Professional Documents

Culture Documents

What Are MSME Its Role

Uploaded by

Neet 7200 ratings0% found this document useful (0 votes)

11 views8 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views8 pagesWhat Are MSME Its Role

Uploaded by

Neet 720Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

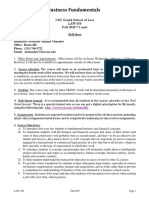

B.Com. (Hons.): Semester-II Paper BCH 2.

4(a): ENTREPRENEURSHIP

(General Elective) Gargi College, University of Delhi

Taught by- Nupur Tyagi

Topic: What are Micro, Small & Medium Enterprises?

Definitions of Micro, Small & Medium Enterprises In accordance with

the provision of Micro, Small & Medium Enterprises Development

(MSMED) Act, 2006 the Micro, Small and Medium Enterprises (MSME)

are classified in two Classes:

i. Manufacturing enterprise; and

ii. Service enterprise.

1. Manufacturing Enterprises-he enterprises engaged in the

manufacture or production of goods pertaining to any industry

specified in the first schedule to the industries (Development and

regulation) Act, 1951) or employing plant and machinery in the

process of value addition to the final product having a distinct name

or character or use. The Manufacturing Enterprise are defined in

terms of investment in Plant & Machinery.

2. Service Enterprises:-The enterprises engaged in providing or

rendering of services and are defined in terms of investment in

equipment..

The limit for investment in plant and machinery / equipment for

manufacturing / service enterprises, as notified, are as under

Manufacturing Sector

Enterprises Investment in plant & machinery

Micro

Enterprises Does not exceed twenty five lakh rupees

Small More than twenty five lakh rupees but does

Enterprises not exceed five crore rupees

Medium More than five crore rupees but does not

Enterprises exceed ten crore rupees

Service Sector

Enterprises Investment in equipment

Micro

Enterprises Does not exceed ten lakh rupees:

Small More than ten lakh rupees but does not

Enterprises exceed two crore rupees

Medium More than two crore rupees but does not

Enterprises exceed five crore rupees

• MSME stands for Micro, Small and Medium Enterprises. In a

developing country like India, MSME industries are the backbone

of the economy.

• The MSME sector contributes to 45% of India’s Total Industrial

Employment, 50% of India’s Total Exports and 95% of all

industrial units of the country and more than 6000 types of

products are manufactured in these industries (As per

msme.gov.in). When these industries grow, the economy of the

country grows as a whole and flourishes. These industries are

also known as small-scale industries or SSI’s.

• Even if the Company is in the manufacturing line or the service

line, registrations for both these areas can be obtained through

the MSME act. This registration is not yet made mandatory by

the Government but it is beneficial to get one’s business

registered under this because it provides a lot of benefits in

terms of taxation, setting up the business, credit facilities, loans

etc.

• The MSME became operational on October 02, 2006. It was

established to promote, facilitate and develop the

competitiveness of the micro, small and medium enterprises.

• The Micro, Small and Medium Enterprises (MSMEs) play a

pivotal role in the economic and social development of the

country, often acting as a nursery of entrepreneurship.

• They also play a key role in the development of the economy

with their effective, efficient, flexible and innovative

entrepreneurial spirit. The MSME sector contributes

significantly to the country’s manufacturing output,

employment and exports and is credited with generating the

highest employment growth as well as accounting for a major

share of industrial production and exports.

• MSMEs have been globally considered as an engine of

economic growth and as key instruments for promoting

equitable development. The major advantage of the sector is

its employment potential at low capital cost. The labour

intensity of the MSME sector is much higher than that of large

enterprises. MSMEs constitute more than 90% of total

enterprises in most of the economies and are credited with

generating the highest rates of employment growth and

account for a major share of industrial production and exports.

• In India too, MSMEs play an essential role in the overall

industrial economy of the country. In recent years, the MSME

sector has consistently registered higher growth rate compared

with the overall industrial sector. With its agility and dynamism,

the sector has shown admirable innovativeness and

adaptability to survive the recent economic downturn and

recession.

• The MSME sector in India is highly heterogeneous in terms of

the size of the enterprises, variety of products and services, and

levels of technology. The sector not only plays a critical role in

providing employment opportunities at comparatively lower

capital cost than large industries but also helps in

industrialisation of rural and backward areas, reducing regional

imbalances and assuring more equitable distribution of

national income and wealth. MSMEs complement large

industries as ancillary units and contribute enormously to the

socioeconomic development of the country.

• Key Challenges faced by the MSME Sector:

o Lack of availability of adequate and timely credit

o High cost of credit

o Collateral requirements

o Limited access to equity capital

o Procurement of raw material at a competitive cost •

o Problems of storage, designing, packaging and product

display

o Lack of access to global markets

o Inadequate infrastructure facilities, including power,

water, roads

o Low technology levels and lack of access to modern

technology

o Lack of skilled manpower for manufacturing, services,

marketing, etc

o Multiplicity of labour laws and complicated procedures

associated with compliance of such laws.

Despite the various challenges it has been facing, the MSME sector

has shown admirable innovativeness, adaptability and resilience to

survive the recent economic downturn and contribute significantly to

India’s industrial growth. Considering the importance of the MSMEs

in supporting the Indian economy’s growth, the MSME sector needs

to have timely, adequate and affordable funds to upgrade its

technological competencies and plug financial gaps, so as to move up

the value chain.

What is the Importance and role of MSMEs in Indian Economy?

1. To generate large scale employment In India, capital is scarce

and labour abundant. MSMEs are thought to have lower

capital-output and capital-labour ratios than large-scale

industries, and therefore, better serve growth and employment

objectives. The MSME sector in India has grown significantly

since 1960 – with an average annual growth rate of 4.4% in the

number of units and 4.62% in employment (currently

employing 30 million). Not only do MSMEs generate the

highest employment per capita investment, they also go a long

way in checking rural-urban migration by providing people

living in isolated areas with a sustainable source of

employment.

2. To sustain economic growth and increase exports Non-

traditional products account for more than 95% of the MSME

exports (dominating in the export of sports goods, readymade

garments, plastic products etc.). Since these products are

mostly handcrafted and hence eco-friendly, there exists a

tremendous potential to expand the quantum of MSME led

exports. Also, MSMEs act as ancillary industries for Large Scale

Industries providing them with raw materials, vital components

and backward linkages e.g. large scale cycle manufacturers of

Ludhiana rely heavily on the MSMEs of Malerkotla which

produce cycle parts.

3. Making Growth Inclusive The inclusive growth is at the top of

the agenda of Ministry for Medium, and small and Medium-

sized enterprises for several years. On the other hand, poverty

and deprivation are a deterrent to the development of India.

Besides, it includes marginalized sections of a society which is a

key challenge lying before the Ministry of MSME.MSMEs are

instruments of inclusive growth which touch upon the lives of

the most vulnerable and marginalized. For many families, it is

the only source of livelihood. Thus, instead of taking a welfare

approach, this sector seeks to empower people to break the

cycle of poverty and deprivation. It focuses on people’s skills

and agency. However, different segments of the MSME sector

are dominated by different social groups. The Twelfth Plan has

listed the following as the objectives for the MSME sector •

Promoting competitiveness and productivity in the MSME

space. • Making the MSME sector innovative, improving

technology and depth. • Enabling environment for promotion

and development of MSMEs. • Strong presence in exports. •

Improved managerial processes in MSMEs.

4. Economic stability in terms of Growth and leverage Exports: It

is the most significant driver in India contributing to the tune of

8% to GDP. Considering the contribution of MSME to

manufacturing, exports, and employment, other sectors are

also benefitting from it. Nowadays, MNCs are buying semi-

finished, and auxiliary products from small enterprises, for

example, buying of clutches and brakes by automobile

companies. It is helpful in creating a linkage between MSME

and big companies even after the implementation of the GST

40% MSME sector also applied GST Registration that plays an

important role to increase the government revenue by 11%.

5. Cheap Labour and minimum overhead: While in the large-scale

organizations, one of the main challenge is to retain the human

resource through an effective human resource management

professional manager. But, when it comes to MSME, the

requirement of labour is less and it does not need a highly

skilled labourer. Therefore, the indirect expenses incurred by

the owner is also low

.

6. Simple Management Structure for Enterprises: MSME can

start with limited resources within the control of the owner.

From this decision making gets easy and efficient. On the

contrary, a large corporation requires a specialist for every

departmental functioning as it has a complex organizational

structure. Whereas a small enterprise does not need to hire an

external specialist for its management. The owner can manage

himself. Hence, it could run single-handedly.

7. The main role in the mission of “Make in India”: The signature

initiative by the Prime Minister of India “Make in India” has

been made easy with MSME. It is taken as a backbone in

making this dream a possibility. In addition, the government

has directed the financial institution to lend more credit to

enterprises in the MSME sector.

You might also like

- Somaliland: Private Sector-Led Growth and Transformation StrategyFrom EverandSomaliland: Private Sector-Led Growth and Transformation StrategyNo ratings yet

- What-are-MSME - MA NotesDocument7 pagesWhat-are-MSME - MA NotesIsha ShirodkarNo ratings yet

- Prateek Rest FinalDocument130 pagesPrateek Rest FinalPrateek Singh SidhuNo ratings yet

- Unit 2: Micro, Small & Medium Enterprises Have Been Defined in Accordance With The Provision ofDocument15 pagesUnit 2: Micro, Small & Medium Enterprises Have Been Defined in Accordance With The Provision ofTanishika MehraNo ratings yet

- MSMEs Project ReportDocument11 pagesMSMEs Project ReportAnkita GoyalNo ratings yet

- MSMEs Project ReportDocument10 pagesMSMEs Project ReportVishal Goyal82% (11)

- Micro Small and Medium EnterprisesvDocument6 pagesMicro Small and Medium EnterprisesvdhiwakarNo ratings yet

- Role of Micro, Small and Medium Enterprises in Indian Economic DevelopmentDocument6 pagesRole of Micro, Small and Medium Enterprises in Indian Economic DevelopmentKarthik AbhiNo ratings yet

- Monograph On Micro, Small and Medium Enterprises (Msmes) : The Institute of Cost & Works Accountants of IndiaDocument21 pagesMonograph On Micro, Small and Medium Enterprises (Msmes) : The Institute of Cost & Works Accountants of IndiaSsNo ratings yet

- Section IDocument4 pagesSection ISoumya JainNo ratings yet

- MSMEDocument6 pagesMSMEkhagesh100% (1)

- Micro Small Medium Enterprises (Msme)Document5 pagesMicro Small Medium Enterprises (Msme)Abhishek KhobeyNo ratings yet

- MSMEDocument12 pagesMSMEVarun Tandon50% (2)

- AbstractDocument7 pagesAbstracts_mishra01No ratings yet

- KSFC ProjectDocument26 pagesKSFC ProjectsrinNo ratings yet

- Unit I: Steps in Setting-Up A Msme: (30 Marks)Document18 pagesUnit I: Steps in Setting-Up A Msme: (30 Marks)Vishal GaonkarNo ratings yet

- Role of Msmes in The Growth of Indian EconomyDocument4 pagesRole of Msmes in The Growth of Indian EconomyShashiNo ratings yet

- MSME ReportDocument9 pagesMSME ReportAnuj Sharma100% (1)

- MSME Policy OverviewDocument13 pagesMSME Policy OverviewSagar BhargavNo ratings yet

- MICRO AND SMALL ProjectDocument17 pagesMICRO AND SMALL ProjectJapgur Kaur100% (1)

- Indian Legal System Protections For SME SectorDocument5 pagesIndian Legal System Protections For SME SectorAbhra MukherjeeNo ratings yet

- Presentation On MSME'sDocument19 pagesPresentation On MSME'sKunal PuriNo ratings yet

- Micro and Small Scale Industries ProjectDocument13 pagesMicro and Small Scale Industries ProjectAnonymous ldN95iANo ratings yet

- Chap 11 - MSME SectorDocument7 pagesChap 11 - MSME Sector229 SYBCOM-II SAMEER SHINDENo ratings yet

- ProjectDocument16 pagesProjectKrishna AhujaNo ratings yet

- Unit 2Document47 pagesUnit 2Harini SaiNo ratings yet

- Economics ProjectDocument13 pagesEconomics ProjectDivya Vatsa63% (38)

- Prospects and Challenges of Sme's in IndiaDocument16 pagesProspects and Challenges of Sme's in IndiaBharath Pavanje100% (5)

- Report On Quality Management Practices and Tools Being Used by SME's in Industries in PunjabDocument32 pagesReport On Quality Management Practices and Tools Being Used by SME's in Industries in Punjabmandeep_tcNo ratings yet

- FInal Project Report IOB 1Document52 pagesFInal Project Report IOB 1Jain NirmalNo ratings yet

- Micro Small Med-Wps OfficeDocument25 pagesMicro Small Med-Wps OfficeCapture PhotographyNo ratings yet

- MSME Issues and Challenges 1Document7 pagesMSME Issues and Challenges 1Rashmi Ranjan PanigrahiNo ratings yet

- Indian industrial environment post-independenceDocument6 pagesIndian industrial environment post-independenceabhi2calmNo ratings yet

- Scales of BusinessDocument23 pagesScales of BusinessShrikant RathodNo ratings yet

- 16 Role of SME in Indian Economoy - Ruchika - FINC004Document22 pages16 Role of SME in Indian Economoy - Ruchika - FINC004Ajeet SinghNo ratings yet

- 208 - Umer - What Ails The MSME Sector in India Is It Poor Access To FundsDocument7 pages208 - Umer - What Ails The MSME Sector in India Is It Poor Access To FundsnomadisnoNo ratings yet

- Industrial Economics Is The Study of FirmsDocument3 pagesIndustrial Economics Is The Study of FirmsRaheel HusainNo ratings yet

- MSMEs in IndiaDocument3 pagesMSMEs in IndianiyanmiloNo ratings yet

- MSME Sector Backbone of Indian EconomyDocument20 pagesMSME Sector Backbone of Indian EconomyHimanshu chauhanNo ratings yet

- Unit 5Document22 pagesUnit 5ShubhamkumarsharmaNo ratings yet

- Library Assignment Business Environment (302) TOPIC-Challenges and Strategies For MSME's in IndiaDocument5 pagesLibrary Assignment Business Environment (302) TOPIC-Challenges and Strategies For MSME's in IndiaHeer BatraNo ratings yet

- English Assignment 1Document30 pagesEnglish Assignment 1Satyapriya PangiNo ratings yet

- Sandeepan Ray CMN SMBDocument43 pagesSandeepan Ray CMN SMBVenkat UppalapatiNo ratings yet

- Assignment-I Msmes in India: Guided By: Submitted byDocument6 pagesAssignment-I Msmes in India: Guided By: Submitted byArpita Nayyar100% (1)

- Small and Medium EnterprisesDocument16 pagesSmall and Medium Enterprisesmadhavimba67% (3)

- Importance and Definition of Small and Medium Enterprises (SMEsDocument42 pagesImportance and Definition of Small and Medium Enterprises (SMEsAshish LakwaniNo ratings yet

- (Faculty: PMEC & Research Scholar: Berhampur University) : Edited By: MANAV SIRDocument36 pages(Faculty: PMEC & Research Scholar: Berhampur University) : Edited By: MANAV SIRRima AroraNo ratings yet

- Small Scale and Village IndustryDocument17 pagesSmall Scale and Village IndustryNishant Gupta100% (1)

- Msme EnterprisesDocument6 pagesMsme EnterprisesRavi Shonam KumarNo ratings yet

- Module 5 B and C IEGSDocument11 pagesModule 5 B and C IEGSRiddhima KarkeraNo ratings yet

- MS-93 Sol PDFDocument15 pagesMS-93 Sol PDFShraddha OnkarNo ratings yet

- Small and Medium Enterprises: Submitted By: Nishant Kr. Oraon Cuj/I/2011/Imba/18Document13 pagesSmall and Medium Enterprises: Submitted By: Nishant Kr. Oraon Cuj/I/2011/Imba/18nishant oraon100% (1)

- A Study On Small Scale Industry (ProjectDocument16 pagesA Study On Small Scale Industry (ProjectYashas KumarNo ratings yet

- MSMEDocument36 pagesMSMEBHANUPRIYANo ratings yet

- Small and Medium BusinessDocument19 pagesSmall and Medium BusinessSaikiran PegallapatiNo ratings yet

- 10 Innovations and Challenges in Msme SectorDocument5 pages10 Innovations and Challenges in Msme SectorShukla SuyashNo ratings yet

- Impact of GlobalizationDocument3 pagesImpact of GlobalizationpalakNo ratings yet

- MSME Strategic Action PlanDocument27 pagesMSME Strategic Action PlanRakesh SinghNo ratings yet

- Economics Module - II-1Document70 pagesEconomics Module - II-1Neet 720No ratings yet

- Adobe Scan 01-Nov-2023Document3 pagesAdobe Scan 01-Nov-2023Neet 720No ratings yet

- Modern EconomicsDocument1 pageModern EconomicsNeet 720No ratings yet

- Economics Module - IVDocument22 pagesEconomics Module - IVNeet 720No ratings yet

- Economics Module - IIIDocument23 pagesEconomics Module - IIINeet 720No ratings yet

- English Assignment MasDocument4 pagesEnglish Assignment MasNeet 720No ratings yet

- FAO Introduction To FSDocument3 pagesFAO Introduction To FSBin LiuNo ratings yet

- Eng PY Question Paper Sem-1Document2 pagesEng PY Question Paper Sem-1Neet 720No ratings yet

- Kebo111 PDFDocument22 pagesKebo111 PDFLukesh SadhNo ratings yet

- Micro OrganismsDocument2 pagesMicro OrganismsNeet 720No ratings yet

- Modern EconomicsDocument1 pageModern EconomicsNeet 720No ratings yet

- Marketing Plan Restoran: October 2015Document29 pagesMarketing Plan Restoran: October 2015Ricky ImandaNo ratings yet

- GST PresentationDocument92 pagesGST PresentationMehzabeen ShaheenNo ratings yet

- Friedman and Freeman MaterialsDocument3 pagesFriedman and Freeman MaterialsHieu LeNo ratings yet

- Property Law-II ProjectDocument19 pagesProperty Law-II ProjectVanshita GuptaNo ratings yet

- Abstracti ON: (Using Our Illustrative Problem, The Labahan Laundry Services, The FollowingDocument11 pagesAbstracti ON: (Using Our Illustrative Problem, The Labahan Laundry Services, The FollowingAkosi NoynoypiNo ratings yet

- Marquez vs. Secretary of Labor, G.R. No. 80685 (March 16, 1989)Document1 pageMarquez vs. Secretary of Labor, G.R. No. 80685 (March 16, 1989)Jolynne Anne GaticaNo ratings yet

- Delhi's transportation hub at Anand ViharDocument17 pagesDelhi's transportation hub at Anand ViharshishirkrNo ratings yet

- Occupational Safety and HealthDocument49 pagesOccupational Safety and HealthNUR AFIFAH AHMAD SUBUKINo ratings yet

- FS017 Quality Management Principles FishboneDocument1 pageFS017 Quality Management Principles FishboneR AshokNo ratings yet

- Human Resource Management Mathis 14th Edition Test BankDocument31 pagesHuman Resource Management Mathis 14th Edition Test Bankindignperusery1nxijNo ratings yet

- Indian Textile Industry: Opportunities, Challenges and SuggestionsDocument16 pagesIndian Textile Industry: Opportunities, Challenges and SuggestionsGadha GopalNo ratings yet

- Performance Management: Definition, Tools, and Case StudiesDocument3 pagesPerformance Management: Definition, Tools, and Case Studiesgolden kookieNo ratings yet

- Expenses Internal AuditDocument19 pagesExpenses Internal AuditLamineNo ratings yet

- The Effect of Profit and Cash Indices and The Financial Increase On The Distribution of Cash Profits in The Industrial Companies Listed in Amman Stock ExchangeDocument15 pagesThe Effect of Profit and Cash Indices and The Financial Increase On The Distribution of Cash Profits in The Industrial Companies Listed in Amman Stock ExchangeD rekaiaNo ratings yet

- Advantages and Disadvantages of TelemarketingDocument3 pagesAdvantages and Disadvantages of TelemarketingVenky PragadaNo ratings yet

- Introduction To Enterprise SystemsDocument51 pagesIntroduction To Enterprise Systemsvarsha bansodeNo ratings yet

- Ker & Co, Ltd. LingadDocument1 pageKer & Co, Ltd. Lingadamareia yapNo ratings yet

- IAM Anatomy V3 Dec 2015 Esp PDFDocument166 pagesIAM Anatomy V3 Dec 2015 Esp PDFCamilo Andres Cardozo FajardoNo ratings yet

- FPT ShopDocument25 pagesFPT ShopNhư MaiNo ratings yet

- ACC 102 ReviewerDocument18 pagesACC 102 ReviewerFlo-an Marie Gello-aniNo ratings yet

- English 2 - Directions Vocabulary - MapDocument3 pagesEnglish 2 - Directions Vocabulary - MapMariana MirandaNo ratings yet

- IB1816104 EntrepreneurshipDocument22 pagesIB1816104 EntrepreneurshipNavdhaNo ratings yet

- Amway's Indian Network Marketing Dream Gone AwryDocument8 pagesAmway's Indian Network Marketing Dream Gone AwryMwenda MongweNo ratings yet

- Retail TelDocument70 pagesRetail TelSairam RaghunathanNo ratings yet

- Thamesbay PPT Training Size Reduice PDFDocument40 pagesThamesbay PPT Training Size Reduice PDFRiyas ct80% (5)

- Synergo Intro DeckDocument14 pagesSynergo Intro DeckAri titikNo ratings yet

- MF Scheme Performance MetricsDocument12 pagesMF Scheme Performance MetricsKiran VidhaniNo ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperVenkataRajuNo ratings yet

- Business FundamentalsDocument7 pagesBusiness FundamentalsjfasldjflakdjqdfNo ratings yet

- 095 Priyanka TejwaniDocument19 pages095 Priyanka TejwaniNitin BasoyaNo ratings yet