Professional Documents

Culture Documents

Corporation - Retained Earnings and Dividends

Corporation - Retained Earnings and Dividends

Uploaded by

Jay Mayca TyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporation - Retained Earnings and Dividends

Corporation - Retained Earnings and Dividends

Uploaded by

Jay Mayca TyCopyright:

Available Formats

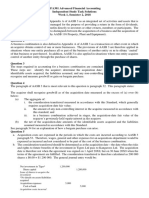

Retained Earnings Dividends

Represents the component of the Shareholder’s Equity Refers to distribution to shareholders of cash, property,

arising from the retention of assets generated from or stocks from unrestricted retained earnings on the

profit-oriented activities of the corporation. basis of all issued and fully paid shares, and all

subscribed par value shares except treasury shares.

Retained Earnings – profit

Retained Deficit – loss

Dividends

Example: An entity earned 1,000,000 on the first year of its

operations.

Closing Entry: Pro-forma Entitled

If profit:

Income Summary 1,000,000

Retained Earnings 1,000,000 Outstanding

Subscribed

(Issued - Treasury Shares)

If loss:

Retained Earnings 1,000,000

Income Summary 1,000,000 Cash Dividends: Important Dates

1. Date of Declaration

Case 1. Suppose that there is profit and entire amount of is Corporation creates a constructive obligation to pay

declared as dividends, how much is the balance of retained dividends to their shareholders.

earnings?

Retained Earnings xx

- 0 Cash Dividends Payable xx

Case 2. Suppose that there is profit and P200,000 is declared

2. Date of Record

as dividends, how much is the balance of retained earnings?

Date wherein holder of the stock is entitled for

- P800,000 dividend distribution. Not important for corporation.

Case 3. Suppose that there is profit and the entire amount is

No entry

set aside by management, how much is the balance of retained

earnings?

3. Date of Payment

- P1,000,000

Actual payment of the constructive obligation.

Classification of Retained Earnings Cash Dividends Payable xx

Cash xx

1. Unappropriated

Unrestricted, portion of retained earnings that is

available for future distribution to the shareholders. Property Dividends: Important Dates

Appropriate and okay for dividends - Historical cost applies.

2. Appropriated 1. Date of Declaration

Restricted, portion of retained earnings that is not Fair value of property is declared as dividend.

available for distribution unless the restriction is

subsequently reversed. Retained Earnings xx

Property Dividends Payable xx

Not okay for dividends

Reclassification Entry: Pro-forma 2. Date of Record

Retained Earnings xx

No entry

Retained Earnings - Appropriated xx

Types of Appropriated Retained Earnings 3. Date of Payment

1. Legal – treasury shares Adjustment of fair value of property as dividend.

2. Contractual – loans Actual payment of the obligation.

3. Voluntary – expansion

When there is an increase in fair value: Case 3.

Retained Earnings xx

Date of declaration

Property Dividends Payable xx Retained Earnings 200,000.00

Property Dividends Payable 200,000.00

When there is a decrease in fair value:

Date of record

Property Dividends Payable xx No entry

Retained Earnings xx

Date of payment

Property Dividends Payable 50,000.00

Calculation of change in fair value:

Retained Earnings 50,000.00

Fair value at the date of declaration xx

Property Dividends Payable 150,000.00

Fair value at the date of payment xx Non-cash Asset 100,000.00

Adjustment to Property Dividends Payable xx Gain on Distribution of Property Dividends Payable 50,000.00

To record payment of Property Dividends Payable Stock Dividends: Important Dates

Property Dividends Payable xx

Loss on Distribution of PDP xx 1. Date of Declaration

Property xx Retained earnings are recorded at fair value. Hence

or when the case is a small stock dividend, there is a

Property Dividends Payable xx share premium. No share premium is recorded when

Property xx it is a large stock dividend.

Gain on Distribution of PDP xx

Retained Earnings xx

Stock Dividends Payable xx

Example:

Share Premium – Ordinary

Case 1 Case 2 Case 3

2. Date of Record

Cost 150,000.00 200,000.00 100,000.00

Fair value at

No entry

Date of declaration 150,000.00 100,000.00 200,000.00

Date of record 160,000.00 140,000.00 120,000.00

Date of payment 150,000.00 150,000.00 150,000.00 3. Date of Payment

Case 1. Stock Dividends Payable xx

Ordinary Share Capital xx

Date of declaration

Retained Earnings 150,000.00

Property Dividends Payable 150,000.00

Kinds of Stock Dividends

Date of record

No entry

Date of payment

Small Stock Dividend Large Stock Dividend

Property Dividends Payable 150,000.00

Non-cash Asset 150,000.00

Case 2. Less than 20% 20% or more

Date of declaration

Retained Earnings 100,000.00

Property Dividends Payable 100,000.00

Recorded at par value Recorded at fair value

Date of record at the date of at the date of

No entry the declaration the declaration

Date of payment

Retained Earnings 50,000.00

Property Dividends Payable 50,000.00

Property Dividends Payable 150,000.00

Loss on Distribution of Property Dividends Payable 50,000.00

Non-cash Asset 200,000.00

Example: Example: A 100 par value 10% preference share is declared

dividends on the 4th year.

Stock Dividends

Authorized share 100,000 Case 1. Cumulative

Issued share 15,000 1 2 3 4

Treasury share 5,000

Outstanding share 10,000

Each share is entitled for the date of declaration as well as the

Par value 50.00

arrears amounting to 40 per share.

Fair value 75.00

Case 2. Non-Cumulative

Case 1. Small Stock Dividend

1 2 3 4

Small stock dividend 10%

Date of declaration

Retained Earnings 75,000.00 Only entitled for the dividends at the time of declaration. Total

Stock Dividends Payable 50,000.00

Share Premium - Ordinary 25,000.00 amount of dividend is 10.

Date of record Four Types of Preference Share

No entry

1. Cumulative and Participating

Date of payment

2. Cumulative and Non -Participating

Stock Dividends Payable 50,000.00

Ordinary Share Capital 50,000.00 3. Non - Cumulative and Participating

4. Non - Cumulative and Non – Participating

Case 2. Large Stock Dividend

- Details as to the type and rate of preference share are

Large stock dividend 20%

found in the Stock Certificate.

Date of declaration

Retained Earnings 100,000.00 Case 1. Cumulative and Participating. Suppose the

Stock Dividends Payable 100,000.00 corporation declared 1,000,000 as dividends. 3 years in

dividend in arrears.

Date of record

No entry

10% Preference 10% Ordinary

Total

Date of payment Share Share

Stock Dividends Payable 100,000.00 Outstanding Share Capital 1,000,000.00 3,000,000.00 4,000,000.00

Ordinary Share Capital 100,000.00

Preferred Shares - Arrears 300,000.00 300,000.00

Preferred Shares 100,000.00 100,000.00

Preference Share Dividends: General Classification Ordinary Rate 300,000.00 300,000.00

Remainder 75,000.00 225,000.00 300,000.00

Is it cumulative? Dividends 475,000.00 525,000.00 1,000,000.00

1. Cumulative

Holders of this type are entitled to receive dividends Case 2. Cumulative and Non-Participating. Suppose the

every year. corporation declared 1,000,000 as dividends. 3 years in

2. Non-cumulative dividend in arrears.

Holders of this type are only entitled to receive 10% Preference

Ordinary Share Total

dividends on the years where there is declaration. Share

Outstanding Share Capital 1,000,000.00 3,000,000.00 4,000,000.00

Is it participating?

Preferred Shares - Arrears 300,000.00 300,000.00

3. Participating

Preferred Shares 100,000.00 100,000.00

Entitle holders to the receipt of additional dividend Remaining - Ordinary Share 600,000.00 600,000.00

after holders of both preference and ordinary shares Dividends 400,000.00 600,000.00 1,000,000.00

have been paid up to the current year’s dividends.

4. Non-participating

Dividends on preference share are limited only on the

preference rate.

Case 3. Non-cumulative and Participating. Suppose the

corporation declared 1,000,000 as dividends.

10% Preference 10% Ordinary

Total

Share Share

Outstanding Share Capital 1,000,000.00 3,000,000.00 4,000,000.00

Preferred Shares 100,000.00 100,000.00

Ordinary Rate 300,000.00 300,000.00

Remainder 150,000.00 450,000.00 600,000.00

Dividends 250,000.00 750,000.00 1,000,000.00

Case 4. Non-cumulative and Non-participating. Suppose the

corporation declared 1,000,000 as dividends.

10% Preference Ordinary

Total

Share Share

Outstanding Share Capital 1,000,000.00 3,000,000.00 4,000,000.00

Preferred Shares 100,000.00 100,000.00

Remaining - Ordinary Share 900,000.00 900,000.00

Dividends 100,000.00 900,000.00 1,000,000.00

Book Value Per Share

Is the amount that would be paid to each share if the

corporation is liquidated.

Book value

Book value per share=

Outstanding share

Preference Shares

ሾ ሿ

ൌ

Ordinary Shares

- Suppose there are no preference shares.

ᇱ

ൌ

- Suppose there are preference shares.

െሾ െ ሿ

ൌ

Where:

LV Liquidation value

SHE Shareholder’s equity

PS Preference shares

OS Outstanding shares

DVD Dividends

You might also like

- Diva Shoes Inc CaseDocument1 pageDiva Shoes Inc Casedavid schwaiger100% (1)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Legal Framework For PetroleumDocument45 pagesLegal Framework For PetroleumInieke Sendy100% (2)

- Fuqua Casebook - 2015-2016Document274 pagesFuqua Casebook - 2015-2016wuNo ratings yet

- Profe03 - Chapter 2 Business Combinations Specific CasesDocument12 pagesProfe03 - Chapter 2 Business Combinations Specific CasesSteffany RoqueNo ratings yet

- Corporation - Transactions Subsequent To FormationDocument7 pagesCorporation - Transactions Subsequent To FormationJohncel Tawat100% (1)

- Business Combination - ExercisesDocument36 pagesBusiness Combination - ExercisesJessalyn CilotNo ratings yet

- Group 6 (Ia Ii)Document8 pagesGroup 6 (Ia Ii)LexNo ratings yet

- Liquidating DividendDocument2 pagesLiquidating Dividendw3n123No ratings yet

- Retained Earnings ModuleDocument2 pagesRetained Earnings Modulehansel0% (1)

- Accounting For Business CombinationsDocument42 pagesAccounting For Business CombinationsAngelica CerioNo ratings yet

- Chap 23 Retained Earnings Dividends Fin Acct 2 - Barter Summary Team PDFDocument3 pagesChap 23 Retained Earnings Dividends Fin Acct 2 - Barter Summary Team PDFSuper JhedNo ratings yet

- Are Present Obligation of An Entity: As A Result of Past EventsDocument14 pagesAre Present Obligation of An Entity: As A Result of Past EventsMARY ACOSTANo ratings yet

- Retained Earnings DividendsDocument3 pagesRetained Earnings DividendsLyka Faye AggabaoNo ratings yet

- Intermediate Accounting IIDocument10 pagesIntermediate Accounting IILexNo ratings yet

- Shareholder NotesDocument4 pagesShareholder NotesDuane CabasalNo ratings yet

- 01 Handout FINAC2 Lease Accounting Debt Restructuring PDFDocument4 pages01 Handout FINAC2 Lease Accounting Debt Restructuring PDFNil Allen Dizon FajardoNo ratings yet

- 1st Year - 6th SheetDocument9 pages1st Year - 6th SheetAhmed Ameen Nour EldinNo ratings yet

- Current LiabilitiesDocument3 pagesCurrent LiabilitiesKent Raysil PamaongNo ratings yet

- Ac12 - Module1Document4 pagesAc12 - Module1Mon Rean Villaroza JuatchonNo ratings yet

- Donated CapitalDocument2 pagesDonated CapitalQueen ValleNo ratings yet

- Intermediate Accounting: Seventeenth EditionDocument97 pagesIntermediate Accounting: Seventeenth EditionheyyyukizxNo ratings yet

- Illustrative Problem - Share Capital TransactionsDocument12 pagesIllustrative Problem - Share Capital TransactionsJulienne DivadNo ratings yet

- Receivable Financing CH14 by LailaneDocument30 pagesReceivable Financing CH14 by LailaneEunice BernalNo ratings yet

- Solution:: Problem 4: For Classroom DiscussionDocument2 pagesSolution:: Problem 4: For Classroom DiscussionAnika Gaudan PonoNo ratings yet

- 2 Cash Flows and Cash BudgetDocument17 pages2 Cash Flows and Cash Budgetangelika dijamcoNo ratings yet

- Pledge - : Far 6810 - Receivable FinancingDocument3 pagesPledge - : Far 6810 - Receivable FinancingKent Raysil PamaongNo ratings yet

- Accounting For Special Transactions - Module 4Document9 pagesAccounting For Special Transactions - Module 4Jcel JcelNo ratings yet

- Seminar 8 - Change in Shareholding InterestDocument37 pagesSeminar 8 - Change in Shareholding InterestCeline LowNo ratings yet

- Capital Gains and Losses: Ebook Summary - Chapter 12Document1 pageCapital Gains and Losses: Ebook Summary - Chapter 12arianxxxNo ratings yet

- Owners Equity (1) Full NotesDocument9 pagesOwners Equity (1) Full NotesEmmanuelNo ratings yet

- Unang Pahina Far LiabilitiesDocument41 pagesUnang Pahina Far LiabilitiesNadin Olga SemiraNo ratings yet

- Assignment Presentation 3Document4 pagesAssignment Presentation 3MarryRose Dela Torre FerrancoNo ratings yet

- Acc ReviewerDocument21 pagesAcc ReviewerYza IgartaNo ratings yet

- Quiz 3 - Accounting For CorporationDocument4 pagesQuiz 3 - Accounting For CorporationZariyah RiegoNo ratings yet

- Unit Number/ Heading: Intermediate Accounting 3 (Ae 17) Learning Material: Statement of Cash FlowsDocument7 pagesUnit Number/ Heading: Intermediate Accounting 3 (Ae 17) Learning Material: Statement of Cash FlowsSandia EspejoNo ratings yet

- Financial Accounting and Reporting - Trade and Other Receivables (Recognition, Measurement, Estimation and Valuation)Document6 pagesFinancial Accounting and Reporting - Trade and Other Receivables (Recognition, Measurement, Estimation and Valuation)LuisitoNo ratings yet

- Receivable Financing - NotesDocument3 pagesReceivable Financing - NotesTEOPE, EMERLIZA DE CASTRONo ratings yet

- Receivable FinancingDocument34 pagesReceivable FinancingmaryzeenNo ratings yet

- Receivable Financing: Pledge, Assignment, and FactoringDocument30 pagesReceivable Financing: Pledge, Assignment, and FactoringJoy UyNo ratings yet

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDocument5 pagesBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- BFA301 Independent Study Task Solutions Week 1 PDFDocument3 pagesBFA301 Independent Study Task Solutions Week 1 PDFerinNo ratings yet

- Non Financial Liabilities Provision and Contingencies.v2Document44 pagesNon Financial Liabilities Provision and Contingencies.v2Angelica Mingaracal RosarioNo ratings yet

- CLWTAXN Module 4 Principles of Income Taxation (Income Tax Notes) v012024-1Document7 pagesCLWTAXN Module 4 Principles of Income Taxation (Income Tax Notes) v012024-1kdcngan162No ratings yet

- 8 Retained Earnings and Quasi-ReorganizationDocument5 pages8 Retained Earnings and Quasi-ReorganizationNasiba M. AbdulcaderNo ratings yet

- Chapter 02 - Consolidation of Financial Information: PROBLEMS 2-20, 2-21, 2-27, 2-22Document33 pagesChapter 02 - Consolidation of Financial Information: PROBLEMS 2-20, 2-21, 2-27, 2-22Su Ed100% (1)

- Business Combination - I: "Your Online Partner To Get Your Title"Document8 pagesBusiness Combination - I: "Your Online Partner To Get Your Title"Arlene Diane OrozcoNo ratings yet

- CH 08Document70 pagesCH 08Ismadth2918388No ratings yet

- Partnership Formation Partnership AccountingDocument14 pagesPartnership Formation Partnership AccountingJesseca JosafatNo ratings yet

- Name: Ortega, Jacqueline L. Course & Year: BS Accountancy 3 Business Combination: Specific Cases Problem 1: True or FalseDocument6 pagesName: Ortega, Jacqueline L. Course & Year: BS Accountancy 3 Business Combination: Specific Cases Problem 1: True or FalseJacqueline OrtegaNo ratings yet

- Equity: Lecturer: Madarasiné Szirmai AndreaDocument35 pagesEquity: Lecturer: Madarasiné Szirmai AndreaxuNo ratings yet

- Notes - COMPUTATION OF INCOME FROM BUSINESS OR PROFESSIONDocument8 pagesNotes - COMPUTATION OF INCOME FROM BUSINESS OR PROFESSIONSajan N ThomasNo ratings yet

- Handout #4 Journalizing, Posting and Unadjusted Trial BalanceDocument11 pagesHandout #4 Journalizing, Posting and Unadjusted Trial BalanceGian HiwatigNo ratings yet

- Gibson10e ch02Document23 pagesGibson10e ch02SHAMRAIZKHANNo ratings yet

- Introduction To Financial Statements and Other Financial Reporting TopicsDocument18 pagesIntroduction To Financial Statements and Other Financial Reporting TopicsSeptiana DANo ratings yet

- Ifrs 9 - Financial Instruments Review QuestionsDocument9 pagesIfrs 9 - Financial Instruments Review QuestionsHamad Sadiq100% (1)

- The Consolidated Statement of Financial PositionDocument58 pagesThe Consolidated Statement of Financial PositionObeng CliffNo ratings yet

- CH 08Document71 pagesCH 08ANGELLINA SADRA SOETANDYNo ratings yet

- Accounting 571-9Document6 pagesAccounting 571-9Nicolle PotvinNo ratings yet

- Gross Income TaxationDocument8 pagesGross Income TaxationJenelyn FloresNo ratings yet

- Cash Flow StatementDocument5 pagesCash Flow StatementDebaditya SenguptaNo ratings yet

- Corp. Retained EarningsDocument9 pagesCorp. Retained EarningshsjhsNo ratings yet

- The Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeFrom EverandThe Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeNo ratings yet

- Chapter 6Document16 pagesChapter 6Arju LubnaNo ratings yet

- Gjensidige - Digital Transformation JourneyDocument29 pagesGjensidige - Digital Transformation JourneyFederico DonatiNo ratings yet

- An Analysis of The Satyam Computers Fraud and Whether It Could Have Been PreventedDocument29 pagesAn Analysis of The Satyam Computers Fraud and Whether It Could Have Been PreventedNGA NGUYEN HANGNo ratings yet

- Feeder SeparationDocument28 pagesFeeder SeparationBobby RunNo ratings yet

- Topic 2 I P ProcessDocument16 pagesTopic 2 I P Processkitderoger_391648570No ratings yet

- ESTUDIO PUERTOS H2V CHILE 2022 - DNV - Hydrogen Export Terminals in ChileDocument231 pagesESTUDIO PUERTOS H2V CHILE 2022 - DNV - Hydrogen Export Terminals in ChileRodrigo SantanaNo ratings yet

- SBI BANKING-Digital Transformation FinalDocument16 pagesSBI BANKING-Digital Transformation FinalVaibhav RajNo ratings yet

- Cost of Onion Production in Eastern Oregon and IdahoDocument12 pagesCost of Onion Production in Eastern Oregon and IdahoByaktiranjan PattanayakNo ratings yet

- The 10 As of Successful Tourism DestinatDocument4 pagesThe 10 As of Successful Tourism DestinatRei Reinhard SihombingNo ratings yet

- Bills of Quantities (PDFDrive) PDFDocument179 pagesBills of Quantities (PDFDrive) PDFLakshya GuptaNo ratings yet

- CDOIF Guideline Demonstrating Prior Use v7 FinalDocument34 pagesCDOIF Guideline Demonstrating Prior Use v7 Finaldwi rakhmatullahNo ratings yet

- Medium Voltage, 6kV (Um 7.2kV) To 30kV (Um 36kV), Power Conductors For Deepwater UmbilicalsDocument13 pagesMedium Voltage, 6kV (Um 7.2kV) To 30kV (Um 36kV), Power Conductors For Deepwater UmbilicalsJacob PhilipNo ratings yet

- Ey e Commerce and Consumer Internet Sector India Trendbook 2022Document100 pagesEy e Commerce and Consumer Internet Sector India Trendbook 2022bhanu64No ratings yet

- Education: Accountant/ Operation SupervisorDocument1 pageEducation: Accountant/ Operation SupervisorehsanNo ratings yet

- Wet and Dry Milling Solutions. How They Work and What They OfferDocument8 pagesWet and Dry Milling Solutions. How They Work and What They OfferEmir RasicNo ratings yet

- 10 5923 C Economics 201501 04 PDFDocument10 pages10 5923 C Economics 201501 04 PDFFrancis RiveroNo ratings yet

- As 3007.5-2004 Electrical Installations - Surface Mines and Associated Processing Plant Operating RequirementDocument7 pagesAs 3007.5-2004 Electrical Installations - Surface Mines and Associated Processing Plant Operating RequirementSAI Global - APAC0% (1)

- Coal Industry ResearchDocument14 pagesCoal Industry ResearchSURABHI SUSHREE NAYAKNo ratings yet

- Design Thinking and InnovationDocument2 pagesDesign Thinking and InnovationKate ComtoisNo ratings yet

- Account Statement: Account No. Account TypeDocument1 pageAccount Statement: Account No. Account TypebaskoroNo ratings yet

- 4042 - Jan 03, 2023Document57 pages4042 - Jan 03, 2023FA Nepan Whse BcdNo ratings yet

- Hostel ManagementDocument9 pagesHostel ManagementKATHIRIYA NIRLEP100% (1)

- SWOT (Strength, Weakness, Opportunity and Threat) MatrixDocument2 pagesSWOT (Strength, Weakness, Opportunity and Threat) MatrixnamshamiedNo ratings yet

- Urban Land Use ModelDocument16 pagesUrban Land Use ModelSHAIBAL ROY BAPPINo ratings yet

- Menil v. CADocument2 pagesMenil v. CAAiress Canoy CasimeroNo ratings yet

- Cover Letter - Celonis - Intern Content MarketingDocument1 pageCover Letter - Celonis - Intern Content Marketingbenjaminwilly.felixNo ratings yet

- BP 22, Defanged.Document2 pagesBP 22, Defanged.Anjo AlbaNo ratings yet