Professional Documents

Culture Documents

Dues As On 16-12-2020 15:46:13: 159.9 Full-Payment K019 KALOL (PMS) K002 Khyati Ceramics 12/12/2006 Housing-Quater

Uploaded by

rajuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dues As On 16-12-2020 15:46:13: 159.9 Full-Payment K019 KALOL (PMS) K002 Khyati Ceramics 12/12/2006 Housing-Quater

Uploaded by

rajuCopyright:

Available Formats

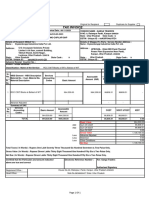

GUJARAT INDUSTRIAL DEVELOPMENT CORPORATION

Unique Trade Centre, 5,6 Floor, Hotel Kansar, Sayaji Ganj,

Vadodara 390005

Summary Letter As On 16/12/2020 Status : FULL-PAYMENT

Estate : K019 KALOL(PMS) Area : 159.9

Party Name : K002 KHYATI CERAMICS Dt. Of Allotment : 12/12/2006

Plot No : B,7,17,18 Asset Type : Housing-Quater

Address : 179-180/A, GIDC ESTATE, KALOL - 389330 KALOL (P.M.)

Dues as on 16-12-2020 15:46:13

1. Installment Rs. 0

2. Interest On Delayed payment Including Penal Intere Rs. 0

3. Service Charge Rs. 0

4. Service Charge(ST) Rs. 0

5. Service Charge(EC) Rs. 0

6. Service Charge(SBC) Rs. 0

7. Service Charge(KKC) Rs. 0

8. Service Charge(CGST) Rs. 0

9. Service Charge(SGST) Rs. 0

10. NAA Rs. 327

11. NAA(ST) Rs. 15

12. NAA(EC) Rs. 0

13. NAA(SBC) Rs. 1

14. NAA(KKC) Rs. 1

15. NAA(CGST) Rs. 0

16. NAA(SGST) Rs. 0

17. LR Rs. 4

18. LR(ST) Rs. 1

19. LR(EC) Rs. 0

20. LR(SBC) Rs. 0

21. LR(KKC) Rs. 1

22. LR(CGST) Rs. 0

23. LR(SGST) Rs. 0

24. Interest On Revenue Charges Rs. 63

25. Interest On Revenue Charges(CGST) Rs. 0

26. Interest On Revenue Charges(SGST) Rs. 0

27. Infrastructure Fund Rs. 0

28. Infrastructure Fund (ST) Rs. 0

29. Infrastructure Fund (EC) Rs. 0

Total Rs. 413

Can be Waived as per circuler 50% O/S(IDP-Portion) Rs. 0

Dated 16-06-2020 till 31-12-2020

100% O/S(PI-Portion) Rs. 0

Net To be Recovered Rs. 413

PAN NUMBER OF GIDC :AABCG8033D GSTIN No of GIDC :- 24AABCG8033D1Z2

SERV. TAX NO. OF REGIONAL OFFICE :AABCG8033DSD012

E.&.O.E

--> This is a Computer generated statement and does not require any signature.

--> It will be treated as final on verification by concerned Regional Account Branch.

--> In case of any discrepancy in the accounts, you are requested to send the T.R No,

& Date through which the Payment is made.

--> This Report and Other Account related reports are also available on our Website

www.gidc.gov.in .

--> Rates for the year 2016-17 are provisional and subject to Revision.

--> GST at the rate mention in the act is applicable from 01-07-2017.

--> GSTIN no is mandatory to avail the benefit of Input Tax Credit(ITC).

--> Interest On Outstanding dues of Revenue Charges as on 31-03-2016 will be charged

@ 1% per month upto date of payment received, Interest on revenue charges due

during the year will be charged @ 1% per month after 30-06-2016.

Printed On: 16-12-2020

You might also like

- Engine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryFrom EverandEngine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryNo ratings yet

- 507-1 - MKP As On 08-01-2021Document1 page507-1 - MKP As On 08-01-2021rajuNo ratings yet

- 2 PH - (II) SUR-3 - GIDC HalolDocument1 page2 PH - (II) SUR-3 - GIDC Halolrcvbrd06No ratings yet

- ACFrOgBfcDc4ZkmRxDGfX36N bCUJVh - 6PwtZDXRz4ogV8C6WoSxUxvyYTthYmFqClgsElasl Q lzKNI92cfkyz0geGUBwq4L2Df23OEi1ME67J3fWfKFP7SuPF0RADocument1 pageACFrOgBfcDc4ZkmRxDGfX36N bCUJVh - 6PwtZDXRz4ogV8C6WoSxUxvyYTthYmFqClgsElasl Q lzKNI92cfkyz0geGUBwq4L2Df23OEi1ME67J3fWfKFP7SuPF0RAKishor HansoraNo ratings yet

- Plot No. 2-60 - GIDC HalolDocument1 pagePlot No. 2-60 - GIDC Halolrcvbrd06No ratings yet

- Summary BillDocument1 pageSummary BillVipul RathodNo ratings yet

- PLOT NO. 2-74 - GIDC HalolDocument1 pagePLOT NO. 2-74 - GIDC Halolrcvbrd06No ratings yet

- Caparo Engg I PVT Ltd. - Gidc HalolDocument1 pageCaparo Engg I PVT Ltd. - Gidc Halolrcvbrd06No ratings yet

- Krishiv Infotech: Tax InvoiceDocument3 pagesKrishiv Infotech: Tax InvoiceRiviera SarkhejNo ratings yet

- Fin Tab 40201767 105426251Document1 pageFin Tab 40201767 105426251RAJPALNo ratings yet

- DocumentDocument2 pagesDocumentRavi ShuklaNo ratings yet

- Tyre Tube With FlapDocument2 pagesTyre Tube With FlapAadil ModassirNo ratings yet

- FolioInvoice15 PDFDocument1 pageFolioInvoice15 PDFHotel City gardenNo ratings yet

- CLTKR Qrqftrrttffie:: Ffi - FfimkffiffiDocument4 pagesCLTKR Qrqftrrttffie:: Ffi - FfimkffiffiNitin SoniNo ratings yet

- Joshi Ventures Private LimitedDocument1 pageJoshi Ventures Private Limitedakshat.kapoor.9599No ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnram4a5No ratings yet

- Form No.16 Aa-1Document2 pagesForm No.16 Aa-1Vishnu Vardhan ANo ratings yet

- Be CHK260Document2 pagesBe CHK260Yogini ManeNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnhavejsnjNo ratings yet

- Fazal PTCL BillDocument1 pageFazal PTCL Billgajari gulNo ratings yet

- 8659225Document2 pages8659225Vivek TanwerNo ratings yet

- DDocument2 pagesDKedia FinanceNo ratings yet

- PANEER CHICKEN - Merged (AJMER SATABDI 15.12.22)Document11 pagesPANEER CHICKEN - Merged (AJMER SATABDI 15.12.22)pradeep kumarNo ratings yet

- InvoiceDocument1 pageInvoiceawanish639No ratings yet

- 8115674Document3 pages8115674sumit pandeyNo ratings yet

- Ecr CHLN Rec GRCDP0043475000 1212203002720 1646735919520 2022030858119520249Document1 pageEcr CHLN Rec GRCDP0043475000 1212203002720 1646735919520 2022030858119520249Shaik BashaNo ratings yet

- Cgycb2100016901 EreDocument2 pagesCgycb2100016901 EreRupeshAkreNo ratings yet

- 20x76mm Forged Rivet TabulationDocument2 pages20x76mm Forged Rivet TabulationAadil ModassirNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inGOKUL HD LIVE EVENTSNo ratings yet

- Cnee Shipping Docs ONEYNGOC02954700Document88 pagesCnee Shipping Docs ONEYNGOC02954700maheshsolankiNo ratings yet

- KIA QuotationDocument1 pageKIA Quotationshishir tiwariNo ratings yet

- Ecr CHLN Rec GRCDP0043475000 1212204007476 1651122031576 2022042837831576920Document1 pageEcr CHLN Rec GRCDP0043475000 1212204007476 1651122031576 2022042837831576920Shaik BashaNo ratings yet

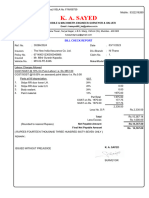

- BillCheck 30266 2024Document1 pageBillCheck 30266 2024kasayedgroupNo ratings yet

- Document 7 - OCRDocument1 pageDocument 7 - OCRLavish SoodNo ratings yet

- ECR - CHLN - REC - Penaly Mar16-Apr-17Document1 pageECR - CHLN - REC - Penaly Mar16-Apr-17Chandan ChatterjeeNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnSijo Kaviyil JosephNo ratings yet

- Src01nov2324 2Document1 pageSrc01nov2324 2Anik RoyNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inKATHI JAYANo ratings yet

- Dci PCB BillDocument1 pageDci PCB BillBiswarup PalNo ratings yet

- Joshi Ventures Private LimitedDocument1 pageJoshi Ventures Private Limitedakshat.kapoor.9599No ratings yet

- FreightDocument1 pageFreightAnirban SarkarNo ratings yet

- Degree Application 2018Document2 pagesDegree Application 2018ldineshkumarNo ratings yet

- 2018 03 31 12 23 14 702 - 1958189601Document5 pages2018 03 31 12 23 14 702 - 1958189601Kethavarapu RamjiNo ratings yet

- Bartronics Update 16 Oct. 2009Document7 pagesBartronics Update 16 Oct. 2009achopra14No ratings yet

- Ecr CHLN Rec Orkjr0025165000 3632309002329 1695290037291 2023092155437291250Document1 pageEcr CHLN Rec Orkjr0025165000 3632309002329 1695290037291 2023092155437291250naresh mjNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnpavanNo ratings yet

- Sylink U.P East DPRDocument20 pagesSylink U.P East DPRAkash SharmaNo ratings yet

- Dipu BillDocument1 pageDipu BillNaresh KamlaniNo ratings yet

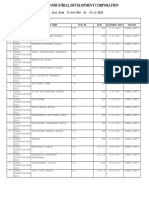

- SL - No Date Asset No.s Unit PriceDocument20 pagesSL - No Date Asset No.s Unit PriceRajendran SivanthirajanNo ratings yet

- 2017 09 18 16 47 37 050 - 118817245Document5 pages2017 09 18 16 47 37 050 - 118817245Nitin KumarNo ratings yet

- Xotic Bill - 28.02.2021Document1 pageXotic Bill - 28.02.2021Vanshaj SharmaNo ratings yet

- Credit Note (Balance Items)Document1 pageCredit Note (Balance Items)pradeep kumarNo ratings yet

- Ecr CHLN Rec Apkkp0068211000 1282310006315 1697285648378 2023101463848378762Document1 pageEcr CHLN Rec Apkkp0068211000 1282310006315 1697285648378 2023101463848378762aravindm1110No ratings yet

- Fin Tab 52225237 105777789Document1 pageFin Tab 52225237 105777789Surendra RathiNo ratings yet

- Malhar - Materil For Rubber PlantDocument1 pageMalhar - Materil For Rubber Plantajit kadamNo ratings yet

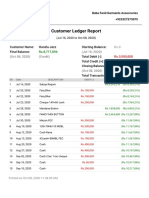

- Customer Ledger Report 1602139491350Document2 pagesCustomer Ledger Report 1602139491350Hanzla GhaffarNo ratings yet

- PTCL Bill New FormatDocument2 pagesPTCL Bill New Formatfarhad khanNo ratings yet

- Fin Tab 28231040 106008775 PDFDocument1 pageFin Tab 28231040 106008775 PDFMAA ENGINEERING WORKNo ratings yet

- Consignee - Diesel Stores Depot BGKTDocument2 pagesConsignee - Diesel Stores Depot BGKTP DagaNo ratings yet

- Fin Tab 16200645 105549768Document1 pageFin Tab 16200645 105549768P DagaNo ratings yet

- Project Report - STYANAAM Sand Blasting and FabricationDocument7 pagesProject Report - STYANAAM Sand Blasting and FabricationrajuNo ratings yet

- Project ReportDocument11 pagesProject ReportrajuNo ratings yet

- Dahod IIDocument8 pagesDahod IIrajuNo ratings yet

- Dahod Exp. NPDocument7 pagesDahod Exp. NPrajuNo ratings yet

- Auth Form ACH or CC Recurring PaymentDocument2 pagesAuth Form ACH or CC Recurring PaymentAurora BorealissNo ratings yet

- Forwarding Data DictionaryDocument214 pagesForwarding Data DictionaryRohit JainNo ratings yet

- International and Local Company - Registration FormDocument6 pagesInternational and Local Company - Registration FormWisnu NugrohoNo ratings yet

- Tax Card TY 2022Document8 pagesTax Card TY 2022princecharming14No ratings yet

- Assignment Problem 1Document6 pagesAssignment Problem 1Al Norin AhmadNo ratings yet

- CIR V. TRANSITIONS OPTICAL PHILIPPINES, INC. (G.R. No. 227544, November 22, 2017)Document2 pagesCIR V. TRANSITIONS OPTICAL PHILIPPINES, INC. (G.R. No. 227544, November 22, 2017)Digna LausNo ratings yet

- Kakinada Municipal Corporation: ReceiptDocument1 pageKakinada Municipal Corporation: ReceiptYagna PrakashraoNo ratings yet

- Part IVa - Member Bank Interface v5.3 - HIGHLIGHTEDDocument550 pagesPart IVa - Member Bank Interface v5.3 - HIGHLIGHTEDAbdul MajidNo ratings yet

- Bank Statement Sept 2017Document2 pagesBank Statement Sept 2017Yogesh PangareNo ratings yet

- Ecommerce (July) - Promo Mechanics (Targeted) - As of July 25Document2 pagesEcommerce (July) - Promo Mechanics (Targeted) - As of July 25MaraNo ratings yet

- 05 Subhash May-17 PDFDocument1 page05 Subhash May-17 PDFCma Subhash AtipamulaNo ratings yet

- Landed CostDocument2 pagesLanded CostReise MendozaNo ratings yet

- Neft and RtgsDocument4 pagesNeft and RtgsmukeshkpatidarNo ratings yet

- Spaze TowerDocument1 pageSpaze TowerShubhamvnsNo ratings yet

- Case No. 69Document2 pagesCase No. 69Eleazar CallantaNo ratings yet

- Christ Jyoti School Singrauli: Fee Structure-2022-23Document1 pageChrist Jyoti School Singrauli: Fee Structure-2022-23rachit websitesNo ratings yet

- Definition of TaxDocument3 pagesDefinition of TaxAbdullah Al Asem0% (1)

- RentoMojo - Start Renting - Furniture, Appliances, Electronics 1Document2 pagesRentoMojo - Start Renting - Furniture, Appliances, Electronics 1Trilok AshpalNo ratings yet

- Direct Tax Interview Questions For ArticleshipDocument15 pagesDirect Tax Interview Questions For ArticleshipAayush GamingNo ratings yet

- Taxation Microsoft Philippines Inc. Vs CIRDocument9 pagesTaxation Microsoft Philippines Inc. Vs CIRHazel BatuegasNo ratings yet

- IllustrationDocument3 pagesIllustrationShivakant ManchandaNo ratings yet

- NGOs Contract - Room OnlyDocument2 pagesNGOs Contract - Room OnlyLuon AnchamnanNo ratings yet

- Arthakranti BTT Budget Proposal - Advertorial PDFDocument1 pageArthakranti BTT Budget Proposal - Advertorial PDFAryann GuptaNo ratings yet

- Enquiry For Manufacture, Testing & Supply of Generator Power and Auxiliary Transformers For Our Ongoing Three Projects in NepalDocument7 pagesEnquiry For Manufacture, Testing & Supply of Generator Power and Auxiliary Transformers For Our Ongoing Three Projects in NepalPritam SinghNo ratings yet

- OD327981941808242100Document1 pageOD327981941808242100HATHEEKATHUL AROOSIYANo ratings yet

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Document1 pageVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- Activity Final Tax On Passive IncomeDocument7 pagesActivity Final Tax On Passive IncomeElla Marie Lopez100% (2)

- Account Statement 230919 221019Document7 pagesAccount Statement 230919 221019Latest UpdatesNo ratings yet

- ChallanDocument2 pagesChallanHoshen MollaNo ratings yet

- Fiscal Policy: Expansionary Fiscal Policy When The Government Spend More Then It Receives in Order ToDocument2 pagesFiscal Policy: Expansionary Fiscal Policy When The Government Spend More Then It Receives in Order TominhaxxNo ratings yet