Professional Documents

Culture Documents

Global Financial Case Study: Hedging JPY Exposure with Options

Uploaded by

david schwaigerOriginal Title

Copyright

Available Formats

Share this document

Read this document in other languages

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global Financial Case Study: Hedging JPY Exposure with Options

Uploaded by

david schwaigerCopyright:

Available Formats

Case Study Global Financial Management:

For October 1995 a spot rate of 87,7 JPY/USD (or 0,1141 USD/JPY) can be expected.

Derived from the non-arbitrage condition of Covered Interest Parity we can compute the

USD/JPY forward rate. We use the 6 month yearly interest rates given in the case which are

1,69% for the foreign money market (JPY) and 6,12% for the home money market (USD),

which are divided by 2 to adjust the interest rate to the 6 month time frame. By multiplying

the current spot rate (0,0112) by (1+0,0306)/(1+0,0085) we obtain the expected forward rate

as indicated in the table below. We expect that the JPY will appreciate against the USD.

direct rate indirect rate

Spot rate (USD/JPY) 0,01116 89,6

F(T) rate (USD/JPY) 0,01141 87,7

The table below shows the expected revenues in foreign currency converted into the home

currency using the expected spot rates for October 1995. The JPY exposure should be

inspected in more detail. Indeed, the JPY revenues make up 39% of our expected total

revenue and are expected to increase by 28% YoY making it by far the largest FX position.

Furthermore, the Japanese and the US Economy are less intertwined and currency fluctuations

become more likely, which leads to higher risk. The volatility estimates from Exhibit 1 show

that JPY is the second most volatile currency with 9,7% right after the Italian lira with 10,9%.

However, the exposure to Italian lira does not have to be inspected more closely since Diva

Shoes has payables to Italian suppliers which act as an operating hedge. The CAD revenues

represent 27% of revenue, however this currency shows the lowest volatility estimate with

4,4% and thus bears lower risk. The exposure to French francs is less important with only 6%

of revenues. Since the firm has high margins (i.e. gross margin of 45%) and is in a solid

financial position it can afford not to hedge all its FX risk.

USD revenues JPY revenues FRF revenues Lira revenues CAD revenues

in FC - JPY 1803519043 FRF 14010000 LIRA 7909729000 CAD 17123000

Expected rate (USD/FC) - $ 0,01141 $ 0,20000 $ 0,00062 $ 0,79365

in HC $ 9 000 000,00 $ 20 570 672,52 $ 2 802 000,00 $ 4 882 548,77 $ 13 589 682,54

as % of total revenue 18% 40% 6% 10% 27%

% change vs 9/26/1994 13% 28% -2% -6% -14%

In order to hedge the FX exposure there are two options. First, there is the possibility to enter

into a forward contract to buy dollars for a fixed amount of foreign currency. The second

possibility would be to buy put options on JPY.

In the table below we can identify the USD pay-offs in the different scenarios. The forward

hedge pay-off was computed by multiplying the expected JPY amount by the direct forward

rate. For the option hedge pay-off we first computed the pay-off in the three different

scenarios comparing the exercise of the option with the pay-off without exercising the option.

Then we subtracted the option premium (0,0003 multiplied by the expected JPY revenue)

from the higher of the two previously calculated values.

We can see that in Scenario 1 and 2 it would be best to use the forward hedging option

since the forward hedge pay-off is higher. In contrast, in Scenario 3 the put option hedging

alternative leads to a significantly higher pay-off. We can see that with put options we limit

or downward potential by keeping the upward potential associated with currency fluctuations.

Since Diva Shoes Inc. is in a solid financial position, which enables the company to bear a

limited and calculated downward risk we recommend hedging the FX exposure buying put

options on JPY, since in this case we can take advantage of significant upward potential.

Forward hedge pay-off Option hedge pay-off Option premium Option is exercised Option is not exercised

Scenario 1 $ 20 541 219,17 $ 19 953 478,87 $ 541 055,71 $ 20 494 534,58 $ 20 039 100,48

Scenario 2 $ 20 541 219,17 $ 20 430 095,95 $ 541 055,71 $ 20 494 534,58 $ 20 971 151,66

Scenario 3 $ 20 541 219,17 $ 21 188 089,38 $ 541 055,71 $ 20 494 534,58 $ 21 729 145,10

You might also like

- BBB Case Write-UpDocument2 pagesBBB Case Write-UpNeal Karski100% (1)

- Wire Transfer Procedure PDFDocument7 pagesWire Transfer Procedure PDFombonoNo ratings yet

- Cash Flow Analysis and StatementDocument127 pagesCash Flow Analysis and Statementsnhk679546100% (6)

- Foreign Exchange Hedging Strategies at General Motors: Case Study SolutionDocument27 pagesForeign Exchange Hedging Strategies at General Motors: Case Study SolutionKrishna Kumar67% (3)

- 6 M Interest Rate JPY USD USD/JPY Spot RateDocument4 pages6 M Interest Rate JPY USD USD/JPY Spot Ratedavid schwaigerNo ratings yet

- Mercury Athletic SlidesDocument28 pagesMercury Athletic SlidesTaimoor Shahzad100% (3)

- Valuing Leveraged Buyouts with the Adjusted Present Value ApproachDocument5 pagesValuing Leveraged Buyouts with the Adjusted Present Value ApproachFelipe Kasai MarcosNo ratings yet

- New Heritage Doll - SolutionDocument4 pagesNew Heritage Doll - Solutionrath347775% (4)

- Group2 - Clarkson Lumber Company Case AnalysisDocument3 pagesGroup2 - Clarkson Lumber Company Case AnalysisDavid WebbNo ratings yet

- Carrefour S.A. Case: USD Debt FinancingDocument9 pagesCarrefour S.A. Case: USD Debt FinancingIzzaNo ratings yet

- SLFI610-Project Appraisal & FinanceDocument2 pagesSLFI610-Project Appraisal & FinanceVivek GujralNo ratings yet

- New Heritage Doll Company Report: Design Your Own Doll Project Best ChoiceDocument5 pagesNew Heritage Doll Company Report: Design Your Own Doll Project Best ChoiceRahul LalwaniNo ratings yet

- Clarkson QuestionsDocument5 pagesClarkson QuestionssharonulyssesNo ratings yet

- Seagate CaseDocument1 pageSeagate Casepexao87No ratings yet

- Massey Questions 1-4Document4 pagesMassey Questions 1-4Samir IsmailNo ratings yet

- Mcqs On ForexDocument62 pagesMcqs On ForexRaushan Ratnesh70% (20)

- Compagnie Du Froid S ADocument8 pagesCompagnie Du Froid S Avtiwari10% (3)

- Marriott Case AnalysisDocument3 pagesMarriott Case AnalysisNikhil ThaparNo ratings yet

- Deluxe Corporation's Debt Policy AssessmentDocument7 pagesDeluxe Corporation's Debt Policy Assessmentankur.mastNo ratings yet

- Marriott ExcelDocument2 pagesMarriott ExcelRobert Sunho LeeNo ratings yet

- Case AnalysisDocument11 pagesCase AnalysisSagar Bansal50% (2)

- Online AnswerDocument4 pagesOnline AnswerYiru Pan100% (2)

- Key Features of EPF Act 1952Document3 pagesKey Features of EPF Act 1952Fency Jenus67% (3)

- Foreign Exchange Hedging Strategies at General MotorsDocument6 pagesForeign Exchange Hedging Strategies at General MotorsMelania PenzaNo ratings yet

- Compagnie Du FroidDocument18 pagesCompagnie Du FroidSuryakant Kaushik0% (3)

- Bankruptcy and Restructuring at Marvel Entertainment GroupDocument12 pagesBankruptcy and Restructuring at Marvel Entertainment Groupvikaskumar_mech89200% (2)

- Case StudyDocument4 pagesCase StudylifeisyoungNo ratings yet

- Diageo CaseDocument5 pagesDiageo CaseMeena67% (9)

- AirThread Valuation MethodsDocument21 pagesAirThread Valuation MethodsSon NguyenNo ratings yet

- Group6 - Heritage Doll CaseDocument6 pagesGroup6 - Heritage Doll Casesanket vermaNo ratings yet

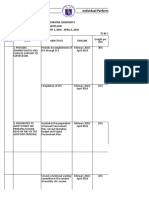

- Individual Performance Commitment and Review FormTITLE Individual Performance Commitment and Review FormDocument17 pagesIndividual Performance Commitment and Review FormTITLE Individual Performance Commitment and Review FormCabittaogan Nhs69% (13)

- Lex Service PLCDocument3 pagesLex Service PLCMinu RoyNo ratings yet

- Quiz 2 SwapDocument3 pagesQuiz 2 SwapJoel Christian MascariñaNo ratings yet

- Analyzing Mercury Athletic Footwear AcquisitionDocument5 pagesAnalyzing Mercury Athletic Footwear AcquisitionCuong NguyenNo ratings yet

- Case 34 - The Wm. Wrigley Jr. CompanyDocument72 pagesCase 34 - The Wm. Wrigley Jr. CompanyQUYNH100% (1)

- MERCURY ATHLETIC FOOTWEAR COST OF CAPITAL ANALYSISDocument16 pagesMERCURY ATHLETIC FOOTWEAR COST OF CAPITAL ANALYSISBharat KoiralaNo ratings yet

- PlanetTran EvaluationDocument18 pagesPlanetTran EvaluationNATOEENo ratings yet

- Case 4, BF - Goodrich WorksheetDocument1 pageCase 4, BF - Goodrich Worksheetisgigles157100% (2)

- AirThread G015Document6 pagesAirThread G015sahildharhakim83% (6)

- Sampath Card Estatement 2020-10-28-4051226 PDFDocument1 pageSampath Card Estatement 2020-10-28-4051226 PDFBuddhika Gihan Wijerathne0% (1)

- Stone Container Case DiscussionDocument7 pagesStone Container Case DiscussionMeena83% (6)

- JetBlue 2012 Fuel Hedging StrategyDocument3 pagesJetBlue 2012 Fuel Hedging StrategyPritam Karmakar0% (1)

- Practice Questions - International FinanceDocument18 pagesPractice Questions - International Financekyle7377No ratings yet

- Excel File Exhibits For Marriott CaseDocument18 pagesExcel File Exhibits For Marriott Caset3ddyme123No ratings yet

- Average EV/Sales, EV/EBITDA and P/E Ratios for Automotive CompaniesDocument6 pagesAverage EV/Sales, EV/EBITDA and P/E Ratios for Automotive CompaniesAhmed NiazNo ratings yet

- Case StudyDocument10 pagesCase StudyEvelyn VillafrancaNo ratings yet

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDocument12 pagesBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNo ratings yet

- New Heritage DollDocument8 pagesNew Heritage DollJITESH GUPTANo ratings yet

- New Heritage DollDocument26 pagesNew Heritage DollJITESH GUPTANo ratings yet

- New Heritage Doll Company Financial AnalysisDocument31 pagesNew Heritage Doll Company Financial AnalysisSoundarya AbiramiNo ratings yet

- Case BBBYDocument7 pagesCase BBBYgregordejong100% (1)

- Foreign Exchange Hedging Strategies at General MotorsDocument8 pagesForeign Exchange Hedging Strategies at General MotorsMoh. Farid Adi PamujiNo ratings yet

- Case Analysis - Compania de Telefonos de ChileDocument4 pagesCase Analysis - Compania de Telefonos de ChileSubrata BasakNo ratings yet

- Walmart ValuationDocument24 pagesWalmart ValuationnessawhoNo ratings yet

- Francisco Partners CaseDocument32 pagesFrancisco Partners CaseJose M Terrés-NícoliNo ratings yet

- Marriott Cost of Capital Analysis for Lodging DivisionDocument3 pagesMarriott Cost of Capital Analysis for Lodging DivisionPabloCaicedoArellanoNo ratings yet

- Cadillac Cody CaseDocument13 pagesCadillac Cody CaseKiran CheriyanNo ratings yet

- Case Background: Kaustav Dey B18088Document9 pagesCase Background: Kaustav Dey B18088Kaustav DeyNo ratings yet

- Marriott Case WACC AnalysisDocument3 pagesMarriott Case WACC AnalysisNaman SharmaNo ratings yet

- BF RaboBankDocument8 pagesBF RaboBanknjwill100% (1)

- Chapter 5 - Currency Derivatives (FX Management Tools)Document7 pagesChapter 5 - Currency Derivatives (FX Management Tools)jamilkhannNo ratings yet

- PS7 Primera ParteDocument5 pagesPS7 Primera PartethomasNo ratings yet

- Chap 6 ProblemsDocument5 pagesChap 6 ProblemsCecilia Ooi Shu QingNo ratings yet

- MF Tutorial 6Document29 pagesMF Tutorial 6Hueg Hsien0% (1)

- International Financial ManagementDocument23 pagesInternational Financial Managementmartins faithNo ratings yet

- FINA3020 Question Bank Solutions PDFDocument27 pagesFINA3020 Question Bank Solutions PDFTrinh Phan Thị NgọcNo ratings yet

- MF 6Document29 pagesMF 6Hueg HsienNo ratings yet

- Case Study ch6Document3 pagesCase Study ch6shouqNo ratings yet

- Revision Test Paper CAP III June 2020Document233 pagesRevision Test Paper CAP III June 2020Roshan PanditNo ratings yet

- Basic Finance FormulasDocument1 pageBasic Finance Formulasmafe moraNo ratings yet

- Differences Between Forward, Futures and OptionsDocument10 pagesDifferences Between Forward, Futures and OptionsDIANA CABALLERONo ratings yet

- Exercise No.2Document4 pagesExercise No.2Jeane Mae BooNo ratings yet

- M&A - CH 29Document10 pagesM&A - CH 29Frizky PutraNo ratings yet

- Indian Money Market Structure and ComponentsDocument9 pagesIndian Money Market Structure and ComponentsPrasun KumarNo ratings yet

- MBFM Chapters 1 2Document170 pagesMBFM Chapters 1 2Aysha KamalNo ratings yet

- 2022 AL Economics Past Paper - English MediumDocument11 pages2022 AL Economics Past Paper - English Mediumcrisgk1234No ratings yet

- Caguioa,: en Banc G.R. No. 225433 - Lara'S Gifts & Decors, Inc., Midtown Industrial Sales, Inc.Document50 pagesCaguioa,: en Banc G.R. No. 225433 - Lara'S Gifts & Decors, Inc., Midtown Industrial Sales, Inc.PhilAeonNo ratings yet

- 1 s2.0 S0040162521007691 MainDocument9 pages1 s2.0 S0040162521007691 Mainyiyi liaoNo ratings yet

- Chapter 5 Quantitative ProblemsDocument2 pagesChapter 5 Quantitative ProblemsVăn Ngọc PhượngNo ratings yet

- Georgia Economic Outlook 2022Document43 pagesGeorgia Economic Outlook 2022Jessie GarciaNo ratings yet

- Ebullient Services invoice for 400kg gold shipment to ItalyDocument1 pageEbullient Services invoice for 400kg gold shipment to ItalyYimbi King Dénis-PârisNo ratings yet

- Future Generali Flexi Online Term Plan Provides Affordable Life Cover and Income Protection for Your FamilyDocument19 pagesFuture Generali Flexi Online Term Plan Provides Affordable Life Cover and Income Protection for Your FamilySangeeta LakhoteNo ratings yet

- 7Ps of Central Bank of IndiaDocument78 pages7Ps of Central Bank of Indiaanil gondNo ratings yet

- Lecture 2 Is in The EnterpriseDocument44 pagesLecture 2 Is in The EnterpriseAludahNo ratings yet

- SARFAESI Act ExplainedDocument27 pagesSARFAESI Act ExplainedTC-6 Client Requesting sideNo ratings yet

- 299 342 PDFDocument44 pages299 342 PDFmahmoud_hawk100% (1)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Omkesh PanchalNo ratings yet

- Financial Distress: The Impacts of Profitability, Liquidity, Leverage, Firm Size, and Free Cash FlowDocument9 pagesFinancial Distress: The Impacts of Profitability, Liquidity, Leverage, Firm Size, and Free Cash FlowDoyNo ratings yet

- 01 - Activity - 1 - AuditingDocument4 pages01 - Activity - 1 - AuditingMillania ThanaNo ratings yet

- List of Courses OfferedDocument170 pagesList of Courses OfferedSam100% (1)