Professional Documents

Culture Documents

Chapter 5.1

Uploaded by

Adejumoke ElizabethOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 5.1

Uploaded by

Adejumoke ElizabethCopyright:

Available Formats

Update Details for this Workbook

Last Update by: Lauren Steveson

Scenarios Updated on: 12/28/2022

Scenarios for fiscal year-end: 12/31/2023

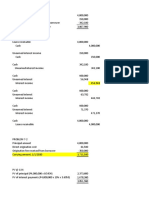

Loan for Borrowing Cash

Fiscal Year 2023

APR 4.25%

Repayment in Years 5

Amount Borrowed $ 200,000

Closing Date 12/15/2022

First Payment Due 1/31/2023

Monthly Payment $ 3,706

First Month Interest Expense $ 708

Payments for One Year $ 44,471

Estimated Interest Expense

for One Year $ 8,500

Finance Lease for New Equipment

Fiscal Year 2023

APR 4.10%

Lease Duration in Years 10

Asset Cost $ 333,807

Residual Value $ 40,000

Closing Date 1/27/2023

Annual Payment $38,044

First Payment Due Date 1/31/2024

Depreciation Expense $ 329,807

Estimated Interest Expense $ (291,763)

Present Value of Lease

Payments $ 307,043

Stella Products Corporation

Pro Forma Income Statement

Estimated for: December 31, 2023

Revenue $ 2,975,000

Cost of Goods Sold $ 1,950,000

Gross Profit $ 1,025,000

Operating Expenses

Depreciation $ 329,807

Salaries $ 530,000

Advertising $ 105,000

Utilities $ 20,000

Other $ 7,000

Total Operating Expenses $ 991,807

Net Operating Income $ 33,193

Interest Expense $ (283,263)

Income Before Income Tax $ 316,456

Income Tax $ 66,456 21% Tax Rate

Net Income $ 250,000

Net Income Projection

Growth Rate 8.00%

Future Years 5

Pro Forma Net Income $ 250,000

Future Net Income $ 1,466,650

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Part III Ratio AnalysisDocument7 pagesPart III Ratio AnalysisamahaktNo ratings yet

- Problem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueDocument11 pagesProblem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueJane Carla GarbidaNo ratings yet

- Intacc2-Quiz ExamDocument5 pagesIntacc2-Quiz ExamCmNo ratings yet

- Loan Receivable ProblemsDocument6 pagesLoan Receivable ProblemsKathleen Frondozo100% (1)

- CC 0742 - 2031 AnnuityDocument1 pageCC 0742 - 2031 AnnuityterrygohNo ratings yet

- BSA 314 Module 4 Output, Atillo Lyle CDocument10 pagesBSA 314 Module 4 Output, Atillo Lyle CJeth MahusayNo ratings yet

- Acctg Lab 7Document8 pagesAcctg Lab 7AngieNo ratings yet

- Multifamily Apartment ProformaDocument4 pagesMultifamily Apartment Proformaartsan3No ratings yet

- IA 1 - Chapter 6 Notes Receivable Problems Part 1Document6 pagesIA 1 - Chapter 6 Notes Receivable Problems Part 1John CentinoNo ratings yet

- Date Descriptions 2020: General JournalDocument10 pagesDate Descriptions 2020: General JournalDanica RamosNo ratings yet

- Trial-Đã G PDocument2 pagesTrial-Đã G PDang Van Dat QP3697No ratings yet

- Chapter 7 Loans ReceivableDocument12 pagesChapter 7 Loans ReceivableJohn Fraleigh Dagohoy Carillo100% (2)

- IA 1 - Chapter 7 Loan Receivable ProblemsDocument5 pagesIA 1 - Chapter 7 Loan Receivable ProblemsJohn CentinoNo ratings yet

- Mount Moreland Hospital: Perform Financial CalculationsDocument9 pagesMount Moreland Hospital: Perform Financial CalculationsJacob Sheridan0% (1)

- Ch5 Additional Q OnlyDocument13 pagesCh5 Additional Q OnlynigaroNo ratings yet

- Unit 2 Topic 2 Practice Set - 2Document9 pagesUnit 2 Topic 2 Practice Set - 2Dev KhatriNo ratings yet

- Assignment 5.3 Note PayableDocument4 pagesAssignment 5.3 Note PayableJohn Williever GonzalezNo ratings yet

- Chapter 4 SpreadsheetDocument5 pagesChapter 4 SpreadsheetChâu Trần Dương MinhNo ratings yet

- Q323 Quarterly Press Release-EnDocument14 pagesQ323 Quarterly Press Release-EndavidbayatNo ratings yet

- Statement AnalysisDocument4 pagesStatement AnalysisrameelNo ratings yet

- Chapter 7Document18 pagesChapter 7Raven Vargas DayritNo ratings yet

- Practice Exercise Ch18Document3 pagesPractice Exercise Ch18ngocanhhlee.11No ratings yet

- 1 MW - Solar Power Financial ModelDocument15 pages1 MW - Solar Power Financial Modelannu priyaNo ratings yet

- Chapter 4-Book ExercisesDocument3 pagesChapter 4-Book ExercisesRita Angela DeLeonNo ratings yet

- IA2Document9 pagesIA2Claire BarbaNo ratings yet

- San Antonio Water System Series 2007 Debt Disclosure ReportDocument16 pagesSan Antonio Water System Series 2007 Debt Disclosure ReportTexas WatchdogNo ratings yet

- Existing Building AnalysisDocument15 pagesExisting Building AnalysisAmir H.TNo ratings yet

- Quiz 2 Solution LeaseDocument5 pagesQuiz 2 Solution LeaseLalaine BeatrizNo ratings yet

- 1t Chan Activity2Document14 pages1t Chan Activity2irish chanNo ratings yet

- Tata Technologies FinancialsDocument22 pagesTata Technologies FinancialsRitvik DuttaNo ratings yet

- Smart Rentals LTD General Journal 30 June 2020: Date Account Name Post Ref Debit CreditDocument3 pagesSmart Rentals LTD General Journal 30 June 2020: Date Account Name Post Ref Debit CreditSt Dalfour CebuNo ratings yet

- Loan ReceivableDocument10 pagesLoan ReceivableClyde SaladagaNo ratings yet

- FINC 301 Assignment 2023 1Document8 pagesFINC 301 Assignment 2023 1kd5d26xw5rNo ratings yet

- MSFT 10qDocument145 pagesMSFT 10qAaron WardNo ratings yet

- The Hair Pro IncDocument5 pagesThe Hair Pro IncIan Paolo EspanolaNo ratings yet

- Answers Practical Assignments Week 46 2022/2023 Name ... Student Number .... . Assignment 1 FastprintDocument5 pagesAnswers Practical Assignments Week 46 2022/2023 Name ... Student Number .... . Assignment 1 FastprintT.F. EvansNo ratings yet

- NP EX19 9a JinruiDong 2Document9 pagesNP EX19 9a JinruiDong 2Ike DongNo ratings yet

- Franchising Consignment KeyDocument22 pagesFranchising Consignment KeyMichael Jay SantosNo ratings yet

- Assignment 4 - SolutionsDocument2 pagesAssignment 4 - SolutionsstoryNo ratings yet

- Date Payment Interest Principal Present Value: Table of AmortizationDocument6 pagesDate Payment Interest Principal Present Value: Table of AmortizationJekoeNo ratings yet

- Assignment 5.2 Note PayableDocument2 pagesAssignment 5.2 Note PayableKate HerederoNo ratings yet

- Loans Receivable Practice (Review)Document6 pagesLoans Receivable Practice (Review)Deviline MichelleNo ratings yet

- Problem 1: ComputationsDocument6 pagesProblem 1: ComputationsClarissa BorbonNo ratings yet

- ანრი მაჭავარიანი ფინალურიDocument40 pagesანრი მაჭავარიანი ფინალურიAnri MachavarianiNo ratings yet

- Mini CaseDocument7 pagesMini CaseHarrisha Arumugam0% (1)

- UTS Managerial FinanceDocument6 pagesUTS Managerial FinanceSatria PgNo ratings yet

- Maddelein - Performance ReportDocument1 pageMaddelein - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Villena Stephanie A12-02 QA2 Attempt2Document8 pagesVillena Stephanie A12-02 QA2 Attempt2Stephanie VillenaNo ratings yet

- DCF ModelDocument4 pagesDCF Modeljuilee bhoirNo ratings yet

- Ch04Prob4 14A-Exe1Document4 pagesCh04Prob4 14A-Exe1kanika019No ratings yet

- 5-Year Financial Plan - Manufacturing 1Document8 pages5-Year Financial Plan - Manufacturing 1tulalit008No ratings yet

- q2 Fy23 EarningsDocument19 pagesq2 Fy23 EarningsGan ZhiHanNo ratings yet

- Tax Case 1 1 - 1709848234743Document4 pagesTax Case 1 1 - 1709848234743Yo TuNo ratings yet

- Financial Accounting-Assignment-4Document4 pagesFinancial Accounting-Assignment-4Margaux JohannaNo ratings yet

- Week-2-Chapter-3-Financial-Build-A-Mode LDocument7 pagesWeek-2-Chapter-3-Financial-Build-A-Mode LCrusty GirlNo ratings yet

- Fixed Assets Amount Depreciation (Years) Notes: You Are Fully Funded (Balanced)Document4 pagesFixed Assets Amount Depreciation (Years) Notes: You Are Fully Funded (Balanced)Paulo TorresNo ratings yet

- Delaware: Hashicorp INCDocument148 pagesDelaware: Hashicorp INCmiracfragrancesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet