Professional Documents

Culture Documents

Additional Practical Problems-19

Uploaded by

Danish Danish0 ratings0% found this document useful (0 votes)

7 views1 pageHdhdxb

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHdhdxb

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageAdditional Practical Problems-19

Uploaded by

Danish DanishHdhdxb

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

1.

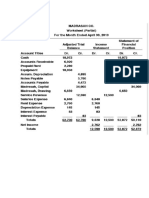

From the following Trial Balance, prepare Trading and Profit and Loss Account for the year

ended 31st March, 2020 and Balance Sheet as at that date:

Heads of Accounts L.F. Dr. Balance (`) Cr. Balance (`)

Sundry Debtors .................................................................................................... 15,000 ...

Stock on 1st April, 2019 .................................................................................................... 50,000 ...

Land and Building .................................................................................................... 1,00,000 ...

Capital .................................................................................................... ... 2,50,000

Rent .................................................................................................... ... 6,000

Cash in Hand .................................................................................................... 16,000 ...

Cash at Bank .................................................................................................... 40,000 ...

Wages .................................................................................................... 30,000 ...

Sundry Creditors .................................................................................................... ... 75,000

Bills Receivable .................................................................................................... 20,000 ...

Interest ..................................................................................................... 2,000 ...

Bad Debts .................................................................................................... 5,000 ...

Repairs ..................................................................................................... 3,000 ...

Sales .................................................................................................... ... 1,70,000

Bills Payable .................................................................................................... ... 40,000

Furniture and Fixtures .................................................................................................... 15,000 ...

Depreciation .................................................................................................... 10,000 ...

Discount .................................................................................................... 8,000 ...

Salaries .................................................................................................... 20,000 ...

Drawings .................................................................................................... 20,000 ...

Purchases .................................................................................................... 1,00,000 ...

Office Expenses .................................................................................................... 25,000 ...

Plant and Machinery .................................................................................................... 57,000 ...

Input CGST A/c .................................................................................................... 15,000 ...

Input SGST A/c .................................................................................................... 15,000 ...

Output CGST A/c .................................................................................................... ... 10,000

Output SGST A/c .................................................................................................... ... 10,000

Output IGST A/c .................................................................................................... ... 5,000

Total 5,66,000 5,66,000

On 31st March, 2020, the stock was valued at ` 1,00,000.

[Gross Profit—` 90,000; Net Profit—` 23,000; Balance Sheet Total—` 3,68,000.]

[Hint: Balance of Input SGST of ` 5,000 will be shown in the assets side of Balance Sheet.]

2. From the following balances taken from the books of Hari & Co., prepare Trading and Profit

and Loss Account for the year ended 31st March, 2020 and Balance Sheet as at that date:

` `

Capital 3,50,000 Salaries 11,100

Building 1,87,500 Discount Allowed 3,000

Machinery 92,500 Interest on Investments 1,000

Debtors 35,000 Stock (1st April, 2019) 1,65,000

Investments 35,000 Bills Payable 50,000

General Expenses 8,000 Sales 6,35,000

Rent Paid 37,100 Purchases 4,68,500

Proprietor’s Drawings 6,500 Wages 25,000

Electricity Charges 1,900 Cash in Hand 18,000

Carriage Inwards 8,500 Sundry Creditors 1,00,000

Cash at Bank 30,000 Returns Inward 4,500

Returns Outward 1,100

Closing Stock was valued at ` 1,82,100.

[Gross Profit—` 1,46,700; Net Profit—` 86,600; Balance Sheet Total—` 5,80,100.]

[Hint: Investment is an asset. Thus, interest on Investments is an income.]

1

You might also like

- Institutional Investment in Infrastructure in Emerging Markets and Developing EconomiesFrom EverandInstitutional Investment in Infrastructure in Emerging Markets and Developing EconomiesNo ratings yet

- Additional Practical Problems-20Document16 pagesAdditional Practical Problems-20areet2701No ratings yet

- Delhi Public School, Nacharam Accountancy - Xi Practice Paper - 4Document4 pagesDelhi Public School, Nacharam Accountancy - Xi Practice Paper - 4lasyaNo ratings yet

- Additional Practical Problems-19Document16 pagesAdditional Practical Problems-19rockboy2599No ratings yet

- Mannie Company worksheet data adjustmentsDocument17 pagesMannie Company worksheet data adjustmentsVy Pham Nguyen KhanhNo ratings yet

- Final Accounts Without Adj Day 1 CW-1Document2 pagesFinal Accounts Without Adj Day 1 CW-1ROHIT PAREEKNo ratings yet

- More Cash Flow ExercisesDocument4 pagesMore Cash Flow ExercisesLorenzodeLunaNo ratings yet

- CW 2 SolutionDocument4 pagesCW 2 SolutionMtl AndyNo ratings yet

- CH 2 ExercisesDocument4 pagesCH 2 ExercisesAnonymous Jf9PYY2E80% (1)

- Total: Balance Sheet Total-' 82,120. The Following EntryDocument2 pagesTotal: Balance Sheet Total-' 82,120. The Following EntryTanishq BindalNo ratings yet

- Fa AssignmentDocument6 pagesFa AssignmentemnagrichiNo ratings yet

- Financial Management, MBA511, Section: 01 Chapter 3: ProblemsDocument2 pagesFinancial Management, MBA511, Section: 01 Chapter 3: ProblemsShakilNo ratings yet

- Practice Questions # 3 With AnswersDocument13 pagesPractice Questions # 3 With AnswersIzzahIkramIllahiNo ratings yet

- Problems: Final Review Intermediate 1Document33 pagesProblems: Final Review Intermediate 1Nguyên NguyễnNo ratings yet

- Trial BalanceDocument3 pagesTrial Balancesunny0135No ratings yet

- NKLT - PR1-3B-GR8Document1 pageNKLT - PR1-3B-GR8kimphuc3819No ratings yet

- TP2Document9 pagesTP2frenky bayuNo ratings yet

- Tugas 4 - Mukhlasin S 142170091Document10 pagesTugas 4 - Mukhlasin S 142170091Mukhlasin SyaifullahNo ratings yet

- The Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- Tutorial Test 2 AnswerDocument4 pagesTutorial Test 2 AnswerHoang Bich Kha NgoNo ratings yet

- Ordinary Level (J03)Document16 pagesOrdinary Level (J03)MahmozNo ratings yet

- Final Exam AnswerDocument5 pagesFinal Exam AnswerPham Ngoc AnhNo ratings yet

- Test of T.B (2 Copies)Document4 pagesTest of T.B (2 Copies)vriddhi kanodiaNo ratings yet

- Additional Illustration-19Document1 pageAdditional Illustration-19Gulneer LambaNo ratings yet

- 11 - Final Accounts Assessment 2 PDFDocument6 pages11 - Final Accounts Assessment 2 PDFShreyas ParekhNo ratings yet

- Chapter 4 Exercises & SolutionsDocument13 pagesChapter 4 Exercises & SolutionsMariamNo ratings yet

- ACCT1100 PA1 AssignmentSolutionManual 1Document6 pagesACCT1100 PA1 AssignmentSolutionManual 1Chi IuvianamoNo ratings yet

- 3512 Chapter 23 Cash Flows HW Exercises ProblemsDocument12 pages3512 Chapter 23 Cash Flows HW Exercises ProblemsM MustafaNo ratings yet

- Financial Statemnet Part - ADocument5 pagesFinancial Statemnet Part - AZeba LubabaNo ratings yet

- Semere Tesfaye MBAO 8977 14B - 2Document17 pagesSemere Tesfaye MBAO 8977 14B - 2amirhaile71No ratings yet

- Final Exam AnsDocument8 pagesFinal Exam AnsTien NguyenNo ratings yet

- Soal Akuntansi OSN Ekonomi Dan PembahasaDocument6 pagesSoal Akuntansi OSN Ekonomi Dan PembahasaQurrotul AyuniNo ratings yet

- Key Chapter 2Document11 pagesKey Chapter 2JinAe NaNo ratings yet

- AHM Chapter 3 Exercises CKvxWXG1tmDocument2 pagesAHM Chapter 3 Exercises CKvxWXG1tmASHUTOSH BISWALNo ratings yet

- Accounting for Business CombinationsDocument10 pagesAccounting for Business CombinationsnaddieNo ratings yet

- 2010 06 24 - 172141 - P3 3aDocument4 pages2010 06 24 - 172141 - P3 3aVivian0% (1)

- Chapter 13 solutions 11e E13-2 and E13-3 journal entriesDocument19 pagesChapter 13 solutions 11e E13-2 and E13-3 journal entriessabrina danteNo ratings yet

- Accounting ExerciseDocument6 pagesAccounting Exercisenourhan hegazyNo ratings yet

- November 2022 62501/CZ21A/AY21A/BS21A: 4. That Do You Mean B - 4x'erage Clause Police ?Document9 pagesNovember 2022 62501/CZ21A/AY21A/BS21A: 4. That Do You Mean B - 4x'erage Clause Police ?KavithaNo ratings yet

- Winterschid Company 2008 year-end trial balance and financial statementsDocument6 pagesWinterschid Company 2008 year-end trial balance and financial statementsJa Mi LahNo ratings yet

- Assignment 1 ACCOUNTANCYDocument3 pagesAssignment 1 ACCOUNTANCYCHINMAY AGRAWALNo ratings yet

- FIN 220, Ch3, Selected Problems 2Document3 pagesFIN 220, Ch3, Selected Problems 23ooobd1234No ratings yet

- Key Chapter 4Document12 pagesKey Chapter 4JinAe NaNo ratings yet

- Trading & Profit & Loss Sheet 3Document2 pagesTrading & Profit & Loss Sheet 3Anshul JainNo ratings yet

- Prepare Trading and P&L Accounts from given balancesDocument3 pagesPrepare Trading and P&L Accounts from given balancesKUNAL SHARMANo ratings yet

- Frq-Acc-Grade 11-Set 05Document3 pagesFrq-Acc-Grade 11-Set 05itzmellowteaNo ratings yet

- Basic Acc ReviewerDocument7 pagesBasic Acc ReviewerReign PangilinanNo ratings yet

- Exercise On Adjusting Entries Trial BalanceDocument5 pagesExercise On Adjusting Entries Trial Balancemarvin fajardoNo ratings yet

- Only For Students Who Have Problem With AbsencesDocument2 pagesOnly For Students Who Have Problem With Absencesusman akbarNo ratings yet

- Fin Account-Sole Trading AnswersDocument10 pagesFin Account-Sole Trading AnswersAR Ananth Rohith BhatNo ratings yet

- Charles Company Balance Sheet Problem 1-1Document4 pagesCharles Company Balance Sheet Problem 1-1ASHUTOSH BISWALNo ratings yet

- Practice Question 2Document2 pagesPractice Question 2Prerna AroraNo ratings yet

- Final accounts for year ending 1992Document50 pagesFinal accounts for year ending 1992kalyanikamineniNo ratings yet

- Accounts Assignment Class 11 CandE 20220111131012374Document5 pagesAccounts Assignment Class 11 CandE 20220111131012374Jithu EmmanuelNo ratings yet

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- AKM 1 Bab 3Document5 pagesAKM 1 Bab 3alesha nindyaNo ratings yet

- 1621 Acct6174 Tabe TK1-W3-S4-R1 Team1Document11 pages1621 Acct6174 Tabe TK1-W3-S4-R1 Team1Raisul Ma'arif100% (1)

- Extra Applications - Lecture Week 2Document5 pagesExtra Applications - Lecture Week 2Muhammad HusseinNo ratings yet

- Questions On Chapter FourDocument2 pagesQuestions On Chapter Fourbrook butaNo ratings yet

- Ex.1 Transactions For The Mariam Company For The Month of October Are PresentedDocument4 pagesEx.1 Transactions For The Mariam Company For The Month of October Are PresentedAA BB MMNo ratings yet

- Basel III Regulation CommerzbankDocument6 pagesBasel III Regulation CommerzbankUpnaPunjabNo ratings yet

- SS Topic 6Document8 pagesSS Topic 6ibrahimkingpubg7No ratings yet

- 12 Accountancy sp04 230604 170905Document27 pages12 Accountancy sp04 230604 170905RishiNo ratings yet

- Capital Budgeting TechniquesDocument12 pagesCapital Budgeting Techniquesshahin selkar100% (1)

- Valuation: A Conceptual Overview: Enterprise Value: The 30,000-Foot ViewDocument19 pagesValuation: A Conceptual Overview: Enterprise Value: The 30,000-Foot ViewCandelNo ratings yet

- Test Bank Financial Accounting 6E by Libby Chapter 14Document47 pagesTest Bank Financial Accounting 6E by Libby Chapter 14Ronald James Siruno MonisNo ratings yet

- DCF Analysis PDFDocument11 pagesDCF Analysis PDFanandbajaj0No ratings yet

- Vidvatam Est. Fy 22-23Document6 pagesVidvatam Est. Fy 22-23Kunal SinghNo ratings yet

- Chapter 1-DigabungkanDocument78 pagesChapter 1-Digabungkanummul AimanahNo ratings yet

- Now This Deed Wintesseth As UnderDocument6 pagesNow This Deed Wintesseth As UnderTANUNo ratings yet

- Tata Steel's History and Financial AnalysisDocument10 pagesTata Steel's History and Financial AnalysisNIHARIKA AGARWALNo ratings yet

- BFIN 3321 Final Exam - Louder BackDocument4 pagesBFIN 3321 Final Exam - Louder BackDenounce GovNo ratings yet

- Ch. 31 Forecasting and Managing Cash FlowsDocument4 pagesCh. 31 Forecasting and Managing Cash FlowsRosina KaneNo ratings yet

- Test Bank - Mgt. Acctg 2 - CparDocument16 pagesTest Bank - Mgt. Acctg 2 - CparChristian Blanza LlevaNo ratings yet

- Problems: Quiz ExercisesDocument3 pagesProblems: Quiz ExercisesMavani snehaNo ratings yet

- Case Digest on Contex Corporation v. CIR examines VAT exemptionsDocument3 pagesCase Digest on Contex Corporation v. CIR examines VAT exemptionsTimothy Joel CabreraNo ratings yet

- Deluxe SolutionDocument6 pagesDeluxe SolutionR K Patham100% (1)

- NISM SERIES XV - RESEARCH ANALYST CERTIFICATION EXAMDocument40 pagesNISM SERIES XV - RESEARCH ANALYST CERTIFICATION EXAMjack75% (4)

- Projected Cash Flow Statement in ExcelDocument19 pagesProjected Cash Flow Statement in ExcelfarshidianNo ratings yet

- Pine Street Capital CaseDocument14 pagesPine Street Capital CaseRonieeNo ratings yet

- Financial Management:: Financial Analysis - Sizing Up Firm PerformanceDocument105 pagesFinancial Management:: Financial Analysis - Sizing Up Firm Performancefreakguy 313No ratings yet

- Summary Notes On Regular Allowable Itemized Deductions - CompressDocument4 pagesSummary Notes On Regular Allowable Itemized Deductions - CompressRochel Ada-olNo ratings yet

- Case Study Equity Valuation and Portfolio SelectionDocument3 pagesCase Study Equity Valuation and Portfolio SelectionUbaid DarNo ratings yet

- 2013 Annual Report enDocument206 pages2013 Annual Report enspachecofdzNo ratings yet

- Joint arrangements under Ind AS 111Document26 pagesJoint arrangements under Ind AS 111Dheeraj TurpunatiNo ratings yet

- Ashok Leyland Limited: RatiosDocument6 pagesAshok Leyland Limited: RatiosAbhishek BhattacharjeeNo ratings yet

- (Der), Dan Ukuran Perusahaan Terhadap Return Saham PadaDocument20 pages(Der), Dan Ukuran Perusahaan Terhadap Return Saham PadaNabilaNo ratings yet

- Quiz Shareholders Equity TH With Questions PDFDocument4 pagesQuiz Shareholders Equity TH With Questions PDFMichael Angelo FangonNo ratings yet

- PROSPECTUS OVERVIEWDocument18 pagesPROSPECTUS OVERVIEWGUNGUN GUPTANo ratings yet

- MoaDocument4 pagesMoaRaghvirNo ratings yet