Professional Documents

Culture Documents

FL Excel Old

FL Excel Old

Uploaded by

alvarez.jayden12070 ratings0% found this document useful (0 votes)

9 views5 pagesThe document contains 5 cases that calculate the tax liability of various individuals (resident non-senior, resident senior, resident super senior, non-resident) with different levels of taxable income (Rs. 4,00,000, Rs. 5,00,000, Rs. 7,00,000, Rs. 12,00,000) under the old tax rates regime for the previous year 2022-23 and assessment year 2023-24. It applies tax slabs and exemptions to determine the tax payable for each case, adding a 4% health and education cess.

Original Description:

financial literacy old regime excel

Original Title

FL-Excel-Old

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains 5 cases that calculate the tax liability of various individuals (resident non-senior, resident senior, resident super senior, non-resident) with different levels of taxable income (Rs. 4,00,000, Rs. 5,00,000, Rs. 7,00,000, Rs. 12,00,000) under the old tax rates regime for the previous year 2022-23 and assessment year 2023-24. It applies tax slabs and exemptions to determine the tax payable for each case, adding a 4% health and education cess.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views5 pagesFL Excel Old

FL Excel Old

Uploaded by

alvarez.jayden1207The document contains 5 cases that calculate the tax liability of various individuals (resident non-senior, resident senior, resident super senior, non-resident) with different levels of taxable income (Rs. 4,00,000, Rs. 5,00,000, Rs. 7,00,000, Rs. 12,00,000) under the old tax rates regime for the previous year 2022-23 and assessment year 2023-24. It applies tax slabs and exemptions to determine the tax payable for each case, adding a 4% health and education cess.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

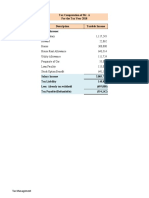

Previous Year 2022-23 (Assessment Year 2023-24) Old Tax Rates Regime Case-1

Calculation of Tax Liability Resident Non-Senior Resident Senior Resident Super Senior Non-Resident

Narendra Damodardas Lal Krishna Imran Ahmad

Name of Assessee Rahul Gandhi

Modi Advani Khan Niazi

Date of Birth DD/MM/YYYY 19/06/1970 17/09/1950 08/11/1927 05/10/1952

Exemption Limit Rs. 2,50,000 Rs. 3,00,000 Rs. 5,00,000 Rs. 2,50,000

Taxable Income Rs. 4,00,000

Exemption Limit to Rs. 5,00,000 5% ₹ 7,500 ₹ 5,000 Nil ₹ 7,500

Rs. 5,00,000 to Rs. 10,00,000 20%

Above Rs. 10,00,000 30%

₹ 7,500 ₹ 5,000 ₹0 ₹ 7,500

Less Rebate u/s 87A to Resident, if Taxable

Income not exceeding Rs. 5,00,000

Max. Rs. 12,500

-₹ 7,500 -₹ 5,000 ₹0 Not Allowed

₹0 ₹0 ₹0 ₹ 7,500

Add Health & Education Cess 4% ₹ 300

Tax Liability ₹0 ₹0 ₹0 ₹ 7,800

Previous Year 2022-23 (Assessment Year 2023-24) Old Tax Rates Regime Case-2

Calculation of Tax Liability Resident Non-Senior Resident Senior Resident Super Senior Non-Resident

Narendra Damodardas Lal Krishna Imran Ahmad

Name of Assessee Rahul Gandhi

Modi Advani Khan Niazi

Date of Birth 19/06/1970 17/09/1950 08/11/1927 05/10/1952

Exemption Limit Rs. 2,50,000 Rs. 3,00,000 Rs. 5,00,000 Rs. 2,50,000

Taxable Income Rs. 5,00,000

Exemption Limit to Rs. 5,00,000 5% ₹ 12,500 ₹ 10,000 Nil ₹ 12,500

Rs. 5,00,000 to Rs. 10,00,000 20%

Above Rs. 10,00,000 30%

₹ 12,500 ₹ 10,000 ₹0 ₹ 12,500

Less Rebate u/s 87A to Resident, if Taxable

Income not exceeding Rs. 5,00,000

Max. Rs. 12,500

-₹ 12,500 -₹ 10,000 ₹0 Not Allowed

₹0 ₹0 ₹0 ₹ 12,500

Add Health & Education Cess 4% ₹ 500

Tax Liability ₹0 ₹0 ₹0 ₹ 13,000

Previous Year 2022-23 (Assessment Year 2023-24) Old Tax Rates Regime Case-3

Calculation of Tax Liability Resident Non-Senior Resident Senior Resident Super Senior Non-Resident

Narendra Damodardas Lal Krishna Imran Ahmad

Name of Assessee Rahul Gandhi

Modi Advani Khan Niazi

Date of Birth 19/06/1970 17/09/1950 08/11/1927 05/10/1952

Exemption Limit Rs. 2,50,000 Rs. 3,00,000 Rs. 5,00,000 Rs. 2,50,000

Taxable Income Rs. 7,00,000

Exemption Limit to Rs. 5,00,000 5% ₹ 12,500 ₹ 10,000 Nil ₹ 12,500

Rs. 5,00,000 to Rs. 10,00,000 20% ₹ 40,000 ₹ 40,000 ₹ 40,000 ₹ 40,000

Above Rs. 10,00,000 30%

₹ 52,500 ₹ 50,000 ₹ 40,000 ₹ 52,500

Less Rebate u/s 87A to Resident, if Taxable

Income not exceeding Rs. 5,00,000

Max. Rs. 12,500

Not Allowed Not Allowed Not Allowed Not Allowed

₹ 52,500 ₹ 50,000 ₹ 40,000 ₹ 52,500

Add Health & Education Cess 4% ₹ 2,100 ₹ 2,000 ₹ 1,600 ₹ 2,100

Tax Liability ₹ 54,600 ₹ 52,000 ₹ 41,600 ₹ 54,600

Previous Year 2022-23 (Assessment Year 2023-24) Old Tax Rates Regime Case-4

Calculation of Tax Liability Resident Non-Senior Resident Senior Resident Super Senior Non-Resident

Narendra Damodardas Lal Krishna Imran Ahmad

Name of Assessee Rahul Gandhi

Modi Advani Khan Niazi

Date of Birth 19/06/1970 17/09/1950 08/11/1927 05/10/1952

Exemption Limit Rs. 2,50,000 Rs. 3,00,000 Rs. 5,00,000 Rs. 2,50,000

Taxable Income Rs. 12,00,000

Exemption Limit to Rs. 5,00,000 5% ₹ 12,500 ₹ 10,000 Nil ₹ 12,500

Rs. 5,00,000 to Rs. 10,00,000 20% ₹ 1,00,000 ₹ 1,00,000 ₹ 1,00,000 ₹ 1,00,000

Above Rs. 10,00,000 30% ₹ 60,000 ₹ 60,000 ₹ 60,000 ₹ 60,000

₹ 1,72,500 ₹ 1,70,000 ₹ 1,60,000 ₹ 1,72,500

Less Rebate u/s 87A to Resident, if Taxable

Income not exceeding Rs. 5,00,000

Max. Rs. 12,500

Not Allowed Not Allowed Not Allowed Not Allowed

₹ 1,72,500 ₹ 1,70,000 ₹ 1,60,000 ₹ 1,72,500

Add Health & Education Cess 4% ₹ 6,900 ₹ 6,800 ₹ 6,400 ₹ 6,900

Tax Liability ₹ 1,79,400 ₹ 1,76,800 ₹ 1,66,400 ₹ 1,79,400

Previous Year 2022-23 (Assessment Year 2023-24) Old Tax Rates Regime Case-5

Calculation of Tax Liability Resident Non-Senior Resident Senior Resident Super Senior Non-Resident

Narendra Damodardas Lal Krishna Imran Ahmad

Name of Assessee Rahul Gandhi

Modi Advani Khan Niazi

Date of Birth 19/06/1970 17/09/1950 08/11/1927 05/10/1952

Exemption Limit Rs. 2,50,000 Rs. 3,00,000 Rs. 5,00,000 Rs. 2,50,000

Taxable Income Rs. 20,00,000

Exemption Limit to Rs. 5,00,000 5% ₹ 12,500 ₹ 10,000 Nil ₹ 12,500

Rs. 5,00,000 to Rs. 10,00,000 20% ₹ 1,00,000 ₹ 1,00,000 ₹ 1,00,000 ₹ 1,00,000

Above Rs. 10,00,000 30% ₹ 3,00,000 ₹ 3,00,000 ₹ 3,00,000 ₹ 3,00,000

₹ 4,12,500 ₹ 4,10,000 ₹ 4,00,000 ₹ 4,12,500

Less Rebate u/s 87A to Resident, if Taxable

Max. Rs. 12,500

Income not exceeding Rs. 5,00,000 Not Allowed Not Allowed Not Allowed Not Allowed

₹ 4,12,500 ₹ 4,10,000 ₹ 4,00,000 ₹ 4,12,500

Add Health & Education Cess 4% ₹ 16,500 ₹ 16,400 ₹ 16,000 ₹ 16,500

Tax Liability ₹ 4,29,000 ₹ 4,26,400 ₹ 4,16,000 ₹ 4,29,000

You might also like

- Shri Ram Garments: Tax InvoiceDocument1 pageShri Ram Garments: Tax InvoicePUNAM JAINNo ratings yet

- Pay Slip - 607043 - Jul-22Document1 pagePay Slip - 607043 - Jul-22Supriya KandukuriNo ratings yet

- Pay Slip - 604316 - Feb-23Document1 pagePay Slip - 604316 - Feb-23ArchanaNo ratings yet

- Axis Bank LTD Payslip For The Month of July - 2019Document1 pageAxis Bank LTD Payslip For The Month of July - 2019Rohit Kumar33% (3)

- DT Shrey RathiDocument33 pagesDT Shrey RathiranveerNo ratings yet

- Yadnya-Income Tax Regime CalculatorDocument16 pagesYadnya-Income Tax Regime CalculatorRaghavendra DeshpandeNo ratings yet

- FL Excel NewDocument5 pagesFL Excel Newalvarez.jayden1207No ratings yet

- IT Amendment 2018 AttemptDocument14 pagesIT Amendment 2018 AttemptrakeshNo ratings yet

- Tax CalculatorDocument3 pagesTax CalculatorumaNo ratings yet

- New Tax Regime Vs Old Calculator - by AssetYogiDocument7 pagesNew Tax Regime Vs Old Calculator - by AssetYogiGajendra HoleNo ratings yet

- New Tax Regime Vs Old Calculator by AssetYogiDocument4 pagesNew Tax Regime Vs Old Calculator by AssetYogijohnNo ratings yet

- Dhruv Kumar COMPUTATION 2022-2023Document1 pageDhruv Kumar COMPUTATION 2022-2023RAHUL KUMARNo ratings yet

- Self Declaration Form Ay 2022-23-ArthisDocument7 pagesSelf Declaration Form Ay 2022-23-ArthisMurugesan JeevaNo ratings yet

- New-Tax-Regime-vs-Old-Calculator by Juned ShaikhDocument4 pagesNew-Tax-Regime-vs-Old-Calculator by Juned ShaikhJunedNo ratings yet

- Chapter 1 - Basic Concepts and General Tax RatesDocument11 pagesChapter 1 - Basic Concepts and General Tax RatesPuran GuptaNo ratings yet

- New Tax Regime Vs Old Calculator by AssetYogiDocument3 pagesNew Tax Regime Vs Old Calculator by AssetYogiSukanta MondalNo ratings yet

- Hotel BillDocument1 pageHotel BillAmitNo ratings yet

- Policy Name Interest Rate No. of Years Amount To Be InvestedDocument5 pagesPolicy Name Interest Rate No. of Years Amount To Be InvestedAman sehgalNo ratings yet

- International Tax ComparisonsDocument23 pagesInternational Tax ComparisonsJahnavi BadlaniNo ratings yet

- JAYME, Marx Yuri - 2BSMA-B - PAYROLLDocument42 pagesJAYME, Marx Yuri - 2BSMA-B - PAYROLLMarx Yuri JaymeNo ratings yet

- Finshots Calculator For Tax RegimeDocument6 pagesFinshots Calculator For Tax RegimeSantosh mudaliarNo ratings yet

- Annual Plan 2Document7 pagesAnnual Plan 2bansal_shivangiNo ratings yet

- 9114 Accts-SERVICE CHARGhjgjgnj)Document5 pages9114 Accts-SERVICE CHARGhjgjgnj)Girish KumarNo ratings yet

- Tax Slabs - Exemptions - Ay 2022-23Document19 pagesTax Slabs - Exemptions - Ay 2022-23RatnaPrasadNalamNo ratings yet

- Hotel Bill SampleDocument1 pageHotel Bill Samplemohdzuberalam73No ratings yet

- Budget - 2017 - 2018Document3 pagesBudget - 2017 - 2018kannnamreddyeswarNo ratings yet

- How To Pay Zero Income Tax On 20 Lakhs SalaryDocument9 pagesHow To Pay Zero Income Tax On 20 Lakhs SalaryvijaytechskillupgradeNo ratings yet

- Quotation: CODE 81150 Code: 81150 Code: 81150Document1 pageQuotation: CODE 81150 Code: 81150 Code: 81150raghuramNo ratings yet

- Financial Profiling ExampleDocument8 pagesFinancial Profiling ExampleWasim SNo ratings yet

- Irs (Mumbai) Co-Operative Houseing Society LTD: Flat No. Name Email Id: Mobile No. AddressDocument6 pagesIrs (Mumbai) Co-Operative Houseing Society LTD: Flat No. Name Email Id: Mobile No. AddressA K OJHANo ratings yet

- JAWAIDocument1 pageJAWAIPrateekKackarNo ratings yet

- Year Azm Mini Suv Cumulative Azf Full Suv CumulativeDocument4 pagesYear Azm Mini Suv Cumulative Azf Full Suv CumulativeSomesh KumarNo ratings yet

- Payslip 4811 Mar 2023 4628246975309252139 1683290932204Document1 pagePayslip 4811 Mar 2023 4628246975309252139 1683290932204Keshav ChinnuNo ratings yet

- Submitted by - 1. Simran Agarwal 2. Rohit Kumar Singh 3. Rishabh Rajora 4. Hitesh Khandawal 5. Aditi SinghDocument20 pagesSubmitted by - 1. Simran Agarwal 2. Rohit Kumar Singh 3. Rishabh Rajora 4. Hitesh Khandawal 5. Aditi SinghChirag JainNo ratings yet

- IncomDocument48 pagesIncomMahendra BabuNo ratings yet

- September 2022 TDS WorksheetDocument4 pagesSeptember 2022 TDS Worksheetsri sainathNo ratings yet

- Business Budgeting For Cloud Kitchen - FINALDocument21 pagesBusiness Budgeting For Cloud Kitchen - FINALgcgary87No ratings yet

- UntitledDocument30 pagesUntitledRavi BanothNo ratings yet

- 589-Sales - Invoice-Guruprasad PittyDocument1 page589-Sales - Invoice-Guruprasad PittyVara Prasad BNo ratings yet

- Latest Income Tax Slabs - Fundfolio by Sharique SamsudheenDocument1 pageLatest Income Tax Slabs - Fundfolio by Sharique SamsudheensalmanNo ratings yet

- Should You Prepay Home LoanDocument1 pageShould You Prepay Home LoanAbhay MishraNo ratings yet

- PayslipsDocument63 pagesPayslipsPrem AahvaNo ratings yet

- Income Tax Calculator FY 2024 25 Age Below 60 Years 1Document4 pagesIncome Tax Calculator FY 2024 25 Age Below 60 Years 1Kiran KumarNo ratings yet

- Receipt - LinkedInDocument2 pagesReceipt - LinkedIndevam.srivastavaNo ratings yet

- SfsfgegDocument1 pageSfsfgegvishalNo ratings yet

- Tax&InvestmentDocument31 pagesTax&Investmentapi-3758009No ratings yet

- Hotel Bill SampleDocument1 pageHotel Bill Samplemohdzuberalam73No ratings yet

- To Gross Profit C/D 989,985.00: Proprietor Auditor & Tax PractitionerDocument4 pagesTo Gross Profit C/D 989,985.00: Proprietor Auditor & Tax Practitionerkazeem ahamedNo ratings yet

- Inv 2023 00002Document1 pageInv 2023 00002Aamna NoreenNo ratings yet

- 113-Delivery - Challan-Hyatt Regency Bhikaji Cama Place New DelhiDocument1 page113-Delivery - Challan-Hyatt Regency Bhikaji Cama Place New DelhiNaseem ahmadNo ratings yet

- EMI Prepayment CalculatorDocument13 pagesEMI Prepayment Calculatorgcvs8rb84yNo ratings yet

- Raghu M N Gym Invoice 2023Document1 pageRaghu M N Gym Invoice 2023Raghu GowdaNo ratings yet

- TM PQsDocument9 pagesTM PQsAnooshayNo ratings yet

- Sales - Invoice-10151-Shree StoresDocument1 pageSales - Invoice-10151-Shree StoresSantosh Ramdawar JaiswarNo ratings yet

- Irs (Mumbai) Co-Operative Houseing Society LTD: Flat No. Name Email Id: Mobile No. AddressDocument6 pagesIrs (Mumbai) Co-Operative Houseing Society LTD: Flat No. Name Email Id: Mobile No. AddressA K OJHANo ratings yet

- 6th Month PayslipDocument1 page6th Month Payslipsugudeva0No ratings yet

- Pension Payment OrderDocument1 pagePension Payment Ordernivito seriesNo ratings yet