Professional Documents

Culture Documents

FL Excel New

FL Excel New

Uploaded by

alvarez.jayden1207Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FL Excel New

FL Excel New

Uploaded by

alvarez.jayden1207Copyright:

Available Formats

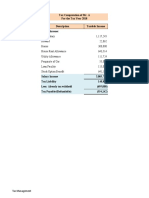

Previous Year 2022-23 (Assessment Year 2023-24) New Tax Rates Regime Case-6

Calculation of Tax Liability Resident Non-Senior Resident Senior Resident Super Senior Non-Resident

Narendra Damodardas Lal Krishna Imran Ahmad

Name of Assessee Rahul Gandhi

Modi Advani Khan Niazi

Date of Birth DD/MM/YYYY 19/06/1970 17/09/1950 08/11/1927 05/10/1952

Exemption Limit Rs. 2,50,000 Rs. 2,50,000 Rs. 2,50,000 Rs. 2,50,000

Taxable Income Rs. 4,00,000

Rs. 2,50,000 to Rs. 5,00,000 5% ₹ 7,500 ₹ 7,500 ₹ 7,500 ₹ 7,500

Rs. 5,00,000 to Rs. 7,50,000 10%

Rs. 7,50,000 to Rs. 10,00,000 15%

Rs. 10,00,000 to Rs. 12,50,000 20%

Rs. 12,50,000 to Rs. 15,00,000 25%

Above Rs. 15,00,000 30%

₹ 7,500 ₹ 7,500 ₹ 7,500 ₹ 7,500

Less Rebate u/s 87A to Resident, if Taxable

Income not exceeding Rs. 5,00,000

Max. Rs. 12,500 -₹ 7,500 -₹ 7,500 -₹ 7,500 Not Allowed

₹0 ₹0 ₹0 ₹ 7,500

Add Health & Education Cess 4% ₹ 300

Tax Liability ₹0 ₹0 ₹0 ₹ 7,800

Previous Year 2022-23 (Assessment Year 2023-24) New Tax Rates Regime Case-7

Calculation of Tax Liability Resident Non-Senior Resident Senior Resident Super Senior Non-Resident

Narendra Damodardas Lal Krishna Imran Ahmad

Name of Assessee Rahul Gandhi

Modi Advani Khan Niazi

Date of Birth 19/06/1970 17/09/1950 08/11/1927 05/10/1952

Exemption Limit Rs. 2,50,000 Rs. 2,50,000 Rs. 2,50,000 Rs. 2,50,000

Taxable Income Rs. 5,00,000

Rs. 2,50,000 to Rs. 5,00,000 5% ₹ 12,500 ₹ 12,500 ₹ 12,500 ₹ 12,500

Rs. 5,00,000 to Rs. 7,50,000 10%

Rs. 7,50,000 to Rs. 10,00,000 15%

Rs. 10,00,000 to Rs. 12,50,000 20%

Rs. 12,50,000 to Rs. 15,00,000 25%

Above Rs. 15,00,000 30%

₹ 12,500 ₹ 12,500 ₹ 12,500 ₹ 12,500

Less Rebate u/s 87A to Resident, if Taxable

Max. Rs. 12,500

Income not exceeding Rs. 5,00,000 -₹ 12,500 -₹ 12,500 -₹ 12,500 Not Allowed

₹0 ₹0 ₹0 ₹ 12,500

Add Health & Education Cess 4% ₹ 500

Tax Liability ₹0 ₹0 ₹0 ₹ 13,000

Previous Year 2022-23 (Assessment Year 2023-24) New Tax Rates Regime Case-8

Calculation of Tax Liability Resident Non-Senior Resident Senior Resident Super Senior Non-Resident

Narendra Damodardas Lal Krishna Imran Ahmad

Name of Assessee Rahul Gandhi

Modi Advani Khan Niazi

Date of Birth 19/06/1970 17/09/1950 08/11/1927 05/10/1952

Exemption Limit Rs. 2,50,000 Rs. 2,50,000 Rs. 2,50,000 Rs. 2,50,000

Taxable Income Rs. 7,00,000

Rs. 2,50,000 to Rs. 5,00,000 5% ₹ 12,500 ₹ 12,500 ₹ 12,500 ₹ 12,500

Rs. 5,00,000 to Rs. 7,50,000 10% ₹ 20,000 ₹ 20,000 ₹ 20,000 ₹ 20,000

Rs. 7,50,000 to Rs. 10,00,000 15%

Rs. 10,00,000 to Rs. 12,50,000 20%

Rs. 12,50,000 to Rs. 15,00,000 25%

Above Rs. 15,00,000 30%

₹ 32,500 ₹ 32,500 ₹ 32,500 ₹ 32,500

Less Rebate u/s 87A to Resident, if Taxable

Income not exceeding Rs. 5,00,000

Max. Rs. 12,500 Not Allowed Not Allowed Not Allowed Not Allowed

₹ 32,500 ₹ 32,500 ₹ 32,500 ₹ 32,500

Add Health & Education Cess 4% ₹ 1,300 ₹ 1,300 ₹ 1,300 ₹ 1,300

Tax Liability ₹ 33,800 ₹ 33,800 ₹ 33,800 ₹ 33,800

Previous Year 2022-23 (Assessment Year 2023-24) New Tax Rates Regime Case-9

Calculation of Tax Liability Resident Non-Senior Resident Senior Resident Super Senior Non-Resident

Narendra Damodardas Lal Krishna Imran Ahmad

Name of Assessee Rahul Gandhi

Modi Advani Khan Niazi

Date of Birth 19/06/1970 17/09/1950 08/11/1927 05/10/1952

Exemption Limit Rs. 2,50,000 Rs. 2,50,000 Rs. 2,50,000 Rs. 2,50,000

Taxable Income Rs. 12,00,000

Rs. 2,50,000 to Rs. 5,00,000 5% ₹ 12,500 ₹ 12,500 ₹ 12,500 ₹ 12,500

Rs. 5,00,000 to Rs. 7,50,000 10% ₹ 25,000 ₹ 25,000 ₹ 25,000 ₹ 25,000

Rs. 7,50,000 to Rs. 10,00,000 15% ₹ 37,500 ₹ 37,500 ₹ 37,500 ₹ 37,500

Rs. 10,00,000 to Rs. 12,50,000 20% ₹ 40,000 ₹ 40,000 ₹ 40,000 ₹ 40,000

Rs. 12,50,000 to Rs. 15,00,000 25%

Above Rs. 15,00,000 30%

₹ 1,15,000 ₹ 1,15,000 ₹ 1,15,000 ₹ 1,15,000

Less Rebate u/s 87A to Resident, if Taxable

Income not exceeding Rs. 5,00,000

Max. Rs. 12,500 Not Allowed Not Allowed Not Allowed Not Allowed

₹ 1,15,000 ₹ 1,15,000 ₹ 1,15,000 ₹ 1,15,000

Add Health & Education Cess 4% ₹ 4,600 ₹ 4,600 ₹ 4,600 ₹ 4,600

Tax Liability ₹ 1,19,600 ₹ 1,19,600 ₹ 1,19,600 ₹ 1,19,600

Previous Year 2022-23 (Assessment Year 2023-24) New Tax Rates Regime Case-10

Calculation of Tax Liability Resident Non-Senior Resident Senior Resident Super Senior Non-Resident

Narendra Damodardas Lal Krishna Imran Ahmad

Name of Assessee Rahul Gandhi

Modi Advani Khan Niazi

Date of Birth 19/06/1970 17/09/1950 08/11/1927 05/10/1952

Exemption Limit Rs. 2,50,000 Rs. 2,50,000 Rs. 2,50,000 Rs. 2,50,000

Taxable Income Rs. 20,00,000

Rs. 2,50,000 to Rs. 5,00,000 5% ₹ 12,500 ₹ 12,500 ₹ 12,500 ₹ 12,500

Rs. 5,00,000 to Rs. 7,50,000 10% ₹ 25,000 ₹ 25,000 ₹ 25,000 ₹ 25,000

Rs. 7,50,000 to Rs. 10,00,000 15% ₹ 37,500 ₹ 37,500 ₹ 37,500 ₹ 37,500

Rs. 10,00,000 to Rs. 12,50,000 20% ₹ 50,000 ₹ 50,000 ₹ 50,000 ₹ 50,000

Rs. 12,50,000 to Rs. 15,00,000 25% ₹ 62,500 ₹ 62,500 ₹ 62,500 ₹ 62,500

Above Rs. 15,00,000 30% ₹ 1,50,000 ₹ 1,50,000 ₹ 1,50,000 ₹ 1,50,000

₹ 3,37,500 ₹ 3,37,500 ₹ 3,37,500 ₹ 3,37,500

Less Rebate u/s 87A to Resident, if Taxable

Income not exceeding Rs. 5,00,000

Max. Rs. 12,500 Not Allowed Not Allowed Not Allowed Not Allowed

₹ 3,37,500 ₹ 3,37,500 ₹ 3,37,500 ₹ 3,37,500

Add Health & Education Cess 4% ₹ 13,500 ₹ 13,500 ₹ 13,500 ₹ 13,500

Tax Liability ₹ 3,51,000 ₹ 3,51,000 ₹ 3,51,000 ₹ 3,51,000

You might also like

- Axis Bank LTD Payslip For The Month of July - 2019Document1 pageAxis Bank LTD Payslip For The Month of July - 2019Rohit Kumar33% (3)

- Sandia Homes Pricelist As of 09.25.20 Local OnlyDocument1 pageSandia Homes Pricelist As of 09.25.20 Local OnlyvicNo ratings yet

- FL Excel OldDocument5 pagesFL Excel Oldalvarez.jayden1207No ratings yet

- IT Amendment 2018 AttemptDocument14 pagesIT Amendment 2018 AttemptrakeshNo ratings yet

- Self Declaration Form Ay 2022-23-ArthisDocument7 pagesSelf Declaration Form Ay 2022-23-ArthisMurugesan JeevaNo ratings yet

- New Tax Regime Vs Old Calculator - by AssetYogiDocument7 pagesNew Tax Regime Vs Old Calculator - by AssetYogiGajendra HoleNo ratings yet

- New-Tax-Regime-vs-Old-Calculator by Juned ShaikhDocument4 pagesNew-Tax-Regime-vs-Old-Calculator by Juned ShaikhJunedNo ratings yet

- New Tax Regime Vs Old Calculator by AssetYogiDocument3 pagesNew Tax Regime Vs Old Calculator by AssetYogiSukanta MondalNo ratings yet

- New Tax Regime Vs Old Calculator by AssetYogiDocument4 pagesNew Tax Regime Vs Old Calculator by AssetYogijohnNo ratings yet

- Tax CalculatorDocument3 pagesTax CalculatorumaNo ratings yet

- Policy Name Interest Rate No. of Years Amount To Be InvestedDocument5 pagesPolicy Name Interest Rate No. of Years Amount To Be InvestedAman sehgalNo ratings yet

- UntitledDocument30 pagesUntitledRavi BanothNo ratings yet

- Irs (Mumbai) Co-Operative Houseing Society LTD: Flat No. Name Email Id: Mobile No. AddressDocument6 pagesIrs (Mumbai) Co-Operative Houseing Society LTD: Flat No. Name Email Id: Mobile No. AddressA K OJHANo ratings yet

- Chapter 1 - Basic Concepts and General Tax RatesDocument11 pagesChapter 1 - Basic Concepts and General Tax RatesPuran GuptaNo ratings yet

- Budget - 2017 - 2018Document3 pagesBudget - 2017 - 2018kannnamreddyeswarNo ratings yet

- JAYME, Marx Yuri - 2BSMA-B - PAYROLLDocument42 pagesJAYME, Marx Yuri - 2BSMA-B - PAYROLLMarx Yuri JaymeNo ratings yet

- International Tax ComparisonsDocument23 pagesInternational Tax ComparisonsJahnavi BadlaniNo ratings yet

- Financial Profiling ExampleDocument8 pagesFinancial Profiling ExampleWasim SNo ratings yet

- Dhruv Kumar COMPUTATION 2022-2023Document1 pageDhruv Kumar COMPUTATION 2022-2023RAHUL KUMARNo ratings yet

- Annual Plan 2Document7 pagesAnnual Plan 2bansal_shivangiNo ratings yet

- Irs (Mumbai) Co-Operative Houseing Society LTD: Flat No. Name Email Id: Mobile No. AddressDocument6 pagesIrs (Mumbai) Co-Operative Houseing Society LTD: Flat No. Name Email Id: Mobile No. AddressA K OJHANo ratings yet

- Tax Slabs - Exemptions - Ay 2022-23Document19 pagesTax Slabs - Exemptions - Ay 2022-23RatnaPrasadNalamNo ratings yet

- JAWAIDocument1 pageJAWAIPrateekKackarNo ratings yet

- Hotel Bill SampleDocument1 pageHotel Bill Samplemohdzuberalam73No ratings yet

- Shri Ram Garments: Tax InvoiceDocument1 pageShri Ram Garments: Tax InvoicePUNAM JAINNo ratings yet

- Finshots Calculator For Tax RegimeDocument6 pagesFinshots Calculator For Tax RegimeSantosh mudaliarNo ratings yet

- 9114 Accts-SERVICE CHARGhjgjgnj)Document5 pages9114 Accts-SERVICE CHARGhjgjgnj)Girish KumarNo ratings yet

- Detailed Comparison Between New Tax Regime Vs Old 2Document1 pageDetailed Comparison Between New Tax Regime Vs Old 2praveen917No ratings yet

- DT Shrey RathiDocument33 pagesDT Shrey RathiranveerNo ratings yet

- 6 ProjectedDocument3 pages6 Projectedsheikh mohiuddinNo ratings yet

- Salary Tax Rates (2022 & 2023 Comparison)Document2 pagesSalary Tax Rates (2022 & 2023 Comparison)by kirmaniNo ratings yet

- Income Tax Calculator FY 2024 25 Age Below 60 Years 1Document4 pagesIncome Tax Calculator FY 2024 25 Age Below 60 Years 1Kiran KumarNo ratings yet

- Pakistan Salary Income Tax Calculator Tax Year 2021 2022Document4 pagesPakistan Salary Income Tax Calculator Tax Year 2021 2022Kashif NiaziNo ratings yet

- Irs (Mumbai) Co-Operative Houseing Society LTD: FY - 2018 To 2019 (1-Feb 2019 To 31 - Mar - 2019) Date ParticularsDocument4 pagesIrs (Mumbai) Co-Operative Houseing Society LTD: FY - 2018 To 2019 (1-Feb 2019 To 31 - Mar - 2019) Date ParticularsA K OJHANo ratings yet

- Quotation: CODE 81150 Code: 81150 Code: 81150Document1 pageQuotation: CODE 81150 Code: 81150 Code: 81150raghuramNo ratings yet

- Receipt - LinkedInDocument2 pagesReceipt - LinkedIndevam.srivastavaNo ratings yet

- Income Tax CircularDocument6 pagesIncome Tax Circularu19n6735No ratings yet

- IncomDocument48 pagesIncomMahendra BabuNo ratings yet

- Hotel Bill SampleDocument1 pageHotel Bill Samplemohdzuberalam73No ratings yet

- Income Tax Slabs Have Not Kept Pace With Inflation (2023)Document4 pagesIncome Tax Slabs Have Not Kept Pace With Inflation (2023)AR HemantNo ratings yet

- Correction in Income Tax Volume 1Document12 pagesCorrection in Income Tax Volume 1CrcNo ratings yet

- EMI Prepayment CalculatorDocument13 pagesEMI Prepayment Calculatorgcvs8rb84yNo ratings yet

- TM PQsDocument9 pagesTM PQsAnooshayNo ratings yet

- Submitted by - 1. Simran Agarwal 2. Rohit Kumar Singh 3. Rishabh Rajora 4. Hitesh Khandawal 5. Aditi SinghDocument20 pagesSubmitted by - 1. Simran Agarwal 2. Rohit Kumar Singh 3. Rishabh Rajora 4. Hitesh Khandawal 5. Aditi SinghChirag JainNo ratings yet

- Yadnya-Income Tax Regime CalculatorDocument16 pagesYadnya-Income Tax Regime CalculatorRaghavendra DeshpandeNo ratings yet

- Texvalley InvestmentDocument19 pagesTexvalley Investmentkarthick sudharsanNo ratings yet

- Vista Print TaxInvoiceDocument2 pagesVista Print TaxInvoicebhageshlNo ratings yet

- You Can See No-Cost EMI Options For 3-Month and 6 Month EMI. For Longer Tenure RepaymentDocument7 pagesYou Can See No-Cost EMI Options For 3-Month and 6 Month EMI. For Longer Tenure RepaymentHarshil MehtaNo ratings yet

- Indian Taxation Shimmer and ShineDocument17 pagesIndian Taxation Shimmer and ShinemailshimmerandshineNo ratings yet

- Hotel BillDocument1 pageHotel BillAmitNo ratings yet

- Income Tax A.Y. 2023-24Document6 pagesIncome Tax A.Y. 2023-24sandeepsbiradar100% (3)

- Week 4Document22 pagesWeek 4Lawprep TutorialgovNo ratings yet

- Should You Prepay Home LoanDocument1 pageShould You Prepay Home LoanAbhay MishraNo ratings yet

- Regular Vs Limited PremiumDocument3 pagesRegular Vs Limited Premiumnagireddy nareshNo ratings yet

- Difference Bill Upto Mar 2022Document24 pagesDifference Bill Upto Mar 2022Field Store, OkaraNo ratings yet

- PD Interest RateDocument2 pagesPD Interest RatecraftylandofficialNo ratings yet

- How To Pay Zero Income Tax On 20 Lakhs SalaryDocument9 pagesHow To Pay Zero Income Tax On 20 Lakhs SalaryvijaytechskillupgradeNo ratings yet

- 10th Module ELearningDocument68 pages10th Module ELearningMahalingam RamasamyNo ratings yet

- Account Summary: Credit Card NumberDocument6 pagesAccount Summary: Credit Card Numberanilvishaka7621No ratings yet

- Rani Jarkas - Novogen To Establish China Entity To Further Commercialisation and Partnerships in World's Second-Largest Pharmaceutical MarketDocument2 pagesRani Jarkas - Novogen To Establish China Entity To Further Commercialisation and Partnerships in World's Second-Largest Pharmaceutical MarketMatthews GilchristNo ratings yet

- Giải Chi Tiết Toeic Reading 2022Document17 pagesGiải Chi Tiết Toeic Reading 2022Lê Nguyễn Minh ThùyNo ratings yet

- ANS 2021 Tipo de ContrataçãoDocument2 pagesANS 2021 Tipo de ContrataçãoPedro AlvesNo ratings yet

- JD 5603Document314 pagesJD 5603Kassio SalesNo ratings yet

- Beyond The Crisis State by DR Maleeha LodhiDocument10 pagesBeyond The Crisis State by DR Maleeha Lodhibushra shahidNo ratings yet

- Was The Subprime Crisis Unique? An Analysis of The Factors That Help Predict Banking Crises in OECD CountriesDocument23 pagesWas The Subprime Crisis Unique? An Analysis of The Factors That Help Predict Banking Crises in OECD CountriesNoah Azlan NgahNo ratings yet

- Trustline Summer Training Report PresentationDocument27 pagesTrustline Summer Training Report Presentationatul kumar100% (1)

- InvoiceDocument1 pageInvoicewidiyanto wiryawanNo ratings yet

- Partial Equilibrium: EconomicsDocument5 pagesPartial Equilibrium: EconomicsSamantha SamdayNo ratings yet

- CIR Vs CADocument1 pageCIR Vs CAJazem AnsamaNo ratings yet

- Document #10B.1 - FY2018 Operating Budget Report - January 24, 2018 PDFDocument5 pagesDocument #10B.1 - FY2018 Operating Budget Report - January 24, 2018 PDFGary RomeroNo ratings yet

- Indigo: Strategic Management ProjectDocument17 pagesIndigo: Strategic Management ProjectSumathi SrinivasNo ratings yet

- Motion For DisgorgementDocument3 pagesMotion For Disgorgementattorneyinmichigan@yahoo.com100% (1)

- Letter From ED To Corps Reg SBM2.0 Guidelines 26.10.2021 - FinalDocument3 pagesLetter From ED To Corps Reg SBM2.0 Guidelines 26.10.2021 - FinalEr Pawan JadhaoNo ratings yet

- Costos de Transporte m3-Km y Ton-KmDocument68 pagesCostos de Transporte m3-Km y Ton-KmROBERT50% (2)

- A Bisleri - Market in IndiaDocument18 pagesA Bisleri - Market in IndiaChirag PatelNo ratings yet

- Car Rental - Sap InvoiceDocument10 pagesCar Rental - Sap InvoicejaanNo ratings yet

- WEEK 3-LESSON 5-Definition and Meaning of RentDocument4 pagesWEEK 3-LESSON 5-Definition and Meaning of RentSixd WaznineNo ratings yet

- President Uhuru Kenyatta's Speech During The Official Launch of The Price-Waterhouse Coopers Kenya Office, Westlands, NairobiDocument4 pagesPresident Uhuru Kenyatta's Speech During The Official Launch of The Price-Waterhouse Coopers Kenya Office, Westlands, NairobiState House KenyaNo ratings yet

- Change Management in Businesses PowerPoint Presentation SlidesDocument60 pagesChange Management in Businesses PowerPoint Presentation SlidesSlideTeam0% (1)

- Case: Toyota, UkDocument2 pagesCase: Toyota, UkDavid ShrsthNo ratings yet

- Cambridge International AS & A Level: Economics 9708/22 October/November 2022Document17 pagesCambridge International AS & A Level: Economics 9708/22 October/November 2022kutsofatsoNo ratings yet

- Maintenance Pyramid NewDocument13 pagesMaintenance Pyramid NewYen NguyenNo ratings yet

- Hong Kong Bus Route NumberingDocument19 pagesHong Kong Bus Route NumberingKoda MaNo ratings yet

- Proof of CashDocument11 pagesProof of CashAndrea FontiverosNo ratings yet

- Accounting, Auditing & Accountability Journal: Article InformationDocument26 pagesAccounting, Auditing & Accountability Journal: Article InformationAnonymous yMOMM9bsNo ratings yet

- Conservation of Mineral Resources For Sustainable GrowthDocument13 pagesConservation of Mineral Resources For Sustainable GrowthmitheleshpurohitNo ratings yet

- Example: Marketing PlanDocument18 pagesExample: Marketing Planerika100% (1)

- Amadeus All Fares User Guide V4.3 Nov09Document31 pagesAmadeus All Fares User Guide V4.3 Nov09Viktor MadaraszNo ratings yet