Professional Documents

Culture Documents

BBA 27 Batch (Section A & C) Advanced Financial Accounting - II (2201)

Uploaded by

ahmedxisan179Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BBA 27 Batch (Section A & C) Advanced Financial Accounting - II (2201)

Uploaded by

ahmedxisan179Copyright:

Available Formats

Department of Accounting & Information Systems

BBA 27th Batch (Section A & C)

2 Year 2 Semester 2nd Mid Term Examination 2023

nd nd

Advanced Financial Accounting – II (2201)

9th May 2023

Course Instructor: Ms. Bilkis Akhter

Square Ltd acquired two subsidiaries as follows:

1 July 2011 80% of Ethos Ltd for TK 10 million when the carrying amount of the net assets of

Ethos Ltd was TK 8 million (represented by share capital of TK 76,00,000 and

retained earnings of TK 400,000).

30 November 2017 65% of Pathos Ltd for TK 4 million when the carrying amount of the net assets

of Pathos Ltd was TK 3.2 million (represented by share capital of TK 24,00,000

and retained earnings of TK 800,000).

The income statements of the companies for the year ended 31 March 2018 were as follows.

Square Ethos Pathos

Ltd Ltd Ltd

TK '000 TK '000 TK '000

Revenue 10,000 6,000 5,820

Cost of sales (6,000) (4,600) (5,640)

Gross profit 4,000 1,400 180

Net operating expenses (2,000) (1,000) (300)

Finance cost – (100) (420)

Investment income 460 – –

Profit/(loss) before tax 2,460 300 (540)

Income tax expense (600) (100) –

Profit/(loss) for the year 1,860 200 (540)

Extracts from the statements of changes in equity of the companies (all relating to retained earnings) for theyear

ended 31 March 2018 were as follows.

Square Ethos Pathos

Ltd Ltd Ltd

TK '000 TK '000 TK '000

Net profit/(loss) for the year 1860 200 (540)

Interim dividends on ordinary shares (400) (100) –

1,460 100 (540)

Balance brought forward 3,000 480 1.160

Balance carried forward 4,460 580 620

Additional information

(i) On 1 April 2017 Pathos Ltd issued TK 4.2 million 10% loan stock to Square Ltd. Interest is

payable twice yearly on 1 October and 1 April. Square Ltd has accounted only for the interest

received on 1 October 2017.

(ii) On 1 April 2017 Ethos Ltd sold a freehold property to Square Ltd for TK 16,00,000 (land element

TK 600,000). The property originally cost TK 18,00,000 (land element TK 200,000) on 1 April

2007. The property's total useful life was 50 years on 1 April 2007 and there has been no change in the

useful lifesince that time. Ethos Ltd has credited the profit on disposal to 'Net operating expenses'.

(iii) The property, plant and equipment of Pathos Ltd on 30 November 2017 was valued at TK 10,00,000

Answered – Nurun Nabi Mahmud, A&IS 26th

(carrying amount TK 7,00,000) and was all acquired in April 2017. Those assets have a total useful life

of ten years. Pathos Ltd has not adjusted its accounting records to reflect fair values.

(iv) Square Ltd charges Ethos Ltd an annual fee of TK 170,000 for management services. This has been

recognised by Square Ltd in 'Investment income'.

(v) Square Ltd has recognised its dividend received from Ethos Ltd in 'Investment income'.

(vi) In 2012 the impairment review revealed a loss of TK 21,60,000 in relation to Ethos Ltd. A further loss

of TK 360,000 has been identified in the current year. In addition, the impairment review in relationto

the acquisition of Pathos Ltd has revealed a loss of TK 204,000.

Requirement

Prepare the consolidated income statement for Square Ltd for the year ended 31 March 2018 and

the movement on retained earnings and minority interest (Non-Controlling Interest) as they

would appear in the consolidated statement of changes in equity for the year ended 31 March

2018.

Answer

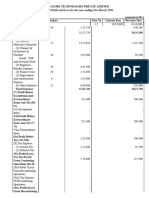

Consolidated income statement for the year ended 31 March 2018 TK '000

Revenue (W2) 17,940

Cost of sales (W2) (12,480)

Gross profit 5,460

Net operating expenses (W2) (3,632)

Finance cost (W2) (100)

Investment income (W2) 280

Profit before tax 2,008

Income tax expense (W2) (700)

Profit after tax 1,308

Attributable to equity holders of Square Ltd (β) 1,360

Minority interest (W3) (52)

1,308

Consolidated statement of changes in equity for the year ended 31 March 2018 (extract)

Retained Minority

earnings Interest

TK '000 TK '000

Profit/(loss) for the period 1,360 (52)

Interim dividends on ordinary shares (50 × 20%) (400) (20)

960 (72)

Arising on acquisition of subsidiary (W9) – 1,225

Balance brought forward (W7 and W8) 904 1,616

Balance carried forward 1,864 2,769

Answered – Nurun Nabi Mahmud, A&IS 26th

WORKINGS

1) Group structure

Square Ltd

Ethos Ltd Pathos Ltd

80% 65% 4 /12 (30 November 2017)

2) Consolidation schedule

Square Ethos Pathos

Ltd Ltd Ltd 4/12 Adj Consol

TK '000 TK '000 TK '000 TK '000 TK '000

Revenue 10,000 6,000 1,940 17,940

C of S (6,000) (4,600) (1,880) (12,480)

Op expenses

Per question (2,000) (1,000) (100) 170

PURP (W4) (128)

Dep adj (W5) (10)

Impairment of GW (360 + 204) (564) (3,632)

Finance cost (W6) (100) (140) 140 (100)

Inv income

Per question (460 – (80% × 100)) 380 (170)

Accrued loan stock interest 210 (140) 280

(W6)

Tax (600) (100) (700)

PAT/(loss) 72 (190)

3) Minority Interest (NCI)

Ethos Ltd (20% × 72 (W2)) 14

Pathos Ltd (35% × (190) (W2)) (66)

(52)

4) PURP on freehold property – Ethos Ltd

i) Profit on sale TK’ 000 TK’ 000 TK’ 000

Proceeds 1600

Less: Carrying amount of land and property at

disposal

Land 200

Property:

Cost 1600

Less: Accum dep [(1600/50)*10] (320) 1280 (1480)

120

Answered – Nurun Nabi Mahmud, A&IS 26th

ii) Depreciation adjustment

Annual depreciation

Without transfer (1600 50) 32

Actual depreciation with transfer ((1600 – 600) 40) (24)

8

128

5) Depreciation adjustment – Pathos Ltd

Fair value adjustment [(1000 – 700)/10]*(4/12) 10

6) Interest on loan stock

Loan of TK 4.2m with interest @ 10%

Annual interest 420,000

Split: Pre-acquisition 8 /12 280,000

Post-acquisition 4 /12 140,000

Square Ltd has accounted for six months only = TK 210,000 (6 /12 420,000)

Adjustment:

i) Include TK 210,000 in Square Ltd

ii) Remove TK 140,000 as post-acquisition intra-group transaction

7) Retained earnings b/f

Square Ltd 3,000

Ethos Ltd (80% × (480 – 400)) 64

Pathos Ltd –

Impairment of goodwill (2,160)

904

8) Minority interest b/f – Ethos Ltd

Share capital 7,600

Retained earnings b/f 480

Net assets b/f 8,080

× 20% 1,616

9) Minority interest arising on acquisition of subsidiary – Pathos Ltd

Share capital 2,400

Retained earnings at 1 April 2017 1,160

Loss to date of acquisition (800 – 1,160) (360)

800

Fair value adjustment (1,000 – 700) 300

3,500

× 35% 1,225

Answered – Nurun Nabi Mahmud, A&IS 26th

You might also like

- Test and Exam Qs Topic 2 - Solutions - v2 PDFDocument20 pagesTest and Exam Qs Topic 2 - Solutions - v2 PDFCindy YinNo ratings yet

- 11e Ch3 Mini Case Planning MemoDocument10 pages11e Ch3 Mini Case Planning MemoHao Cui0% (1)

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Financial Accounting IFRS Student Mark Plan June 2019Document16 pagesFinancial Accounting IFRS Student Mark Plan June 2019scottNo ratings yet

- Afar - Partnership, Corporate Liquadation & Home Office and BranchDocument31 pagesAfar - Partnership, Corporate Liquadation & Home Office and BranchMitch MinglanaNo ratings yet

- Problem 7-15 Part ADocument7 pagesProblem 7-15 Part AImelda100% (1)

- Batch 18 Final Preboard (P1)Document16 pagesBatch 18 Final Preboard (P1)Mike Oliver NualNo ratings yet

- FAR270 JULY 2022 SolutionDocument8 pagesFAR270 JULY 2022 SolutionNur Fatin Amirah100% (1)

- Statement of Cash Flows Lecture Questions and AnswersDocument9 pagesStatement of Cash Flows Lecture Questions and AnswersSaaniya AbbasiNo ratings yet

- Ifrs Feb 2019 KeyDocument4 pagesIfrs Feb 2019 Keyjad NasserNo ratings yet

- Assignment 2Document4 pagesAssignment 2Loveness Mphande100% (1)

- AFE 5008-B Model Answers For The Final Examinations: SolutionsDocument10 pagesAFE 5008-B Model Answers For The Final Examinations: SolutionsDiana TuckerNo ratings yet

- HKICPA QP Exam (Module A) Feb2006 Question PaperDocument7 pagesHKICPA QP Exam (Module A) Feb2006 Question Papercynthia tsuiNo ratings yet

- Bangladesh IFRS Project Extended Question - SanganaDocument13 pagesBangladesh IFRS Project Extended Question - SanganaShakhawatNo ratings yet

- Хариу HW2 ACC732Document6 pagesХариу HW2 ACC732ZayaNo ratings yet

- Cashflow Statements IAS 7 - P4Document10 pagesCashflow Statements IAS 7 - P4Vardhan Chulani100% (1)

- Standlone Cash Flow StatementDocument2 pagesStandlone Cash Flow StatementVaibhav SìňghNo ratings yet

- Ans Jan 2018 Far410Document8 pagesAns Jan 2018 Far4102022478048No ratings yet

- 5202 Rashed, With Solution - 123541Document10 pages5202 Rashed, With Solution - 123541RashedNo ratings yet

- Vitrox q22020Document16 pagesVitrox q22020Dennis AngNo ratings yet

- (Nikolay TSD) LCBB4001 Accounting Fundamentals-A1Document24 pages(Nikolay TSD) LCBB4001 Accounting Fundamentals-A1munnaNo ratings yet

- Growl Company Statement of Changes in Equity For The Year Ended December 31, 2023 Share Capital Share Premium Revaluation Surplus Gain - OCI (Debt)Document4 pagesGrowl Company Statement of Changes in Equity For The Year Ended December 31, 2023 Share Capital Share Premium Revaluation Surplus Gain - OCI (Debt)Jian CarlNo ratings yet

- Lesson 5c Pro-Forma Statement of EquityDocument3 pagesLesson 5c Pro-Forma Statement of EquityBEN CLADONo ratings yet

- Vitrox q42019Document17 pagesVitrox q42019Dennis AngNo ratings yet

- Cat Bact 312 June 2018Document4 pagesCat Bact 312 June 2018JohnNo ratings yet

- FRS 107 Ie 2016BBDocument10 pagesFRS 107 Ie 2016BBAmelia RahmawatiNo ratings yet

- Lecture 1 & 2 ExamplesDocument5 pagesLecture 1 & 2 ExamplesAbubakari Abdul MananNo ratings yet

- Choo Bee Metal Industries Berhad (10587-A)Document18 pagesChoo Bee Metal Industries Berhad (10587-A)Iqbal YusufNo ratings yet

- PPBInt RPT 2003Document15 pagesPPBInt RPT 2003Gan ZhiHanNo ratings yet

- 1Q 20 - Bursa (PMMA) FinalDocument12 pages1Q 20 - Bursa (PMMA) FinalGan ZhiHanNo ratings yet

- © The Institute of Chartered Accountants of India: ST STDocument6 pages© The Institute of Chartered Accountants of India: ST STVishal MehraNo ratings yet

- AdvancDocument4 pagesAdvancDerick cheruyotNo ratings yet

- Statement of CF - Dallas LTD - Intermediate Level ExerciseDocument4 pagesStatement of CF - Dallas LTD - Intermediate Level ExerciseNhư QuỳnhNo ratings yet

- CR Inter QuestionsDocument22 pagesCR Inter QuestionsRichie BoomaNo ratings yet

- SOLUTION DEC 2018 No TicksDocument8 pagesSOLUTION DEC 2018 No Ticksanis izzatiNo ratings yet

- GT Company (GTC) : Balance Sheet As On 31 March .Document1 pageGT Company (GTC) : Balance Sheet As On 31 March .Karthikeyan RamamoorthyNo ratings yet

- Illustrative Examples: A Statement of Cash Flows For An Entity Other Than A Financial InstitutionDocument9 pagesIllustrative Examples: A Statement of Cash Flows For An Entity Other Than A Financial InstitutionjohnNo ratings yet

- Wahyudi-Syaputra Homework-10Document5 pagesWahyudi-Syaputra Homework-10Wahyudi SyaputraNo ratings yet

- Corporate Reporting - ND2020 - Suggested - Answers - Review by SBDocument13 pagesCorporate Reporting - ND2020 - Suggested - Answers - Review by SBTamanna KinnoreNo ratings yet

- AFR 2 End of Semester Examination 2022-2023Document10 pagesAFR 2 End of Semester Examination 2022-2023Sebastian MlingwaNo ratings yet

- Advanced Accounting 2aDocument4 pagesAdvanced Accounting 2aHarusiNo ratings yet

- Eeff Ilustrativos Niif PymesDocument16 pagesEeff Ilustrativos Niif PymesjgilzamoraNo ratings yet

- Adv Level Corporate Reporting (CR)Document24 pagesAdv Level Corporate Reporting (CR)FarhadNo ratings yet

- Financial Accounting and Reporting: IFRS - 2016 June MSDocument17 pagesFinancial Accounting and Reporting: IFRS - 2016 June MSMarchella LukitoNo ratings yet

- Running Head: Financial AccountingDocument9 pagesRunning Head: Financial AccountingKashémNo ratings yet

- HKICPA QP Exam (Module A) Sep2008 Question PaperDocument9 pagesHKICPA QP Exam (Module A) Sep2008 Question Papercynthia tsui67% (3)

- Advanced Financial Reporting 1.PDF Nov 2011 1Document12 pagesAdvanced Financial Reporting 1.PDF Nov 2011 1Prof. OBESENo ratings yet

- AFA IIP.L IIIQuestion June 2016Document4 pagesAFA IIP.L IIIQuestion June 2016HossainNo ratings yet

- Tutorial 2 A192 QuestionDocument9 pagesTutorial 2 A192 QuestionMastura Abd HamidNo ratings yet

- OLC Chap 6Document11 pagesOLC Chap 6Isha SinghNo ratings yet

- Bishop Group (IAS-21 + Cashflow) : Cfap 1: A A F RDocument1 pageBishop Group (IAS-21 + Cashflow) : Cfap 1: A A F R.No ratings yet

- ProfitLoss - FY 22-23Document2 pagesProfitLoss - FY 22-23lekha vesatNo ratings yet

- Financial Accounting and Reporting: IFRS - 2021 December AKDocument15 pagesFinancial Accounting and Reporting: IFRS - 2021 December AKMarchella LukitoNo ratings yet

- Practice QNSDocument2 pagesPractice QNSIan chisemaNo ratings yet

- Master Question (Foreign) SOFP SOCIDocument2 pagesMaster Question (Foreign) SOFP SOCIShaheryar ShahidNo ratings yet

- Juara S Nainggolan SE. Case For Financial ReportingDocument4 pagesJuara S Nainggolan SE. Case For Financial Reportinganugrah dwi priadiNo ratings yet

- Financial Analysis 4Document10 pagesFinancial Analysis 4Alaitz GNo ratings yet

- Financial Management Economics For Finance 2023 1671444516Document36 pagesFinancial Management Economics For Finance 2023 1671444516RADHIKANo ratings yet

- Lesson 2Document5 pagesLesson 2kabaso jaroNo ratings yet

- Practice Exercise - Cobble Hill Part 3 Cash Flow - SolutionDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Solution155- Salsabila GadingNo ratings yet

- Charging All Costs To Expense When IncurredDocument27 pagesCharging All Costs To Expense When IncurredAnonymous N9dx4ATEghNo ratings yet

- AirtelDocument2 pagesAirtelShraddha RawatNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- C - 22 - Retained Earnings (Dividends, Appropriation, and Quasi-Reorganization) (PDocument14 pagesC - 22 - Retained Earnings (Dividends, Appropriation, and Quasi-Reorganization) (PJoyluxxiNo ratings yet

- Balance Sheet As Per Schedule VI Indian Companies Act, 1956: Liabilities AssetsDocument50 pagesBalance Sheet As Per Schedule VI Indian Companies Act, 1956: Liabilities AssetsSreekumar NarayanaNo ratings yet

- Profit Planning PDFDocument86 pagesProfit Planning PDFZinia SultanaNo ratings yet

- Working Capital Management of RINLDocument3 pagesWorking Capital Management of RINLSneha GuptaNo ratings yet

- Final Grading Examination Key AnswersDocument22 pagesFinal Grading Examination Key AnswersKimNo ratings yet

- Pt. Bhumi Saprolite Indonesia Summary Financial Projection Pabrik NickelDocument8 pagesPt. Bhumi Saprolite Indonesia Summary Financial Projection Pabrik Nickelfahbi firnandaNo ratings yet

- FAR560 GROUP PROJECT & PRESENTATION MAY2020 Q AmendedDocument7 pagesFAR560 GROUP PROJECT & PRESENTATION MAY2020 Q AmendedftnNo ratings yet

- Tutorial A - Topic 1 - Introduction To Accounting Concepts and PracticeDocument15 pagesTutorial A - Topic 1 - Introduction To Accounting Concepts and PracticeLUKMAN HAKIM BIN BORHANUDINNo ratings yet

- CFAS Chapter 8-9, 11 Financial StatementsDocument2 pagesCFAS Chapter 8-9, 11 Financial StatementsKaren CaelNo ratings yet

- Accounting 206Document3 pagesAccounting 206Evan MiñozaNo ratings yet

- Rapid Review Kieso v1Document12 pagesRapid Review Kieso v1mehmood981460No ratings yet

- Jntu QPR Financial Accounting and AnalysisDocument3 pagesJntu QPR Financial Accounting and AnalysisVijay KumarNo ratings yet

- Answer To Exercises On Inventory 1Document4 pagesAnswer To Exercises On Inventory 1Ria BryleNo ratings yet

- Income Statement Problems With AnswersDocument6 pagesIncome Statement Problems With AnswerskoftaNo ratings yet

- Summary Notes - Chapter 4 - 17th EditionDocument18 pagesSummary Notes - Chapter 4 - 17th EditionJosh ChakrabartyNo ratings yet

- Answer 4 - "Answers Only For Vaughn Company, Bennett Enterprise"Document3 pagesAnswer 4 - "Answers Only For Vaughn Company, Bennett Enterprise"Rheu ReyesNo ratings yet

- Gitman Test Bank CH - 11Document44 pagesGitman Test Bank CH - 11Hazem TharwatNo ratings yet

- Naic Cavite2019 Audit ReportDocument101 pagesNaic Cavite2019 Audit ReportKristin Jan OrbetaNo ratings yet

- TM01 - Lembar JawabanDocument4 pagesTM01 - Lembar JawabanMuhammad naufal FadhilNo ratings yet

- Solutions To Exercises - Chap 6Document20 pagesSolutions To Exercises - Chap 6InciaNo ratings yet

- Quiz 3. Adjusting Entries Attempt ReviewDocument11 pagesQuiz 3. Adjusting Entries Attempt ReviewTrisha Monique VillaNo ratings yet

- AMC Entertainment Holdings, Inc. Reports Second Quarter 2023 ResultsDocument17 pagesAMC Entertainment Holdings, Inc. Reports Second Quarter 2023 ResultsDinheirama.comNo ratings yet

- Fabm2 LMSDocument21 pagesFabm2 LMSJuliana WaniwanNo ratings yet

- Module No. 1 - Chart of AccountsDocument4 pagesModule No. 1 - Chart of AccountsJingRellinNo ratings yet

- Mike Owjai Finance Income Statements For The Year Ended December 31, 2020Document6 pagesMike Owjai Finance Income Statements For The Year Ended December 31, 2020Alvaro LopezNo ratings yet

- Section A Answer BOTH Questions in This Section. 1 Aaron and Bitan Are in Partnership, Sharing Profits and Losses EquallyDocument15 pagesSection A Answer BOTH Questions in This Section. 1 Aaron and Bitan Are in Partnership, Sharing Profits and Losses EquallySethmika DiasNo ratings yet

- Capital Reduction 2Document6 pagesCapital Reduction 2SANJIB SHARMANo ratings yet