Mark-up/Return/Interest Earned 26 xxxxxxxx xxxxxxxx

Mark-up/Return/Interest Expensed 27 xxxxxxxx xxxxxxxx

Net Mark-up/ Interest Income xxxxxxxx xxxxxxxx

NON MARK-UP/INTEREST INCOME

Fee and Commission Income 28 xxxxxxxx xxxxxxxx

Dividend Income xxxxxxxx xxxxxxxx

Foreign Exchange Income xxxxxxxx xxxxxxxx

Income / (loss) from derivatives xxxxxxxx xxxxxxxx

Gain / (Loss) on securities 29 xxxxxxxx xxxxxxxx

Other Income 30 xxxxxxxx xxxxxxxx

Total non-markup/interest Income xxxxxxxx xxxxxxxx

Total Income xxxxxxxx xxxxxxxx

NON MARK-UP/INTEREST EXPENSES

Operating expenses 31 xxxxxxxx xxxxxxxx

Workers Welfare Fund xxxxxxxx xxxxxxxx

Other charges 32 xxxxxxxx xxxxxxxx

Total non-markup/interest expenses xxxxxxxx xxxxxxxx

Profit / (Loss) Before Provisions xxxxxxxx xxxxxxxx

Provisions and write offs - net 33 xxxxxxxx xxxxxxxx

Extra ordinary / unusual items (to be specified) xxxxxxxx xxxxxxxx

PROFIT/(LOSS) BEFORE TAXATION xxxxxxxx xxxxxxxx

Taxation 34 xxxxxxxx xxxxxxxx

PROFIT/(LOSS) AFTER TAXATION xxxxxxxx xxxxxxxx

Rupees

Basic Earnings/(Loss) per share 35 xxxxxxxx xxxxxxxx

Diluted Earnings/(Loss) per share 36 xxxxxxxx xxxxxxxx

The annexed notes 1 to 48 and annexures I and II form an integral part of these financial statements.

________________________ ___________________ ___________ ___________ ___________

President/Chief Executive Chief Financial Officer Director Director Director

Format of Annual Financial Statements

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED _________

Current Year Prior Year

-------------(Rupees in ‘000)-------------

Profit after taxation for the year xxxxxx xxxxx

Other comprehensive income

Items that may be reclassified to profit and loss account in subsequent periods:

Effect of translation of net investment in foreign branches xxxxxx xxxxx

Movement in surplus / (deficit) on revaluation of investments - net of tax xxxxxx xxxxxx

Others (to be specified) xxxxxx xxxxx

xxxxxx xxxxxx

Items that will not be reclassified to profit and loss account in subsequent periods:

Remeasurement gain / (loss) on defined benefit obligations - net of tax xxxxxx xxxxx

Movement in surplus on revaluation of operating fixed assets - net of tax xxxxxx xxxxxx

Movement in surplus on revaluation of non-banking assets - net of tax xxxxxx xxxxxx

Others (to be specified) xxxxxx xxxxx

xxxxxx xxxxx

Total comprehensive income xxxxx xxxxx

The annexed notes 1 to 48 and annexures I and II form an integral part of these financial statements.

________________________ ___________________ ___________ ___________ __________

President/Chief Executive Chief Financial Officer Director Director Director

Format of Annual Financial Statements

STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED __________

Share capital/ Capital Statutory Revenue Surplus/(Deficit) on revaluation of Others Unappropriated/ Total

reserve (to reserve reserve (to Investments Fixed / Non

(to be

Head office be be specified) Banking Unremitted

specified)

capital specified) Assets profit/ (loss)

account

Rupees in '000

Opening Balance (prior year) xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Profit after taxation for the prior year xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Other comprehensive income - net of tax xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Remittances made to/ received

from head office xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Transfer to statutory reserve xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Transfer from surplus on revaluation of

assets to unappropriated profit - net of tax xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Other appropriations (to be specified) xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Transactions with owners, recorded

directly in equity

Dividend (separate line for each dividend) xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Issue of share capital xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Exchange adjustments on

revaluation of capital xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Opening Balance (Current year) xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Profit after taxation for the current year xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Other comprehensive income - net of tax

Remittances made to/ received

from head office xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Transfer to statutory reserve xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Transfer from surplus on revaluation of

assets to unappropriated profit - net of tax xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Other appropriations (to be specified) xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Transactions with owners, recorded

directly in equity

Dividend (separate line for each dividend) xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Issue of share capital xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Exchange adjustments on

revaluation of capital xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Closing Balance (Current Year) xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx xxxxxxxx

Capital reserves shall include capital redemption reserve, profit prior to incorporation, share premium, issue of bonus shares or any reserve not

regarded free for distribution by way of dividend (to be specified).

Revenue reserves shall include general reserve, dividend equalization reserve, contingencies reserve including general banking risks reserve and

other reserves created out of profits (to be specified).

Disclose a description of the nature and purpose of each reserve, if not apparent, in the notes to the accounts. Disclose as a note, any proposed

dividend or bonus shares.

The annexed notes 1 to 48 and annexures I and II form an integral part of these financial statements.

________________________ ___________________ ___________ ___________ ______________

President/Chief Executive Chief Financial Officer Director Director Director

Format of Annual Financial Statements

CASH FLOW STATEMENT FOR THE YEAR ENDED ______________

Note (Current Year) (Prior Year)

Rupees in '000

CASH FLOW FROM OPERATING ACTIVITIES

Profit/(Loss) before taxation xxxxxxxx xxxxxxxx

Less: Dividend income xxxxxxxx xxxxxxxx

xxxxxxxx xxxxxxxx

Adjustments:

Depreciation xxxxxxxx xxxxxxxx

Amortization xxxxxxxx xxxxxxxx

Provision and write-offs 33 xxxxxxxx xxxxxxxx

Loss/ (Gain) on sale of fixed assets xxxxxxxx xxxxxxxx

Finance charges on leased assets xxxxxxxx xxxxxxxx

Others (to be specified) xxxxxxxx xxxxxxxx

xxxxxxxx xxxxxxxx

xxxxxxxx xxxxxxxx

(Increase)/ Decrease in operating assets

Lendings to financial institutions xxxxxxxx xxxxxxxx

Held-for-trading securities xxxxxxxx xxxxxxxx

Advances xxxxxxxx xxxxxxxx

Others assets (excluding advance taxation) xxxxxxxx xxxxxxxx

xxxxxxxx xxxxxxxx

Increase/ (Decrease) in operating liabilities

Bills Payable xxxxxxxx xxxxxxxx

Borrowings from financial institutions xxxxxxxx xxxxxxxx

Deposits xxxxxxxx xxxxxxxx

Other liabilities (excluding current taxation) xxxxxxxx xxxxxxxx

xxxxxxxx xxxxxxxx

Payments against off-balance sheet obligations xxxxxxxx xxxxxxxx

Income tax paid xxxxxxxx xxxxxxxx

Net cash flow from / (used in) operating activities xxxxxxxx xxxxxxxx

CASH FLOW FROM INVESTING ACTIVITIES

Net investments in available-for-sale securities xxxxxxxx xxxxxxxx

Net investments in held-to-maturity securities xxxxxxxx xxxxxxxx

Dividends received xxxxxxxx xxxxxxxx

Investments in operating fixed assets xxxxxxxx xxxxxxxx

Proceeds from sale of fixed assets xxxxxxxx xxxxxxxx

Effect of translation of net investment in foreign branches xxxxxxxx xxxxxxxx

Net cash flow from / (used in) investing activities xxxxxxxx xxxxxxxx

CASH FLOW FROM FINANCING ACTIVITIES

Receipts/ Payments of Subordinated debt xxxxxxxx xxxxxxxx

Receipts/ Payments of lease obligations xxxxxxxx xxxxxxxx

Issue of share capital xxxxxxxx xxxxxxxx

Dividend paid xxxxxxxx xxxxxxxx

Remittances made to/ received from head office xxxxxxxx xxxxxxxx

Net cash flow from / (used in) financing activities xxxxxxxx xxxxxxxx

Effects of exchange rate changes on cash and cash equivalents xxxxxxxx xxxxxxxx

Increase/(Decrease) in cash and cash equivalents xxxxxxxx xxxxxxxx

Cash and cash equivalents at beginning of the year 37 xxxxxxxx xxxxxxxx

Cash and cash equivalents at end of the year 37 xxxxxxxx xxxxxxxx

Disclose cash flows from acquisition and disposal of subsidiaries etc. (if any) under the head of Cash

Flow from Investing Activities.

The annexed notes 1 to 48 and annexures I and II form an integral part of these financial statements.

________________________ __________________ ___________ ___________ ___________

President/Chief Executive Chief Financial Officer Director Director Director

Format of Annual Financial Statements

(Current (Prior

Year) Year)

Rupees in '000

5. CASH AND BALANCES WITH TREASURY BANKS

In hand

Local currency xxxx xxxx

Foreign currency xxxx xxxx

xxxx xxxx

With State Bank of Pakistan in

Local currency current account xxxx xxxx

Foreign currency current account xxxx xxxx

Local currency deposit account (to be specified) xxxx xxxx

Foreign currency deposit account (to be specified) xxxx xxxx

xxxx xxxx

With other central banks in

Foreign currency current account xxxx xxxx

Foreign currency deposit account xxxx xxxx

xxxx xxxx

With National Bank of Pakistan in

Local currency current account xxxx xxxx

Local currency deposit account (to be specified) xxxx xxxx

xxxx xxxx

Prize bonds xxxx xxxx

xxxx xxxx

Disclose information about the extent and nature of the deposit accounts, including significant terms and conditions

that may affect the amount, timing and certainty of future cash flows.

(Current (Prior

Year) Year)

Rupees in '000

6. BALANCES WITH OTHER BANKS

In Pakistan

In current account xxxx xxxx

In deposit account xxxx xxxx

xxxx xxxx

Outside Pakistan

In current account xxxx xxxx

In deposit account xxxx xxxx

xxxx xxxx

xxxx xxxx

Disclose information about the extent and nature of the deposit accounts, including significant terms and conditions

that may affect the amount, timing and certainty of future cash flows. Nostro accounts with branches outside

Pakistan should be classified here.

(Current (Prior

Year) Year)

Rupees in '000

7. LENDINGS TO FINANCIAL INSTITUTIONS

Call / clean money lendings xxxx xxxx

Repurchase agreement lendings(Reverse Repo) xxxx xxxx

Bai Muajjal receivable xxxx xxxx

- with State Bank of Pakistan xxxx xxxx

- with other financial institutions xxxx xxxx

Others (to be specified) xxxx xxxx

xxxx xxxx

Less: provision held against Lending to Financial Institutions xxxx xxxx

Lending to Financial Institutions - net of provision xxxx xxxx

Disclose information about the extent and nature, including significant terms and conditions that may affect the

amount, timing and certainty of future cash flows.

(Current (Prior

7.1 Particulars of lending Year) Year)

Rupees in '000

In local currency xxxx xxxx

In foreign currencies xxxx xxxx

xxxx xxxx

Format of Annual Financial Statements

Current Year Prior Year

7.2 Securities held as collateral against Lending Further Further

Held by Held by

to financial institutions given as Total given as Total

Bank Bank

collateral collateral

Rupees in '000

Market Treasury Bills xxxx xxxx xxxx xxxx xxxx xxxx

Pakistan Investment Bonds xxxx xxxx xxxx xxxx xxxx xxxx

Others (to be specified) xxxx xxxx xxxx xxxx xxxx xxxx

Total xxxx xxxx xxxx xxxx xxxx xxxx

Current Year Prior Year

7.3 Category of classification Classified Provision Classified Provision

Lending held Lending held

Rupees in '000

Domestic

Other assets especially mentioned xxxx xxxx xxxx xxxx

Substandard xxxx xxxx xxxx xxxx

Doubtful xxxx xxxx xxxx xxxx

Loss xxxx xxxx xxxx xxxx

xxxx xxxx xxxx xxxx

Overseas

Not past due but impaired xxxx xxxx xxxx xxxx

Overdue by:

Upto 90 days xxxx xxxx xxxx xxxx

91 to 180 days xxxx xxxx xxxx xxxx

181 to 365 days xxxx xxxx xxxx xxxx

˃ 365 days xxxx xxxx xxxx xxxx

xxxx xxxx xxxx xxxx

Total xxxx xxxx xxxx xxxx

The aggregate amount of relaxation in any classification / provisioning granted by SBP should be disclosed in a sub-

note along with financial impact.

8. INVESTMENTS (Current Year) (Prior Year)

Cost / Provision Cost / Provision

Surplus / Carrying Surplus / Carrying

8.1 Investments by type: Amortised for Amortised for

(Deficit) Value (Deficit) Value

cost diminution cost diminution

Rupees in '000

Held-for-trading securities

Federal Government Securities xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Provincial Government Securities xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Shares xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Non Government Debt Securities xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Foreign Securities xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Others (to be specified) xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Available-for-sale securities

Federal Government Securities xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Provincial Government Securities xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Shares xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Non Government Debt Securities xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Foreign Securities xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Others (to be specified) xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Held-to-maturity securities

Federal Government Securities xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Provincial Government Securities xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Non Government Debt Securities xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Foreign Securities xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Others (to be specified) xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Associates xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Subsidiaries xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Total Investments xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

For Investments in associates and subsidiaries, give details in respect of individual entities specifying pecentage of holding and

country of incorporation alongwith details regarding assets, liabilities, revenue, profit after taxation and total comprehensive income of

Format of Annual Financial Statements

(Current Year) (Prior Year)

Cost/ Provision Cost Provision

Surplus / Carrying Surplus / Carrying

Amortised for /Amortise for

(Deficit) Value (Deficit) Value

8.2 Investments by segments: cost diminution d cost diminution

'Rupees in '000

Federal Government Securities:

Market Treasury Bills xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Pakistan Investment Bonds xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Ijarah Sukuks xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Others ( All investments to be specified) xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Provincial Government Securities xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Shares:

Listed Companies xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Unlisted Companies xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Non Government Debt Securities

Listed xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Unlisted xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Foreign Securities

Government securities xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Non Government Debt securities xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Equity securities xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Associates

(disclose individually by name) xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Subsidiaries

(disclose individually by name) xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

Total Investments xxxx xxxx xxxx xxxx xxxx xxxx xxxx xxxx

8.2.1 Investments given as collateral Current Prior

Year Year

Rupees in '000

To be specified xxxx xxxx

8.3 Provision for diminution in value of investments Current Prior

Year Year

8.3.1 Opening balance xxxx xxxx

Exchange adjustments xxxx xxxx

Charge / reversals

Charge for the year xxxx xxxx

Reversals for the year xxxx xxxx

Reversal on disposals xxxx xxxx

xxxx xxxx

Transfers - net xxxx xxxx

Amounts written off xxxx xxxx

Closing Balance xxxx xxxx

8.3.2 Particulars of provision against debt securities

Category of classification Current Year Prior Year

NPI Provision NPI Provision

Domestic

Other assets especially mentioned xxxx xxxx xxxx xxxx

Substandard xxxx xxxx xxxx xxxx

Doubtful xxxx xxxx xxxx xxxx

Loss xxxx xxxx xxxx xxxx

xxxx xxxx xxxx xxxx

Overseas

Not past due but impaired xxxx xxxx xxxx xxxx

Overdue by:

Upto 90 days xxxx xxxx xxxx xxxx

91 to 180 days xxxx xxxx xxxx xxxx

181 to 365 days xxxx xxxx xxxx xxxx

˃ 365 days xxxx xxxx xxxx xxxx

xxxx xxxx xxxx xxxx

Total xxxx xxxx xxxx xxxx

The aggregate amount of relaxation in any classification / provisioning granted by SBP should be disclosed in a sub

note along with financial impact

Format of Annual Financial Statements

8.4 Quality of Available for Sale Securities

Details regarding quality of Available for Sale (AFS) securities are as follows

(Current year) (Prior year)

Cost

Rupees in '000

Federal Government Securities - Government guaranteed

Market Treasury Bills XXXX XXXX

Pakistan Investment Bonds XXXX XXXX

Ijarah Sukuks XXXX XXXX

Others (to be specified) XXXX XXXX

XXXX XXXX

Provincial Government Securities - Government guaranteed XXXX XXXX

(Current year) (Prior year)

Shares Cost

Rupees in '000

Listed Companies

Sector-wise exposure to be given as per the sectors defined in the Pakistan Stock

- Cement XXXX XXXX

- Fertilizer XXXX XXXX

- Others to be specified XXXX XXXX

XXXX XXXX

(Current year) (Prior year)

Unlisted Companies Cost Breakup value Cost Breakup value

Rupees in '000

Entity wise disclosure to be given

Company A XXXX XXXX XXXX XXXX

Company B XXXX XXXX XXXX XXXX

Others XXXX XXXX XXXX XXXX

XXXX XXXX XXXX XXXX

Non Government Debt Securities (Current year) (Prior year)

Cost

Listed Rupees in '000

To be categorised based on long term rating by Credit Rating Agency

- AAA XXXX XXXX

- AA+, AA, AA- XXXX XXXX

- A+, A, A- XXXX XXXX

- BBB+, BBB, BBB- XXXX XXXX

- BB+, BB, BB- XXXX XXXX

- B+, B, B- XXXX XXXX

- CCC and below XXXX XXXX

- Unrated XXXX XXXX

XXXX XXXX

(Current year) (Prior year)

Cost

Rupees in '000

Unlisted

To be categorised based on long term rating by Credit Rating Agency

- AAA XXXX XXXX

- AA+, AA, AA- XXXX XXXX

- A+, A, A- XXXX XXXX

- BBB+, BBB, BBB- XXXX XXXX

- BB+, BB, BB- XXXX XXXX

- B+, B, B- XXXX XXXX

- CCC and below XXXX XXXX

- Unrated XXXX XXXX

XXXX XXXX

Format of Annual Financial Statements

Foreign Securities

(Current year) (Prior year)

Government Securities Cost Rating Cost Rating

To be categorised country wise Rupees in '000

- Yemen XXXX XXXX XXXX XXXX

- Nigeria XXXX XXXX XXXX XXXX

Others to be specified XXXX XXXX XXXX XXXX

XXXX XXXX XXXX XXXX

Non Government Debt Securities

(Current year) (Prior year)

Cost

Listed Rupees in '000

To be categorised based on long term rating by Credit Rating Agency

- AAA XXXX XXXX

- AA+, AA, AA- XXXX XXXX

- A+, A, A- XXXX XXXX

- BBB+, BBB, BBB- XXXX XXXX

- BB+, BB, BB- XXXX XXXX

- B+, B, B- XXXX XXXX

- CCC and below XXXX XXXX

- Unrated XXXX XXXX

XXXX XXXX

(Current year) (Prior year)

Cost

Unlisted Rupees in '000

To be categorised based on long term rating by Credit Rating Agency

- AAA XXXX XXXX

- AA+, AA, AA- XXXX XXXX

- A+, A, A- XXXX XXXX

- BBB+, BBB, BBB- XXXX XXXX

- BB+, BB, BB- XXXX XXXX

- B+, B, B- XXXX XXXX

- CCC and below XXXX XXXX

- Unrated XXXX XXXX

XXXX XXXX

Equity Securities

(Current year) (Prior year)

Cost

Listed Rupees in '000

To be categorised company wise

Company A XXXX XXXX

Company B XXXX XXXX

Company C XXXX XXXX

Others to be specified XXXX XXXX

XXXX XXXX

(Current year) (Prior year)

Cost

Unlisted Rupees in '000

To be categorised company wise

Company A XXXX XXXX

Company B XXXX XXXX

Company C XXXX XXXX

Others to be specified XXXX XXXX

XXXX XXXX

Format of Annual Financial Statements

8.5 Particulars relating to Held to Maturity securities are as follows: (Current year) (Prior year)

Cost

Rupees in '000

Federal Government Securities - Government guaranteed

Market Treasury Bills XXXX XXXX

Pakistan Investment Bonds XXXX XXXX

Sukuk XXXX XXXX

Others (to be specified) XXXX XXXX

XXXX XXXX

Provincial Government Securities - Government guaranteed XXXX XXXX

Non Government Debt Securities

Listed

To be categorised based on long term rating by Credit Rating Agency

- AAA XXXX XXXX

- AA+, AA, AA- XXXX XXXX

- A+, A, A- XXXX XXXX

- BBB+, BBB, BBB- XXXX XXXX

- BB+, BB, BB- XXXX XXXX

- B+, B, B- XXXX XXXX

- CCC and below XXXX XXXX

- Unrated XXXX XXXX

XXXX XXXX

Unlisted

To be categorised based on long term rating by Credit Rating Agency

- AAA XXXX XXXX

- AA+, AA, AA- XXXX XXXX

- A+, A, A- XXXX XXXX

- BBB+, BBB, BBB- XXXX XXXX

- BB+, BB, BB- XXXX XXXX

- B+, B, B- XXXX XXXX

- CCC and below XXXX XXXX

- Unrated XXXX XXXX

XXXX XXXX

Foreign Securities

(Current year) (Prior year)

Government Securities Cost Rating Cost Rating

To be categorised country wise Rupees in '000

- Yemen XXXX XXXX XXXX XXXX

- Nigeria XXXX XXXX XXXX XXXX

Others to be specified XXXX XXXX XXXX XXXX

XXXX XXXX XXXX XXXX

Non Government Debt Securities (Current year) (Prior year)

Cost

Listed Rupees in '000

To be categorised based on long term rating by Credit Rating Agency

- AAA XXXX XXXX

- AA+, AA, AA- XXXX XXXX

- A+, A, A- XXXX XXXX

- BBB+, BBB, BBB- XXXX XXXX

- BB+, BB, BB- XXXX XXXX

- B+, B, B- XXXX XXXX

- CCC and below XXXX XXXX

- Unrated XXXX XXXX

XXXX XXXX

Unlisted

To be categorised based on long term rating by Credit Rating Agency

- AAA XXXX XXXX

- AA+, AA, AA- XXXX XXXX

- A+, A, A- XXXX XXXX

- BBB+, BBB, BBB- XXXX XXXX

- BB+, BB, BB- XXXX XXXX

- B+, B, B- XXXX XXXX

- CCC and below XXXX XXXX

- Unrated XXXX XXXX

XXXX XXXX

8.5.1 The market value of securities classified as held-to-maturity as at December 31, XXXX amounted to Rs. XXXX million

(December 31, XXXX: Rs. XXXXX million).

Format of Annual Financial Statements

9. ADVANCES

Performing Non Performing Total

Current Prior Current Prior

Current Year Prior Year

Year Year Year Year

Rupees in '000

Loans, cash credits, running finances, etc. 9.1 xxxx xxxx xxxx xxxx xxxx xxxx

Islamic financing and related assets xxxx xxxx xxxx xxxx xxxx xxxx

Bills discounted and purchased xxxx xxxx xxxx xxxx xxxx xxxx

Advances - gross xxxx xxxx xxxx xxxx xxxx xxxx

Provision against advances

- Specific xxxx xxxx xxxx xxxx xxxx xxxx

- General xxxx xxxx xxxx xxxx xxxx xxxx

xxxx xxxx xxxx xxxx xxxx xxxx

Advances - net of provision xxxx xxxx xxxx xxxx xxxx xxxx

9.1 Includes Net Investment in Finance Lease as disclosed below:

(Current Year) (Prior Year)

Later Later

Not later than one Not later than one

Over five

than one and less Total than one and less Over five years Total

years

year than five year than five

years years

Rupees in '000

Lease rentals receivable xxx xxx xxx xxx xxx xxx xxx xxx

Residual value xxx xxx xxx xxx xxx xxx xxx xxx

Minimum lease payments xxx xxx xxx xxx xxx xxx xxx xxx

Financial charges for future periods xxx xxx xxx xxx xxx xxx xxx xxx

xxx xxx xxx xxx xxx xxx xxx xxx

Present value of minimum

lease payments xxx xxx xxx xxx xxx xxx xxx xxx

(Current Year) (Prior Year)

9.2 Particulars of advances (Gross) Rupees in '000

In local currency xxx xxx

In foreign currencies xxx xxx

xxx xxx

Format of Annual Financial Statements

9.3 Advances include Rs._______ (20XX ---------) which have been placed under non-performing status as detailed

below:-

Current Year Prior Year

Non Non

Category of Classification

Performing Performing

Loans Provision Loans Provision

Rupees in '000

Domestic

Other Assets Especially Mentioned xxx xxx xxx xxx

Substandard xxx xxx xxx xxx

Doubtful xxx xxx xxx xxx

Loss xxx xxx xxx xxx

xxx xxx xxx xxx

Overseas

Not past due but impaired xxx xxx xxx xxx

Overdue by:

Upto 90 days xxx xxx xxx xxx

91 to 180 days xxx xxx xxx xxx

181 to 365 days xxx xxx xxx xxx

˃ 365 days xxx xxx xxx xxx

xxx xxx xxx xxx

Total xxx xxx xxx xxx

9.4 Particulars of provision against advances (Current Year) (Prior Year)

Specific General Total Specific General Total

Rupees in '000

Opening balance xxx xxx xxx xxx xxx xxx

Exchange adjustments xxx xxx xxx xxx xxx xxx

Charge for the year xxx xxx xxx xxx xxx xxx

Reversals xxx xxx xxx xxx xxx xxx

xxx xxx xxx xxx xxx xxx

Amounts written off 9.5 xxx xxx xxx xxx xxx xxx

Amounts charged off - agriculture financing xxx xxx xxx xxx xxx xxx

Other movements (to be specified) xxx xxx xxx xxx xxx xxx

Closing balance xxx xxx xxx xxx xxx xxx

9.4.1 Particulars of provision against advances (Current Year) (Prior Year)

Specific General Total Specific General Total

Rupees in '000

In local currency xxx xxx xxx xxx xxx xxx

In foreign currencies xxx xxx xxx xxx xxx xxx

xxx xxx xxx xxx xxx xxx

9.4.2 The Bank should adequately disclose the details and impact of Forced Sale Value (FSV) benefit availed as allowed

under instructions issued by the State Bank of Pakistan.

Note (Current Year) (Prior Year)

9.5 PARTICULARS OF WRITE OFFs: Rupees in '000

9.5.1 Against Provisions 9.4 xxx xxx

Directly charged to Profit & Loss account xxx xxx

xxx xxx

9.5.2 Write Offs of Rs. 500,000 and above 9.6

- Domestic xxx xxx

- Overseas xxx xxx

Write Offs of Below Rs. 500,000 xxx xxx

xxx xxx

9.6 DETAILS OF LOAN WRITE OFF OF Rs. 500,000/- AND ABOVE

In terms of sub-section (3) of Section 33A of the Banking Companies Ordinance, 1962 the Statement in respect of

written-off loans or any other financial relief of rupees five hundred thousand or above allowed to a person(s) during

the year ended is given in Annexure-1.(except where such disclosure is restricted by overseas regulatory authorities).

(Current Year) (Prior Year)

10. FIXED ASSETS Rupees in '000

Capital work-in-progress 10.1 xxx xxx

Property and equipment 10.2 xxx xxx

xxxx xxxx

10.1 Capital work-in-progress

Civil works xxx xxx

Equipment xxx xxx

Advances to suppliers xxx xxx

Others (to be specified) xxx xxx

xxxx xxxx

Format of Annual Financial Statements

(Current

(Prior Year)

Year)

Rupees in '000

15. BILLS PAYABLE

In Pakistan xxx xxx

Outside Pakistan xxx xxx

xxx xxx

16 BORROWINGS (Current

(Prior Year)

Year)

Rupees in '000

Secured

Borrowings from State Bank of Pakistan

Under export refinance scheme xxx xxx

Under Locally Manufactured Machinery (LMM) scheme xxx xxx

Others (to be specified) xxx xxx

xxx xxx

Repurchase agreement borrowings xxx xxx

Borrowings from subsidiary companies, managed modarabas

and associated undertakings xxx xxx

Borrowings from directors (including chief executive) of the bank xxx xxx

Others (to be specified) xxx xxx

Total secured xxx xxx

Unsecured

Call borrowings xxx xxx

Overdrawn nostro accounts xxx xxx

Others (to be specified) xxx xxx

Total unsecured xxx xxx

xxx xxx

Disclose information about the extent and nature, including significant terms and conditions that may affect the

amount, timing and certainty of future cash flows. Further, disclose the nature and carrying amount of the assets

pledged as security.

Format of Annual Financial Statements

(Current Year) (Prior Year)

16.1 Particulars of borrowings with respect to Currencies Rupees in '000

In local currency xxx xxx

In foreign currencies xxx xxx

xxx xxx

17. DEPOSITS AND OTHER ACCOUNTS

Current Year Prior Year

In Local In Foreign In Local In Foreign

Total Total

Currency currencies Currency currencies

Rupees in '000

Customers

Current deposits xxx xxx xxx xxx xxx xxx

Savings deposits xxx xxx xxx xxx xxx xxx

Term deposits xxx xxx xxx xxx xxx xxx

Others xxx xxx xxx xxx xxx xxx

xxx xxx xxx xxx xxx xxx

Financial Institutions

Current deposits xxx xxx xxx xxx xxx xxx

Savings deposits xxx xxx xxx xxx xxx xxx

Term deposits xxx xxx xxx xxx xxx xxx

Others xxx xxx xxx xxx xxx xxx

xxx xxx xxx xxx xxx xxx

xxx xxx xxx xxx xxx xxx

Current accounts - deposits repayable on demand, non-remunerative

Saving accounts - deposits repayable on demand, remunerative

Others: Disclose those accounts in this category that are neither current or saving accounts and those do not fall under the aforesaid definition

of current and saving acounts e.g. margin, call deposits etc.

Vostro accounts should be classified here.

(Current Year) (Prior Year)

Rupees in '000

17.1 Composition of deposits

- Individuals xxx xxx

- Government (Federal and Provincial) xxx xxx

- Public Sector Entities xxx xxx

- Banking Companies xxx xxx

- Non-Banking Financial Institutions xxx xxx

- Private Sector xxx xxx

xxx xxx

17.2 This includes deposits eligible to be covered under insurance arrangements amounting to Rs xxxx.

18. LIABILITIES AGAINST ASSETS SUBJECT TO FINANCE LEASE

(Current Year) (Prior Year)

Minimum Financial Principal Minimum Financial Principal

lease charges for outstanding lease charges for outstanding

payments future periods payments future periods

Rupees in '000

Not later than one year xxx xxx xxx xxx xxx xxx

Later than one year and upto five years xxx xxx xxx xxx xxx xxx

Over five years xxx xxx xxx xxx xxx xxx

xxx xxx xxx xxx xxx xxx

Disclose the interest rates used as the discounting factor; the existence and terms of renewal or purchase options

and escalation clauses; restrictions imposed by lease arrangements, such as those concerning dividends, additional

debt and further leasing; and any other material terms.

19. SUBORDINATED DEBT

Disclose information about the extent and nature, including significant terms and conditions that may affect the

amount, timing and certainty of future cash flows. Further, disclose the nature and carrying amount of assets given (if

any) as security and a description of sub-ordination to other creditors. The disclosure should include:

Issue amount

Issue date

Maturity date

Rating

Security

Profit payment frequency

Redemption

Mark-up

Call option (if any)

Lock-in-clause (if any)

Loss absorbency clause

Format of Annual Financial Statements

25 DERIVATIVE INSTRUMENTS

Current Year

25.1 Product Analysis * Rupees in '000

Interest Rate Swaps Forward Rate Agreements FX Options

Counterparties Notional Mark to market Notional Mark to market Notional Mark to market

Principal ** gain / loss Principal gain / loss Principal gain / loss

With Banks for

Hedging xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx

Market Making xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx

With FIs other than banks

Hedging xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx

Market Making xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx

With other entities for

Hedging xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx

Market Making xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx

Total

Hedging xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx

Market Making xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx

* These columns are for indicative purposes only. Separate columns should be presented for each type of derivative instrument.

** At the exchange rate prevailing at the end of the reporting period

Prior Year

Rupees in '000

Interest Rate Swaps Forward Rate Agreements FX Options

Counterparties Notional Mark to market Notional Mark to market Notional Mark to market

Principal gain / loss Principal gain / loss Principal gain / loss

With Banks for

Hedging xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx

Market Making xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx

With FIs other than banks

Hedging xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx

Market Making xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx

With other entities for

Hedging xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx

Market Making xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx

Total

Hedging xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx

Market Making xxxxx xxxxx xxxxx xxxxx xxxxx xxxxx

25.2 Maturity Analysis Current Year

Rupees in '000

Remaining No. of Notional Mark to Market

Maturity Contracts Principal Negative Positive Net

Upto 1 month xxxxx xxxxx xxxxx xxxxx xxxxx

1 to 3 months xxxxx xxxxx xxxxx xxxxx xxxxx

3 to 6 months xxxxx xxxxx xxxxx xxxxx xxxxx

6 month to 1 Year xxxxx xxxxx xxxxx xxxxx xxxxx

1 to 2 Year xxxxx xxxxx xxxxx xxxxx xxxxx

2 to 3 Years xxxxx xxxxx xxxxx xxxxx xxxxx

3 to 5 Years xxxxx xxxxx xxxxx xxxxx xxxxx

5 to 10 years xxxxx xxxxx xxxxx xxxxx xxxxx

Above 10 Years xxxxx xxxxx xxxxx xxxxx xxxxx

Total xxxxx xxxxx

Prior Year

Rupees in '000

Remaining No. of Notional Mark to Market

Maturity Contracts Principal Negative Positive Net

Upto 1 month xxxxx xxxxx xxxxx xxxxx xxxxx

1 to 3 months xxxxx xxxxx xxxxx xxxxx xxxxx

3 to 6 months xxxxx xxxxx xxxxx xxxxx xxxxx

6 month to 1 Year xxxxx xxxxx xxxxx xxxxx xxxxx

1 to 2 Year xxxxx xxxxx xxxxx xxxxx xxxxx

2 to 3 Years xxxxx xxxxx xxxxx xxxxx xxxxx

3 to 5 Years xxxxx xxxxx xxxxx xxxxx xxxxx

5 to 10 years xxxxx xxxxx xxxxx xxxxx xxxxx

Above 10 Years xxxxx xxxxx xxxxx xxxxx xxxxx

Total xxxxx xxxxx

25.3 Disclose qualitative and quantitative information on exchange traded derivatives, (relating to activities, if any,

during the financial year under reporting.)

25.4 Risk management related to derivatives is discussed in note 47.5.

Format of Annual Financial Statements

(Current (Prior

Year) Year)

Rupees in '000

26 MARK-UP/RETURN/INTEREST EARNED

On:

a) Loans and advances xxxxxx xxxxxx

b) Investments xxxxxx xxxxxx

c) Lendings to financial institutions xxxxxx xxxxxx

d) Balances with banks xxxxxx xxxxxx

e) Others (to be specified) xxxxxx xxxxxx

xxxxxx xxxxxx

27 MARK-UP/RETURN/INTEREST EXPENSED

Deposits xxxxxx xxxxxx

Borrowings xxxxxx xxxxxx

Subordinated debt xxxxxx xxxxxx

Cost of foreign currency swaps against foreign currency deposits / borrowings xxxxxx xxxxxx

Others (to be specified) xxxxxx xxxxxx

xxxxxx xxxxxx

(Current Year) (Prior Year)

Rupees in '000

31.3 Auditors' remuneration

Audit fee xxxxxx xxxxxx

Fee for other statutory certifications xxxxxx xxxxxx

Fee for audit of foreign branches (for banks incorporated in Pakistan) xxxxxx xxxxxx

Fee for audit of employee funds xxxxxx xxxxxx

Special certifications and sundry advisory services xxxxxx xxxxxx

Tax services xxxxxx xxxxxx

Out-of-pocket expenses xxxxxx xxxxxx

xxxxxx xxxxxx

In case of joint auditors the above information should be shown separately for each of the joint auditors.

38 STAFF STRENGTH Number

Permanent xxxxxx xxxxxx

On Bank contract xxxxxx xxxxxx

Others (please specify) xxxxxx xxxxxx

Bank's own staff strength at the end of the year xxxxxx xxxxxx

38.1 In addition to the above, xxxxx (prior year: xxx) employees of outsourcing services companies were assigned to the

Bank as at the end of the year to perform services other than guarding and janitorial services. Further, disclose the

bifurcation of employees working domestically and abroad (if any) of current and prior year both.

Format of Annual Financial Statements

41 COMPENSATION OF DIRECTORS AND KEY MANAGEMENT PERSONNEL

41.1 Total Compensation Expense

(Current year)

Directors

Other

Members Key

Executives President / Material

Items Non- Shariah Management

Chairman (other than CEO Risk Takers/

Executives Board Personnel

CEO) Controllers

Fees and Allowances etc. xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Managerial Remuneration

i) Fixed xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

ii) Total Variable xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

of which

a) Cash Bonus / Awards xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

b) Bonus & Awards in Shares xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Charge for defined benefit plan xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Contribution to defined contribution plan xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Rent & house maintenance xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Utilities xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Medical xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Conveyance xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Others * xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Number of Persons xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

(Prior year)

Directors

Other

Members Key

Executives President / Material Risk

Items Non- Shariah Management

Chairman (other than CEO Takers/

Executives Board Personnel

CEO) Controllers

Fees and Allowances etc. xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Managerial Remuneration

i) Fixed xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

ii) Total Variable xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

of which

a) Cash Bonus / Awards xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

b) Bonus & Awards in Shares xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Charge for defined benefit plan xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Contribution to defined contribution plan xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Rent & house maintenance xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Utilities xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Medical xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Conveyance xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Others * xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Number of Persons xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Any Other Perks and Privileges: allowed to above officials should also be disclosed and specified separately.

* Others such as Leave Fare Assistance, club memberships, children education etc. please specify item-wise if greater than rupees Rs..0.5

million per individual

The term "Key Management Personnel" means the following functional responsibilities:

(a) Any executive or key executive, acting as second to CEO, by whatever name called, and including the Chief

Operating Officer (COO) and Deputy Managing Director.

(b) Any executive or key executive reporting directly to the CEO / President or the person mentioned in (a) above.

The terms Directors/ Executive Directors/ Non-Executive Directors, CEO and Key Executives have same meaning as defined

in Prudential Regulations (PRs) for Corporate and Commercial Banking. For the purpose of these disclosures Key Executive

will also include Executives who have direct reporting line to the President/CEO or BoD or its Committees.

Format of Annual Financial Statements

41.2 Remuneration paid to Directors for participation in Board and Committee Meetings

(Current year)

Meeting Fees and Allowances Paid

For Board Committees

Sr.

Name of Director For Board Name of Name of Name of Total

No. Name of Board

Meetings Board Board Board Amount

Committee

Committee Committee Committee Paid

Rs. in '000'

1 xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

2 xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total Amount Paid xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

(Prior year)

Meeting Fees and Allowances Paid

For Board Committees

Sr.

Name of Director For Board Name of Name of Name of

No. Name of Board Total Amount

Meetings Board Board Board

Committee Paid

Committee Committee Committee

Rs. in '000'

1 xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

2 xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total Amount Paid xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

41.3 Remuneration paid to Shariah Board Members

(Current year) (Prior year)

Non-

Resident Resident Non-Resident

Items Chairman Resident Chairman

Member Member Member(s)

Member(s)

Rs. in '000'

a. Meeting Fees and Allowances xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

b. Other Heads (please specify) xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total Amount xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total Number of Persons xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

42 FAIR VALUE MEASUREMENTS

The fair value of quoted securities other than those classified as held to maturity, is based on quoted market price. Quoted

securities classified as held to maturity are carried at cost. The fair value of unquoted equity securities, other than

investments in associates and subsidiaries, is determined on the basis of the break-up value of these investments as per

their latest available audited financial statements.

The fair value of unquoted debt securities, fixed term loans, other assets, other liabilities, fixed term deposits and borrowings

cannot be calculated with sufficient reliability due to the absence of a current and active market for these assets and liabilities

and reliable data regarding market rates for similar instruments.

42.1 Fair value of financial assets

The Bank measures fair values using the following fair value hierarchy that reflects the significance of the inputs used in

making the measurements:

Level 1: Fair value measurements using quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2: Fair value measurements using inputs other than quoted prices included within Level 1 that are observable for the

assets or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices).

Level 3: Fair value measurements using input for the asset or liability that are not based on observable market data (i.e.

unobservable inputs).

Format of Annual Financial Statements

The table below analyses financial instruments measured at the end of the reporting period by the level in the fair

value hierarchy into which the fair value measurement is categorised:

(Current Year)

Level 1 Level 2 Level 3 Total

On balance sheet financial instruments Rupees in '000

Financial assets - measured at fair value

Investments

Federal Government Securities xxxxxx xxxxxx xxxxxx xxxxxx

Provincial Government Securities xxxxxx xxxxxx xxxxxx xxxxxx

Shares xxxxxx xxxxxx xxxxxx xxxxxx

Non-Government Debt Securities xxxxxx xxxxxx xxxxxx xxxxxx

Foreign Securities xxxxxx xxxxxx xxxxxx xxxxxx

Others (to be specified) xxxxxx xxxxxx xxxxxx xxxxxx

Others (to be specified)

Financial assets - disclosed but not measured at fair value

Investments xxxxxx xxxxxx xxxxxx xxxxxx

Others (to be specified) xxxxxx xxxxxx xxxxxx xxxxxx

Off-balance sheet financial instruments - measured at fair value

Forward purchase of foreign exchange xxxxxx xxxxxx xxxxxx xxxxxx

Forward sale of foreign exchange xxxxxx xxxxxx xxxxxx xxxxxx

Forward agreements for lending xxxxxx xxxxxx xxxxxx xxxxxx

Forward agreements for borrowing xxxxxx xxxxxx xxxxxx xxxxxx

Derivatives purchases xxxxxx xxxxxx xxxxxx xxxxxx

Derivatives sales xxxxxx xxxxxx xxxxxx xxxxxx

(Prior Year)

Level 1 Level 2 Level 3 Total

On balance sheet financial instruments Rupees in '000

Financial assets - measured at fair value

Investments

Federal Government Securities xxxxxx xxxxxx xxxxxx xxxxxx

Provincial Government Securities xxxxxx xxxxxx xxxxxx xxxxxx

Shares xxxxxx xxxxxx xxxxxx xxxxxx

Non-Government Debt Securities xxxxxx xxxxxx xxxxxx xxxxxx

Foreign Securities xxxxxx xxxxxx xxxxxx xxxxxx

Others (to be specified) xxxxxx xxxxxx xxxxxx xxxxxx

Others (to be specified)

Financial assets - disclosed but not measured at fair value

Investments xxxxxx xxxxxx xxxxxx xxxxxx

Others (to be specified) xxxxxx xxxxxx xxxxxx xxxxxx

Off-balance sheet financial instruments - measured at fair value

Forward purchase of foreign exchange xxxxxx xxxxxx xxxxxx xxxxxx

Forward sale of foreign exchange xxxxxx xxxxxx xxxxxx xxxxxx

Forward agreements for lending xxxxxx xxxxxx xxxxxx xxxxxx

Forward agreements for borrowing xxxxxx xxxxxx xxxxxx xxxxxx

Derivatives purchases xxxxxx xxxxxx xxxxxx xxxxxx

Derivatives sales xxxxxx xxxxxx xxxxxx xxxxxx

Valuation techniques used in determination of fair valuation of financial instruments within level 2 and level 3

Item Valuation approach and input used

Format of Annual Financial Statements

43 SEGMENT INFORMATION

43.1 Segment Details with respect to Business Activities

Segment determination should be on the basis of management accountability and monitoring and should be

properly documented (based on the guidelines specified in IFRS)

Current Year

Segment 1 Segment 2 Segment 3 Segment 4 Segment 5 Total

Profit & Loss xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Net mark-up/return/profit xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Inter segment revenue - net xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Non mark-up / return / interest income xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total Income xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Segment direct expenses xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Inter segment expense allocation xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total expenses xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Provisions xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Profit before tax xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Balance Sheet Segment 1 Segment 2 Segment 3 Segment 4 Segment 5 Total

Cash & Bank balances xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Investments xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Net inter segment lending xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Lendings to financial institutions xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Advances - performing xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Advances - non-performing xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Others xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total Assets xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Borrowings xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Subordinated debt xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Deposits & other accounts xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Net inter segment borrowing xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Others xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total liabilities xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Equity xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total Equity & liabilities xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Contingencies & Commitments xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Prior Year

Segment 1 Segment 2 Segment 3 Segment 4 Segment 5 Total

Profit & Loss

Net mark-up/return/profit xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Inter segment revenue - net xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Non mark-up / return / interest income xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total Income xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Segment direct expenses xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Inter segment expense allocation xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total expenses xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Provisions xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Profit before tax xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Balance Sheet Segment 1 Segment 2 Segment 3 Segment 4 Segment 5 Total

Cash & Bank balances xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Investments xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Net inter segment lending xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Lendings to financial institutions xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Advances - performing xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Advances - non-performing xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Others xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total Assets xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Borrowings xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Subordinated debt xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Deposits & other accounts xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Net inter segment borrowing xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Others xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total liabilities xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Equity xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total Equity & liabilities xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Contingencies & Commitments xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Format of Annual Financial Statements

43.2 Segment details with respect to geographical locations

GEOGRAPHICAL SEGMENT ANALYSIS

(Current Year)

Segment 1 Segment 2 Segment 3 Segment 4 Segment 5 Total

Profit & Loss

Net mark-up/return/profit xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Inter segment revenue - net xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Non mark-up / return / interest income xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total Income xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Segment direct expenses xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Inter segment expense allocation xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total expenses xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Provisions xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Profit before tax xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Segment 1 Segment 2 Segment 3 Segment 4 Segment 5 Total

Balance Sheet

Cash & Bank balances xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Investments xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Net inter segment lendings xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Lendings to financial institutions xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Advances - performing xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Advances - non-performing xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Others xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total Assets xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Borrowings xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Subordinated debt xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Deposits & other accounts xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Net inter segment borrowing xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Others xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total liabilities xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Equity xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total Equity & liabilities xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Contingencies & Commitments xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

(Prior Year)

Segment 1 Segment 2 Segment 3 Segment 4 Segment 5 Total

Profit & Loss

Net mark-up/return/profit xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Inter segment revenue - net xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Non mark-up / return / interest income xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total Income xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Segment direct expenses xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Inter segment expense allocation xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total expenses xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Provisions xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Profit before tax xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Segment 1 Segment 2 Segment 3 Segment 4 Segment 5 Total

Balance Sheet

Cash & Bank balances xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Investments xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Net inter segment lendings xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Lendings to financial institutions xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Advances - performing xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Advances - non-performing xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Others xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total Assets xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Borrowings xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Subordinated debt xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Deposits & other accounts xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Net inter segment borrowing xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Others xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total liabilities xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Equity xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Total Equity & liabilities xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Contingencies & Commitments xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

44 TRUST ACTIVITIES

Banks commonly act as trustees and in other fiduciary capacities that result in the holding or placing of assets on

behalf of individuals, trusts, retirement benefit plans and other institutions. Provided the trustees or similar

relationship is legally supported, these assets are not assets of the bank and, therefore, are not included in its

balance sheet. If the bank is engaged in significant trust activities, disclosure of that fact and an indication of the

extent of those activities should be made in its financial statements because of the potential liability if it fails in its

fiduciary duties. For this purpose, trust activities do not encompass safe custody functions.

Format of Annual Financial Statements

45 RELATED PARTY TRANSACTIONS

The Bank has related party transactions with its parent, subsidiaries, associates, joint ventures, employee benefit plans and its directors and Key Management Personnel.

The Banks enters into transacitons with related paties in the ordinary course of business and on substantially the same terms as for comparable transactions with person of similar

standing. Contributions to and accruals in respect of staff retirement benefits and other benefit plans are made in accordance with the actuarial valuations / terms of the

contribution plan. Remuneration to the executives / officers is determined in accordance iwth the terms of their appointment.

Details of transacitons with related parties during the year, other than those which have been disclosed elsewhere in these financial statements are as follows:

(Current year) (Prior year)

Key Key

Other Other

Director manage- Subsidiarie Associate Joint Director manage- Subsidiarie Associate Joint

Parent related Parent related

s ment s s venture s ment s s venture

parties parties

personnel personnel

----------------------------------------------------------------------------------------------------- (Rupees in '000) -----------------------------------------------------------------------------------------------------

Balances with other banks

In current accounts XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

In deposit accounts XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Lendings to financial institutions

Opening balance XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Addition during the year XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Repaid during the year XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Transfer in / (out) - net XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Closing balance XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Investments

Opening balance XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Investment made during the year XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Investment redeemed / disposed off during the year XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Transfer in / (out) - net XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Closing balance XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Provision for diminution in value of investments XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Advances

Opening balance XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Addition during the year XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Repaid during the year XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Transfer in / (out) - net XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Closing balance XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Provision held against advances XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Format of Annual Financial Statements

(Current year) (Prior year)

Key Key

Other Other

Director manage- Subsidiarie Associate Joint Director manage- Subsidiarie Associate Joint

Parent related Parent related

s ment s s venture s ment s s venture

parties parties

personnel personnel

----------------------------------------------------------------------------------------------------- (Rupees in '000) -----------------------------------------------------------------------------------------------------

Other Assets

Interest / mark-up accrued XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Receivable from staff retirement fund XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Other receivable

(to be specified separately if > Rs 5 million) XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Provision against other assets XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Borrowings

Opening balance XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Borrowings during the year XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Settled during the year XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Transfer in / (out) - net XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Closing balance XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Subordinated debt

Opening balance XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Issued / Purchased during the year XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Redemption / Sold during the year XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Closing balance XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Deposits and other accounts

Opening balance XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Received during the year XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Withdrawn during the year XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Transfer in / (out) - net XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Closing balance XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Other Liabilities

Interest / mark-up payable XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Payable to staff retirement fund XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Other liabilities

(to be specified separately if > Rs 5 million) XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Contingencies and Commitments

Other contingencies XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Format of Annual Financial Statements

(Current Year) (Prior Year)

46 CAPITAL ADEQUACY, LEVERAGE RATIO & LIQUIDITY REQUIREMENTS Rupees in '000

Minimum Capital Requirement (MCR):

Paid-up capital (net of losses) xxxxxx xxxxxx

Capital Adequacy Ratio (CAR):

Eligible Common Equity Tier 1 (CET 1) Capital xxxxxx xxxxxx

Eligible Additional Tier 1 (ADT 1) Capital xxxxxx xxxxxx

Total Eligible Tier 1 Capital xxxxxx xxxxxx

Eligible Tier 2 Capital xxxxxx xxxxxx

Total Eligible Capital (Tier 1 + Tier 2) xxxxxx xxxxxx

Risk Weighted Assets (RWAs):

Credit Risk xxxxxx xxxxxx

Market Risk xxxxxx xxxxxx

Operational Risk xxxxxx xxxxxx

Total xxxxxx xxxxxx

Common Equity Tier 1 Capital Adequacy ratio xxxxxx xxxxxx

Tier 1 Capital Adequacy Ratio xxxxxx xxxxxx

Total Capital Adequacy Ratio xxxxxx xxxxxx

Banks should specify the capital requirements applicable to them including the minimum capital adequacy ratio

requirements.

Banks should also disclose the approach followed by them for determining credit risk, market risk and operational

risk exposures in the capital adequacy calculation.

Leverage Ratio (LR):

Eligiblle Tier-1 Capital xxxxxx xxxxxx

Total Exposures xxxxxx xxxxxx

Leverage Ratio xxxxxx xxxxxx

Liquidity Coverage Ratio (LCR):

Total High Quality Liquid Assets xxxxxx xxxxxx

Total Net Cash Outflow xxxxxx xxxxxx

Liquidity Coverage Ratio xxxxxx xxxxxx

Net Stable Funding Ratio (NSFR):

Total Available Stable Funding xxxxxx xxxxxx

Total Required Stable Funding xxxxxx xxxxxx

Net Stable Funding Ratio xxxxxx xxxxxx

46.1 The full disclsoures on the CAPITAL ADEQUACY, LEVERAGE RATIO & LIQUIDITY REQUIREMENTS as per SBP

instructions issued from time to time shall be placed on the website. The link to the full discloures shall be short and

clear and be provided within this note such as, The link to the full disclosure is avialable at http://

47 RISK MANAGEMENT

The principal risks associated with the banking business are credit risk, market risk, liquidity risk and operational

risk. The banks/DFIs should have comprehensive risk management framework in place for managing these risks

which is constantly evolving as the business activities change in response to credit, market, product and other

developments. The risk management should be guided by number of factors and principles including the formal

definition of risk management, governance, risk appetite, independent risk management and assessment and

measurement by tools like Earning at Risk (EaR), Value-at-Risk (VaR) methodologies with stress testing under

different economic scenarios and with diversification of risks.

All banks/DFIs are required to disclose all the steps taken to ensure identification of risks and compliance with

guiding factors and principles mentioned above. For this, the banks/DFIs are also required to refer to the

instructions given to them by SBP from time to time.

Format of Annual Financial Statements

In general, for each type of risk area mentioned above, banks / DFIs must describe their risk management objectives

and policies including :-

- Strategies and processes

- the structure and organization of the relevant risk management function

- the scope and nature of risk reporting and / or measurement systems

- policies for hedging and / or mitigating risk and strategies and processes for monitoring the

continuing effectiveness of hedges / mitigants

The disclosures are required to be made with respect to minimum of the following risks:-

47.1 Credit Risk

The disclosure to credit risk should include the amount that best represents its maximum credit risk exposure at the

balance sheet date with and without taking account of the fair value/forced sale value of any collateral, in the event

borrowers fail to perform their obligations. Further, disclosure should be made regarding the banks'/DFIs' credit risk

management objectives and policies. The banks/DFIs are required to disclose whether they are dependent on the

ratings of their portfolio by the external rating agencies or they have their own rating system. What type of mitigants are

used to control credit risks in various segments and business activities should also be disclosed.

Banks/DFIs are required to provide as much of the specific information listed below as possible in audited financial

statement in addition to the above:-

- The accounting policies and methods it uses to determine specific and general allowances, and explanation on key

assumptions (reference to notes relating to Advances, provisions etc )

- Qualitative information about the nature of credit risk in its activities and describe how credit risk arises in those

activities.

- Definition Techniques and methods used for managing past due and impaired assets

- Use of portfolio credit risk measurement models

- Views on the segment information disclosed

- Credit risk disclosures specified under Basel Accord including the specifications of credit ratings used to determine

the capital requirements in respect of credit risk and the mapping of such ratings to SBP grades.

- The effects of credit risk mitigation techniques, including collateral, guarantees, and legally enforceable netting

agreement (if any)

- Quantitative and qualitative information about its securitization activities and contractual obligations with respect to

recourse arrangements and the expected loses under those arrangements.

Particulars of bank's significant on-balance sheet and off-balance sheet credit risk in various sectors are analysed as

follows:

47.1.1 Lendings to financial institutions

Credit risk by public / private sector

Non-performing

Gross lendings Provision held

lendings

Current year Prior Year Current year Prior Year Current year Prior Year

Public/ Government xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Private xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

47.1.2 Investment in debt securities

Credit risk by industry sector Rs '000

Non-performing

Gross investments Provision held

investments

Current year Prior Year Current year Prior Year Current year Prior Year

Agriculture, Forestry, Hunting and Fishing xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Mining and Quarrying xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Textile xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Chemical and Pharmaceuticals xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Cement xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Sugar xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Footwear and Leather garments xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Automobile and transportation equipment xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Electronics and electrical appliances xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Construction xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Power (electricity), Gas, Water, Sanitary xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Wholesale and Retail Trade xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Exports/Imports xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Transport, Storage and Communication xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Financial xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Insurance xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Services xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Individuals xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Others xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Format of Annual Financial Statements

Non-performing

Gross investments Provision held

Credit risk by public / private sector investments

Current year Prior Year Current year Prior Year Current year Prior Year

Public/ Government xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Private xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

*

Industry sectors should be aggregated and reported based on the SBP Standard Industry Classification (SIC) codes.

** All segments where exposure is greater than 1% of total should be disclosed.

47.1.3 Advances

Credit risk by industry sector Rs '000

Non-performing

Gross advances Provision held

advances

Current year Prior Year Current year Prior Year Current year Prior Year

Agriculture, Forestry, Hunting and Fishing xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Mining and Quarrying xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Textile xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Chemical and Pharmaceuticals xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Cement xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Sugar xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Footwear and Leather garments xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Automobile and transportation equipment xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Electronics and electrical appliances xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Construction xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Power (electricity), Gas, Water, Sanitary xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Wholesale and Retail Trade xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Exports/Imports xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Transport, Storage and Communication xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Financial xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Insurance xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Services xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Individuals xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Others xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Credit risk by public / private sector Non-performing

Gross advances Provision held

advances

Current year Prior Year Current year Prior Year Current year Prior Year

Public/ Government xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

Private xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx xxxxxx

* Industry sectors should be aggregated and reported based on SBP SIC codes.

** All segments where exposure is greater than 1% of total should be disclosed.

47.1.4 Contingencies and Commitments

Amount in Rs '000

Credit risk by industry sector

Current

Prior Year

year

Agriculture, Forestry, Hunting and Fishing xxxxxx xxxxxx

Mining and Quarrying xxxxxx xxxxxx

Textile xxxxxx xxxxxx

Chemical and Pharmaceuticals xxxxxx xxxxxx

Cement xxxxxx xxxxxx

Sugar xxxxxx xxxxxx

Footwear and Leather garments xxxxxx xxxxxx

Automobile and transportation equipment xxxxxx xxxxxx

Electronics and electrical appliances xxxxxx xxxxxx

Construction xxxxxx xxxxxx

Power (electricity), Gas, Water, Sanitary xxxxxx xxxxxx

Wholesale and Retail Trade xxxxxx xxxxxx

Exports/Imports xxxxxx xxxxxx

Transport, Storage and Communication xxxxxx xxxxxx

Financial xxxxxx xxxxxx

Insurance xxxxxx xxxxxx

Services xxxxxx xxxxxx

Individuals xxxxxx xxxxxx

Others xxxxxx xxxxxx

xxxxxx xxxxxx

Format of Annual Financial Statements

Credit risk by public / private sector

Public/ Government xxxxxx xxxxxx

Private xxxxxx xxxxxx

xxxxxx xxxxxx

* Industry sectors should be aggregated and reported based on SBP SIC codes.

** All segments where exposure is greater than 1% of total should be disclosed.

47.1.5 Concentration of Advances

The bank top 10 exposures on the basis of total (funded and non-funded expsoures) aggregated to

Rs XXXX (prior year: XXXX) are as following:

(Current (Prior

Year) Year)

Rupees in '000

Funded xxxx xxxx

Non Funded xxxx xxxx

Total Exposure xxxxxx xxxxxx

The sanctioned limits against these top 10 expsoures aggregated to Rs XXXX (prior year: XXXX)

Total funded classified therein (Current Year) (Prior Year)

Provision Provision

Amount Amount

held held

OAEM xxxx xxxx xxxx xxxx

Substandard xxxx xxxx xxxx xxxx

Doubtful xxxx xxxx xxxx xxxx