Professional Documents

Culture Documents

NPS Transaction Statement For Tier I Account: Current Scheme Preference

NPS Transaction Statement For Tier I Account: Current Scheme Preference

Uploaded by

alokranjangoluOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NPS Transaction Statement For Tier I Account: Current Scheme Preference

NPS Transaction Statement For Tier I Account: Current Scheme Preference

Uploaded by

alokranjangoluCopyright:

Available Formats

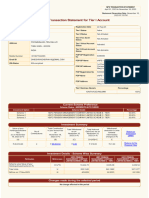

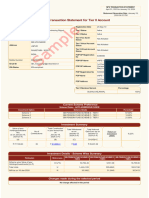

NPS TRANSACTION STATEMENT

April 01, 2023 to December 31, 2023

Statement Generation Date :December 31,

2023 04:24 PM

NPS Transaction Statement for Tier I Account

PRAN 110124644190 Registration Date 21-Apr-20

Subscriber Name SHRI ANKIT RANJAN Tier I Status Active

DEORIA KHAS,WARD NO 13 Tier II Status Active

BARI SCHOOL Tier II Tax Saver Not Activated

Status

DEORIA

Tier I Virtual Account Not Activated

JUNIOR HIGH SCHOOL(YUG NIRMAN) Status

Address

Tier II Virtual Account Not Activated

DEORIA Status

UTTAR PRADESH - 274001 CBO Registration No 6524663

INDIA CBO Name Ambuja Cements Limited

3rd Flr, Elegant Business Park, MIDC Cross

Mobile Number +919453439526 CBO Address Road

B Andheri East, Mumbai, 400059

Email ID PRAKASHANKITSONU@GMAIL.COM

CHO Registration No 5524551

IRA Status IRA compliant

CHO Name Ambuja Cements Limited

3rd Floor, Elegant Business Park

CHO Address MIDC Cross Road,B Andheri East, Mumbai,

400059

Tier I Nominee Name/s Percentage

ASHOK KUMAR SRIVASTAVA 100%

Current Scheme Preference

Scheme Choice - ACTIVE CHOICE

Investment Option Scheme Details Percentage

Scheme 1 HDFC PENSION MANAGEMENT COMPANY LIMITED SCHEME E - TIER I 50.00%

Scheme 2 HDFC PENSION MANAGEMENT COMPANY LIMITED SCHEME C - TIER I 30.00%

Scheme 3 HDFC PENSION MANAGEMENT COMPANY LIMITED SCHEME G - TIER I 20.00%

Investment Summary

Value of your Total Total Total Notional Withdrawal/

Holdings(Invest Contribution in Withdrawal as Gain/Loss as deduction in

ments) No of your account as on on units towards Return on

as on Contributions on December 31, December 31, intermediary Investment 20.68%

December 31, December 31, 2023 (in ₹) 2023 (in ₹) charges (in ₹) (XIRR)

2023 (in ₹) 2023 (in ₹)

(A) (B) (C) D=(A-B)+C E

₹ 67,522.62 18 ₹ 62,053.80 ₹ 0.00 ₹ 5,468.82 ₹ 124.48

Investment Details - Scheme Wise Summary

HDFC PENSION HDFC PENSION HDFC PENSION

Particulars References MANAGEMENT COMPANY MANAGEMENT COMPANY MANAGEMENT COMPANY

LIMITED SCHEME E - TIER I LIMITED SCHEME C - TIER I LIMITED SCHEME G - TIER I

Scheme wise Value of your E=U*N 35,435.25 19,258.82 12,828.55

Holdings(Investments) (in ₹)

Total Units U 792.8255 766.0903 525.9460

NAV as on 29-Dec-2023 N 44.6949 25.1391 24.3914

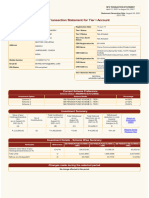

Changes made during the selected period

Date Tier Type Transaction Type

SUBSCRIBER SHIFT

05-Jun-2023 Tier-1 Subscriber Shifting From ::UOS To :=>Corporate.

Contribution/Redemption Details during the selected period

Contribution

Date Particulars Uploaded By Employee Employer's Total

Contribution Contribution (₹)

(₹) (₹)

27-Apr-2023 By Voluntary Contributions eNPS - Online (5000682), 2,500.00 0.00 2,500.00

27-Apr-2023 By Voluntary Contributions eNPS - Online (5000682), 2,500.00 0.00 2,500.00

27-Apr-2023 By Voluntary Contributions eNPS - Online (5000682), 2,500.00 0.00 2,500.00

11-May- By Voluntary Contributions eNPS - Online (5000682), 2,500.00 0.00 2,500.00

2023

08-Jun- By Voluntary Contributions eNPS - Online (5000682), 5,000.00 0.00 5,000.00

2023

15-Jun- For May, 2023 HDFC Bank Limited (5000800), 0.00 4,793.40 4,793.40

2023

04-Jul-2023 By Voluntary Contributions eNPS - Online (5000682), 2,500.00 0.00 2,500.00

13-Jul-2023 For June, 2023 HDFC Bank Limited (5000800), 0.00 4,793.40 4,793.40

07-Aug- By Voluntary Contributions eNPS - Online (5000682), 2,500.00 0.00 2,500.00

2023

23-Aug- For July, 2023 HDFC Bank Limited (5000800), 0.00 4,793.40 4,793.40

2023

20-Sep- By Voluntary Contributions eNPS - Online (5000682), 2,500.00 0.00 2,500.00

2023

04-Oct-2023 For August, 2023 HDFC Bank Limited (5000800), 0.00 4,793.40 4,793.40

09-Oct-2023 By Voluntary Contributions eNPS - Online (5000682), 2,500.00 0.00 2,500.00

11-Oct-2023 For September, 2023 HDFC Bank Limited (5000800), 0.00 4,793.40 4,793.40

10-Nov- For October, 2023 HDFC Bank Limited (5000800), 0.00 4,793.40 4,793.40

2023

04-Dec- By Voluntary Contributions eNPS - Online (5000682), 2,500.00 0.00 2,500.00

2023

29-Dec- For November, 2023 HDFC Bank Limited (5000800), 0.00 4,793.40 4,793.40

2023

Transaction Details

HDFC PENSION HDFC PENSION HDFC PENSION

Withdrawal/ MANAGEMENT COMPANY MANAGEMENT COMPANY MANAGEMENT COMPANY

deduction in units LIMITED SCHEME E - TIER I LIMITED SCHEME C - TIER I LIMITED SCHEME G - TIER I

Date Particulars

towards intermediary

charges(₹) Amount (₹) Amount (₹) Amount (₹)

Units Units Units

NAV (₹) NAV (₹) NAV (₹)

01-Apr-

2023 Opening balance 32.4247 4.0308 5.8873

06-Apr- (16.92) (1.41) (2.02)

Billing for Q4, 2022-2023 (20.35) (0.4771) (0.0591) (0.0870)

2023 35.4604 23.8465 23.2153

27-Apr- 1,875.00 250.00 375.00

By Voluntary Contributions 52.0418 10.3987 16.0090

2023 36.0287 24.0413 23.4242

27-Apr- 1,875.00 250.00 375.00

By Voluntary Contributions 52.0418 10.3987 16.0090

2023 36.0287 24.0413 23.4242

27-Apr- 1,875.00 250.00 375.00

By Voluntary Contributions 52.0418 10.3987 16.0090

2023 36.0287 24.0413 23.4242

26-Apr- On account of Rebalancing of (112.51) 42.04 70.47

2023 Assets as per Regulatory (3.1373) 1.7488 3.0084

Requirement 35.8649 24.0388 23.4240

11-May- 1,875.00 250.00 375.00

By Voluntary Contributions 50.8153 10.3587 15.9080

2023 36.8983 24.1343 23.5730

06-Jun- To Withdrawal On Account of (3,012.50) (0.00) (0.00)

(79.7420) (0.0000) (0.0000)

2023 Subscriber Shifting 37.7782 - -

08-Jun- By Contribution On Account of 0.00 2,385.22 627.28

0.0000 98.1180 26.4229

2023 Subscriber Shifting - 24.3097 23.7400

08-Jun- 2,500.00 1,500.00 1,000.00

By Voluntary Contributions 66.0797 61.7037 42.1229

2023 37.8331 24.3097 23.7400

15-Jun- 2,396.70 1,438.02 958.68

By Contribution for May,2023 63.0722 59.1634 40.4020

2023 37.9993 24.3059 23.7285

04-Jul- 1,250.00 750.00 500.00

By Voluntary Contributions 31.9274 30.8020 21.1283

2023 39.1513 24.3490 23.6649

13-Jul- 2,396.70 1,438.02 958.68

By Contribution for June,2023 61.0153 58.9388 40.3294

2023 39.2803 24.3985 23.7712

14-Jul- (31.22) (18.28) (12.15)

Billing for Q1, 2023-2024 (61.65) (0.7979) (0.7511) (0.5140)

2023 39.1274 24.3351 23.6365

07-Aug- 1,250.00 750.00 500.00

By Voluntary Contributions 31.4008 30.6267 21.0518

2023 39.8079 24.4884 23.7509

23-Aug- 2,396.70 1,438.02 958.68

By Contribution for July,2023 60.3237 58.5935 40.2139

2023 39.7306 24.5423 23.8395

20-Sep- 1,250.00 750.00 500.00

By Voluntary Contributions 30.7061 30.3401 20.8294

2023 40.7084 24.7197 24.0045

04-Oct- 2,396.70 1,438.02 958.68

By Contribution for August,2023 60.2584 58.0607 40.1222

2023 39.7737 24.7675 23.8940

07-Oct- (21.56) (12.60) (8.32)

Billing for Q2, 2023-2024 (42.48) (0.5366) (0.5104) (0.3503)

2023 40.1776 24.6839 23.7476

09-Oct- 1,250.00 750.00 500.00

By Voluntary Contributions 31.3404 30.4056 21.0922

2023 39.8845 24.6665 23.7054

11-Oct- By Contribution for 2,396.70 1,438.02 958.68

59.2089 58.2116 40.2833

2023 September,2023 40.4787 24.7033 23.7984

10-Nov- By Contribution for 2,396.70 1,438.02 958.68

59.8808 57.8500 39.9898

2023 October,2023 40.0245 24.8577 23.9731

04-Dec- 1,250.00 750.00 500.00

By Voluntary Contributions 29.3138 30.0599 20.7745

2023 42.6419 24.9501 24.0679

29-Dec- By Contribution for 2,396.70 1,438.02 958.68

53.6235 57.2025 39.3040

2023 November,2023 44.6949 25.1391 24.3914

31-Dec-

Closing Balance 792.8255 766.0903 525.9460

2023

Notes

1. The 'Investment Details' section gives an overall status of the total contribution processed under the account and the returns accrued

2. 'Notional Gain / Loss' indicates the overall gain or loss after factoring for the withdrawals processed in the account.

3. Returns based on Inflows' gives the annualized effective compounded return rate in PRAN account and is calculated using the formula of XIRR. The

calculation is done considering all the contribution / redemptions processed in PRAN account since inception and the latest valuation of the

investments. The transactions are sorted based on the NAV date.

4. 'Changes made during the selected period' indicates all the change requests processed in PRAN account during the period for which the

statement is generated.

5. The section 'Contribution / Redemption Details' gives the details of the contributions and redemption processed in subscribers' account during the

period for which the statement is generated. While contribution amount indicates the amount invested in subscribers account, the redemption

amount indicates the cost of units redeemed from the account. The cost of units is calculated on a First-In-First-Out (FIFO) basis. The details are

sorted based on date when the transaction is posted in PRAN account, which may / may not be the date for allotment of the NAV.

6. 'Transaction Details' gives the units allotted under different schemes / asset classes for each of the contributions processed in subscribers'

account during the period for which the statement is generated. It also contains units debited from the account for redemption and rectification. The

details are sorted based on date when the transaction is posted in PRAN account, which may / may not be the date for allotment of the NAV.

7. For transactions with the remarks "To Unit Redemption", the cost of units redeemed are adjusted against the total contribution in the Investment

Details section. Further, the cost of units is calculated on a First-In-First-Out (FIFO) basis. For calculating the 'Returns based on Inflows', the actual

redemption value corresponding to the units redeemed has been considered.

8. "Cost of Withdrawal", "Cost of GPF Withdrawal" and "Cost of One Way Switch", is the cost of units for the particular transaction and is calculated on a

First-In-First-Out (FIFO) basis. For calculating the 'Returns based on Inflows', the actual redemption value corresponding to the units redeemed has

been considered. Further, 'Total Withdrawal' in the Investment Summary section includes actual redemption value of Withdrawal and One Way

Switch transactions.

9. The Transaction statement is dynamic. The value and other computations in the Transaction statement depend upon the generation date.

10. The above returns are calculated based on scheme NAVs and the securities held under the scheme portfolio are valued on mark to market basis

and are subject to change on NAV fluctuations. .

11. If you are an employee or if you are self-employed , you will be able to avail of deduction on contribution made from your taxable income to the extent

of (u/s 80 CCD (1) of income Tax Act, 1961)

- 10% of salary (Basic + DA ) - if you are salaried employee

- 20% of your gross income - if you are self-employed

However, please note that the maximum deduction from your taxable income is limited to RS.1.50 lac, as permitted under Sec 80 CCE of the

Income Tax Act.

Further, an additional deduction from your taxable income to the extent of Rs. 50,000/- is available only for contribution in NPS u/s Sec. 80 CCD (1B).

To give an example, your salary is Rs.15 lac per annum. On contribution of Rs. 2 lac, you can avail:

Deduction under Sec. 80 CCD (1) - ₹- Rs. 1.50 lac

Deduction under Sec. 80 CCD (1B)- ₹- Rs. 0.50 lac

Total deduction - ₹- Rs. 2.00 lac

Also note that your employer's contribution upto 10% of your salary is fully deductible from your taxable income.

This is applicable only for Tier-I account.

12. Best viewed in Internet Explorer 9.0 & above or Mozilla Firefox Ver 3 & above with a resolution of 1024 X 768.

13. This is computer generated statement and does not require any signature/stamp.

14. Kindly refer Table 1 for various charges applicable under NPS:

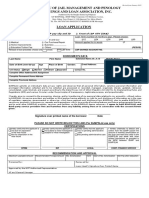

Table 1

Service Charges* (excluding taxes)

Intermediary Charge head Mode of Deduction

Private / Govt.

CRA charges for account opening if the CRA charges for account opening if the subscriber

subscriber opts for Physical PRAN card opts for ePRAN card (in Rs.)

PRA Opening charges Welcome kit sent in Welcome kit sent vide email Through Unit

(in Rs.) Deduction

physical only

Rs. 40 (also applicable to reissue of PRAN

CRA card) Rs. 35 Rs. 18

Annual PRA Maintenance Through Unit

Rs. 69

cost per account Deduction

Through Unit

Charge per transaction Rs. 3.75

Deduction

- Private Govt. -

Initial subscriber registration Min Rs. 200 and Max Rs. 400

NA Collected by POP

and contribution upload (Negotiable within slab only)

0.50% of contribution

Any subsequent Min. Rs. 30 Max. Rs. 25,000

NA Collected by POP

transactions Non-Financial Rs. 30

(Negotiable within slab only)

Rs. 50 per annum for annual

POP contribution Rs. 1,000 to Rs. 2,999

Persistency Rs. 75 per annum for annual Through Unit

> 6 months contribution Rs. 3,000 to Rs. 6,000 NA Deduction

Rs. 100 per annum for annual

contribution above Rs. 6,000

Upfront deduction

0.20% of contribution,

Contribution through eNPS NA from contribution

Min. Rs.15 Max. Rs.10,000

amount

Processing of Exit / @0.125% of Corpus with

NA Collected by POP

Withdrawal Min. Rs. 125 and Max. Rs. 500

Custodian Asset Servicing charges 0.0032% p.a for Electronic segment & Physical segment Through AUM

Slabs of AUM managed by the Pension Fund Maximum Investment

Management Fee (IMF)

Upto 10,000 Cr. 0.09%$

Investment Management

PF charges Through AUM

Fee# 10,001 - 50,000 Cr. 0.06%

50,001 - 1,50,000 Cr. 0.05%

Above 1,50,000 Cr. 0.03%

Reimbursement of

NPS Trust Expenses

0.005% p.a Through AUM

* In case of Government employees, CRA charges for Tier I account are being paid by the respective Government except for voluntary contribution, partial

withdrawal and scheme preference change.

# It includes brokerage fee up to 3 basis points.

$ UTI Retirement Solutions Ltd charges a fee of 0.07% under this slab.

The IMF to be charge by the Pension Fund on the slab structure would be on the aggregate AUM of the Pension Fund under all schemes managed by

Pension Funds.

You might also like

- Centralrecordkeepingagency: National Pension System Transaction Statement - Tier IDocument2 pagesCentralrecordkeepingagency: National Pension System Transaction Statement - Tier Izuheb0% (1)

- NPS Transaction Statement For Tier I AccountDocument3 pagesNPS Transaction Statement For Tier I Accountvikas0207ikash0% (1)

- NPS Fy23Document5 pagesNPS Fy23Sudhir Kumar SinghNo ratings yet

- Central Recordkeeping AgencyDocument3 pagesCentral Recordkeeping AgencyKaran RamchandaniNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRajakumar Reddy25% (4)

- PDFDocument3 pagesPDFKritarth KapoorNo ratings yet

- 1501137243609Document2 pages1501137243609Sougata Ghosh0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRaj Kumar SinghNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAmit Gupta50% (2)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument1 pageNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRajakumar ReddyNo ratings yet

- TAX Calculation FY 22-23 AY23-24Document9 pagesTAX Calculation FY 22-23 AY23-24SamratNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencevikas_2No ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountAkash RahangdaleNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferenceVikash ChetiwalNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencePullakiranreddy ReddyNo ratings yet

- HR-036 Authority To DeductDocument3 pagesHR-036 Authority To DeductADParametrik IncNo ratings yet

- Income Tax Plannig in India With Respectred To Individual AssesseeDocument79 pagesIncome Tax Plannig in India With Respectred To Individual AssesseeSAJIDA SHAIKHNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceKuldeep JadhavNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceLaya DonthulaNo ratings yet

- Nps 2021Document3 pagesNps 2021Joyanto Saha100% (2)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceNIkhil GuptaNo ratings yet

- Project Report: Life Insurance Corporation of IndiaDocument60 pagesProject Report: Life Insurance Corporation of IndiaSammy Zala100% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceDarshan MNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceHrshiya SharmaNo ratings yet

- NPS Account StatementDocument2 pagesNPS Account Statementdinesh rajendranNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencevasumscrmNo ratings yet

- Soft PDFDocument5 pagesSoft PDFraghuvardhan41No ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceHrshiya SharmaNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceHrshiya SharmaNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbhineet Kumar SinhaNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceFUN TVNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceraviNo ratings yet

- Nps StatementDocument3 pagesNps StatementLokesh KevinNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument5 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencedk1100861No ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencesaurajNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- 2023t1allDocument5 pages2023t1allsriharisreeramNo ratings yet

- StatementDocument5 pagesStatementmayurrajput1012No ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencedilip kumarNo ratings yet

- 80CCD (1B) - 52000 - National Pension Scheme (NPS)Document2 pages80CCD (1B) - 52000 - National Pension Scheme (NPS)Abhishek SenguptaNo ratings yet

- Soft PDFDocument5 pagesSoft PDFSaripudi Gangadhara RaoNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument4 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencerahulNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountABhishekNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- 2024t1allDocument5 pages2024t1allshankargadankush98No ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceMichelle MeanNo ratings yet

- NPS CertificateDocument2 pagesNPS CertificateSatish Tiwari100% (1)

- Master Data - PSRDCLDocument2 pagesMaster Data - PSRDCLskarshad007.saNo ratings yet

- The PrologueDocument2 pagesThe Prologueanuprabhakara.gNo ratings yet

- Unaudited Financial Results 31dec2022Document20 pagesUnaudited Financial Results 31dec2022Hiren PatelNo ratings yet

- Sunshine Tower, 30 Floor, Senapati Bapat Marg, Dadar (West), MUMBAI, INDIA-400013 Phone - 022-61309999Document1 pageSunshine Tower, 30 Floor, Senapati Bapat Marg, Dadar (West), MUMBAI, INDIA-400013 Phone - 022-61309999Logesh Waran KmlNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountAnonymous HvihZxGNNo ratings yet

- 1516352333813Document3 pages1516352333813gullipalli srinivasa raoNo ratings yet

- Latest NPS Sunny Dogra - RemovedDocument1 pageLatest NPS Sunny Dogra - Removeddinesh makwanaNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceBikram NongmaithemNo ratings yet

- Makemy Trip InvoiceDocument1 pageMakemy Trip InvoicesamiirjoshiiNo ratings yet

- 723325EB5C13Document1 page723325EB5C13HR RMQNo ratings yet

- EMDLILAVBHAVANDocument1 pageEMDLILAVBHAVANshirishdrajaNo ratings yet

- 24032000089211KKBK ChallanStatementDocument2 pages24032000089211KKBK ChallanStatementcasadegorrasfashionllp1No ratings yet

- KALIKANTA SINGHA Print - Udyam Registration CertificateDocument3 pagesKALIKANTA SINGHA Print - Udyam Registration Certificatebjoy.itinfoNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceBhanu PrakashNo ratings yet

- India Payslip January 2023Document1 pageIndia Payslip January 2023rraji078583No ratings yet

- Print - Udyam Registration CertificateDocument2 pagesPrint - Udyam Registration CertificateRohit SolankiNo ratings yet

- Ind As 19Document86 pagesInd As 19binuNo ratings yet

- 244585723Document41 pages244585723Raymundo EirahNo ratings yet

- Physically Handicapped - GOI CircularsDocument4 pagesPhysically Handicapped - GOI CircularsSomorjit YambemchaNo ratings yet

- SSEPD - Social Security & Empowerment of Persons With Disabilities DepartmentDocument3 pagesSSEPD - Social Security & Empowerment of Persons With Disabilities DepartmentSudhansu SabarNo ratings yet

- Part A: PersonalDocument2 pagesPart A: PersonalVikas DNo ratings yet

- Salary: What Is Salary Structure?Document3 pagesSalary: What Is Salary Structure?Sri SubhaNo ratings yet

- Sector Industry Coverage: Summary of HighlightsDocument2 pagesSector Industry Coverage: Summary of HighlightsAkena RichardNo ratings yet

- Income Tax Calculation Sheet For 2020-21 VER 9.0: (Fill Colum N Only)Document8 pagesIncome Tax Calculation Sheet For 2020-21 VER 9.0: (Fill Colum N Only)Jnv MANACAMP RAIPURNo ratings yet

- Income Tax Calculator For IndiaDocument4 pagesIncome Tax Calculator For Indiamahalakshmi muruganNo ratings yet

- LNL Iklcqd /: Page 1 of 3Document3 pagesLNL Iklcqd /: Page 1 of 3Kundan KumarNo ratings yet

- National Pension System One Pager V2Document2 pagesNational Pension System One Pager V2ramboNo ratings yet

- IAS 19 Employee BenefitsDocument3 pagesIAS 19 Employee BenefitsPui Fun LeoNo ratings yet

- Porm 27 NDocument11 pagesPorm 27 Njohn paroNo ratings yet

- THTHA00997420000029485 NewDocument3 pagesTHTHA00997420000029485 NewSagar JoshiNo ratings yet

- Bjmpslai Loan Application Form New - Jan2023Document3 pagesBjmpslai Loan Application Form New - Jan2023Mae Loudy Arendon100% (1)

- CHO Registration FormDocument3 pagesCHO Registration FormfarahsNo ratings yet

- Understanding Lump SumDocument2 pagesUnderstanding Lump SumYhamNo ratings yet

- WinzDocument4 pagesWinzQuestsNo ratings yet

- Ho2-Employee Benefits and Share-Based Compensation (Student's Copy)Document10 pagesHo2-Employee Benefits and Share-Based Compensation (Student's Copy)Alliah ArrozaNo ratings yet

- Emp ID Emp Name Job Grade Job Title Employmen T DateDocument4 pagesEmp ID Emp Name Job Grade Job Title Employmen T Dateoib ameyaNo ratings yet

- Retirement BenefitDocument66 pagesRetirement Benefitmike tandocNo ratings yet

- FS38 Treatment of Property in The Means-Test For Permanent Care Home Provision FcsDocument28 pagesFS38 Treatment of Property in The Means-Test For Permanent Care Home Provision FcsIp CamNo ratings yet

- AILRSA Central Committee - Reoresentation To Finance Ministry On NPS LatestDocument2 pagesAILRSA Central Committee - Reoresentation To Finance Ministry On NPS LatestMary SantosNo ratings yet

- Intermediate Accounting2 Finals TheoriesDocument10 pagesIntermediate Accounting2 Finals TheoriesColeen BiocalesNo ratings yet

- CM Employee Benefit and ServicesDocument63 pagesCM Employee Benefit and ServicesFaisal AminNo ratings yet

- Assignment 1 - f22Document2 pagesAssignment 1 - f22Alaa ShaathNo ratings yet