Professional Documents

Culture Documents

FN3105 Formula Spreadsheet Mid Term

Uploaded by

GD GamingOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FN3105 Formula Spreadsheet Mid Term

Uploaded by

GD GamingCopyright:

Available Formats

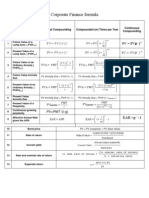

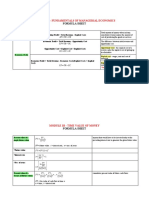

FN 3105 - FINANCIAL MANAGEMENT

MID TERM FORMULA SPREADSHEET

Continues

Annual Compounding (m) Compounding per year

Compounding

Simple Interest FV=PV (1+i * n) PV=FV / (1+i* n) I=P*i* n

nm

i

Future Value ( FVi,n ) F V = P V ( 1 + i )n FV = PV 1 + FV = PVeit

m

- nm

-n i

Present Value ( PVi,n ) PV = FV ( 1 + i ) PV = FV 1 + PV = FVe-it

m

Future Value of Annuity

( 1 + i )n - 1 (1 + (i / m) )nm − 1

(FVAi,n )

FVA = PMT FVA = PMT

i i/m

Future Value of Annuity

FV Annuity Due = FVA*(1+ i ) FV Annuity Due = FVA*(1+ ieffective )

Due

Present Value of Annuity 1 - ( 1 + i )- n 1 - ( 1 + (i / m) )- nm

(PVAi,n )

PVA = PMT PVA = PMT

i i/m

Present Value of Annuity

PV Annuity Due = PVA*(1+ i ) PV Annuity Due = PVA*(1+ ieffective )

Due

Present Value of PMT PMT

PVperpetuity = PVperpetuity =

Perpetuity

i [(1 + i)1/ m − 1]

Effective Annual Interest

Rate EAR = [1+ Quoted Interest Rate/m]m-1

Interpolation Formula y2 = 𝑦1 + (𝑦3 − 𝑦1) ∗ (𝑥2 − 𝑥1/ 𝑥3 − 𝑥1)

You might also like

- Time Value of Money FormulasDocument1 pageTime Value of Money FormulasAmit Shankar Choudhary100% (1)

- Time Value of Money Formulas SheetDocument1 pageTime Value of Money Formulas SheetBilal HussainNo ratings yet

- Corporate Finance FormulasDocument3 pagesCorporate Finance FormulasMustafa Yavuzcan83% (12)

- ICT formula sheet shortcutsDocument2 pagesICT formula sheet shortcutsNat Siow100% (1)

- Formula SheetDocument1 pageFormula Sheetnick07052004No ratings yet

- Time Value Money Formulas ExplainedDocument3 pagesTime Value Money Formulas ExplainedRahat IslamNo ratings yet

- Time Value of Money: FormulaDocument2 pagesTime Value of Money: FormulaParvez RahmanNo ratings yet

- Business Finance FORMULA SHEETDocument1 pageBusiness Finance FORMULA SHEETAli JibranNo ratings yet

- Test 2 Formula SheetDocument1 pageTest 2 Formula Sheetgabriella portelliNo ratings yet

- PMT I N: 1 +) (FVA) (LNDocument2 pagesPMT I N: 1 +) (FVA) (LNSave All Hindu TemplesNo ratings yet

- CA5102 Q1 FORMULA SHEETDocument12 pagesCA5102 Q1 FORMULA SHEETDyra Mae OmegaNo ratings yet

- TVM Formulas (I, N)Document2 pagesTVM Formulas (I, N)basco23No ratings yet

- Formula for Simple, Compound Interest, Annuities, Capital CostsDocument2 pagesFormula for Simple, Compound Interest, Annuities, Capital CostsWYNDYLL ARTUZNo ratings yet

- Cong ThucDocument12 pagesCong ThucGiang Thái HươngNo ratings yet

- Corporate Finance Formulas - PDF - Cost of Capital - Present ValueDocument7 pagesCorporate Finance Formulas - PDF - Cost of Capital - Present ValueSurojit PattanayakNo ratings yet

- Assignment On Fundamentals of FinanceDocument29 pagesAssignment On Fundamentals of FinanceIsmail AliNo ratings yet

- FV PV: LN LN (1)Document2 pagesFV PV: LN LN (1)Danneek BillingsNo ratings yet

- Economics 1Document12 pagesEconomics 1jhozabethcarbonelNo ratings yet

- Formula Time Value of MoneyDocument2 pagesFormula Time Value of MoneySaifur R. SabbirNo ratings yet

- ECONOMICSDocument12 pagesECONOMICSJenielle SisonNo ratings yet

- Time Value - ADocument22 pagesTime Value - ANAVNIT CHOUDHARYNo ratings yet

- Formulas: F - Future Value P - Present/Principal ValueDocument2 pagesFormulas: F - Future Value P - Present/Principal ValueJimuel Ace SarmientoNo ratings yet

- Distance Test PDFDocument10 pagesDistance Test PDFSoneni HandaNo ratings yet

- Quiz 1 FormulasDocument2 pagesQuiz 1 FormulasCristina Beatrice MallariNo ratings yet

- test ediDocument2 pagestest ediHeba AbdullahNo ratings yet

- FINA 1310 - Lecture 3 NotesDocument6 pagesFINA 1310 - Lecture 3 NotesAayushi ReddyNo ratings yet

- TVM formulae cheat sheetDocument4 pagesTVM formulae cheat sheetShawron weevNo ratings yet

- Engineering Economics FormulasDocument2 pagesEngineering Economics FormulasBorja, Alexandra C.No ratings yet

- Formula Sheet Corporate Finance (COF) : Stockholm Business SchoolDocument6 pagesFormula Sheet Corporate Finance (COF) : Stockholm Business SchoolLinus AhlgrenNo ratings yet

- MATH 01 FormulaDocument3 pagesMATH 01 FormulaJae Bert UbisoftNo ratings yet

- Interest Rates That Vary With Time: I A I CWDocument3 pagesInterest Rates That Vary With Time: I A I CWTepe HolmNo ratings yet

- Financial Management - Paper 1: Chapter: - Indian Financial SystemDocument23 pagesFinancial Management - Paper 1: Chapter: - Indian Financial SystemToyaj JaiswalNo ratings yet

- Formula Sheet - Quantitative FinanceDocument1 pageFormula Sheet - Quantitative FinanceInês SoaresNo ratings yet

- FormulasDocument2 pagesFormulasKalid JCNo ratings yet

- TMV Practice ProblemsDocument3 pagesTMV Practice ProblemsPrometheus SmithNo ratings yet

- P/ F, I%, NDocument3 pagesP/ F, I%, NCheerag DuggalNo ratings yet

- E ENGINEERING ECONOMICS ReviewDocument16 pagesE ENGINEERING ECONOMICS ReviewJM CopinoNo ratings yet

- Real Estate Economics Mortgage Instruments: Jing Li Singapore Management UniversityDocument72 pagesReal Estate Economics Mortgage Instruments: Jing Li Singapore Management UniversityKwan Kwok AsNo ratings yet

- BUS286 Final Exam Formulae Sheet - BUS286Document2 pagesBUS286 Final Exam Formulae Sheet - BUS286DelishaNo ratings yet

- BU283 Midterm1 Formula SheetDocument1 pageBU283 Midterm1 Formula SheetClarissa MichaelsNo ratings yet

- Engineering EconomicsDocument10 pagesEngineering EconomicsrenegadeNo ratings yet

- MAF101 Formula Sheet-2010TR1Document2 pagesMAF101 Formula Sheet-2010TR1Ann VuNo ratings yet

- 26 - Summary of MafaDocument3 pages26 - Summary of Mafahina1234No ratings yet

- Formule - Finansijski MenadžmentDocument5 pagesFormule - Finansijski MenadžmentEminaNo ratings yet

- Chap2 - Security Market IndicesDocument5 pagesChap2 - Security Market Indiceseya KhamassiNo ratings yet

- Self CollectionDocument10 pagesSelf Collectionmc150201627 Adeela KiranNo ratings yet

- Formula Sheet Principles of FinanceDocument6 pagesFormula Sheet Principles of FinanceSI PNo ratings yet

- Calculating future and present value of assetsDocument1 pageCalculating future and present value of assetss_786886338No ratings yet

- TablesDocument30 pagesTablesAhmed walidNo ratings yet

- Factors: How Time and Interest Affect MoneyDocument62 pagesFactors: How Time and Interest Affect MoneyGörkem DamdereNo ratings yet

- Time value of money cheat sheetDocument3 pagesTime value of money cheat sheetTechbotix AppsNo ratings yet

- Final Exam Cover Formulas COMM 308 JMSBDocument4 pagesFinal Exam Cover Formulas COMM 308 JMSBmeilleurlNo ratings yet

- Formula EquationDocument1 pageFormula Equationmax pannirselvamNo ratings yet

- Discrete Optimization Assignment: Knapsack: 1 Problem StatementDocument3 pagesDiscrete Optimization Assignment: Knapsack: 1 Problem StatementaslimanNo ratings yet

- Mit6 S095iap18 Puzzle 7Document8 pagesMit6 S095iap18 Puzzle 7DevendraReddyPoreddyNo ratings yet

- Problem Formulation (LP Section1)Document34 pagesProblem Formulation (LP Section1)Swastik MohapatraNo ratings yet

- 15-451 Homework 7 SolutionsDocument2 pages15-451 Homework 7 SolutionsjaneNo ratings yet

- Breast Cancer Detection Using Deep Learning Technique: Shwetha K Spoorthi MDocument4 pagesBreast Cancer Detection Using Deep Learning Technique: Shwetha K Spoorthi MPRATIK AMBADENo ratings yet

- Distributions QFT (42 Marks) : MarkschemeDocument8 pagesDistributions QFT (42 Marks) : MarkschemeboostoberoiNo ratings yet

- Johnny's Taxi Routing ProblemDocument2 pagesJohnny's Taxi Routing ProblemМилош МујовићNo ratings yet

- Finite State Machines: Moore MachineDocument4 pagesFinite State Machines: Moore Machineborakas_borakasNo ratings yet

- Navidi ch5Document34 pagesNavidi ch5binoNo ratings yet

- Unit 5 ClusteringDocument70 pagesUnit 5 ClusteringrrrNo ratings yet

- Linear Control System ProjectDocument15 pagesLinear Control System Projectname choroNo ratings yet

- GSU Algorithm Design CourseDocument19 pagesGSU Algorithm Design CourseCory PattersonNo ratings yet

- A Hidden MarkovDocument8 pagesA Hidden MarkovDevaki sitoulaNo ratings yet

- Probability Return ($) 0.5 0.25 0.2 0.05Document3 pagesProbability Return ($) 0.5 0.25 0.2 0.05Muskan ValbaniNo ratings yet

- International Data Encryption Algorithm (IDEA) Is Perceived AsDocument23 pagesInternational Data Encryption Algorithm (IDEA) Is Perceived AsAshutosh MhalsekarNo ratings yet

- Structural Dynamic ModificationDocument2 pagesStructural Dynamic Modificationcelestinodl736No ratings yet

- CS221 - Artificial Intelligence - Machine Learning - 2 Linear RegressionDocument24 pagesCS221 - Artificial Intelligence - Machine Learning - 2 Linear RegressionArdiansyah Mochamad NugrahaNo ratings yet

- Design of Computationally Efficient 2D FIR Filters Using Sampling-Kernel-Based Interpolation and Frequency TransformationDocument2 pagesDesign of Computationally Efficient 2D FIR Filters Using Sampling-Kernel-Based Interpolation and Frequency TransformationHitendra SinghNo ratings yet

- Computational Fluid Dynamics in PracticeDocument209 pagesComputational Fluid Dynamics in PracticePakito GalvanNo ratings yet

- Pyopt: A Python-Based Object-Oriented Framework For Nonlinear Constrained OptimizationDocument18 pagesPyopt: A Python-Based Object-Oriented Framework For Nonlinear Constrained OptimizationOlivia brianneNo ratings yet

- Forecasting: Theory and PracticeDocument241 pagesForecasting: Theory and PracticenakaNo ratings yet

- Real Time System - : BITS PilaniDocument36 pagesReal Time System - : BITS PilanivithyaNo ratings yet

- FML Assignments Uni-1,2,3,4,6Document5 pagesFML Assignments Uni-1,2,3,4,6hitarth parekhNo ratings yet

- Phase Space Learning With Neural NetworksDocument24 pagesPhase Space Learning With Neural NetworksCarlos GonzálezNo ratings yet

- Pids PIDDocument126 pagesPids PIDjohnshxxx100% (1)

- 1997 Vol 23 No 2 1001 AbstractDocument1 page1997 Vol 23 No 2 1001 AbstractFatih KantaşNo ratings yet

- Fractional Order Signal Pro PDFDocument109 pagesFractional Order Signal Pro PDFEladio LagosNo ratings yet

- IME634: Management Decision AnalysisDocument82 pagesIME634: Management Decision AnalysisBeHappy2106No ratings yet

- JCSSP 2024 564 573Document10 pagesJCSSP 2024 564 573Alfian ArdhiNo ratings yet

- VI Sem Machine Learning CS 601 PDFDocument28 pagesVI Sem Machine Learning CS 601 PDFpankaj guptaNo ratings yet