Professional Documents

Culture Documents

NPS Transaction Statement For Tier I Account: Current Scheme Preference

Uploaded by

Abhineet Kumar SinhaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NPS Transaction Statement For Tier I Account: Current Scheme Preference

Uploaded by

Abhineet Kumar SinhaCopyright:

Available Formats

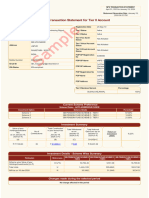

NPS TRANSACTION STATEMENT

April 01, 2022 to January 06, 2023

Statement Generation Date :January 06,

2023 09:58 AM

NPS Transaction Statement for Tier I Account

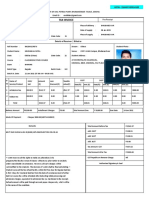

PRAN 111106388132 Registration Date 05-Jan-23

Subscriber Name SHRI ABHINEET KUMAR SINHA Tier I Status Active

MID TOWN HSG SOC Tier II Status Not Activated

FLAT NO. A-408 Tier II Tax Saver Not Activated

Status

SURVEY NO.185/3/1/4

Tier I Virtual Account Not Activated

Address Status

RAVET,,PUNE

Tier II Virtual Account Not Aplicable

MAHARASHTRA - 412101 Status

INDIA POP-SP Registration 6396950

No

Mobile Number +918809628590 POP-SP Name eNPS - Online

Email ID ABHINEET.SINHA1992@GMAIL.COM 1st Floor, Times Tower, Kamala, Mills

POP-SP Address Compound, Senapati Bapat

IRA Status IRA compliant Marg, Lower Parel, Mumbai, 400013

POP Registration No 5000682

POP Name eNPS - Online

1st Floor, Times Tower, Kamala, Mills

POP Address Compound, Senapati Bapat

Marg, Lower Parel, Mumbai, 400013

Tier I Nominee Name/s Percentage

PRAGYA BHARTI 100%

Current Scheme Preference

Scheme Choice - MODERATE AUTO CHOICE

Investment Option Scheme Details Percentage

Scheme 1 SBI PENSION FUND SCHEME E - TIER I 50.00%

Scheme 2 SBI PENSION FUND SCHEME C - TIER I 30.00%

Scheme 3 SBI PENSION FUND SCHEME G - TIER I 20.00%

Investment Summary

Value of your Total Contribution in Total Withdrawal as

Holdings(Investments your account as on on Total Notional

) No of Contributions January 06, 2023 (in January 06, 2023 (in Gain/Loss as on Return on Investment

as on January 06, ₹) ₹) January 06, 2023 (in ₹) (XIRR)

2023 (in ₹)

(A) (B) (C) D=(A-B)+C

₹ 0.00 0 ₹ 0.00 ₹ 0.00 ₹ 0.00 Returns for the

Financial Year

Investment Details - Scheme Wise Summary

Particulars References SBI PENSION FUND SCHEME E SBI PENSION FUND SCHEME C SBI PENSION FUND SCHEME G

- TIER I - TIER I - TIER I

Scheme wise Value of your E=U*N 0.00 0.00 0.00

Holdings(Investments) (in ₹)

Total Units U 0.0000 0.0000 0.0000

NAV as on 05-Jan-2023 N 39.6469 35.5727 32.6088

Changes made during the selected period

No change affected in this period

Contribution/Redemption Details during the selected period

Contribution

Date Particulars Uploaded By Employee Employer's Total

Contribution Contribution (₹)

(₹) (₹)

No change affected in this period

Transaction Details

SBI PENSION FUND SCHEME E - SBI PENSION FUND SCHEME C - SBI PENSION FUND SCHEME G -

TIER I TIER I TIER I

Date Particulars

Amount (₹) Amount (₹) Amount (₹)

Units Units Units

NAV (₹) NAV (₹) NAV (₹)

01-Apr-2022 Opening balance 0.0000 0.0000 0.0000

06-Jan-2023 Closing Balance 0.0000 0.0000 0.0000

Notes

1.The 'Investment Details' section gives an overall status of the total contribution processed under the account and the returns accrued

2.'Notional Gain / Loss' indicates the overall gain or loss after factoring for the withdrawals processed in the account.

3.Returns based on Inflows' gives the annualized effective compounded return rate in PRAN account and is calculated using the formula of XIRR. The

calculation is done considering all the contribution / redemptions processed in PRAN account since inception and the latest valuation of the

investments. The transactions are sorted based on the NAV date.

View More

Retired life ka sahara, NPS hamara

Home | Contact Us | System Configuration / Best Viewed | Entrust Secured | Privacy Policy | Grievance Redressal Policy

You might also like

- 53RD Personal Bank StatementDocument3 pages53RD Personal Bank StatementKelvin Dominic50% (2)

- Central Recordkeeping AgencyDocument3 pagesCentral Recordkeeping AgencyKaran RamchandaniNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencePullakiranreddy ReddyNo ratings yet

- Nps 123Document3 pagesNps 123Md Sharma SharmaNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountthilaksafaryNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountQC&ISD1 LMD COLONYNo ratings yet

- 1501137243609Document2 pages1501137243609Sougata Ghosh0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument1 pageNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRajakumar ReddyNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferenceVikash ChetiwalNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencekids funNo ratings yet

- NPS Fy23Document5 pagesNPS Fy23Sudhir Kumar SinghNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountAkash RahangdaleNo ratings yet

- NPS 2021Document2 pagesNPS 2021Jagannath PradhanNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceLaya DonthulaNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRajakumar Reddy25% (4)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencevikas_2No ratings yet

- OFTC Lesson 18 - Integrating Order Flow With Traditional Technical AnalysisDocument34 pagesOFTC Lesson 18 - Integrating Order Flow With Traditional Technical AnalysisThanhdat Vo100% (1)

- Midterms - Case DigestsDocument192 pagesMidterms - Case DigestskuheDSNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAmit Gupta50% (2)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceKuldeep JadhavNo ratings yet

- Franchising Finals 49Document8 pagesFranchising Finals 49KtNo ratings yet

- Nps 2021Document3 pagesNps 2021Joyanto Saha100% (2)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceGaurav SrivastavNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRahul PanwarNo ratings yet

- PDFDocument3 pagesPDFKritarth KapoorNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceNIkhil GuptaNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferencePradeep KumarNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument3 pagesNPS Transaction Statement For Tier I Accountvikas0207ikash0% (1)

- Quiz 1 Non Current Asset Held For SaleDocument1 pageQuiz 1 Non Current Asset Held For SaleLayla SimNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRaj Bharath33% (3)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencesaurajNo ratings yet

- 80CCD (1B) - 52000 - National Pension Scheme (NPS)Document2 pages80CCD (1B) - 52000 - National Pension Scheme (NPS)Abhishek SenguptaNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceraviNo ratings yet

- StatementDocument5 pagesStatementmayurrajput1012No ratings yet

- NPS Account StatementDocument2 pagesNPS Account Statementdinesh rajendranNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencedilip kumarNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceMichelle MeanNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceHrshiya SharmaNo ratings yet

- Latest NPS Sunny Dogra - RemovedDocument1 pageLatest NPS Sunny Dogra - Removeddinesh makwanaNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountAnonymous HvihZxGNNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceHrshiya SharmaNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencevasumscrmNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceHrshiya SharmaNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountABhishekNo ratings yet

- 1516352333813Document3 pages1516352333813gullipalli srinivasa raoNo ratings yet

- 2023t1allDocument5 pages2023t1allsriharisreeramNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceDarshan MNo ratings yet

- Oct2022Document3 pagesOct2022Vinod tiwariNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- The PrologueDocument2 pagesThe Prologueanuprabhakara.gNo ratings yet

- NPS LatestDocument4 pagesNPS Latestdinesh makwanaNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument5 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencedk1100861No ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument6 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencealokranjangoluNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument4 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencerahulNo ratings yet

- 2024t1allDocument5 pages2024t1allshankargadankush98No ratings yet

- Nps StatementDocument3 pagesNps StatementLokesh KevinNo ratings yet

- Central Recordkeeping AgencyDocument3 pagesCentral Recordkeeping Agencydeep bhattNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceBikram NongmaithemNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceBhanu PrakashNo ratings yet

- NPS CertificateDocument2 pagesNPS CertificateSatish Tiwari100% (1)

- Declartion LetterDocument1 pageDeclartion LetterAbhineet Kumar SinhaNo ratings yet

- LT E-BillDocument3 pagesLT E-BillAbhineet Kumar SinhaNo ratings yet

- TOI Delhi 24 Jan 2023Document26 pagesTOI Delhi 24 Jan 2023Abhineet Kumar SinhaNo ratings yet

- Ignou Mba Ii Sem Re RegistrationDocument1 pageIgnou Mba Ii Sem Re RegistrationAbhineet Kumar SinhaNo ratings yet

- TOI Delhi 26 Jan 2023Document29 pagesTOI Delhi 26 Jan 2023Abhineet Kumar SinhaNo ratings yet

- Canara HSBC (10 - 15)Document4 pagesCanara HSBC (10 - 15)AbhishekNo ratings yet

- NO2 Kampung Kuak Hulu 33100 Pengkalan Hulu Perak: Abdul Arif Bin Mahamad HanafiahDocument1 pageNO2 Kampung Kuak Hulu 33100 Pengkalan Hulu Perak: Abdul Arif Bin Mahamad HanafiahMuhammad ikmail KhusaimiNo ratings yet

- Financial Literacy Literature ReviewDocument7 pagesFinancial Literacy Literature Reviewf1gisofykyt3100% (1)

- PT Aksi Bergerak Cepat ChartOfAccounts 2022-11-23Document16 pagesPT Aksi Bergerak Cepat ChartOfAccounts 2022-11-23adisetNo ratings yet

- Journal Home GridDocument1 pageJournal Home Grid03217925346No ratings yet

- Revised LFAR Textile Market SuratDocument69 pagesRevised LFAR Textile Market Suratsreenath nanduNo ratings yet

- Fulton Iron Works V CHina BankDocument5 pagesFulton Iron Works V CHina BankAlfonso Miguel LopezNo ratings yet

- Money MattersDocument20 pagesMoney MattersGaurang PatelNo ratings yet

- Financial ReportsDocument6 pagesFinancial ReportsCatherine KimNo ratings yet

- CRE52Document44 pagesCRE52Renu MundhraNo ratings yet

- Concept Classes: Economics Paper - 3Document23 pagesConcept Classes: Economics Paper - 3Kunal SardanaNo ratings yet

- LP Modeling For Asset-Liability Management: A Survey of Choices and SimplificationsDocument17 pagesLP Modeling For Asset-Liability Management: A Survey of Choices and SimplificationsRidwan GunawanNo ratings yet

- CHAPTER 17 - AnswerDocument7 pagesCHAPTER 17 - AnswerKlare HayeNo ratings yet

- Document 1113 9704Document52 pagesDocument 1113 9704javierwarrenqswgiefjynNo ratings yet

- FMA Financial Accounting Assignments SolutionsDocument58 pagesFMA Financial Accounting Assignments SolutionskrishanptfmsNo ratings yet

- Power of Commissioner Penalties PDFDocument14 pagesPower of Commissioner Penalties PDFKomal JaiswalNo ratings yet

- Cash FlowsDocument35 pagesCash FlowsYahya MuhammadNo ratings yet

- Engineering Economics FormulasDocument2 pagesEngineering Economics FormulasBorja, Alexandra C.No ratings yet

- Banking and Money VocabularyDocument5 pagesBanking and Money VocabularygustavoragaNo ratings yet

- A Project Report On Title: Submitted ByDocument15 pagesA Project Report On Title: Submitted ByChirag LaxmanNo ratings yet

- Budi Q2 2021 FSDocument74 pagesBudi Q2 2021 FSPanama TreasureNo ratings yet

- Vanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQDocument1 pageVanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQNRUSINGHA PATRANo ratings yet

- Tally 1Document2 pagesTally 1Anushka TiwariNo ratings yet

- Issuances On Archax FlyerDocument3 pagesIssuances On Archax FlyerWalid El AmineNo ratings yet

- ACC00724 (Accounting For Managers) S2, 2016 Assignment 1 (20 Marks)Document4 pagesACC00724 (Accounting For Managers) S2, 2016 Assignment 1 (20 Marks)Asfawosen DingamaNo ratings yet