Professional Documents

Culture Documents

Employees Tax Summary

Employees Tax Summary

Uploaded by

Given Refilwe0 ratings0% found this document useful (0 votes)

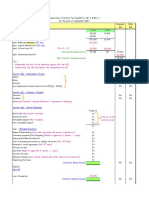

4 views1 pageEmployees tax is calculated as follows:

1) Remuneration includes income but excludes certain allowances, government pensions, and fully reimbursed expenses.

2) Allowable deductions include employee pension and RAF contributions (limited), income protection insurance (option of employee or employer), and medical scheme contributions (option of employer for those over 65).

3) Tax is calculated on the balance of remuneration (BOR) and annual equivalent amount.

4) Rebates are subtracted to determine the employee tax liability which is divided by 12 to calculate the monthly tax amount.

5) Annual payments are added to the annual equivalent amount and taxed, with the difference being the tax on the bonus

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEmployees tax is calculated as follows:

1) Remuneration includes income but excludes certain allowances, government pensions, and fully reimbursed expenses.

2) Allowable deductions include employee pension and RAF contributions (limited), income protection insurance (option of employee or employer), and medical scheme contributions (option of employer for those over 65).

3) Tax is calculated on the balance of remuneration (BOR) and annual equivalent amount.

4) Rebates are subtracted to determine the employee tax liability which is divided by 12 to calculate the monthly tax amount.

5) Annual payments are added to the annual equivalent amount and taxed, with the difference being the tax on the bonus

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageEmployees Tax Summary

Employees Tax Summary

Uploaded by

Given RefilweEmployees tax is calculated as follows:

1) Remuneration includes income but excludes certain allowances, government pensions, and fully reimbursed expenses.

2) Allowable deductions include employee pension and RAF contributions (limited), income protection insurance (option of employee or employer), and medical scheme contributions (option of employer for those over 65).

3) Tax is calculated on the balance of remuneration (BOR) and annual equivalent amount.

4) Rebates are subtracted to determine the employee tax liability which is divided by 12 to calculate the monthly tax amount.

5) Annual payments are added to the annual equivalent amount and taxed, with the difference being the tax on the bonus

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

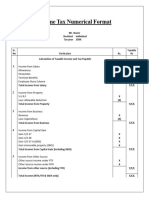

EMPLOYEES TAX

WITHOUT ANNUAL AMOUNTS R

REMUNERATION Must be income NOT exempt income xxx

Excluded:

50% of public officer allowances

Independent contractors

80% of TA and R of use of MV Gov. pensions / grants

Fully reimbursed

(20% if ≥ 80% for BUSINESS) Annuity ito divorce order

N/A: TA R/km ≤ fixed rate table for ≤ 8000km (R3.16p/km)

LESS: a. EE PF contribution (LIMITED to allowable) (xxx)

Par 2(4)

b. EE RAF Contribution (LIMITED to allowable)

ALLOWABLE

DEDUCTIONS c. EE income protection insurance policy (option E’R)

d. ER contribute income protection insurance policy

e. EE (≥ 65) medical scheme (@ option of ER)

f. ER s18A donation on EE behalf (LIMITED: 5% of a-e)

= BoR Xxx

ANNUAL EQUIVALENT (X 12) Xxxx

TAX THEREON (According to tax table) Xxx

LESS: (xxx)

Primary Rebate

LESS: Par 9(6) (xxx)

s6A medical

rebate

EE TAX LIABILITY A

*** PER MONTH (A ÷ 12) xxxx

WITH ANNUAL AMOUNTS R

ANNUAL EQUIVALENT (X 12) Xxxx

+ ANNUAL Eg: bonus

PAYMENT

TAX THEREON (According to tax table) Xxx

LESS: (xxx)

Primary Rebate

LESS: Par 9(6) (xxx)

s6A medical

rebate

EE TAX LIABILITY (B)

TAX ON BONUS = (B) – (A) (C)

TAX PAYABLE IN MONTH WITH ANNUAL PAYMENT = *** + (C)

You might also like

- Mastering BIR Year-End Compliance Requirements.: AIT Webinar, January 22, 2022 By: Dante R. TorresDocument66 pagesMastering BIR Year-End Compliance Requirements.: AIT Webinar, January 22, 2022 By: Dante R. TorresClarine Kyla Bautista100% (1)

- Income From EmploymentFormatDocument3 pagesIncome From EmploymentFormatsatyaNo ratings yet

- Monetary Policy and Central Banking Midterm Quiz 2Document7 pagesMonetary Policy and Central Banking Midterm Quiz 2Santi SeguinNo ratings yet

- Investment Banks, Hedge Funds and Private Equity: The New ParadigmDocument16 pagesInvestment Banks, Hedge Funds and Private Equity: The New ParadigmPrashantKNo ratings yet

- FranchiseeDocument43 pagesFranchiseeMAHENDERNo ratings yet

- TAX4862 TL107 - 2019 Slides 1 Per PGDocument139 pagesTAX4862 TL107 - 2019 Slides 1 Per PGMagda100% (1)

- Transfer Pricing Rules DecodingDocument74 pagesTransfer Pricing Rules DecodingWaqas AtharNo ratings yet

- Audit of Cash and Cash Equivalents 1Document9 pagesAudit of Cash and Cash Equivalents 1nena cabañesNo ratings yet

- Ho 09 - Computation of Individual Taxpayers Income Tax PDFDocument14 pagesHo 09 - Computation of Individual Taxpayers Income Tax PDFArah Opalec100% (1)

- Structures of The Philippine Financial System.Document2 pagesStructures of The Philippine Financial System.acetidus2478% (9)

- Castro v. Tan 605 Scra 231Document1 pageCastro v. Tan 605 Scra 231Sarah Jane UsopNo ratings yet

- Divisible Income/ (Loss) : Computation of Tax Payable For Each PartnerDocument1 pageDivisible Income/ (Loss) : Computation of Tax Payable For Each PartnerNURAISHA AIDA ATANNo ratings yet

- Tax3702 Exam Quick NotesDocument8 pagesTax3702 Exam Quick NotesnhlakaniphoNo ratings yet

- Summary Sheet NumericalDocument2 pagesSummary Sheet NumericalSamina HyderNo ratings yet

- Format ComputationDocument2 pagesFormat Computationathirah jamaludinNo ratings yet

- Chapter 9 Ptx1033/Personal TaxDocument10 pagesChapter 9 Ptx1033/Personal TaxNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Income From Employment FormatDocument3 pagesIncome From Employment FormatsatyaNo ratings yet

- Format of Computation For Income Tax PayableDocument2 pagesFormat of Computation For Income Tax PayableMiera FrnhNo ratings yet

- Tax Credits - TY 2022 (Taweez)Document3 pagesTax Credits - TY 2022 (Taweez)Taaha JanNo ratings yet

- 2 Income From SalaryDocument3 pages2 Income From Salaryatharvaanila5587No ratings yet

- Module 4 - Specific Inclusions Lecture Notes-3Document31 pagesModule 4 - Specific Inclusions Lecture Notes-3Sphephelo MbhamalyNo ratings yet

- Format For Computation of Income Under Income Tax ActDocument3 pagesFormat For Computation of Income Under Income Tax ActAakash67% (3)

- Ya2022 - Format Tax Computation Trust BodyDocument4 pagesYa2022 - Format Tax Computation Trust BodyDaniel HaziqNo ratings yet

- Computation Format - Company's Income TaxDocument2 pagesComputation Format - Company's Income TaxNik Fatehah NajwaNo ratings yet

- Prepared By: (Zeeshan Amjad Baig)Document20 pagesPrepared By: (Zeeshan Amjad Baig)zeeshan655No ratings yet

- Format YA 2022Document2 pagesFormat YA 2022sharifah nurshahira sakinaNo ratings yet

- Personal Income Tax - FormatDocument1 pagePersonal Income Tax - Format2021460632No ratings yet

- Taxation of Individuals: Step 1 Step 2: Step 3Document39 pagesTaxation of Individuals: Step 1 Step 2: Step 3Pratyanshi MehtaNo ratings yet

- Format Relief Rebate Ya 2021 - LatestDocument4 pagesFormat Relief Rebate Ya 2021 - LatestJasne OczyNo ratings yet

- Sample Personal Tax ComputationDocument1 pageSample Personal Tax ComputationHaris HashimNo ratings yet

- Income Tax RevisionDocument249 pagesIncome Tax Revisionsharmayashi1111No ratings yet

- RupalDocument6 pagesRupalsivaganga MNo ratings yet

- RMC 35-2011 DigestDocument1 pageRMC 35-2011 DigestA CybaNo ratings yet

- 59678RMC 35-2011 PDFDocument1 page59678RMC 35-2011 PDFCliff DaquioagNo ratings yet

- 59678RMC 35-2011Document1 page59678RMC 35-2011Hannah BonillaNo ratings yet

- Computation Format For Individual Tax Liability For The Year of Assessment 20XXDocument4 pagesComputation Format For Individual Tax Liability For The Year of Assessment 20XXannastasia luyah100% (1)

- Less: Trading Losses Brought Forward Under CTA 2010, S. 45Document2 pagesLess: Trading Losses Brought Forward Under CTA 2010, S. 45Dime PierrowNo ratings yet

- Partnership AccountsDocument1 pagePartnership Accountsmeelas123No ratings yet

- Computation of Assessable Income From Employment of .. For The Income Year 2077/78 Particulars AmountsDocument16 pagesComputation of Assessable Income From Employment of .. For The Income Year 2077/78 Particulars AmountsSophiya PrabinNo ratings yet

- Ap 34PW2-2 PDFDocument1 pageAp 34PW2-2 PDFRyan PelitoNo ratings yet

- Published Accounts (Format) Sem Oct 2022 For Students PDFDocument8 pagesPublished Accounts (Format) Sem Oct 2022 For Students PDFNur SyafiqahNo ratings yet

- Partnership - Income StatementDocument2 pagesPartnership - Income StatementChan Chin ChunNo ratings yet

- REVISIONDocument4 pagesREVISIONTâm TốngNo ratings yet

- Partner FORMATDocument2 pagesPartner FORMATRownak SahaNo ratings yet

- US Internal Revenue Service: f4970 - 1996Document2 pagesUS Internal Revenue Service: f4970 - 1996IRSNo ratings yet

- T8 Tutorial SolutionsDocument4 pagesT8 Tutorial SolutionsAnathi AnathiNo ratings yet

- Computation Format For Individual Tax Liability For The Year of Assessment 20XXDocument4 pagesComputation Format For Individual Tax Liability For The Year of Assessment 20XXMiera FrnhNo ratings yet

- Format PartnershipDocument1 pageFormat PartnershipAyu IbrahimNo ratings yet

- BEL200 Gross Income Slides 2023Document39 pagesBEL200 Gross Income Slides 2023bonolotau58No ratings yet

- Computation of Total Income & Tax LiabilityDocument5 pagesComputation of Total Income & Tax LiabilityMehtab MalikNo ratings yet

- FFS Working NotesDocument3 pagesFFS Working NotesVignesh NarayananNo ratings yet

- FCFF Calculation 16.05.2022Document5 pagesFCFF Calculation 16.05.2022রাফিউল রিয়াজ অমিNo ratings yet

- Computation of TaxesDocument34 pagesComputation of TaxesIrish D DagmilNo ratings yet

- TAX228 - Individuals 2023Document42 pagesTAX228 - Individuals 2023edwardsyaameenNo ratings yet

- Investment Decisions NotesDocument2 pagesInvestment Decisions NotesSaumya AllapartiNo ratings yet

- Clarification On The Amendment To Section 16 of Companies Income Tax Act in Relation To Taxation of Insurance CompaniesDocument7 pagesClarification On The Amendment To Section 16 of Companies Income Tax Act in Relation To Taxation of Insurance CompaniesOluwagbenga OgunsakinNo ratings yet

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxKakay EspirituNo ratings yet

- 5.consolidated SOCI - AAFRDocument11 pages5.consolidated SOCI - AAFRAli OptimisticNo ratings yet

- Di Bawah Ini Disajikan Contoh Penyajian Laporan Laba Rugi Dan Penghasilan Lain Secara Lengkap Yang Sesuai Dengan PSAK 1 Sebagai BerikutDocument2 pagesDi Bawah Ini Disajikan Contoh Penyajian Laporan Laba Rugi Dan Penghasilan Lain Secara Lengkap Yang Sesuai Dengan PSAK 1 Sebagai Berikutnoviliaa7No ratings yet

- Withholding Tax On Monthly Compensation IncomeDocument11 pagesWithholding Tax On Monthly Compensation IncomeRyDNo ratings yet

- Salary HP Liability in Special CasesDocument30 pagesSalary HP Liability in Special CasesParth ThakkarNo ratings yet

- Salary HP Liability in Special CasesDocument33 pagesSalary HP Liability in Special CasesMr FunambulistNo ratings yet

- Salary HP Liability in Special CasesDocument33 pagesSalary HP Liability in Special CasesPriyanshu tripathiNo ratings yet

- Partnership Name Computation of Partners' - For YA2020Document1 pagePartnership Name Computation of Partners' - For YA2020Anis RoslanNo ratings yet

- Calculation Sheet 2022 - 23 OLDDocument2 pagesCalculation Sheet 2022 - 23 OLDmandalsomithmandal1986No ratings yet

- Cybersecurity Part BDocument4 pagesCybersecurity Part BGiven RefilweNo ratings yet

- ISA610 (Amended) - Considering Internal AuditingDocument5 pagesISA610 (Amended) - Considering Internal AuditingGiven RefilweNo ratings yet

- Cyber SecurityDocument6 pagesCyber SecurityGiven RefilweNo ratings yet

- Trial Balance - Student VersionDocument4 pagesTrial Balance - Student VersionGiven RefilweNo ratings yet

- Module 5 - Ias 2 Inventory (CN)Document14 pagesModule 5 - Ias 2 Inventory (CN)Given RefilweNo ratings yet

- IAS 8 Tutorial Question (Q)Document2 pagesIAS 8 Tutorial Question (Q)Given RefilweNo ratings yet

- Module One Pre-Engagement Activities - Course NotesDocument5 pagesModule One Pre-Engagement Activities - Course NotesGiven RefilweNo ratings yet

- Module 6 - IAS 2 Inventory SlidesDocument58 pagesModule 6 - IAS 2 Inventory SlidesGiven RefilweNo ratings yet

- Ctaa040 - Ctaf080 - Test 4 Solution - 2023Document7 pagesCtaa040 - Ctaf080 - Test 4 Solution - 2023Given RefilweNo ratings yet

- Module 1 Audit Process and Pre EngagementactivitiesDocument8 pagesModule 1 Audit Process and Pre EngagementactivitiesGiven RefilweNo ratings yet

- MODULE 5 - IAS 2 Inventory (Tutorial Question - SS)Document5 pagesMODULE 5 - IAS 2 Inventory (Tutorial Question - SS)Given RefilweNo ratings yet

- CTAA 031 Ch. 32 (SILKE) Ch. 30 (NOTES)Document29 pagesCTAA 031 Ch. 32 (SILKE) Ch. 30 (NOTES)Given RefilweNo ratings yet

- CTAA 031 Ch. 32 (SILKE) Ch. 30 (NOTES)Document40 pagesCTAA 031 Ch. 32 (SILKE) Ch. 30 (NOTES)Given RefilweNo ratings yet

- 8 - Ratio Analysis AnswerDocument49 pages8 - Ratio Analysis AnswerDj babuNo ratings yet

- List of Consumer Reporting CompaniesDocument33 pagesList of Consumer Reporting CompaniesAnaoj28No ratings yet

- Neft FormatDocument2 pagesNeft FormatVinay Kumar100% (1)

- Pre-Lecture Quiz 6 (For Session 7 - Chapter 10 and 11) - Corporate Finance-T323WSB-7Document6 pagesPre-Lecture Quiz 6 (For Session 7 - Chapter 10 and 11) - Corporate Finance-T323WSB-722003067No ratings yet

- Cheque Introduction: A Cheque Is A Document of Very Great Importance in TheDocument13 pagesCheque Introduction: A Cheque Is A Document of Very Great Importance in The777priyankaNo ratings yet

- Debt Ceiling - How It Affects The MarketDocument5 pagesDebt Ceiling - How It Affects The Marketagniv.royNo ratings yet

- Final Project Report (Group 1)Document19 pagesFinal Project Report (Group 1)FaizanNo ratings yet

- Accounting Ratios - Class NotesDocument8 pagesAccounting Ratios - Class NotesAbdullahSaqibNo ratings yet

- BUS 5110 Managerial Accounting-Portfolio Activity Unit 6Document5 pagesBUS 5110 Managerial Accounting-Portfolio Activity Unit 6LaVida LocaNo ratings yet

- Journal, Ledger, Trial BalanceDocument34 pagesJournal, Ledger, Trial Balancepankaj tiwariNo ratings yet

- Usahawan Business PlanDocument4 pagesUsahawan Business PlanAbdul Azim Bin Abu Bakar E22A0281No ratings yet

- Chapter 10 Share Capital Transactions Subsequent To Original Issuance Exercises 15 ItemsDocument7 pagesChapter 10 Share Capital Transactions Subsequent To Original Issuance Exercises 15 ItemsdmangiginNo ratings yet

- Maharashtra State Electricity Distribution Co. LTD.: For Any Queries On This Bill Please Contact MSEDCL CallDocument1 pageMaharashtra State Electricity Distribution Co. LTD.: For Any Queries On This Bill Please Contact MSEDCL CallShaikh AbbasNo ratings yet

- Dhamultan ChallanDocument1 pageDhamultan ChallanZee ShahzadNo ratings yet

- Syllabus Case Studies in Corporate FinanceDocument6 pagesSyllabus Case Studies in Corporate FinanceFahima_lmNo ratings yet

- Case Harvard - Marriott Corporation Restructuring - SpreadsheetDocument25 pagesCase Harvard - Marriott Corporation Restructuring - SpreadsheetCarla ArecheNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionAlok .kNo ratings yet

- BillDocument5 pagesBill7cdqt5g66sNo ratings yet

- Weekly Market Compass 21 Sep PDFDocument3 pagesWeekly Market Compass 21 Sep PDFYasahNo ratings yet

- Account Activity Generated Through HBL MobileDocument2 pagesAccount Activity Generated Through HBL MobileMuhammad NaveedNo ratings yet

- Kertas Kerja - UTSDocument10 pagesKertas Kerja - UTSAlviana RenoNo ratings yet

- Financial LiteracyDocument5 pagesFinancial LiteracyEdwin Javier San BuenaventuraNo ratings yet

- Money Market vs. Capital Market: What's The Difference? Money Market vs. Capital Market: An OverviewDocument16 pagesMoney Market vs. Capital Market: What's The Difference? Money Market vs. Capital Market: An OverviewyanaNo ratings yet