Professional Documents

Culture Documents

507-1 - MKP As On 08-01-2021

Uploaded by

rajuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

507-1 - MKP As On 08-01-2021

Uploaded by

rajuCopyright:

Available Formats

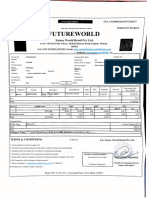

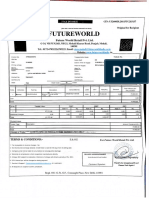

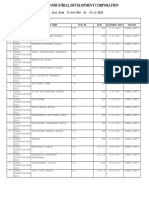

GUJARAT INDUSTRIAL DEVELOPMENT CORPORATION

Unique Trade Centre, 5,6 Floor, Hotel Kansar, Sayaji Ganj,

Vadodara 390005

Summary Letter As On 08/01/2021 Status : FULL-PAYMENT

Estate : M003 MAKARPURA Area : 2109.69

Party Name : M037 MODERN FOOD PRODUCT Dt. Of Allotment : 01/08/1979

Plot No : 507/1 Asset Type : Industrial Plot

Address : PLOT NO 507/1 GIDC MAKARPURA BARODA

Dues as on 08-01-2021 13:20:59

1. Installment Rs. 0

2. Int. On Delayed payment Including Penal Interest Rs. 0

3. Service Charge Rs. 0

4. Service Charge(ST) Rs. 0

5. Service Charge(EC) Rs. 0

6. Service Charge(SBC) Rs. 0

7. Service Charge(KKC) Rs. 0

8. Service Charge(CGST) Rs. 0

9. Service Charge(SGST) Rs. 0

10. NAA Rs. 0

11. NAA(ST) Rs. 0

12. NAA(EC) Rs. 0

13. NAA(SBC) Rs. 0

14. NAA(KKC) Rs. 0

15. NAA(CGST) Rs. 639

16. NAA(SGST) Rs. 639

17. LR Rs. 9

18. LR(ST) Rs. 0

19. LR(EC) Rs. 0

20. LR(SBC) Rs. 0

21. LR(KKC) Rs. 0

22. LR(CGST) Rs. 3

23. LR(SGST) Rs. 3

24. Interest On Revenue Charges Rs. 204

25. Interest On GST Of Revenue Charges Interest Rs. 4

26. Interest On Revenue Charges(CGST) Rs. 22

27. Interest On Revenue Charges(SGST) Rs. 22

28. Infrastructure Fund Rs. 0

29. Infrastructure Fund (ST) Rs. 0

30. Infrastructure Fund (EC) Rs. 0

Total Rs 1545

Can be Waived as per circuler 50% O/S(IDP-Portion) Rs. 0

Dated 20-06-2020 till 31-12-2020

100% O/S(PI-Portion) Rs. 0

Net To be Recovered Rs. 1545

PAN NUMBER OF GIDC : AABCG8033D GSTIN No of GIDC. 24AABCG8033D1Z2

SERV. TAX NO. OF REGIONAL OFFICE :AABCG8033DSD012

E.&.O.E

--> This is a Computer generated statement and does not require any signature.

--> It will be treated as final on verification by concerned Regional Account Branch.

--> In case of any discrepancy in the accounts, you are requested to send the T.R No,

& Date through which the Payment is made.

--> This Report and Other Account related reports are also available on our Website

www.gidc.gov.in .

--> GSTIN no is mandatory to avail the benefit of Input Tax Credit(ITC).

--> Interest On Outstanding dues of Revenue Charges as on 31-03-2020 will be charged

@ 1% per month upto date of payment received, Interest on revenue charges due during

the year will be charged @ 1% per month after 1-10-2020.

--> Over & above these dues Non Utilization Penalty is also leviable based on

non-utilization of plot/shed as per prevailing policy. In case of sale, transfer fee

shall also be charged.

Printed On: 08-01-2021

You might also like

- PTCL invoice detailsDocument1 pagePTCL invoice detailsmuneebNo ratings yet

- Document 7 - OCRDocument1 pageDocument 7 - OCRLavish SoodNo ratings yet

- Future WorldDocument1 pageFuture WorldLavish SoodNo ratings yet

- PTCL Bill New FormatDocument2 pagesPTCL Bill New Formatfarhad khanNo ratings yet

- Boettke-The Elgar Companion To Austrian EconomicsDocument646 pagesBoettke-The Elgar Companion To Austrian EconomicsrochalieberNo ratings yet

- 2 PH - (II) SUR-3 - GIDC HalolDocument1 page2 PH - (II) SUR-3 - GIDC Halolrcvbrd06No ratings yet

- GIDC Plot Summary LetterDocument1 pageGIDC Plot Summary LetterKishor HansoraNo ratings yet

- Dues As On 16-12-2020 15:46:13: 159.9 Full-Payment K019 KALOL (PMS) K002 Khyati Ceramics 12/12/2006 Housing-QuaterDocument1 pageDues As On 16-12-2020 15:46:13: 159.9 Full-Payment K019 KALOL (PMS) K002 Khyati Ceramics 12/12/2006 Housing-QuaterrajuNo ratings yet

- Gujarat Industrial Plot Payment SummaryDocument1 pageGujarat Industrial Plot Payment SummaryVipul RathodNo ratings yet

- Plot No. 2-60 - GIDC HalolDocument1 pagePlot No. 2-60 - GIDC Halolrcvbrd06No ratings yet

- Caparo Engg I PVT Ltd. - Gidc HalolDocument1 pageCaparo Engg I PVT Ltd. - Gidc Halolrcvbrd06No ratings yet

- PLOT NO. 2-74 - GIDC HalolDocument1 pagePLOT NO. 2-74 - GIDC Halolrcvbrd06No ratings yet

- Tax Invoice for Hotel SuppliesDocument11 pagesTax Invoice for Hotel Suppliespradeep kumarNo ratings yet

- InvoiceDocument1 pageInvoiceawanish639No ratings yet

- Krishiv Infotech: Tax InvoiceDocument3 pagesKrishiv Infotech: Tax InvoiceRiviera SarkhejNo ratings yet

- PTCL invoice detailsDocument1 pagePTCL invoice detailsgajari gulNo ratings yet

- Contract note cum tax invoice for equity trades on 31/03/2023Document4 pagesContract note cum tax invoice for equity trades on 31/03/2023Deebak SNo ratings yet

- DocumentDocument2 pagesDocumentRavi ShuklaNo ratings yet

- Src01nov2324 2Document1 pageSrc01nov2324 2Anik RoyNo ratings yet

- Credit Note (Balance Items)Document1 pageCredit Note (Balance Items)pradeep kumarNo ratings yet

- Be CHK260Document2 pagesBe CHK260Yogini ManeNo ratings yet

- Lexus Con NT 24 ThuDocument136 pagesLexus Con NT 24 ThuPranat BajajNo ratings yet

- FolioInvoice15 PDFDocument1 pageFolioInvoice15 PDFHotel City gardenNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inKATHI JAYANo ratings yet

- Fin Tab 40201767 105426251Document1 pageFin Tab 40201767 105426251RAJPALNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inGOKUL HD LIVE EVENTSNo ratings yet

- Cgycb2100016901 EreDocument2 pagesCgycb2100016901 EreRupeshAkreNo ratings yet

- Malhar - Materil For Rubber PlantDocument1 pageMalhar - Materil For Rubber Plantajit kadamNo ratings yet

- FORM NO.16 AA-1Document2 pagesFORM NO.16 AA-1Vishnu Vardhan ANo ratings yet

- Invoice Kaynes 05Document2 pagesInvoice Kaynes 05Mohammed ZubairNo ratings yet

- Bartronics Update 16 Oct. 2009Document7 pagesBartronics Update 16 Oct. 2009achopra14No ratings yet

- PRTCL PrintDupBill1Document1 pagePRTCL PrintDupBill1TariqMahmoodNo ratings yet

- RegularBill 2106659109 900000080665413Document1 pageRegularBill 2106659109 900000080665413Ghyias MirNo ratings yet

- BillCheck 30266 2024Document1 pageBillCheck 30266 2024kasayedgroupNo ratings yet

- Tyre Tube With FlapDocument2 pagesTyre Tube With FlapAadil ModassirNo ratings yet

- CLTKR Qrqftrrttffie:: Ffi - FfimkffiffiDocument4 pagesCLTKR Qrqftrrttffie:: Ffi - FfimkffiffiNitin SoniNo ratings yet

- 0204Document1 page0204akshat.kapoor.9599No ratings yet

- SL - No Date Asset No.s Unit PriceDocument20 pagesSL - No Date Asset No.s Unit PriceRajendran SivanthirajanNo ratings yet

- Degree Application 2018Document2 pagesDegree Application 2018ldineshkumarNo ratings yet

- DDocument2 pagesDKedia FinanceNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnhavejsnjNo ratings yet

- 8115674Document3 pages8115674sumit pandeyNo ratings yet

- InvoiceDocument2 pagesInvoiceHritesh HaldarNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherAnonymous eKt1FCDNo ratings yet

- PTCL invoice details for bundle, TV and late payment chargesDocument1 pagePTCL invoice details for bundle, TV and late payment chargesImraan IqbalNo ratings yet

- KIA QuotationDocument1 pageKIA Quotationshishir tiwariNo ratings yet

- 01shk Ghadge 5P 2223 30806Document1 page01shk Ghadge 5P 2223 30806Manish GhadgeNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceKumar RohitNo ratings yet

- Xotic Bill - 28.02.2021Document1 pageXotic Bill - 28.02.2021Vanshaj SharmaNo ratings yet

- Proforma InvoiceDocument1 pageProforma InvoiceDeepak avinashNo ratings yet

- Sales_001Document2 pagesSales_001TARUN KUMARNo ratings yet

- 8659225Document2 pages8659225Vivek TanwerNo ratings yet

- Tax Invoice: (Valid For Input Tax)Document1 pageTax Invoice: (Valid For Input Tax)अनुरूपम स्वामीNo ratings yet

- Tax Invoice: 638,616.00 Inr Six Lakh Thirtyeight Thousand Six Hundred Sixteen OnlyDocument1 pageTax Invoice: 638,616.00 Inr Six Lakh Thirtyeight Thousand Six Hundred Sixteen Onlysiva manikandanNo ratings yet

- Naseruddin Barring StoreDocument1 pageNaseruddin Barring StoresunitachanchaliyaNo ratings yet

- Kailash Hardware InvoiceDocument3 pagesKailash Hardware InvoiceNavneet KhemaniNo ratings yet

- Sun Earth Painting - Proforma InvoiceDocument1 pageSun Earth Painting - Proforma Invoicebhikam jainNo ratings yet

- WB 68 A D 9916 DDocument1 pageWB 68 A D 9916 Dmdneyaz9831No ratings yet

- Tax Invoice: Description of Goods Amount Disc. % Per Rate Quantity GST Hsn/SacDocument1 pageTax Invoice: Description of Goods Amount Disc. % Per Rate Quantity GST Hsn/SacAashima sharmaNo ratings yet

- Engine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryFrom EverandEngine, Turbine & Power Transmission Equipment World Summary: Market Values & Financials by CountryNo ratings yet

- Sand, Gravel & Stone Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandSand, Gravel & Stone Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Project Report - STYANAAM Sand Blasting and FabricationDocument7 pagesProject Report - STYANAAM Sand Blasting and FabricationrajuNo ratings yet

- Final Ap 2023 24 With Circular 1804202318042023014956Document9 pagesFinal Ap 2023 24 With Circular 1804202318042023014956jitu2968No ratings yet

- Project ReportDocument11 pagesProject ReportrajuNo ratings yet

- 507-1 - MKP As On 08-01-2021Document1 page507-1 - MKP As On 08-01-2021rajuNo ratings yet

- 507-1 - MKP As On 08-01-2021Document1 page507-1 - MKP As On 08-01-2021rajuNo ratings yet

- 507-1 - MKP As On 08-01-2021Document1 page507-1 - MKP As On 08-01-2021rajuNo ratings yet

- Dahod IIDocument8 pagesDahod IIrajuNo ratings yet

- 507-1 - MKP As On 08-01-2021Document1 page507-1 - MKP As On 08-01-2021rajuNo ratings yet

- Dahod Exp. NPDocument7 pagesDahod Exp. NPrajuNo ratings yet

- About NTPC's Joint Venture PartnershipsDocument6 pagesAbout NTPC's Joint Venture Partnershipsshantanu kumar BaralNo ratings yet

- PP - Externalities & Public Goods (Final)Document40 pagesPP - Externalities & Public Goods (Final)Eustass RellyyNo ratings yet

- 2008tpu PDFDocument207 pages2008tpu PDFMicrosoft SumberdjantinNo ratings yet

- L&T Detailed Policy - SMB - Credit Norms - DSA-DST - July 2022Document15 pagesL&T Detailed Policy - SMB - Credit Norms - DSA-DST - July 2022Tejas GaubaNo ratings yet

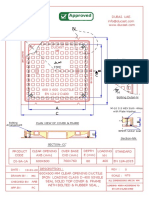

- Ducast UAE Manhole Cover Product InformationDocument1 pageDucast UAE Manhole Cover Product InformationSohail YounisNo ratings yet

- Sales ContractDocument3 pagesSales ContractLY LE THI CAM100% (2)

- Letter of Authorization For Filing in FIRMS ApplicationDocument2 pagesLetter of Authorization For Filing in FIRMS Applicationmicro man0% (1)

- Exercise 1 Demand Theory and Elasticities01Document3 pagesExercise 1 Demand Theory and Elasticities01Muhammad FikryNo ratings yet

- A Study of OFWs in Dipolog City. Prevalence, Trends and Economic Impacts On HouseholdsDocument18 pagesA Study of OFWs in Dipolog City. Prevalence, Trends and Economic Impacts On HouseholdsRichard CaneteNo ratings yet

- Assignment 111Document20 pagesAssignment 111Mary Ann F. MendezNo ratings yet

- India - Rado Service Price List - 01.10.2020Document1 pageIndia - Rado Service Price List - 01.10.2020PrachiNo ratings yet

- Website QuotationDocument1 pageWebsite QuotationBalaji DNo ratings yet

- Economics Project Manish Kumar Bharti 11th DDocument14 pagesEconomics Project Manish Kumar Bharti 11th DManish Kumar BhartiNo ratings yet

- ValuationDocument227 pagesValuationmohammad sadegh movahedifarNo ratings yet

- Pre-Feasibility Study Marble Quarrying ProjectDocument21 pagesPre-Feasibility Study Marble Quarrying Projectasad munirNo ratings yet

- Learn Financial ReportsDocument6 pagesLearn Financial ReportsMai RuizNo ratings yet

- F 1040 SBDocument2 pagesF 1040 SBapi-252942620No ratings yet

- India Mapping Static & CADocument54 pagesIndia Mapping Static & CAJit MukherheeNo ratings yet

- Forecasting Life Cycle CO2 Emissions of Electrified Vehicles by 2030 Considering Japan%u2019s Energy MixDocument9 pagesForecasting Life Cycle CO2 Emissions of Electrified Vehicles by 2030 Considering Japan%u2019s Energy MixMathew UsfNo ratings yet

- SIMOPS Drilling Cost AnalysisDocument4 pagesSIMOPS Drilling Cost AnalysisMarkyNo ratings yet

- Lecturer Economics - CSS Forums PDFDocument19 pagesLecturer Economics - CSS Forums PDFmuhammad atta ur rehmanNo ratings yet

- NISADocument4 pagesNISAWinnie AustinNo ratings yet

- MEPCO Electricity Bill Details for Muhammad Saleem GhaznaviDocument1 pageMEPCO Electricity Bill Details for Muhammad Saleem GhaznaviSyed Muhammad Hasan BilalNo ratings yet

- What is a Bull Trap? Detecting False BreakoutsDocument2 pagesWhat is a Bull Trap? Detecting False BreakoutsAli Abdelfatah MahmoudNo ratings yet

- Term Loan and Lease FinancingDocument3 pagesTerm Loan and Lease FinancingSoo CealNo ratings yet

- Brick Sku Description Status 6047 6060Document14 pagesBrick Sku Description Status 6047 6060Hemant Keshav SharmaNo ratings yet

- GROUP 1 - Top-Down AnalysisDocument26 pagesGROUP 1 - Top-Down AnalysisSukma Wardha0% (1)

- Measuring Exposure To Exchange Rate FluctuationsDocument36 pagesMeasuring Exposure To Exchange Rate FluctuationsTawhid Ahmed ChowdhuryNo ratings yet

- UiTM SHAH ALAM Public Transport SurveyDocument4 pagesUiTM SHAH ALAM Public Transport SurveyKhairul AnazNo ratings yet