Professional Documents

Culture Documents

Tariff Sheet Youth Plan

Uploaded by

Vishvaraj ManeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tariff Sheet Youth Plan

Uploaded by

Vishvaraj ManeCopyright:

Available Formats

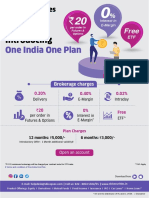

TARIFF SHEET Mandatory

I, hereby, consent to the following charges:

Account Opening Fee - 0 Inclusive of GST

Subscription Fee - 499 p.a. Inclusive of GST

Initial Cash Margin - 0

Brokerage Rates:

Cash Equity Derivative Currency Derivative Commodity Derivative

Segment Segment Segment Segment

Delivery Intraday Carry Intraday Carry Intraday Carry Intraday

forward forward forward

F&O F&O F&O

Rs.0 Rs.0 Rs.0 Rs.0 Rs.0 Rs.0 Rs.0 Rs.0

Interest rates:

Description Interest Rates

Stock used as Margin 0.049% per day for derivative trades (For non-cash

collateral limits used above 50% of the total required

margin).

Margin Trading Facility (MTF) 0.049% per day

For Delayed Payments 0.049% per day

Terms & Conditions:

1. Brokerage of Rs.49/- per executed order will be charged for orders placed through dealers/customer

service executives and trades squared off by Kotak Securities.

2. Trade Free Plan will be applicable from the 3rd year.

3. Processing fee for Securities Lending & Borrowing Mechanism (SLBM) will be 15% of lending &

borrowing fee, subject to minimum of 10 paise per share.

4. For Intraday trades, a nominal charge of 1 paise per scrip will apply.

5. For delivery trades, a nominal charge of 1 paise per order will apply.

6. In Equity F&O, additional brokerage of Rs.100 per executed order and the system square off charges will be

levied in case of risk liquidating positions due to margin or debtors shortfall.

7. Brokerage will not exceed the rates specified by SEBI and the Exchanges.

8. STT, CTT, GST and all other applicable exchange/ regulatory/ statutory charges/ taxes will be levied as per

applicable rates.

9. Interest would be charged on a monthly basis and is subject to change with 1 day prior notice.

Kindly refer our website for information on MarginTrading Facility(MTF).

For Office Use Only:

DP Rate Product Cash Derivative Currency Commodity Signature of account holder

Code Code

OV YP 23791 76320 76320 4022

You might also like

- TariffSheet YouthPlanDocument1 pageTariffSheet YouthPlanRahul PatilNo ratings yet

- Trad Free ChargesDocument1 pageTrad Free ChargesanimeshtechnosNo ratings yet

- Trade Free Pro Tariff SheetDocument1 pageTrade Free Pro Tariff Sheetmr.13sepNo ratings yet

- Trade_Free_Pro_f0986013a8Document1 pageTrade_Free_Pro_f0986013a8Deep NamataNo ratings yet

- Fit Diy 1hDocument1 pageFit Diy 1hRahul PatilNo ratings yet

- Tariff sheet consent for account opening chargesDocument1 pageTariff sheet consent for account opening chargesDeebak Ashwin ViswanathanNo ratings yet

- GFCBJJVDFBKKDocument1 pageGFCBJJVDFBKKHare KrishnaNo ratings yet

- Brokerage Rates: If You Are Trade Free Plan Customer, Below Brokerage Rate Will Be ApplicableDocument2 pagesBrokerage Rates: If You Are Trade Free Plan Customer, Below Brokerage Rate Will Be ApplicableLaser ArtzNo ratings yet

- Tradewise Tax PNL ReportDocument47 pagesTradewise Tax PNL ReportSamir KumarNo ratings yet

- Fit DiyDocument1 pageFit DiyTRANSIT STRNo ratings yet

- Tradewise Tax PNL ReportDocument71 pagesTradewise Tax PNL Reportchitranjan JegadeesanNo ratings yet

- Religare - (500 Account Opening) - V5Document2 pagesReligare - (500 Account Opening) - V5Bibhas HaldarNo ratings yet

- SBI Cap SecuritiesDocument2 pagesSBI Cap SecuritiesPooja maskeNo ratings yet

- IIFL Z20 - Revised Plan - Product Note - 31st Dec 2020Document2 pagesIIFL Z20 - Revised Plan - Product Note - 31st Dec 2020Piyush JainNo ratings yet

- Privy Optima: Brokerage Details-Applicable For Both SidesDocument1 pagePrivy Optima: Brokerage Details-Applicable For Both SidesSharma SNo ratings yet

- WLA Pricing W e F 21st June 2021Document9 pagesWLA Pricing W e F 21st June 2021Juri SaikiaNo ratings yet

- Franchise Financing Scheme (FFS) Credit Guarantee Corporation - Powering Malaysian SMEs®Document2 pagesFranchise Financing Scheme (FFS) Credit Guarantee Corporation - Powering Malaysian SMEs®ydjnaxNo ratings yet

- Financial Details Derivatives Segment PDFDocument2 pagesFinancial Details Derivatives Segment PDFSoumava PalNo ratings yet

- Financial Details Derivatives Segment PDFDocument2 pagesFinancial Details Derivatives Segment PDFyunusNo ratings yet

- List of All Fees, Charges, and Taxes On Trading and Investing - ZerodhaDocument5 pagesList of All Fees, Charges, and Taxes On Trading and Investing - Zerodhashah siddiqNo ratings yet

- Idirect - Brokerage PlansDocument7 pagesIdirect - Brokerage PlansJitenNo ratings yet

- Satrixnow Cost ProfileDocument3 pagesSatrixnow Cost ProfileMohavi MoaruNo ratings yet

- PDS Equity Home Financing IDocument10 pagesPDS Equity Home Financing IsyahnooraimanNo ratings yet

- PDS Personal Financing-I Programme TawarruqDocument6 pagesPDS Personal Financing-I Programme Tawarruq2023259044No ratings yet

- SME-Bank-PDS_MYS3_ENG_240616Document4 pagesSME-Bank-PDS_MYS3_ENG_240616Yowan SolomunNo ratings yet

- Ril Pe Price DT.01.02.2019Document89 pagesRil Pe Price DT.01.02.2019Akshat JainNo ratings yet

- Ril Pe Price DT.16.01.2019 PDFDocument86 pagesRil Pe Price DT.16.01.2019 PDFAkshat JainNo ratings yet

- Ril Pe Price Dt. 10.01.2019 PDFDocument89 pagesRil Pe Price Dt. 10.01.2019 PDFAkshat JainNo ratings yet

- Equity delivery plans and brokerage ratesDocument1 pageEquity delivery plans and brokerage ratesPraveen KumarNo ratings yet

- Product Disclosure Sheet: Export Credit Refinancing-IDocument5 pagesProduct Disclosure Sheet: Export Credit Refinancing-IRandaZarkelNo ratings yet

- Home Loan Sanction LetterDocument2 pagesHome Loan Sanction LetterKanakaReddyKannaNo ratings yet

- PDS BSN MyHome-i AHB40 Islamic Eng VersionDocument5 pagesPDS BSN MyHome-i AHB40 Islamic Eng VersionIqram RoslyNo ratings yet

- Reliance PE Pricing Policy UpdateDocument91 pagesReliance PE Pricing Policy UpdateAkshat JainNo ratings yet

- PDS - Personal Financing-I (Eng)Document3 pagesPDS - Personal Financing-I (Eng)Muhammad TaqiyuddinNo ratings yet

- Everything About ArtDocument88 pagesEverything About ArtRavinder SInghNo ratings yet

- Tradewise Tax PNL ReportDocument38 pagesTradewise Tax PNL Reportuodal rajNo ratings yet

- Tariff Sheet (Trading) : Fixed Brokerage PlanDocument5 pagesTariff Sheet (Trading) : Fixed Brokerage Planakhilsahu2004No ratings yet

- Costs and Profit Estimation in Equity InvestingDocument9 pagesCosts and Profit Estimation in Equity Investing483-ROHIT SURAPALLINo ratings yet

- Cash Plus Account InfosheetDocument5 pagesCash Plus Account Infosheetmarwane rokhoNo ratings yet

- Pe Price Dt. 01.03.2019Document89 pagesPe Price Dt. 01.03.2019mohdNo ratings yet

- PE_RO_PRICE_CIRCULAR_12.04.2024Document115 pagesPE_RO_PRICE_CIRCULAR_12.04.2024Prathamesh SinghNo ratings yet

- FAQ's Commodity: 1. How Can I Activate Commodity Segment For My Trading Account Held With SSL?Document9 pagesFAQ's Commodity: 1. How Can I Activate Commodity Segment For My Trading Account Held With SSL?AJAYNo ratings yet

- Profit Prior To IncorporationDocument11 pagesProfit Prior To IncorporationVasu JainNo ratings yet

- RHB Credit Cards Explained in 40 CharactersDocument13 pagesRHB Credit Cards Explained in 40 CharactersLoVe YiYiNo ratings yet

- 41 New Products of SBI (As On 30.09.2010)Document10 pages41 New Products of SBI (As On 30.09.2010)Abhinav SaraswatNo ratings yet

- CGTMSE: Supporting Micro and Small EnterprisesDocument28 pagesCGTMSE: Supporting Micro and Small EnterprisesAREAMANAGER MADURAINo ratings yet

- HL Pni V1 NTR 3596132948944013913 NTR 7818877607244788448Document2 pagesHL Pni V1 NTR 3596132948944013913 NTR 7818877607244788448KanakaReddyKannaNo ratings yet

- 12.T24 Money Market - R15Document68 pages12.T24 Money Market - R15Jagadeesh JNo ratings yet

- PE RO Price Circular Wef 1st Aug 2022Document103 pagesPE RO Price Circular Wef 1st Aug 2022DEEKSHA GUPTANo ratings yet

- 2022 Purchase Convert Special Rate - HomeDocument3 pages2022 Purchase Convert Special Rate - HomeOT PRACTICE TIMENo ratings yet

- Easy Equities Cost ProfileDocument5 pagesEasy Equities Cost ProfileKaka KuxNo ratings yet

- MANDATORY TARIFF SHEETDocument1 pageMANDATORY TARIFF SHEETIron XculptNo ratings yet

- Schedule of ChargesDocument1 pageSchedule of ChargesDivyesh DubeyNo ratings yet

- Pre-Incorporation Profits and LossesDocument37 pagesPre-Incorporation Profits and LossesGokarakonda Sandeep100% (1)

- Prepaid Brokerage Plan - ICICIDirectDocument1 pagePrepaid Brokerage Plan - ICICIDirect7v4cj5nrq9No ratings yet

- Tradewise Tax PNL ReportDocument184 pagesTradewise Tax PNL ReportShivani SinghNo ratings yet

- Sovereign Gold Bond: August 2020Document7 pagesSovereign Gold Bond: August 2020Chintan SardaNo ratings yet

- Risk To SharekhanDocument8 pagesRisk To SharekhanprakashinduNo ratings yet

- How to Trade Cfds Profitably: A Trader's Guide to Successful Cfd TradingFrom EverandHow to Trade Cfds Profitably: A Trader's Guide to Successful Cfd TradingNo ratings yet

- Bitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsFrom EverandBitcoin Mining 101: The Bitcoin Beginner's Guide to Making Money with BitcoinsNo ratings yet

- MK - ch12 - Cost of CapitalDocument13 pagesMK - ch12 - Cost of CapitalDwi Slamet RiyadiNo ratings yet

- Investors' Perceptions of Mutual Fund Risks An Empirical StudyDocument7 pagesInvestors' Perceptions of Mutual Fund Risks An Empirical StudySumeet SharmaNo ratings yet

- Security Selection and Asset AllocationDocument14 pagesSecurity Selection and Asset AllocationUzoamaka Okenwa-OkoyeNo ratings yet

- Accounting For Share CapitalDocument86 pagesAccounting For Share CapitalJPS JNo ratings yet

- National HighwayDocument12 pagesNational Highwayanuj19iitNo ratings yet

- Csec Pob January 2013 p2Document6 pagesCsec Pob January 2013 p2Ikera ClarkeNo ratings yet

- DocxDocument28 pagesDocxSunil KumarNo ratings yet

- UBLDocument41 pagesUBLArslan AshfaqNo ratings yet

- Segment ReportingDocument45 pagesSegment ReportingNidhi AnandNo ratings yet

- MF ISIN CodeDocument49 pagesMF ISIN CodeshriramNo ratings yet

- Co Location ScamDocument3 pagesCo Location ScamcdhjvkfyutdtjyNo ratings yet

- Chapter 7 Consolidated FS - Part 4Document8 pagesChapter 7 Consolidated FS - Part 4Shane KimNo ratings yet

- Primary and Secondary Functions of Commercial BanksDocument4 pagesPrimary and Secondary Functions of Commercial BanksVinod AroraNo ratings yet

- ForexDocument1 pageForexUMAK Juris DoctorsNo ratings yet

- GM Financial Analysis - Final Paper-1Document12 pagesGM Financial Analysis - Final Paper-1api-534291498No ratings yet

- Exchange Arithmetic - Problems PDFDocument13 pagesExchange Arithmetic - Problems PDFNipul BafnaNo ratings yet

- Financing in Startups (Venture Capital) : Project TopicDocument5 pagesFinancing in Startups (Venture Capital) : Project TopicKaran Raj DeoNo ratings yet

- ACCOUNTANCY - II MID - Quastion PaperDocument6 pagesACCOUNTANCY - II MID - Quastion PaperveenaNo ratings yet

- Fundamentals of Futures and Options Markets 8th Edition Hull Solutions ManualDocument25 pagesFundamentals of Futures and Options Markets 8th Edition Hull Solutions ManualBeckySmithnxro98% (61)

- FM CH 3Document18 pagesFM CH 3samuel kebedeNo ratings yet

- Tutorial Letter 4/0/2017 Financial Strategy MAC4865: Define TomorrowDocument12 pagesTutorial Letter 4/0/2017 Financial Strategy MAC4865: Define TomorrowdevashneeNo ratings yet

- Financial Statement Analysis NotesDocument9 pagesFinancial Statement Analysis Notesshe lacks wordsNo ratings yet

- Gates Foundation 2009 IRS 990Document235 pagesGates Foundation 2009 IRS 990jointhefutureNo ratings yet

- Project Report On IIFLDocument8 pagesProject Report On IIFLPRIYA SHARMANo ratings yet

- Regulation 7 of SEBI (Prohibition of Insider Trading) Regulations, 2015Document7 pagesRegulation 7 of SEBI (Prohibition of Insider Trading) Regulations, 2015MLastTryNo ratings yet

- HUDCO - Term SheetDocument2 pagesHUDCO - Term SheetSandy DheerNo ratings yet

- E11 Optimum Capital StructureDocument10 pagesE11 Optimum Capital StructureTENGKU ANIS TENGKU YUSMANo ratings yet

- PGDFM Finacial Mangment Final PDFDocument260 pagesPGDFM Finacial Mangment Final PDFAnonymous H4xWhTmNo ratings yet

- FSD7Document2 pagesFSD7Leo the BulldogNo ratings yet

- Tarea 1 TallerDocument5 pagesTarea 1 TallerMiguel RomeroNo ratings yet