Professional Documents

Culture Documents

Nirmal Singh Comp1

Uploaded by

ca.lakshaykhannaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nirmal Singh Comp1

Uploaded by

ca.lakshaykhannaCopyright:

Available Formats

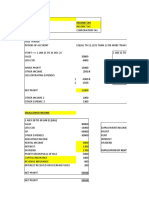

NAME OF ASSESSEE : NIRMAL SINGH

PAN : DQTPS8571Q

FATHER'S NAME : KARNAIL SINGH

RESIDENTIAL ADDRESS : 12, PATTI AFGAN, KAITHAL, KAITHAL, HARYANA-136027

STATUS : INDIVIDUAL ASSESSMENT YEAR : 2021 - 2022

WARD NO : FINANCIAL YEAR : 2020 - 2021

GENDER : MALE DATE OF BIRTH : 10/01/1969

AADHAAR NO. : 462008110892

MOBILE NO. : 7988619744

EMAIL ADDRESS : rajvinderkaur4867@gmail.com

RESIDENTIAL STATUS : RESIDENT

OPTED FOR TAXATION : NO

U/S 115BAC

RETURN : UPDATED (PREVIOUS RETURN FILED-NO) (FILING DATE : 23/10/2023 &

NO. : 433357480231023)

IMPORT DATE : AIS : 23-10-2023 04:44 PM TIS : 23-10-2023 04:44 PM

26AS : 23-10-2023 04:45 PM

COMPUTATION OF TOTAL INCOME

PROFITS AND GAINS FROM BUSINESS AND 444497

PROFESSION

PROFIT U/S 44AD - RETAIL SALE OF BATTERIES AND IN

PROFIT DEEMED U/S 44AD @ 8% OF RS. 2614690 209176

PROFIT DECLARED U/S 44AD @ 17% OF RS. 2614690 444497

PROFIT (HIGHER OF THE ABOVE) 444497

GROSS TOTAL INCOME 444497

TOTAL INCOME 444497

TOTAL INCOME ROUNDED OFF U/S 288A 444500

COMPUTATION OF TAX ON TOTAL INCOME

TAX ON RS. 250000 NIL

TAX ON RS. 194500 (444500-250000) @ 5% 9725

TAX ON RS. 444500 9725

9725

LESS : REBATE U/S 87A 9725

ADD: FEE PAYABLE U/S 234F 1000

1000

TAX PAYABLE 1000

COMPUTATION OF TOTAL UPDATED INCOME AND TAX

PAYABLE U/S 139(8A)

TAX PAYABLE AS PER UPDATED RETURN 1000

FEE FOR DEFAULT IN FURNISHING RETURN OF INCOME 1000

U/S 234F

AGGREGATE LIABILITY ON ADDITIONAL INCOME 1000

NET AMOUNT PAYABLE 1000

LESS TAX PAID U/S 140b

0180002 - 4985 - 23/10/2023 1000 1000

TAX DUE NIL

NIRMAL SINGH

(Self)

You might also like

- Ashok Garg PDFDocument3 pagesAshok Garg PDFGourav sheelNo ratings yet

- Computatation AY 21-22Document1 pageComputatation AY 21-22Afzal HussainNo ratings yet

- Mus Bhai Munda ComputitationDocument3 pagesMus Bhai Munda Computitationsatish devdaNo ratings yet

- Nirmal Singh Comp2Document2 pagesNirmal Singh Comp2ca.lakshaykhannaNo ratings yet

- Rahul Comp 22Document1 pageRahul Comp 22knowthebest787No ratings yet

- E BillDocument1 pageE BillAshwani KumarNo ratings yet

- Prakash - Computation AY 2020-21Document1 pagePrakash - Computation AY 2020-21Koppisetti KrishnaNo ratings yet

- Yusuf Bhai Munda Computation 2019-20Document3 pagesYusuf Bhai Munda Computation 2019-20satish devdaNo ratings yet

- Ilovepdf MergedDocument10 pagesIlovepdf Mergedknowthebest787No ratings yet

- Nirdosh Comp 21-22Document1 pageNirdosh Comp 21-22Asfa rehmanNo ratings yet

- PDF - 13-02-23 14-59-47Document2 pagesPDF - 13-02-23 14-59-47Miraculous IndiaNo ratings yet

- COMPUTATIONDocument1 pageCOMPUTATIONsiwantaxsolution1No ratings yet

- ComputationDocument3 pagesComputationsaurabh240386No ratings yet

- Krishna Chattri Comp 22-23Document1 pageKrishna Chattri Comp 22-23Fascino WhiteNo ratings yet

- Arwpk6809n 2022Document2 pagesArwpk6809n 2022sehaj raizadaNo ratings yet

- COMDocument2 pagesCOMkrishnajielectricNo ratings yet

- Name of Assessee: Chandadevi Ghevarchand Jain PAN: ACLPJ0515ADocument3 pagesName of Assessee: Chandadevi Ghevarchand Jain PAN: ACLPJ0515ADpr MachineriesNo ratings yet

- Payslip-34 (Lankalapalli Durga Prasad) Jul 2022Document2 pagesPayslip-34 (Lankalapalli Durga Prasad) Jul 2022Durga PrasadNo ratings yet

- Income Tax Calulator With Computation of IncomeDocument18 pagesIncome Tax Calulator With Computation of IncomeSurendra DevadigaNo ratings yet

- Ay 19-20 HDFCDocument1 pageAy 19-20 HDFCSankalp BhardwajNo ratings yet

- Name of Assessee: Ghevarchand Premchand Jain PAN: AAUPJ0346ADocument3 pagesName of Assessee: Ghevarchand Premchand Jain PAN: AAUPJ0346ADpr MachineriesNo ratings yet

- Computation of Total Income Profits and Gains From Business and ProfessionDocument1 pageComputation of Total Income Profits and Gains From Business and Professionvishal_srivastava_48No ratings yet

- Employee Name: Thota Ramesh BabuDocument1 pageEmployee Name: Thota Ramesh BaburameshNo ratings yet

- PaySlip-34 (LANKALAPALLI DURGA PRASAD) - JUN - 2022Document2 pagesPaySlip-34 (LANKALAPALLI DURGA PRASAD) - JUN - 2022Durga PrasadNo ratings yet

- Chandrakanth Yerram AY 2021-22 ComputationDocument2 pagesChandrakanth Yerram AY 2021-22 ComputationChandrakanth ChanduNo ratings yet

- Employee Name: Badipati Phani KrishnaDocument2 pagesEmployee Name: Badipati Phani KrishnaphanikrishnabNo ratings yet

- Payslip-34 (Lankalapalli Durga Prasad) Aug 2022Document2 pagesPayslip-34 (Lankalapalli Durga Prasad) Aug 2022Durga PrasadNo ratings yet

- COM1Document2 pagesCOM1jikadarasamrat29No ratings yet

- Name of Assessee: Guljar Singh PAN: ESTPS4544ADocument1 pageName of Assessee: Guljar Singh PAN: ESTPS4544ASUNIL KUMARNo ratings yet

- P.Saralakshmi: Head Clerk LW MSD PerDocument4 pagesP.Saralakshmi: Head Clerk LW MSD Permayur1980No ratings yet

- Salary ComputationDocument3 pagesSalary Computationmukesh3602223No ratings yet

- New Business P&L TemplateDocument9 pagesNew Business P&L TemplateJ PNo ratings yet

- PDF - 06-12-22 11-19-08Document4 pagesPDF - 06-12-22 11-19-08Jay SharmaNo ratings yet

- Computation of Total Income Income From House Property (Chapter IV C) - 149209Document5 pagesComputation of Total Income Income From House Property (Chapter IV C) - 149209MVLNo ratings yet

- Total Income StatementDocument1 pageTotal Income StatementsamaadhuNo ratings yet

- ComputationDocument1 pageComputationbirpal singhNo ratings yet

- Name of The Assessee: P.A.N.: Father's Name: Status: Date of Birth: Sex: Residential Status: P.Y.: Return: A.Y.: AddressDocument1 pageName of The Assessee: P.A.N.: Father's Name: Status: Date of Birth: Sex: Residential Status: P.Y.: Return: A.Y.: Addressgovindadv75No ratings yet

- Business Income Template (Ain)Document9 pagesBusiness Income Template (Ain)Imran FarhanNo ratings yet

- PT Sinar MotorDocument67 pagesPT Sinar MotorHesti RisqyasariNo ratings yet

- Jai Mata Di Enterprises: Proprieter Name:-Niraj Kumar SinghDocument4 pagesJai Mata Di Enterprises: Proprieter Name:-Niraj Kumar SinghSANDEEP KUMAR GUPTA 1417920No ratings yet

- Hemant Kumar Agarwal Coi Ay 21-22Document2 pagesHemant Kumar Agarwal Coi Ay 21-22Deepanshu AgarwalNo ratings yet

- COMPUTATIONDocument1 pageCOMPUTATIONITR FILENo ratings yet

- Current Month April To Date Entitlement Amount Deductions Amount DeductionsDocument1 pageCurrent Month April To Date Entitlement Amount Deductions Amount DeductionsBIPINNo ratings yet

- In The Books of Ajit Trading A/C & P/L Account For The Year Ended 31.3.16 Particulars Amount AmountDocument43 pagesIn The Books of Ajit Trading A/C & P/L Account For The Year Ended 31.3.16 Particulars Amount AmountflamerydersNo ratings yet

- Hasmukhray Kalyanray Pandya - Computation - 2023-24Document3 pagesHasmukhray Kalyanray Pandya - Computation - 2023-24Akshar MakwanaNo ratings yet

- Ud DNF Neraca Lajur Per 31 Desember 2014 Jurnal Penyesuaian NSSD Laporan Laba Rugi NeracaDocument2 pagesUd DNF Neraca Lajur Per 31 Desember 2014 Jurnal Penyesuaian NSSD Laporan Laba Rugi NeracaMutiaraNo ratings yet

- R K S Infra Computation 2022Document4 pagesR K S Infra Computation 2022birpal singhNo ratings yet

- Income Tax Statement T.D.S. For The Year 2015 - 16: D. Deductions Under Chapter Vi - A Deductions U/S 80 CDocument6 pagesIncome Tax Statement T.D.S. For The Year 2015 - 16: D. Deductions Under Chapter Vi - A Deductions U/S 80 CkannanchammyNo ratings yet

- Income Tax Planning: Total 122200 131950 Net Total Saving U/S 80 C 14644 111106 JULY 07 TO MAR.08 1106 114Document22 pagesIncome Tax Planning: Total 122200 131950 Net Total Saving U/S 80 C 14644 111106 JULY 07 TO MAR.08 1106 114gaurav bhambotaNo ratings yet

- 0 - Income-Tax-Calculator-FY-2018-19 Final ProformaaDocument9 pages0 - Income-Tax-Calculator-FY-2018-19 Final ProformaaSrinivas PulimamidiNo ratings yet

- Comp Anubhav Garg 23-24Document5 pagesComp Anubhav Garg 23-24prateek gangwaniNo ratings yet

- VK TradersDocument16 pagesVK TradersMOHAN ChandNo ratings yet

- M/S Fateh Chand Bhansali & Sons: Ix/6482, Nehru Gali, Gandhi Nagar, DELHI - 110 031Document18 pagesM/S Fateh Chand Bhansali & Sons: Ix/6482, Nehru Gali, Gandhi Nagar, DELHI - 110 031Neelam BothraNo ratings yet

- (PER) (PER) (Form 1120) (Feerick) Difference IncomeDocument4 pages(PER) (PER) (Form 1120) (Feerick) Difference Incometom3044No ratings yet

- Sambasiva Rao K 2020-21 Comp 01Document1 pageSambasiva Rao K 2020-21 Comp 01hari tejaNo ratings yet

- Computation 2021-22Document2 pagesComputation 2021-22priyapatelfreeNo ratings yet

- Trading ProfitDocument9 pagesTrading ProfitEhsan KhanNo ratings yet

- CRQS ConsolidationDocument54 pagesCRQS ConsolidationAtka FahimNo ratings yet

- Tax Ritan18-19 PDFDocument4 pagesTax Ritan18-19 PDFRishabh SharmaNo ratings yet

- Salamina Khoza Social Grant CaseDocument11 pagesSalamina Khoza Social Grant CaseKrash KingNo ratings yet

- Sunlife Grepa Application FormDocument2 pagesSunlife Grepa Application Formkathreentracy0% (1)

- Dwnload Full Managing Human Resources Productivity Quality of Work Life Profits 10th Edition Cascio Test Bank PDFDocument36 pagesDwnload Full Managing Human Resources Productivity Quality of Work Life Profits 10th Edition Cascio Test Bank PDFlhayesdrr100% (10)

- Nikhil 053 SCLMDocument13 pagesNikhil 053 SCLMnikhilNo ratings yet

- Villareal V AligaDocument2 pagesVillareal V AligaKyraNo ratings yet

- Hokushin A686 Dockleveller-80000020Document6 pagesHokushin A686 Dockleveller-80000020budiNo ratings yet

- Development Near Rail Tunnels: StandardDocument52 pagesDevelopment Near Rail Tunnels: Standardroshansm1978No ratings yet

- Romney Ais14 CH 16 General Ledger and Reporting SystemDocument11 pagesRomney Ais14 CH 16 General Ledger and Reporting SystemHabteweld EdluNo ratings yet

- OIF 400ZR 01.0 - Reduced2Document100 pagesOIF 400ZR 01.0 - Reduced2Peter AdelNo ratings yet

- 1 Succession TSN 2019 2020Document95 pages1 Succession TSN 2019 2020jovelyn davoNo ratings yet

- Iocl TenderDocument22055Document769 pagesIocl TenderDocument22055dineshhindujaNo ratings yet

- Unlawful AssemblyDocument3 pagesUnlawful AssemblysreevarshaNo ratings yet

- Pericles Funeral Oration in DepthDocument5 pagesPericles Funeral Oration in DepthMary Grace Quinto PaladNo ratings yet

- Coast Guard Training School: Rules of The RoadDocument88 pagesCoast Guard Training School: Rules of The RoadStri Der100% (1)

- Accountancy Notes PDF Class 11 Chapter 6Document4 pagesAccountancy Notes PDF Class 11 Chapter 6Rishi ShibdatNo ratings yet

- Development of The Banking System of The Republic of UzbekistanDocument3 pagesDevelopment of The Banking System of The Republic of UzbekistanEditor IJTSRDNo ratings yet

- Analyses of The Labor Policies of The PhilippinesDocument4 pagesAnalyses of The Labor Policies of The PhilippinesOsfer GonzalesNo ratings yet

- A Victim Lost in Saqifah V 3Document100 pagesA Victim Lost in Saqifah V 3Akbar Ali Khan100% (1)

- Times Leader 12-28-2011Document44 pagesTimes Leader 12-28-2011The Times LeaderNo ratings yet

- Fcii-Cdi HandoutsDocument37 pagesFcii-Cdi HandoutsToni Bien CalmaNo ratings yet

- 003 LEONG Abaria v. NLRCDocument6 pages003 LEONG Abaria v. NLRCCarl IlaganNo ratings yet

- Affidavit of Lot IdentificationDocument2 pagesAffidavit of Lot IdentificationBe Bhing0% (1)

- Hrishad - Income TaxDocument9 pagesHrishad - Income Taxkhayyum0% (1)

- Berlin BlockadeDocument17 pagesBerlin Blockadeapi-247690393No ratings yet

- Natwest StatementDocument2 pagesNatwest Statementshahid2opu100% (2)

- H. F. Wilcox Oil & Gas Co. v. Diffie H. F. Wilcox Oil & Gas Co. v. Carpenter H. F. Wilcox Oil & Gas Co. v. McInnis, 186 F.2d 683, 10th Cir. (1950)Document23 pagesH. F. Wilcox Oil & Gas Co. v. Diffie H. F. Wilcox Oil & Gas Co. v. Carpenter H. F. Wilcox Oil & Gas Co. v. McInnis, 186 F.2d 683, 10th Cir. (1950)Scribd Government DocsNo ratings yet

- Firestone V Luzon Development BankDocument3 pagesFirestone V Luzon Development BankiptrinidadNo ratings yet

- Case Study Singapore Presentation Development v1Document22 pagesCase Study Singapore Presentation Development v1NaizJuzharNo ratings yet

- RINA IACS CertDocument3 pagesRINA IACS CertFaiz KasimNo ratings yet

- MarketingDocument129 pagesMarketingRuslan LogmanogluNo ratings yet