Professional Documents

Culture Documents

LAS in Acounting 2 Week 2

LAS in Acounting 2 Week 2

Uploaded by

dorothytorino8Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LAS in Acounting 2 Week 2

LAS in Acounting 2 Week 2

Uploaded by

dorothytorino8Copyright:

Available Formats

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

LEARNING ACTIVITY SHEET IN FUNDAMENTALS OF ACCOUNTANCY,

BUSINESS AND MANGEMENT 2

Quarter 2 Week 2: BANK RECONCILIATION STATEMENT

MELC: 1. Describe the nature of a bank reconciliation statement

2. Analyze the effects of the identified reconciling items

3. Prepare a bank reconciliation statement

Objective: After going through this module, you are expected to:

1. Describe the nature of a bank reconciliation statement;

2. Identify common reconciling items and describe each of them.

3. Analyze the effect of the identified reconciling items

4. Prepared a bank reconciliation statements

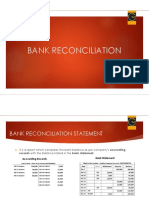

An accounting tool used by businesses and individuals to know the true balance of cash in a

bank account is the bank reconciliation statement. Under the adjusted balance method of bank

reconciliation, the balance per bank is reconciled with the balance per depositor’s books.

These three methods of preparing a bank reconciliation statement of business as follows:

a. The adjusted method is a method that adjusts both balances per bank and balances per book to

determine the correct cash balance separately.

b. Book to Bank Method is a method that adjusts the book balance to agree with the bank balance.

c. Bank to Book Method is a method that adjusts the bank balance to agree with the book balance.

Credit Memo- are additions made by the bank to the account of the depositor. Examples are

bank collections and interest income.

a. Bank Collections collection of receivables made by the bank on behalf of the depositor.

b. Interest Income appears as an addition to the depositors' account given by the bank as an interest

to the depositors' account balance.

Debit Memo - are deductions made by the bank to the account of the depositor. Examples are

bank charges for returned checks due to no sufficient fund (NSF Checks), automatic debits, or

payment of bills made by the bank on behalf of the depositor and bank service charge such as for

printing, checkbooks, and mailing the bank statement.

Bank service charges - are fees such as check printing and processing that the bank deducts

from the depositor.

NSF (no sufficient fund) check - is a check that was dishonored and returned by the bank to

the person or company writing the check because that account did not have enough funds. Book

Errors - are items erroneously recorded by the company. For example, the company deposit

P20,000 but recorded it P2,000.

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

Deposit in Transit- amounts received and recorded by the company but not yet deposited or

the amount deposited after the bank's cut-off time.

Outstanding Checks - checks issued by the company to payees but not yet encashed with

the bank or cleared by the bank

Bank Errors - are items erroneously recorded by the bank. For example, a check deposit of

P10,000 was recorded P1,000.

Analysis of the Effects of the Identified Reconciling Items

TRANSACTION NAME OF THE BANK / ADD/ DEDUCT ADD/DEDUCT

BOOK RECONCILING ITEM TO BOOK TO BANK

1. A check of Ᵽ35, 000 issued to a Outstanding Check Deduct to bank

supplier, was not yet presented as

payment to the bank

2. Ᵽ1,500 cash received by the Deposit in Transit Add to bank

company, recorded on March 31,

however, the cash deposited at the

bank on the afternoon of April 1

3. The bank erroneously added Bank Error Deduct to bank

Ᵽ12,000 deposit of Rommel Note: The cash

Upholstery Co, to Rommel Repairs bank balance

account.

overstated, thus

the correction is a

deduction of P

Ᵽ12,000 to the

cash bank balance

4. The teller erroneously debited Bank Error Add to bank Note:

Ᵽ20,000 to Rommel Repairs The cash bank

account instead of Ᵽ2,000. balance was

understated; thus

the correction is an

addition of Ᵽ18,000

(20,000-2,000) to

the cash bank

balance

5. The customer deposited Ᵽ10,000 Collection of receivables Add to book

to the company’s bank account as directly received by the bank

payment of receivable but not (Credit Memo)

recorded in the company’s book.

6. Payment of electric bills Auto Debits (Debit Memo) Deduct to book

automatically deducted on the

company’s bank account

7. A collection of Ᵽ10,000 recorded Book Error Add to book Note:

in the company’s book as Ᵽ1,000. The cash book

The bank statement shows the balance was

correct amount of Ᵽ10,000 understated; thus

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

the correction is

an addition of

Ᵽ9,000 (10,000-

1,000) to the

cash book

balance

8. A collection of Ᵽ5,000 recorded Book Error Deduct to book

in the company’s book as Ᵽ50,000. Note: The cash

The bank statement shows the book balance

correct amount of Ᵽ5,000 overstated; thus

the correction is a

deduction of

Ᵽ45,000 (5,000-

50,000) to the

cash book

balance

9. Charge for printing company Bank Service Charge (Debit Deduct to book

checks and service fee Memo)

10.Interest credited to the bank Interest Income (Credit Memo) Add to book

accoun

11. The bank statement shows a NSF- No sufficient fund (Debit Deduct to book

return check of Ᵽ500 by the Memo)

customer.

ILLUSTRATION: TRANSACTION ANALYSIS

Kayanatin Repairs March 2020 bank statement shown Ᵽ510,000 balance. As of March 31, 2020,

accounting records had a cash balance of Ᵽ710,000. Determined the following information.

a. Kayanatin Repairs issued a check amounting Ᵽ55,000 to a supplier, which not yet

presented to the bank for payment.

b. A deposit slip no. 1234 was a check deposit amounting to Ᵽ305,000, which not yet added to

the company's account.

c. Collection of account receivable amounting to Ᵽ70,000 deposited by a customer directly to

the company's account, which not yet recorded to the company's record.

d. The bank directly takes out Ᵽ20,000 as payment to the company's monthly PLDT bill.

Requirement: Analyze the transactions and prepare the Bank Reconciliation

Solution:

a. The check of Ᵽ55,000 issued to the supplier but not yet encashed is an Outstanding check,

which deducted to the bank cash balance.

b. The check deposited of Ᵽ305,000 but not yet credited to the company's bank account is a

Deposit in Transit added to the bank cash balance.

c. The collection of Receivable amounted to Ᵽ70,000 is not yet recorded to the company's cash

balance. Therefore, it should be a Credit Memo added to the company's book balance.

d. Ᵽ20,000 payment or auto-debit should be deducted to the cash book balance as a Debit

Memo since the company's had no record of it yet.

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

WRITTEN TASK:

TASK 1.

Identify whether the following independent transaction is a book or a bank reconciling. In addition,

determine the amount of the error and state whether the amount will be added or deducted in the

preparation of the bank reconciliation(use adjusted method):

1. Eagle Repairs received P1,500 from Jane. The bookkeeper recorded the amount as P500.

2. Nation Bank collected from the customer of Eagle the sum of P5,000 representing payment of

the said customer to Eagle. No entry was made in the books of Eagle.

3. The bank teller deducted CK 123 for P3,500 from the account of Eagle. The said check was

issued by Egles Company a different depositor of the bank.

4. The bookkeeper of Eagle recorded Check No. 345 in the Cash Disbursement Journal as

P5,205. The correct amount of the check was P5,250

5. The deposits of Eagle earned interest of P100 for the month. Eagle does not have knowledge of

interest earned until it receives the bank statement

TASK 2.

1. The bank statement for August 2014 shows an ending balance of Php3,490.

2. On August 31 the bank statement shows charges of Php35 for the service charge for

maintaining the checking account.

3. On August 28 the bank statement shows a return item of Php100 plus a related bank fee of

Php10. The return item is a customer's check that was returned because of insufficient funds

4. The bank statement shows a charge of Php80 for check printing on August 20

5. The bank statement shows that Php8 was added to the checking account on August 31 for

interest earned by the company during the month of August.

6. The bank statement shows that a note receivable of Php1,000 was collected by the bank on

August 29 and was deposited into the company's account. On the same day, the bank

withdrew Php40 from the company's account as a fee for collecting the note receivable

7. The company's Cash account at the end of August shows a balance of Php967.

8. During the month of August the company wrote checks totaling more than Php50,000. As of

August 31 Php3,021 of the checks written in August had not yet cleared the bank and

Php200 of checks written in June had not yet cleared the bank.

9. The Php1,450 of cash received by the company on August 31 was recorded on the company's

books as of August 31. However, the Php1,450 of cash receipts was deposited at the bank on

the morning of September 1.

10. On August 29 the company's Cash account shows cash sales of Php145. The bank statement

shows the amount deposited was actually Php154. The company reviewed the transactions

and found that Php154 was the correct amount.

Requirements: Given the above information, discuss each item whether it is a book reconciling or a

bank reconciling item. After the discussion, prepare a bank reconciliation statement.

PERPORMANCE TASKS: Bank reconciliation problem:

The bank statement for Juan Company shows a balance per bank of P15,907.45 on April 30,2015.

On this date the balance of cash per books is P11,589.45.

Additional information are provided below:

Deposits in transit: April 30 deposit (received by the bank on May 1) P2,201.40

Outstanding checks: No. 453-P3,000.00

No. 457-P1,401.30

No. 460-P1,502.70

Errors: Juan wrote check no. 443 for P1,226.00 and the bank correctly paid that amount. However,

he recorded the check as P1,262.00.

Bank memoranda: Debit– NSF check from Pedro P425.60 .

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

Debit– Charge for printing company checks P30.00

Credit – Collection of note receivable for P1,000 plus interest earned of P50, less

bank collection fee of P15.00.

Required: Prepare a bank reconciliation statement using the adjusted method.

Hint: Bank Debit Memo are deductions made by the bank to the account of the depositor

Bank Credit Memo are additions made by the bank to the account of the depositor

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

Republic of the Philippines

Department of Education

REGION IV-A CALABARZON

SCHOOLS DIVISION OFFICE OF BATANGAS PROVINCE

DR. JUAN A. PASTOR MEMORIAL NATIONAL HIGH SCHOOL

TALAIBON, IBAAN, BATANGAS

Address: Talaibon, Ibaan, Batangas

Telephone No.: (043) 311-2651

Email Ad: djapmnhs69@yahoo.com

You might also like

- FABM2 Q2 Module WS 1Document14 pagesFABM2 Q2 Module WS 1Mitch Dumlao73% (11)

- FABM2 Q2 Module WS 2Document10 pagesFABM2 Q2 Module WS 2Mitch Dumlao100% (1)

- CashDocument7 pagesCashhellohello100% (1)

- Fundamentals Accountancy, Business & Management: Fundamentals of ABM 2 By: Ferrer & MillanDocument20 pagesFundamentals Accountancy, Business & Management: Fundamentals of ABM 2 By: Ferrer & MillanJoyce OberesNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: Senior High SchoolDocument19 pagesFundamentals of Accountancy, Business and Management 2: Senior High SchoolMarvelous Julia StamariaNo ratings yet

- Module 7.2Document23 pagesModule 7.2Yen AllejeNo ratings yet

- Abm 11 - Fabm2 2ND Semester Finals Module 2 (Pielago)Document13 pagesAbm 11 - Fabm2 2ND Semester Finals Module 2 (Pielago)edjay.mercado85No ratings yet

- Basic Reconciliation StatementDocument13 pagesBasic Reconciliation StatementEaster Adina-LumangNo ratings yet

- ABM FABM2 Q2 Wk3 LAS3Document11 pagesABM FABM2 Q2 Wk3 LAS3ayaNo ratings yet

- Bank ReconciliationDocument30 pagesBank ReconciliationshannelebelenNo ratings yet

- Illustrative Problem On Adjusted Bank MethodDocument15 pagesIllustrative Problem On Adjusted Bank MethodRyDNo ratings yet

- Fabm2 Q2 W1 QaDocument16 pagesFabm2 Q2 W1 Qajoshua.mayo.09152004No ratings yet

- Bank Reconciliation1Document18 pagesBank Reconciliation1Kim Ella50% (2)

- Las1 Q2 BankreconDocument12 pagesLas1 Q2 BankreconCharlyn CastroNo ratings yet

- Chapter Test - Answer KeyDocument4 pagesChapter Test - Answer KeyKyle NaliNo ratings yet

- LAS Q2 Week3 FABM2Document9 pagesLAS Q2 Week3 FABM2Dash DomingoNo ratings yet

- LAS Q2 FABM 2 Week 3Document12 pagesLAS Q2 FABM 2 Week 3Mahika BatumbakalNo ratings yet

- LAS in Acounting 2 Week 1Document8 pagesLAS in Acounting 2 Week 1dorothytorino8No ratings yet

- Worksheet 3 Q2 Acctg. 2Document14 pagesWorksheet 3 Q2 Acctg. 2Allan TaripeNo ratings yet

- Learning Activity Sheet No. 16 2 Quarter: Grade Level/ Subject Grade 12 - Fundamentals of ABM 2Document13 pagesLearning Activity Sheet No. 16 2 Quarter: Grade Level/ Subject Grade 12 - Fundamentals of ABM 2Yuri GalloNo ratings yet

- Module 2 - Bank Reconciliation - With Sample ExercisesDocument24 pagesModule 2 - Bank Reconciliation - With Sample ExercisesJudie Ellaine SumandacNo ratings yet

- Module 2 - Topic 2 Bank Reconciliation: Ms. Daizy Marie P. Nicart, CPADocument24 pagesModule 2 - Topic 2 Bank Reconciliation: Ms. Daizy Marie P. Nicart, CPALucas BantilingNo ratings yet

- FABM2 - q2 - Clas2 Preparation of Bank Reconciliation Statement - v3Document14 pagesFABM2 - q2 - Clas2 Preparation of Bank Reconciliation Statement - v3Joey AgnasNo ratings yet

- FABM2 Quarter2 Notes FinalDocument15 pagesFABM2 Quarter2 Notes FinalnahatdoganNo ratings yet

- Fabm2 q2 m3 Bank Reconciliation EditedDocument29 pagesFabm2 q2 m3 Bank Reconciliation EditedMaria anjilu VillanuevaNo ratings yet

- Bank Reconciliation: Prepared By: Rezel A. Funtila R, LPTDocument19 pagesBank Reconciliation: Prepared By: Rezel A. Funtila R, LPTRezel FuntilarNo ratings yet

- Problem 6 Bank Recon23Document14 pagesProblem 6 Bank Recon23Mavi AngelNo ratings yet

- Bugal Atria Lenn V. Grade 12-Luca Pacioli Fundamentals of Accountancy, Business ManagementDocument2 pagesBugal Atria Lenn V. Grade 12-Luca Pacioli Fundamentals of Accountancy, Business ManagementAtria Lenn Villamiel BugalNo ratings yet

- Bank ReconciliationDocument12 pagesBank ReconciliationJenny Pearl Dominguez CalizarNo ratings yet

- IA 1 Module Week 3-4Document8 pagesIA 1 Module Week 3-4Yamit, Angel Marie A.No ratings yet

- Bank ReconciliationDocument60 pagesBank ReconciliationLourdes EyoNo ratings yet

- Fabm2 q2 Module 3 Bank ReconDocument13 pagesFabm2 q2 Module 3 Bank ReconLady Hara100% (1)

- Bank ReconciliationDocument41 pagesBank ReconciliationKarl Mendez100% (2)

- Bank ReconciliationDocument20 pagesBank ReconciliationLoslyn LumacangNo ratings yet

- Content No. 07 Bank Reconciliation StatementDocument3 pagesContent No. 07 Bank Reconciliation StatementAway To PonderNo ratings yet

- Worksheet 3 Q2 Acctg. 2 - 1 31Document14 pagesWorksheet 3 Q2 Acctg. 2 - 1 31Allan TaripeNo ratings yet

- Bank ReconciliationDocument7 pagesBank ReconciliationMikaella Adriana GoNo ratings yet

- F.A.B.M PortfolioDocument28 pagesF.A.B.M PortfolioLjoy Vlog SurvivedNo ratings yet

- Financial Accounting Week 5Document5 pagesFinancial Accounting Week 5chapmanalexis73No ratings yet

- 07 - Petty Cash Fund and Bank ReconciliationDocument2 pages07 - Petty Cash Fund and Bank ReconciliationCy Miolata100% (2)

- Fabm2 - June 17, 2021 Asynchronous Activity: Thanks, Happy Working. 3Document7 pagesFabm2 - June 17, 2021 Asynchronous Activity: Thanks, Happy Working. 3Khaira PeraltaNo ratings yet

- Fabm2 QTR.2 Las 7.1Document10 pagesFabm2 QTR.2 Las 7.1Trunks KunNo ratings yet

- Quiz 1A - Cash and Cash Equivalents, Bank ReconciliationDocument9 pagesQuiz 1A - Cash and Cash Equivalents, Bank ReconciliationLorence Ibañez100% (1)

- AE 111 Midterm Departmental AssessmentDocument8 pagesAE 111 Midterm Departmental AssessmentDjunah ArellanoNo ratings yet

- Module 3Document5 pagesModule 3Simoun EnriqueNo ratings yet

- 2nd QTR Week 8 Fabm 2 Bank ReconDocument9 pages2nd QTR Week 8 Fabm 2 Bank ReconHannah Grace ManagasNo ratings yet

- Basic Reconciliation StatementsDocument41 pagesBasic Reconciliation StatementsBeverly EroyNo ratings yet

- Bangayan, Melody D. Discussion (Correction of Errors and Cash) PDFDocument5 pagesBangayan, Melody D. Discussion (Correction of Errors and Cash) PDFMelody Domingo BangayanNo ratings yet

- Bangayan, Melody D. Discussion (Correction of Errors and Cash)Document5 pagesBangayan, Melody D. Discussion (Correction of Errors and Cash)Melody Domingo BangayanNo ratings yet

- Lecture Notes Bank Reconciliation StatementDocument3 pagesLecture Notes Bank Reconciliation StatementSyed Azlan Shah LUNo ratings yet

- Tle ModuleDocument3 pagesTle ModuleThalia ManzanillaNo ratings yet

- Cce HandoutDocument7 pagesCce HandoutSophia AlaizaNo ratings yet

- Bank ReconciliationDocument18 pagesBank ReconciliationJanaica MacaraegNo ratings yet

- Receivable FinancingDocument15 pagesReceivable FinancingshaneNo ratings yet

- Bank ReconciliationDocument11 pagesBank ReconciliationWijdan saleemNo ratings yet

- 2nd Q EXAMDocument6 pages2nd Q EXAMChristian TonogbanuaNo ratings yet

- Week 2 Leap FabmDocument7 pagesWeek 2 Leap FabmDanna Marie EscalaNo ratings yet

- Bank Reconciliation StatementDocument14 pagesBank Reconciliation StatementMarvie MendozaNo ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- 09 CH08Document22 pages09 CH08girmayadane7No ratings yet

- IMT Ghaziabad - Ujjawal - 18.02.23Document28 pagesIMT Ghaziabad - Ujjawal - 18.02.23Kartik SharmaNo ratings yet

- Vainu Sales Playbook TemplateDocument47 pagesVainu Sales Playbook TemplateRustam KoshelevNo ratings yet

- Donors and VolunteersDocument32 pagesDonors and VolunteersAshley GarnerNo ratings yet

- Chapter 8 Managing in Competitive, Monopolistic, and Monopolistically Competitive MarketsDocument26 pagesChapter 8 Managing in Competitive, Monopolistic, and Monopolistically Competitive Marketsdimitri foxNo ratings yet

- Golden Harvest Agro Industries LimitedDocument121 pagesGolden Harvest Agro Industries LimitedAdnan Al ShahidNo ratings yet

- Pec2143 AssignmentDocument9 pagesPec2143 AssignmentARIANEE BINTI AHMAD SAINI (BG)No ratings yet

- The Oxford Handbook of Banking 3nbsped 0198824637 9780198824633Document1,309 pagesThe Oxford Handbook of Banking 3nbsped 0198824637 9780198824633cyvhjbNo ratings yet

- FDip Fundamentals of Marketing AS2 MCQ AnswersDocument12 pagesFDip Fundamentals of Marketing AS2 MCQ Answersasilbekyakubov0525No ratings yet

- Statement of Comprehensive Income LessonsDocument2 pagesStatement of Comprehensive Income LessonsDarlyn Dalida San PedroNo ratings yet

- What Are The 4 Types of Market SegmentationsDocument3 pagesWhat Are The 4 Types of Market SegmentationsMoisés MancillaNo ratings yet

- Fund Managers Report - Conventional - May 2023Document14 pagesFund Managers Report - Conventional - May 2023Aniqa AsgharNo ratings yet

- Chapter 2 - Retail Strategic Planning and Operations ManagementDocument23 pagesChapter 2 - Retail Strategic Planning and Operations ManagementCedrick LabaoskiNo ratings yet

- Lecture 7 Forms of Business OwnershipDocument19 pagesLecture 7 Forms of Business OwnershipSAMUEL ACHEAMPONGNo ratings yet

- Amalgamation of Partnership FirmDocument14 pagesAmalgamation of Partnership FirmCopycat100% (1)

- myfinancelab作业答案Document6 pagesmyfinancelab作业答案egxigxmpd100% (1)

- Money and Banking Research PaperDocument5 pagesMoney and Banking Research Paperaflbrpwan100% (1)

- Regulation and Supervision of Financial InstitutionsDocument43 pagesRegulation and Supervision of Financial Institutionskim byunooNo ratings yet

- IGCSE Business Analysis Past PaperDocument4 pagesIGCSE Business Analysis Past PaperPasta SempaNo ratings yet

- BM2102 Lecture 7Document48 pagesBM2102 Lecture 7shahnaz chNo ratings yet

- Fin420 ReportDocument30 pagesFin420 ReportHalim NordinNo ratings yet

- Technical Analysis of The Financial MarketsDocument26 pagesTechnical Analysis of The Financial Marketsmcjn.commercialNo ratings yet

- Refinement of The Ecb Guide To Internal ModelsDocument16 pagesRefinement of The Ecb Guide To Internal ModelsjayaNo ratings yet

- Unit 5 AssignmentDocument4 pagesUnit 5 Assignmentmyriam HtooNo ratings yet

- Finance Report enDocument1 pageFinance Report enPhương Linh VũNo ratings yet

- Coca Cola AnalysisDocument4 pagesCoca Cola AnalysisAlishaNo ratings yet

- Teaser MoyasarDocument20 pagesTeaser Moyasarkanwalbilal37No ratings yet

- Risks, Returns and Capital StructureDocument2 pagesRisks, Returns and Capital StructureAnne Clarisse ConsuntoNo ratings yet

- UNITE BMI Patterns PrintDocument1 pageUNITE BMI Patterns PrintkishoreuxNo ratings yet

- UNILEVER Marketing StrategyDocument5 pagesUNILEVER Marketing Strategyanand.tvsmNo ratings yet