Professional Documents

Culture Documents

Korea-EU FTA Represents A Challenge For The United States by Troy Stangarone

Uploaded by

Korea Economic Institute of America (KEI)Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Korea-EU FTA Represents A Challenge For The United States by Troy Stangarone

Uploaded by

Korea Economic Institute of America (KEI)Copyright:

Available Formats

Korea-EU FTA Represents a Challenge for the United States

by Troy Stangarone (ts@keia.org) Korea is a relative newcomer to the negotiation of bilateral FTAs, concluding its first agreement with Chile only in 2003. Prior to engaging in bilateral FTAs, Korea emphasized the multilateral trading system. However, as other nations aggressively pursued bilateral agreements to open up promising markets and multilateral trade negotiations stagnated, Korea responded to the changing international trade environment with a series of bilateral trade agreements. Koreas most recent agreement, with the European Union (EU), will only strengthen its claim to being the FTA hub of Asia and presents a challenge for the United States, whose own agreement with Korea is currently stalled. Koreas FTA with the EU, which surpasses the KORUS FTA as the largest bilateral FTA, will immediately eliminate 82 percent of Koreas tariffs and 94 percent of the EUs tariffs. In five years it will eliminate 94 percent of Koreas tariffs and 99.6 percent of the EUs tariffs, with both the EU and Korea eliminating 98 percent or more of their tariffs in seven years. In contrast, the KORUS FTA would eliminate 94.5 percent of Korean tariffs in three years, with virtually all tariffs eliminated in ten years. Once fully implemented, the Korea-EU FTA would potentially increase Koreas GDP by 2.4 percent and the EUs by less than one percent. European estimates have the agreement increasing exports to Korea by 19 billion (1=$1.48), while the KORUS FTA is estimated to increase U.S. exports by up to $11 billion. Studies of the agreements potential impact suggest that the greatest gains will come from the liberalization of services, with gains from financial and business services for both Korea and the EU. For Korea, the auto industry will likely benefit the most from the FTA, with electric goods, iron and steel, and textiles also expected to gain. For the EU, the biggest gains will come from increased services exports to Korea, but processed foods and manufacturing are also expected to benefit. The EU is Koreas second largest trading partner after China, and its largest source of FDI, while Korea is the EUs fourth largest trading partner after the United States, Japan, and China. In 2008, the two conducted $98 billion in goods trade, with Korea importing nearly $40 billion worth of goods from the EU, while exporting $58.4 billion to the EU. The United States is Koreas fourth largest trading partner with two-way trade of $85 billion in 2008. How the Korea-EU FTA Differs from the KORUS FTA Much like the KORUS FTA, the Korea-EU FTA is a comprehensive agreement that excludes rice. However, the agreements do differ in some key areas, including the most controversial, trade in automobiles. In regards to autos trade, the EU and the United States took different approaches to address the non-tariff barriers the industry has faced in Korea, but there are also differences related to the elimination of tariffs. Under the Korea-EU FTA, Koreas automobile tariffs will be eliminated depending on engine size in three or five years. The KORUS FTA provides for the immediate elimination of Koreas automobile tariff.

In addressing the barriers posed by safety standards in Korea, the Korea-EU FTA commits Korea to recognizing the standards set by the United Nations Economic Commission for Europe (UN-ECE) as equivalent to Korean standards for core safety standards and to harmonize regulations pertaining to an additional 29 standards with UN-ECE regulations within five years. For all the standards not subject to harmonization or equivalence, Korea is committed to ensuring that they are not applied in a manner which limits market access. The agreement also provides that any new standards be based on UN-ECE standards, and that new features and technologies be allowed without difficulty. In contrast to the EUs approach, the United States secured an exemption that allows each U.S. automaker to sell up to 6,500 vehicles per year in Korea built to U.S. safety standards. The KORUS FTA also contains provisions for Korea to reform many of the aspects of its tax structure pertaining to the sale of automobiles, which has been identified as one of the barriers to sales in Korea. While each agreement addresses issues in separate manners, any changes to Koreas regulatory or tax structure would apply to all WTO members on a most favored nation (MFN) basis. The EU and the United States have also taken a different approach to handling dispute settlement related to automobiles. Both the EU and the United States have expedited dispute settlement mechanisms in their FTAs with Korea. The differences mainly reside in the how quickly each panel would reach a decision and the remedies that are open to the parties involved. Under the Korea-EU FTA, a final ruling would take no more than 75 days, while under the KORUS FTA a final report from the dispute settlement panel could take 141 days. However, while the Korea-EU FTA would produce a faster decision, the KORUS FTA has stronger remedy provisions. The Korea-EU FTAs remedy provisions are governed under the same rules as normal dispute settlement resolution under the FTA, while the KORUS FTA allows for the aggrieved party to restore, or snap back, its tariff to MFN levels. Both agreements include provisions on outward processing zones on the Korean peninsula, which would include the Kaesong Industrial Complex that is managed by South Korea but located in North Korea. Under each FTA, a committee on outward processing zones on the Korean peninsula is created to determine what geographic areas would qualify as outward processing zones and the criteria for the zones to be considered as part of the FTA. The KORUS FTA specifies that these criteria could include, but not be limited to, progress on denuclearization on the Korean peninsula, the impact of the zones on interKorea relations, environmental standards, wages, labor standards, management practices, and other criteria. The KORUS FTA would also require legislative approval by Korea and the United States of the committees recommendations for goods from outward processing zones to be considered under the FTA. The Korea-EU FTA, however, does not specify what criteria would be considered for the inclusion of goods from outward processing zones and does not require additional legislative approval. The two agreements also differ in how they handle the services sector, as well as labor and environmental issues. For the services sector the Korea-EU FTA uses a positive list, delineating Korea and the EUs commitments to liberalization. The KORUS FTA, in contrast, utilizes a negative list approach, which helps to ensure that new services are covered as innovation occurs. On labor and the environment, the Korea-EU FTA calls for both parties to enforce their laws and to not weaken them to encourage trade and investment. However, unlike the KORUS FTAs provisions, these

are not covered by the agreements dispute settlement mechanism. The agreement also differs from the KORUS FTA in that it contains no investment chapter or investor-state dispute settlement provisions, as investment matters still remain the purview of EUs member states. Passing the Korea-EU FTA Now that the EU-Korea FTA has been initialed, the European Commission will present the agreement to member states after it has been translated into the EUs 23 official languages, most likely sometime in early 2010. After the EU Presidency and the Commission sign the agreement, the FTA will be presented to the European Parliament for approval. In Korea, consideration of the FTA will begin in the Foreign Affairs, Trade, and Unification committee before proceeding to the floor of the National Assembly for approval. The European automobile industry has opposed the Korea-EU FTA, much as the U.S. industry has opposed the KORUS FTA, but, unlike the situation in the United States, it is not expected to be able to stall the agreements approval in Europe. Expectations are that the Korea-EU FTA will come into effect sometime in the middle or second half of next year. While USTR is continuing its efforts to find an acceptable solution for the concerns of the U.S. automobile industry, it seems unlikely that the KORUS FTA would come into force any time prior to mid-2011. The KORUS FTAs most significant obstacles have always been opposition to the agreements auto provisions and the political calendar, neither of which has shown signs of changing. The current healthcare debate is likely to consume much of the administrations political capital and time for the remainder of the year, leaving only a small window early in 2010 for potential consideration by Congress before the mid-term elections begin to gear back up. Koreas Other FTAs Korea currently has FTAs with Chile, Singapore, ASEAN, and the European Free Trade Association and has concluded agreements with the United States and India, in addition to its agreement with the EU. It is currently negotiating FTAs with Canada, Mexico, Australia, New Zealand, the Gulf Cooperation Council, and Peru, while agreements with China, Russia, MERCOSUR, Turkey, Colombia, Israel, and the South African Customs Union are under consideration. Korea has also had preliminary discussions with Japan about restarting its previously stalled negotiations and has expressed support for a potential Korea-ChinaJapan FTA. How the Korea-EU FTA Could Impact the United States While it is still too early to make a definitive assessment of the impact the Korea-EU FTA will have on U.S. exports to Korea or the EU, there are two considerations that may shed light on the effect it is likely to have on the United States. The first is the likely effect the agreement will have on the United States as a whole, while the other is the effect the Korea-EU FTA may have on specific industries and products. A study of the potential benefits of a Korea-EU FTA by Copenhagen Economics pointed out that, even in the absence of a Korea-EU FTA, the EU would not necessarily be worse off as Korea concluded FTAs with other large partners. The study noted that, while the EU would lose market share from import

substitution, as Koreas GDP grew from increased trade liberalization, it would also import more goods and the growth in the value of its import market would compensate for the EU's loss of market share. While the United States may not as a whole suffer from the Korea-EU FTA, the same may not be the case for specific products or industries. A commodity like pork may be a good example. After the KORUS FTA was concluded, Iowa State University produced a study indicating that once the KORUS FTA was fully implemented U.S. pork exports would increase to 600,000 metric tons, more than is currently exported to Japan, the number one export destination for U.S. pork. However, the EU currently exports more pork to Korea by value, with U.S. exports totaling $284 million in 2008 and EU exports 240 million. Once the Korea-EU FTA is implemented, it is plausible that the EU would increase its market lead in Korea and cut into the predicted increase of U.S. pork exports to Korea. While U.S. pork exports would increase, they may not achieve the level they would have seen with European pork producers experiencing a first movers advantage.

You might also like

- Rulings, New Agreements, and Advisory Committee Assessments Alter The Course For The KORUS FTA by Troy StangaroneDocument3 pagesRulings, New Agreements, and Advisory Committee Assessments Alter The Course For The KORUS FTA by Troy StangaroneKorea Economic Institute of America (KEI)No ratings yet

- U.S. International Trade Commission Finds FTA Would Substantially Affect U.S.-Korea Trade and Investment, Korea Pushes Ahead by Troy StangaroneDocument2 pagesU.S. International Trade Commission Finds FTA Would Substantially Affect U.S.-Korea Trade and Investment, Korea Pushes Ahead by Troy StangaroneKorea Economic Institute of America (KEI)No ratings yet

- EU-Korea FTA - Key BenefitsDocument4 pagesEU-Korea FTA - Key BenefitsHyeji Giselle LeeNo ratings yet

- Deep and Not Comprehensive? What The WTO Rules Permit For A UK-EU FTADocument29 pagesDeep and Not Comprehensive? What The WTO Rules Permit For A UK-EU FTAkhải Đào Quang KhảiNo ratings yet

- U.S.-Korea Economic Relations: View From SeoulDocument11 pagesU.S.-Korea Economic Relations: View From SeoulKorea Economic Institute of America (KEI)No ratings yet

- U.S.-Korea Economic Relations: A Washington PerspectiveDocument8 pagesU.S.-Korea Economic Relations: A Washington PerspectiveKorea Economic Institute of America (KEI)No ratings yet

- Matsuhita 1Document18 pagesMatsuhita 1hotshot17763No ratings yet

- EU Draft Mandate Avoids Farm Subsidies, Privacy Highlights ProcurementDocument3 pagesEU Draft Mandate Avoids Farm Subsidies, Privacy Highlights Procurementapi-208605666No ratings yet

- Beneficios TLC ObamaDocument2 pagesBeneficios TLC ObamaLa Silla VacíaNo ratings yet

- Group 4: Why United State Currently Does Not Have A Commercial Trade Agreement With Korea and Many Latin American Countries?Document1 pageGroup 4: Why United State Currently Does Not Have A Commercial Trade Agreement With Korea and Many Latin American Countries?game over x5xNo ratings yet

- Highlights - Trade AgreementDocument4 pagesHighlights - Trade AgreementfdkfoNo ratings yet

- Korea'S Fta Policy Structure: Ybpark@deu - Ac.krDocument11 pagesKorea'S Fta Policy Structure: Ybpark@deu - Ac.krBUINo ratings yet

- EU-UK Trade and Cooperation Agreement Protecting European Interests Ensuring Fair Competition and Continued Cooperation in Areas of Mutual InterestDocument3 pagesEU-UK Trade and Cooperation Agreement Protecting European Interests Ensuring Fair Competition and Continued Cooperation in Areas of Mutual InterestFpt HieuNo ratings yet

- Dee Fta Report PDFDocument155 pagesDee Fta Report PDFAbhishek SealNo ratings yet

- Consolidated version of the Treaty on the Functioning of the European Union (TFEU, 2007)From EverandConsolidated version of the Treaty on the Functioning of the European Union (TFEU, 2007)No ratings yet

- Engelhardt2015 - ArticleDocument38 pagesEngelhardt2015 - ArticleKevin FacunNo ratings yet

- Brexit DisputesDocument5 pagesBrexit DisputesnellaNo ratings yet

- Fasil Laws 1st DoneDocument4 pagesFasil Laws 1st DoneJabir AngillathNo ratings yet

- As We Know That, Brexit Negotiating Was A Complex, Sometimes There Were Bitter Negotiation, But They Finally Agreed A Deal On 24 December 2020. ThereforeDocument2 pagesAs We Know That, Brexit Negotiating Was A Complex, Sometimes There Were Bitter Negotiation, But They Finally Agreed A Deal On 24 December 2020. Thereforehakseng lyNo ratings yet

- EU and US Conclude Second Round of TTIP Negotiations in BrusselsDocument3 pagesEU and US Conclude Second Round of TTIP Negotiations in BrusselsΚούλα ΒάμβαNo ratings yet

- Free Trade Agreement With Eu and Opportunities, Challenges For KoreaDocument4 pagesFree Trade Agreement With Eu and Opportunities, Challenges For Koreavinay kumarNo ratings yet

- IS410 ScriptDocument2 pagesIS410 Scripthakseng lyNo ratings yet

- The Economic Partnership Agreements With The European Union: Boon or Bane For Africa's Development?Document11 pagesThe Economic Partnership Agreements With The European Union: Boon or Bane For Africa's Development?skavi_2702No ratings yet

- Challenges Facing The World Trade Organization: Jeffrey J. SchottDocument22 pagesChallenges Facing The World Trade Organization: Jeffrey J. SchottАнастасия ЕрковичNo ratings yet

- Acuerdo Comercial UecolueDocument16 pagesAcuerdo Comercial Uecolueapi-193638731No ratings yet

- Dispute Settlement Under WtoDocument10 pagesDispute Settlement Under WtoItisha GoyalNo ratings yet

- The EU-China Bilateral Investment Treaty - A Challenging First Test of The EU's Evolving BIT ModelDocument23 pagesThe EU-China Bilateral Investment Treaty - A Challenging First Test of The EU's Evolving BIT ModelJi LiNo ratings yet

- Economic Effects of A Korea-U.S. Free Trade Agreement by Kozo Kiyota and Robert M. SternDocument72 pagesEconomic Effects of A Korea-U.S. Free Trade Agreement by Kozo Kiyota and Robert M. SternKorea Economic Institute of America (KEI)No ratings yet

- CLAT 2017 Entrance Examination Question Paper: Section: English Including ComprehensionDocument71 pagesCLAT 2017 Entrance Examination Question Paper: Section: English Including Comprehensionmohammed hassan kolaNo ratings yet

- Pre-Exam Update 2022 - EU LawDocument4 pagesPre-Exam Update 2022 - EU Lawymjv7kpdw5No ratings yet

- Brexit Truth v3Document5 pagesBrexit Truth v3Edwin HaywardNo ratings yet

- Brexit Analysis IIDocument7 pagesBrexit Analysis IIPhine TanayNo ratings yet

- What Does Brexit Mean For The Uk'S Trading Relationships?Document8 pagesWhat Does Brexit Mean For The Uk'S Trading Relationships?Jasmine JacksonNo ratings yet

- TABD-BRT-ERT Public Comments On US/EU Regulatory Cooperation IssuesDocument12 pagesTABD-BRT-ERT Public Comments On US/EU Regulatory Cooperation IssuesBusiness RoundtableNo ratings yet

- Clat 2017Document60 pagesClat 2017Adish BanahiNo ratings yet

- Ass. 1,2&3 (Elera)Document4 pagesAss. 1,2&3 (Elera)BA 13 Jun kateleen eleraNo ratings yet

- BrexitDocument10 pagesBrexitShlok GargateNo ratings yet

- Alternatives To BrexitDocument56 pagesAlternatives To BrexitMuhammad Bin QasimNo ratings yet

- Agriculture Law: RL31356Document19 pagesAgriculture Law: RL31356AgricultureCaseLawNo ratings yet

- Uk-Eu Trade Relations Post Brexit: Too Many Red Lines?Document12 pagesUk-Eu Trade Relations Post Brexit: Too Many Red Lines?khải Đào Quang KhảiNo ratings yet

- Emily Reid - Regulatory Autonomy in The EU and WTO - Defining and Defending Its LimitsDocument25 pagesEmily Reid - Regulatory Autonomy in The EU and WTO - Defining and Defending Its LimitsMieras HandicraftsNo ratings yet

- EU Free Trade Agreements Manual: Eight Briefings On The European Union's Approach To Free Trade AgreementsDocument6 pagesEU Free Trade Agreements Manual: Eight Briefings On The European Union's Approach To Free Trade AgreementsOxfamNo ratings yet

- China Trade WTO Membership and Most-Favored-Nation Status: TestimonyDocument28 pagesChina Trade WTO Membership and Most-Favored-Nation Status: TestimonyJare'el ChangNo ratings yet

- CoscoDocument7 pagesCoscoILLAPU RAKESHNo ratings yet

- New Competition Law in India Vs USA and EUDocument3 pagesNew Competition Law in India Vs USA and EUNidhi PillayNo ratings yet

- European Commission 2009 The Official Website of European Union Dorman, Ron 2002 European Commission 2009 Thijs NoordzijDocument8 pagesEuropean Commission 2009 The Official Website of European Union Dorman, Ron 2002 European Commission 2009 Thijs NoordzijArman FadaeiNo ratings yet

- Current Topic SinemDocument4 pagesCurrent Topic SinembaturayNo ratings yet

- The Future of EU Law As A Subject in British UniversitiesDocument3 pagesThe Future of EU Law As A Subject in British UniversitiesHugo CaveroNo ratings yet

- The Regulatory Environment: Part Two of The Investors' Guide to the United Kingdom 2015/16From EverandThe Regulatory Environment: Part Two of The Investors' Guide to the United Kingdom 2015/16No ratings yet

- What Has The EU Ever Done for Us?: How the European Union changed Britain - what to keep and what to scrapFrom EverandWhat Has The EU Ever Done for Us?: How the European Union changed Britain - what to keep and what to scrapNo ratings yet

- Still Hazy After All These Years: The Interpretation of National Treatment in The GATT/WTO Case-Law On Tax DiscriminationDocument31 pagesStill Hazy After All These Years: The Interpretation of National Treatment in The GATT/WTO Case-Law On Tax DiscriminationSampark PanigrahiNo ratings yet

- Kyotos Carbon Currency - AAUs ExplainedDocument4 pagesKyotos Carbon Currency - AAUs ExplainedAnaBarrNo ratings yet

- Investment Down, But More Free Trade in Korea's Future by Troy StangaroneDocument2 pagesInvestment Down, But More Free Trade in Korea's Future by Troy StangaroneKorea Economic Institute of America (KEI)No ratings yet

- UntitledDocument1 pageUntitledAnnalyse VellaniNo ratings yet

- U.S.-Korea Economic Relations: View From SeoulDocument12 pagesU.S.-Korea Economic Relations: View From SeoulKorea Economic Institute of America (KEI)No ratings yet

- The Truth About BrexitDocument5 pagesThe Truth About BrexitEdwin HaywardNo ratings yet

- Eu AssignmentDocument8 pagesEu Assignmentsabahat akhtarNo ratings yet

- Brexit: Economic ShockDocument9 pagesBrexit: Economic ShockblahNo ratings yet

- Eu Compeition Law InsutitonsDocument7 pagesEu Compeition Law InsutitonsthephrasemakersNo ratings yet

- Ohio - 10Document2 pagesOhio - 10Korea Economic Institute of America (KEI)No ratings yet

- Ohio - 7Document2 pagesOhio - 7Korea Economic Institute of America (KEI)No ratings yet

- Ohio - 4Document2 pagesOhio - 4Korea Economic Institute of America (KEI)No ratings yet

- Ohio - 12Document2 pagesOhio - 12Korea Economic Institute of America (KEI)No ratings yet

- Oregon - 5Document2 pagesOregon - 5Korea Economic Institute of America (KEI)No ratings yet

- Ohio - 6Document2 pagesOhio - 6Korea Economic Institute of America (KEI)No ratings yet

- Florida - 25Document2 pagesFlorida - 25Korea Economic Institute of America (KEI)No ratings yet

- Maryland - 6Document2 pagesMaryland - 6Korea Economic Institute of America (KEI)No ratings yet

- Top CA-13th Export of Goods To Korea in 2016Document2 pagesTop CA-13th Export of Goods To Korea in 2016Korea Economic Institute of America (KEI)No ratings yet

- Top CA-34th Export of Goods To Korea in 2016Document2 pagesTop CA-34th Export of Goods To Korea in 2016Korea Economic Institute of America (KEI)No ratings yet

- Utah - 3Document2 pagesUtah - 3Korea Economic Institute of America (KEI)No ratings yet

- Ohio - 1Document2 pagesOhio - 1Korea Economic Institute of America (KEI)No ratings yet

- Tennessee - 7Document2 pagesTennessee - 7Korea Economic Institute of America (KEI)No ratings yet

- Top TX-30th Export of Goods To Korea in 2016Document2 pagesTop TX-30th Export of Goods To Korea in 2016Korea Economic Institute of America (KEI)No ratings yet

- Connecticut - 1Document2 pagesConnecticut - 1Korea Economic Institute of America (KEI)No ratings yet

- Top FL-17th Export of Goods To Korea in 2016Document2 pagesTop FL-17th Export of Goods To Korea in 2016Korea Economic Institute of America (KEI)No ratings yet

- Oregon - 4Document2 pagesOregon - 4Korea Economic Institute of America (KEI)No ratings yet

- Texas - 35 - UpdatedDocument2 pagesTexas - 35 - UpdatedKorea Economic Institute of America (KEI)No ratings yet

- Top TX-19th Export of Goods To Korea in 2016Document2 pagesTop TX-19th Export of Goods To Korea in 2016Korea Economic Institute of America (KEI)No ratings yet

- Washington - 1Document2 pagesWashington - 1Korea Economic Institute of America (KEI)No ratings yet

- Georgia - 9Document2 pagesGeorgia - 9Korea Economic Institute of America (KEI)No ratings yet

- Top TX-17th Export of Goods To Korea in 2016Document2 pagesTop TX-17th Export of Goods To Korea in 2016Korea Economic Institute of America (KEI)No ratings yet

- Top AL-4th Export of Goods To Korea in 2016Document2 pagesTop AL-4th Export of Goods To Korea in 2016Korea Economic Institute of America (KEI)No ratings yet

- Florida - 14Document2 pagesFlorida - 14Korea Economic Institute of America (KEI)No ratings yet

- Utah - 2Document2 pagesUtah - 2Korea Economic Institute of America (KEI)No ratings yet

- Florida - 2Document2 pagesFlorida - 2Korea Economic Institute of America (KEI)No ratings yet

- North Carolina - 1Document2 pagesNorth Carolina - 1Korea Economic Institute of America (KEI)No ratings yet

- Top AR-3rd Export of Goods To Korea in 2016Document2 pagesTop AR-3rd Export of Goods To Korea in 2016Korea Economic Institute of America (KEI)No ratings yet

- Arizona - 3Document2 pagesArizona - 3Korea Economic Institute of America (KEI)No ratings yet

- Top OH-9th Export of Goods To Korea in 2016Document2 pagesTop OH-9th Export of Goods To Korea in 2016Korea Economic Institute of America (KEI)No ratings yet

- IB Chapter 9 Regional Economic IntegrationDocument34 pagesIB Chapter 9 Regional Economic IntegrationqianqianNo ratings yet

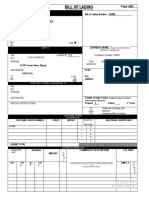

- Bill of Lading No.: Mediterranean Shipping Company S.ADocument1 pageBill of Lading No.: Mediterranean Shipping Company S.Aaliaga14No ratings yet

- Quiz Solution Consignment 2AAC and 2BAC Apr 2023Document10 pagesQuiz Solution Consignment 2AAC and 2BAC Apr 2023Lorifel Antonette Laoreno TejeroNo ratings yet

- Bank ReconciletionDocument36 pagesBank Reconciletionzahara nesruNo ratings yet

- Chapter 1Document10 pagesChapter 1Mohamed Jabir100% (3)

- Konsep Capital Budgeting - TurkiDocument20 pagesKonsep Capital Budgeting - TurkiyayaNo ratings yet

- Accounting Chapter 5Document42 pagesAccounting Chapter 5Joy PacotNo ratings yet

- NAHCo AVIANCE 5-Year Review - June 2010 by ProshareDocument39 pagesNAHCo AVIANCE 5-Year Review - June 2010 by ProshareProshareNo ratings yet

- FD 2Document5 pagesFD 2Nikita Shekhawat100% (1)

- MSC Indonesia Local Charges Updates - 22 February 2024Document10 pagesMSC Indonesia Local Charges Updates - 22 February 2024letandat14122003No ratings yet

- Module 3 AssignmentDocument2 pagesModule 3 AssignmentLhyn ForioNo ratings yet

- Conocimiento de Embarque BLDocument10 pagesConocimiento de Embarque BLMaryuri MendozaNo ratings yet

- Institutional Finance To EntrepreneursDocument17 pagesInstitutional Finance To EntrepreneursSelvi balanNo ratings yet

- (Xi) 2023 Target Paper Eco, Poc, Acc & Bmaths by Sir IrfanDocument17 pages(Xi) 2023 Target Paper Eco, Poc, Acc & Bmaths by Sir IrfanMosa AbdullahNo ratings yet

- Biruk TekleDocument60 pagesBiruk TekleuvygNo ratings yet

- Pas 2 TheoriesDocument8 pagesPas 2 TheoriesErich Joy Dela CruzNo ratings yet

- How To BitcoinDocument210 pagesHow To BitcoinBruno MaganinhoNo ratings yet

- From How Many Years Are You A Resident of Bopal?Document12 pagesFrom How Many Years Are You A Resident of Bopal?sghulyaniNo ratings yet

- China: The Rise of The Mighty DragonDocument14 pagesChina: The Rise of The Mighty DragonArpit SetyaNo ratings yet

- Particulars As Furnished by The Shipper: Carrier'S ReceiptDocument1 pageParticulars As Furnished by The Shipper: Carrier'S ReceiptMOUSTAPHA gueyeNo ratings yet

- Future of Retailing in PakistanDocument9 pagesFuture of Retailing in PakistanSaigha ArshadNo ratings yet

- 2005-03-09 - Trade Policy Review - Report by The Secretariat On Jamaica Rev1. PART4 (WTTPRS139R1-4)Document50 pages2005-03-09 - Trade Policy Review - Report by The Secretariat On Jamaica Rev1. PART4 (WTTPRS139R1-4)Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- Shifa International Hospitals Limited.: Status Approved Date: PO NoDocument1 pageShifa International Hospitals Limited.: Status Approved Date: PO NoHiJackNo ratings yet

- Belgrade Retail MarketView H2 2012 PDFDocument3 pagesBelgrade Retail MarketView H2 2012 PDFJason JacksonNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountPriya SinghNo ratings yet

- Midterm Exam in Treasury ManagementDocument5 pagesMidterm Exam in Treasury ManagementJoel PangisbanNo ratings yet

- 1 Scope of International MarketingDocument35 pages1 Scope of International MarketingLORENA HERRERA CASTRO100% (1)

- ES032 Assignment6Document6 pagesES032 Assignment6TerkNo ratings yet

- Financial Management MCQDocument11 pagesFinancial Management MCQdylan.cosgrove2000No ratings yet

- Requirements For Bahrain PortDocument9 pagesRequirements For Bahrain PortVinodh KumarNo ratings yet