Professional Documents

Culture Documents

Sample Personal Tax Computation

Sample Personal Tax Computation

Uploaded by

Haris Hashim0 ratings0% found this document useful (0 votes)

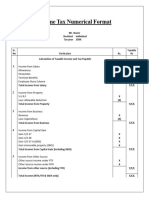

21 views1 pageThis document provides details on calculating personal tax for an individual. It lists various sources of income and tax reliefs that are deducted from statutory income to determine chargeable income. Standard tax rates are then applied to different portions of chargeable income to compute total income tax charged. Applicable rebates and monthly tax deductions are subtracted to determine the total tax to be paid or any overpayment.

Original Description:

Sample Personal Tax Computation

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides details on calculating personal tax for an individual. It lists various sources of income and tax reliefs that are deducted from statutory income to determine chargeable income. Standard tax rates are then applied to different portions of chargeable income to compute total income tax charged. Applicable rebates and monthly tax deductions are subtracted to determine the total tax to be paid or any overpayment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views1 pageSample Personal Tax Computation

Sample Personal Tax Computation

Uploaded by

Haris HashimThis document provides details on calculating personal tax for an individual. It lists various sources of income and tax reliefs that are deducted from statutory income to determine chargeable income. Standard tax rates are then applied to different portions of chargeable income to compute total income tax charged. Applicable rebates and monthly tax deductions are subtracted to determine the total tax to be paid or any overpayment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

PERSONAL TAX COMPUTATION

RM RM

EMPLOYMENT INCOME XX

BUSINESS INCOME XX

STATUTORY INCOME FROM EMPLOYMENT/BUSINESS XXX

Less : Approved Donations (if any) (Restricted 10%) (XX)

TOTAL INCOME XXX

Less : Tax Reliefs

Self 9,000

Wife 4,000

Medical treatment and expenses (parents) (Restricted to RM8,000) 8,000

Medical treatment and expenses (self,spouse and child) (Restricted to RM8,000) 8,000

Lifestyle expenses (self, spouse and child) (Restricted to RM2,500) :-

*Purchase of books, personal computer, sports equipment, internet subscription 2,500

*Additional purchase of personal computer, smartphone or tablet 2,500

Education fees (self) (Restricted to RM7,000) 7,000

Ordinary child relief :-

*Unmarried child and under the age of 18 years old 2,000

*Unmarried child of 18 years old and above (Receiving full time education) 2,000

*Unmarried child of 18 years old and above (Receive further education in diploma or

8,000

higher level)

Disable child 6,000

Education & Medical Insurance Premium (Restricted to RM3,000) 3,000

Life insurance and EPF (Restricted to RM3,000) 3,000

EPF Contribution (Restricted to RM4,000) 4,000

SOCSO Contribution (Restricted to RM250) 250

(XXX)

CHARGEABLE INCOME XXX

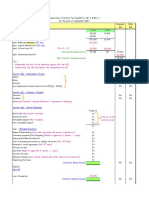

PERSONAL TAX COMPUTATION (continued)

RM RM

From the amount of Chargeable Income

TAX PAYABLE (Based on the Tax Rate stated by Inland Revenue Board)

On First RM XXX XX

Next RM XXX @ % XX

TOTAL INCOME TAX CHARGED XXX

Less : Tax Rebate

Self rebate (Entitled if the Chargeable Income Less than RM35,000) (XX)

Zakat / Zakat Fitrah (If any) (XX)

TOTAL TAX PAYABLE XXX

Less : Monthly Tax Deduction (PCB) (If any) (XX)

TOTAL TAX TO BE PAID / (TAX OVERPAID) XXX

You might also like

- Income StatementDocument4 pagesIncome StatementBurhan AzharNo ratings yet

- Philippine Accountancy Review For Excellence: A. Format of Computation (Bir Form 1801)Document17 pagesPhilippine Accountancy Review For Excellence: A. Format of Computation (Bir Form 1801)beayaoNo ratings yet

- DocxDocument21 pagesDocxDhiananda zhuNo ratings yet

- How Does It Work?: Train Law Vs Nirc What Is NIRC?Document7 pagesHow Does It Work?: Train Law Vs Nirc What Is NIRC?Bryant R. CanasaNo ratings yet

- Mastering BIR Year-End Compliance Requirements.: AIT Webinar, January 22, 2022 By: Dante R. TorresDocument66 pagesMastering BIR Year-End Compliance Requirements.: AIT Webinar, January 22, 2022 By: Dante R. TorresClarine Kyla Bautista100% (1)

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Income and Business TaxationDocument1 pageIncome and Business TaxationTomo Euryl San JuanNo ratings yet

- Introduction To Regular Income TaxDocument44 pagesIntroduction To Regular Income TaxGabriel Trinidad Soniel0% (1)

- Proforma Financial StatementDocument2 pagesProforma Financial StatementKeyo BintajolNo ratings yet

- ACCA F6 Notes FA 2016Document69 pagesACCA F6 Notes FA 2016ATNo ratings yet

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxKakay EspirituNo ratings yet

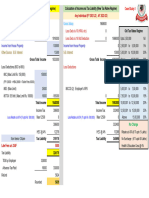

- Summary Sheet NumericalDocument2 pagesSummary Sheet NumericalSamina HyderNo ratings yet

- Format Relief Rebate Ya 2021 - LatestDocument4 pagesFormat Relief Rebate Ya 2021 - LatestJasne OczyNo ratings yet

- Format For TaxationDocument4 pagesFormat For TaxationSITI NURFARHANA AB RAZAKNo ratings yet

- Tax Credits - TY 2022 (Taweez)Document3 pagesTax Credits - TY 2022 (Taweez)Taaha JanNo ratings yet

- INCOTAX - 06 - Individuals, Estates, TrustsDocument6 pagesINCOTAX - 06 - Individuals, Estates, TrustsJainder de GuzmanNo ratings yet

- Format of Computation For Income Tax PayableDocument2 pagesFormat of Computation For Income Tax PayableMiera FrnhNo ratings yet

- Sol 1Document1 pageSol 1alex breymannNo ratings yet

- CGT Notes - AnnotatedDocument54 pagesCGT Notes - AnnotatedDr SafaNo ratings yet

- Computation Format For Individual Tax Liability For The Year of Assessment 20XXDocument4 pagesComputation Format For Individual Tax Liability For The Year of Assessment 20XXMiera FrnhNo ratings yet

- Train Law WordDocument12 pagesTrain Law WordIsaac CursoNo ratings yet

- How To Calculate Total IncomeDocument16 pagesHow To Calculate Total IncomeAshish ChatrathNo ratings yet

- INCOME TAX AssignmentDocument5 pagesINCOME TAX AssignmentShakib studentNo ratings yet

- Tax Calculator Version 2Document4 pagesTax Calculator Version 2SoikotNo ratings yet

- Format of Relief and Rebate (Ya 2016) : Sec 4 (A) - Business IncomeDocument4 pagesFormat of Relief and Rebate (Ya 2016) : Sec 4 (A) - Business IncomeWei Sheng ChuaNo ratings yet

- Employees Tax SummaryDocument1 pageEmployees Tax SummaryGiven RefilweNo ratings yet

- Computation of TaxDocument3 pagesComputation of TaxsautglaizamaeabcomNo ratings yet

- Final-Requirement (Actcy 12S2)Document26 pagesFinal-Requirement (Actcy 12S2)Ralph Carlo SumaculubNo ratings yet

- Employment IncomeDocument26 pagesEmployment IncomeEhsan KhanNo ratings yet

- CTC 4000000 Particulars: 1 Performance Linked Incentive 2 Basic 3 House Rent AllowanceDocument12 pagesCTC 4000000 Particulars: 1 Performance Linked Incentive 2 Basic 3 House Rent AllowanceNamita BhattNo ratings yet

- Divisible Income/ (Loss) : Computation of Tax Payable For Each PartnerDocument1 pageDivisible Income/ (Loss) : Computation of Tax Payable For Each PartnerNURAISHA AIDA ATANNo ratings yet

- Case Study 2Document2 pagesCase Study 2Anil NagarajNo ratings yet

- For Holders: Automated Income Tax CalculationDocument16 pagesFor Holders: Automated Income Tax Calculationmaruf048No ratings yet

- Examples Salary 2019Document18 pagesExamples Salary 2019Asma ZeeshanNo ratings yet

- Morales Taxation Topic 6 Tax On Corporations Partnerships and Joint VenturesDocument28 pagesMorales Taxation Topic 6 Tax On Corporations Partnerships and Joint VenturesMary Joice Delos santosNo ratings yet

- 06 Donors TaxDocument4 pages06 Donors Taxpatburner1108No ratings yet

- Income Tax ComputationDocument26 pagesIncome Tax ComputationEhsan KhanNo ratings yet

- Transfer Taxes (Estate and Donor'S Taxation) Estate Tax ModelDocument4 pagesTransfer Taxes (Estate and Donor'S Taxation) Estate Tax ModelJohn Karlo CamineroNo ratings yet

- Format of Final Accounts (Vertical Format)Document3 pagesFormat of Final Accounts (Vertical Format)ummieulfahNo ratings yet

- V L GovindarajanDocument18 pagesV L GovindarajanWS KNIGHTNo ratings yet

- TaxationDocument8 pagesTaxationPeligrino MacNo ratings yet

- ACC106-FORMAT OF FINAL ACCOUNTS-amendedDocument2 pagesACC106-FORMAT OF FINAL ACCOUNTS-amendedMuhammad Irfan100% (1)

- SYLLABUS and TAX RATESDocument2 pagesSYLLABUS and TAX RATESVENKATESWARLUMCOMNo ratings yet

- Format Sopl SofpDocument2 pagesFormat Sopl SofpkhaiNo ratings yet

- Donor's TaxDocument15 pagesDonor's Taxyes it's kaiNo ratings yet

- Tax3702 Exam Quick NotesDocument8 pagesTax3702 Exam Quick NotesnhlakaniphoNo ratings yet

- Salary Tax FormatDocument10 pagesSalary Tax Formathizbullah chandioNo ratings yet

- Computation of Total Income & Tax LiabilityDocument5 pagesComputation of Total Income & Tax LiabilityMehtab MalikNo ratings yet

- CAF 2 Spring 2021Document8 pagesCAF 2 Spring 2021Muhammad Ahsan RiazNo ratings yet

- Income TaxesDocument6 pagesIncome TaxesKezNo ratings yet

- Income TaxDocument21 pagesIncome TaxKhalid Aziz50% (2)

- ABC Co. Started Its OperationsDocument1 pageABC Co. Started Its OperationsQueen ValleNo ratings yet

- HW 16.1.24 Personal TaxationDocument8 pagesHW 16.1.24 Personal TaxationhusninanorzainNo ratings yet

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income TaxRavikarthik GurumurthyNo ratings yet

- Computation of Tax Liability.Document1 pageComputation of Tax Liability.anurags pageNo ratings yet

- Tabc - Train - Noel N. Cobangbang, CpaDocument117 pagesTabc - Train - Noel N. Cobangbang, CpaIsaac CursoNo ratings yet

- How To Save Tax For Salary Above 20 LakhsDocument12 pagesHow To Save Tax For Salary Above 20 LakhsvijaytechskillupgradeNo ratings yet

- Answers: Tuition (Course) ExaminationDocument16 pagesAnswers: Tuition (Course) ExaminationHussein SeetalNo ratings yet

- On Income From Salary - 20210202100403Document14 pagesOn Income From Salary - 20210202100403AJ WalkerNo ratings yet