Professional Documents

Culture Documents

Hong Kong

Hong Kong

Uploaded by

rafaelamorim34h0 ratings0% found this document useful (0 votes)

1 views4 pagesHong Kong remains the world's freest economy according to the index, receiving a score of 1.30. It levies no import tariffs and has few barriers to trade or foreign investment. However, the economy contracted by over 5% in 1998 and the government intervened in the stock market, worsening its score for government intervention. Overall Hong Kong's score remained the same due to offsetting changes in monetary policy and government intervention scores.

Original Description:

Original Title

Hong_Kong

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHong Kong remains the world's freest economy according to the index, receiving a score of 1.30. It levies no import tariffs and has few barriers to trade or foreign investment. However, the economy contracted by over 5% in 1998 and the government intervened in the stock market, worsening its score for government intervention. Overall Hong Kong's score remained the same due to offsetting changes in monetary policy and government intervention scores.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views4 pagesHong Kong

Hong Kong

Uploaded by

rafaelamorim34hHong Kong remains the world's freest economy according to the index, receiving a score of 1.30. It levies no import tariffs and has few barriers to trade or foreign investment. However, the economy contracted by over 5% in 1998 and the government intervened in the stock market, worsening its score for government intervention. Overall Hong Kong's score remained the same due to offsetting changes in monetary policy and government intervention scores.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

HONG KONG

Rank: #1

Category: Free

Score: 1.30

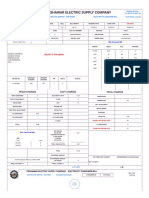

Trade Policy 1 Government Intervention 2 Foreign Investment 1 Wages and Prices 2 Regulation 1

Fiscal Burden 1 Monetary Policy 2 Banking 1 Property Rights 1 Black Market 1

Hong Kong became a Special Administrative Region (SAR) of the People’s

Republic of China (PRC) on July 1, 1997. Two years later, it remains the world’s Scores for Prior Years:

freest economy. The economy has been built on Hong Kong’s status as a major 1999: 1.30 1997: 1.40 1995: 1.30

trading port and financial center for East Asia. In particular, Hong Kong is 1998: 1.30 1996: 1.30

renowned for its rule of law, lack of trade barriers, and low taxes. Nevertheless, it

suffered in the recent currency crisis. The economy contracted by over 5 percent in

1998, with only modest growth predicted for the next two years. Moreover, Population: 6,706,965 (July 1998

exports remain weak, banks are reluctant to lend, and consumer spending has est.)

fallen. Of great concern is recent government intervention in the economy. In

Land area: 1,092 sq. km

August 1998, the Hong Kong government intervened in the country’s stock

exchange to counter speculative attacks. This raised concerns about the Major industries: textiles, clothing,

government’s commitment to a free market. Recently announced plans for tourism, electronics, plastics, toys,

watches, clocks

orderly disposal of the assets acquired in the intervention are encouraging. In

contrast to its predecessors, however, the government seems inclined to favor some Major agricultural products:

sectors at the expense of others. This would represent a step back from its fresh vegetables, poultry

successful laissez-faire policy and would lead to fears of crony capitalism (which GDP: $169.4 billion

the government heretofore has avoided). Since the handover, the rule of law in GDP growth rate: -5.0%

Hong Kong has been called into question by the Mainland’s interference in the

Per capita GDP: $25,257

operation of Hong Kong’s independent judiciary. As a result of a decrease in

inflation, Hong Kong’s monetary policy score has improved over last year. Exports of goods and services:

However, as a result of Hong Kong’s intervention in the stock market, its $192.8 billion

government intervention score has worsened. These two changes cancel each Major export trading partners:

other out, and Hong Kong’s overall score remains the same as last year. China 34.9%, US 21.7%, Japan

6.1%, Germany 3.9%, UK 3.4%,

Singapore 2.6%

TRADE POLICY

Imports of goods and services:

Score: 1–Stable (very low level of protectionism)

$214.1 billion

Hong Kong levies virtually no import tariffs or duties and is considered a duty-free Major import trading partners:

port.1 There are, in fact, very few barriers to imports in Hong Kong, which has China 37.7%, Japan 13.7%, US

one of the world’s most accessible markets. It is a vital market for U.S. exports and 7.8%, Taiwan 7.7%, Singapore 4.9%,

consumes U.S. manufactured and agricultural goods at a higher rate per capita South Korea 4.5%

than most of the world’s other economies. Foreign direct investment: n/a

FISCAL BURDEN OF GOVERNMENT

Score—Income and Corporate Taxation: 1.5–Stable

(low tax rates)

Score—Government Expenditures: 1–Stable

(very low level of government expenditure)

Final Score: 1–Stable (very low cost of government)

The top marginal personal income tax rate is 17 percent;2 the average taxpayer

falls in the 17 percent income tax bracket. The corporate tax is a flat 16 percent.

Government expenditures equaled 13.5 percent of GDP in 1997.

Chapter 6: The Countries 255

GOVERNMENT INTERVENTION IN THE WAGES AND PRICES

ECONOMY Score: 2–Stable (low level of intervention)

Score: 2–Worse (low level) Hong Kong’s market largely sets wages and prices (the only

According to the U.S. Department of Commerce, “The Hong exception being certain telecommunications services). There

Kong Special Administrative Region Government continues are, however, price controls on rent, public transport, and

to pursue a generally non-interventionist approach to electricity. The government has the power to enforce

economic policy that stresses the predominant role of the minimum wages, but rarely does so.

private sector, just as it did prior to the transition to Chinese

sovereignty in July 1997. Economic policy is based primarily PROPERTY RIGHTS

on minimal interference with market forces.”3 Government

Score: 1–Stable (very high level of

consumes about 8.9 percent of GDP, and Hong Kong has

virtually no state-owned enterprises. However, Hong Kong protection)

did intervene in its stock market in August 1998, purchasing The government fully protects private property rights. The

some $15.2 billion in private stocks. As a result, Hong Kong’s legal system to protect these rights is both highly efficient

government intervention in the economy score is 1 point and effective. According to the U.S. Department of Com-

worse this year. merce, “The local court system provides effective enforce-

ment of contracts, disputes settlements and protection of

MONETARY POLICY rights, including intellectual property. Secured interests in

property are recognized and enforced.”4

Score: 2–Better (low level of inflation)

Hong Kong’s weighted average annual rate of inflation from REGULATION

1989 to 1998 equaled 4.1 percent, down from 6.3 percent

Score: 1–Stable (very low level)

from 1988 to 1997. As a result, Hong Kong’s monetary policy

score is 1 point better this year. Hong Kong has a simple system for the licensing of busi-

nesses. The regulations imposed on business are few, not

CAPITAL FLOWS AND FOREIGN burdensome, and are applied uniformly. According to the U.S.

Department of Commerce, “Hong Kong’s body of law and

INVESTMENT regulation implicitly and explicitly promotes competition in

Score: 1–Stable (very low barriers) all forms of economic endeavor…. Tax, labor, health and

Hong Kong’s government is one of the most receptive to safety and other laws and policies avoid distortions or

investment in the world. There are virtually no restrictions impediments to the efficient mobilization and allocation of

on foreign capital or investment, except in the media sector. investment. Bureaucratic procedures and ‘red tape’ are held

to the minimum and are equally transparent to local and

BANKING foreign investors.”5

Score: 1–Stable (very low level of

restrictions) BLACK MARKET

Score: 1–Stable (very low level of activity)

Hong Kong is a global banking center and one of the

world’s freest banking environments. Banks are independent The black market is virtually nonexistent. For example, there

of the government, and foreign banks are free to operate is no evidence to suggest that there is significant black

with only limited restrictions on the number of automated market activity in such areas as construction, labor, and

teller machines and branches. The Hong Kong Monetary transportation. While there is evidence that piracy of

Authority (HKMA) planned to liberalize these restrictions in intellectual property products is a problem, Hong Kong has

the second half of 1999 and is proposing to consider, in 2001, passed several laws since 1997 that make it more difficult for

their total elimination. Additionally, the HKMA is planning a pirated products to enter and be sold in Hong Kong. Accord-

phased elimination of the remaining Interest Rate Rules ing to the U.S. Trade Representative, “Hong Kong has made

beginning in July 2000. significant progress over the past year to address the problem

of piracy, including passage of the Prevention of Copyright

Piracy Ordinance, closing approximately 70 pirate CD

production lines, and closing shops dealing with pirated

products in major retail arcades.”6

256 2000 Index of Economic Freedom

NOTES

1

Although Hong Kong levies no import tariffs, it does have domestic consumption taxes that apply to some imports

such as tobacco, alcoholic beverages, methyl alcohol, and some fuels. See U.S. Department of Commerce, Country

Commercial Guide Hong Kong Fiscal Year 1999.

2

The income tax on individuals is a progressive rate from 2 percent to 17 percent after deductions and allowances, or

at a flat rate of 15 percent on gross salary—whichever produces the lower tax liability. For purposes of grading Hong

Kong’s income tax rate, the flat 15 percent rate was used.

3

U.S. Department of Commerce, Country Commercial Guide Hong Kong Fiscal Year 1999.

4

Ibid.

5

Ibid.

6

Office of the United States Trade Representative, 1999 National Trade Estimate Report on Foreign Trade Barriers.

Chapter 6: The Countries 257

258 2000 Index of Economic Freedom

You might also like

- Paycheck 20211203 002360 Maurisha 202112231136Document1 pagePaycheck 20211203 002360 Maurisha 202112231136saraNo ratings yet

- PESTEL Analysis On China and FinlandDocument26 pagesPESTEL Analysis On China and FinlandAmeer Shafiq89% (18)

- N5 Economics QP 2017Document5 pagesN5 Economics QP 2017Edwin AmanzeNo ratings yet

- 10-Hong KongDocument4 pages10-Hong KongGabriel PotarcaNo ratings yet

- BIZZOP HKDocument13 pagesBIZZOP HKIsabel Barredo Del MundoNo ratings yet

- China PRCDocument4 pagesChina PRCrafaelamorim34hNo ratings yet

- Hong Kong Final EditedDocument4 pagesHong Kong Final Editedprathapvasu072701No ratings yet

- Ii.D.2. Institutions and PoliciesDocument38 pagesIi.D.2. Institutions and Policiesapi-51069617No ratings yet

- Hong Kong: Economic Freedom ScoreDocument2 pagesHong Kong: Economic Freedom ScoreIsabel Barredo Del MundoNo ratings yet

- PESTEL Analysis On China and FinlandDocument26 pagesPESTEL Analysis On China and Finlandttom123No ratings yet

- Financial Nationalism Vs International Financial LawDocument3 pagesFinancial Nationalism Vs International Financial LawMarc SyapzeNo ratings yet

- JAPANDocument9 pagesJAPANThy HuỳnhNo ratings yet

- Hong Kong MArketDocument4 pagesHong Kong MArketOyin AyoNo ratings yet

- ProtectionismDocument23 pagesProtectionismRaniMarie Lopez-MalinaoNo ratings yet

- Hong Kong: Economic Freedom ScoreDocument2 pagesHong Kong: Economic Freedom ScoreHpone Myint ThuNo ratings yet

- Lecture 2 International and Global Marketing EnvironmentDocument34 pagesLecture 2 International and Global Marketing EnvironmentFasika Mekete100% (2)

- Liberalisation, Privatisation, GlobalisationDocument20 pagesLiberalisation, Privatisation, Globalisationkhanriyaz23941560No ratings yet

- Tobin Tax" On Financial Transactions: Presented By: Pallavi Vidhi Zahid AnkurDocument23 pagesTobin Tax" On Financial Transactions: Presented By: Pallavi Vidhi Zahid AnkurletmebeshirlyNo ratings yet

- Fiscal Policy Presentation 2Document11 pagesFiscal Policy Presentation 2Shafique UR Rehman JuttNo ratings yet

- Eco548 Ca-2Document25 pagesEco548 Ca-2Himanshu JindalNo ratings yet

- Chuyen de Kinh Doanh Quoc TeDocument13 pagesChuyen de Kinh Doanh Quoc TeFarwa HashmiNo ratings yet

- Discriminatory Public Procurement and International Trade: World Economy February 2000Document21 pagesDiscriminatory Public Procurement and International Trade: World Economy February 2000AKUmayuNo ratings yet

- Internal BalanceDocument4 pagesInternal BalanceAnne NavarroNo ratings yet

- Oecd Global Forum On International InvestmentDocument16 pagesOecd Global Forum On International InvestmentGajendra DeshmukhNo ratings yet

- Individual AssignmentDocument11 pagesIndividual AssignmentNgoc Đặng Thị PhươngNo ratings yet

- (Paper) (Vanessa Fong & James N. Mohs (2020) ) Exploring The Impact of Tariffs On Foreign Direct Investment and Economic ProsperityDocument5 pages(Paper) (Vanessa Fong & James N. Mohs (2020) ) Exploring The Impact of Tariffs On Foreign Direct Investment and Economic ProsperityFadhillah SidikNo ratings yet

- MicroeconomicsDocument12 pagesMicroeconomicsMar Angelo De LaraNo ratings yet

- Impacts and Main Issues of Korea-China FTADocument6 pagesImpacts and Main Issues of Korea-China FTAKorea Economic Institute of America (KEI)No ratings yet

- 1 Week01 - Overview of MacroeconomicsDocument20 pages1 Week01 - Overview of MacroeconomicsAhmad Ayis AydinNo ratings yet

- II. Events Affecting The Hong Kong EconomyDocument2 pagesII. Events Affecting The Hong Kong Economyyiuzz hcyNo ratings yet

- 1) Political Factors I. Constitutional SystemDocument18 pages1) Political Factors I. Constitutional Systemapplesquash786No ratings yet

- International Business Answers Q2. Influence of PEST Factors On International BusinessDocument15 pagesInternational Business Answers Q2. Influence of PEST Factors On International BusinessJoju JohnyNo ratings yet

- Lahiri 2006Document18 pagesLahiri 2006Duknaker 2100No ratings yet

- International Equity MarketsDocument32 pagesInternational Equity MarketsSachin PadolNo ratings yet

- Globalization in South KoreaDocument6 pagesGlobalization in South KoreakaykiminkoreaNo ratings yet

- Economics SlidesDocument27 pagesEconomics Slidesidivi1020No ratings yet

- Narrative ReportDocument5 pagesNarrative ReportHazel BorboNo ratings yet

- Prof.V.R.Kishore Kumar M.A., Mphil (Int. Eco.)Document31 pagesProf.V.R.Kishore Kumar M.A., Mphil (Int. Eco.)kishore.vadlamani100% (1)

- HRV Vietnam FinalDocument25 pagesHRV Vietnam FinalAndrew James Balili BesoNo ratings yet

- 9 FijiDocument6 pages9 FijiGabriel PotarcaNo ratings yet

- S3 BF Unit 2 PowerpointDocument9 pagesS3 BF Unit 2 PowerpointOlivia LinNo ratings yet

- Economic Globalization: Kathlyn D. Gellangarin BAB1ADocument23 pagesEconomic Globalization: Kathlyn D. Gellangarin BAB1AJong GellangarinNo ratings yet

- "Economic and Fiscal Costs of Corruption in A Country": Student Number: 397022 Name: Katitja MoleleDocument8 pages"Economic and Fiscal Costs of Corruption in A Country": Student Number: 397022 Name: Katitja MoleleKatitja MoleleNo ratings yet

- Economic Freedom AssignmentDocument4 pagesEconomic Freedom AssignmentSotiriosNo ratings yet

- WTO - 10038 - Paper - Df96Q83kDocument26 pagesWTO - 10038 - Paper - Df96Q83kAmrNo ratings yet

- Lesson 1:: Understanding Economics and How It Affects BusinessDocument11 pagesLesson 1:: Understanding Economics and How It Affects BusinessÔng Quốc TrungNo ratings yet

- Joel Rothstein, Paul HastingsDocument50 pagesJoel Rothstein, Paul HastingsMalcolm RiddellNo ratings yet

- 6-7. International Marketing EnvironmentDocument5 pages6-7. International Marketing EnvironmentAina AlmuniaNo ratings yet

- Market Scenarios: Perfect Competition, Monopoly, OligopolyDocument38 pagesMarket Scenarios: Perfect Competition, Monopoly, OligopolyAlfonsoNo ratings yet

- Report On GDP of Top 6 Countries.: Submitted To: Prof. Sunil MadanDocument5 pagesReport On GDP of Top 6 Countries.: Submitted To: Prof. Sunil MadanAbdullah JamalNo ratings yet

- 07 Chpt-7 The Trade StructureDocument32 pages07 Chpt-7 The Trade StructurealikazimovazNo ratings yet

- (IMF Working Papers) Determinants of Tax Revenue Efforts in Developing CountriesDocument30 pages(IMF Working Papers) Determinants of Tax Revenue Efforts in Developing CountriesNahid Md. AlamNo ratings yet

- Fiscal Policy: Country's Residents Over A Period of TimeDocument6 pagesFiscal Policy: Country's Residents Over A Period of TimeCenidoNo ratings yet

- Estimation of The Black Economy of Pakistan Through The Monetary ApproachDocument17 pagesEstimation of The Black Economy of Pakistan Through The Monetary ApproachSyed Masroor Hussain ZaidiNo ratings yet

- Trade PoliciesDocument4 pagesTrade PoliciesVinish ChandraNo ratings yet

- W10 - Effects of The Various Socio Economic Factors Affecting Business and IndustryDocument6 pagesW10 - Effects of The Various Socio Economic Factors Affecting Business and Industryۦۦ RhoanNo ratings yet

- China Trade PolicyDocument23 pagesChina Trade PolicyJayphi Taganas BaddungonNo ratings yet

- Chapter 18Document26 pagesChapter 18Châu Anh TrịnhNo ratings yet

- Telegram Group Current Affairs: UPSCACADS (T.me/upscacads), Aptitude Telegram: PSIKNOW FacebookDocument49 pagesTelegram Group Current Affairs: UPSCACADS (T.me/upscacads), Aptitude Telegram: PSIKNOW FacebookANJALINo ratings yet

- Global Tax Revolution: The Rise of Tax Competition and the Battle to Defend ItFrom EverandGlobal Tax Revolution: The Rise of Tax Competition and the Battle to Defend ItNo ratings yet

- Research Review AssignmntDocument6 pagesResearch Review AssignmntGetaw AlamnewNo ratings yet

- Biocon Biologics India Limited Biocon Park, Plot Nos. 2,3,4 & 5 Bangalore-560099 Tel:+91 28082808 Fax: +91Document1 pageBiocon Biologics India Limited Biocon Park, Plot Nos. 2,3,4 & 5 Bangalore-560099 Tel:+91 28082808 Fax: +91Siddiq MohammedNo ratings yet

- The MENA Construction Infrastructure Projects Market 2024 Sample PagesDocument17 pagesThe MENA Construction Infrastructure Projects Market 2024 Sample Pagesmohammed musthafaNo ratings yet

- ADBI4201 Bahasa Inggris NiagaDocument3 pagesADBI4201 Bahasa Inggris NiagaVicktor Rogen100% (1)

- The YES BANK STORYDocument2 pagesThe YES BANK STORYAyushi SrivastavaNo ratings yet

- The Product Cycle Theory The Linder Theory The Intra-Industry Trade TheoryDocument19 pagesThe Product Cycle Theory The Linder Theory The Intra-Industry Trade TheoryPatrick OwenNo ratings yet

- Venn DiagramDocument2 pagesVenn DiagramCherry lyn EstabilloNo ratings yet

- Current Trend in IndustrializationDocument5 pagesCurrent Trend in IndustrializationManoj Kumar0% (2)

- Report On SCB Customer SatisfactionDocument8 pagesReport On SCB Customer Satisfactionapi-3844412No ratings yet

- Answers 1601Document6 pagesAnswers 1601Raeesa ShaikNo ratings yet

- Functions of RBI (Reserve Bank of India) : India's Bitcoin (Digital Currency)Document10 pagesFunctions of RBI (Reserve Bank of India) : India's Bitcoin (Digital Currency)abhishek pathakNo ratings yet

- 00104269 (26)Document2 pages00104269 (26)James ParkerNo ratings yet

- Statistic - Id444743 - Gross Domestic Product GDP Per Capita in Vietnam 2028Document5 pagesStatistic - Id444743 - Gross Domestic Product GDP Per Capita in Vietnam 2028Nguyễn Thị Tường ViNo ratings yet

- Export-Import Management (520135) : Chapter - 1 Introduction) Lecture-03Document8 pagesExport-Import Management (520135) : Chapter - 1 Introduction) Lecture-03873 jannatul FerdausNo ratings yet

- GST Invoice: Cdho Jilla Panchayat JunagadhDocument1 pageGST Invoice: Cdho Jilla Panchayat JunagadhOmkar DaveNo ratings yet

- CSEC Economics June 2007 P2Document5 pagesCSEC Economics June 2007 P2Sachin Bahadoorsingh100% (1)

- SynergyDocument5 pagesSynergyUnmesh RajguruNo ratings yet

- Eleventh Edition, Global EditionDocument21 pagesEleventh Edition, Global EditionBilge SavaşNo ratings yet

- Chapter 04 PQDocument3 pagesChapter 04 PQTayyeb AhmadNo ratings yet

- Free Trade and ProtectionismDocument12 pagesFree Trade and ProtectionismPrakshi Aggarwal100% (1)

- Case Study Financial CrisisDocument6 pagesCase Study Financial CrisisNicoleParedesNo ratings yet

- International Trade TheoriesDocument3 pagesInternational Trade TheoriesAbidullahNo ratings yet

- 161 - Midterm Question Paper - IWE - Aug 28 - 2020Document3 pages161 - Midterm Question Paper - IWE - Aug 28 - 2020Balvinde1234No ratings yet

- Chap005 The Political Economy of International TradeDocument21 pagesChap005 The Political Economy of International TradeJaycel BayronNo ratings yet

- Peshawar Electric Supply Company: Say No To CorruptionDocument2 pagesPeshawar Electric Supply Company: Say No To CorruptionJan AlamNo ratings yet

- Oil Fact-SheetDocument2 pagesOil Fact-SheetAbelardo Garza DomínguezNo ratings yet

- AP Micro 2-6 Excise TaxesDocument12 pagesAP Micro 2-6 Excise TaxesARINNo ratings yet

- Exchange Rates and Forex Business: Ultimate Study Material Is Macmillan Book OnlyDocument66 pagesExchange Rates and Forex Business: Ultimate Study Material Is Macmillan Book Onlyd746746No ratings yet