Professional Documents

Culture Documents

Acm 2

Uploaded by

Ꮢ.Gᴀɴᴇsн ٭ʏт᭄0 ratings0% found this document useful (0 votes)

5 views2 pagesI declare that the project report entitled “A STUDY ON OVERALL FINANICAL

PERFORMANCE OF MARUTI SUZUKI KOHIMA” submitted by me for the award of

the degree of Bachelor of Commerce of Nagaland University is my own work. The

project report has not been submitted for any other degree of this University or any other

university.

Original Title

ACM 2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentI declare that the project report entitled “A STUDY ON OVERALL FINANICAL

PERFORMANCE OF MARUTI SUZUKI KOHIMA” submitted by me for the award of

the degree of Bachelor of Commerce of Nagaland University is my own work. The

project report has not been submitted for any other degree of this University or any other

university.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesAcm 2

Uploaded by

Ꮢ.Gᴀɴᴇsн ٭ʏт᭄I declare that the project report entitled “A STUDY ON OVERALL FINANICAL

PERFORMANCE OF MARUTI SUZUKI KOHIMA” submitted by me for the award of

the degree of Bachelor of Commerce of Nagaland University is my own work. The

project report has not been submitted for any other degree of this University or any other

university.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

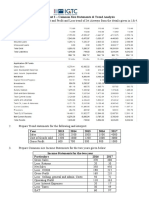

VIDHYAA GIRI COLLEGE OF ARTS AND SCIENCE – PUDUVAYAL

(Affiliated to Alagappa University)

(Recognized Under Section 2(f) by the UGC)

Department of Business Administration

Unit Test-II

Class: I BBA ACCOUNTING FOR MANAGEMENT – II –23BBA2C2 Max Marks: 75

Date: 2024 Time : 3 hours

Part – A (Answer all the Questions) (10X2=20)

1. Define Management Accounting.

2. What is meant by Financial Statement Analysis?

3. What is Internal Analysis?

4. What is Dynamic Analysis?

5. What is Trend percentage?

6. What is Comparative statement?

7. What is Common Size Statement?

8. What is Comparative Statement?

9. List down the Current Assets?

10. List down the Current Liabilities?

Part-B (Answer all the Questions) (5x5= 25)

11. State the different between Financial Accounting VS Management Accounting?

12. Explain the Nature & Scope of Management Accounting?

13. Explain the Functions of Management Accounting?

14. What are the Objectives of Management Accounting?

15. What are the Objectives of Financial Statements?

Part-C (Answer all the Questions) (10x3= 25)

16. Explain the Advantages & Disadvantages of Management Accounting.

17. From the following information calculate comparative income statement for the year ended 2005

&2006.

Particulars 2005 2006

Net sales 900 1050

Cost of goods sold 650 850

Administrative Expenses 40 40

Selling Expenses 20 20

Net Profit 190 140

18. From the Following Information, Compute trend percentage using 2001 as the base year.

Year Sales Cost of Profit

Goods sold Balance Tax

2001 600 360 120

2002 680 414 138

2003 840 512 186

2004 960 574 204

2005 1040 600 228

2006 1200 666 300

You might also like

- Financial Statement Analysis QuestionsDocument11 pagesFinancial Statement Analysis QuestionsShrunaliNo ratings yet

- AccntsDocument10 pagesAccntsLav RamgopalNo ratings yet

- Asad MemonDocument3 pagesAsad Memonshahzeb memonNo ratings yet

- Knickknac: Cah Is A Big and Multidivisional Company, Working in The Furnishing Sector. The Company'SDocument2 pagesKnickknac: Cah Is A Big and Multidivisional Company, Working in The Furnishing Sector. The Company'SAkanksha SinghNo ratings yet

- Acc 2112: Accounting Theory and Practice Assignment (February 2021)Document6 pagesAcc 2112: Accounting Theory and Practice Assignment (February 2021)Ranson MerciecaNo ratings yet

- Strategic Financial ManagementDocument5 pagesStrategic Financial ManagementdechickeraNo ratings yet

- FSA - Intro PDFDocument10 pagesFSA - Intro PDFsingh somyadeepNo ratings yet

- QUESTION 1: IFRS 8 Operating SegmentsDocument2 pagesQUESTION 1: IFRS 8 Operating SegmentsduncanNo ratings yet

- Excel Task 2Document4 pagesExcel Task 2michael songaNo ratings yet

- Basic Practice of Ratio Analysis NumericalDocument9 pagesBasic Practice of Ratio Analysis NumericalhammadmajeedNo ratings yet

- Financial Analysis TestDocument11 pagesFinancial Analysis TestAlaitz GNo ratings yet

- Problem Sheet 2 - Common Size Statements & Trend AnalysisDocument3 pagesProblem Sheet 2 - Common Size Statements & Trend AnalysisAkshita KapoorNo ratings yet

- Fs With AnswersDocument8 pagesFs With AnswersJomar VillenaNo ratings yet

- Analysis and Interpretation of Financial StatementsDocument12 pagesAnalysis and Interpretation of Financial StatementsK MuruganNo ratings yet

- Section A - Answer Question One (Compulsory Question)Document5 pagesSection A - Answer Question One (Compulsory Question)Adeel KhalidNo ratings yet

- Finacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsDocument5 pagesFinacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsJohanna AseliNo ratings yet

- CE On Operating SegmentsDocument3 pagesCE On Operating SegmentsalyssaNo ratings yet

- Corporate ValuationDocument9 pagesCorporate ValuationPRACHI DASNo ratings yet

- The Professionals' Academy of Commerce: Financial Accounting & Reporting-II IFRS-8Document1 pageThe Professionals' Academy of Commerce: Financial Accounting & Reporting-II IFRS-8Waseim khan Barik zaiNo ratings yet

- Panda Eco System Berhad - Prospectus Dated 8 November 2023 (Part 3)Document172 pagesPanda Eco System Berhad - Prospectus Dated 8 November 2023 (Part 3)geniuskkNo ratings yet

- Cases Topic 1 2021 Intl Fin RepDocument10 pagesCases Topic 1 2021 Intl Fin Repyingqiao.panNo ratings yet

- Group 1 Assignment MCPC 618Document3 pagesGroup 1 Assignment MCPC 618alfredarmah51No ratings yet

- Assignment 2 (C)Document1 pageAssignment 2 (C)Linda YaacobNo ratings yet

- Comparative & Common Size StatementDocument2 pagesComparative & Common Size StatementTaaran ReddyNo ratings yet

- Comparative & Common Size SPCC Term 2 PDFDocument2 pagesComparative & Common Size SPCC Term 2 PDFTaaran ReddyNo ratings yet

- ACCTGREV1 - 008 Operating Segments and Interim ReportingDocument2 pagesACCTGREV1 - 008 Operating Segments and Interim ReportingNhaj100% (3)

- Fim01 - Fs AnalysisDocument8 pagesFim01 - Fs AnalysisJomar VillenaNo ratings yet

- Segment ReportingDocument7 pagesSegment ReportingNamita GoburdhanNo ratings yet

- New Heritage Doll Capital Budgeting Case SolutionDocument5 pagesNew Heritage Doll Capital Budgeting Case SolutiontroyanxNo ratings yet

- Accounting and Management Exam - MancosaDocument11 pagesAccounting and Management Exam - MancosaFrancis Mtambo100% (1)

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- Accounting and Financial Management - Question PaperDocument11 pagesAccounting and Financial Management - Question PaperKim-Rushay WilliamsNo ratings yet

- Ge02 Model Question - Cma June 2018 - PacademiaDocument6 pagesGe02 Model Question - Cma June 2018 - PacademiaSumon Kumar DasNo ratings yet

- I Practice of Horizontal & Verticle Analysis Activity IDocument3 pagesI Practice of Horizontal & Verticle Analysis Activity IZarish AzharNo ratings yet

- I Practice of Horizontal & Verticle Analysis Activity IDocument3 pagesI Practice of Horizontal & Verticle Analysis Activity IZarish AzharNo ratings yet

- L12 Problem On Profitability Measures For Profit CenterDocument8 pagesL12 Problem On Profitability Measures For Profit Centerapi-3820619No ratings yet

- New Heritage Doll Capital Budgeting Case SolutionDocument5 pagesNew Heritage Doll Capital Budgeting Case Solutionalka murarka50% (14)

- 12 - Advanced Corporate Reporting For Strategic BusinessDocument3 pages12 - Advanced Corporate Reporting For Strategic BusinessFatima FXNo ratings yet

- GLOTEC Annual Report 2020Document184 pagesGLOTEC Annual Report 2020Law Yong SeinNo ratings yet

- Project Report Power UnsoiledDocument20 pagesProject Report Power Unsoiledshubham jagtapNo ratings yet

- Assignment N3Document12 pagesAssignment N3Maiko KopadzeNo ratings yet

- FM&EconomicsQUESTIONPAPER MAY21Document6 pagesFM&EconomicsQUESTIONPAPER MAY21Harish Palani PalaniNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationjrcoronel100% (1)

- FIN 408 MT 01 Fall 2020Document2 pagesFIN 408 MT 01 Fall 2020Tamim RahmanNo ratings yet

- Sba1501 Management Accounting Unit IiDocument76 pagesSba1501 Management Accounting Unit Iisandhya lakshmanNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessBacarrat BNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessHẬU ĐỖ NGỌCNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationahmed HOSNYNo ratings yet

- Cloudpoint Technology Berhad IPO Prospectus 9 May 2023 Part 2Document154 pagesCloudpoint Technology Berhad IPO Prospectus 9 May 2023 Part 2Oliver Oscar100% (1)

- Homework N3Document24 pagesHomework N3Maiko KopadzeNo ratings yet

- L5-BFE Assignment Guide 2023Document9 pagesL5-BFE Assignment Guide 2023himanshusharma9435No ratings yet

- Analysis For The Profit Margin For SAIF POWERTEC LIMITEDDocument20 pagesAnalysis For The Profit Margin For SAIF POWERTEC LIMITEDAameer ShahansahNo ratings yet

- FSA - Tutorial 4 - Fall 2021Document3 pagesFSA - Tutorial 4 - Fall 2021Ging freexNo ratings yet

- Advanced Accounting 2eDocument3 pagesAdvanced Accounting 2eHarusiNo ratings yet

- WBSLive Lecture 5 Slides Pres VevoxDocument25 pagesWBSLive Lecture 5 Slides Pres VevoxabhirejanilNo ratings yet

- A - Case Study: Dreaming Corp.: The Financial Statements of Dreaming Corp. Are The Following (In K )Document7 pagesA - Case Study: Dreaming Corp.: The Financial Statements of Dreaming Corp. Are The Following (In K )Mohamed Lamine SanohNo ratings yet

- Practice Questions For Ratio AnalysisDocument11 pagesPractice Questions For Ratio AnalysisFaria AlamNo ratings yet

- ACCN 101-Jan 2022Document6 pagesACCN 101-Jan 2022Chapo madzivaNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- TIME TABLE Final 1 (June 23-November 23)Document4 pagesTIME TABLE Final 1 (June 23-November 23)Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- NM Bba..Document1 pageNM Bba..Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Edii IprDocument2 pagesEdii IprᏒ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Cab 2Document1 pageCab 2Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Student Manual - Microsoft - Employability Skills CourseDocument10 pagesStudent Manual - Microsoft - Employability Skills CourseᏒ.Gᴀɴᴇsн ٭ʏт᭄100% (2)

- Edii Ipr ReportDocument2 pagesEdii Ipr ReportᏒ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Edii Ipr 2Document2 pagesEdii Ipr 2Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Ma 2019..Document6 pagesMa 2019..Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- HRM 2019..Document2 pagesHRM 2019..Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- P.suba CV - 20240131 - 190901 - 0000Document1 pageP.suba CV - 20240131 - 190901 - 0000Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Certificate 594119 21 Wk0o9Document1 pageCertificate 594119 21 Wk0o9Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Edii Ipr 3Document3 pagesEdii Ipr 3Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- MR .Prabavathi CV - 20240131 - 192134 - 0000Document1 pageMR .Prabavathi CV - 20240131 - 192134 - 0000Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Sam Chapter 3Document21 pagesSam Chapter 3Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- R.Nihashini CV - 20240131 - 184732 - 0000Document1 pageR.Nihashini CV - 20240131 - 184732 - 0000Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Acm 4Document1 pageAcm 4Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Acm 1Document2 pagesAcm 1Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- SubaDocument1 pageSubaᏒ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- MM 4Document1 pageMM 4Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- MM 1Document1 pageMM 1Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- MM 5Document1 pageMM 5Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Acm 3Document2 pagesAcm 3Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- 22be3 3Document1 page22be3 3Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Certificate 594119 17 368r0Document1 pageCertificate 594119 17 368r0Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Certificate 594119 16 4d2jdDocument1 pageCertificate 594119 16 4d2jdᏒ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Certificate 594119 18 0f0tzDocument1 pageCertificate 594119 18 0f0tzᏒ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- 22be3 1Document1 page22be3 1Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Certificate 905083 194 Oq3eaDocument1 pageCertificate 905083 194 Oq3eaᏒ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Certificate 594119 15 2s3jyDocument1 pageCertificate 594119 15 2s3jyᏒ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Effectiveness of Workers Participation in ManagementDocument59 pagesEffectiveness of Workers Participation in ManagementᏒ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Coefficient of Variation : Standard Deviation Expected EPSDocument2 pagesCoefficient of Variation : Standard Deviation Expected EPSJPNo ratings yet

- Shoreline Equity Partners Finder Fee EngagementDocument5 pagesShoreline Equity Partners Finder Fee EngagementMarius AngaraNo ratings yet

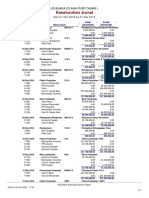

- Keseluruhan Jurnal: Ud Buana (Diana Puspitasari)Document3 pagesKeseluruhan Jurnal: Ud Buana (Diana Puspitasari)diana puspitasariNo ratings yet

- TMM Millionaire Mystery EbookDocument154 pagesTMM Millionaire Mystery EbookMiguel HoffmannNo ratings yet

- Cost Sheet QuestionsDocument10 pagesCost Sheet QuestionsSameer RaiNo ratings yet

- Reverse Percentages PDFDocument6 pagesReverse Percentages PDFChido DzirutweNo ratings yet

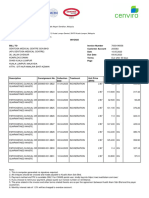

- Wo-013 - Valvetecq EngineersDocument1 pageWo-013 - Valvetecq EngineersDesign V-Tork ControlsNo ratings yet

- COST ACCOUNTING - Cost Concepts and ClassificationDocument18 pagesCOST ACCOUNTING - Cost Concepts and ClassificationJustine Reine CornicoNo ratings yet

- Kualiti Alam April 2023Document63 pagesKualiti Alam April 2023Zarifah AlamsahNo ratings yet

- HLL Vs Itc Big Fight 300805 SskiDocument35 pagesHLL Vs Itc Big Fight 300805 Sskimohit_rawatNo ratings yet

- Portfolio Return & RiskDocument25 pagesPortfolio Return & RiskSohag KhanNo ratings yet

- Supply Chain Management For Dummies - A Quick RefresherDocument2 pagesSupply Chain Management For Dummies - A Quick Refresherrenzoc.helixNo ratings yet

- Marketing Final AssignmentDocument21 pagesMarketing Final AssignmentHÂN HUỲNH ĐẶNG BẢONo ratings yet

- 2019 760 Instructions PDFDocument52 pages2019 760 Instructions PDFLelosPinelos123No ratings yet

- Sanc Nawada 4271914 263639Document2 pagesSanc Nawada 4271914 263639kumarmanchun249No ratings yet

- Top Glove Ar 2018Document220 pagesTop Glove Ar 2018Santhiya MogenNo ratings yet

- A Comparative Analysis of Lean Practices and Performance in TheDocument17 pagesA Comparative Analysis of Lean Practices and Performance in TheDanilo Martin Tuppia ReyesNo ratings yet

- Online Shoping With ShopeeDocument7 pagesOnline Shoping With ShopeeXII MM1Reiza Fauzan FirdausNo ratings yet

- Current Liabilities and ContingenciesDocument12 pagesCurrent Liabilities and ContingenciesLu CasNo ratings yet

- Financial Analysis: Metro Pacific Investment Corporation 2018Document19 pagesFinancial Analysis: Metro Pacific Investment Corporation 2018Trixie HicaldeNo ratings yet

- This Study Resource Was: Alyssa Quast MKT 4330 Professor Pullig Individual Case-Write-up #4: Altius GolfDocument2 pagesThis Study Resource Was: Alyssa Quast MKT 4330 Professor Pullig Individual Case-Write-up #4: Altius GolfNic CannonNo ratings yet

- Pas 7 Statement of Cash FlowsDocument3 pagesPas 7 Statement of Cash FlowsJESSIE GIL DUMONo ratings yet

- Case Study Financial Analysis of AmazonDocument12 pagesCase Study Financial Analysis of AmazonjastocazaNo ratings yet

- Ilec Unit 2 Company Law: Company Formation and ManagementDocument4 pagesIlec Unit 2 Company Law: Company Formation and Managementხათუნა გოგიაშვილიNo ratings yet

- Business Questions - Edited-1697955343.6471043Document4 pagesBusiness Questions - Edited-1697955343.6471043Philis NafulaNo ratings yet

- Case Problem 10.1:: Somerset Furniture Company's Global Supply ChainDocument2 pagesCase Problem 10.1:: Somerset Furniture Company's Global Supply ChainAlyssa CasabalNo ratings yet

- The Contemporary World ReviewerDocument3 pagesThe Contemporary World ReviewerJoanna Perez100% (1)

- 10.sei Nei KOH-Measuring Manufacturing Production - SingaporeDocument16 pages10.sei Nei KOH-Measuring Manufacturing Production - SingaporeSanja AngNo ratings yet

- Statistik Perusahaan Pergadaian Indonesia - Januari 2023Document16 pagesStatistik Perusahaan Pergadaian Indonesia - Januari 2023math.daringNo ratings yet

- Capital Planning 2Document87 pagesCapital Planning 2kudasanyahNo ratings yet