Professional Documents

Culture Documents

Answer To Auditing Questions

Uploaded by

rita tamohOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer To Auditing Questions

Uploaded by

rita tamohCopyright:

Available Formats

Answer to Revision question on auditing

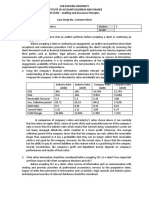

Ethical threats

ETHICS THREAT MITIGATION OF THREAT

Mr Son, the engagement partner has Mr Son should be rotated from being

been involved with the client for the engagement partner. He can still

last nine years. contact the client but should not be in

the position of signing the audit report.

This means he may be too familiar

with the client to be able to make

objective decisions due to this long

association.

There is no ethical rule which stops Mr To show complete independence, Zoe

Son recommending Zoe for the audit, should not be part of the audit team.

or letting Zoe take part in the audit. This ruling should stilrapply even if

Mr Son is no longer the engagement

However, there may be the impression

partner.

of lack of independence as Zoe is

related to the engagement partner. Zoe

could be tempted not to identify errors

in : case this prejudiced her father's

relationship with the client.

As long as Mr Fai paid a full fee to Mr Fai should be asked not to use the

Stark Co for investment advice, then services of Stark Co again unless this

there is no ethical threat. is first agreed with the engagement

partner.

However, continued use of client

services could imply a lack of

independence as Mr Fai may not be

paying a full fee and therefore

receiving a benefit from the client.

The audit team have been offered a The balloon flight should not be

balloon flight at the end of the audit. accepted. 1 would

investigate why hospitality was

ETHICS THREAT MITIGATION OF THREAT

Acceptance of gifts from a client, accepted in previous

unless of an insignificant amount, is

years.

not allowed. The fact that the flight

costs less than the yacht expense is

irrelevant, independence could still be

impaired.

Agreeing to accept taxation work on The audit firm must confirm that

the percentage of the tax saved Is assistance with taxation work is

essentially accepting a contingent fee. acceptable, although the fee must be

based on time and experience for the

There will be pressure to gain the

job, not the contingent fee.

highest tax refund for the client and

this could tempt the audit firm to

suggest illegal tax avoidance schemes.

Representing Stark Co in court could To remain independent, the audit firm

be seen as an advocacy threat - that is should decline to represent the client in

the audit firm is promoting the position court.

of the client.

Objectivity could be compromised

because the audit firm is seen to take

the position that the client is correct,

affecting judgement on the tax issue.

(b) Benefits of internal audit

Regulation

Stark Co operates in a regulated sector and is under the supervision of a

regulatory authority. It is very likely that there are regulatory controls and reports

that Stark must produce or comply with. Establishing an internal audit department

will enable Stark to produce those reports more efficiently and show compliance

with the regulatory regime. Even if internal audit is not required now, codes of

governance increasingly suggest that it is good practice to have an internal audit

department.

Reports to the board

As a financial services provider, Stark Co will be producing various

financial reports for their board. The internal audit department will be able to

monitor the accuracy of those reports, especially those not audited by the external

auditors. This function will help enhance the accuracy and reliability of the reports.

Liaison with external auditors

The internal auditors can liaise with the external auditors, especially where it

is possible for the external auditors to place reliance on the work of internal audit.

This will decrease the time and cost of the external audit.

Internal audit can also monitor the external audit to ensure they are carrying out an

efficient and effective service.

Monitor effectiveness of internal controls

It is likely that Stark has to maintain a strong internal control system as the

company is regulated and will be handling significant amounts of client cash.

Internal audit can review the effectiveness of those controls and make

recommendations to management for improvement where necessary.

Value for Money Audit

Internal audit can carry out value for money audits within Stark Co. for

example, a review could be undertaken on the cost-effectiveness of the various

control systems or whether investment advice being provided is cost-effective

given the nature of products being recommended and the income/commission

generated from those products.

Risk assessment

Internal audit could also carry out risk assessments on the portfolios being

recommended to clients to ensure the portfolio matched the client's risk profile and

Stark Co's risk appetite. Any weaknesses in this area would result in a

recommendation to amend investment policies as well as decreasing Stark's

exposure to unnecessary risk.

Taxation services

Stark Co require assistance with the preparation of taxation computations and

specialist assistance in court regarding a taxation dispute. Internal audit could

assist in both areas as long as appropriate specialists were available in the

department. Provision of these services would remove any conflict of interest that

Stark's auditors have as well as ensuring expertise was available in house when

necessary.

You might also like

- BFA 713 Solution Past ExamDocument17 pagesBFA 713 Solution Past ExamPhuong Anh100% (1)

- Aaa 5Document3 pagesAaa 5Hamza ZahidNo ratings yet

- 2-6int 2002 Dec ADocument14 pages2-6int 2002 Dec AJay ChenNo ratings yet

- Discussion Questions Topic 1Document2 pagesDiscussion Questions Topic 1dabianNo ratings yet

- Answer To 2020Document24 pagesAnswer To 2020Phebieon MukwenhaNo ratings yet

- Tugas AuditDocument5 pagesTugas Auditsofwan_ariadi5347No ratings yet

- ACCY342 Tutorial Solutions (CHP 2) s1 2014Document5 pagesACCY342 Tutorial Solutions (CHP 2) s1 2014Bella SeahNo ratings yet

- Threats To IndependenceDocument13 pagesThreats To IndependenceJoseph SimudzirayiNo ratings yet

- ACCA AAA EthicsDocument24 pagesACCA AAA EthicsSIRUI DINGNo ratings yet

- AUDIT AND INTERNAL REVIEW SolutionsDocument13 pagesAUDIT AND INTERNAL REVIEW SolutionsBilliee ButccherNo ratings yet

- Ocean Manufacturing Inc. Case Study: Before Accepting A New Client, An Auditor Should Establish ReasonableDocument7 pagesOcean Manufacturing Inc. Case Study: Before Accepting A New Client, An Auditor Should Establish ReasonableAssignemntNo ratings yet

- Case 2Document7 pagesCase 2sulthanhakimNo ratings yet

- AAA Revision Notes Dec 23-1 2Document29 pagesAAA Revision Notes Dec 23-1 2ibtisaamgoolamNo ratings yet

- Solution Audit and Internal Review Nov Ember2010Document9 pagesSolution Audit and Internal Review Nov Ember2010samuel_dwumfourNo ratings yet

- To Take Into Account 2Document8 pagesTo Take Into Account 2Omaira DiazNo ratings yet

- MonetsDocument15 pagesMonetsPraneel NagNo ratings yet

- Case 2Document4 pagesCase 2Chris WongNo ratings yet

- SD20 Q2 River CoDocument3 pagesSD20 Q2 River CoFarahliyana OmarNo ratings yet

- AC 526 Cases AssignmentDocument8 pagesAC 526 Cases AssignmentLorenz BaguioNo ratings yet

- Code of Ethics Reviewer - CompressDocument44 pagesCode of Ethics Reviewer - CompressGlance Piscasio CruzNo ratings yet

- ACT1202.Case Study No. 1 Answer SheetDocument4 pagesACT1202.Case Study No. 1 Answer SheetDonise Ronadel SantosNo ratings yet

- LARK (6/12) : Discuss The Implications of The Circumstances Described in The Audit Senior's Note andDocument31 pagesLARK (6/12) : Discuss The Implications of The Circumstances Described in The Audit Senior's Note andHarsh KhandelwalNo ratings yet

- Complete Ethics and Professional Issues (Along Professional Marks)Document6 pagesComplete Ethics and Professional Issues (Along Professional Marks)moizzaiqbalNo ratings yet

- CA Final Audit Ke Sawaal Professional Ethics Free Sample NotesDocument53 pagesCA Final Audit Ke Sawaal Professional Ethics Free Sample NotesSarabjeet SinghNo ratings yet

- Section A Part 2Document9 pagesSection A Part 2Sheda AshrafNo ratings yet

- Cases Mancon 10-12Document2 pagesCases Mancon 10-12Teresa RevilalaNo ratings yet

- Name of The Student: Aamir Iqbal Student ID: VSS31013 Name of The Course: HI6036 Auditing, Assurance and Compliance S1Document5 pagesName of The Student: Aamir Iqbal Student ID: VSS31013 Name of The Course: HI6036 Auditing, Assurance and Compliance S1Haris AliNo ratings yet

- ACCT3101 Tutorial 3 SolutionsDocument4 pagesACCT3101 Tutorial 3 SolutionsAnonymous 7CxwuBUJz3No ratings yet

- Ethical Threats To IndependenceDocument4 pagesEthical Threats To IndependenceANASNo ratings yet

- Ocean ManufacturingDocument5 pagesOcean ManufacturingАриунбаясгалан НоминтуулNo ratings yet

- Chapter 05 - AnswerDocument12 pagesChapter 05 - Answerlou-924100% (3)

- ACCA AAA Ethical Threats and Safeguards by Alan Biju Palak PDFDocument8 pagesACCA AAA Ethical Threats and Safeguards by Alan Biju Palak PDFBlade StormNo ratings yet

- Section Iii - Independence at WorkDocument3 pagesSection Iii - Independence at WorkhannaniNo ratings yet

- AA - Jul-Aug'-2022Document8 pagesAA - Jul-Aug'-2022Mohammad Monir uz ZamanNo ratings yet

- Audit Group Assignment 1Document3 pagesAudit Group Assignment 1Wang Hon Yuen100% (1)

- Audit and Assurance - Past Papers Question With AnswerDocument153 pagesAudit and Assurance - Past Papers Question With AnswerMuhammad SufyanNo ratings yet

- Audit AssignmentDocument5 pagesAudit AssignmentA Muneeb QNo ratings yet

- Factors Favoring Acceptance Concerns About AcceptanceDocument3 pagesFactors Favoring Acceptance Concerns About AcceptanceWatthakan Omar ThaniNo ratings yet

- DETAILDocument26 pagesDETAILHuajingWangNo ratings yet

- APC P7 Notes 2017Document336 pagesAPC P7 Notes 2017Muhammad Imran100% (3)

- Final Audit AssignmentDocument11 pagesFinal Audit Assignmenttaohid khanNo ratings yet

- Section 400 SummaryDocument5 pagesSection 400 SummaryMuhammadNaumanNo ratings yet

- Tugas Mata Kuliah Etika Bisnis (Daniel Edy Mulyono 1651901)Document6 pagesTugas Mata Kuliah Etika Bisnis (Daniel Edy Mulyono 1651901)Daniel Edy MulyonoNo ratings yet

- Process of Assurance: Obtaining An Engagement: Topic ListDocument20 pagesProcess of Assurance: Obtaining An Engagement: Topic ListAslam HossainNo ratings yet

- Advanced Audit and Assurance (AAA) Solution Pack: Questions Syllabus AreaDocument67 pagesAdvanced Audit and Assurance (AAA) Solution Pack: Questions Syllabus AreaMus'ab Abdullahi BulaleNo ratings yet

- Finman 1Document5 pagesFinman 1Denny Kridex OmolonNo ratings yet

- AAA - Revision Material: Jun 2010 Q4 - CarterDocument5 pagesAAA - Revision Material: Jun 2010 Q4 - CarterDee AnnNo ratings yet

- Summary of Audit & Assurance Application Level - Worked ExampleDocument22 pagesSummary of Audit & Assurance Application Level - Worked ExampleIQBAL MAHMUDNo ratings yet

- Audit ExerciseDocument6 pagesAudit ExerciseAlodia Lulu SmileNo ratings yet

- Presentation 2 - Analysis of Potential Audit ClientDocument23 pagesPresentation 2 - Analysis of Potential Audit ClientcamillediazNo ratings yet

- Audit IndependenceDocument19 pagesAudit IndependenceTanviNo ratings yet

- 5 6197308886647570711 PDFDocument20 pages5 6197308886647570711 PDFB GANAPATHYNo ratings yet

- F8 - IPRO - Mock A - AnswersDocument13 pagesF8 - IPRO - Mock A - Answersfeysal shurieNo ratings yet

- Pervezvikiyo - 3498 - 17836 - 2 - Ethics, Threats & Safeguards (Nov 1, 2021)Document11 pagesPervezvikiyo - 3498 - 17836 - 2 - Ethics, Threats & Safeguards (Nov 1, 2021)Sadia AbidNo ratings yet

- AccaDocument4 pagesAccaIleo AliNo ratings yet

- Solutions of The Audit Process. Principles, Practice and CasesDocument71 pagesSolutions of The Audit Process. Principles, Practice and Casesletuan221290% (10)

- GTHW 2010 Chapter 6 Preaudit ActivitiesDocument18 pagesGTHW 2010 Chapter 6 Preaudit ActivitiesasaNo ratings yet

- Business Risk Factors: Evaluation and Guidelines for EntrepreneursFrom EverandBusiness Risk Factors: Evaluation and Guidelines for EntrepreneursNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Lukong Blessing Exercise 08 FormationDocument7 pagesLukong Blessing Exercise 08 Formationrita tamohNo ratings yet

- 03 Tazoah Francis Exercise 03 CostDocument4 pages03 Tazoah Francis Exercise 03 Costrita tamohNo ratings yet

- TEMATIO SANDRINE'S DATA - New1Document49 pagesTEMATIO SANDRINE'S DATA - New1rita tamohNo ratings yet

- Introduction To Law and Fundamental RightsDocument55 pagesIntroduction To Law and Fundamental Rightsrita tamohNo ratings yet

- PBG208 TC+CorrDocument25 pagesPBG208 TC+Corrrita tamohNo ratings yet

- PBG207 TC+CorrDocument20 pagesPBG207 TC+Corrrita tamohNo ratings yet

- Esg Budget Management Final VersionDocument66 pagesEsg Budget Management Final Versionrita tamohNo ratings yet

- Sample Life Exam QuestionsDocument10 pagesSample Life Exam Questionsrita tamohNo ratings yet

- OHADA Uniform Act 2000 Harmonization Accounts of Enterprises1Document13 pagesOHADA Uniform Act 2000 Harmonization Accounts of Enterprises1rita tamohNo ratings yet

- IBS and SIBO Differential Diagnosis, SiebeckerDocument1 pageIBS and SIBO Differential Diagnosis, SiebeckerKrishna DasNo ratings yet

- Technical and Business WritingDocument3 pagesTechnical and Business WritingMuhammad FaisalNo ratings yet

- Game ApiDocument16 pagesGame ApiIsidora Núñez PavezNo ratings yet

- Commercial BanksDocument11 pagesCommercial BanksSeba MohantyNo ratings yet

- Haymne Uka@yahoo - Co.ukDocument1 pageHaymne Uka@yahoo - Co.ukhaymne ukaNo ratings yet

- 100 IdeasDocument21 pages100 IdeasNo ID100% (1)

- MSDS Charcoal Powder PDFDocument3 pagesMSDS Charcoal Powder PDFSelina VdexNo ratings yet

- S O S Services Alert Level Help Sheet - REFERENCIALESDocument20 pagesS O S Services Alert Level Help Sheet - REFERENCIALESDavid Poma100% (1)

- STRUNK V THE STATE OF CALIFORNIA Etal. NYND 16-cv-1496 (BKS / DJS) OSC WITH TRO Filed 12-15-2016 For 3 Judge Court Electoral College ChallengeDocument1,683 pagesSTRUNK V THE STATE OF CALIFORNIA Etal. NYND 16-cv-1496 (BKS / DJS) OSC WITH TRO Filed 12-15-2016 For 3 Judge Court Electoral College ChallengeChristopher Earl Strunk100% (1)

- Chapter 10 Planetary Atmospheres: Earth and The Other Terrestrial WorldsDocument27 pagesChapter 10 Planetary Atmospheres: Earth and The Other Terrestrial WorldsEdwin ChuenNo ratings yet

- Introduction To History AnswerDocument3 pagesIntroduction To History AnswerLawrence De La RosaNo ratings yet

- Estill Voice Training and Voice Quality Control in Contemporary Commercial Singing: An Exploratory StudyDocument8 pagesEstill Voice Training and Voice Quality Control in Contemporary Commercial Singing: An Exploratory StudyVisal SasidharanNo ratings yet

- Robbie Hemingway - Text God VIP EbookDocument56 pagesRobbie Hemingway - Text God VIP EbookKylee0% (1)

- Forex 1 PDFDocument3 pagesForex 1 PDFChandreshNo ratings yet

- Story 1Document3 pagesStory 1api-296631749No ratings yet

- SLTMobitel AssignmentDocument3 pagesSLTMobitel AssignmentSupun ChandrakanthaNo ratings yet

- 8. Nguyễn Tất Thành- Kon TumDocument17 pages8. Nguyễn Tất Thành- Kon TumK60 TRẦN MINH QUANGNo ratings yet

- Prediction of Mechanical Properties of Steel Using Artificial Neural NetworkDocument7 pagesPrediction of Mechanical Properties of Steel Using Artificial Neural NetworkInternational Association of Scientific Innovations and Research (IASIR)No ratings yet

- The Function and Importance of TransitionsDocument4 pagesThe Function and Importance of TransitionsMarc Jalen ReladorNo ratings yet

- Ezpdf Reader 1 9 8 1Document1 pageEzpdf Reader 1 9 8 1AnthonyNo ratings yet

- What Is An EcosystemDocument42 pagesWhat Is An Ecosystemjoniel05No ratings yet

- What Is Terrorism NotesDocument3 pagesWhat Is Terrorism NotesSyed Ali HaiderNo ratings yet

- Starbucks Progressive Web App: Case StudyDocument2 pagesStarbucks Progressive Web App: Case StudyYesid SuárezNo ratings yet

- CLASS XI (COMPUTER SCIENCE) HALF YEARLY QP Bhopal Region Set-IIDocument4 pagesCLASS XI (COMPUTER SCIENCE) HALF YEARLY QP Bhopal Region Set-IIDeepika AggarwalNo ratings yet

- NSTP SlabDocument2 pagesNSTP SlabCherine Fates MangulabnanNo ratings yet

- Corregidor Title DefenseDocument16 pagesCorregidor Title DefenseJaydee ColadillaNo ratings yet

- Bloomsbury Fashion Central - Designing Children's WearDocument16 pagesBloomsbury Fashion Central - Designing Children's WearANURAG JOSEPHNo ratings yet

- Industry and Community Project: Jacobs - Creating A Smart Systems Approach To Future Cities Project OutlineDocument14 pagesIndustry and Community Project: Jacobs - Creating A Smart Systems Approach To Future Cities Project OutlineCalebNo ratings yet

- AREMA Shoring GuidelinesDocument25 pagesAREMA Shoring GuidelinesKCHESTER367% (3)

- Internal Gear Pump: Replaces: 03.08 Material No. R901216585 Type PGH.-3XDocument36 pagesInternal Gear Pump: Replaces: 03.08 Material No. R901216585 Type PGH.-3XbiabamanbemanNo ratings yet