Professional Documents

Culture Documents

Vertical Analysis of Interloop

Uploaded by

Syed Usarim Ali ShahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vertical Analysis of Interloop

Uploaded by

Syed Usarim Ali ShahCopyright:

Available Formats

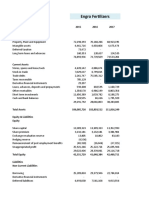

VERTICAL ANALYSIS ON STATEMENT OF PROFIT OR LOSS:

2023 2022 2021

Sales 100% 100% 100%

Cost of Sales 66.55% 71.25% 74.16.%

Gross Profit 33.45% 28.68% 25.86%

Operating expenses 10.71% 11.17% 11.27%

Distribution Cost 3,952,564 3,382,031 2,007,264

Administrative Exp 6,245,370 4,681,472 2,197,949

Other Operating Exp 2,721,284 2,143,370 504,513

Other income 0% 0% 0%

Profit from operations 22.74% 17.51% 14.59%

Finance cost 4.64% 2.74% 2.09%

Profit before taxation 18.11% 14.77% 12.50%

Taxation 1.18% 1.17% 1.06%

Profit for the year 16.92% 13.60% 11.45%

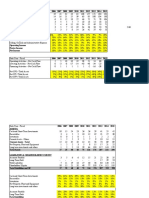

VERTICLE ANALYSIS ON STATEMENT OF FINANCIAL POSITION:

PARTICULARS 2023 2022 2021

PERCENTAGE

Assets

Non-Current Assets

Property, plant and equipment 47% 36% 43%

Intangible Asset 0% 0% 0%

Long term investments 0% 0% 0%

Long term loans 0% 0% 0%

Long term deposit 0% 0% 0%

Total non-current assets 47% 36% 43%

Current Assets

Stores and spares 2% 2% 2%

Stock in trade 16% 24% 19%

Trade debts 27% 30% 25%

Loan and advances 2% 2% 2%

Deposit, prepayment and other receivables 1% 1% 0%

Derivative financial instruments 0% – –

Accrued Income 0% 0% 0%

Refunds due from Government

and statutory authorities 4% 4% 7%

Short term investments 0% 1% 1%

Deferred employee share option

compensation expense 0% 0% 0%

Cash and bank balances 1% 0% 1%

Total current assets 53% 64% 57%

Total Assets 100% 100% 100%

Equity & Liabilities

Equity

Issued, subscribed and paid-up capital 11% 9% 14%

Reserves 3% 4% 6%

Unappropriated profit 21% 18% 13%

Total equity 35% 31% 33%

Non-current liabilities

Long term financing 12% 15% 14%

Lease liabilities 0% 0% 0%

Deferred liabilities 6% 6% 7%

Total non-current liabilities 18% 21% 21%

Current liabilities

Trade and other payables 10% 9% 9%

Unclaimed dividend 0% 0% 0%

Accrued markup 1% 1% 1%

Short term borrowings 34% 36% 32%

Derivative financial instruments 0% 0% 0%

Current portion of non-current liabilities 2% 2% 4%

Total current liabilities 46% 48% 46%

Total equity and liabilities 100% 100% 100%

You might also like

- Balance Sheet (KGL)Document6 pagesBalance Sheet (KGL)Mehak FatimaNo ratings yet

- Coca-Cola Common Size Financials - Balance SheetDocument1 pageCoca-Cola Common Size Financials - Balance Sheetapi-584364787No ratings yet

- Analysis Common Size Balance SheetDocument2 pagesAnalysis Common Size Balance SheetAnh Trần ViệtNo ratings yet

- Habib Bank Limited - Financial ModelDocument69 pagesHabib Bank Limited - Financial Modelmjibran_1No ratings yet

- Horizontal Analysis of InterloopDocument3 pagesHorizontal Analysis of InterloopSyed Usarim Ali ShahNo ratings yet

- Unitedhealth Care Income Statement & Balance Sheet & PE RatioDocument8 pagesUnitedhealth Care Income Statement & Balance Sheet & PE RatioEhab elhashmyNo ratings yet

- Financial Reporting and Analysis: Muhammad Ali Akram ROLL#33 MBA 1.5 (MORNING)Document45 pagesFinancial Reporting and Analysis: Muhammad Ali Akram ROLL#33 MBA 1.5 (MORNING)Muhammad Farooq QadirNo ratings yet

- Abdullah Report IbfDocument14 pagesAbdullah Report Ibfkhanbaba1998No ratings yet

- Financial Statement Analysis FIN3111Document9 pagesFinancial Statement Analysis FIN3111Zile MoazzamNo ratings yet

- Horizontal Analysis of CEBU Holdings' Financial StatementsDocument14 pagesHorizontal Analysis of CEBU Holdings' Financial StatementsHannahbea LindoNo ratings yet

- Financial Overview5Document8 pagesFinancial Overview5Nishad Al Hasan SagorNo ratings yet

- Common Size Analysis and Financial RatiosDocument4 pagesCommon Size Analysis and Financial RatiosLina Levvenia RatanamNo ratings yet

- Engro FertilizerDocument9 pagesEngro FertilizerAbdullah Sohail100% (1)

- Group AssignmentDocument6 pagesGroup Assignmentmai bannNo ratings yet

- Fs Analysis - SampleDocument7 pagesFs Analysis - SampleRui ManaloNo ratings yet

- Common BalancesheetDocument1 pageCommon Balancesheetyuvrajsoni17112001No ratings yet

- VERTICAL ANALYSIS OF INCOME STATEMENT of Toyota 2022-2021Document8 pagesVERTICAL ANALYSIS OF INCOME STATEMENT of Toyota 2022-2021Touqeer HussainNo ratings yet

- Financial Analysis of Cherat Cement Company LimitedDocument18 pagesFinancial Analysis of Cherat Cement Company Limitedumarpal100% (1)

- Example of PresentationDocument22 pagesExample of PresentationAygerim NurlybekNo ratings yet

- Chapter - 3 HW 3 - Apple RatiosDocument4 pagesChapter - 3 HW 3 - Apple RatiosSubhash MishraNo ratings yet

- The Searle Company Li MitedDocument20 pagesThe Searle Company Li MitedJunaid AhmadNo ratings yet

- Fin 421 Term PaperDocument46 pagesFin 421 Term PaperSadab Rahaman RidamNo ratings yet

- HDFC Bank Balance Sheet and Financials OverviewDocument11 pagesHDFC Bank Balance Sheet and Financials OverviewPooja JainNo ratings yet

- Assignment For Final Assesment: Submitted By: Subitted To: Subject: Course Name: Course Code: DateDocument13 pagesAssignment For Final Assesment: Submitted By: Subitted To: Subject: Course Name: Course Code: DateNeel ManushNo ratings yet

- Consolidated Balance SheetsDocument8 pagesConsolidated Balance SheetsCarlos Manuel CabreraNo ratings yet

- Daktronics Analysis 1Document27 pagesDaktronics Analysis 1Shannan Richards100% (3)

- 100% Net Investment IncomeDocument3 pages100% Net Investment IncomeFarabee FerdousNo ratings yet

- Balance Sheet: Particulars 2016 2017 2018 2019Document12 pagesBalance Sheet: Particulars 2016 2017 2018 2019Muhammad BilalNo ratings yet

- Chapter No 6Document19 pagesChapter No 6AliNo ratings yet

- Vertical Analysis (BALANCE SHEET) Assets FY 2016 FY 2017 FY 2018Document2 pagesVertical Analysis (BALANCE SHEET) Assets FY 2016 FY 2017 FY 2018mastermind_asia9389No ratings yet

- NidaDocument4 pagesNidaseerat fatimahNo ratings yet

- Colgate Estados Financieros 2021Document3 pagesColgate Estados Financieros 2021Lluvia RamosNo ratings yet

- AAPL - Income StatementDocument31 pagesAAPL - Income StatementRahul BindrooNo ratings yet

- Bank Balance Sheets and Income Statements ExplainedDocument75 pagesBank Balance Sheets and Income Statements ExplainedtusedoNo ratings yet

- TP 1 Financial ModellingDocument9 pagesTP 1 Financial ModellingChristina Yunita Intan100% (1)

- Financial Analysis: Horizontal Analysis: (As Per Excel)Document7 pagesFinancial Analysis: Horizontal Analysis: (As Per Excel)mehar noorNo ratings yet

- Vertical and Horizontal Analysis of Assets, Liabilities and Equity for 2016-2018Document3 pagesVertical and Horizontal Analysis of Assets, Liabilities and Equity for 2016-2018mastermind_asia9389No ratings yet

- Uses and Sources El Sewedy 2018-2019.2020Document4 pagesUses and Sources El Sewedy 2018-2019.2020Shahenda HabibNo ratings yet

- ILS in BFDocument10 pagesILS in BFNicole Andrea TuazonNo ratings yet

- Financial Performance OverviewDocument102 pagesFinancial Performance Overviewaditya jainNo ratings yet

- Hex AwareDocument37 pagesHex Awaretarun slowNo ratings yet

- Ind AS Balance Sheet of Dr. Reddy Labs 2020 2021: Non-Current AssetsDocument24 pagesInd AS Balance Sheet of Dr. Reddy Labs 2020 2021: Non-Current Assetssumeet kumarNo ratings yet

- Financial Highlights Dec 2015Document18 pagesFinancial Highlights Dec 2015Mubbasher HassanNo ratings yet

- I. Background: About The CompanyDocument6 pagesI. Background: About The CompanyPriya RadhakrishnanNo ratings yet

- Common-Size Balance SheetDocument2 pagesCommon-Size Balance SheetKamilla KamillaNo ratings yet

- Project Report (ABBOTT)Document29 pagesProject Report (ABBOTT)MohsIn IQbalNo ratings yet

- Common Size Statement nestle-FRDocument4 pagesCommon Size Statement nestle-FRIvan Tan28100% (1)

- Induslnd Bank: National Stock Exchange of India Ltd. (Symbol: INDUSINDBK)Document49 pagesInduslnd Bank: National Stock Exchange of India Ltd. (Symbol: INDUSINDBK)Ash SiNghNo ratings yet

- Vertical Analysis (Balance Sheet) 2015 Current Assets: (Receivables, Rentals & Investment)Document2 pagesVertical Analysis (Balance Sheet) 2015 Current Assets: (Receivables, Rentals & Investment)Ara TaningcoNo ratings yet

- Nimisha Ka Akhri Project SadDocument25 pagesNimisha Ka Akhri Project Sadharshit18084No ratings yet

- J&J FS AnalysisDocument5 pagesJ&J FS AnalysisEarl Justine FerrerNo ratings yet

- Assignment Help Guide SheetDocument11 pagesAssignment Help Guide SheetShakil KhanNo ratings yet

- Nestle Pakistan Limited Balance Sheet Horizontal AnalysisDocument39 pagesNestle Pakistan Limited Balance Sheet Horizontal AnalysisFarah NazNo ratings yet

- Gerresheimer GXI - deDocument11 pagesGerresheimer GXI - deDju DjuNo ratings yet

- Investor Presentation Q2 FY24Document48 pagesInvestor Presentation Q2 FY24kush.kumawat.pgdm25No ratings yet

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- FINANCEDocument13 pagesFINANCErimshaanwar617No ratings yet

- Partial Financial Statement and Analysis of San Miguel CorporationDocument3 pagesPartial Financial Statement and Analysis of San Miguel CorporationKaithleen Coreen EbaloNo ratings yet

- Particulars Note No Assets Non-Current Assets: Balance SheetDocument20 pagesParticulars Note No Assets Non-Current Assets: Balance Sheetnikhil shyamNo ratings yet

- I2) Chapter 4 Consumption AFTER CHANGES FinalDocument50 pagesI2) Chapter 4 Consumption AFTER CHANGES FinalSyed Usarim Ali ShahNo ratings yet

- Suzuki Ibf ReportDocument30 pagesSuzuki Ibf ReportSyed Usarim Ali ShahNo ratings yet

- 8) Demand For LabourDocument16 pages8) Demand For LabourSyed Usarim Ali ShahNo ratings yet

- Chap 02 - Riba&GharrarDocument30 pagesChap 02 - Riba&GharrarhamzaNo ratings yet

- 1) Chap 01 - Sources of ShariahDocument20 pages1) Chap 01 - Sources of ShariahSyed Usarim Ali ShahNo ratings yet

- Assignment One - BriefDocument1 pageAssignment One - BriefSISkobirNo ratings yet

- Cost of Capital-ProblemsDocument6 pagesCost of Capital-ProblemsUday GowdaNo ratings yet

- Final Accounts - 2 Solved ProblemsDocument6 pagesFinal Accounts - 2 Solved ProblemsrijaNo ratings yet

- Acorn AAT L3 FinalAccountsPreparation MockExamOneDocument47 pagesAcorn AAT L3 FinalAccountsPreparation MockExamOneIra CașuNo ratings yet

- Accounting For Investments: TheoriesDocument20 pagesAccounting For Investments: TheoriesJohn AlbateraNo ratings yet

- Accounting cycle stepsDocument36 pagesAccounting cycle stepsRodolfo CorpuzNo ratings yet

- Financial Management-Ch01Document32 pagesFinancial Management-Ch01hasan jabrNo ratings yet

- Aud FeDocument11 pagesAud FeMark Domingo MendozaNo ratings yet

- Valuation Aspect in M&A DealsDocument21 pagesValuation Aspect in M&A DealsShivam KapoorNo ratings yet

- Gillette and P&GDocument6 pagesGillette and P&GAbhishek PandaNo ratings yet

- BSIS ePA 313 - Preparation of Statement of Changes in EquityDocument6 pagesBSIS ePA 313 - Preparation of Statement of Changes in EquityKen ChanNo ratings yet

- Capital MarketDocument8 pagesCapital Marketshounak3No ratings yet

- Course Syllabus - ACC 103 Financial Accounting and Reporting, Part 2Document4 pagesCourse Syllabus - ACC 103 Financial Accounting and Reporting, Part 2star lightNo ratings yet

- Akuntansi, DavidDocument11 pagesAkuntansi, DavidTema Exaudi DaeliNo ratings yet

- Private Equity Holding AGDocument68 pagesPrivate Equity Holding AGArvinLedesmaChiongNo ratings yet

- Module 1 & 2 Accounting For Special TransactionsDocument19 pagesModule 1 & 2 Accounting For Special TransactionsLian MaragayNo ratings yet

- Fundamentals of Corporate Finance Canadian Canadian 8th Edition Ross Test BankDocument26 pagesFundamentals of Corporate Finance Canadian Canadian 8th Edition Ross Test BankMadelineTorresdazb100% (54)

- Ifrs VS PsakDocument58 pagesIfrs VS PsakAnisyaCahyaningrumNo ratings yet

- Chap 2 Cost of Capital MainDocument33 pagesChap 2 Cost of Capital Maintemesgen yohannesNo ratings yet

- GR 9 EMS P1 (English) November 2022 Answer BookDocument8 pagesGR 9 EMS P1 (English) November 2022 Answer Booksamanthamachingura45100% (1)

- DocumentDocument5 pagesDocumentJannelle SalacNo ratings yet

- Assignment - Leases Part 2Document2 pagesAssignment - Leases Part 2Jane DizonNo ratings yet

- Transtutors005 ch11 QuestionsDocument25 pagesTranstutors005 ch11 QuestionsAstha GoplaniNo ratings yet

- Entries For Various Dilutive Securities The Stockholders Equi PDFDocument1 pageEntries For Various Dilutive Securities The Stockholders Equi PDFAnbu jaromiaNo ratings yet

- Top Kolkata-based stock brokers and directorsDocument2 pagesTop Kolkata-based stock brokers and directorsswati_progNo ratings yet

- Idbi Credit Risk ManagementDocument24 pagesIdbi Credit Risk ManagementGaurav GuptaNo ratings yet

- Benefits of Sole PropDocument12 pagesBenefits of Sole PropRisha Mae SalingayNo ratings yet

- Sop For Legal Secretarial ComplianceDocument127 pagesSop For Legal Secretarial ComplianceHairul Izwan Abdul MokhtiNo ratings yet

- ACTBFAR Work Text - Chapter 13. - 2T1920 - FormattedDocument7 pagesACTBFAR Work Text - Chapter 13. - 2T1920 - FormattednuggsNo ratings yet

- Luxembourg SICAR: A Vehicle For Venture Capital InvestmentsDocument5 pagesLuxembourg SICAR: A Vehicle For Venture Capital InvestmentsYemna NsiriNo ratings yet

- Resumen: Capitulo 2 Ross Financial Statements and Flow of CashDocument2 pagesResumen: Capitulo 2 Ross Financial Statements and Flow of CashEric CarreraNo ratings yet