Professional Documents

Culture Documents

Assignment 4 - Mr. Peter's Portfolio

Assignment 4 - Mr. Peter's Portfolio

Uploaded by

sawan.traderebootOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 4 - Mr. Peter's Portfolio

Assignment 4 - Mr. Peter's Portfolio

Uploaded by

sawan.traderebootCopyright:

Available Formats

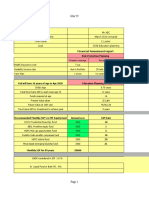

Client Name Mr.

Peter

Date of Commencement Jul-22

Present Age 2 years

Goals to achieve Child Education

Present Value Rs 25 Lakhs

Financial Assessment Report

Risk Protection Planning

Present Coverage

Health Insurance Cover Rs 3 Lakhs

Disability Income Order Not in portfolio

Term Plan Rs 50 Lakhs

Son will turn 16 years of age in April 2036 Education Planning for Son

Son's Age 2 years

Total time frame left to reach Goal age 18 16 years

Funds required at age 16

Present value taken Rs 25 Lakhs

Future Value at 18th year ₹ 13,277,235.83

Time left for investment to achieve the goal 14

Recommended Monthly SIP in Mutual Equity Fund Amount p.m. SIP Date

0

0

0

0

0

0

Monthly SIP for 14 years

CAGR considered in SIP: 16%

In Liquid Funds or Bank FD: 6%

When the child turns 16 years of age, we highly

recommend to redeem the fund with approx value

of Rs 1,07,76,102.45 in July 2036 and then

reinvest /park the amount in liquid funds or bank

FDs for the next 2 years and expect a return of 6%

Child Marriage Planning

Child Age 2 years

Total time frame to reach 25 23 years

Funds reuired at age 23

Time left for investment to achieve the goal 21 years

Present Value Rs 20 Lakhs

Future Value at age of 25 ₹ 17,908,604.87

Monthly Income

Less: Monthly Expenses

Less: EMI

Remaining amount to invest

Child Marriage Planning Buying a house

Rs 20 Lakhs Rs 70 Lakhs

nancial Assessment Report

Risk Protection Planning

Recommended

Rs 10 Lakhs

Rs 50 Lakhs minimum

Rs 10 Lakhs

Education Planning for Son Targeted amount at the age of 16

₹ 10,776,102.45

Date of Commencement Fund Market Value at age of 16

Amount invested in 14 years is Rs xx lakhs, which becomes Rs xx lakhs in

14 years with CAGR of 16%

Expected maturity amount in July 2036 ₹ 10,776,102.45

Expected maturity amount in July 2038 ₹ 12,108,028.71

Child Marriage Planning

100000

40000

30000

30000

You might also like

- Verdadero Cjezerei Borrowing CostsDocument11 pagesVerdadero Cjezerei Borrowing CostsPeter PiperNo ratings yet

- Time Value of Money QuestionsDocument2 pagesTime Value of Money QuestionsDavidNo ratings yet

- Globalisation and Counter-Globalisation: The Caribbean in The Context of The South - Norman Gir - VanDocument11 pagesGlobalisation and Counter-Globalisation: The Caribbean in The Context of The South - Norman Gir - VanMecheal ThomasNo ratings yet

- SAPM - Case StudyDocument4 pagesSAPM - Case StudySaloni Jain 1820343No ratings yet

- WP Sawan Singh Assignment 4Document11 pagesWP Sawan Singh Assignment 4sawan.traderebootNo ratings yet

- Dummy PortfolioDocument4 pagesDummy PortfolioManik KainthNo ratings yet

- (Investor) Sbi MF - Children's Benefit Fund - Compliance Approved PPT - 21.08.2020Document31 pages(Investor) Sbi MF - Children's Benefit Fund - Compliance Approved PPT - 21.08.2020Abhishek JainNo ratings yet

- Assignment 4Document6 pagesAssignment 4Kanishk SinghNo ratings yet

- Retirement PlanningDocument6 pagesRetirement Planningdaddyyankee995No ratings yet

- Financial Planner For Unmarried IndividualDocument16 pagesFinancial Planner For Unmarried IndividualAnkesh MishraNo ratings yet

- RE examDocument10 pagesRE examgoel.animesh105No ratings yet

- Financial Planning Guide SampleDocument10 pagesFinancial Planning Guide SampleBalakrishnanNo ratings yet

- Financial_Planning_and_Wealth_Management_kXHmbbjRDUDocument13 pagesFinancial_Planning_and_Wealth_Management_kXHmbbjRDUgoel.animesh105No ratings yet

- BOB Analyis ReportDocument7 pagesBOB Analyis ReportSudhanshu Kumar SinghNo ratings yet

- Wealth Management Group 8: Name Roll NoDocument16 pagesWealth Management Group 8: Name Roll NoAdii AdityaNo ratings yet

- Planing For Your Golden YearsDocument11 pagesPlaning For Your Golden YearsRavi ganganiNo ratings yet

- Portfolio Management Ganesh SawantDocument14 pagesPortfolio Management Ganesh SawantAvinash BobadeNo ratings yet

- Portfolio Management Avinash BobadeDocument14 pagesPortfolio Management Avinash BobadeAvinash BobadeNo ratings yet

- Time Value of Money - Practical ApplicationsDocument3 pagesTime Value of Money - Practical Applicationsmanoj_yadav7350% (1)

- Financial Planning March 2020Document18 pagesFinancial Planning March 2020rajat SharmaNo ratings yet

- Questions and AnswersDocument234 pagesQuestions and AnswersSoumen MitraNo ratings yet

- Personal Financial Planning - RenewedDocument24 pagesPersonal Financial Planning - RenewedrvarathanNo ratings yet

- Booklet On Securing Your Child's FutureDocument12 pagesBooklet On Securing Your Child's FutureshreeganeshjewellersmumbaiNo ratings yet

- NMHYDWM019Document33 pagesNMHYDWM019SHAWKATMANZOORNo ratings yet

- Arman Financial Services LTD (BSE Code 531179) - HBJ Capital's (MPS Unit) Business Insight Penny Stock Reco For June'10Document52 pagesArman Financial Services LTD (BSE Code 531179) - HBJ Capital's (MPS Unit) Business Insight Penny Stock Reco For June'10sumansaha33No ratings yet

- Batch 2019-21 - Semester II Specialization - MHR Subject: Submitted ToDocument4 pagesBatch 2019-21 - Semester II Specialization - MHR Subject: Submitted ToMamata SreenivasNo ratings yet

- Prestige Institute of Management and ResearchDocument11 pagesPrestige Institute of Management and ResearchVijay SinghNo ratings yet

- Financial Planning and MathematicsDocument63 pagesFinancial Planning and MathematicsApurva ShahNo ratings yet

- Spring 2022 - FIN630 - 2Document2 pagesSpring 2022 - FIN630 - 2Usman GhaniNo ratings yet

- Business Standard Case StuiesDocument52 pagesBusiness Standard Case StuiesRahulNo ratings yet

- Financial PlanningDocument91 pagesFinancial PlanningRakshit GoyalNo ratings yet

- LalalDocument22 pagesLalalHetviNo ratings yet

- Case Study: Family ProfileDocument1 pageCase Study: Family Profilekill_my_kloneNo ratings yet

- Financial and Capital Market Services Assignment: Individual StatusDocument4 pagesFinancial and Capital Market Services Assignment: Individual StatusJAMES ABY RCBSNo ratings yet

- Gupta'S - Personal Financial Statements and Plans: IMG-3 Personal Wealth ManagementDocument11 pagesGupta'S - Personal Financial Statements and Plans: IMG-3 Personal Wealth ManagementAnand YadavNo ratings yet

- Metro South Cooperative Bank of NCR Group ViciousDocument9 pagesMetro South Cooperative Bank of NCR Group ViciousLenard Garcia50% (2)

- Planning For Your Child'S Future With Mutual Fund SipsDocument4 pagesPlanning For Your Child'S Future With Mutual Fund SipsRanjan SharmaNo ratings yet

- Financial Planning CalculatorDocument12 pagesFinancial Planning Calculatorabcd1234No ratings yet

- Mutual FundDocument13 pagesMutual FundMd ThoufeekNo ratings yet

- Systematic Investment Plan: DSP Blackrock Mutual FundDocument33 pagesSystematic Investment Plan: DSP Blackrock Mutual FundSatish LankaNo ratings yet

- #6 Financial Plan CasestudyDocument4 pages#6 Financial Plan CasestudyKiran KumarNo ratings yet

- Sahanubhuti UniqueDocument10 pagesSahanubhuti UniquePrashanth JogimuttNo ratings yet

- How You Should InvestDocument2 pagesHow You Should InvestNischal JainNo ratings yet

- Financial_Planning_and_Wealth_Management_Document3 pagesFinancial_Planning_and_Wealth_Management_goel.animesh105No ratings yet

- FinancialPlanning & MutualFundsDocument32 pagesFinancialPlanning & MutualFundsChris LukeNo ratings yet

- How To Use Capital Budgeting To Make Investment Decisions - LinkedInDocument18 pagesHow To Use Capital Budgeting To Make Investment Decisions - LinkedInRamish Kamal SyedNo ratings yet

- 123Document6 pages123Trần Thuỳ TrangNo ratings yet

- FEIA Unit-1 NewDocument8 pagesFEIA Unit-1 NewMansi Vats100% (2)

- Case Study 7Document2 pagesCase Study 7.No ratings yet

- Financial Plan Specially Prepared For Mr. Sumeet SinghDocument18 pagesFinancial Plan Specially Prepared For Mr. Sumeet Singh86sujeetsinghNo ratings yet

- Business Brochure Template DesignDocument2 pagesBusiness Brochure Template Designramenpann07No ratings yet

- Sums Time ValueDocument2 pagesSums Time ValueMavani snehaNo ratings yet

- Case Study: Realty CheckDocument1 pageCase Study: Realty Checkkill_my_kloneNo ratings yet

- Financial Education For Young Citizen - Session 1 To 8 AxisDocument235 pagesFinancial Education For Young Citizen - Session 1 To 8 AxisMuskan KumariNo ratings yet

- The House Building Finance CorporationDocument41 pagesThe House Building Finance CorporationSana Javaid100% (1)

- Research Study On Puravankara Limited: Umang ShekarDocument13 pagesResearch Study On Puravankara Limited: Umang ShekarUmang ShekarNo ratings yet

- Power FinanceDocument7 pagesPower FinanceMrigank MauliNo ratings yet

- Power FinanceDocument7 pagesPower FinanceMrigank MauliNo ratings yet

- Goals Within Reach With Higher Equity Exposure: FinancesDocument1 pageGoals Within Reach With Higher Equity Exposure: FinanceskrjuluNo ratings yet

- Questions and Problems: BasicDocument2 pagesQuestions and Problems: BasicTas MimaNo ratings yet

- Material Requirements Planning (MRP) and ERPDocument90 pagesMaterial Requirements Planning (MRP) and ERPDesryadi Ilyas MohammadNo ratings yet

- Proficiência em Inglês Area 2Document3 pagesProficiência em Inglês Area 2Charmila SouzaNo ratings yet

- Engg EconDocument6 pagesEngg EconSean Earl NapeNo ratings yet

- Org ChartDocument7 pagesOrg ChartIvy Joy UbinaNo ratings yet

- Growth of Fishnet IndustryDocument11 pagesGrowth of Fishnet Industrychanus92No ratings yet

- Credit Risk Management at ICICI BankDocument68 pagesCredit Risk Management at ICICI BankPragati singhaniaNo ratings yet

- Introduction Bop 2Document10 pagesIntroduction Bop 2muhammad umairNo ratings yet

- Payroll HonorariumDocument18 pagesPayroll HonorariumStefano Abao OyanNo ratings yet

- #58 Security Bank V Mar Tierra CorpDocument1 page#58 Security Bank V Mar Tierra CorpVicente Del Castillo IVNo ratings yet

- KSP Brochure - EngDocument8 pagesKSP Brochure - EngDimas AnjarkusumaNo ratings yet

- Financial Affidavit BlankDocument10 pagesFinancial Affidavit BlankNicole FloresNo ratings yet

- CSR - CaseAnalysis - Group 3Document7 pagesCSR - CaseAnalysis - Group 3HardikNo ratings yet

- Performance of Mutual Fund Selected SachemsDocument25 pagesPerformance of Mutual Fund Selected SachemsprashantNo ratings yet

- Reading TestDocument14 pagesReading TestgiangNo ratings yet

- Why WeWork Went Wrong - WeWork - The GuardianDocument13 pagesWhy WeWork Went Wrong - WeWork - The GuardianViswajit SrinivasanNo ratings yet

- Brands and Brand ManagementDocument25 pagesBrands and Brand ManagementShakeeb HashmiNo ratings yet

- Blueprint of Banking SectorDocument33 pagesBlueprint of Banking SectormayankNo ratings yet

- Solution Manual For Corporate Finance Linking Theory To What Companies Do 3rd Edition by GrahamDocument16 pagesSolution Manual For Corporate Finance Linking Theory To What Companies Do 3rd Edition by GrahamLarryHickseqfsc100% (82)

- Law MCQSDocument33 pagesLaw MCQSChaitanya ShaligramNo ratings yet

- Profile On Bamboo FarmDocument14 pagesProfile On Bamboo FarmKaramara Training & ConsultancyNo ratings yet

- Adv Investment Appraisal 2Document44 pagesAdv Investment Appraisal 2kuttan1000100% (1)

- 2021102511075470Document46 pages2021102511075470Abdulah S AllyNo ratings yet

- Lecture 3 The Cost Accounting CycleDocument15 pagesLecture 3 The Cost Accounting CycleHailsey WinterNo ratings yet

- T Lo I 2021 AaDocument15 pagesT Lo I 2021 AaTrang NguyễnNo ratings yet

- Kolkatta 5Document38 pagesKolkatta 5amitmulikNo ratings yet

- Characteristics of Foreign Trade of BangladeshDocument2 pagesCharacteristics of Foreign Trade of BangladeshChoton Amin100% (1)

- Covid19 and The Power Sector ReportDocument7 pagesCovid19 and The Power Sector ReportSunny EnergyEfficiency EjimaNo ratings yet

- Business Law RND Term NotesDocument6 pagesBusiness Law RND Term NotesGarima SambarwalNo ratings yet