Professional Documents

Culture Documents

PERITO, Paul Bryan F - CASE STUDY

Uploaded by

Paul Bryan PeritoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PERITO, Paul Bryan F - CASE STUDY

Uploaded by

Paul Bryan PeritoCopyright:

Available Formats

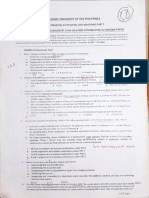

Paul Bryan F.

Perito

BSBA-HRDM 4A

1. Evaluate the effectiveness of the “two-strikes” policy in ensuring greater board

accountability in Australia. How has shareholder activism influenced the behavior of

Cabcharge’s management?

- The two-strikes policy provides a framework once the company suffers from no votes

received from the renumeration report. This improves the accountability and

transparency of executive compensation frameworks and gives shareholders more

power over the pay of company directors. From the case provided shareholder activism

influenced the behavior of Cabcharges management in a way that it helps the company

to see situation about the transparency of votes from the shareholder since the

company seeking for change in their company policy on renumeration. Shareholders

take this action based on their rights as owners. It is mostly employed to rectify a

corporation's blunder or cause a crucial transformation of corporate guidelines.

2. What was the remuneration mix and level of each key management personnel in 2014?

How were they determined by the Board? How did it align management’s interests and

shareholders’ interests as set out in the CGPR?

- 2014 brought focus on Cabcharge's employee compensation practices. The structure of

compensation for important management people, including the CEO and top executives, as

well as the board's decision-making process, were both examined. Fixed pay, short-term

incentives, and long-term incentives made up the compensation package. To comprehend

the significance of management employees, it was critical to recognize their roles and

contributions. The board made decisions about employee compensation by considering

things like individual and business performance. To preserve compliance and openness,

they also made sure that their strategy was in line with Corporate Governance Principles

and Recommendations (CGPR). With a focus on performance-based components, the

examination also considered the harmony between management's interests and those of

shareholders. To make decisions about compensation, past trends and shareholder

comments were analyzed.

3. Do you feel that Kermode’s compensation package was reasonable? In companies where a

director is a controlling shareholder, what measures should be in place to prevent him from

paying himself excessively? Evaluate the effectiveness of the measures implemented by

Cabcharge.

- The CEO of Cabcharge, Reginald Kermode, is the subject of criticism regarding his

disputed salary package. Shareholders were unhappy with their fixed annual pay (FAR)

of A$2–3 million because they thought it was expensive and lacked performance-based

elements. An independent pay committee, open disclosure, and shareholder approval

are critical when evaluating measures to evaluate director compensation in

organizations with controlling shareholders. Cabcharge implemented the "two-strikes"

rule, restructured the compensation with a long-term incentive plan (LTIP), and

strengthened governance through role separations in response to shareholder

dissatisfaction. Analysis of Kermode's compensation's reasonableness, the success of

implemented measures in preventing excessive pay for controlling shareholders,

ongoing governance issues, the effect of shareholder activism, the long-term viability of

changes, and lessons for other businesses in addressing comparable issues are all

encouraged by discussion questions.

4. Accounting firms provide a variety of services for companies. Are there any potential

conflicts of interest arising from the provision of such services? If so, what are the measures

that can be put in place to avoid such conflicts of interest?

- The implicit conflicts of interest in account enterprises center on businesses like inspection

independence, where providing both inspection and non-audit services to the same client

may jeopardize adjudicators' objectivity and jeopardize the veracity of financial statements.

Conflicts can arise from consulting services, especially when the advice is directly related to

financial reporting or commercial governance, as in the case of administrative

compensation. Figure dependency occurs when a business is overly reliant on one account

establishment, potentially affecting that establishment's impartiality out of concern for the

loss of a sizable client. Measures including separating inspection from non-audit services,

rotating inspection businesses on a regular basis, and openly disclosing services in financial

statements are crucial for resolving these issues. Maintaining a balance between providing

critical services and safeguarding the integrity and independence of fiscal reporting also

benefits from regulatory oversight, rigorous inspection commission review, ethical training,

shareholder activism, and adherence to legal and nonsupervisory compliance.

5. Evaluate Cabcharge’s board independence. Should there be stricter rules with regards to

board independence?

- The extended travels of numerous directors posed difficulties for the independence of

the Cabcharge board, which could have jeopardized that independence. To improve

independence, the recommendation emphasized stronger adherence to the Commercial

Governance Principles and Recommendations (CGPR), advocating for regular reviews,

and encouraging directors to serve for longer than 10 terms. After Kermode's tenure

ended, it was observed that the CGPR recommendations had been followed by

designating distinct Chairman and CEO positions. Rodney Gilmour's independence was

questioned because of his prior consulting work for Cabcharge, which led to a

suggestion for tougher regulations and exposure requirements to help with implicit

conflicts of interest. Following Kermode and Gilmour's resignation, an independent

deputy chairman was appointed, demonstrating a willingness to work with businesses.

The overall evaluation identified areas for improvement and recommended stronger

adherence to CGPR for more responsibility and transparency. The benefits of tougher

regulations included better accountability and investor confidence, while the drawbacks

focused on the potential of gift drain and implicit restrictions on board composition

flexibility. The conclusion emphasized the need for continuous improvement in

corporate governance and emphasized the importance of a balanced strategy that

considers the circumstances of each company. Regular evaluations, transparency, and

responsiveness to shareholder interests are key preconditions for an effective board of

directors' independence.

You might also like

- MeetingsDocument12 pagesMeetingsMD Hafizul Islam HafizNo ratings yet

- Corporate Governance Enhancing The Valuation of Stock HoldersDocument16 pagesCorporate Governance Enhancing The Valuation of Stock Holders123helperNo ratings yet

- Case Study Special Topics in AccountingDocument5 pagesCase Study Special Topics in AccountingSonia Dora DemoliaNo ratings yet

- Role of Independent DirectorsDocument18 pagesRole of Independent DirectorsSiddhanNo ratings yet

- Corporate Governance ASSIGNMENTDocument4 pagesCorporate Governance ASSIGNMENTARAAJ YOUSUFNo ratings yet

- BODY (Slide 2) : CindyDocument11 pagesBODY (Slide 2) : CindymichelleNo ratings yet

- 1 - AG (Chapter 1)Document54 pages1 - AG (Chapter 1)Candice WrightNo ratings yet

- Corporate Governance CodesDocument6 pagesCorporate Governance CodesSatyam KumarNo ratings yet

- Q1) Define The Meaning of Agency Theory?Document8 pagesQ1) Define The Meaning of Agency Theory?vivek1119No ratings yet

- Corporate GovernanceDocument32 pagesCorporate GovernanceummarimtiyazNo ratings yet

- Cadbusry Committee On CGCorporate - GovernanceDocument14 pagesCadbusry Committee On CGCorporate - Governancekush mandaliaNo ratings yet

- CGDocument23 pagesCGMaQsud AhMad SaNdhuNo ratings yet

- Corporate Governance - Christine Mallin - Chapter 9 - Directors Performance and RemunerationDocument4 pagesCorporate Governance - Christine Mallin - Chapter 9 - Directors Performance and RemunerationUzzal Sarker - উজ্জ্বল সরকার100% (4)

- Cadbury CommitteeDocument65 pagesCadbury CommitteeGaganNo ratings yet

- Directors' remuneration issuesDocument3 pagesDirectors' remuneration issuesWitty BlinkzNo ratings yet

- Borrowing Powers of Directors of Public Limited CompaniesDocument14 pagesBorrowing Powers of Directors of Public Limited CompaniesMuhammad Saeed BabarNo ratings yet

- Corp Gov - TybmsDocument46 pagesCorp Gov - TybmsNurdayantiNo ratings yet

- Chapter FourDocument11 pagesChapter FourTofael MajumderNo ratings yet

- REvision Pack 08-Questions and AnswersDocument45 pagesREvision Pack 08-Questions and Answerssunshine9016No ratings yet

- Components of Directors' Remuneration PackageDocument6 pagesComponents of Directors' Remuneration PackageFidas RoyNo ratings yet

- CadburyDocument7 pagesCadburymahesh_thadani6743No ratings yet

- What is Corporate GovernanceDocument13 pagesWhat is Corporate GovernanceReniva KhingNo ratings yet

- Cadbury Committee: The Recommendation Made by The Cadbury Committee Are As FollowsDocument21 pagesCadbury Committee: The Recommendation Made by The Cadbury Committee Are As FollowsSaiprasad Nitin LolekarNo ratings yet

- Corp GovernanceDocument15 pagesCorp GovernanceChirag BhuvaNo ratings yet

- Unit - 1 - Conceptual Framework of Corporate GovernanceDocument15 pagesUnit - 1 - Conceptual Framework of Corporate GovernanceRajendra SomvanshiNo ratings yet

- Corporate Governance Value & Ethics Unit-1Document17 pagesCorporate Governance Value & Ethics Unit-1SachinSinghalNo ratings yet

- Corporate Governance Framework Ensures AccountabilityDocument27 pagesCorporate Governance Framework Ensures AccountabilityjeffNo ratings yet

- Of The Shareholders First Since Their Remuneration Is in LineDocument4 pagesOf The Shareholders First Since Their Remuneration Is in LineWeera Soon Jin XueNo ratings yet

- Corporate Governance Implementation Key to Value CreationDocument11 pagesCorporate Governance Implementation Key to Value CreationVaibhav GuptaNo ratings yet

- Corporate Governance - Effective Performance Evaluation of the BoardFrom EverandCorporate Governance - Effective Performance Evaluation of the BoardNo ratings yet

- OWNERSHIP AND CONTROLDocument37 pagesOWNERSHIP AND CONTROLAmrit RallNo ratings yet

- Corporate Governance Models, Principles and Best PracticesDocument20 pagesCorporate Governance Models, Principles and Best PracticesNarayana ReddyNo ratings yet

- Corp. Governance 1Document11 pagesCorp. Governance 1ridhiNo ratings yet

- Corporate Governance Rules & PracticesDocument31 pagesCorporate Governance Rules & PracticesHabib ZibranNo ratings yet

- Corporate Governance (Self Study For Students)Document4 pagesCorporate Governance (Self Study For Students)akwadNo ratings yet

- Corporate governance ratings agenciesDocument9 pagesCorporate governance ratings agenciesPrachi AggarwalNo ratings yet

- CG AnswersDocument8 pagesCG Answerstripathy_amrita6089No ratings yet

- Corporate Governance: Prof. Khan Abdul KadirDocument46 pagesCorporate Governance: Prof. Khan Abdul KadirhardikrimaNo ratings yet

- Corporate Governance RatingsDocument4 pagesCorporate Governance RatingsNuman Rox100% (2)

- Corporate Governance: Constitution of CommitteeDocument26 pagesCorporate Governance: Constitution of CommitteeRajeev KambleNo ratings yet

- Corporate GovernanceDocument33 pagesCorporate GovernanceAmol Shelar50% (2)

- 1 2 3 Corporate Goverance NOTESDocument51 pages1 2 3 Corporate Goverance NOTESomkargaikwad0077No ratings yet

- Corporate Governance and Ethics in International BusinessDocument15 pagesCorporate Governance and Ethics in International BusinessAbigail WavinyaNo ratings yet

- Ch10 Monitoring and ControlDocument7 pagesCh10 Monitoring and ControlchristineNo ratings yet

- The Practice of Governance PoliciesDocument12 pagesThe Practice of Governance Policiesmarketingninjas7No ratings yet

- Becg m-5Document16 pagesBecg m-5CH ANIL VARMANo ratings yet

- Corporate Governance Another ThemeDocument9 pagesCorporate Governance Another ThemeAhmed YasinNo ratings yet

- MBA 402 ReportDocument6 pagesMBA 402 ReportawasthisailesNo ratings yet

- Tutorial 11Document3 pagesTutorial 11Hou Shu YuNo ratings yet

- UK Corporate Governance Code 2024 GuidanceDocument58 pagesUK Corporate Governance Code 2024 Guidancexijaban127No ratings yet

- Corporate GovernanceDocument25 pagesCorporate GovernanceSameer Patro0% (1)

- ANSWERS ON CORPORATE GOVARNANCE May 2022Document6 pagesANSWERS ON CORPORATE GOVARNANCE May 2022EmmaNo ratings yet

- Corporate Governance and Combined CodeDocument9 pagesCorporate Governance and Combined CodeSiddharth NairNo ratings yet

- Chapter 5 UpdatedDocument60 pagesChapter 5 UpdatedXi Bough Esce0% (1)

- Corporate Governance Part-1Document13 pagesCorporate Governance Part-1Varun KumarNo ratings yet

- 10 issues implementing corporate governanceDocument4 pages10 issues implementing corporate governancemohamed saidNo ratings yet

- Corporate governance is a fundamental aspect of business operationsDocument5 pagesCorporate governance is a fundamental aspect of business operationsprojectssupervision70No ratings yet

- Executive Compensation Update 2011Document13 pagesExecutive Compensation Update 2011brent-buford-9451No ratings yet

- What is corporate governanceDocument19 pagesWhat is corporate governanceCH ANIL VARMANo ratings yet

- PUMBA - DSE A - 506 - LDIM - 1.1 Nature and Scope of International Trade Law - PPTDocument34 pagesPUMBA - DSE A - 506 - LDIM - 1.1 Nature and Scope of International Trade Law - PPTTô Mì HakkaNo ratings yet

- There Are No Permanent Changes Because Change Itself Is Permanent. It Behooves The Industrialist To Research and The Investor To Be VigilantDocument10 pagesThere Are No Permanent Changes Because Change Itself Is Permanent. It Behooves The Industrialist To Research and The Investor To Be Vigilantagrvinit123No ratings yet

- Annual Report Laporan Tahunan: PT Gudang Garam TBKDocument132 pagesAnnual Report Laporan Tahunan: PT Gudang Garam TBKAnnisa Rosie NirmalaNo ratings yet

- Process Interaction: Plutofab Engineers Private LimitedDocument1 pageProcess Interaction: Plutofab Engineers Private LimitedRahul MenchNo ratings yet

- Promotion, Transfer and DemotionDocument33 pagesPromotion, Transfer and DemotionShalini WahalNo ratings yet

- Colorants For The Agricultural Industry: Agrocer™Document4 pagesColorants For The Agricultural Industry: Agrocer™Xavier CastilloNo ratings yet

- SREA TrainingDocument59 pagesSREA TrainingYoohyun LeeNo ratings yet

- Marketing Research Project On Nike ShoesDocument8 pagesMarketing Research Project On Nike ShoesRi TalzNo ratings yet

- Consultation Paper On Sustainability Reporting: IFRS® FoundationDocument22 pagesConsultation Paper On Sustainability Reporting: IFRS® FoundationSofiya BayraktarovaNo ratings yet

- Software Product Launch Plan TemplateDocument6 pagesSoftware Product Launch Plan TemplateShady Mohamed El-KhattabyNo ratings yet

- Exploring Strateg1Document7 pagesExploring Strateg1soomsoomislamNo ratings yet

- COMPARISON OF PHILIPPINE TAX RATESDocument3 pagesCOMPARISON OF PHILIPPINE TAX RATESKevin JugaoNo ratings yet

- Semester 4 Theory Regional Indian Cuisine and LarderDocument13 pagesSemester 4 Theory Regional Indian Cuisine and LarderCletus PaulNo ratings yet

- Solution Manual For Strategic Management A Competitive Advantage Approach Concepts Cases 15 e 15th Edition Fred R David Forest R DavidDocument13 pagesSolution Manual For Strategic Management A Competitive Advantage Approach Concepts Cases 15 e 15th Edition Fred R David Forest R DavidChristinaVillarrealfdqs100% (45)

- Digital Marketing Campaign Plan For Lloyds BankDocument23 pagesDigital Marketing Campaign Plan For Lloyds BankOkikioluwa FajemirokunNo ratings yet

- Sales Quiz 4Document3 pagesSales Quiz 4bantucin davooNo ratings yet

- Megersa Business Plan. Mba 2024Document26 pagesMegersa Business Plan. Mba 2024Megersa100% (1)

- Unit II: Absorption, Variable, and Throughput Costing: Multiple Choice QuestionsDocument43 pagesUnit II: Absorption, Variable, and Throughput Costing: Multiple Choice QuestionsJosh EspirituNo ratings yet

- Polytechnic University of the Philippines Advanced Financial Accounting and Reporting Part 2 Assessment ExamDocument9 pagesPolytechnic University of the Philippines Advanced Financial Accounting and Reporting Part 2 Assessment ExamBazinga HidalgoNo ratings yet

- Economics: Introduction To Applied EconomicsDocument22 pagesEconomics: Introduction To Applied EconomicsJoy ChoiNo ratings yet

- 5S mottos and methods for workplace organizationDocument2 pages5S mottos and methods for workplace organizationJsham100% (1)

- Ft2020czech RepublicDocument11 pagesFt2020czech RepublicvisegaNo ratings yet

- Accenture Ready Set Scale PDFDocument48 pagesAccenture Ready Set Scale PDFKristo SootaluNo ratings yet

- Pad381 - Am1104b - Group 1 ReportDocument19 pagesPad381 - Am1104b - Group 1 ReportNOR EZALIA HASBINo ratings yet

- Types of Media and Media ConvergenceDocument47 pagesTypes of Media and Media ConvergenceEmely FrancoNo ratings yet

- The Impact of Sustainability Reporting Quality On The Value Relevance of Corporate Sustainability PerformanceDocument21 pagesThe Impact of Sustainability Reporting Quality On The Value Relevance of Corporate Sustainability PerformanceFarwa KhalidNo ratings yet

- Business Advantages and DisadvantagesDocument2 pagesBusiness Advantages and DisadvantagesTYA HERYANINo ratings yet

- Cost Accounting Part 1 (University of Cebu) Cost Accounting Part 1 (University of Cebu)Document6 pagesCost Accounting Part 1 (University of Cebu) Cost Accounting Part 1 (University of Cebu)Shane TorrieNo ratings yet

- Likely Be Classified As ADocument32 pagesLikely Be Classified As AJoel Christian MascariñaNo ratings yet

- Ummary of Study Objectives: 96 The Recording ProcessDocument5 pagesUmmary of Study Objectives: 96 The Recording ProcessYun ChandoraNo ratings yet