Professional Documents

Culture Documents

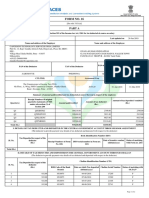

TAX 1 Sample

Uploaded by

rhieelaaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TAX 1 Sample

Uploaded by

rhieelaaCopyright:

Available Formats

Individuals Earning Purely Compensation Income

CASE I. Mr. Ihong, a minimum wage earner works for G.O.D., Inc. He is not engaged in business nor

earned a total compensation income of P135,000.00 with non taxable benefits of P15,000.00.

How much is the tax liability of Mr. Ihong?

Total Compensation Income P 135,000.00

Less: Non-Taxable benefits 15,000.00

Taxable Income 120,000.00

Tax Due -

CASE II. Mr. Macly, who also works for G.O.D., Inc. He is not engaged in business nor

earned a total compensation income of P278,000.00 with non taxable benefits of P16,000.00.

How much is the tax payable of Mr. Macly?

Total Compensation Income P 278,000.00

Less: Non-Taxable benefits 16,000.00

Taxable Income 262,000.00

Tax Due 2,400.00

Self-Employed Individuals Earning Income Purely from

Self-Employment or practice of Profession

CASE 1. Ms. Samson operates a convenience store while she offers bookkeeping services to her clients.

In 2018, her gross sales amounted to P800,000.00, in addition to her receipts from bookkeeping

services of P300,000.00. She already signified her intention to be taxed at 8% gross income tax rate

in her 1st quarter return.

How much is her tax liability?

Gross Sales - Convenience Store P 800,000.00

Gross Receipts - Bookkeeping 300,000.00

Total Sales/Receipts 1,100,000.00

Less: Amount allowed as Deduction 250,000.00

Taxable Income 850,000.00

Tax Due 68,000.00

CASE II. Ms. Datu-Pution, failed to signify her intention to be taxed at 8% fross income tax rate on her

initial Quartely Income Tax Return, her gross income is P1,100,000.00 and she incured cost of sales and

operating expenses amounting P600,000.00 and P200,000.00. respectively or a total of P800,000.00

How much is her tax liability?

Gross Sales/Receipts P 1,100,000.00

Less: Cost of Sales 600,000.00

Gross Income 500,000.00

Less: Operating Expenses 200,000.00

Taxable Income 300,000.00

Tax Due 10,000.00

CASE III. Ms. Ganda, opted to be taxed using the Graduated Rates under the Optional Standard Deduction on her

initial Quartely Income Tax Return, her Gross Receipts is P1,300,000.00 and she incured cost of sales and

operating expenses amounting P700,000.00 and P250,000.00. respectively or a total of P950,000.00

How much is her tax liability?

Gross Sales/Receipts 1,300,000.00

Less: Optional Standard Deduction 520,000.00

Taxable Income 780,000.00

Tax Due 125,000.00

Individual Earning Income Both from Compensation and from Self-employment

(business or practice of profession)

CASE I. Mr. MAG, a Financial Comptroller of JAB Company, earned annual compensation in 2018 of P1,500,000.00

with non taxable benefits of P60,000. Aside from employment income, he owns a convenience store , with

gross sales of P2,400,000. His cost of sales and operating expenses are P1,000,000.00 and P600,000.00.

Mr. MAG opted for 8% Gross Income Tax.

How much is the tax liability of Mr. Mag?

On Compensation:

Total Compensation Income P 1,500,000.00

Less: Non-Taxable benefits 60,000.00

Taxable Income 1,440,000.00

Tax Due on Compensation Income 322,000.00

On Business Income:

Gross Sales 2,400,000.00

Less: Amount allowed as Deduction - (250,000 allowed deduction

Taxable Income 2,400,000.00 not available for mixed income

earners under 8% GIT)

Tax Due 192,000.00

Total Income Tax Due (Compensation and Business) 514,000.00

Case II. Compute the tax of Mr. MAG using Graduatued Tax Rates under Optional Standard Deduction Method

Total Compensation Income P 1,500,000.00

Less: Non Taxable Benefit 60,000.00

Total Compensation Income 1,440,000.00

Add: Taxable Income from Business

Gross Sales/Receipts 2,400,000.00

Less: Optional Standard Deduction 960,000.00

Taxable Income from business 1,440,000.00

Total Taxable Income (Compensation and Business) 2,880,000.00

Tax Due 771,600.00

Case III. Compute the tax of Mr. MAG using Graduatued Tax Rates under Itemized Deduction Method

Total Compensation Income P 1,500,000.00

Less: Non Taxable Benefit 60,000.00

Total Compensation Income 1,440,000.00

Add: Taxable Income from Business

Gross Sales/Receipts 2,400,000.00

Less: Cost of Sales 1,000,000.00

Gross Income 1,400,000.00

Less: Operating Expenses 600,000.00

Taxable Income 800,000.00

Total Taxable Income (Compensation and Business) 2,240,000.00

Tax Due 566,800.00

You might also like

- Income TAX: Prof. Jeanefer Reyes CPA, MPADocument37 pagesIncome TAX: Prof. Jeanefer Reyes CPA, MPAmark anthony espiritu75% (4)

- Assessment 4 Tax 1Document3 pagesAssessment 4 Tax 1Judy Ann Gaceta0% (1)

- TAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedDocument16 pagesTAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedSophia PerezNo ratings yet

- Income-Tax Banggawan2019 CR7Document10 pagesIncome-Tax Banggawan2019 CR7Noreen Ledda11% (9)

- TAXATION ON INDIVIDUALS Lecture NotesDocument4 pagesTAXATION ON INDIVIDUALS Lecture NotesLucille Rose MamburaoNo ratings yet

- M6 - Deductions P4 (13C) Students'Document43 pagesM6 - Deductions P4 (13C) Students'micaella pasionNo ratings yet

- Ias 37 PDFDocument27 pagesIas 37 PDFmohedNo ratings yet

- International Taxation OutlineDocument138 pagesInternational Taxation OutlineMa FajardoNo ratings yet

- Bir Train Income TaxDocument34 pagesBir Train Income TaxJC CASTILLONo ratings yet

- Income Tax ExercisesDocument3 pagesIncome Tax ExercisesLaguna HistoryNo ratings yet

- How To Compute Individual Income TaxDocument4 pagesHow To Compute Individual Income TaxberinguelajunahNo ratings yet

- Income Tax Computation for Two Trusts and BeneficiaryDocument14 pagesIncome Tax Computation for Two Trusts and BeneficiaryPark MinyoungNo ratings yet

- Taxation On IndividualsDocument10 pagesTaxation On IndividualsHERNANDO REYESNo ratings yet

- 5 - Tax Rules For Individuals Earning Income Both From Compensation and From Self-EditedDocument5 pages5 - Tax Rules For Individuals Earning Income Both From Compensation and From Self-EditedKiara Marie P. LAGUDANo ratings yet

- Lesson 5 Part 2 TranscriptionDocument10 pagesLesson 5 Part 2 TranscriptionErica Joy M. SalvaneraNo ratings yet

- New Train Income Tax Table Year 2018 To 2022 and 2023 OnwardsDocument8 pagesNew Train Income Tax Table Year 2018 To 2022 and 2023 OnwardsSD AccountingNo ratings yet

- Lesson 1 - 2 Tax On The Self Employed Andor Professional 2Document4 pagesLesson 1 - 2 Tax On The Self Employed Andor Professional 2Aaron HernandezNo ratings yet

- Compensation Income Tax CalculationDocument4 pagesCompensation Income Tax Calculationlena cpaNo ratings yet

- Income Tax TableDocument6 pagesIncome Tax TableMarian's PreloveNo ratings yet

- Income Tax - Individuals With SolutionsDocument5 pagesIncome Tax - Individuals With SolutionsRandom VidsNo ratings yet

- AK Mock MT ProbDocument7 pagesAK Mock MT ProbJJCookieNo ratings yet

- BIR ComputationsDocument10 pagesBIR Computationsbull jack100% (1)

- Activity 1Document4 pagesActivity 1Louisa de VeraNo ratings yet

- Assignment 1 Taxes On IndividualsDocument7 pagesAssignment 1 Taxes On IndividualsMarynissa CatibogNo ratings yet

- Module No 16 - Regular Income Tax IndividualsDocument7 pagesModule No 16 - Regular Income Tax IndividualsKimberly DantesNo ratings yet

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocument3 pagesVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpa100% (2)

- CABATCAN, HANNAH LEAH'S BUSINESS FINANCE MODULEDocument27 pagesCABATCAN, HANNAH LEAH'S BUSINESS FINANCE MODULEHannah CabatcanNo ratings yet

- TaxationDocument3 pagesTaxationHamot KentNo ratings yet

- TaxationDocument3 pagesTaxationHamot KentNo ratings yet

- Taxation CompressDocument3 pagesTaxation CompressJulie BagaresNo ratings yet

- Mixed Income EarnersDocument6 pagesMixed Income EarnersEzi AngelesNo ratings yet

- Solving Tax ProblemsDocument4 pagesSolving Tax ProblemsPaupauNo ratings yet

- OSD and NOLCODocument2 pagesOSD and NOLCOAccounting FilesNo ratings yet

- Aprelim - Mixed IncomeDocument17 pagesAprelim - Mixed IncomeAshley VasquezNo ratings yet

- Individual Income Tax ComputationsDocument13 pagesIndividual Income Tax ComputationsclarizaNo ratings yet

- Tax: Classification of Individual Taxpayers Income Tax For Individual TaxpayersDocument20 pagesTax: Classification of Individual Taxpayers Income Tax For Individual TaxpayersKezia SantosidadNo ratings yet

- AEC-7 MIDTERM EXAMINATION SOLUTIONSDocument9 pagesAEC-7 MIDTERM EXAMINATION SOLUTIONSDaisy TañoteNo ratings yet

- Income Tax 2022 Part 2Document6 pagesIncome Tax 2022 Part 2Chezkie EmiaNo ratings yet

- Tax and Income ComputationDocument11 pagesTax and Income ComputationJudylyn SakitoNo ratings yet

- Optional Standard Deductions ExampleDocument7 pagesOptional Standard Deductions ExampleSandia EspejoNo ratings yet

- TaxationDocument9 pagesTaxationEnitsuj Eam EugarbalNo ratings yet

- Philhealth and Pag-IBIG contribution tables explainedDocument5 pagesPhilhealth and Pag-IBIG contribution tables explainedMaraiah InciongNo ratings yet

- Income and Business Taxation AssignmentsDocument5 pagesIncome and Business Taxation AssignmentsGideon Tangan Ines Jr.No ratings yet

- Osd CorrectionDocument2 pagesOsd CorrectionSai BomNo ratings yet

- Rodel's 2020 Income Tax Computation with Itemized DeductionsTITLE Mulry's 2020 Taxable Income and Tax Payable TITLE Sharon's Various 2020 Tax Computations as Resident, Non-Resident ETB and NETBDocument5 pagesRodel's 2020 Income Tax Computation with Itemized DeductionsTITLE Mulry's 2020 Taxable Income and Tax Payable TITLE Sharon's Various 2020 Tax Computations as Resident, Non-Resident ETB and NETByezaquera100% (1)

- Individual Income Tax RegimesDocument77 pagesIndividual Income Tax RegimesAriza CastroverdeNo ratings yet

- Special Allowable Itemized DeductionsDocument13 pagesSpecial Allowable Itemized DeductionsSandia EspejoNo ratings yet

- BIR Computations for Self-Employed ProfessionalsDocument10 pagesBIR Computations for Self-Employed Professionalsbull jackNo ratings yet

- Tax On Individuals: Instructor: Cathryn Cyra I. Cordova, CpaDocument28 pagesTax On Individuals: Instructor: Cathryn Cyra I. Cordova, CpaEddie Mar JagunapNo ratings yet

- Sample Computation PrintDocument1 pageSample Computation PrintXiwey SekwetNo ratings yet

- Tax Sample ComputationDocument9 pagesTax Sample ComputationErykaNo ratings yet

- Direction: Answer The Problem and Provide Your Solution in Good FormDocument1 pageDirection: Answer The Problem and Provide Your Solution in Good FormRenzo KarununganNo ratings yet

- Tax Revenue Regulation Illustrative Problems Compilation iCPA NotesDocument13 pagesTax Revenue Regulation Illustrative Problems Compilation iCPA Notesmendoza.adrianeNo ratings yet

- How To Tax An Individual 1Document25 pagesHow To Tax An Individual 1Lianna Xenia EspirituNo ratings yet

- Explanation For The Activity ProblemDocument3 pagesExplanation For The Activity ProblemRhyllin RamosNo ratings yet

- CPA in Transit Reviewer: Tax Reform R.A. 10963 SummaryDocument8 pagesCPA in Transit Reviewer: Tax Reform R.A. 10963 SummaryZaaavnn VannnnnNo ratings yet

- Chapter 2 AssignmentDocument8 pagesChapter 2 AssignmentRoss John JimenezNo ratings yet

- Cash Flow Statement (Direct Method)Document3 pagesCash Flow Statement (Direct Method)Margarette RobiegoNo ratings yet

- TaxationDocument2 pagesTaxationMesdame Jane TubalinalNo ratings yet

- CLWTAXN Income Taxation of Individuals PDFDocument12 pagesCLWTAXN Income Taxation of Individuals PDFBerlen BellezaNo ratings yet

- M7 - P1 Individual Income Taxation - Students'Document66 pagesM7 - P1 Individual Income Taxation - Students'micaella pasionNo ratings yet

- Revenue Regulations No. 8 Section 2C: Theories RITX IndividualDocument5 pagesRevenue Regulations No. 8 Section 2C: Theories RITX IndividualChristine Joyce ArevaloNo ratings yet

- Philippine Taxation Questions GuideDocument36 pagesPhilippine Taxation Questions GuideShaira BugayongNo ratings yet

- Determination of Income Tax Due and Payable If There Is A Given Creditable Withholding TaxDocument12 pagesDetermination of Income Tax Due and Payable If There Is A Given Creditable Withholding Taxgellie mare flores100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- (D) Capital of The Surviving SpouseDocument3 pages(D) Capital of The Surviving SpouseAnthony Angel TejaresNo ratings yet

- Module1 - Basic PrinciplesDocument14 pagesModule1 - Basic PrinciplesChristian Mark AbarquezNo ratings yet

- Form 15 AADocument2 pagesForm 15 AAAmit BhatiNo ratings yet

- Tax Card Moldova EN 2023Document20 pagesTax Card Moldova EN 2023VNo ratings yet

- (2023) 147 Taxmann - Com 449 (Nagpur - Trib.) (07-10-2022) Krushi Vibhag Karmchari Vrund Sahakari Pat Sanstha Maryadit vs. Income-Tax OfficerDocument6 pages(2023) 147 Taxmann - Com 449 (Nagpur - Trib.) (07-10-2022) Krushi Vibhag Karmchari Vrund Sahakari Pat Sanstha Maryadit vs. Income-Tax OfficerJai ModiNo ratings yet

- 2y2s Syllabus CompilationDocument99 pages2y2s Syllabus CompilationChaNo ratings yet

- WEEK 4 To 10 TAXDocument27 pagesWEEK 4 To 10 TAXStella BertilloNo ratings yet

- Tax Allowable ExpensesDocument2 pagesTax Allowable Expensesdavidhor75% (4)

- DTC Agreement Between Netherlands and TurkeyDocument29 pagesDTC Agreement Between Netherlands and TurkeyOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- Prefinals Exam in Income TaxationDocument3 pagesPrefinals Exam in Income TaxationYen YenNo ratings yet

- Commissioner-of-Internal-Revenue-vs.-Gonzales PDFDocument19 pagesCommissioner-of-Internal-Revenue-vs.-Gonzales PDFChristle CorpuzNo ratings yet

- Notes On Exempted IncomeDocument4 pagesNotes On Exempted Incomevaibs8900No ratings yet

- CIR vs. Phoenix (TAX)Document2 pagesCIR vs. Phoenix (TAX)Teff Quibod100% (2)

- UntitledDocument127 pagesUntitledemielyn lafortezaNo ratings yet

- Taxation ProjectDocument12 pagesTaxation ProjectSagar DhanakNo ratings yet

- Comparative Analysis of the Steps to Register a Business in the PhilippinesDocument15 pagesComparative Analysis of the Steps to Register a Business in the PhilippinesMiggy YangNo ratings yet

- Name: Section: Coverage: Score: Permit No.: Quiz 6Document7 pagesName: Section: Coverage: Score: Permit No.: Quiz 6Christopher MagsayoNo ratings yet

- Tax MCQDocument16 pagesTax MCQRosheil SamorenNo ratings yet

- FABM2 Q2W5 TaxationDocument8 pagesFABM2 Q2W5 TaxationDanielle SocoralNo ratings yet

- Form 16 TDS CertificateDocument10 pagesForm 16 TDS CertificateLogeshwaranNo ratings yet

- China Bank Vs CIR Passive Investment IncomeDocument7 pagesChina Bank Vs CIR Passive Investment IncomeThremzone17No ratings yet

- Income Taxation BasicsDocument26 pagesIncome Taxation BasicsReynamae Garcia AbalesNo ratings yet

- C.T.A. Case No. 6188Document21 pagesC.T.A. Case No. 6188doraemoanNo ratings yet

- Labuan Tax Exemptions for Professionals and BusinessesDocument3 pagesLabuan Tax Exemptions for Professionals and BusinessesewinzeNo ratings yet

- Tabc - Train - Noel N. Cobangbang, CpaDocument117 pagesTabc - Train - Noel N. Cobangbang, CpaIsaac CursoNo ratings yet