Professional Documents

Culture Documents

Bougeema

Uploaded by

samadozousCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bougeema

Uploaded by

samadozousCopyright:

Available Formats

FX-Trading: Challenging Intelligence

Marc Wildi

marc.wildi@zhaw.ch

Institute of data analysis and process design

Zurich University of Applied Sciences

September 6, 2018

AI in Finance 2018, ZHAW Winterthur

Marc Wildi marc.wildi@zhaw.ch MDFA

Introduction

In the abstract to this presentation: ”...We here sweep

through this methodological range by proposing a series of

novel and less novel, linear and non-linear, intelligent and less

so approaches, either in isolation or in combination...”

Instead of sweeping through a multitude of decorrelated pieces

let me emphasize just one most simple performance booster

in some more detail.

Marc Wildi marc.wildi@zhaw.ch MDFA

Are FX-Markets Efficient?

DB (2018): ”With trillions in currencies exchanging hands

every day, foreign exchange is indisputably the world’s

largest and most liquid financial market. Yet in spite of its

size, this report argues that it is also likely to be the least

”efficient” compared to other asset classes.”

”We review the latest data from a wide range of sources and

conclude that only 45%-60% of FX market participants are

likely to be profit-seeking. The presence of a large portion of

non-profit maximizing participants explains why the

efficient market hypothesis fails to hold in currencies and

why FX moves can be both predictable and profitable. The

rising share of passive investors as well as the increasing

importance of regulation suggests that the FX market may

be becoming less, rather than more efficient over time.”

Marc Wildi marc.wildi@zhaw.ch MDFA

Momentum

The authors of the above report rely on simple momentum,

value and carry strategies

In this presentation we also rely on a deliberately simple

filter strategy

The filter is not supposed to be the star of this presentation

It is used for illustration purposes, mainly

Marc Wildi marc.wildi@zhaw.ch MDFA

A System Based on All Pairwise Combinations (APC)

Trading systems are often based on a home currency (for

example USD)

Foreign currencies are bought by selling (’short’) the home

currency

DB 2018: USD against G9

Common risk factor: home currency

Instead, we here consider all pairwise combinations of n

currencies, APCn:

n(n − 1)

pairs

2

Diversification: smaller risk (see below)

Marc Wildi marc.wildi@zhaw.ch MDFA

Simplifying Assumptions of APCn-Concept

Assumptions:

All pairs are traded simultaneously

Equally-weighted portfolio: resources are split evenly across

APCn

Marc Wildi marc.wildi@zhaw.ch MDFA

Empirical Design

Daily log-returns from 2008 − 09 − 19 to 2018 − 09 − 04

Consider most liquid (low costs) currencies

EUR,USD,GBP,JPY,CHF,CAD,AUD: APC7

Mix of majors, crosses and commodity pairs

All pairwise combinations amount to 21 pairs

Long/short depending on filter sign

Plain vanilla weekly filter (which is not outstanding)

We account for trading costs

Bid-ask spread

Marc Wildi marc.wildi@zhaw.ch MDFA

Cumulated Return APC7 in %: Weekly Filter

PC7, Mean Performance in %

10 Sharpe : 0.26

Equally−weighted aggregate APC7

8

6

4

2

0

−2

2010−Jan−04 2012−Jul−02 2015−Jan−02 2017−Jul−03

Time

Marc Wildi marc.wildi@zhaw.ch MDFA

Equally-Weighted APC7

The mean annual return is 1.14% (as my Bank’s...) with an

annualized Sharpe of 0.26

Let’s have a look at the individual performances in the next

slide

Marc Wildi marc.wildi@zhaw.ch MDFA

Portfolio and individual FX-performances

Portfolio PC7 and mean (bold)

Sharpe EURUSD 0.55

Sharpe EURGBP 0.44

EURUSD

Sharpe EURJPY 0.13

40

EURGBP

Sharpe EURCHF 0.04

EURJPY

Sharpe EURCAD 0.37

EURCHF

Sharpe EURAUD 0.28

EURCAD

Sharpe GBPUSD 0.09

20

EURAUD

Sharpe USDJPY 0.25

GBPUSD

Sharpe USDCHF −0.15

USDJPY

Sharpe USDCAD −0.06

USDCHF

Sharpe AUDUSD 0.08

USDCAD

Sharpe GBPJPY 0.18

0

AUDUSD

Sharpe GBPCHF 0.15

GBPJPY

Sharpe GBPCAD −0.19

GBPCHF

Sharpe GBPAUD 0.01

GBPCAD

Sharpe CHFJPY 0.04

−20

GBPAUD

Sharpe CADJPY 0.23

CHFJPY

Sharpe AUDJPY 0.12

CADJPY

Sharpe CADCHF 0.31

AUDJPY

Sharpe AUDCHF 0

−40

CADCHF

Sharpe AUDCAD −0.52

AUDCHF

Sharpe Aggregate 0.26

AUDCAD

Aggregate

2010−Jan−04 2012−Jul−02 2015−Jan−02 2017−Jul−03

Time

Marc Wildi marc.wildi@zhaw.ch MDFA

Supremum

The maximal mean annual return of 4.7% is obtained by

EURUSD with an annualized Sharpe of 0.55

Supremum is a benchmark for testing our ideas

Let’s have a look at the trading signals (for illustration we

show all pairs having EUR as base currency)

Marc Wildi marc.wildi@zhaw.ch MDFA

Signals in Portfolio (All Pairs with EUR)

2018-08-31 2018-09-03 2018-09-04

EURUSD -1 -1 -1

EURGBP -1 1 1

EURJPY -1 -1 1

EURCHF -1 -1 1

EURCAD 1 1 1

EURAUD 1 1 -1

Table: Trading signals of pairs with EUR

On 2018 − 09 − 04 (last column) we observe that the EUR is

sold 2-times and bought 4-times: it receives a weight of

4−2=2

Similarly, we observe weights of 0 and −2 for the previous two

days (columns on the left)

Let’s summarize these weights for all currencies in the next

table

Marc Wildi marc.wildi@zhaw.ch MDFA

Weights of Currencies in APC7

EUR USD GBP JPY CHF CAD AUD

2018-08-22 6 -4 4 -6 2 0 -2

2018-08-23 2 4 -2 -4 6 0 -6

2018-08-24 6 4 -6 -4 0 2 -2

2018-08-27 4 -6 -2 -4 0 2 6

2018-08-28 6 -6 -2 -4 4 2 0

2018-08-29 0 -2 6 -6 4 2 -4

2018-08-30 -4 2 6 0 4 -2 -6

2018-08-31 -2 4 0 6 2 -4 -6

2018-09-03 0 2 -6 6 4 -4 -2

2018-09-04 2 4 -4 0 -2 -6 6

Table: Weight of currencies in equally-weighted portfolio

Let’s summarize further the above findings in the next table

Marc Wildi marc.wildi@zhaw.ch MDFA

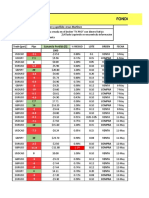

Activated Pairs of APC7

At each time point we report the traded (activated) pairs

only: the columns are arranged from left to right according to

the (absolute) weight of the pairs reported above

Weight 6 Weight 4 Weight 2

2018-08-28 EURUSD CHFJPY GBPCAD

2018-08-29 GBPJPY AUDCHF USDCAD

2018-08-30 GBPAUD EURCHF USDCAD

2018-08-31 AUDJPY USDCAD EURCHF

2018-09-03 GBPJPY CADCHF AUDUSD

2018-09-04 AUDCAD GBPUSD EURCHF

Table: Activated pairs of equally-weighted portfolio

Marc Wildi marc.wildi@zhaw.ch MDFA

Factors of APC7

At each time point we report the daily returns obtained by

applying the filter to the correspondingly (activated) pairs:

the columns are arranged from left to right according to the

(absolute) weight of the pairs reported above

Factor 1 Factor 2 Factor 3

2018-08-28 0.003 0.005 0.004

2018-08-29 0.015 0.009 -0.000

2018-08-30 0.005 0.005 -0.005

2018-08-31 0.012 0.006 0.006

2018-09-03 0.006 0.004 -0.003

2018-09-04 0.002 0.002 -0.002

Table: Daily returns of filter-strategy for the activated pairs

On 2018 − 09 − 04 (last row) the daily returns

0.002, 0.002, −0.002 correspond to the filter-strategy applied

to AUDCAD, GBPUSD, EURCHF

Marc Wildi marc.wildi@zhaw.ch MDFA

Factors of APC7

The series in the above table are called factors

Factors are non-linear time-dependent constructs which are

dependent on the trading strategy (filter or other)

Two different factors do not share a common currency

(orthogonality, diversification)

The first factor F1t (left column) is the most important one

because

it receives the largest weight w1 = 6 (which is relevant for

portfolio-replication)

and other properties to be discussed below

Straightforward extensions to arbitrary set of currencies

and/or to arbitrary trading strategies (filters or others):

generic framework

Marc Wildi marc.wildi@zhaw.ch MDFA

Minimal Replicating Portfolio

In the absence of tradings costs, the payout (profit/loss) of

the entire portfolio APC 7 can be replicated by

RPt (3) = 6F1t + 4F2t + 2F3t

where RP(3) is a minimal replicating portfolio (minimal in

terms of traded pairs and/or costs)

Cumulated returns of RP(3) and of APC7 are shown in the

next figure

Marc Wildi marc.wildi@zhaw.ch MDFA

Cumulated Returns

Replication of equally−weighted portfolio of G7

Sharpe Aggregate 0.26

Sharpe Replicating.portfolio 0.37

25

Aggregate

Replicating.portfolio

20

15

10

5

0

2010−Jan−04 2012−Jul−02 2015−Jan−02 2017−Jul−03

Time

Marc Wildi marc.wildi@zhaw.ch MDFA

Leverage

The payouts of both strategies are identical (in the absence

of trading costs).

But the return of RP(3) is leveraged

APC7 splits the capital evenly into 21 parts

RP(3) splits the capital unevenly into 6 + 4 + 2 = 12 parts

For the same payout, RP(3) requires 12/21 ∗ 100% = 57% of

the capital (no waste of capital in cancelling trades)

RP(3)’s return is inherently leveraged by the factor

21/12 = 1.75

The Sharpe ratio is not affected by leveraging (but by lesser

trading costs by RP(3))

For large n (number of currencies) the leverage term

converges to 2

Marc Wildi marc.wildi@zhaw.ch MDFA

Empirical Analysis: Portfolio and Replication

In the next figure we artificially scale-down the return of

RP(3) by its inverse leverage 0.57

Any differences illustrate the effect of trading costs (less

trades by RP(3))

Which affect the Sharpe ratio

Marc Wildi marc.wildi@zhaw.ch MDFA

Replication: Aligned Returns

Replicating vs equally−weighted portfolio of G7

15 Sharpe Aggregate 0.26

Sharpe Replicating.portfolio 0.37

Aggregate

Replicating.portfolio

10

5

0

2010−Jan−04 2012−Jul−02 2015−Jan−02 2017−Jul−03

Time

Marc Wildi marc.wildi@zhaw.ch MDFA

RP(3): Added-Value

The added-value of RP(3) is twofold:

Leverage (1.75 in our example) : does not affect Sharpe

Smaller costs: improve return and Sharpe

After these ’trivial bits’ let us look more thoroughly at the

above factors

Marc Wildi marc.wildi@zhaw.ch MDFA

Correlations

The first factor F1t of RP(3) receives the largest weight

w1 = 6 and therefore the correlation between APC 7t and F1t

is generally ’large’

The correlation between the cumulated performances of F1t

and APC7 is 0.94

The correlation between the daily returns is 0.89

Diversification? Yes, see below...

Marc Wildi marc.wildi@zhaw.ch MDFA

Factor-Based Strategies

Let Fit , i = 1, 2, 3 be considered as separate

trading-strategies (rather than unequally aggregated in RP3)

Intuition:

F1t should track APC 7t more or less closely in terms of

payouts

Largest weight, highest correlation

Therefore, the single-pair factor F1t should boost the return

through additional leveraging

And some more goodies, see below

The cumulated returns of the factors are displayed on the next

slide, together with APC 7 and RP(3)

Marc Wildi marc.wildi@zhaw.ch MDFA

Factor Performances: Distinguishing First Factor (blue

line)

Equally−weighted and Replicating Portfolios and Factors

Sharpe Aggregate 0.26

50

Sharpe Replicating.portfolio 0.37

Aggregate

Sharpe Factor 1 0.44

Replicating.portfolio

Sharpe Factor 2 0.01

Factor 1

40

Sharpe Factor 3 0.08

Factor 2

Factor 3

30

20

10

0

−10

−20

2010−Jan−04 2012−Jul−02 2015−Jan−02 2017−Jul−03

Time

Marc Wildi marc.wildi@zhaw.ch MDFA

Analysis

We observe improved performances of F1t (blue line) in terms

of absolute return as well as of Sharpe ratio

Surprising because F1t is a single-pair return series

(admittedly composite over time, see below)

Leverage:

Assume that the performances of F2t and F3t are ’small’ when

compared to F1t (as is the case here)

Using the replicating portfolio formula we then obtain

APC 7t = 6F1t + 4F2t + 2F3t ≈ 6F1t

We then infer that it would require 6/21 ∗ 100% = 30% of the

capital only for replicating the payout of the portfolio

Leverage term of 21/6 = 3.5 (approaches 4 by increasing the

number of currencies n in APCn)

The above figure suggests even stronger outperformance, see

next slide

Marc Wildi marc.wildi@zhaw.ch MDFA

The Distinguishing First Factor

In the above explanation we assumed that performances of

F2t and F3t were ’small’ when compared to F1t

Justification:

F1t selects pairs by combining the strongest currency (the

filter is long 6-times) with the weakest currency (the filter is

short 6-times) at each time point t

If the filter delivers ’pertinent’ signals then F1t should

outperform the other factors, as assumed

We expect the first factor to perform exceedingly well

because of

1 the improved leverage effect: this affects the return but not

Sharpe

2 smaller costs (less trades): affects both return and Sharpe

3 distinguishing feature: a strengthening of the filter

inference by identification of the max-min pair

(strongest/weakest currencies): affects both return and

Sharpe. The better the filter, the stronger the effect!

Marc Wildi marc.wildi@zhaw.ch MDFA

First Factor (bold blue line) vs. (Supremum of) Portfolio

First factor (bold line) vs. portfolio

EURUSD

Factor 1

40

EURJPY

EURCHF

EURCAD

EURAUD

20

GBPUSD

USDJPY

USDCHF

USDCAD

AUDUSD

0

GBPJPY

GBPCHF

GBPCAD

−20

GBPAUD

CHFJPY

CADJPY

AUDJPY

CADCHF

−40

AUDCHF

AUDCAD

Aggregate

2010−Jan−04Extreme.pair

2012−Jul−02 2015−Jan−02 2017−Jul−03

Time

Marc Wildi marc.wildi@zhaw.ch MDFA

The Distinguishing First Factor

The first factor dominates the supremum of the portfolio on

the ’long run’

The extent of the dominance depends on the quality of the

signals (which is not outstanding but ’sufficient’ in the case

of our plain-vanilla filter)

More research would be needed for elucidating the relation

between F1t and the supremum of the portfolio as a function

of filter performances (would fit nicely into a phd-topic)

Marc Wildi marc.wildi@zhaw.ch MDFA

Diversification by Factors

Let’s talk a bit about ’diversification’...

Max-min pairs activated by first factor

2018-08-22 EURJPY

2018-08-23 AUDCHF

2018-08-24 EURGBP

2018-08-27 AUDUSD

2018-08-28 EURUSD

2018-08-29 GBPJPY

2018-08-30 GBPAUD

2018-08-31 AUDJPY

2018-09-03 GBPJPY

2018-09-04 AUDCAD

Table: Selected pairs in first factor

Marc Wildi marc.wildi@zhaw.ch MDFA

Distribution of Pairs in First Factor

Distribution of pairs in first factor

0.12

0.10

0.08

0.06

0.04

0.02

0.00

AUDCAD CADCHF EURCAD EURUSD GBPJPY USDJPY

Marc Wildi marc.wildi@zhaw.ch MDFA

Distribution of Currencies in First Factor

Distribution of currencies in first factor

0.20

0.15

0.10

0.05

0.00

AUD CAD CHF EUR GBP JPY USD

Marc Wildi marc.wildi@zhaw.ch MDFA

Longitudinal Diversification

The first factor substitutes a longitudinal diversification for

the ordinary cross-sectional diversification

In contrast to the undiscriminating cross-sectional smoothing

by the equally-weighted scheme, the novel longitudinal

diversification reflects filter inferences

In summary: we have a diversification but it’s along the

time axis and it’s a bit smarter under the assumption that

the filter is able to extract relevant information

Marc Wildi marc.wildi@zhaw.ch MDFA

Factor-Based Trading Subsystems

Given our above system APC7 of all pairwise combinations

Select a subset of FX-pairs from this set

For example select all pairs with USD (home-currency)

Subsystem based on F1t :

Pick-out only those trading episodes of F1t corresponding to

the selected pairs (otherwise stay out of the market)

Illustration: next slide

Marc Wildi marc.wildi@zhaw.ch MDFA

Subsystem Based on USD (Major G7 Pairs)

Returns first factor Subsystem USD

2018-08-22: EURUSD 0.0033 0.0033

2018-08-23: EURJPY 0.0103 0.0000

2018-08-24: AUDCHF 0.0032 0.0000

2018-08-27: EURGBP -0.0037 0.0000

2018-08-28: AUDUSD 0.0025 0.0025

2018-08-29: EURUSD 0.0150 0.0150

2018-08-30: GBPJPY 0.0052 0.0000

2018-08-31: GBPAUD 0.0124 0.0000

2018-09-03: AUDJPY 0.0058 0.0000

2018-09-04: GBPJPY 0.0020 0.0000

Table: Trading signals of pairs with EUR

Subsystem (second column): pick-out all performances when

USD is selected by F1t and stay out of the market otherwise

Marc Wildi marc.wildi@zhaw.ch MDFA

Trading Subsystem based on USD (G7, black line)

G7

50 Sharpe : Subsystem 0.563 , market exposure 20%

Sharpe : Factor 1 0.437 , market exposure 100%

Subsystem

Factor 1

40

30

20

10

0

2010−Jan−04 2012−Jul−02 2015−Jan−02 2017−Jul−03

Time

Marc Wildi marc.wildi@zhaw.ch MDFA

Trading Subsystems: Align Performances to Exposure

The return of the subsystem based on USD (G7) (black line)

is smaller because its market exposure of 20.3% is smaller

The annualized Sharpe ratio is underrating the performance

because it does not account for the smaller exposure

We now scale performances according to

inverse exposure (for the returns)

square root of inverse exposure (for Sharpe)

see the following figure.

Marc Wildi marc.wildi@zhaw.ch MDFA

Subsystem based on USD (G2): Performances Aligned for

Exposure

G7: performances aligned to exposure

Sharpe : Subsystem 1.249

120

Sharpe : Factor 1 0.437

Subsystem

Factor 1

100

80

60

40

20

0

2010−Jan−04 2012−Jul−02 2015−Jan−02 2017−Jul−03

Time

Marc Wildi marc.wildi@zhaw.ch MDFA

Remarks

Instead of assigning full/zero weight (depending on whether a

pair is activated by the factor) one could think about a more

elaborated weighting scheme...

The subsystem could be based on a single pair, only

Example: EURUSD

The figure in the next slide compares F1t (blue line), EURUSD

based on weekly filter (red) and the subsystem of EURUSD

based on picking out selected returns of F1t (black line).

Once more the annualized Sharpe ratio of the subsystem is

underrating performances because of the (much) smaller

market exposure of 3.2%

Marc Wildi marc.wildi@zhaw.ch MDFA

Trading Subsystem based on EURUSD

EURUSD

50 Sharpe : Subsystem 0.287 , market exposure 3%

Sharpe : Factor 1 0.437 , market exposure 100%

Subsystem

Sharpe : EURUSD 0.549 , market exposure 100%

Factor 1

EURUSD

40

30

20

10

0

2010−Jan−04 2012−Jul−02 2015−Jan−02 2017−Jul−03

Time

Marc Wildi marc.wildi@zhaw.ch MDFA

Subsystem based on EURUSD: Performances Aligned for

Exposure

EURUSD: performances aligned to exposure

Sharpe : Subsystem 1.602

150

Sharpe : Factor 1 0.437

Subsystem

Sharpe : EURUSD 0.549

Factor 1

EURUSD

100

50

0

−50

2010−Jan−04 2012−Jul−02 2015−Jan−02 2017−Jul−03

Time

Marc Wildi marc.wildi@zhaw.ch MDFA

Revert the Above Framework: Embedding System

Given a real trading system FX (n) of pairs based on n

different currencies c1 , c2 , ..., cn

Not necessarily all pairwise combinations of currencies

For example the above major G7

And given a trading strategy applied to the pairs of FX (n)

For example the plain vanilla weekly filter

Derive a fictive embedding system APCn + j of all pairwise

combinations of c1 , ..., cn , cn+1 , ..., cn+j where cn+1 , ..., cn+j

are possibly additional currencies of interest

If j = 0 then we just consider APCn i.e. all pairwise

combinations of currencies of the real system

Marc Wildi marc.wildi@zhaw.ch MDFA

Embedding of Real System into Fictive Factor-Based

Strategy

Assume that the following hold in the fictive APCn + j

equal-weighting

trade synchronization

These assumptions need not hold for the real system FX (n)

Embedding: at each trading time point t of the real system

FX (n)

compute F1t from the fictive APCn + j

assign ’more’ weight to the pair in the real system FX (n)

conforming with the fictive pair activated by F1t

Marc Wildi marc.wildi@zhaw.ch MDFA

Trading Subsystem based on USD (G7, black line)

G7

50 Sharpe : Subsystem 0.563 , market exposure 20%

Sharpe : Factor 1 0.437 , market exposure 100%

Subsystem

Factor 1

40

30

20

10

0

2010−Jan−04 2012−Jul−02 2015−Jan−02 2017−Jul−03

Time

Marc Wildi marc.wildi@zhaw.ch MDFA

To Conclude: a Caveat and a Back Door

A Caveat: the pertinence of the proposed factor-based

strategy depends on the quality of the filter

the filter fuels the factor-based engine

the factors leverage the filter

A back door to filters

McElroy and Wildi (JTSE 2016), Wildi (Handbook on

Seasonal Adjustment, Eurostat 2018), McElroy and Wildi

(IJOF 2018), McElroy and Wildi (submitted 2018)

Marc Wildi marc.wildi@zhaw.ch MDFA

References/Links

DB (2018) Alive and Kicking: A Guide to FX as an Asset

Class, Deutsche Bank Research

Wildi (2018): Eurostat Handbook on Seasonal Adjustment

McElroy and Wildi (2016): Optimal Real-Time Filters for

Linear Prediction Problems (JTSE)

McElroy and Wildi (2018): The Trilemma Between Accuracy,

Timeliness and Smoothness in Real-Time Signal Extraction,

IJOF (2018)

McElroy and Wildi (2018): The Multivariate Linear Prediction

Problem: Model-Based and Direct Filtering Solutions

SEF Blog: Blog on Signal Extraction and Forecasting

Marc Wildi marc.wildi@zhaw.ch MDFA

You might also like

- Addendum To The Client Agreement "Swap-Free Accounts"Document3 pagesAddendum To The Client Agreement "Swap-Free Accounts"marziehdehghaniNo ratings yet

- BNP Steer ExplanationDocument31 pagesBNP Steer ExplanationCynthia SerraoNo ratings yet

- BNP Paribas Steer™: - GlobalDocument17 pagesBNP Paribas Steer™: - Globalmateomejia741No ratings yet

- Fair Value Model - Hardcoded DateDocument9 pagesFair Value Model - Hardcoded DateforexNo ratings yet

- Trading PlanDocument16 pagesTrading PlanMarvin DimaguilaNo ratings yet

- (Silakan Diubah Jika Tidak Sesuai) - Sertakan Screenshot Jika PerluDocument56 pages(Silakan Diubah Jika Tidak Sesuai) - Sertakan Screenshot Jika Perlufaishal idrisNo ratings yet

- Pip Values: Last Updated Friday, June 15, 2012Document363 pagesPip Values: Last Updated Friday, June 15, 2012TestUserNo ratings yet

- Daily I Forex Report: 23 MARCH 2013Document15 pagesDaily I Forex Report: 23 MARCH 2013api-211507971No ratings yet

- LCG Swap Free Account CommissionsDocument2 pagesLCG Swap Free Account CommissionsMuhammad Muslim AbdullahNo ratings yet

- Fictive-Portfolio DAVEDocument42 pagesFictive-Portfolio DAVEMarc PacaoNo ratings yet

- Ashi StrategyDocument5 pagesAshi StrategypriyasujathaNo ratings yet

- 2ndSkiesForex Performance Worksheet TEMPLATEDocument21 pages2ndSkiesForex Performance Worksheet TEMPLATEAdam AhmatNo ratings yet

- Daily I Forex Report: 9 February 2013Document15 pagesDaily I Forex Report: 9 February 2013api-196234891No ratings yet

- Report 3Document40 pagesReport 3Ketan PoddarNo ratings yet

- Daily I Forex Report: 6 February 2013Document15 pagesDaily I Forex Report: 6 February 2013api-196234891No ratings yet

- Daily-I-Forex-Report-1 by Epic Reserach (28-01-2013)Document14 pagesDaily-I-Forex-Report-1 by Epic Reserach (28-01-2013)EpicresearchNo ratings yet

- Diario de Trading - Live Trading RoomDocument683 pagesDiario de Trading - Live Trading RoomAlexisNo ratings yet

- FX Financing Charges December - GenericDocument2 pagesFX Financing Charges December - GenericMuhammad YounusNo ratings yet

- Currency Report - Daily - 15 June 2022 - 15-06-2022 - 07Document4 pagesCurrency Report - Daily - 15 June 2022 - 15-06-2022 - 07Porus Saranjit SinghNo ratings yet

- Daily-i-Forex-report-1 by EPIC RESEARCH 17 MAY 2013Document16 pagesDaily-i-Forex-report-1 by EPIC RESEARCH 17 MAY 2013EpicresearchNo ratings yet

- Fundamental Equity Analysis - Euro Stoxx 50 Index PDFDocument103 pagesFundamental Equity Analysis - Euro Stoxx 50 Index PDFQ.M.S Advisors LLCNo ratings yet

- Fondo de Inversion (Prueba Scalping)Document11 pagesFondo de Inversion (Prueba Scalping)jesusNo ratings yet

- Daily I Forex Report 1 by EPIC RESEARCH 01.04.13Document15 pagesDaily I Forex Report 1 by EPIC RESEARCH 01.04.13EpicresearchNo ratings yet

- Forex Trading StatisticsDocument39 pagesForex Trading StatisticsGeorge ProtonotariosNo ratings yet

- Fundamental Equity Analysis - Euro Stoxx 50 Index PDFDocument103 pagesFundamental Equity Analysis - Euro Stoxx 50 Index PDFQ.M.S Advisors LLCNo ratings yet

- PLANILHA-FOREX Lotes - DólarDocument14 pagesPLANILHA-FOREX Lotes - DólarRubenNo ratings yet

- Daily I Forex Report: 28 February 2013Document17 pagesDaily I Forex Report: 28 February 2013api-196234891No ratings yet

- Daily-i-Forex-report-1 by Epic Research 13 May 2013Document14 pagesDaily-i-Forex-report-1 by Epic Research 13 May 2013EpicresearchNo ratings yet

- PLANILHA-FOREX Lotes - DólarDocument14 pagesPLANILHA-FOREX Lotes - DólardanielNo ratings yet

- Premarket Technical&Derivative Angel 15.12.16Document5 pagesPremarket Technical&Derivative Angel 15.12.16Rajasekhar Reddy AnekalluNo ratings yet

- Daily I Forex Report: 12 February 2013Document14 pagesDaily I Forex Report: 12 February 2013api-196234891No ratings yet

- Ig SB FX Spread CutsDocument2 pagesIg SB FX Spread Cutsgrimweasel47No ratings yet

- Daily-i-Forex-report 15 May 2013 by Epic ResearchDocument16 pagesDaily-i-Forex-report 15 May 2013 by Epic ResearchEpicresearchNo ratings yet

- Diario de Trading - Live Trading RoomDocument683 pagesDiario de Trading - Live Trading RoomYnohtnaAipatNo ratings yet

- Daily I Forex Report 14 March 2013Document15 pagesDaily I Forex Report 14 March 2013Anupriya SaxenaNo ratings yet

- (FalconFX) Trading Performance Kit - ?trading TrackerDocument25 pages(FalconFX) Trading Performance Kit - ?trading Trackeryahia75% (4)

- Trade Journal 2.0 TemplateDocument18 pagesTrade Journal 2.0 TemplatelifaNo ratings yet

- Daily I Forex Report: 13 February 2013Document14 pagesDaily I Forex Report: 13 February 2013api-196234891No ratings yet

- Money Management FXDocument370 pagesMoney Management FXSr.KeelKnightlyNo ratings yet

- Daily I Forex Report: 21 February 2013Document16 pagesDaily I Forex Report: 21 February 2013api-196234891No ratings yet

- Q3 2021 Market Outlook Report E BookDocument39 pagesQ3 2021 Market Outlook Report E BookMiliana SophiosNo ratings yet

- Total Strength USD EUR GBP CHF CAD AUD 3.5 5.6 3.3 6.3 5.0 5.5Document5 pagesTotal Strength USD EUR GBP CHF CAD AUD 3.5 5.6 3.3 6.3 5.0 5.5revolutionaryonesNo ratings yet

- Daily I Forex Report: 8 February 2013Document15 pagesDaily I Forex Report: 8 February 2013EpicresearchNo ratings yet

- Capitalaim-Stock Market, Commodity ReportDocument28 pagesCapitalaim-Stock Market, Commodity ReportArpan SharmaNo ratings yet

- Currency Report - Daily - 14 July 2022 - 13-07-2022 - 22Document4 pagesCurrency Report - Daily - 14 July 2022 - 13-07-2022 - 22Porus Saranjit SinghNo ratings yet

- Daily I Forex Report: 25 EBRUARY 2013Document15 pagesDaily I Forex Report: 25 EBRUARY 2013api-196234891No ratings yet

- Money Management CalculatorDocument3 pagesMoney Management CalculatorjpamcicNo ratings yet

- Weekly Forex Forecast April 13 17 2020Document4 pagesWeekly Forex Forecast April 13 17 2020Raph SunNo ratings yet

- Daily Trading Stance - 2009-08-14Document2 pagesDaily Trading Stance - 2009-08-14Trading FloorNo ratings yet

- Horizon Handout 2021-09Document32 pagesHorizon Handout 2021-09Orkhan GuliyevNo ratings yet

- TRADE PLANNER - Objective Risk ManagementDocument8 pagesTRADE PLANNER - Objective Risk ManagementankitforuNo ratings yet

- FXChoice CFD Product Guide - 2020Document25 pagesFXChoice CFD Product Guide - 2020Gregorius Set TandiNo ratings yet

- Eazy Forex (Buy Strategy)Document10 pagesEazy Forex (Buy Strategy)M1k324080% (1)

- Daily I Forex Report: 11 MARCH 2013Document15 pagesDaily I Forex Report: 11 MARCH 2013api-196234891No ratings yet

- Currency Report - Daily - 13 July 2022 - 13-07-2022 - 09Document4 pagesCurrency Report - Daily - 13 July 2022 - 13-07-2022 - 09Porus Saranjit SinghNo ratings yet

- DailyNewsLetter - 20 Oct 10Document3 pagesDailyNewsLetter - 20 Oct 10checrucifixNo ratings yet

- SEB Report: New FX Scorecard Sees Swedish Currency StrengtheningDocument44 pagesSEB Report: New FX Scorecard Sees Swedish Currency StrengtheningSEB GroupNo ratings yet

- Introduce Re in Tranzactioanre 2011 FinalDocument85 pagesIntroduce Re in Tranzactioanre 2011 FinalCatalin Oprea0% (1)

- Forex Trading: Part 2: Two strategies with weekly pivotsFrom EverandForex Trading: Part 2: Two strategies with weekly pivotsRating: 5 out of 5 stars5/5 (1)

- Chunking Chunking Chunking: Stator Service IssuesDocument1 pageChunking Chunking Chunking: Stator Service IssuesGina Vanessa Quintero CruzNo ratings yet

- Advantages Renewable Energy Resources Environmental Sciences EssayDocument3 pagesAdvantages Renewable Energy Resources Environmental Sciences EssayCemerlang StudiNo ratings yet

- For ClosureDocument18 pagesFor Closuremau_cajipeNo ratings yet

- Cpar ReviewerDocument6 pagesCpar ReviewerHana YeppeodaNo ratings yet

- 2011-11-09 Diana and AtenaDocument8 pages2011-11-09 Diana and AtenareluNo ratings yet

- Steel Price Index PresentationDocument12 pagesSteel Price Index PresentationAnuj SinghNo ratings yet

- Anthony Robbins - Time of Your Life - Summary CardsDocument23 pagesAnthony Robbins - Time of Your Life - Summary CardsWineZen97% (58)

- SXV RXV ChassisDocument239 pagesSXV RXV Chassischili_s16No ratings yet

- Participatory EvaluationDocument4 pagesParticipatory EvaluationEvaluación Participativa100% (1)

- LSL Education Center Final Exam 30 Minutes Full Name - Phone NumberDocument2 pagesLSL Education Center Final Exam 30 Minutes Full Name - Phone NumberDilzoda Boytumanova.No ratings yet

- University Fees Structure (Himalayan Garhwal University) - UttarakhandDocument1 pageUniversity Fees Structure (Himalayan Garhwal University) - UttarakhandabhaybaranwalNo ratings yet

- MQXUSBDEVAPIDocument32 pagesMQXUSBDEVAPIwonderxNo ratings yet

- C++ Program To Create A Student Database - My Computer ScienceDocument10 pagesC++ Program To Create A Student Database - My Computer ScienceSareeya ShreNo ratings yet

- T688 Series Instructions ManualDocument14 pagesT688 Series Instructions ManualKittiwat WongsuwanNo ratings yet

- IPS PressVest Premium PDFDocument62 pagesIPS PressVest Premium PDFLucian Catalin CalinNo ratings yet

- Individual Daily Log and Accomplishment Report: Date and Actual Time Logs Actual AccomplishmentsDocument3 pagesIndividual Daily Log and Accomplishment Report: Date and Actual Time Logs Actual AccomplishmentsMarian SalazarNo ratings yet

- Work Site Inspection Checklist 1Document13 pagesWork Site Inspection Checklist 1syed hassanNo ratings yet

- Bathinda - Wikipedia, The Free EncyclopediaDocument4 pagesBathinda - Wikipedia, The Free EncyclopediaBhuwan GargNo ratings yet

- Weg CFW500 Enc PDFDocument32 pagesWeg CFW500 Enc PDFFabio Pedroso de Morais100% (1)

- Operational Readiness and Airport TransferDocument2 pagesOperational Readiness and Airport TransferochweriNo ratings yet

- Pontevedra 1 Ok Action PlanDocument5 pagesPontevedra 1 Ok Action PlanGemma Carnecer Mongcal50% (2)

- Corporate Restructuring Short NotesDocument31 pagesCorporate Restructuring Short NotesSatwik Jain57% (7)

- India Biotech Handbook 2023Document52 pagesIndia Biotech Handbook 2023yaduraj TambeNo ratings yet

- Profibus Adapter Npba-02 Option/Sp Profibus Adapter Npba-02 Option/SpDocument3 pagesProfibus Adapter Npba-02 Option/Sp Profibus Adapter Npba-02 Option/Spmelad yousefNo ratings yet

- CH 15Document58 pagesCH 15Chala1989No ratings yet

- DN12278 - 5008 - Indicative Cable Way Route - Rev BDocument9 pagesDN12278 - 5008 - Indicative Cable Way Route - Rev BArtjoms LusenkoNo ratings yet

- Assignment RoadDocument14 pagesAssignment RoadEsya ImanNo ratings yet

- The History of Music in Portugal - Owen ReesDocument4 pagesThe History of Music in Portugal - Owen ReeseugenioamorimNo ratings yet

- Check e Bae PDFDocument28 pagesCheck e Bae PDFjogoram219No ratings yet

- April 2021 BDA Case Study - GroupDocument4 pagesApril 2021 BDA Case Study - GroupTinashe Chirume1No ratings yet