Professional Documents

Culture Documents

Computation of Taxes

Uploaded by

Irish D DagmilCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Computation of Taxes

Uploaded by

Irish D DagmilCopyright:

Available Formats

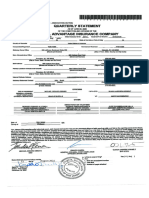

QUARTERLY

COMPUTATION OF TAX

Individuals Self-employed and professional

Estates and trust

Declaration this quarter:

Gross sales/revenue this quarter xxxxx

Less: Total deductions this quarter (itemized or optional) xxxxx

Taxable income this quarter P xxxxx

Add: Declaration previous quarters xxxxx

Gross sales/revenue P xxxxx

Less: Total deductions (for itemized deductions only) xxxxx

Total taxable income to date P xxxxx

Multiply by 20% to 35% [2018 to 2022]; 15% to 35% [Jan 1, 2023 onwards]: %

Tax due P xxxxx

Less: Tax credits/payments (current and previous quarter) xxxxx

Tax payable this quarter P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 134

QUARTERLY

COMPUTATION OF TAX

Individuals: Graduated IT Rate (Starting January 1, 2018)

Declaration this quarter:

Sales/revenues/receipts/fees xxxxx

Less: Cost of sales/services (if availing itemized deductions) xxxxx

Taxable income this quarter P xxxxx

Gross income/(Loss from operation P xxxxx

Less: Allowable itemized deductions OR Optional standard deductions xxxxx

Net income/(Loss) this quarter xxxxx

Add: Taxable Income/(Loss from previous quarter) xxxxx

Non-operating income xxxxx

Amount received/share in income by partner xxxxx

Total Taxable Income to date P xxxxx

Multiply by 5% to 32%; 20% to 35% [2018 to 2022]; 15% to 35% [Jan 1, 2023 onwards]: %

Tax due P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 135

QUARTERLY

COMPUTATION OF TAX

Individuals: For 8% IT Rate (Starting January 1, 2018)

Declaration this quarter:

Sales/revenues/receipts/fees xxxxx

Add: Non-operating income xxxxx

Total Income for this quarter P xxxxx

Add: Total taxable income/(loss from previous quarter) xxxxx

Cumulative taxable income/(loss as of this this quarter xxxxx

Less: Allowable reduction of P250,000 xxxxx

Total Income/(Loss) to date P xxxxx

Multiplied by tax rate: 8% [Jan 1, 2018 onwards] %

Tax due P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 136

QUARTERLY

COMPUTATION OF TAX

Individuals: Tax Credits/Payments (Starting January 1, 2018)

Total Taxable Income to date

Declaration this quarter:

Prior year’s excess credits xxxxx

Tax payments for the previous quarter xxxxx

Creditable tax withheld for the previous quarter xxxxx

Creditable tax withheld per BIR Form No. 2307 for this quarter xxxxx

Tax Paid in Return previously Filed (if amended return) xxxxx

Foreign tax credits (if applicable) xxxxx

Other tax credits (if applicable) xxxxx

Total Tax Credits/Payments P xxxxx

Tax Payable/(Overpayment): Tax due less total tax credits P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 137

QUARTERLY

COMPUTATION OF TAX

Individuals: Penalties (Starting January 1, 2018)

Declaration this quarter:

Surcharge xxxxx

Interest xxxxx

Compromise xxxxx

Total Penalties P xxxxx

Total Amount Payable/(Overpayment):

Tax Payable/(Overpayment) plus

P xxxxx

Total Penalties

GCRO Module 120 eVer.2.0 JAN 2023 138

QUARTERLY

COMPUTATION OF TAX

The gross income and deductions for the fourth quarter

shall be declared in the Annual Income Tax Return to

be filed on or before April 15 of the following year.

GCRO Module 120 eVer.2.0 JAN 2023 139

Graduated IT with OSD

Gross Income ₱ xxxxx

Less: Allowable Deduction (Itemized or Optional) xxxxx

Net Taxable Income ₱ xxxxx

Multiply by Tax Rate (0% to 35%) %

Income Tax Due: ₱ xxxxx

Less: Tax Withheld (per BIR Form 2307) _______

Income Tax Payable: ₱ xxxxx

Note: Use BIR Form 1701A Annual Income Tax Return for Individuals Earning

Income PURELY from Business/Profession (Those under the graduated income tax

rates with Optional Standard Deduction (OSD) as mode of deductions OR those

who opted to avail of the 8% flat income tax rate) January 2018 version

GCRO Module 120 eVer.2.0 JAN 2023 140

8% option

Gross Sales ₱ xxxxx

Gross Receipts xxxxx

Total Sales/Receipts ₱ xxxxx

Less: Amount allowed as deduction under Sec.

24(A)(2)(b) 250,000.00

Taxable Income: ₱ xxxxx

Tax Due: 8% of Taxable Income ₱ xxxxx

Note: Use BIR Form 1701A Annual Income Tax Return for Individuals Earning Income PURELY

from Business/Profession (Those under the graduated income tax rates with Optional

Standard Deduction (OSD) as mode of deductions OR those who opted to avail of the 8%

flat income tax rate) January 2018 version

GCRO Module 120 eVer.2.0 JAN 2023 141

QUARTERLY

COMPUTATION OF TAX

Non-Individuals: Corporations – Quarterly income tax is computed as follows:

Declaration this quarter:

Gross Sales/revenues P xxxxx

Less: Cost of sales/service xxxxx

Gross Income P xxxxx

Add: Other non-operating and taxable income xxxxx

Total Gross Income P xxxxx

Less: Deductions xxxxx

Total taxable income this quarter P xxxxx

Add: Taxable income from previous quarter xxxxx

Total taxable income to date P xxxxx

Multiplied by the tax rate (except MCIT Rate) %

Income tax other than MCIT P xxxxx

Less: Share of other agencies (RA 7916/8748) xxxxx

Minimum Corporate Income Tax P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 142

QUARTERLY

COMPUTATION OF TAX

Non-Individuals:

Tax Due:

Tax on transactions under regular rate

(normal IT or MCIT whichever is higher) P xxxxx

Less: Unexpired excess of prior year’s MCIT

over normal IT (deductible if the quarterly xxxxx

tax due is the normal rate)

Balance P xxxxx

Add: Tax due to the BIR on transactions

under Special Rate

xxxxx

Aggregate Income Tax Due P xxxxx

Less: Tax Credits/Payments xxxxx

Tax still due ₱ xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 143

QUARTERLY

COMPUTATION OF TAX

Unless otherwise provided in the NIRC, the

tax is twenty five(25%) on taxable income

effective January 1, 2009

or

one percent (1%) MCIT

whichever is higher.

GCRO Module 120 eVer.2.0 JAN 2023 144

QUARTERLY

COMPUTATION OF TAX

Partnerships

General Professional Partnerships

Declaration this quarter:

Gross receipts this quarter P xxxxx

Less: Total deductions this qtr. xxxxx

(direct cost only or optional deduction of 40%)

Taxable income this quarter P xxxxx

Add: Declaration previous qtrs.

Gross receipts P xxxxx

Less: Total deductions xxxxx

(direct cost only or optional deduction of 40%)

Total taxable income previous qtr. P xxxxx

Total taxable income to date xxxxx

Income tax due EXEMPT

GCRO Module 120 eVer.2.0 JAN 2023 145

QUARTERLY

COMPUTATION OF TAX

Individual Partner to the above general professional partnership

Net income of the general professional partnership date P xxxxx

Multiplied by profit and loss/sharing ratios %

Distributive share of the partner

net income or net taxable income P xxxxx

Less: Personal and additional exemption xxxxx

(P50,000 + P25,000/dependent x maximum of 4

[until Dec. 31, 2017])

Taxable Income multiplied by tax rate %

[5% to 32% under Sec. 24(A)(1)(c) then 20% to 35% from

Jan 1, 2018 to Dec. 31, 2022]

Tax due P xxxxx

Less: Tax credits/payments (current and previous qtr.) xxxxx

Tax due this qtr. P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 146

QUARTERLY

COMPUTATION OF TAX

General Partnership

Declaration this quarter:

Gross sales/revenues P xxxxx

Less: Total deductions xxxxx

Taxable income this quarter P xxxxx

Add: Declaration of previous quarter:

Gross sales/revenues P xxxxx

Less: Total deductions xxxxx

Total taxable income previous quarter xxxxx

Total taxable income to date P xxxxx

Multiplied by the tax rate 25%

Income tax due P xxxxx

Less: Tax payments/credits xxxxx

Income tax payable/refundable P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 147

Computation of

ANNUAL INCOME TAX

Individuals

Compensation earners

Resident citizens

Total gross compensation income from sources P xxxxx

within and/or outside the Phil. (all sources)

Less: Personal and additional exemptions premiums xxxx

on health/hospitalization insurance

(if aggregate income of husband and wife does not exceed

P250,000 [until Dec. 31, 2017])

Taxable compensation income P xxxxx

Multiplied by tax rates: 5% to 32% under Sec. 24(A)(1)(c)

then 20% to 35% from Jan 1, 2018 to Dec. 31, 2022] %

Tax due P xxxxx

Less: Tax withheld per BIR Form 2316 xxxxx

Tax payable (refundable) P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 148

Computation of

ANNUAL INCOME TAX

Individuals

Compensation earners

Resident citizens

Starting January 1, 2018:

Gross Sales/Receipts ₱ xxxxx

Less: Cost of Sales xxxxx

Gross Income ₱ xxxxx

Less: Operating Expenses xxxxx

Taxable Income ₱ xxxxx

Tax Due:

On excess (Pxxxxx - P250,000) x 20%

to 35% ₱ xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 149

Computation of

ANNUAL INCOME TAX

Individuals

Non-resident citizen

Total gross business income P xxxxx

from sources within the Phils. (all sources)

Less: Personal and additional exemptions

premiums on health hospitalizations

[until Dec. 31, 2017] xxxx

Taxable business income P xxxxx

Multiplied by tax rates: 5% to 32% %

[under Sec. 24(A)(1)(c)]

Tax due P xxxxx

Less: Tax withheld xxxxx

Tax payable (refundable) P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 150

Computation of

ANNUAL INCOME TAX

Individuals

Non-resident alien engaged in business

Total gross compensation income P xxxxx

from sources within the Phils. (all sources) xxxx

Less: Personal

(subject to reciprocity clause until Dec. 31, 2017)

Taxable compensation income P xxxxx

Multiplied by tax rates: 5% to 32% under

Sec. 24(A)(1)(c) then 20% to 35% from ______ %

Jan 1, 2018 to Dec. 31, 2022]

Tax due P xxxxx

Less: Tax withheld xxxxx

Tax payable (refundable) P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 151

Computation of

ANNUAL INCOME TAX

Individuals

Non-resident aliens not engaged in trade or business:

Gross income from sources within the Philippines P xxxxx

Multiplied by the tax rate 25%

Income tax due P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 152

Computation of

ANNUAL INCOME TAX

Individuals

Alien Employed by RO and RA Headquarters of Multinational Corporation

Gross compensation income from P xxxxx

within the Philippines

Multiplied by graduated tax rate ____%

(20% to 35%)*

Income tax due P xxxxx

Aliens employed by offshore banking units

Gross compensation Income P xxxxx

received from w/in the Phils.

Multiplied by graduated tax rate _______%

(20% to 35%)*

Income tax due P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 153

Computation of

ANNUAL INCOME TAX

Individuals

Aliens employed by petroleum service contractors and subcontractors

Gross compensation received

from within the Philippines P xxxxx

Multiplied by graduated tax rate

(20% to 35%) [previously 15% preferential rate] __%

Income tax due P xxxxx

Starting January 1, 2018:

Compensation Income ₱ xxxxx

Less: Non-taxable 13th Month Pay and other benefits (max) xxxxx

Taxable Compensation Income ₱ xxxxx

Tax Due: ₱ xxxxx

On excess: (₱xxxxx – tax due) x 32% xxxxx

Total tax due ₱ xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 154

Computation of

ANNUAL INCOME TAX

Individuals

Self-employed and professionals (until Dec. 31, 2017)

Annual computation of income tax:

Gross sales/revenue P xxxxx

Less: Total deductions xxxxx

(direct cost only or optional of 40%)

Net income P xxxxx

Less: Total exemptions (or excess thereof over

compensation income) xxxxx

Net taxable income P xxxxx

Multiplied by tax rate - 5% to 32% %

[under Sec. 24(A)(1)(c) ]

Tax due P xxxxx

Less: Tax credits/payments xxxxx

Tax Payable/refund P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 155

Computation of

ANNUAL INCOME TAX

Individuals

Self-employed and professionals availing of 8% Option

(starting January 1, 2018)

Annual computation of income tax:

Total Sales P xxxxx

Less: Cost of Sales xxxxx

Gross Income P xxxxx

Less: Operating Expenses xxxxx

Taxable Income P xxxxx

Income Tax Due:

Tax due under graduated rates P xxxxx

Less 8% income tax previously paid xxxxx

Annual Income Tax Payable P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 156

Computation of

ANNUAL INCOME TAX

Individuals

Estates and Trusts (until Dec. 31, 2017)

Personal exemption of an estate or trust is Twenty Thousand Pesos (20,000)

only, while the tax rate is the rate for individuals under Section

24(A)(1)(c) of the NIRC.

Computation of Income Tax is as follows:

Gross income P xxxxx

Less: Deductions (direct cost only or optional deduction of 40%) xxxxx

Net income P xxxxx

Less: Exemptions (P20,000.00 only) xxxxx

Taxable income xxxxx

Multiplied by the tax rate in Sec. 24(A)(1)(c) %

Income tax due xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 157

Computation of

ANNUAL INCOME TAX

Non-Individuals

Corporations

Domestic Corporations-the computation of the income tax due is as follows:

Regular Domestic Corporations:

Annual Computation of Income Tax P xxxxx

Gross income from sources within and outside the

Philippines (all sources)

Less : Deduction from gross income (all sources) xxxxx

Taxable net income P xxxxx

Multiplied by the tax rate 25 %

Income tax due P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 158

Computation of

ANNUAL INCOME TAX

Non-Individuals

Minimum Corporate Income Tax (MCIT)

Gross income P xxxxx

Multiplied by the tax rate 1%

MCIT due P xxxxx

Tax due or MCIT, whichever is higher

Less credit/payments Pxxxxxx

Tax payable/refundable P xxxxxx

A minimum corporate income tax of one percent (1%) of the gross income as of the

end of the taxable year, is hereby imposed on a corporation, beginning on the

fourth taxable year immediately following the year in which such corporation

commenced its business operations, when the minimum income tax is greater than

the regular/ normal income tax computed at the end of the taxable year.

GCRO Module 120 eVer.2.0 JAN 2023 159

Computation of

ANNUAL INCOME TAX

Any excess of the MCIT over the normal income tax as

computed at the end of taxable year shall be carried

forward and credited against the normal income tax

for the three (3) immediately succeeding taxable

years.

GCRO Module 120 eVer.2.0 JAN 2023 160

Computation of

ANNUAL INCOME TAX

Non-Individuals

Non-regular Corporations - Proprietary Educational Institution

Gross income from school operation xxxxx

Less: Deduction from gross income xxxxx

Taxable income P xxxxx

Multiplied by the tax rate 1%

Income tax due P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 161

Computation of

ANNUAL INCOME TAX

Non-Individuals

Foreign Corporations

Unless otherwise provided in the NIRC the rate of twenty five percent

(25%) applies on the total income received from sources within the

Philippines.

Resident Foreign Corporation

P xxxxx

Gross income from Philippines sources

Less: Deduction xxxxx

Taxable income P xxxxx

Multiplied by the tax rate 25%

Income tax due P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 162

Computation of

ANNUAL INCOME TAX

Non-Individuals

Minimum Corporate Income Tax (MCIT)

Gross Income P xxxxx

Multiplied by the tax rate 1%

MCIT Due P xxxxx

A MCIT of one percent (1%) of the gross income as of the end of

the taxable year, is hereby imposed on a corporation, beginning

on the fourth taxable year immediately following the year in

which such corporation commenced its business operations, when

the minimum income tax is greater than the regular/normal income

tax computed at the end of the taxable year.

GCRO Module 120 eVer.2.0 JAN 2023 163

Computation of

ANNUAL INCOME TAX

Any excess of the MCIT over the normal income tax

as computed at the end of taxable year shall be

carried forward and credited against the normal

income tax for the three (3) immediately

succeeding taxable years.

GCRO Module 120 eVer.2.0 JAN 2023 164

Computation of

ANNUAL INCOME TAX

International Air Carrier

Taxed at the rate of two and one-half percent (2 1/2%)

on their Gross Philippine Billings. Gross Philippine

Billings refers to the amount of gross revenue

derived from carriage of persons, excess baggage,

cargo and mail originating from the Philippines in a

continuous and uninterrupted flight, irrespective of

the place of sale or issue and the place of payment of

the ticket or passage document.

GCRO Module 120 eVer.2.0 JAN 2023 165

Computation of

ANNUAL INCOME TAX

International Shipping

‘Gross Philippine Billings’ means gross revenue

whether cargo or mail originating from the Philippines

up to final destination, regardless of the place of

sale or payments of the passage or freight documents.

Computation of Tax:

Gross Philippine Billings P xxxxx

Multiplied by the tax rate 2 ½ %

Tax due P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 166

Computation of

ANNUAL INCOME TAX

Non-Resident Foreign Corporation

Gross income from Philippine sources P xxxxx

Multiplied by the tax rate 25%

Income tax due P xxxxx

GCRO Module 120 eVer.2.0 JAN 2023 167

You might also like

- GCRO Module 120 - 07 Computation of TaxDocument34 pagesGCRO Module 120 - 07 Computation of TaxKezia100% (1)

- REGULAR INCOME TAXATION OVERVIEWDocument4 pagesREGULAR INCOME TAXATION OVERVIEWMary Jane Pabroa100% (1)

- Ho 09 - Computation of Individual Taxpayers Income Tax PDFDocument14 pagesHo 09 - Computation of Individual Taxpayers Income Tax PDFArah Opalec100% (1)

- Chapter 15 BDocument3 pagesChapter 15 BErinNo ratings yet

- Accounting For Income Taxes Pt. 2: Temporary DifferencesDocument23 pagesAccounting For Income Taxes Pt. 2: Temporary Differenceskrisha milloNo ratings yet

- Individual Tax Payer - Part 2Document18 pagesIndividual Tax Payer - Part 2Ems TeopeNo ratings yet

- First City Providential College: Corporation Part 2Document8 pagesFirst City Providential College: Corporation Part 2Arjhay CruzNo ratings yet

- Tax BT Introduction To VATDocument5 pagesTax BT Introduction To VATJoshua Phillip TorcedoNo ratings yet

- CorporationDocument23 pagesCorporationLiyana Chua50% (2)

- The Regular Income TaxDocument4 pagesThe Regular Income TaxJean Diane JoveloNo ratings yet

- Provisional Tax - SlidesDocument17 pagesProvisional Tax - SlidesZwivhuya MaimelaNo ratings yet

- Notes in Value-Added TAXDocument9 pagesNotes in Value-Added TAXESTRADA, Angelica T.No ratings yet

- Regular Income TaxDocument11 pagesRegular Income Taxwhat ever100% (4)

- TaxaoneDocument20 pagesTaxaonedianne ballonNo ratings yet

- Current and Deferred Tax AssignmentsDocument12 pagesCurrent and Deferred Tax AssignmentsAftab AliNo ratings yet

- Week 10 CorporationssDocument9 pagesWeek 10 CorporationssAdrian MontemayorNo ratings yet

- Guide to Philippine Income and Withholding TaxesDocument8 pagesGuide to Philippine Income and Withholding TaxesEunice SerneoNo ratings yet

- ERG TAX 7.0 CorporationDocument22 pagesERG TAX 7.0 CorporationRiyo Mae MagnoNo ratings yet

- CPTR 5 Optional Corporate Tax On Branch Profit Remittance 1Document5 pagesCPTR 5 Optional Corporate Tax On Branch Profit Remittance 1NaikNo ratings yet

- RMC 35-2011 DigestDocument1 pageRMC 35-2011 DigestA CybaNo ratings yet

- 59678RMC 35-2011Document1 page59678RMC 35-2011Hannah BonillaNo ratings yet

- 59678RMC 35-2011 PDFDocument1 page59678RMC 35-2011 PDFCliff DaquioagNo ratings yet

- 03 Vat Subject TransactionsDocument5 pages03 Vat Subject TransactionsJaneLayugCabacungan100% (1)

- REGULAR INCOME TAX RATES AND FILING DEADLINESDocument10 pagesREGULAR INCOME TAX RATES AND FILING DEADLINESlcNo ratings yet

- Allowable DeductionsDocument17 pagesAllowable DeductionsShanelle SilmaroNo ratings yet

- Reviewer (Tax) : National Internal Revenue Taxes Computation For Mixed Income Earner Who Availed 8%Document7 pagesReviewer (Tax) : National Internal Revenue Taxes Computation For Mixed Income Earner Who Availed 8%LeeshNo ratings yet

- Copy Individual Income TaxDocument10 pagesCopy Individual Income TaxMari Louis Noriell MejiaNo ratings yet

- INCOTAX - 06 - Individuals, Estates, TrustsDocument6 pagesINCOTAX - 06 - Individuals, Estates, TrustsJainder de GuzmanNo ratings yet

- Corporate Income Taxes StudentsDocument6 pagesCorporate Income Taxes StudentsClazther MendezNo ratings yet

- Philippine Tax System: Individual Income TaxationDocument27 pagesPhilippine Tax System: Individual Income TaxationeuniNo ratings yet

- Annual Income Tax Return: II014 Income From Profession-Graduated IT Rates II013 Mixed Income-Graduated IT RatesDocument1 pageAnnual Income Tax Return: II014 Income From Profession-Graduated IT Rates II013 Mixed Income-Graduated IT Ratesmary grace villasenorNo ratings yet

- Accounting For Income Tax FinDocument8 pagesAccounting For Income Tax FinAmparo ReyesNo ratings yet

- Aprelim - Purely Business IncomeDocument37 pagesAprelim - Purely Business IncomeAshley VasquezNo ratings yet

- BIR Form Deadline Quarterly Tax ReturnsDocument6 pagesBIR Form Deadline Quarterly Tax Returnsdianne caballeroNo ratings yet

- Taxation of Individuals: Step 1 Step 2: Step 3Document39 pagesTaxation of Individuals: Step 1 Step 2: Step 3Pratyanshi MehtaNo ratings yet

- Lecture 3 - Income Taxation (Corporate)Document5 pagesLecture 3 - Income Taxation (Corporate)Paula MerrilesNo ratings yet

- Output Tax and Input TaxDocument12 pagesOutput Tax and Input TaxKiro ParafrostNo ratings yet

- Notes Income Taxation IndividualDocument10 pagesNotes Income Taxation IndividualTriscia QuiñonesNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsjoel razNo ratings yet

- TAX RULES FOR CORPORATIONSDocument10 pagesTAX RULES FOR CORPORATIONSeinel dcNo ratings yet

- 1701osd 2018 101224Document7 pages1701osd 2018 101224Janeth Tamayo NavalesNo ratings yet

- Annual Income Tax Return: BrianDocument4 pagesAnnual Income Tax Return: BrianChristine ViernesNo ratings yet

- Assessments and ReassessmentsDocument31 pagesAssessments and ReassessmentsRam PrasadNo ratings yet

- 1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Document5 pages1701 Annual Income Tax Return: (From Part VI Item 5) (From Part VII Item 10)Jennylyn TagubaNo ratings yet

- Percentage TaxDocument3 pagesPercentage TaxTrisha Mae BoholNo ratings yet

- Minimum Corporate Income Tax (MCIT), Improperly Accumulated Earnings Tax (IAET), and Gross Income Tax (GIT)Document57 pagesMinimum Corporate Income Tax (MCIT), Improperly Accumulated Earnings Tax (IAET), and Gross Income Tax (GIT)kyleramosNo ratings yet

- Insurance FormatDocument4 pagesInsurance Formatsmit9993No ratings yet

- Co-Ownership, Estates and TrustsDocument13 pagesCo-Ownership, Estates and TrustsRoronoa Zoro100% (1)

- Taxable IncomeDocument7 pagesTaxable IncomeAileen TangonanNo ratings yet

- Useful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Document6 pagesUseful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Katherine OlidanNo ratings yet

- Bir 1701Document2 pagesBir 1701RAYNAN MARCELO100% (1)

- 1702 Qjuly 2008Document2 pages1702 Qjuly 2008Chona MenorNo ratings yet

- BEL200 Gross Income Slides 2023Document39 pagesBEL200 Gross Income Slides 2023bonolotau58No ratings yet

- 23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Document55 pages23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Aristeia NotesNo ratings yet

- TaxDocument19 pagesTaxjhevesNo ratings yet

- Valued Added TaxDocument5 pagesValued Added TaxCharles Reginald K. Hwang100% (6)

- Types of Taxable Income ExplainedDocument18 pagesTypes of Taxable Income Explainedrav danoNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- MODULE 3 Summary Outline Ownership-IddDocument25 pagesMODULE 3 Summary Outline Ownership-IddIrish D DagmilNo ratings yet

- Module 3 OWNERSHIPDocument3 pagesModule 3 OWNERSHIPIrish D DagmilNo ratings yet

- ASSIGNMENT Feb 06 2024Document1 pageASSIGNMENT Feb 06 2024Irish D DagmilNo ratings yet

- Philippines Supreme Court Suspends Attorney for Misappropriating Client FundsDocument3 pagesPhilippines Supreme Court Suspends Attorney for Misappropriating Client FundsIrish D DagmilNo ratings yet

- Income Tax Return Form-1 Sahaj - Excel FormatDocument9 pagesIncome Tax Return Form-1 Sahaj - Excel Formatswapnil007salunkeNo ratings yet

- Special Topics & Updates TaxationDocument7 pagesSpecial Topics & Updates TaxationMhadzBornalesMpNo ratings yet

- Estimate Calling Script 2023 Financial YearDocument4 pagesEstimate Calling Script 2023 Financial Yearapril jean ondoyNo ratings yet

- Income Tax Return Acknowledgement for AY 2022-23Document9 pagesIncome Tax Return Acknowledgement for AY 2022-23Pavan Kumar SharmaNo ratings yet

- Dwnload Full Taxation of Individuals 6th Edition Spilker Solutions Manual PDFDocument20 pagesDwnload Full Taxation of Individuals 6th Edition Spilker Solutions Manual PDFjeffreymelendeztxnpwjbksc100% (13)

- County of San Bernardino: Victorville TAD/WTW/Child Care/PID 15010 Palmdale RD VICTORVILLE, CA 92392-2546Document37 pagesCounty of San Bernardino: Victorville TAD/WTW/Child Care/PID 15010 Palmdale RD VICTORVILLE, CA 92392-2546Manuel ChavezNo ratings yet

- Solution Manual For Corporate Partnership Estate and Gift Taxation 2013 7th Edition by PrattDocument15 pagesSolution Manual For Corporate Partnership Estate and Gift Taxation 2013 7th Edition by PrattMariaMasontwfj100% (38)

- Fabm 2: Quarter 4 - Module 4 Principles and Processes of Income and Business TaxationDocument22 pagesFabm 2: Quarter 4 - Module 4 Principles and Processes of Income and Business TaxationFlordilyn DichonNo ratings yet

- Tax Papers - 4:17:23 - 2023Document14 pagesTax Papers - 4:17:23 - 2023Jeriah Pecson100% (1)

- TOPICS Income TaxDocument9 pagesTOPICS Income TaxJaizer TimbrezaNo ratings yet

- PHIL. BANK OF COMMUNICATIONS v. CIR, 302 SCRA 250Document15 pagesPHIL. BANK OF COMMUNICATIONS v. CIR, 302 SCRA 250Ronnie Garcia Del RosarioNo ratings yet

- Digital Advantage Insurance Company 6-30-22Document115 pagesDigital Advantage Insurance Company 6-30-22georgi.korovskiNo ratings yet

- Pearsons Federal Taxation 2017 Corporations Partnerships Estates and Trusts 30th Edition Pope Solutions ManualDocument14 pagesPearsons Federal Taxation 2017 Corporations Partnerships Estates and Trusts 30th Edition Pope Solutions Manualsiennamurielhlhk100% (17)

- Veza Eye Care CaseDocument6 pagesVeza Eye Care CaseRohan Bhate0% (1)

- Pennsylvania State TaxesDocument2 pagesPennsylvania State TaxesVikram rajputNo ratings yet

- BCOM-502 CourseHandout IncomeTaxDocument11 pagesBCOM-502 CourseHandout IncomeTaxLoket SinghNo ratings yet

- Interim 7 Consolidation AFAR1Document7 pagesInterim 7 Consolidation AFAR1Bea Tepace PototNo ratings yet

- Module 07 - Overview of Regular Income TaxationDocument32 pagesModule 07 - Overview of Regular Income TaxationTrixie OnglaoNo ratings yet

- UnknownDocument4 pagesUnknownnayla marie santiago cuadradoNo ratings yet

- Final Report BPP & CompanyDocument74 pagesFinal Report BPP & CompanyRohan ChauhanNo ratings yet

- MU Syllabus Taxation-2 Transfer-TaxesDocument3 pagesMU Syllabus Taxation-2 Transfer-TaxesDJabNo ratings yet

- Taxation Preweek and Additional MaterialsDocument26 pagesTaxation Preweek and Additional MaterialsMarvin ClementeNo ratings yet

- Katrina Pierce IndictmentDocument29 pagesKatrina Pierce IndictmentTodd FeurerNo ratings yet

- Income Tax Fundamentals 2019 37th Edition Whittenburg Solutions ManualDocument15 pagesIncome Tax Fundamentals 2019 37th Edition Whittenburg Solutions ManualMarvinGarnerfedpm100% (14)

- Essentials of Federal Taxation 2017 8th Edition Spilker Solutions ManualDocument25 pagesEssentials of Federal Taxation 2017 8th Edition Spilker Solutions ManualRebeccaBartlettqfam100% (53)

- 1 Train Law Draft ModuleDocument17 pages1 Train Law Draft ModuleDaehan CollegeNo ratings yet

- TAX3761 EXAM PACK JPJBLFDocument146 pagesTAX3761 EXAM PACK JPJBLFMonica Deetlefs0% (1)

- Fabm2 q2 Module 4 TaxationDocument17 pagesFabm2 q2 Module 4 TaxationLady HaraNo ratings yet

- Essentials of Federal Taxation 2018 Edition 9th Edition Spilker Solutions Manual 1Document49 pagesEssentials of Federal Taxation 2018 Edition 9th Edition Spilker Solutions Manual 1carrie100% (35)

- W11-Module Tax Return Preparation and Tax PaymentsDocument20 pagesW11-Module Tax Return Preparation and Tax PaymentsVirgilio Jay CervantesNo ratings yet