Professional Documents

Culture Documents

Bos 62312

Uploaded by

mahiseth72Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bos 62312

Uploaded by

mahiseth72Copyright:

Available Formats

Board of Studies

The Institute of Chartered Accountants of India

6th December, 2023

-----------------------------------------------------------------------------------------------

Corrigendum to the April 2023 Edition (Reprint October 2023) of Study Material of

Paper 2 – Advanced Financial Management (Final Level- New Scheme)

The following are the changes made in the webhosted October 2023 Reprint edition.

Chapter Page No. Changes incorporated in the (Reprint October 2023) Edition

(printed

copy)

5 5.34

In the Question No. 7 in the first row of the given table please suffix (` 100

each) after Equity share capital.

8 8.28

In the Question No. 19 in last line of second last para the sentence ‘Other

investments are at par.’ should be read as ‘Other investments are valued at

par.’

10 10.39

In the second last line of 1st para of 12.3 ‘sport rate’ to be read as ‘spot rate’.

10 10.59

In the Question No. 36 in the first table 1 Month Forward and 3 Month Forward

Rates to be read 0.9501 and 0.9556 respectively instead of 0.9301 and 0.9356.

10 10.72

Answer of sub part (ii) of Question No. 10 to be read as “In Japanese Yen, the

net exposure is payable, and the forward rate is quoted at a discount,

effectively offsetting the position. Likewise, in the remaining currencies, the net

exposures are in receivables, and the related currencies are at a premium,

offsetting the positions in their respective currencies.” Instead of “The exposure

of Japanese yen position is being offset by a better forward rate.”

10 10.75

Answer of sub part (ii) of Question No. 15 stands revised as follows:

USD/ ` on 3rd September 49.3800

Swap Point for October 0.1300

49.5100

USD/ SGD on 3 rd September 1.7058

Swap Point for 2 nd

month Forward 0.0096

1.7154

Professional Development Committee

The Institute of Chartered Accountants of India

SGD/ ` (49.5100/ 1.7154) 28.8621

Add: Exchange Margin 0.0500

28.9121

Thus, Cross Rate for SGD/ ` of 30th October shall be ` 28.9121.

10 10.85

Consequent upon the change in the values in the respective question

(mentioned above) In the answer of Question No. 36, the given table stands

revised as follows:

July Sept.

Can $ US $ Can $ US $

Covered by Contracts 1000000 940000 700000 665000

Balance bought at spot rate 10000 9501 5000 4778

Option Costs:

Can $ 50000 x 20 x 0.0102 10200 ---

Can $ 50000 x 14 x 0.0164 --- 11480

Total cost in US $ of 959701 681258

using Option Contract

12 12.17

In the Question No. 7 in third line please ignore the phrase ‘and the duration

of loan is four years’

Accordingly, those students having April 2023 Edition of Study Material are requested to make

note of these changes.

You might also like

- Solution Manual For Accounting 9th Edition by Charles T Horngren Walter T Harrison JR M Suzanne OliverDocument39 pagesSolution Manual For Accounting 9th Edition by Charles T Horngren Walter T Harrison JR M Suzanne OliverPatriciaCooleyMDkrws100% (34)

- 2012-Tcot-008-S.o.w-001 Rev.2Document150 pages2012-Tcot-008-S.o.w-001 Rev.2denyNo ratings yet

- An Overview of Problems of Spare Parts ManagementDocument40 pagesAn Overview of Problems of Spare Parts ManagementPendyalaHariKrishnaNo ratings yet

- Documento PDFDocument6 pagesDocumento PDFangye08vivasNo ratings yet

- Accenture Ready Set Scale PDFDocument48 pagesAccenture Ready Set Scale PDFKristo SootaluNo ratings yet

- Harrison FA IFRS 11e CH07 SMDocument85 pagesHarrison FA IFRS 11e CH07 SMJingjing Zhu0% (1)

- Consumer Perception About Retail Medicine Provided by Apollo PharmacyDocument56 pagesConsumer Perception About Retail Medicine Provided by Apollo PharmacySantu Dey100% (1)

- Introduction To Business ImplementationDocument31 pagesIntroduction To Business ImplementationDumplings DumborNo ratings yet

- HUAWEI Case StudyDocument9 pagesHUAWEI Case StudyTereseAnchetaNo ratings yet

- Harrison FA IFRS 11e CH09 SMDocument106 pagesHarrison FA IFRS 11e CH09 SMShako GrdzelidzeNo ratings yet

- Horngren 9th Edition Solutions Ch3Document157 pagesHorngren 9th Edition Solutions Ch3Vinicio Josue Bonilla Escober100% (1)

- © The Institute of Chartered Accountants of IndiaDocument13 pages© The Institute of Chartered Accountants of IndiaHarsh KumarNo ratings yet

- Ch08 Harrison 8e GE SM (Revised)Document102 pagesCh08 Harrison 8e GE SM (Revised)Muh BilalNo ratings yet

- 70590bos56509 PDFDocument1 page70590bos56509 PDFVikasNo ratings yet

- Hire Purchase PeqDocument21 pagesHire Purchase PeqRishikaNo ratings yet

- Harrison Fa Ifrs 11e Ch09 SMDocument107 pagesHarrison Fa Ifrs 11e Ch09 SMAshleyNo ratings yet

- BosfndcgDocument3 pagesBosfndcgvaddepallyanil goudNo ratings yet

- Depreciation Notes PDFDocument16 pagesDepreciation Notes PDFPriYansh PaTelNo ratings yet

- Depreciation AnalysisDocument12 pagesDepreciation AnalysisGecko100% (1)

- Bos 50836Document3 pagesBos 50836TJ LivestrongNo ratings yet

- Advance 3Document14 pagesAdvance 3pari maheshwariNo ratings yet

- Top 200 FRDocument4 pagesTop 200 FRjasleenchawla326No ratings yet

- Ch03 SM 9eDocument156 pagesCh03 SM 9ekmmkmNo ratings yet

- Errata for 10th Edition of Exam FM/2 ManualDocument3 pagesErrata for 10th Edition of Exam FM/2 ManualNhat HoangNo ratings yet

- PurchaseOrder-raq PrincipalDocument1 pagePurchaseOrder-raq PrincipalTheresa Faye De GuzmanNo ratings yet

- Form 27 Dec 2022Document3 pagesForm 27 Dec 2022srinivasgateNo ratings yet

- Accounting Standards 13. 47Document50 pagesAccounting Standards 13. 47kalyanikamineniNo ratings yet

- Investment Accounts: Question 1Document2 pagesInvestment Accounts: Question 1Rehan PathanNo ratings yet

- MITC 1.64.pdfDocument20 pagesMITC 1.64.pdfRavi kumarNo ratings yet

- Marking Guide - Code 4 - Midterm FA - Sem 2 - 21.22Document3 pagesMarking Guide - Code 4 - Midterm FA - Sem 2 - 21.22TRANG NGUYỄN THỊ HÀNo ratings yet

- INP - 2211 - Account - SUGGESTED ANSWERSDocument15 pagesINP - 2211 - Account - SUGGESTED ANSWERSSachin ChourasiyaNo ratings yet

- Ch07 Harrison 8e GE SMDocument87 pagesCh07 Harrison 8e GE SMMuh BilalNo ratings yet

- Assignment-3 (Solution) : B. Increase in The Price Level Resulting in Decrease in Purchasing Power of MoneyDocument5 pagesAssignment-3 (Solution) : B. Increase in The Price Level Resulting in Decrease in Purchasing Power of MoneyRuturaj NimbalkarNo ratings yet

- 3Q 2008 TOTL Total+Bangun+Persada+TbkDocument50 pages3Q 2008 TOTL Total+Bangun+Persada+TbkMayang Siti MasyitohNo ratings yet

- Foreign Exchange Markets and Dealings: Solution RQ.33.3Document3 pagesForeign Exchange Markets and Dealings: Solution RQ.33.3NeelNo ratings yet

- Solution Manual For Accounting 9th Edition by Charles T Horngren Walter T Harrison JR M Suzanne OliverDocument57 pagesSolution Manual For Accounting 9th Edition by Charles T Horngren Walter T Harrison JR M Suzanne OliverToddNovakmekfw100% (33)

- Corrigendum Final (New) Course Paper 7: Direct Tax Laws & International TaxationDocument1 pageCorrigendum Final (New) Course Paper 7: Direct Tax Laws & International TaxationSiddharth MishraNo ratings yet

- ACCT 551 Week2 PracticeQuestions SolutionsDocument5 pagesACCT 551 Week2 PracticeQuestions SolutionsMD SomratNo ratings yet

- Ias 33 Icab AnswersDocument6 pagesIas 33 Icab AnswersIttihadul islamNo ratings yet

- Chapter 14 - SolutionsDocument17 pagesChapter 14 - SolutionsHolly EntwistleNo ratings yet

- Spreadsheet Functions and Cash Flow AnalysisDocument8 pagesSpreadsheet Functions and Cash Flow AnalysisATEH ARMSTRONG AKOTEHNo ratings yet

- CAF 5 Spring 2022Document7 pagesCAF 5 Spring 2022Zia Ur RahmanNo ratings yet

- Test - 2 Paper - 2 Vsmart Academy Examprep Strategic Financial Management Suggested AnswersDocument10 pagesTest - 2 Paper - 2 Vsmart Academy Examprep Strategic Financial Management Suggested AnswerswinNo ratings yet

- BANTIDocument23 pagesBANTIvikas guptaNo ratings yet

- Solutions to Bond ExercisesDocument31 pagesSolutions to Bond ExercisesMaha M. Al-MasriNo ratings yet

- Model Solution: Solution To The Question No. 1 (B) Required (I)Document4 pagesModel Solution: Solution To The Question No. 1 (B) Required (I)HossainNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument12 pages© The Institute of Chartered Accountants of IndiaMiku JainNo ratings yet

- Accounts Compiler by Rahul Malkan Sir-73-98Document26 pagesAccounts Compiler by Rahul Malkan Sir-73-98sanketNo ratings yet

- Lease 2. Incremental Borrowing Rate of The Lessee Is Used in The Absence of Implicit InterestDocument4 pagesLease 2. Incremental Borrowing Rate of The Lessee Is Used in The Absence of Implicit InterestQueen ValleNo ratings yet

- Form 10 Summary of Indents Stock CreditsDocument1 pageForm 10 Summary of Indents Stock Creditsrfvz6sNo ratings yet

- Form No. 16: (See Rule 31 (1) (A) ) Part ADocument7 pagesForm No. 16: (See Rule 31 (1) (A) ) Part ASiddharth DasNo ratings yet

- Assn1 Solution Sept2022Document7 pagesAssn1 Solution Sept2022Yuqin LuNo ratings yet

- Tutorial Letter 103/3/2020: Financial Accounting Principles For Law PractitionersDocument7 pagesTutorial Letter 103/3/2020: Financial Accounting Principles For Law Practitionersall green associatesNo ratings yet

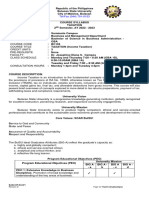

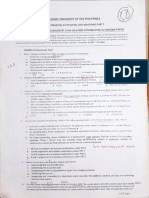

- Bca Semester-II 2023-24 (1)2Document49 pagesBca Semester-II 2023-24 (1)2kimberlyeric009No ratings yet

- BUS 302, Financial Management - Case Assignment, Group 2, PDFDocument6 pagesBUS 302, Financial Management - Case Assignment, Group 2, PDFJannatul FerdausNo ratings yet

- Making Sense of Your Finance - CDP Account StatementDocument1 pageMaking Sense of Your Finance - CDP Account StatementLester ChongaelNo ratings yet

- 5 Investment AccountsDocument11 pages5 Investment AccountsBAZINGANo ratings yet

- Brealey. Myers. Allen Chapter 22 SolutionDocument8 pagesBrealey. Myers. Allen Chapter 22 SolutionPulkit Aggarwal100% (1)

- Bond ValuationDocument7 pagesBond ValuationMd. Saiful IslamNo ratings yet

- Kisi2 UAS AKM 3Document9 pagesKisi2 UAS AKM 3Umi NazlaNo ratings yet

- CH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As FollowsDocument9 pagesCH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As Followschesca marie penarandaNo ratings yet

- Study Note 2.2 Page (80-113)Document34 pagesStudy Note 2.2 Page (80-113)s4sahithNo ratings yet

- Order in the matter of enquiry proceedings against Finquest SecuritiesDocument19 pagesOrder in the matter of enquiry proceedings against Finquest SecuritiesPratim MajumderNo ratings yet

- Practice Set 9 BondsDocument11 pagesPractice Set 9 BondsVivek JainNo ratings yet

- L&ADV. (Modified 27 - 9 - 0911Document11 pagesL&ADV. (Modified 27 - 9 - 0911kunalNo ratings yet

- Solutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Document5 pagesSolutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Adam IngberNo ratings yet

- The Investor's Dilemma Decoded: Recognize Misinformation, Filter the Noise, and Reach Your GoalsFrom EverandThe Investor's Dilemma Decoded: Recognize Misinformation, Filter the Noise, and Reach Your GoalsNo ratings yet

- Bruh KitchenDocument1 pageBruh KitchenNur HanyNo ratings yet

- Fortinet Specialized Partner NFR KitDocument8 pagesFortinet Specialized Partner NFR KitQualit ConsultingNo ratings yet

- Marketing Research Project On Nike ShoesDocument8 pagesMarketing Research Project On Nike ShoesRi TalzNo ratings yet

- Inb 372 Course Outline Summer 2022Document6 pagesInb 372 Course Outline Summer 2022Imrul JoyNo ratings yet

- HRM Assignment 1Document7 pagesHRM Assignment 1Rachel RegoNo ratings yet

- Final Examination TT For Cert & Dip - Feb 2023Document3 pagesFinal Examination TT For Cert & Dip - Feb 2023wilfredNo ratings yet

- Nec TSC High Pressure Cleaning ServicesDocument35 pagesNec TSC High Pressure Cleaning ServicesLiberty MunyatiNo ratings yet

- Holy Angel University School of Business and Accountancy Bachelor of Science in Management AccountingDocument5 pagesHoly Angel University School of Business and Accountancy Bachelor of Science in Management AccountingJoanna GarciaNo ratings yet

- Rice Machinery Safety ProceduresDocument34 pagesRice Machinery Safety ProceduresRommel Tipaklong CorpuzNo ratings yet

- TriaDocument15 pagesTriasadeqNo ratings yet

- Chapter 9 Caselette Audit of SheDocument26 pagesChapter 9 Caselette Audit of SheBusiness MatterNo ratings yet

- Bank Of Punjab Internship ReportDocument49 pagesBank Of Punjab Internship ReportHussain HadiNo ratings yet

- Chap004, Process CostingDocument17 pagesChap004, Process Costingrief1010No ratings yet

- Quiz of MGT211Document19 pagesQuiz of MGT211Aman KhanNo ratings yet

- April 2020 Exam for Introduction to Accounting at UTARDocument5 pagesApril 2020 Exam for Introduction to Accounting at UTARCRYSTAL NGNo ratings yet

- BC 103. Taxation IncomeDocument8 pagesBC 103. Taxation Incomezekekomatsu0No ratings yet

- True/False Questions: labor-intensive (cần nhiều nhân công)Document31 pagesTrue/False Questions: labor-intensive (cần nhiều nhân công)Ngọc MinhNo ratings yet

- Poa - Edu Loan1Document3 pagesPoa - Edu Loan1Anand JoshiNo ratings yet

- Likely Be Classified As ADocument32 pagesLikely Be Classified As AJoel Christian MascariñaNo ratings yet

- Company Profile - MNP Multi Niaga Putra V2-1 - CompressedDocument15 pagesCompany Profile - MNP Multi Niaga Putra V2-1 - CompressedIswahyudiNo ratings yet

- Polytechnic University of the Philippines Advanced Financial Accounting and Reporting Part 2 Assessment ExamDocument9 pagesPolytechnic University of the Philippines Advanced Financial Accounting and Reporting Part 2 Assessment ExamBazinga HidalgoNo ratings yet

- Fifo, Lifo, Simple and Weighted AverageDocument12 pagesFifo, Lifo, Simple and Weighted AverageSanjay SolankiNo ratings yet

- COMPARISON OF PHILIPPINE TAX RATESDocument3 pagesCOMPARISON OF PHILIPPINE TAX RATESKevin JugaoNo ratings yet