Professional Documents

Culture Documents

The Hair Pro Inc

Uploaded by

Ian Paolo EspanolaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Hair Pro Inc

Uploaded by

Ian Paolo EspanolaCopyright:

Available Formats

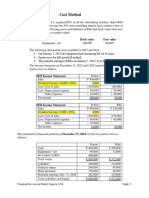

The Hair Pro Inc.

Income Statement

For the Quarter Ended March 31, 2023

Service Revenue $14,400.00

Less: Supplies Expense ($5,800.00)

Less: Salaries and Wages ($3,200.00)

Less: Utilities Expense ($700.00)

Less: Rent Expense ($600.00)

Total Expenses $10,300.00

Net Income $4,100.00

The Hair Pro Inc.

Statement of Retained Earnings

For the Quarter Ended March 31, 2023

Retained Earnings, Jan. 1, 2023 $-

Add: Net Income $4,100.00

Retained Earnings, March 31, 2023 $4,100.00

The Hair Pro Inc.

Balance Sheet

At March 31, 2023

Assets:

Current

Cash $18,000.00

Prepaid Insurance $600.00

Prepaid Rent $7,300.00

Total Current Assets $25,900.00

Non-current

Shop Equipment $9,700.00

Shop Furniture and Fixtures $9,700.00

Total Non-current Assets $19,400.00

Total Assets $45,300.00

Liabilities and Stockholder’s Equity:

Liabilities

Current

Accounts Payable $10,800.00

Deferred Revenue $400.00

Total Current Liabilities $11,200.00

Non-current

Notes Payable (Long-term) $20,000.00

Total Non-current Liabilities $20,000.00

Total Liabilities $31,200.00

Stockholder’s Equity

Common Stock $10,000.00

Retained Earnings, March 31, 2023 $4,100.00

Total Equity $14,100.00

Total Liabilities and Equity $45,300.00

Evaluation:

a. The business is profitable, as evidenced by the positive net income of $4,100.00 for the quarter.

b. The company can pay its current obligations and liabilities. To determine the current ratio, we divide

current assets by current liabilities.

Current Ratio = Current Assets / Current Liabilities

Current Ratio = $25,900 / $11,200

Current Ratio = 2.31

A current ratio above 1 indicates that the company has sufficient current assets to cover its current

liabilities. In this case, The Hair Pro, Inc. has a current ratio of 2.31, indicating that it can meet its current

obligations.

c. To evaluate the financing of utility assets, we can calculate the debt-to-equity ratio.

Debt-to-Equity Ratio = Total Liabilities / Total Equity

Debt-to-Equity Ratio = $31,200.00 / $14,100.00

Debt-to-Equity Ratio = 2.21

With a debt-to-equity ratio of 2.21, it suggests that a higher proportion of The Hair Pro, Inc.'s utility

assets are financed by debts rather than equity.

Overall, The Hair Pro, Inc. had a profitable quarter, demonstrating positive financial performance. The

company's current ratio indicates its ability to meet short-term obligations, and the debt-to-equity ratio

highlights its reliance on debt financing for utility assets. It is important for the company to monitor its

debt levels and ensure sustainable financial management practices for long-term success.

You might also like

- Pony Up Stables FinalDocument5 pagesPony Up Stables FinalNatalie DaguiamNo ratings yet

- Mariusz Skonieczny EbookDocument11 pagesMariusz Skonieczny EbookMariuszSkonieczny50% (2)

- Exercise 1: On December 31, Bryniuk's Company, The Accounting Records Showed The Following InformationDocument10 pagesExercise 1: On December 31, Bryniuk's Company, The Accounting Records Showed The Following InformationJohn Kenneth Bohol50% (2)

- Problem No 5.2-A Affordable Lawn Care IncDocument5 pagesProblem No 5.2-A Affordable Lawn Care IncZeeshan AjmalNo ratings yet

- Solution Aassignments CH 5Document5 pagesSolution Aassignments CH 5RuturajPatilNo ratings yet

- AC4301 FinalExam 2020-21 SemA AnsDocument9 pagesAC4301 FinalExam 2020-21 SemA AnslawlokyiNo ratings yet

- Midterm Analysis TestDocument33 pagesMidterm Analysis TestDan Andrei BongoNo ratings yet

- DIFFICULTDocument7 pagesDIFFICULTQueen ValleNo ratings yet

- Answer Key (Drills) - Understanding-Financial-StatementsDocument4 pagesAnswer Key (Drills) - Understanding-Financial-StatementsVergel MartinezNo ratings yet

- Beechy 7e Tif Ch09Document20 pagesBeechy 7e Tif Ch09mashta04No ratings yet

- Smart Rentals LTD General Journal 30 June 2020: Date Account Name Post Ref Debit CreditDocument3 pagesSmart Rentals LTD General Journal 30 June 2020: Date Account Name Post Ref Debit CreditSt Dalfour CebuNo ratings yet

- Week 13 - SoalDocument3 pagesWeek 13 - SoalHeidi ParamitaNo ratings yet

- General Accounting 2Document5 pagesGeneral Accounting 2Rheu ReyesNo ratings yet

- Financial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesDocument7 pagesFinancial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesAndy MoralesNo ratings yet

- Lecture Practice QuestionsDocument5 pagesLecture Practice QuestionsMariøn Lemonnier BruelNo ratings yet

- Chapter 5.1Document5 pagesChapter 5.1Adejumoke ElizabethNo ratings yet

- Unit 2 Topic 2 Practice Set - 2Document9 pagesUnit 2 Topic 2 Practice Set - 2Dev KhatriNo ratings yet

- Clairemont Co Ejercio de Practica MartesDocument2 pagesClairemont Co Ejercio de Practica Martescarlos huertasNo ratings yet

- HW 4Document4 pagesHW 4Mishalm96No ratings yet

- Ch5 Additional Q OnlyDocument13 pagesCh5 Additional Q OnlynigaroNo ratings yet

- Finance ProjectDocument6 pagesFinance Projectrawan joudehNo ratings yet

- CH.2 HWDocument11 pagesCH.2 HWSally PhungNo ratings yet

- Computer Project 1Document5 pagesComputer Project 1Alex SmallzNo ratings yet

- Sample Financial StatmentDocument2 pagesSample Financial Statmentkiya TadeleNo ratings yet

- 010-18 Section-A Assignment 3Document5 pages010-18 Section-A Assignment 3VallabhRemaniNo ratings yet

- Cost Model Skeletal Approach Ans KeysDocument4 pagesCost Model Skeletal Approach Ans KeysMelvin BagasinNo ratings yet

- Trial-Đã G PDocument2 pagesTrial-Đã G PDang Van Dat QP3697No ratings yet

- Use The Above Information To Answer The Following Questions From A To e (Use Direct Method and Show All Calculations)Document2 pagesUse The Above Information To Answer The Following Questions From A To e (Use Direct Method and Show All Calculations)karunakar vNo ratings yet

- Tax Case 1 1 - 1709848234743Document4 pagesTax Case 1 1 - 1709848234743Yo TuNo ratings yet

- Week 1 621 NotesDocument6 pagesWeek 1 621 NotesSameera VithanaNo ratings yet

- CH 13 Wiley Kimmel Quiz HomeworkDocument8 pagesCH 13 Wiley Kimmel Quiz HomeworkmkiNo ratings yet

- Abraar Dairy and Farming Financial Template-1Document13 pagesAbraar Dairy and Farming Financial Template-1Ganacsi KaabNo ratings yet

- Tarea Taller 1 FINA 503Document4 pagesTarea Taller 1 FINA 503Hugo LombardiNo ratings yet

- WBE Brion Service Centre Statement of Financial Position As of December 31, 2019 AssetsDocument4 pagesWBE Brion Service Centre Statement of Financial Position As of December 31, 2019 AssetsCheche Casaljay AmpoanNo ratings yet

- 94 - AFAR Preweek LectureDocument18 pages94 - AFAR Preweek LectureBarbado ArleneNo ratings yet

- Final Exam - AccountingDocument5 pagesFinal Exam - Accountingtanvi virmaniNo ratings yet

- FAR Exercise1Document16 pagesFAR Exercise1Warren Carlo G. ManulatNo ratings yet

- Chapter 7 Loans ReceivableDocument12 pagesChapter 7 Loans ReceivableJohn Fraleigh Dagohoy Carillo100% (2)

- Villena Stephanie A12-02 QA2 Attempt2Document8 pagesVillena Stephanie A12-02 QA2 Attempt2Stephanie VillenaNo ratings yet

- Computation For Exercise 1Document10 pagesComputation For Exercise 1Xyzra AlfonsoNo ratings yet

- MAY Financial ReportingDocument32 pagesMAY Financial ReportingKizito KizitoNo ratings yet

- Assignment - Operating Lease & Direct Financing LeaseDocument8 pagesAssignment - Operating Lease & Direct Financing Leaseangelian bagadiongNo ratings yet

- Assets Current AssetsDocument3 pagesAssets Current AssetsJere Mae MarananNo ratings yet

- Cost Accounting Week 3 - AnswersDocument10 pagesCost Accounting Week 3 - AnswersFiles OrganizedNo ratings yet

- ExerciseDocument12 pagesExercisesde.ofcl20No ratings yet

- Notes Single Entry System c8fc1377 Aa41 4a83 8fa4 13677428260dDocument10 pagesNotes Single Entry System c8fc1377 Aa41 4a83 8fa4 13677428260dar5769584No ratings yet

- Principle of Financial Management CH 4Document18 pagesPrinciple of Financial Management CH 4amna hafeezNo ratings yet

- Financial Statement Analysis Live ProjectDocument6 pagesFinancial Statement Analysis Live ProjectAnand Shekhar MishraNo ratings yet

- Catapang Hazel Ann E.Document4 pagesCatapang Hazel Ann E.Johnlloyd BarretoNo ratings yet

- Eco Assignment by Allan SmithDocument4 pagesEco Assignment by Allan SmithUmar AshrafNo ratings yet

- Chapter 1 - Some Solved ProblemsDocument12 pagesChapter 1 - Some Solved ProblemsBracu 2023No ratings yet

- Problem 2.19Document3 pagesProblem 2.19CNo ratings yet

- Chapter 2 FM For BMDocument22 pagesChapter 2 FM For BMMeron TemisNo ratings yet

- Revision - Additional ExercisesDocument2 pagesRevision - Additional ExercisesĐào Huyền Trang 4KT-20ACNNo ratings yet

- Mid Term ExamDocument6 pagesMid Term ExamWaizin KyawNo ratings yet

- Exercise 3 Basic Acctg. TemplateDocument6 pagesExercise 3 Basic Acctg. TemplateKiana FernandezNo ratings yet

- AkunDocument9 pagesAkunmorinNo ratings yet

- FS Consolidation at The Date of Acquisition v2Document16 pagesFS Consolidation at The Date of Acquisition v2Pagatpat, Apple Grace C.No ratings yet

- Blue Bill Corp Module 6 Assignment-1cxlc8byxz6r5 - 1euusngisn9vlDocument4 pagesBlue Bill Corp Module 6 Assignment-1cxlc8byxz6r5 - 1euusngisn9vlKimberley WrightNo ratings yet

- Tutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityDocument5 pagesTutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- Thumbs Up & ChemaliteDocument8 pagesThumbs Up & ChemaliteVaibhav MahajanNo ratings yet

- Roshita Desthi Nurimah - A20 - Tugas BAB 3Document12 pagesRoshita Desthi Nurimah - A20 - Tugas BAB 3Roshita Desthi NurimahNo ratings yet

- BD21060 Aman Assignment5Document6 pagesBD21060 Aman Assignment5Aman KundraBD21060No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- AssignmentDocument3 pagesAssignmentIan Paolo EspanolaNo ratings yet

- AssignmentDocument3 pagesAssignmentIan Paolo EspanolaNo ratings yet

- General Control Vs Application ControlDocument6 pagesGeneral Control Vs Application ControlIan Paolo EspanolaNo ratings yet

- Information Systems in The EnterpriseDocument61 pagesInformation Systems in The EnterpriseImam WahyudiNo ratings yet

- Business EthicsDocument5 pagesBusiness EthicsIan Paolo EspanolaNo ratings yet

- Influence From The Management Team ", This Means That They Can Act and Decide As TheyDocument1 pageInfluence From The Management Team ", This Means That They Can Act and Decide As TheyXI MonteroNo ratings yet

- Common Unethical Practices of Business EstablishmentsDocument3 pagesCommon Unethical Practices of Business EstablishmentsIan Paolo EspanolaNo ratings yet

- ExplanationDocument2 pagesExplanationIan Paolo EspanolaNo ratings yet

- ExplanationDocument2 pagesExplanationIan Paolo EspanolaNo ratings yet

- Basic Greetings and Special OccasionsDocument2 pagesBasic Greetings and Special OccasionsIan Paolo EspanolaNo ratings yet

- EditingDocument98 pagesEditingIan Paolo EspanolaNo ratings yet

- IsmDocument1 pageIsmIan Paolo EspanolaNo ratings yet

- This Is Developmental Zone Afternoon TalkshowDocument3 pagesThis Is Developmental Zone Afternoon TalkshowIan Paolo EspanolaNo ratings yet

- MetaphorsDocument1 pageMetaphorsIan Paolo EspanolaNo ratings yet

- The Inductive Technique of Teaching and Learning Is An Umbrella Term For A Variety of Instructional StrategiesDocument1 pageThe Inductive Technique of Teaching and Learning Is An Umbrella Term For A Variety of Instructional StrategiesIan Paolo EspanolaNo ratings yet

- QuestionDocument1 pageQuestionIan Paolo EspanolaNo ratings yet

- Exercises 1-8Document2 pagesExercises 1-8Ian Paolo EspanolaNo ratings yet

- Jap BodyDocument1 pageJap BodyIan Paolo EspanolaNo ratings yet

- JapaneseDocument2 pagesJapaneseIan Paolo EspanolaNo ratings yet

- Akal Company Profile For Wadessa BridgeDocument308 pagesAkal Company Profile For Wadessa BridgeAbudi KasahunNo ratings yet

- HKICPA QP Exam (Module A) Feb2006 AnswerDocument12 pagesHKICPA QP Exam (Module A) Feb2006 Answercynthia tsuiNo ratings yet

- Financial Planning Part 2Document33 pagesFinancial Planning Part 2Carlsberg AndresNo ratings yet

- Krispy Kreme Case Study Solution FinanceDocument32 pagesKrispy Kreme Case Study Solution FinanceMd Sakawat HossainNo ratings yet

- Chapter 3 Financial Statements and Ratio Analysis: Principles of Managerial Finance, 14e (Gitman/Zutter)Document31 pagesChapter 3 Financial Statements and Ratio Analysis: Principles of Managerial Finance, 14e (Gitman/Zutter)chinyNo ratings yet

- Korea Western Power Co., LTDDocument31 pagesKorea Western Power Co., LTDEva HarunNo ratings yet

- Deepesh Agarwal - Financial Statement Analysis of Tata Motors LTDDocument72 pagesDeepesh Agarwal - Financial Statement Analysis of Tata Motors LTDBhanu PrakashNo ratings yet

- Chapter 4 Investments in Equity and Debt Instruments Exercises T3AY2021Document4 pagesChapter 4 Investments in Equity and Debt Instruments Exercises T3AY2021Carl Vincent BarituaNo ratings yet

- CH 17Document77 pagesCH 17Nasim Rosin100% (1)

- ACCT1002 Assignment 3B 2nd S 2021-2022Document16 pagesACCT1002 Assignment 3B 2nd S 2021-2022Zenika PetersNo ratings yet

- Gilbert Company-WPS OfficeDocument17 pagesGilbert Company-WPS OfficeTrina Mae Garcia100% (1)

- Irac 2011Document101 pagesIrac 2011satish chanakyaNo ratings yet

- Assignment 1 IBFDocument2 pagesAssignment 1 IBFSameer AsifNo ratings yet

- DELL LBO Model Part 1 CompletedDocument45 pagesDELL LBO Model Part 1 CompletedascentcommerceNo ratings yet

- Investment Practice ProblemsDocument14 pagesInvestment Practice ProblemsmikeNo ratings yet

- Central University of South Bihar: School of Law & Governance Financial Market RegulationDocument22 pagesCentral University of South Bihar: School of Law & Governance Financial Market RegulationRajeev RajNo ratings yet

- Accounting GuideDocument73 pagesAccounting GuideJoseph Habert100% (1)

- Reading 23 Residual Income Valuation - AnswersDocument47 pagesReading 23 Residual Income Valuation - Answerstristan.riolsNo ratings yet

- BankDocument43 pagesBankLïkïth Räj100% (2)

- Review Questions and ProblemsDocument13 pagesReview Questions and ProblemsLalaina EnriquezNo ratings yet

- Concession Agreement: A Brief Note On NHAIDocument39 pagesConcession Agreement: A Brief Note On NHAIshravan38No ratings yet

- CCASBBAR13Document57 pagesCCASBBAR13Wall HackNo ratings yet

- Advanced Accounting CH 3Document35 pagesAdvanced Accounting CH 3Jan Spanton67% (6)

- Exam Questions and Answers PDFDocument30 pagesExam Questions and Answers PDFThanh Hương ĐoànNo ratings yet

- GRADE 12 - First Quarter - Pointers For ReviewDocument11 pagesGRADE 12 - First Quarter - Pointers For ReviewClazther MendezNo ratings yet

- Chapter 1 EnterprDocument11 pagesChapter 1 EnterprSundas FareedNo ratings yet