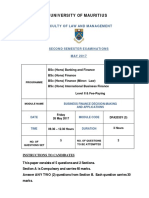

Professional Documents

Culture Documents

1 SM

Uploaded by

ZinebOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 SM

Uploaded by

ZinebCopyright:

Available Formats

http://bmr.sciedupress.com Business and Management Research Vol. 10, No.

2; 2021

Problems and Prospects of SME Financing in Bangladesh

Md.ShahinAlam Khan1, Aminul Hasan1, Jitesh Paul1&Salmana Chowdhury2

1

Shahjalal University of Science & Technology, Sylhet, Bangladesh

2

Leading University, Sylhet, Bangladesh

Correspondence: Md.ShahinAlam Khan, Shahjalal University of Science & Technology.

Received: April 22, 2021 Accepted: May 31, 2021 Online Published: June 18, 2021

doi:10.5430/bmr.v10n2p10 URL: https://doi.org/10.5430/bmr.v10n2p10

Abstract

To conduct a comprehensive study on the SME sector of Bangladesh of its present state, prospects, issues and

emerging challenges this “problems & Prospects of SME Financing in Bangladesh” research is carried out. The main

objective of the study is to find out the SME financing’s different types of strategies & policies in Bangladesh. The

SMEs are playing gradually more significant role as a mainstream of economic escalation in Bangladesh as well as all

over the world. The SME usually creates the opportunities of employment at lower costs and render flexibility to the

economy. The SMEs are playing an indispensable role for overall economic development. Since this sector is a manual

labor intensivewith the short period of time, usually it is capable of increasing the national income as well as hasty

employmentcreation by achieving the Millennium Development Goals (MDGs) as well as the abolition of

extremepoverty and starvation, gender equality and women empowerment. This SME sector has played a vital role

intheeconomic progress of some prosperous countries of Asia. In national economy of Bangladesh SMEs play mainly

vital role by making manufacturing enterprises by providing the employment of industrial workers and contributing to

the over one-third of industrial value-added to gross domestic product (GDP) and become accustomed quickly to

change the market condition, create employment, help diversify economic activities, and also make a

significantcontribution to the exports and trade. The economic competence and the overall performance of the SMEs

are considerably depended upon the policy of environmental and specific promotional policies pursued for their

benefits. Consequently, the policies and initiatives to develop the condition of SMEs and toincrease their

competitiveness are a main concern of Bangladesh.

Keywords: SME, Entrepreneurship, Business Entrepreneurship, Economy, GDP

1. Introduction

TheSmall and medium enterprises (SMEs) are playing increasingly important role as mechanisms of economic growth

in many countries.The tectonic arrangements of the Bangladesh’s industries demonstrate several types of industries

like the textile industries, the hand-operated welding, different types of food processing industries, leather, ceramics,

electrics industries, essential metal and chemical engineering, paper and publication industries, small fabrication

industry, battery industries, electrical devices, electronics, handicrafts, agro-based food industries, multilateral jute

goods, silk industries, fruit processing, poultry farming, fisheries, tea gardening and processing, vegetable seed

farming, and printing industries, construction industries, transportation, film and the photography, fast food, frozen

food, the pathological laboratories, cold storage, furniture, etc, under the service industries, and many other sectors are

included in the SMEs. Generally, in the Industrial Policy 2005 there are 11 different booster sectors of SMEs which are

mainly Electrical, Software Development, Illumination engineering and Alloy works, Agro –business or Agriculture

specialist, Farming or Tissue business, Leather related goods, Knitwear and ready-made garments, Plastics and other

synthetics, Healthcare and diagnostics, Pharmaceuticals, Cosmetics, consumption goods.

2. Literature Review

Some foreign and national experts undertake some studies on the SME sector of Bangladesh. Some Bangladeshi’s

institutions like the SME Foundation, the IFIC and some other financial institutions stated about SMEs potentialities

that this SME is going up from micro to small and medium enterprise. Author Uddin (2008) has stated in his book

about the SMEs total performance and economic efficiency in some countries mainly in the rising countries where

these countries are noticeably dependent on the macro economic’s environmental & some of the promotional policies

followed for their benefits. According to the context of Bangladesh Chowdhury (2007) emphasized on his book that

Published by Sciedu Press 10 ISSN 1927-6001E-ISSN 1927-601X

http://bmr.sciedupress.com Business and Management Research Vol. 10, No. 2; 2021

SME is featurized by the low capitalization and inadequate assets, environmental diversity, the high morality, limited

knowledge about SME, exceedingly restricted access to the credit’s formal source as well as the strength of cash in

some transactions, very inadequate documentation making a habit with meager monetary exposing on the account,

taxes issues, very elevated risk insight has led to lofty borrowing costs. Miah (2007) stated that the main barriers for

SMEs are the shortage of sufficient investment, insuffiecient modern technology, poor systems of bank loans,

intermitten power supply, pitiable corporeal infrastructure, lack of proper information about the marketrequirements

and opportunities, invailability of needed raw materials, the shortage of trained technical expert and workers as well as

limited facilities of research & development about SME in the context of Bangladesh.

3. Methodology

The study is conducted primarily based on the secondary data. The needed data have been gathered from the diverse

resources of sources like websites, books, publications like Bangladesh Bank’s publications, Ministry of Industrial

sectors as well as the different SME policies of South Asian country’s different types of SME policies and some

scholars’s pertinent writings. In order to carry out our research we did exploratory as well as descriptive research. We

have conducted the exploratory research because we need to obtain information to conduct our research. We also

conducted the descriptive research to analysis the policies and recommend some suggestions for the improvement of

SMEs in Bangladesh. The population size isall South Asian countries where sample size six South Asian countries

have taken i.e. Bangladesh, India, Pakistan, Nepal, Bhutan and Srilanka.

4. Small Enterprise

When a business is operated and owned independently and not dominated in it’s field is called Small Enterprise.(Small

Business Act 1934). A business is called a Small Enterprise when a small firm has, relatively a small share of profits in

the market(Bolton Report on small business firms 1977). When a business is owned and managed often with very few

employees working at a single location which is mainly locally owned (Stoner, Freeman &Gillbert, 1995). The US

Government is defined that a small business is one with fewer than 500 employees.

5. SME in the Context of Bangladesh

5.1 Small Segment

The Small Enterprise means that a firm or a industry which is not a public limited company as well as the value of fixed

assets (excluding building & land) up to Tk. 5000000 in case of manufacturing enterprise and maximum 25 workers in

trading or service enterprise.

Table 1.The Small Enterprise criteria

Fixed Asset other than Land Employed Manpower

Serial No. Sector

and Building (Tk.) (not above)

01. Service 50,000-50,00,000 25

02. Business 50,000-50,00,000 25

5.2 Medium Segment

The Medium Enterprises refer to the organizations/firms which are usually not public limited companies and values of

fixed assets (except land & building) up to Tk. 100000000 in case of manufacturing enterprise and maximum 50

workers in trading or service enterprise.

Table 2.The Medium Enterprises criteria

Fixed Asset other than Land and Employed Manpower

Serial No. Sector

Building (Tk.) (not above)

01. Service 50,00,000-10,00,00,000 50

02. Business 50,00,000-10,00,00,000 50

Published by Sciedu Press 11 ISSN 1927-6001E-ISSN 1927-601X

http://bmr.sciedupress.com Business and Management Research Vol. 10, No. 2; 2021

5.3 SMEs in Bangladesh

Dissimilar countries with some organizations delineate the Small & Medium Enterprise in various ways where the

government of Bangladesh has divided the SME into two wide classes:

• Manufacturing enterprises

• Non-Manufacturing enterprises

5.3.1 Manufacturing Activities

There are two broad types of manufacturing activities;

Small Enterprise: Aamall enterprise is an enterprisewhen it’s current market prices of the placement costs of the plant,

the equipment, different components, fittings, maintaining utilites and technical involvement services without the fixed

assets like land and building are usually up to Tk. 5000000.

Medium Enterprise: When the market current prices, the replacement cost of plant as well as the equipment and other

essential parts & fittings with supporting effectiveness and associated mechanical services apart from the land and

building are usually up to Tk. 100000000 then an enterprise would be called as a medium size enterprise.

5.3.2 Non- Manufacturing Activities (Like Trading or Other Services)

The Non-Manufacturing activities are usually trading or other services.The Non-Manufacturing activities can be

divided into two wide categories;

A) Small Ennterprise: An enterprise would be treated a small enterprise if an enterprise has less than 25 full time or

equivalent.

B) Medium enterprise: If an enterprise has between 25-50 workers, then it would be treated as Medium Enterprise.

6. Different SME strategies & Policies in South Asian Countries

The SMEs are the mainstream of South Asian economies where this SMEs have emerged as mainly growth, production,

export and import of different sectors. The South Asian countries execute their some SME advancement strategies

especially in six crucial areas like Environment of Business, Entrepreneurship, admittance of finance, Research &

development. It is designed to provide as a training for the entrepreneurs and trainers for increasing SME building

capacity.

7. SME Policies & Strategies in Bangladesh

When some rules or principles usually guiding the decisions in order to get intended balanced outcomes is called

policies. Generally, policy means some sets of guiding principles or rules of taking right decisions which is very

essential to attain balanced outcomes. It is important that the government policies & strategies should be observed by

almost all the ministers as well as the different government institutions & agencies or else the intended cogent outcome

might not be attained. As a result the Government has adopted different types of SME policies & strategies the

government has taken. The “Policies & Strategies of SME-2005” usually identified 11 crucial sectors for promotion.

Where, these gave a significant emphasize as a thrust sector for the development of Small and Medium Enterprises

(SMEs) for the intended proper and sustainable industrial growth with a vision for facing some burning issues of

globalization and economic market through the contributor monetary resources made available particularly to aid with

the implementation of the SME policies & strategies. According to the availability of whole resources only 20% may

be commenced for medium enterprises where the rest biggest percentage around 80% will be commenced for only

small type enterprises. The modalities which are very crucial of how to execute both the credit-fund and the

venture-capital fund will be determined by the Misistry of & the Advisory Panel. The Development of SME Policoes&

Strategies 2005 has played crucial role to the development of the SME sector where only 19.01% industrial sector

contributed to the GDP.

The Wide Objectives of Policy Would Be to:

• Recognize the SME as vital thespian in the growth speeding up and poverty diminution as well as proper

commitment which is very crucial to formulate policy & it’s implement The policies and strategies of SME will be

entrenched in a wide sense and incorporated manner.

• Establish a good governance with some codes of ethics as well as management of Technology & Information

based knowledge and consumer superiority in the markets in order to motivate and induce the development of

private sectors as well as promote the growth of FDI.

Published by Sciedu Press 12 ISSN 1927-6001E-ISSN 1927-601X

http://bmr.sciedupress.com Business and Management Research Vol. 10, No. 2; 2021

• Recognize and set up an apposite corporeal and Technological infrastructural and some institutional delivering

methods which will facilitate the SME promotion.

• Re-introduce the presented financial as well as the authoritarian construction and the government support of

different institutions towards facilitating achievement SME policy’s specific goals. In order to deliver the very

needed services, goods, leadership with proper commencement, analysis, mentoring and tutoring the nurture as

well as the civil society institutions partner have appreciable management teams.

• Create pioneering means that the meritocratic planning so that the commendable small enterprises with most

wanted commercial track record and the promises can be offered as financial rewards within the industries .

• Aid to execute the procedures of argue settlement that the proactively defend the small businesses particularly

from the much authorized costsas well as the subtle harassment.

• Take the procedures to form platforms to activate the liability without collaterals to match in order to aid the small

enterprises in the efficient dealing with their invasive lack of access to finance.

• Systematically accord the precedence to small versus medium enterprises within the limitations of government’s

resources where everyone is facing the resources limitations.

• To tie together the information & the communications technologies which are very crucial for the better

performance of SME.

8. Data Analysis & Findings

The contribution of SMEs to the total economy differs from country to.The SMEs contribute to the total performance

of GDP is 20%-25 % in Bangladesh while in India the SMEs contribute surprisingly almost 80% to the total GDP but

in Pakistan only 15% of the total GDP comes from SMEs performance in Pakistan. In Bangladesh almost 80% of the

entire enterprises are usually come from SMEs where in Pakistan 60% of the whole enterprises are usually come from

SMEs.

100%

80%

60%

40%

20%

0%

Bangladesh India Pakistan Sri Lanka Nepal

Figure 1. Contribution to Country's Economy

8.1 Labor Force Employed in SMEs

Bangladesh employs 40% of its labor force In SMEs Bangladesh employs around 40% of it’s total labor force while 80%

of its total labor force employs in SME sector in Pakistan but only 40% of it’s total labor force in India.

Published by Sciedu Press 13 ISSN 1927-6001E-ISSN 1927-601X

http://bmr.sciedupress.com Business and Management Research Vol. 10, No. 2; 2021

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Bangladesh India Pakistan

Figure 2.Labor force employed in SMEs

8.2 Credit Limit

Generally, in Bangladesh the Priorities are given to all entrepreneurs especially to small entrepreneurs like SME. The

limit of credit will be from Tk. 500000 to Tk.5000000 usually for all the small entrepreneurs where in India the SME

borrowers are given bank loan up to Tk. 5 crores which is quite high than that of Bangladesh. On the otherhand, in

Bhutan, the rate of getting the SME loan is quite lower as only 48 get out of 198 entrepreneurs.

8.3 Tax Rate

High tax rate is one of the major reasons for firms to float into the informal economy in Pakistan. According to the

recent research 67% of enterprises which are known as the tax regulations as the most challenging for firms. The

government of Sri Lanka Recently the government of Sri Lanka has sanction a tax exclusion for some specific sectors

of the SMEs with a minimum of 25 million where the tax rate is 12%.

8.4 Credit Guarentee

If the lender fails to pay back the intended loan in India the fund of credit guarantee covers only up to 85% while the

Royal Government of Bhutan along with the two financial institutions formed the credit guarantee schemes to provide

the sufficient loans to the eligible applicants. The Sri Lankan government introduced a credit guarantee insurance

scheme in 2008 to assist 50 SMEs engaged in gems and jewellery sector.

9. Conclusion

Over the years the SME sector of Bangladesh has grown rapidly. Actually, the SME sector has broadened in

Bangladesh but the depth has to be achieved in true sense. Usually, the SMEs performance in Bangladesh is found

drastically below the level of international standard. The different sectors have to be made investor’s investment

forthcoming environment otherwise the strength of the SME’s sector cannot be achieved. Though the government of

Bangladesh has taken some initiatives. Though in order to ensure the growth of SME sector the government of

Bangladesh has taken some essential steps but these steps are not adequate at all for ensuring the ultimate growth of

SME sector. Nevertheless, the government has already shown its positive approach towards this potential SME sector.

The government of Bangladesh as well as the people should prolong to give more focal point on some desired areas.

The government should come forward in order to identify realistic and secure policies for the development of SME

sectors in the country. The provision should be made In order to improve the separate and specialized institutions in

three vspecific areas like: (a) finance, (b) technology, and (c) skill development for making a policy for the SMEs the

condition should be made as well as to downsize the existing policies, strategies and institutions. We are completely

hopeful that the potentialities SMEs of Bangladesh will get a boost if the suggested measures are implemented.

References

Ahmad, Q. K. (2008).Rural Industries Study Project (RISP); An Introduction, TheBangladesh Development Studies

(Vol XII, No. 1 and 2, Special concern on the RuralIntroduction in Bangladesh).

Ahmed, M. U. (2006). The SME Policy making Process. Dhaka, Bangladesh: Academic Publishers.

Published by Sciedu Press 14 ISSN 1927-6001E-ISSN 1927-601X

http://bmr.sciedupress.com Business and Management Research Vol. 10, No. 2; 2021

Chowdhury. (2007). Small and Medium Enterpries.

Hallberg, C. (2006). Small Medium Enterprises policies (Vol. 76, pp 237-269).

Brahmanadam. (1981). Small and Medium Enterprises: Overcoming Growth Constraints.

Saha,S. (2012).A Comprehensive Study on SMEs of Bangladesh: Constraints and prospect.

Shahnur, M. A., Golam, A. M. K., & Islam, S. (n.d.). Problems and Prospects of SME Financing in Bangladesh.

Government of the People's Republic of Bangladesh, Industrial Policy.(2009).Ministry of Industries, Dhaka,

Bangladesh.

Policy Agenda for Sri Lanka in Growth, Finance, Industry.(2012).

Growing micro and small enterprises in Nepal. (2012).

A Country Paper for the Joint Regional Workshop on SME Development and Regional Economic Integration,

BHUTAN.

Dhar, P.N., & Lydall, H.F. (1961). The Role of Small Enterprise in Indian Economic Development. New York: Asia

Publishing House, USA.

Sarder, J. H. (1995). The Small Enterprise Development in Bangladesh: A Case study of nature and effectiveness of

support services.

Hossain, N. (1998). Constraints to SME Development in Bangladesh.

Hallberg. (2002). Stable macro-economy, an open trade and investment regime.

Chopra, K. C. (n.d.). Financing for the Decentralized Sector- Small and Medium Industries.

Zhang and Wang. (2002). The life cycle of an SME was closely related to its access to finance. Sri Lanka.

Lin. (2009). SME financing in Nepal. Nepal.

Copyrights

Copyright for this article is retained by the author(s), with first publication rights granted to the journal.

This is an open-access article distributed under the terms and conditions of the Creative Commons Attribution

license (http://creativecommons.org/licenses/by/4.0/).

Published by Sciedu Press 15 ISSN 1927-6001E-ISSN 1927-601X

You might also like

- Small and Medium Enterprise Development PDFDocument34 pagesSmall and Medium Enterprise Development PDFNazmin NurNo ratings yet

- AAAAAAChapte-8, MSMEs in BangladeshDocument20 pagesAAAAAAChapte-8, MSMEs in BangladeshArafatNo ratings yet

- Small Scale Industries in India: Opportunities and ChallengesDocument6 pagesSmall Scale Industries in India: Opportunities and ChallengesindhuNo ratings yet

- 08 Chapter 1Document28 pages08 Chapter 1Syed Rehan AliNo ratings yet

- Notes On Small Scale IndustriesDocument19 pagesNotes On Small Scale IndustriesAli SaifyNo ratings yet

- Title: Study of Impact of Coronavirus Pandemic On Small and Medium Enterprises (SME's) in IndiaDocument7 pagesTitle: Study of Impact of Coronavirus Pandemic On Small and Medium Enterprises (SME's) in IndiaShruti JainNo ratings yet

- Of Bangladesh: Determinants and Remedial Measures: Financial Distress in Small and Medium Enterprises (SME)Document16 pagesOf Bangladesh: Determinants and Remedial Measures: Financial Distress in Small and Medium Enterprises (SME)Yasmine MagdiNo ratings yet

- Sagar (Assignment of Innovation &entrepreneurship)Document13 pagesSagar (Assignment of Innovation &entrepreneurship)Sagar BhargavNo ratings yet

- BodyDocument15 pagesBodyMd Abdullah ShaimoonNo ratings yet

- Proposed Research Direction For Sustainable Smes in BangladeshDocument13 pagesProposed Research Direction For Sustainable Smes in BangladeshDr. Engr. Md Mamunur RashidNo ratings yet

- Unit 5: Small Scale IndustriesDocument21 pagesUnit 5: Small Scale Industriesjyoti.singhNo ratings yet

- Challenges of Internationalisation For The SMEs of BangladeshDocument14 pagesChallenges of Internationalisation For The SMEs of BangladeshTahera SultanaNo ratings yet

- Central BankingDocument25 pagesCentral Bankingnandish30No ratings yet

- IGNOU Course EntrepreneurshipDocument10 pagesIGNOU Course EntrepreneurshipChetan Metkar100% (1)

- Ed Unit-IiDocument70 pagesEd Unit-IiSäi DäťťaNo ratings yet

- Key Words: Small Scale Industry, Economic DevelopmentDocument15 pagesKey Words: Small Scale Industry, Economic DevelopmentBibinNo ratings yet

- Q.1. What Is The Definition of MSME?: FaqsDocument26 pagesQ.1. What Is The Definition of MSME?: FaqsVaibhav SattikarNo ratings yet

- NA - Session 22 - Micro, Small and Medium Enterprises in IndiaDocument12 pagesNA - Session 22 - Micro, Small and Medium Enterprises in IndiaSumit GuptaNo ratings yet

- EASJEHL - 312 - 548-554c - nPK0mbBDocument7 pagesEASJEHL - 312 - 548-554c - nPK0mbBmy addaxNo ratings yet

- Problems and Prospects of Small Scale Industrial Units (A Case Study of Exporting and Non - Exporting Units in Haryana)Document20 pagesProblems and Prospects of Small Scale Industrial Units (A Case Study of Exporting and Non - Exporting Units in Haryana)brijesh_1112No ratings yet

- Quader, S. M., & Abdullah, M. N. (2009) - Constraints To SMEs A Rotated Factor Analysis Approach. A Research Journal of South Asian Studies, 24 (2), 334-350.Document23 pagesQuader, S. M., & Abdullah, M. N. (2009) - Constraints To SMEs A Rotated Factor Analysis Approach. A Research Journal of South Asian Studies, 24 (2), 334-350.ImranNo ratings yet

- Financial DistressDocument17 pagesFinancial DistressPeriyanti GunawanNo ratings yet

- MSMEs Project ReportDocument11 pagesMSMEs Project ReportAnkita GoyalNo ratings yet

- Management of Small Scale IndustryDocument31 pagesManagement of Small Scale IndustryASHA0575% (20)

- Sandeepan Ray CMN SMBDocument43 pagesSandeepan Ray CMN SMBVenkat UppalapatiNo ratings yet

- @@@course PaperDocument46 pages@@@course PaperNina HooperNo ratings yet

- 16 Role of SME in Indian Economoy - Ruchika - FINC004Document22 pages16 Role of SME in Indian Economoy - Ruchika - FINC004Ajeet SinghNo ratings yet

- MSMEs Project ReportDocument10 pagesMSMEs Project ReportVishal Goyal82% (11)

- Factors Affecting Access To Finance of Small and Medium EnterprisDocument15 pagesFactors Affecting Access To Finance of Small and Medium Enterprisamirhayat15No ratings yet

- HRM Practices in BangladeshDocument85 pagesHRM Practices in BangladeshShawonAshrafNo ratings yet

- Unit 2: Micro, Small & Medium Enterprises Have Been Defined in Accordance With The Provision ofDocument15 pagesUnit 2: Micro, Small & Medium Enterprises Have Been Defined in Accordance With The Provision ofTanishika MehraNo ratings yet

- Sme Credit FlowDocument34 pagesSme Credit Flowsakiv2112No ratings yet

- Unit 6 Small Scale IndustriesDocument108 pagesUnit 6 Small Scale IndustriesHannan WaniNo ratings yet

- ED-UNIT-V-Small Scale Industries Mark-UpDocument34 pagesED-UNIT-V-Small Scale Industries Mark-UpTinandaNo ratings yet

- Prateek Rest FinalDocument130 pagesPrateek Rest FinalPrateek Singh SidhuNo ratings yet

- SME Report SynopsisDocument5 pagesSME Report SynopsisPiyush JainNo ratings yet

- English Assignment 1Document30 pagesEnglish Assignment 1Satyapriya PangiNo ratings yet

- Credit Appraisal SystemDocument48 pagesCredit Appraisal SystemRavi Joshi50% (2)

- A Study On Small Scale Industries and Its Impact in India: GS MounikaDocument11 pagesA Study On Small Scale Industries and Its Impact in India: GS MounikaGobi DarkrayNo ratings yet

- Marcoz 2 CompleteDocument50 pagesMarcoz 2 Completemaaz bangiNo ratings yet

- Likeliness of SME's in Adopting E-Commerce: Chapter 1: Industry Profile and Company ProfileDocument58 pagesLikeliness of SME's in Adopting E-Commerce: Chapter 1: Industry Profile and Company ProfileAnusha simhadriNo ratings yet

- Paper8 ICSSRSeminarPaperDocument12 pagesPaper8 ICSSRSeminarPaperima doucheNo ratings yet

- Co-Creation - An Exploratory Study of MSMEs & Large Bank in INDIADocument19 pagesCo-Creation - An Exploratory Study of MSMEs & Large Bank in INDIAAlok TiwariNo ratings yet

- MSME Economics ProjectDocument15 pagesMSME Economics Projectsinghjia2004No ratings yet

- Micro and Small Enterprises in IndiaDocument23 pagesMicro and Small Enterprises in IndiaSuryamaniNo ratings yet

- Micro and Small Enterprises in India PDFDocument23 pagesMicro and Small Enterprises in India PDFSuryamaniNo ratings yet

- Subject: Entrepreneurship and Small Business Development: Course Code: MC-202Document40 pagesSubject: Entrepreneurship and Small Business Development: Course Code: MC-202rajeeevaNo ratings yet

- Accounts-Small Scale IndustriesDocument7 pagesAccounts-Small Scale IndustriesdevugoriyaNo ratings yet

- ProjectDocument16 pagesProjectKrishna AhujaNo ratings yet

- Black BookDocument56 pagesBlack Bookyashvidoshi04No ratings yet

- A Community Connect Report On Small Medium Enterprise (Sme) : YEAR-2019 Isha Lohani 2018016014 MBA (B&F)Document41 pagesA Community Connect Report On Small Medium Enterprise (Sme) : YEAR-2019 Isha Lohani 2018016014 MBA (B&F)Isha lohaniNo ratings yet

- Working Capital FinanceDocument54 pagesWorking Capital FinanceAnkur RazdanNo ratings yet

- Credit Rating For Small & Medium EnterprisesDocument47 pagesCredit Rating For Small & Medium EnterprisesKunal ThakurNo ratings yet

- 138 Ijaema October 4768Document9 pages138 Ijaema October 4768Rajesh KumarNo ratings yet

- Redefining MSME With CRM Practices: Dr. Suresh Chandra BihariDocument7 pagesRedefining MSME With CRM Practices: Dr. Suresh Chandra BihariBipul BanerjeeNo ratings yet

- Document PDFDocument52 pagesDocument PDFBharat SharmaNo ratings yet

- 11 Arihant Surana - Small Scale Industries and Their Role inDocument33 pages11 Arihant Surana - Small Scale Industries and Their Role inPrashant RanaNo ratings yet

- Somaliland: Private Sector-Led Growth and Transformation StrategyFrom EverandSomaliland: Private Sector-Led Growth and Transformation StrategyNo ratings yet

- Final+template+manuscript English Niken+Novita+Sari+Document14 pagesFinal+template+manuscript English Niken+Novita+Sari+ZinebNo ratings yet

- Theeffectofdebtfinancingonthefinancialperformanceof SMEsin ZimbabweDocument21 pagesTheeffectofdebtfinancingonthefinancialperformanceof SMEsin ZimbabweZinebNo ratings yet

- Covid 19andtheMoroccanFinancialMarket IJAEFADocument8 pagesCovid 19andtheMoroccanFinancialMarket IJAEFAZinebNo ratings yet

- The Effect of Credit and Market Risk On Bank Performance - Evidence From Turkey (#352457) - 363360Document8 pagesThe Effect of Credit and Market Risk On Bank Performance - Evidence From Turkey (#352457) - 363360ZinebNo ratings yet

- 04 Conflictsof Interestof Sharia Supervisory BoardDocument20 pages04 Conflictsof Interestof Sharia Supervisory BoardZinebNo ratings yet

- Integrated Weed Management 22.11.2021Document8 pagesIntegrated Weed Management 22.11.2021Izukanji KayoraNo ratings yet

- Peri Komponentu Katalogas Pastoliams 2015 enDocument372 pagesPeri Komponentu Katalogas Pastoliams 2015 enLim Yew KwangNo ratings yet

- DWC Ordering InformationDocument15 pagesDWC Ordering InformationbalaNo ratings yet

- Module 1 Ethernet and VLAN: Lab 1-1 Ethernet Interface and Link Configuration Learning ObjectivesDocument15 pagesModule 1 Ethernet and VLAN: Lab 1-1 Ethernet Interface and Link Configuration Learning ObjectivesChaima BelhediNo ratings yet

- Case Study: The Firm Wide 360 Degree Performance Evaluation Process at Morgan Stanley SummaryDocument1 pageCase Study: The Firm Wide 360 Degree Performance Evaluation Process at Morgan Stanley SummaryMehran MalikNo ratings yet

- Week 4 - Vapor-Liquid Separation (Multicomponent Distillation)Document19 pagesWeek 4 - Vapor-Liquid Separation (Multicomponent Distillation)psychopassNo ratings yet

- Conceptual Framework For Financial Reporting: Student - Feedback@sti - EduDocument4 pagesConceptual Framework For Financial Reporting: Student - Feedback@sti - Eduwaeyo girlNo ratings yet

- Project On Teaining DevelopmentDocument88 pagesProject On Teaining Developmentsurya annamdevulaNo ratings yet

- Thesis HealthDocument5 pagesThesis Healthcreasimovel1987100% (1)

- FBS Ii enDocument10 pagesFBS Ii enunsalNo ratings yet

- Volatility Index 75 Macfibonacci Trading PDFDocument3 pagesVolatility Index 75 Macfibonacci Trading PDFSidibe MoctarNo ratings yet

- BOM For Solar Water PumpDocument11 pagesBOM For Solar Water PumpNirat PatelNo ratings yet

- BF PP 2017Document4 pagesBF PP 2017Revatee HurilNo ratings yet

- CPS Fitting Stations by County - 22 - 0817Document33 pagesCPS Fitting Stations by County - 22 - 0817Melissa R.No ratings yet

- MCD2000CM4 T1 014 (8 7 12) - CompleteDocument1,062 pagesMCD2000CM4 T1 014 (8 7 12) - CompletePablo Marchant TorresNo ratings yet

- Science and Technology in Nation BuildingDocument40 pagesScience and Technology in Nation BuildingDorothy RomagosNo ratings yet

- Section 2 Structure and FunctionDocument42 pagesSection 2 Structure and FunctionRached Douahchua100% (1)

- SEBI Circular On Online Processing of Investor Service Requests and Complaints by RTAs - June 8, 2023Document5 pagesSEBI Circular On Online Processing of Investor Service Requests and Complaints by RTAs - June 8, 2023Diya PandeNo ratings yet

- A Study On Flywheel Energy Recovery From Aircraft BrakesDocument5 pagesA Study On Flywheel Energy Recovery From Aircraft BrakesRaniero FalzonNo ratings yet

- FDD SRM & NDGDocument3 pagesFDD SRM & NDGEnd EndNo ratings yet

- Dissertation Bowden PDFDocument98 pagesDissertation Bowden PDFmostafaNo ratings yet

- (Your Business Name Here) - Safe Work Procedure Metal LatheDocument1 page(Your Business Name Here) - Safe Work Procedure Metal LatheSafety DeptNo ratings yet

- TechRef SoftstarterDocument11 pagesTechRef SoftstarterCesarNo ratings yet

- Invoice: Buyer Information Delivery Information Transaction DetailsDocument1 pageInvoice: Buyer Information Delivery Information Transaction DetailsZarida SahdanNo ratings yet

- Technical Sheet Azud Watertech WW EngDocument2 pagesTechnical Sheet Azud Watertech WW EngMiguel Torres ObrequeNo ratings yet

- Application & Registration Form MSC International Business Management M2Document11 pagesApplication & Registration Form MSC International Business Management M2Way To Euro Mission Education ConsultancyNo ratings yet

- Genose Massal D - 6 Juli 2021Document102 pagesGenose Massal D - 6 Juli 2021Phyto LianoNo ratings yet

- LT32567 PDFDocument4 pagesLT32567 PDFNikolayNo ratings yet

- Keystone Account Opening FormDocument6 pagesKeystone Account Opening Formenumah francisNo ratings yet

- Wheel Loader Manual Agrison PDFDocument138 pagesWheel Loader Manual Agrison PDFTravisReign Dicang02No ratings yet