Professional Documents

Culture Documents

Investment Property

Uploaded by

Aguirre Rexor Angelo0 ratings0% found this document useful (0 votes)

10 views4 pagesInvestment property refers to land or buildings held by an owner to earn rentals or for capital appreciation rather than use in operations. Such property includes land held for future development or sale, land for a potential plant site, and buildings leased out under operating leases or to subsidiaries. Investment property is initially measured at cost and can subsequently be measured using either the cost model (cost less depreciation and impairment) or fair value model (fair value with gains/losses recorded in profit or loss).

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInvestment property refers to land or buildings held by an owner to earn rentals or for capital appreciation rather than use in operations. Such property includes land held for future development or sale, land for a potential plant site, and buildings leased out under operating leases or to subsidiaries. Investment property is initially measured at cost and can subsequently be measured using either the cost model (cost less depreciation and impairment) or fair value model (fair value with gains/losses recorded in profit or loss).

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views4 pagesInvestment Property

Uploaded by

Aguirre Rexor AngeloInvestment property refers to land or buildings held by an owner to earn rentals or for capital appreciation rather than use in operations. Such property includes land held for future development or sale, land for a potential plant site, and buildings leased out under operating leases or to subsidiaries. Investment property is initially measured at cost and can subsequently be measured using either the cost model (cost less depreciation and impairment) or fair value model (fair value with gains/losses recorded in profit or loss).

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

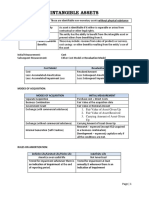

Investment Property

Investment Property – land or building held by the owner for undetermined future use, capital appreciation,

or earn rentals.

What if: Partly PPE – Partly Investment Property

1. Can be sold/rented out separately – value of the property should be split up to PPE and Investment

Property.

2. Cannot be sold/rented out separately – PPE portion is significant, the whole property is accounted as PPE.

IP portion is significant, the whole property is accounted as IP.

3. Ancillary Services – if insignificant, account as investment property. However, if it is significant account as

PPE.

Investment Property includes the following:

1. Land held for capital appreciation or undetermined future use

2. Land held for potential plant site

3. Land or building being leased out under operating lease

4. Land or building leased out to subsidiary in the separate financial statement

5. Land or building under construction or being developed as investment property

Initial Measurement:

Cost = Purchase Price + Directly Attributable Cost

Subsequent Measurement:

Cost Model = Cost – Accumulated Depreciation – Accumulated Impairment Loss

Fair Value Model = Fair Value

Cost Model Fair Value Model

Initial Measurement Same as PPE Same as PPE

Subsequent Measurement Cost Fair Value = Carrying Amount

Less: Accumulated Depreciation

Accumulated Impairment

Carrying Amount

Depreciation With Without

Impairment With Without

Unrealize gains/losses Without With

Reclassification of Investment Property:

Fair Value Model

Cost Model

You might also like

- Module 1 - FA at FVDocument5 pagesModule 1 - FA at FVNorfaidah Didato GogoNo ratings yet

- FAR Handout Investment PropertyDocument4 pagesFAR Handout Investment PropertyPIOLA CAPINANo ratings yet

- FAR 007 Summary Notes - Intangible AssetsDocument5 pagesFAR 007 Summary Notes - Intangible AssetsMarynelle Labrador SevillaNo ratings yet

- 07 Long-Lived Non-Monetary Assets and Amortization - StudentDocument30 pages07 Long-Lived Non-Monetary Assets and Amortization - StudentNileshAgarwalNo ratings yet

- Handout AP 2306 FDocument14 pagesHandout AP 2306 FDyosa MeNo ratings yet

- Intangible AssetsDocument3 pagesIntangible Assetsgreat angelNo ratings yet

- IAS 16 PPE - LectureDocument11 pagesIAS 16 PPE - LectureBeatrice Ella DomingoNo ratings yet

- DEDUCTIONSDocument13 pagesDEDUCTIONSmigueltanfelix149No ratings yet

- Investment Property Owner-Occupied: If TheDocument6 pagesInvestment Property Owner-Occupied: If TheJoana TrinidadNo ratings yet

- Using Costs in Decision Making: Pricing - Cost Can Determine If A Firm CanDocument10 pagesUsing Costs in Decision Making: Pricing - Cost Can Determine If A Firm Cansneha mallikaNo ratings yet

- Chapter 16Document16 pagesChapter 16soniadhingra1805No ratings yet

- Ppe RevaluationDocument6 pagesPpe RevaluationjonapdfsNo ratings yet

- Cfas Module by Ecp: - Finals Part IDocument13 pagesCfas Module by Ecp: - Finals Part IDenmark CabadduNo ratings yet

- Notes On Depreciation Class-11Document5 pagesNotes On Depreciation Class-11Suresh Kumar100% (1)

- Accountancy 7Document65 pagesAccountancy 7Arif ShaikhNo ratings yet

- Chapter 3 Property, Plant and EquipmentDocument6 pagesChapter 3 Property, Plant and Equipmentvchandy22No ratings yet

- ES6 Lec07a Depreciation Straight Line MethodDocument15 pagesES6 Lec07a Depreciation Straight Line MethodIroha IsshikiNo ratings yet

- Cost of Production: Module - 7Document20 pagesCost of Production: Module - 7Oanh Tôn Nữ ThụcNo ratings yet

- Summary - Ppe - ImpairmentDocument15 pagesSummary - Ppe - ImpairmentLorelie OrtegaNo ratings yet

- Property, Plant & EquipmentDocument5 pagesProperty, Plant & EquipmentBryan NatadNo ratings yet

- Pas 16Document3 pagesPas 16Nguyen Lam SonNo ratings yet

- M 2Document22 pagesM 2r79sivaNo ratings yet

- Chapter 6-Income ApproachDocument37 pagesChapter 6-Income ApproachHosnii QamarNo ratings yet

- Chap-09-Cost-Volume-Profit AnalysisDocument2 pagesChap-09-Cost-Volume-Profit AnalysisMd. Mostafijur RahmanNo ratings yet

- Depletion Notes: Disclaimer: Not EntirelyDocument3 pagesDepletion Notes: Disclaimer: Not EntirelyRes GosanNo ratings yet

- Pas 16 Property Plant and EquipmentDocument4 pagesPas 16 Property Plant and EquipmentKristalen ArmandoNo ratings yet

- Topic 28: Financial Asset at Amortized CostDocument1 pageTopic 28: Financial Asset at Amortized Costemman neriNo ratings yet

- Advances To Officers, Investment Property, Cash Surrender ValueDocument2 pagesAdvances To Officers, Investment Property, Cash Surrender ValueMary Joyce YuNo ratings yet

- Notes - Investment Property BookDocument2 pagesNotes - Investment Property BookJake AustriaNo ratings yet

- Property, Plant & EquipmentDocument19 pagesProperty, Plant & EquipmentErika Mae LegaspiNo ratings yet

- Summary (NEW Lease)Document3 pagesSummary (NEW Lease)Anonymous AGI7npNo ratings yet

- ReviewerDocument5 pagesReviewercholestudyNo ratings yet

- CHAPTER 13 - Principles of DeductionDocument5 pagesCHAPTER 13 - Principles of DeductionDeviane CalabriaNo ratings yet

- Valuation - Study NotesDocument7 pagesValuation - Study NotesNaseem AlamNo ratings yet

- Investment PropertyDocument16 pagesInvestment PropertyDjunah ArellanoNo ratings yet

- Cheat SheetDocument15 pagesCheat SheetJason wonwonNo ratings yet

- AS 10 - Property Plant and Equipment: Recognition CriteriaDocument5 pagesAS 10 - Property Plant and Equipment: Recognition CriteriaAshutosh shriwasNo ratings yet

- Effective Interest MethodDocument1 pageEffective Interest MethodWinter SnowNo ratings yet

- Notes For ACN002Document20 pagesNotes For ACN002Anthony Ariel Ramos DepanteNo ratings yet

- Investment PropertyDocument2 pagesInvestment Propertytopnotcher2011No ratings yet

- Investment Property NotesDocument2 pagesInvestment Property NotesGian CalaNo ratings yet

- Financial Accounting1 Final Exam RevisionDocument18 pagesFinancial Accounting1 Final Exam RevisionCẩm TúNo ratings yet

- Accounting For Fixed Assets I. Property, Plant and EquipmentDocument45 pagesAccounting For Fixed Assets I. Property, Plant and EquipmentLayNo ratings yet

- CH 12Document4 pagesCH 12amu_scribd100% (1)

- Property, Plant and Equipment (IAS 16) : Haroon Arshad Butt IcmapDocument16 pagesProperty, Plant and Equipment (IAS 16) : Haroon Arshad Butt IcmapHaroon A ButtNo ratings yet

- An Analysis of Cost Volume ProfitDocument46 pagesAn Analysis of Cost Volume ProfitKutty PaiyenNo ratings yet

- 3.3 Costs and Break-Even AnalysisDocument3 pages3.3 Costs and Break-Even AnalysisYoumna MatyNo ratings yet

- Analysis and Impact of LeverageDocument88 pagesAnalysis and Impact of LeveragePines MacapagalNo ratings yet

- Cost of CapitalDocument15 pagesCost of CapitalRonmaty VixNo ratings yet

- Chapter 6 Property Plant EquipmentDocument89 pagesChapter 6 Property Plant EquipmentLovely AbadianoNo ratings yet

- AFM - Cost of Capital - AE - Week 1Document41 pagesAFM - Cost of Capital - AE - Week 1AwaiZ zahidNo ratings yet

- Chapter 9 - DepreciationDocument47 pagesChapter 9 - DepreciationsajalNo ratings yet

- DepreciationDocument28 pagesDepreciationREHANRAJNo ratings yet

- Ias 16Document20 pagesIas 16Jasmine LamugNo ratings yet

- Brief Explanation of Various Types of Costs in Cost Accounting With Examples PDFDocument6 pagesBrief Explanation of Various Types of Costs in Cost Accounting With Examples PDFmayankNo ratings yet

- Financial Management FormulasDocument5 pagesFinancial Management FormulasDaniel Kahn GillamacNo ratings yet

- Ind As - 16Document11 pagesInd As - 16OopsbymistakeNo ratings yet

- Notes On Property, Plant and EquipmentDocument49 pagesNotes On Property, Plant and Equipmentcriszel4sobejanaNo ratings yet

- Pas 16Document20 pagesPas 16Princess Jullyn ClaudioNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)