Professional Documents

Culture Documents

Display of Cryptocurrency in Accounting

Display of Cryptocurrency in Accounting

Uploaded by

mustafa khanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Display of Cryptocurrency in Accounting

Display of Cryptocurrency in Accounting

Uploaded by

mustafa khanCopyright:

Available Formats

Makurin A. A.

Display of cryptocurrency in accounting

ISSN 2522-9273 (print)

ISSN 2616-5236 (online)

Economies’ Horizons,

No. 3(14), pp. 13–22.

DOI: https://doi.org/10.31499/2616-

Homepage: http://eh.udpu.edu.ua 5236.3(14).2020.224794

UDC: 657.222

Display of cryptocurrency in accounting

Andrii A. Makurin1, Cand. Ec. Sc., Associate Professor

Received: 28 July 2020 Makurin, A. A. (2020), “Display of cryptocurrency in accounting”, Economies’ Horizons,

Accepted: 7 September 2020 no. 3(14), pp. 13–22, doi: https://doi.org/10.31499/2616-5236.3(14).2020.224794

Abstract. The purpose of the research to determine the main features of the use of cryptocurrency

and its identification as an object in the account. A comparative description of cryptocurrencies, elec-

tronic money and paper money is given. It has been established that there are no grounds to classify

various types of cryptocurrencies in the accounting system as ordinary currencies or assets in a given

period of time because they: are not regulated by any jurisdictions; it is not possible to identify the issuer

or the specific organization responsible for its issuance; cryptocurrency exists only in the virtual Internet

environment. Methods. General scientific methods and approaches, systematic approach, general re-

search methods (analysis, synthesis, generalization, comparison), statistical methods. Results. The list

of stages for reflection of activity of the business entity with use of cryptocurrency is offered and con-

sidered. The mining process is analysed and the list of cost items for the extraction of new digital coins

is highlighted. The variant on reflection in the account of operations with cryptocurrency on accounts of

accounting is offered. There are options for reflection in the accounting of cryptocurrency depending on

its recognition: virtual goods, intangible assets, financial investments, digital money. To calculate the

cost of cryptocurrency obtained by self-extraction, it is necessary to consider the main costs that need to

be identified and reflected in the account. In addition to cryptocurrency, you can extract altcoins, light-

coins or convert cryptocurrencies into stablecoins, which cannot be extracted, but can only be purchased.

The article presents the main aspects of calculating the cost, which include: the cost of electricity for

individuals and legal entities in the country; the cost of the necessary equipment, its depreciation and

maintenance, depreciation; residual value at which you can sell old mining equipment; hash – the speed

of solving mathematical problems with one or another equipment; network load and production com-

plexity; monetary value or exchange rate of a particular cryptocurrency or digital assets. Practical mean-

ing. Despite all the scientific developments, the issue of accounting for cryptocurrency from the point

of view of IFRS is quite debatable. On the one hand, most propose to account for it as a specific intan-

gible asset. Virtual currency is a huge amount of computing power and digital assets. At this stage of

technological development of mankind, cryptocurrency is gaining a stable position in the international

market. Prospects for further research. Rapid development is causing further capacity growth and inter-

est, but may eventually lead to collapse. However, if the price stability of the cryptocurrency is achieved,

it can be used in international transactions, not just for speculative gain. However, this issue will be

directly related to the legalization of the new currency and its recognition by central banks as a means

of exchange or storage of money. There is a need for further research to understand the basic conditions

for the use of digital currency in the payments market.

1

Dnipro University of Technology; Associate Professor at the Department of Accounting; ORCID ID:

https://orcid.org/0000-0001-8093-736X; e-mail: makurin.a.a@nmu.one

Економічні горизонти № 3(14)'2020 http://eh.udpu.edu.ua 13

Economies’ Horizons ISSN 2522-9273; e-ISSN 2616-5236

Keywords: cryptocurrency accounting, accounting object, money, intangible assets, virtual goods,

information technology.

JEL Classification: J 48, M 41, P 17.

Number of references: 22; number of tables: 2; number of figures: 0; number of formulas: 0.

Відображення криптовалюти в бухгалтерському обліку

Андрій Андрійович Макурін1, к. е. н., доцент

Стаття надійшла: 28.07.2020 Makurin A. A. Display of cryptocurrency in accounting. Економічні горизонти.

Стаття прийнята: 09.09.2020 2020. № 3(14). C. 13–22. DOI: 10.31499/2616-5236.3(14).2020.224794

Анотація. Метою роботи є визначення основних особливостей з використання криптова-

люти та її ідентифікації як об’єкта в обліку. Надано порівняльну характеристику криптовалютам,

електронним грошовим коштам та паперовим грошам. Встановлено, що віднести криптовалюту

різних видів у обліковій системі до звичайних валют чи активів в даний проміжок часу не існує

підстав через те, що вони: не врегулюванні ніякими юрисдикціями; не можливо встановити емі-

тента чи конкретну організація, яка відповідає за її випуск; криптовалюта існує лише в віртуаль-

ному інтернет – середовищі. Методи. В ході дослідження використано загальнонаукові методи

та підходи, системний підхід, загальнологічні методи дослідження (аналіз, синтез, узагальнення,

порівняння), статистичні метод. Результати. Запропоновано та розглянуто перелік етапів для

відображення діяльності суб’єкта господарювання з використанням криптовалюти. Проаналізо-

вано процес майнингу та виокремлено перелік статей витрат для видобування нових монет циф-

рових коштів. Запропоновано варіант з відображення в обліку операцій з криптовалютою на ра-

хунках бухгалтерського обліку. Наведено варіанти відображення в обліку криптовалюти в зале-

жності від її визнання: віртуальним товаром, нематеріальним активом, фінансовою інвестицією,

цифровими грошима. Для розрахунку собівартості отриманої криптовалюти шляхом самостій-

ного видобутку необхідно розглянути основні витрати, які необхідно ідентифікувати та відобра-

зити в обліку. Крім криптовалюти, можна видобувати альткоїни, лайткоїни або переводити кри-

птовалюту у стейблкоїни, які не можливо видобути, а можна тільки придбати. У статті наведено

основні аспекти розрахунку собівартості до яких належать: вартість електроенергії для фізичних

та юридичних осіб в країні; вартість необхідного обладнання, його амортизація та обслугову-

вання, моральний знос; залишкова вартість за якою можна реалізувати старе обладнання для май-

нингу; хеш – швидкість вирішення математичних завдань тим чи іншим обладнанням; наванта-

ження мережі та складність видобутку; грошова цінність або курс конкретної криптовалюти або

цифрових активів. Практичне значення. Попри всі наукові доробки достатньо дискусійним є пи-

тання ведення обліку криптовалюти з токи зору МСФЗ. З одного боку більшість пропонує облі-

ковувати її як специфічний нематеріальний актив. Віртуальна валюта – це величезна кількість

обчислювальних потужностей та цифрових активів. На даному етапі технологічного розвитку

людства криптовалюта здобуває стійкі позиції на міжнародному ринку. Перспективи подальших

досліджень. Стрімкий розвиток визиває подальший приріст потужностей та зацікавленість, але

в кінцевому підсумку може призвести до краху. Втім, якщо цінова стабільність криптовалюти

буде досягнута, то її можна буде використовувати у міжнародних транзакціях, а не лише для

спекулятивної вигоди. Однак, це питання вже буде напряму пов’язано з легалізацією нової ва-

люти та її визнанням центральними банками як засобу обміну, або зберігання вартості грошей.

Існує потреба в подальших дослідженнях з метою розуміння основних умов використання циф-

рової валюти на ринку платежів.

1

Національний технічний університет «Дніпровська політехніка»; доцент кафедри обліку і аудиту;

ідентифікатор ORCID: https://orcid.org/0000-0001-8093-736X; e-mail: makurin.a.a@nmu.one

14 http://eh.udpu.edu.ua № 3(14)'2020 Економічні горизонти

Makurin A. A. Display of cryptocurrency in accounting

Ключові слова: криптовалютний облік, об’єкт обліку, гроші, нематеріальні активи,

віртуальні товари, інформаційні технології.

Кількість джерел: 22; кількість таблиць: 2; кількість рисунків: 0; кількість формул: 0.

1. Introduction. range from virtual currency, monetary surro-

The information technology develop- gate, virtual goods, and digital asset to the in-

ment results in the origin of new types of cryp- tangible asset. Basing on that, there are no le-

tocurrency. Main advantages of the cryptocur- gal grounds to recognize cryptocurrency as a

rency use are decentralization and freedom of payment instrument in Ukraine. Along with

transactions. Cryptocurrency acts worldwide that, it is not prohibited to convert cryptocur-

as the inexpensive technological means of pay- rency into the national currency and vice versa

ment as well as special form of investment. as such operations are not prohibited at the leg-

Nowadays, there is no shared idea as for islative level; thus, there is no violation of the

the interpretation of the “cryptocurrency” con- national legislation. Bitcoin-ATMs already

cept. On the one hand, it is considered as the function in the developed countries worldwide

“virtual currency” and called both a special but the no availability of the regulatory system

payment network and a new type of monetary does not allow the operation of electronic pay-

means. On the other hand, it is called a “digital ment system PayPal (cryptocurrency) in

asset”, which can be exchanged for other as- Ukraine (Rysin, Rysin and Fedyuk, 2018,

sets. Cryptocurrency is characterized by a free p. 12).

market rate formed on the demand-supply ba- Legalization of the cryptocurrency oper-

sis. ations requires a complex process of the deter-

Accounting of the traditional monetary mination of cryptocurrency status, a mecha-

means is performed in terms of the identifica- nism of its accounting, and the development of

tion of a payment instrument and participants a system for taxation and control of such oper-

of the agreement. Such a process may be rep- ations. There is the necessity to legalize cryp-

resented as follows: “seller – buyer” (agree- tocurrency and cryptocurrency operations in

ment) on the “money-goods” principle. That is order to legalize and impose taxes on the cryp-

the approach which helps conduct short-term tocurrency operations and mining process.

transactions in terms of similar location of the Basing on the fiscal law, legal entities that buy

counterparties. While using cryptocurrency, the equipment for virtual currency mining

which may be represented as a series of bytes should enter it in the books and put it into op-

of certain information, it is necessary to have eration.

electronic payment system acting as an inter- If a physical party (a sole proprietor) buy

mediary. Main task of such system is the ac- such equipment, he/she does not enter it in the

counting control providing non-admittance of books, only in case if the latter is in the 3rd

repeated set of bytes. Nowadays, there are sev- group of a simplified taxation system, it should

eral similar systems, which increase the risk of be kept in mind that the income is limited by

data and information fraud. Bitcoin (crypto- USD 178,000 (as of 01.06.2020) and costs for

currency) does not mean the involvement of its purchase should be confirmed within the

the third parties to conduct monetary opera- limits of the obtained income (Virtual Cur-

tions; thus, a blockchain system can be consid- rency Schemes, 2012).

ered rather safe. 2. Literature review.

During the recording of cryptocurrency R. Brukhansky and I. Spilnyk (2019b,

and operations with it, the accounting has cer- p. 145–156) try to identify and substantiate the

tain legal limitations as the legal status of such perspectives of solving the problem of digital

assets is different worldwide. It is within the assets integration in the accounting system and

Економічні горизонти № 3(14)'2020 http://eh.udpu.edu.ua 15

Economies’ Horizons ISSN 2522-9273; e-ISSN 2616-5236

financial data reporting. The authors focus on research, S. Ammous (2018) analyses mone-

the necessity of identification and giving cer- tary characteristics for five cryptocurrencies to

tain legal status for cryptocurrencies in terms estimate whether they could act as money. He

of certain legal environment. The research makes a conclusion that only bitcoin has the

states that the acceptance of cryptoassets by potential to act as the value storage owing to

accounting is rather a methodologically com- the facts that it is stick to low supply growth;

plicated but innovative and perspective prob- in addition, it is supported reliably by the dis-

lem requiring complex solution. In his re- tributed network protocol and significant

search, T. Yatsyk (2019, p. 28) represents a demonstration of nonavailability of any au-

comparative characteristic of such main users thority. R. Brukhanskyi and I. Spilnyk (2019a)

of the cryptocurrency market as miners, cryp- consider the essence of cryptocurrency for the

tocurrency emitters, online-exchangers, cryp- accounting purposes: money, their equivalent,

tocurrency exchange markets etc. Moreover, currency, goods, shares, financial investments

the paper analyses stages of the activities of or intangible assets. They conclude that it is re-

economic agents in the cryptocurrency market quired to apply a universal approach to the re-

to single out the cryptocurrency-related opera- cording of cryptoassets in accounting. O. Fo-

tions. It should be also noted that in the near mina et al. (2019) discuss different aspects of

future such standard assets as bonds will be- cryptocurrency recognition in Ukraine. They

come digital, which will make it possible to de- identify the necessity to clarify and harmonize

velop new decentralized business-models the available national accounting standards for

based on a blockchain model. A. Stovpova the determination and reporting during the

(2018) studies key features of tokens as cryp- cryptocurrency operations. Along with the de-

toassets, which differ from cryptocurrencies. velopment of information technology, there

She also considers the problems of recognition are certain changes not only in the technology

of bitcoin and other cryptocurrencies in ac- dealing with the payment transactions; attitude

counting. The author substantiates impossibil- of people to those operations changes as well

ity of using a universal approach to the ac- (Ievdokymov et al., 2020). Different genera-

counting of cryptocurrency due to its variety tions replace each other; we observe transfor-

and functional difference. In their analysis, mation of modern society. D. Procházka

T. Tarasova et al. (2020) use stochastic models (2018) proposes the scenarios, in terms of

to forecast a cryptocurrency exchange rate. which cryptocurrency should be considered as

The authors emphasize the necessity of repre- the (foreign) currency though the financial sys-

sentation of certain operations in cryptocur- tem regulators do not consider cryptocurren-

rency-related accounting; they propose to rec- cies as money (fiat currency). In their work,

ognize digital currency as digital assets. P. Katsiampa et al. (2019) study the interaction

M. Pashkevych et al. (2020) substantiate the between the the information demand measured

necessity of the implementation of a block- by the Google search index, price return, and

chain technology in accounting. They also volumes of trades for five basic cryptocurren-

specify certain risks of the cryptocurrency use cies. S. Pastrana and G. Suarez-Tangil (2019)

and consider the possibility for accounting to prove the illegal conduct of some cryptocur-

record digital assets in financial accounting rency operations. They also substantiate the

and financial data reporting. A. Jumde and possibility of their evening-out. G. Hong et al.

B. Cho (2020) study if cryptocurrency can (2018) state that cryptocurrency and its mining

draw ahead of fiat money with the help of an- is gaining more and more popularity. W. Yiy-

alytical hierarchy process (AHP) for elaborat- ing and Z. Yeze (2019) stress that cryptocur-

ing a scale of pair comparisons. The results rency is growing in its importance in the refor-

have shown that fiat money still prefer crypto- mation of a financial system due to its increas-

currency due to numerous reasons. In his ing popularity and loyalty. However, A. Baur

16 http://eh.udpu.edu.ua № 3(14)'2020 Економічні горизонти

Makurin A. A. Display of cryptocurrency in accounting

et al. (2015) proves that cryptocurrency is a de- 4. Research objectives.

structing instrument of payment. Nevertheless, The purpose is to specify basic parame-

H. Nabilou and A. Prüm (2019) are sure that ters for the identification of cryptocurrency as

soon cryptocurrencies will have considerable the accounting object with its further recording

effect on the banking, financial, and monetary in accounting and financial data reporting.

systems. 5. Results and discussions.

Despite the considerable interest of sci- From the accounting viewpoint, a prob-

entists in digital assets, a problem of crypto- lem of considering cryptocurrency as a pay-

currency determination as the accounting ob- ment instrument has not been analysed to the

ject is rather debating as it is not clear what it full extent. Currently, there are no grounds for

should be recognized as and where should it qualifying different-type cryptocurrencies in

belong to. Consequently, there arises the ne- the accounting as standard currencies or assets

cessity of studying the parameters of crypto- due to the following: they are not regulated by

currency as the accounting object. any jurisdictions; it is impossible to identify an

3. Methodology. emitter or a specific organization responsible

General scientific methods and ap- for their emission; cryptocurrency exists only

proaches, systematic approach, general re- in the virtual internet-medium.

search methods (analysis, synthesis, generali- Basic features peculiar for cryptocurren-

zation), statistical methods. cies and electronic monetary means are given

in Table 1.

Table 1. Comparison of monetary means, electronic money, and cryptocurrencies

Monetary

Parameter Electronic money Cryptocurrency

means

Format Paper Digital Digital

National About 1000

Payment unit Fiat money (USD, UAN, EUR, BYN, ARS)

currency cryptocurrencies

To identify clients, the standards developed by

the Financial Action Task Force on Money-

Passport

Identification of clients laundering (FATF) are used though the stand- Anonymity

data

ards admit the simplified measures for low-risk

financial instruments

Emission in the electronic form in Mining – equip-

State

Methods of emission exchange for fiat money emitted by the central ment and mathe-

institution

regulatory body matical methods

Based on the legal grounds, electronic money

National Private individual,

Emitter emitter (which may be represented by a finan-

banks miners

cial institution)

Book-keeping opera-

tions in terms of the ac- 301, 311 335 127, 301, 335, 35,

counts (Ukraine)

Source: Formed by the authors on the basis of (Jumde and Cho, 2020; Ammous, 2018).

There is a problematic aspect at the initial or electronic resources of currency conversion

stage; that is misunderstanding of the algo- (a peculiar kind of exchange market).

rithm of accounting representation of such op- Thus, anonymity and diversification are

erations as well as a mechanism of its taxation. the main cryptocurrency distinctions compar-

From the technical viewpoint, Ukrainian com- ing to electronic money. The emission method

panies may conduct the operations of crypto- means mining, owing to which new infor-

currency buy and sell, exchange, and payment mation blocks are created and main rewards

using free exchange rate on the Internet-sites for mathematical calculations of certain

Економічні горизонти № 3(14)'2020 http://eh.udpu.edu.ua 17

Economies’ Horizons ISSN 2522-9273; e-ISSN 2616-5236

cryptocurrencies are generated. Bitcoin has the Internet speed, powerful facilities, and electric

greatest market capitalization and, correspond- power. Certain method (ASIC or mining farm)

ingly, the greatest market share. Bitcoin is a should select one correct hashCode among the

peer-to-peer electronic payment system used millions of combinations, which will form the

in terms of the same-name exchange unit. block heading in the blockchain. As soon as

Maximum number of bitcoins, which can be the required number is generated, a block with

mined, is limited by 12 million units. all the transactions is closed, and miners move

Classification of such assets and their on to search for the next one. Miners are re-

further estimation has significant aftereffects warded for the correct hashCode; the reward is

not only for the reporting economic entity but 12.5 bitcoins (Fomina et al., 2019). The rental

also for the state economy in general (Prochá- of premises, heat elimination, and temperature

zka, 2018). control in the premises are the additional con-

According to the preliminary calculations, ditions of the successful equipment perfor-

the last Bitcoin may be mined in 2040. Since mance.

the Bitcoin cryptocurrency emission is limited, The second way is much simpler. That is

becoming more and more resource-intensive cryptocurrency purchase in the exchange mar-

with the course of time, it is quite common to ket for real monetary means. The third way re-

consider Bitcoin as “digital gold”, i.e. as a cer- lates to the Thash equipment rent – virtual

tain standard for other cryptocurrencies. Lead- ASICs on the Internet for certain sum of com-

ing role of Bitcoin is confirmed by statistic data pensation for the costs described in the first

concerning the cryptocurrency market func- way. The fourth way is a mine, i.e. a barter op-

tioning (Brukhanskyi and Spilnyk, 2019a). eration – exchange for some similar asset.

At the beginning of 2018, market capital- All that should be singled out for further

ization of cryptocurrencies reached its peak. accounting of the costs, formation of the cryp-

Cryptocurrencies cannot be neglected in terms tocurrency prime cost, and cryptocurrency rep-

of their involvement in a share of wealth of resentation in both financial and fiscal reports.

both a state and certain parties. Differences in Stage two involves cryptocurrency keep-

the approaches to cryptocurrency interpreta- ing in terms of certain media or virtual wallet.

tions are the main practical problem; later, Two variants are possible here – with and

those differences affect the accounting meth- without the private key transfer; the key is

ods, which influence considerably the finan- formed of 30 words in a virtual wallet or of 20

cial markets. Asymmetry of the information symbols on an information-carrying medium.

between the authorities and the interested par- In this case, form of control and a period, dur-

ties experience certain intensification with fur- ing which an enterprise or sole proprietor can

ther effect on the income control in terms of control such asset, is of great importance.

the lack of proper accounting regulation. Stage three means the cryptocurrency use

To understand better the creation of such in everyday life of enterprises and organiza-

an accounting object as cryptocurrency, it is tions (Сherchata and Andrusiv, 2018). Two

expedient to analyse a mining process with the objectives are possible here: the first one is to

singling out of certain calculation stages of use cryptocurrency for buying goods and ser-

costs and consideration of main stages, which vices; the second one is the investment (An-

form the activity of economic entities in the drusiv et al., 2020). There are also other vari-

cryptocurrency market. ants of cryptocurrency use, e.g. exchange for

Thus, stage one of the cryptocurrency monetary means, but the mentioned ones are

creation, i.e. its emission, is the accrual of the basic. Moreover, while investing, all the possi-

ownership rights. There are several ways to get ble risks should be considered. One cannot

cryptocurrency. The first way requires use of identify all the risks and protect oneself against

specific equipment for cryptocurrency mining, them.

18 http://eh.udpu.edu.ua № 3(14)'2020 Економічні горизонти

Makurin A. A. Display of cryptocurrency in accounting

For instance, prohibition of cryptocur- need to be identified and represented in

rency use in any country of the world may in- accounting. Apart from bitcoins, one can mine

fluence negatively its exchange, resulting in its altcoins and litecoins or transfer cryptocur-

further fluctuation; besides, electricity may be- rency into stablecoins, which are impossible to

come more expensive, making the mining in- mine – they can be only bought. Thus, to cal-

expedient. Miners start switching off the culate the cryptocurrency profitability, follow-

equipment; load of mining complexity will de- ing aspects should be taken into consideration

crease due to the lower number of network par- (Kneysler et al., 2020): cost of electric over for

ticipants; and cryptocurrency will either in- a physical party and legal entity in the country;

crease or reduce its cost. cost of the required equipment, its amortiza-

The accounting objects represented by tion, maintenance, and functional deprecia-

cryptocurrency are accompanied by the sub- tion; residual value in terms of which one can

jects of the cryptocurrency market. Tradition- sell the outdated mining equipment; hash – a

ally, they include salespeople, buyers, and speed of the solution of mathematical prob-

those who deal with mining of new coins. lems by certain equipment; network loading

The wallet owners specify cold and warm and mining complexity; monetary value or ex-

cryptocurrency keeping. Warm keeping in- change rate of a specific cryptocurrency or dig-

cludes such wallets as exchange market wal- ital assets.

lets, mobile applications, and software appli- Thus, cloud mining is profitable for

cations. Cold wallets involves paper ones those, who has just started the cryptocurrency

where a private key is represented by the fol- operations. For those, who have no possibility

lowing: a printable QR code; hardware keep- to invest money either in the equipment pur-

ing as a variety of USB flash disc; a computer, chase or in the cloud service renting, there are

but in case of system crash one can lose the services, which give certain Internet-sites that

wallet access for ever; a coin – developers cre- pay cryptocurrency for watching the advertise-

ate real coins, which code a private key for dig- ments. Relying on that, accounting may record

ital money. To calculate the prime cost of the the operations of the parties, which have de-

cryptocurrency obtained by independent min- cided to start “cryptocurrency mining” (Table

ing, it is necessary to consider main costs that 2).

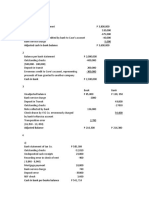

Table 2. Accounting of the cryptocurrency operations

Total sum,

No. Content of the operation Debit Credit

USD

152 209 279

1 ASIC installation (power source and processor) or ASIC purchase

152 631 279

2 Debiting of tax credit with VAT 644 631 46

3 ASIC putting into operation 104 152 325

4 Purchase of the software for ASIC 154 631 107

5 Debiting of tax credit with VAT 644 154 17.8

6 Putting into operation of the software (“firmware upgrade” – software) 127 154 90

Calculations for the services (mining – acc. 977)

92

7 Electric power 631 61

(977)

8 Premises lending 01 428

Rent payment is recalculated, in advance 371 311 36

9 Payment for the Internet 92

631 3.6

(977)

92

10 Remuneration settlements (for ASIC maintenance) 661 286

(977)

92

11 National social insurance settlements 651 62.8

(977)

Source: Generalized by the author.

Економічні горизонти № 3(14)'2020 http://eh.udpu.edu.ua 19

Economies’ Horizons ISSN 2522-9273; e-ISSN 2616-5236

Correct legal interpretation and recogni- your digital wallet. The amount of cryptocur-

tion are the basic problems for the cryptocur- rency affects the calculation of monetary ag-

rency recording in accounting. Due to that, in gregates in a country. Such a specific activity

case of cryptocurrency recognition as a digital as mining allows the state to receive additional

currency, it is proposed to use synthetic ac- revenues from the taxation of such activities.

count 336 “Other means of digital currency” At the social level, humanity is con-

(virtual wallet); in case of cryptocurrency stantly striving for self-development. Crypto-

recognition as a variety of electronic money, it currency is a future form of cash that can be

is proposed to use synthetic sub-ledger account easily and safely used in everyday life. It does

335.1 “Variety of electronic money”; if cryp- not depend on the bank or a country, you can

tocurrency is recognized as virtual goods, then not worry, however, that will not be a country

one should use synthetic sub-ledger account – will not be such money that if the bank goes

287 “Virtual goods”; if cryptocurrency is rec- bankrupt, it will remain guilty of deposits to

ognized as a financial investment, then one certain individuals. The main thing here is that

should use synthetic sub-ledger account 352 countries develop a mechanism for recogniz-

“Other current financial investments”; if one ing and controlling such assets. For example,

recognizes cryptocurrency as an intangible as- most of the US population trusts cryptocur-

set, then it is recommended to use synthetic rency, because after President Donald Trump’s

sub-ledger account 127 “Other intangible as- order to pay a certain amount of $ 1,200 per

sets”. person to support a pandemic, many individu-

6. Conclusions. als were registered on the Coinbase cryptocur-

Given the above, we can conclude that rency exchange people who started buying

given the economic derivative of cryptocur- cryptocurrency in the amount equivalent to

rency, it can affect the economic and social $ 1,000. That is, people try to keep their assets

components of any country. The European Un- in such a digital format.

ion's sustainable development strategy aims to Thus, a virtual currency is a huge amount

develop the information component. Crypto- of computing power and digital assets. At this

currency is a hub that influences the develop- stage of technological development of man-

ment of telecommunications, digital economy, kind, cryptocurrency is gaining a stable posi-

e-business and commerce. It can motivate tion in the international market. Rapid devel-

countries around the world to develop all areas opment is causing further capacity growth and

of activity for the control of such a specific as- interest but may eventually lead to collapse.

set. However, if the price stability of the cryptocur-

At the economic level, cryptocurrency rency is achieved, it can be used in interna-

affects the way certain transactions are carried tional transactions, not just for speculative

out. In the future, if it can be recognized inter- gain. However, this issue will be directly re-

nationally and locally, it will displace paper lated to the legalization of the new currency

money and electronic money, as it is com- and its recognition by central banks as a means

pletely protected from counterfeiting. Under of exchange or storage of money. There is a

coronavirus, most bacteria exist on the surface need for further research to understand the

of paper money, so people use an electronic basic conditions for the use of digital currency

payment format or cryptocurrency. You can in the payments market.

pay with cryptocurrency using a QR code in

References

Ammous, S. (2018), “Can cryptocurrencies fulfil the functions of money?”, Quarterly Review of Economics

and Finance, vol. 70, pp. 38–51, doi: https://doi.org/10.1016/j.qref.2018.05.010

20 http://eh.udpu.edu.ua № 3(14)'2020 Економічні горизонти

Makurin A. A. Display of cryptocurrency in accounting

Andrusiv, U., Kinash, I., Cherchata, A., Polyanska, A., Dzoba, O., Tarasova, T. and Lysak, H. (2020), “Ex-

perience and prospects of innovation development venture capital financing”, Management Science

Letters, vol. 10, pp. 781–788. doi: https://doi.org/10.5267/j.msl.2019.10.019

Baur, A. W., Bühler, J., Bick, M. and Bonorden, C. S. (2015), “Cryptocurrencies as a disruption? Empirical

findings on user adoption and future potential of bitcoin and Co”, In: Janssen M. et al. (eds), Open and

Big Data Management and Innovation, I3E 2015. Lecture Notes in Computer Science, vol. 9373,

Springer, Cham, Switzerland, https://doi.org/10.1007/978-3-319-25013-7_6

Brukhanskyi, R. and Spilnyk, I. (2019a), “Cryptographic objects in the accounting system”, 9th International

Conference on Advanced Computer Information Technologies, ACIT 2019 – Proceedings, Ceske

Budejovice, Czech Republic, pp. 384–387, doi: https://doi.org/10.1109/ACITT.2019.8780073

Brukhanskyi, R. F. and Spilnyk, I. V. (2019b), “Crypto assets in the system of accounting and reporting”,

The Problems of Economy, no. 2(40), pp. 145–156, doi: https://doi.org/10.32983/2222-0712-2019-2-

145-156

Cherchata, А. and Andrusiv, U. (2018), “Reengineering of business-processes of enterprise as an instrument

of their improvement and development”, Problems of modern science: Collection of scientific articles,

Namur, Belgium, pp. 59–63.

Fomina, O., Moshkovska, O., Avhustova, O., Romashko, O. and Holovina, D. (2019), “Current aspects of

the cryptocurrency recognition in Ukraine”, Banks and Bank Systems, vol. 14, no. 2, pp. 203–213, doi:

https://doi.org/10.21511/bbs.14(2).2019.18

Hong, G., Yang, Z., Yang, S., Zhang, L., Nan, Y., Zhang, Z., Yang, M., Zhang, Y., Qian, Z. and Duan, H.

(2018), “How you get shot in the back: A systematical study about cryptojacking in the real world”,

Proceedings of the 2018 ACM SIGSAC Conference on Computer and Communications Security, To-

ronto, Canada, pp. 1701–1713, doi: https://doi.org/10.1145/3243734.3243840

Ievdokymov, V., Lehenchuk, S., Zakharov, D., Andrusiv, U., Usatenko, O. and Kovalenko, L. (2020), “So-

cial capital measurement based on “The value explorer” method”, Management Science Letters,

vol. 10, pp. 1161–1168, doi: https://doi.org/10.5267/j.msl.2019.12.002

Jumde, A. and Cho, B. Y. (2020), “Can cryptocurrencies overtake the fiat money?”, International Journal of

Business Performance Management, vol. 21, no. 1/2, pp. 6–20, doi:

https://doi.org/10.1504/IJBPM.2020.106107

Katsiampa, P., Moutsianas, K. and Urquhart, A. (2019), “Information demand and cryptocurrency market

activity”, Economics Letters, vol. 185, doi: https://doi.org/10.1016/j.econlet.2019.108714

Kneysler, O., Andrusiv, U., Spasiv, N., Marynchak, L. and Kryvytska, O. (2020), “Construction of economic

models of ensuring Ukraine’s energy resources economy”, 10th International Conference on Advanced

Computer Information Technologies, ACIT 2020 – Proceedings, Deggendorf, Germany, pp. 651–656,

doi: https://doi.org/10.1109/ACIT49673.2020.9208813

Nabilou, H. and Prüm, A. (2019), “Ignorance, debt, and cryptocurrencies: The old and the new in the law

and economics of concurrent currencies”, Journal of Financial Regulation, vol. 5, no. 1, pp. 29–63,

doi: https://doi.org/10.1093/jfr/fjz002

Pashkevych, M., Bondarenko, L., Makurin, A., Saukh, I. and Toporkova, O. (2020), “Blockchain technology

as an organization of accounting and management in a modern enterprise”, International Journal of

Management, vol. 11, no. 6, pp. 516–528, doi: https://doi.org/10.34218/IJM.11.6.2020.045

Pastrana, S. and Suarez-Tangil, G. (2019), “A first look at the crypto-mining malware ecosystem: A decade

of unrestricted wealth”, IMC'19: ACM Internet Measurement Conference, Amsterdam, Netherlands,

pp. 73–86, doi: https://doi.org/10.1145/3355369.3355576

Procházka, D. (2018), “Accounting for bitcoin and other cryptocurrencies under IFRS: A comparison and

assessment of competing models”, International Journal of Digital Accounting Research, vol. 18,

pp. 161–188, doi: https://doi.org/10.4192/1577-8517-v18_7

Rysin, V., Rysin, M. and Fedyuk, I. (2018), “Legal status of cryptocurrency as a financial instrument”, Efek-

tyvna ekonomika, [Online], vol. 11, available at: http://www.economy.nayka.com.ua/?op=1&z=6647

(Accessed 14 July 2021), doi: https://doi.org/10.32702/2307-2105-2018.11.7

Stovpova, A. (2018), “Classification of electronic money for accounting purposes”, Investytsiyi: praktyka ta

dosvid, vol. 14, pp. 60–64.

Економічні горизонти № 3(14)'2020 http://eh.udpu.edu.ua 21

Economies’ Horizons ISSN 2522-9273; e-ISSN 2616-5236

Tarasova, T., Usatenko, O., Makurin, A., Ivanenko, V. and Cherchata, A. (2020), “Accounting and features

of mathematical modeling of the system to forecast cryptocurrency exchange rate”, Accounting, no. 6,

pp. 357–364, doi: https://doi.org/10.5267/j.ac.2020.1.003

Virtual Currency Schemes (2012), “European Central Bank”, available at: http://www.ecb.eu-

ropa.eu/pub/pdf/other/virtualcurrencyschemes201210en.pdf (Accessed 14 July 2021)

Yatsyk, T. (2019), “Concept of crypto-assets in the financial accounting system”, Young Scientist, no. 2(66),

pp. 295–298, doi: https://doi.org/10.32839/2304-5809/2019-2-66-64

Yiying, W. and Yeze, Z. (2019), “Cryptocurrency price analysis with artificial intelligence”, 5th Interna-

tional Conference on Information Management (ICIM), Cambridge, United Kingdom, pp. 97–101, doi:

https://doi.org/10.1109/INFOMAN.2019.8714700

Цей твір ліцензовано на умовах Ліцензії Creative Commons «Із Зазначенням Авторства

— Некомерційна 4.0 Міжнародна» (CC BY-NC 4.0).

This is an open access journal and all published articles are licensed under a Creative

Commons “Attribution-NonCommercial 4.0 International” (CC BY-NC 4.0).

22 http://eh.udpu.edu.ua № 3(14)'2020 Економічні горизонти

You might also like

- Benefit Verification Letter: Social Security AdministrationDocument2 pagesBenefit Verification Letter: Social Security AdministrationPeter MouldenNo ratings yet

- J 7 IJAL 2019 1 Kkartikeya14 Gmailcom 20200509 000011Document14 pagesJ 7 IJAL 2019 1 Kkartikeya14 Gmailcom 20200509 000011kumar kartikeyaNo ratings yet

- 1227179.martinevi - Indecs2022 pp640 661Document22 pages1227179.martinevi - Indecs2022 pp640 661mingzkyeNo ratings yet

- Cryptocurrency Advantages and DisadvantagesDocument6 pagesCryptocurrency Advantages and DisadvantagesResearch Park100% (1)

- Indecs2022 pp640 661Document22 pagesIndecs2022 pp640 661Santi Azmi MursalinaNo ratings yet

- Digital Currency: The Future of MoneyDocument12 pagesDigital Currency: The Future of MoneyResearch ParkNo ratings yet

- Engaging The Digital Generation Through Analyzing and Understanding The Growth and Importance of CryptocurrencyDocument13 pagesEngaging The Digital Generation Through Analyzing and Understanding The Growth and Importance of CryptocurrencyInternational Journal of Academic and Practical ResearchNo ratings yet

- The Crypto Effect On Cross Border Transfers and Future Trends of CryptocurrenciesDocument12 pagesThe Crypto Effect On Cross Border Transfers and Future Trends of CryptocurrenciesKasia AdamskaNo ratings yet

- Cryptocurrency Adoption in Travel and TourismDocument18 pagesCryptocurrency Adoption in Travel and Tourism7MSG2 KINGFEBNo ratings yet

- CRYPTDocument8 pagesCRYPTarvsev3103No ratings yet

- Ms151 Research Paper 2Document5 pagesMs151 Research Paper 2mustafa khanNo ratings yet

- Cryptocurrency The Present and The Future ScenarioDocument16 pagesCryptocurrency The Present and The Future ScenarioIJRASETPublicationsNo ratings yet

- Fin Irjmets1658035589Document8 pagesFin Irjmets1658035589Mohd waseemNo ratings yet

- A Novel Cryptocurrency Price Prediction Model Using GRU, LSTM and bi-LSTM Machine Learning AlgorithmsDocument20 pagesA Novel Cryptocurrency Price Prediction Model Using GRU, LSTM and bi-LSTM Machine Learning Algorithmsjaya prakash KoduruNo ratings yet

- Ijbta V1N2 6Document8 pagesIjbta V1N2 6Ridmi KaveeshaNo ratings yet

- Prospects of Cryptocurrencies in BangladeshDocument9 pagesProspects of Cryptocurrencies in BangladeshOld PagesNo ratings yet

- Cryptocurrency in IndiaDocument23 pagesCryptocurrency in IndiaRASHI SETHI-IB0% (1)

- The Economicsof Cryptocurrencies 2Document17 pagesThe Economicsof Cryptocurrencies 2chastomsNo ratings yet

- Implementation and Analysis of CryptocurrencyDocument7 pagesImplementation and Analysis of CryptocurrencyIJRASETPublicationsNo ratings yet

- Cryptocurrencies Market AnalysisDocument18 pagesCryptocurrencies Market AnalysisSana BraiekNo ratings yet

- Can The Market of Cryptocurrency Be Followed With The Technical AnalysispdfDocument23 pagesCan The Market of Cryptocurrency Be Followed With The Technical AnalysispdfIJRASETPublicationsNo ratings yet

- CRYPTO - Research Contributions and Challenges in DLT-based Cryptocurrency Regulation - A Systematic Mapping StudyDocument20 pagesCRYPTO - Research Contributions and Challenges in DLT-based Cryptocurrency Regulation - A Systematic Mapping StudyDebarshi GhoshNo ratings yet

- Prediction of The Price of Ethereum Blockchain CryptocurrencyDocument12 pagesPrediction of The Price of Ethereum Blockchain CryptocurrencyGustavo SandovalNo ratings yet

- Impact of Blockchain in Banking IndustryDocument75 pagesImpact of Blockchain in Banking Industryqamar shahNo ratings yet

- Cryptocurrencies: The Revolution in The World Finance: Sanjeev Kumar Joshi, Nitesh Khatiwada, Jyoti GiriDocument12 pagesCryptocurrencies: The Revolution in The World Finance: Sanjeev Kumar Joshi, Nitesh Khatiwada, Jyoti GirimaryamNo ratings yet

- Journal Homepage: - : IntroductionDocument7 pagesJournal Homepage: - : IntroductionIJAR JOURNALNo ratings yet

- Cryptocurrency: The Economics of Money and Selected Policy IssuesDocument31 pagesCryptocurrency: The Economics of Money and Selected Policy IssuesAKHIL H KRISHNANNo ratings yet

- Analysis of Cryptocurrency, People and FutureDocument7 pagesAnalysis of Cryptocurrency, People and FutureIJRASETPublicationsNo ratings yet

- Economies 08 00041 v2Document27 pagesEconomies 08 00041 v2DonaldNo ratings yet

- Economies 08 000412Document28 pagesEconomies 08 000412Keamogetse MotlogeloaNo ratings yet

- Digital Currency Research PaperDocument6 pagesDigital Currency Research Paperefjr9yx3100% (1)

- An Analysis of CryptocurrencyDocument5 pagesAn Analysis of CryptocurrencyJAVED PATELNo ratings yet

- Cryptocurrencies: Economic Benefits and RisksDocument56 pagesCryptocurrencies: Economic Benefits and RiskssharkieNo ratings yet

- Giudici2020 Article CryptocurrenciesMarketAnalysisDocument18 pagesGiudici2020 Article CryptocurrenciesMarketAnalysisGeysa Pratama EriatNo ratings yet

- Blockchain Technology As An OrganizationDocument13 pagesBlockchain Technology As An Organizationlakhdimi abdelhamidNo ratings yet

- Cryptocurrency and Prospects of Its Development: Ecoforum May 2019Document5 pagesCryptocurrency and Prospects of Its Development: Ecoforum May 2019bao.pham04No ratings yet

- Cryptocurrencies: The Revolution in The World Finance: Sanjeev Kumar Joshi, Nitesh Khatiwada, Jyoti GiriDocument9 pagesCryptocurrencies: The Revolution in The World Finance: Sanjeev Kumar Joshi, Nitesh Khatiwada, Jyoti GirimaryamNo ratings yet

- Cryptocurrency - Are We Ready To Demonetize The World?: AcknowledgementDocument15 pagesCryptocurrency - Are We Ready To Demonetize The World?: AcknowledgementPrarthana SahaNo ratings yet

- Sumc 14 Vetrichelvi+s 7 1191Document9 pagesSumc 14 Vetrichelvi+s 7 1191ruchna dabyNo ratings yet

- Rushil Chavan Project Report The Leading SolutionDocument29 pagesRushil Chavan Project Report The Leading SolutionrastehertaNo ratings yet

- 2023.02 Forecasting Cryptocurrency Prices Using LSTM, GRU, and Bi-Directional LSTMDocument18 pages2023.02 Forecasting Cryptocurrency Prices Using LSTM, GRU, and Bi-Directional LSTMsx9ttnpq9sNo ratings yet

- Gmup5014 Legal Research Methodology (Wong Shi Wei Assignment 2)Document25 pagesGmup5014 Legal Research Methodology (Wong Shi Wei Assignment 2)Wong Shi Wei SamNo ratings yet

- A Study On Cryptocurrency in IndiaDocument6 pagesA Study On Cryptocurrency in IndiaShobanaNo ratings yet

- Study On Awareness and Attitude Towards Cryptocurrency Among Management Students of PNCDocument40 pagesStudy On Awareness and Attitude Towards Cryptocurrency Among Management Students of PNCparaspoudel07No ratings yet

- 1 PBDocument13 pages1 PBKurcu BenNo ratings yet

- Cryptocurrency Market Movement and Tendency Forecasting Using Twitter Emotion and Information QuantityDocument8 pagesCryptocurrency Market Movement and Tendency Forecasting Using Twitter Emotion and Information QuantityEditor IJTSRDNo ratings yet

- Whitepaper: 2019 © ECOMTOKENDocument24 pagesWhitepaper: 2019 © ECOMTOKENHasanNo ratings yet

- 17679-Article Text-62812-1-10-20200928Document14 pages17679-Article Text-62812-1-10-20200928haymanotandualem2015No ratings yet

- Cryptocurrencies and Initial Coin Offerings (ICOs) - ACCA GlobalDocument8 pagesCryptocurrencies and Initial Coin Offerings (ICOs) - ACCA GlobalaisyahNo ratings yet

- Crossover To Crypto Currency Using E-RUPIDocument8 pagesCrossover To Crypto Currency Using E-RUPIIJRASETPublicationsNo ratings yet

- Assignment 8Document4 pagesAssignment 8Alberto Jr. AguirreNo ratings yet

- Cryptocurrency FDocument23 pagesCryptocurrency Fkaka kynNo ratings yet

- Nissan Project - 1Document53 pagesNissan Project - 1Kingshuk brahmacharyNo ratings yet

- The World Practice and Cryptocurrencies: Yaneva Mariya, PHD StudentDocument4 pagesThe World Practice and Cryptocurrencies: Yaneva Mariya, PHD StudentkimberlyNo ratings yet

- Cryptocurrency 570Document36 pagesCryptocurrency 570Penumarthi Sri HarshiniNo ratings yet

- The Importance of Financial Literacy For Cryptocurrency InvestorsDocument21 pagesThe Importance of Financial Literacy For Cryptocurrency InvestorsRidmi KaveeshaNo ratings yet

- Shsconf Icdeba2023 02016Document5 pagesShsconf Icdeba2023 02016vcheck2024No ratings yet

- E-Money and How It Can Influence The World Finance MarketDocument15 pagesE-Money and How It Can Influence The World Finance MarketSamrat SinghNo ratings yet

- I SwastikYadav 153 CryptocurrencyDocument5 pagesI SwastikYadav 153 CryptocurrencySwastik YadavNo ratings yet

- Bitcoin, Blockchain, and Fintech: A Systematic Review and Case Studies in The Supply ChainDocument54 pagesBitcoin, Blockchain, and Fintech: A Systematic Review and Case Studies in The Supply ChainsymopNo ratings yet

- Revised AMFI GuidlinesDocument5 pagesRevised AMFI GuidlinesPreparation StudioNo ratings yet

- 2013 Taxation Bar QuestionsDocument7 pages2013 Taxation Bar QuestionsJocelyn HerreraNo ratings yet

- Income Statement of Apple IncDocument6 pagesIncome Statement of Apple IncBharat PanthiNo ratings yet

- Rental AgreementDocument4 pagesRental Agreementraghavan1948No ratings yet

- Life Insurance Corporation of India: (To Be Mentioned After Issuance of Policy)Document2 pagesLife Insurance Corporation of India: (To Be Mentioned After Issuance of Policy)Priyanka SihagNo ratings yet

- Jobs Dated 031118Document5 pagesJobs Dated 031118api-244053115No ratings yet

- Chapter 1Document29 pagesChapter 1Motiram paudelNo ratings yet

- Case Studies Assignment QuestionsDocument3 pagesCase Studies Assignment QuestionsMbongeni ShongweNo ratings yet

- Ranking de Competitividad PerúDocument2 pagesRanking de Competitividad PerúCarlos Alexander Espinoza HNo ratings yet

- Financial Statement Analysis From Indian Spinal Injuries CentreDocument63 pagesFinancial Statement Analysis From Indian Spinal Injuries CentreshagunNo ratings yet

- LEC03D BSA 2102 012021-Government GrantsDocument2 pagesLEC03D BSA 2102 012021-Government GrantsKatarame LermanNo ratings yet

- 2019 KBCM Saas Survey 102319Document69 pages2019 KBCM Saas Survey 102319Mahasewa IdNo ratings yet

- Win22 Pill2 Budget Taxation HDT MrunalDocument43 pagesWin22 Pill2 Budget Taxation HDT MrunalSmart BoyzNo ratings yet

- Prospectus 2016 07 19Document199 pagesProspectus 2016 07 19Nicolas GrossNo ratings yet

- Pawnshop 2Document15 pagesPawnshop 2Clarissa Espejo De GuzmanNo ratings yet

- Assignment No. 2 (Solution)Document5 pagesAssignment No. 2 (Solution)Christine MalayoNo ratings yet

- DIP Financing Strategies For Distressed CompaniesDocument9 pagesDIP Financing Strategies For Distressed CompaniesThiago CâmaraNo ratings yet

- CHAPTER 17 INVESTMENTS ExercisesDocument14 pagesCHAPTER 17 INVESTMENTS ExercisesAila Marie MovillaNo ratings yet

- IDirect Zomato IPOReviewDocument13 pagesIDirect Zomato IPOReviewSnehashree SahooNo ratings yet

- Effects of Bonus Share On Market Price of A CompanyDocument23 pagesEffects of Bonus Share On Market Price of A CompanyShoray TandonNo ratings yet

- InfrastructureDocument40 pagesInfrastructurenanayikNo ratings yet

- Reading Material and ActivitiesDocument2 pagesReading Material and ActivitiesErlyn Joyce CerillaNo ratings yet

- Bankruptcy of Natural Persons: Emmanuel Otieno OumaDocument23 pagesBankruptcy of Natural Persons: Emmanuel Otieno OumaALEXANDER MUTINDA100% (1)

- The Open Economy Revisited & The Mundell-Fleming Model and The Exchange-Rate RegimeDocument45 pagesThe Open Economy Revisited & The Mundell-Fleming Model and The Exchange-Rate RegimeAditya SinghNo ratings yet

- (Financial Accounting & Reporting 1B) : Lecture AidDocument27 pages(Financial Accounting & Reporting 1B) : Lecture AidShe RCNo ratings yet

- Case Analysis For Midterms (Acctg 202)Document6 pagesCase Analysis For Midterms (Acctg 202)Johnsen YamasNo ratings yet

- The Role of Accounting in Small and Medium-Sized Enterprises (Smes)Document8 pagesThe Role of Accounting in Small and Medium-Sized Enterprises (Smes)abel asratNo ratings yet

- Bonds and DerivativesDocument149 pagesBonds and DerivativesLinh LinhNo ratings yet

- 03a TVM QuestionsDocument2 pages03a TVM QuestionsSaad ZamanNo ratings yet