Professional Documents

Culture Documents

Book 1

Uploaded by

priyankanandy440Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Book 1

Uploaded by

priyankanandy440Copyright:

Available Formats

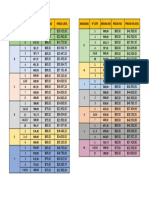

Employee id Name Hourly Wage Hours Work Taxable Income Taxes to be paid Tax Rate: 0.

07

1 Julia $ 60.50 120 $ 7,260.00 $ 508.20

2 Cassie $ 56.00 100 $ 5,600.00 $ 392.00 Summary chart

3 Nate $ 82.00 87 $ 7,134.00 $ 499.38

Column C Column D Column E Column F

4 Jeff $ 69.00 210 $ 14,490.00 $ 1,014.30

5 Emily $ 83.00 68 $ 5,644.00 $ 395.08

6 Fransisca $ 65.00 117 $ 7,605.00 $ 532.35

Taxable income, Taxes owned , etc:-

7 Lucas $ 54.00 98 $ 5,292.00 $ 370.44 $1,014.30

8 Millie $ 50.00 101 $ 5,050.00 $ 353.50

9 Jordan $ 64.00 76 $ 4,864.00 $ 340.48

$508.20 $499.38$14,490.00 $532.35

10 Noah $ 90.00 69 $ 6,210.00 $ 434.70 $392.00 $395.08 $370.44 $353.50 $340.48

$434.70

TOTALS: $ 673.50 1046 $ 69,149.00 $ 4,840.43 $7,260.00

$5,600.00$7,134.00

$7,605.00

$5,644.00 $5,292.00$5,050.00$4,864.00$6,210.00

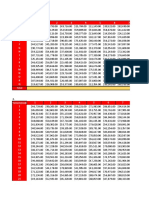

AVERAGE: $ 122.45 190.1818181818 $ 12,572.55 $ 880.08 120 100 87 210 68 117 98 101 76 69

$60.50 $56.00 $82.00 $69.00 $83.00 $65.00 $54.00 $50.00 $64.00 $90.00

Highest: $ 90.00 210 $ 14,490.00 $ 1,014.30

C assi e

Mi l l i e

L u c as

Nat e

Julia

Em i l y

J o rd an

No ah

si sc a

J e ff

Fran

Lowest: $ 50.00 68 $ 4,864.00 $ 340.48

Employees

Number of Employees $ 10.00 10 $ 10.00 $ 10.00 1 2 3 4 5 6 7 8 9 10

You might also like

- Supplier Quality Manual - Edition 3 - April 2010Document14 pagesSupplier Quality Manual - Edition 3 - April 2010sosobigmanNo ratings yet

- Industrial EngineeringDocument15 pagesIndustrial EngineeringSavantNo ratings yet

- 22 Qualities That Make A Great LeaderDocument6 pages22 Qualities That Make A Great LeaderSalisu BorodoNo ratings yet

- Compound Interest CalculatorDocument3 pagesCompound Interest CalculatorAubie MaopeNo ratings yet

- BIM Guide 2014Document37 pagesBIM Guide 2014Luis MogrovejoNo ratings yet

- E-Shopping: Profits of All Departments Average of MonthsDocument6 pagesE-Shopping: Profits of All Departments Average of Monthsstirred-martiniNo ratings yet

- Raw DataDocument2 pagesRaw Dataapi-3833385No ratings yet

- SI Daily Traffic Recharge ReportAug 01-12-2021Document88 pagesSI Daily Traffic Recharge ReportAug 01-12-2021Lindon ManehetaNo ratings yet

- Anne'SCatering CompanyDocument2 pagesAnne'SCatering CompanyMyron BrandwineNo ratings yet

- Savings CalculatorDocument3 pagesSavings Calculatoradamgross155No ratings yet

- Stanley College OSHC-Sheet - 100418Document3 pagesStanley College OSHC-Sheet - 100418Victor EleeasNo ratings yet

- TABLASDocument34 pagesTABLASWENDY OLIVIA ALMERAZ MEDINANo ratings yet

- Reporte de Ventas Ok Market Noviembre 2022Document9 pagesReporte de Ventas Ok Market Noviembre 2022XxKevin 1519No ratings yet

- Retirement Plan - ExcelDocument2 pagesRetirement Plan - ExcelMBNo ratings yet

- Bienvenidos Al Modelo, "Trading Hecho Sencillo"Document18 pagesBienvenidos Al Modelo, "Trading Hecho Sencillo"Daniel RamirezNo ratings yet

- Kopia Pliku Growth PlanDocument167 pagesKopia Pliku Growth PlanzyciemmemNo ratings yet

- Excel Basico 2Document7 pagesExcel Basico 2AlexanderUrbinaNo ratings yet

- SI Daily Traffic Recharge Report (May 01-27 2021)Document97 pagesSI Daily Traffic Recharge Report (May 01-27 2021)Lindon ManehetaNo ratings yet

- 52 Week Challenge - FINALDocument2 pages52 Week Challenge - FINALRizqi Uswatun HasanahNo ratings yet

- 2011 Tax ChartDocument8 pages2011 Tax ChartmreagansNo ratings yet

- Compound Interest CalculatorDocument3 pagesCompound Interest CalculatorLast PlayerNo ratings yet

- Suma de CortesDocument2 pagesSuma de CortesGustavo Juarez PimentelNo ratings yet

- Articulos Inventario Costo Por Unidad Costo Total Descuento DulcesDocument2 pagesArticulos Inventario Costo Por Unidad Costo Total Descuento DulcesNiicckNo ratings yet

- 9 - Advanced Monte CarloDocument9 pages9 - Advanced Monte CarloKevin MartinNo ratings yet

- GraficasDocument6 pagesGraficasRODREYNo ratings yet

- Exercise 16 Looking Up Information: Spell Checking A WorksheetDocument6 pagesExercise 16 Looking Up Information: Spell Checking A WorksheetjoanmubzNo ratings yet

- Investment ReportDocument3 pagesInvestment ReportHung PhanNo ratings yet

- Fho 2023Document6 pagesFho 2023oscar navarroNo ratings yet

- PERT EjercicioClaseDocument9 pagesPERT EjercicioClaseANGIE ROCIO AGUILERA OTALVARONo ratings yet

- Gabriel PCP FinalizadoDocument3 pagesGabriel PCP FinalizadoGabriel BegniniNo ratings yet

- Aplicação Dias 1° Op. 2° Op. 3° Op. 4° Op. 5° Op. 6° Op. 7° Op. 8° Op. 9° Op. 10° Op. Luc./ Prej. CapitalDocument8 pagesAplicação Dias 1° Op. 2° Op. 3° Op. 4° Op. 5° Op. 6° Op. 7° Op. 8° Op. 9° Op. 10° Op. Luc./ Prej. CapitalJosivan PereiraNo ratings yet

- Seattle Campus: Part-Time EnrollmentDocument89 pagesSeattle Campus: Part-Time EnrollmentPalash SharmaNo ratings yet

- Ejemplo de Tabla de AmortizacionDocument2 pagesEjemplo de Tabla de AmortizacionBeltran EsquivelNo ratings yet

- Financial Analysis ExampleDocument19 pagesFinancial Analysis ExampleAldrich BunyiNo ratings yet

- In-State Tuition: Wake Technical Community College Summer 2018 Tuition & FeesDocument1 pageIn-State Tuition: Wake Technical Community College Summer 2018 Tuition & FeesMouad ChoummaNo ratings yet

- Institución Valor Cuota CAE Tasa de Interés MensualDocument32 pagesInstitución Valor Cuota CAE Tasa de Interés MensualJorge Andres Tapia AlburquenqueNo ratings yet

- E-Portfolio Assignment SergioDocument4 pagesE-Portfolio Assignment Sergioapi-311375616No ratings yet

- GraficasDocument8 pagesGraficasRODREYNo ratings yet

- Bates Tuition and Fees 2022-20223-WEB-Updated-AccessibleDocument2 pagesBates Tuition and Fees 2022-20223-WEB-Updated-AccessibleMike KnightNo ratings yet

- Book1 Moises GuzmanDocument2 pagesBook1 Moises Guzmanapi-399083896No ratings yet

- Savings Week by Week DecreaseDocument1 pageSavings Week by Week DecreaseFitria AndrinaNo ratings yet

- Castillo Antonio Act1Document7 pagesCastillo Antonio Act1Antonio Castillo MiguelNo ratings yet

- Signature Assignment Spreadsheet-Spring 2024-AssignmentDocument2 pagesSignature Assignment Spreadsheet-Spring 2024-Assignmentapi-614327421No ratings yet

- Precio de Lista de PacaraosDocument1 pagePrecio de Lista de PacaraosJunior Quintana victorioNo ratings yet

- 001-Functions Financial Amortization SchedulesDocument114 pages001-Functions Financial Amortization SchedulesAbhishek srivastavaNo ratings yet

- Stock Dads Compound Interest CalculatorDocument4 pagesStock Dads Compound Interest CalculatorMNo ratings yet

- TareaS8 MarvinZelayaDocument12 pagesTareaS8 MarvinZelayaMarvin Yovany ZelayaNo ratings yet

- CityofSouthMia CitywideDrainImprovPhaseIV C107 1214 Nov 07Document10 pagesCityofSouthMia CitywideDrainImprovPhaseIV C107 1214 Nov 07graneros1944No ratings yet

- Archivo FormulasDocument19 pagesArchivo Formulasrobinson cabreraNo ratings yet

- Insurance Schedule CalculationsDocument4 pagesInsurance Schedule CalculationsalfredanandNo ratings yet

- Matemáticas Financieras: Evidencia de AprendizajeDocument5 pagesMatemáticas Financieras: Evidencia de AprendizajeMas JovNo ratings yet

- Cost AssignmentDocument4 pagesCost AssignmentAtka chNo ratings yet

- GastosDocument2 pagesGastosAndreyPonteNo ratings yet

- Planilha de Rentabilidade Dicasdodi BlogspotDocument6 pagesPlanilha de Rentabilidade Dicasdodi BlogspotalexjtavaresNo ratings yet

- Esperanza Matematica TradingDocument3 pagesEsperanza Matematica TradingDaniel TorresNo ratings yet

- Desafio 52 SemanasDocument1 pageDesafio 52 SemanasjuniorbarbosaaNo ratings yet

- Learning Excel FCCDocument19 pagesLearning Excel FCCwvansh5051No ratings yet

- My Income Chart: Expenses and SavingsDocument1 pageMy Income Chart: Expenses and SavingsJessica AningatNo ratings yet

- 2023 Math ExcelDocument7 pages2023 Math Excelryan.aristoteliNo ratings yet

- Erika Ximena SueldosDocument4 pagesErika Ximena SueldosXimeeri VFNo ratings yet

- Flujo de Caja Proyectado1Document8 pagesFlujo de Caja Proyectado1CHARLES WILLIAM SALAZAR SANCHEZNo ratings yet

- A B C D E F Lincoln Unified School District: 2019-2020 Certificated Salary ScheduleDocument1 pageA B C D E F Lincoln Unified School District: 2019-2020 Certificated Salary Scheduleapi-298382936No ratings yet

- House Age Square Feet Market Value Square Feet ValueDocument1 pageHouse Age Square Feet Market Value Square Feet ValuegopiNo ratings yet

- Appendix 32 BrgyDocument4 pagesAppendix 32 BrgyJovelyn SeseNo ratings yet

- Final Full Syllabus of ICAB (New Curriculum)Document96 pagesFinal Full Syllabus of ICAB (New Curriculum)Rakib AhmedNo ratings yet

- Company Profile EcaDocument20 pagesCompany Profile EcaStephen Anderson100% (1)

- Reichard Maschinen, GMBH: Nonnal MaintenanceDocument4 pagesReichard Maschinen, GMBH: Nonnal MaintenanceJayanthi HeeranandaniNo ratings yet

- Learnforexsummary Trading Support ResistanceDocument10 pagesLearnforexsummary Trading Support Resistancelewgraves33No ratings yet

- 1.supply Chain MistakesDocument6 pages1.supply Chain MistakesSantosh DevaNo ratings yet

- SAMPLE SALN - TEMPLATE (Legal Size)Document4 pagesSAMPLE SALN - TEMPLATE (Legal Size)Christina AdraoNo ratings yet

- BesorDocument3 pagesBesorPaul Jures DulfoNo ratings yet

- Naric Vs Naric Worker UnionDocument3 pagesNaric Vs Naric Worker UnionHib Atty TalaNo ratings yet

- CB Consumer MovementDocument11 pagesCB Consumer Movementbhavani33% (3)

- Mplus FormDocument4 pagesMplus Formmohd fairusNo ratings yet

- TOYOTA - Automaker Market LeaderDocument26 pagesTOYOTA - Automaker Market LeaderKhalid100% (3)

- Graduate School BrochureDocument2 pagesGraduate School BrochureSuraj TaleleNo ratings yet

- CH 20Document22 pagesCH 20sumihosaNo ratings yet

- PT78ST105HCDocument6 pagesPT78ST105HCLuis TavisNo ratings yet

- Corporate Finance Chapter10Document55 pagesCorporate Finance Chapter10James ManningNo ratings yet

- Accounting Crash CourseDocument7 pagesAccounting Crash CourseschmooflaNo ratings yet

- A cASE STUDY OF MEGA MERGER OF SBI WITH ITS FIVE SUBSIDIARIES PDFDocument4 pagesA cASE STUDY OF MEGA MERGER OF SBI WITH ITS FIVE SUBSIDIARIES PDFkartik naikNo ratings yet

- Module 6 - Operating SegmentsDocument3 pagesModule 6 - Operating SegmentsChristine Joyce BascoNo ratings yet

- Strategic Management Model ExamDocument82 pagesStrategic Management Model ExamSidhu Asesino86% (7)

- Organizational Culture and ChangesDocument3 pagesOrganizational Culture and ChangesCherry MoldeNo ratings yet

- Saving Your Rookie Managers From Themselves: by Carol A. WalkerDocument8 pagesSaving Your Rookie Managers From Themselves: by Carol A. WalkerOmar ChaudhryNo ratings yet

- Final Brand Building ProjectDocument14 pagesFinal Brand Building ProjectSarah TantrayNo ratings yet

- 3.theory Base of Accounting NotesDocument4 pages3.theory Base of Accounting Notesjency.ijaNo ratings yet

- Advanced Cost and Management Accounting ConceptsDocument17 pagesAdvanced Cost and Management Accounting ConceptsharlloveNo ratings yet

- Heartland Bank Brand Guidelines - 3 October 2017Document22 pagesHeartland Bank Brand Guidelines - 3 October 2017nainaNo ratings yet