Professional Documents

Culture Documents

33 Wang Ernestine Exercise 33 Cost

Uploaded by

rita tamoh0 ratings0% found this document useful (0 votes)

2 views4 pagesThe document summarizes the production cost calculations for 19,000 units of SOPHIE completed in December. It includes details on raw material purchases and inventory, direct labor hours, overhead absorption, pre-established unit costs, and the actual production versus the estimates. The variances between the real and estimated costs are analyzed. The total unfavorable variance was 214,466.06, with unfavorable variances in raw materials, direct labor, and intermediate product costs.

Original Description:

33 WANG ERNESTINE EXERCISE 33 COST

Original Title

33 WANG ERNESTINE EXERCISE 33 COST

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes the production cost calculations for 19,000 units of SOPHIE completed in December. It includes details on raw material purchases and inventory, direct labor hours, overhead absorption, pre-established unit costs, and the actual production versus the estimates. The variances between the real and estimated costs are analyzed. The total unfavorable variance was 214,466.06, with unfavorable variances in raw materials, direct labor, and intermediate product costs.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views4 pages33 Wang Ernestine Exercise 33 Cost

Uploaded by

rita tamohThe document summarizes the production cost calculations for 19,000 units of SOPHIE completed in December. It includes details on raw material purchases and inventory, direct labor hours, overhead absorption, pre-established unit costs, and the actual production versus the estimates. The variances between the real and estimated costs are analyzed. The total unfavorable variance was 214,466.06, with unfavorable variances in raw materials, direct labor, and intermediate product costs.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Exercise 33

1. Calculation of the production cost of the 19000units of SOPHIE completed

The overhead absorbtion table

Elements supplying Workshop 1 Workshop 2 distribution

Secondary totals 210000 234800 256000 237000

Nature of work unit Kg of material Hour of Hour machine Cost of production

bought direct labour of output sold

Number of work unit 60000 5200 4800

Cost of work unit 3.5 45 53.333

Purchase cost of raw materials

Elements Material M Material N

quantity Unit price amount quantity Unit price amount

Raw materials 1/12 15000 24 360000 3000 30 900000

Raw materrials 15/12 15000 24.5 367500

Indirect charges 30000 3.5 105000 3000 3.5 105000

Production cost 30000 27.75 832500 30000 33.5 1005000

Inventory of raw materials

Elements Material M Material N

quantity Unit price amount quantity Unit price amount

Opening stock 6000 28 168000 10000 32 320000

Purchases 30000 27.75 832500 30000 33.5 1005000

WAUC 36000 27.79 1000500 40000 33.125 1325000

Consumption 27000 27.79 750375 35000 33.125 1159375

Final stock 9000 27.79 250125 5000 33.125 165625

Production cost of SO

Elements quantity Unit price amount

Raw materials 27000 27.79 750375

Direct labour 5200 65 338000

Indirect expenses 5200 45 234000

Production cost 20000 66.11875 1322375

Production cost of SOPHIE

Elements Quantity Unit price amount

Intermediate SO 20000 66.11875 1322375

Raw material N 35000 33.125 1159375

Direct labour 4800 70 336000

Indirect expenses 4800 53.333 256000

Production cost 19000 161.7763 3073750

3. Presentation of the unit pre- established cost of SOPHIE.

Elements Quantity Unit price Amount

Material M 1.35 27.5 37.125

Direct labour WS 1 0.25 65 16.25

Indirect charges WS 1 0.25 47 11.75

Unit production cost WS 1 1 65.125 65.125

Material N 1.7 34 57.8

Direct labour WS 2 0.235 68 15.98

Indirect charges 0.235 52.3404 12.3

Unit pdtion cost of SOPHIE 1 151.205 151.205

4. DETERRMINATION OF THE REAL PRODUCTION IN DECEMBER

Completed production = 19000

Initial product in process = 2000 for 275000 thus the unit price = 275000/2000 =137.5

Raw materials = (100/100 x 137.5) = 137.5

Direct labour = (60/100 x 137.5) = 82.5

Indirect charges = (70/100 x 137.5) = 55

Topal = (137.5 +82.5 + 55) = 275

Closing product in process =3000 for 438100 thus the unit price =438100/3000 = 146.03

Raw materials = (100/100 x 146.033) = 146.033

Direct labour = ( 80/100 x 146.033) = 116.8266667

Indirect charges = (70/100 x 146.033) = 102.2233333

Final product in process =( 146.033+116.8266667+102.2233333) = 365.083

Real production in December =( 19000 +275) – 365.083 =18910

5. Presentation of the table of comparism between the real cost and the pre- established cost.

Elements Real costs Pre- established costs Va riances

quantity Unit amount quantity Unit price amount - +

price

Intermediate 2000 66.1187 1322375 18910 65.125 1231513.75 _ 90861.25

product 5

Raw material N 35000 33.125 1159375 32147 34 1092998 66377

Direct lobour 4800 70 336000 4443.8 68 302181.8 33818.2

Indirect charges 4800 53.333 256000 4443.8 52.34 232590.383 23409.61

Global variance 214466.0

(unfavourable) 6

6. Analysis of variances on indirect expenses

Formulae

Variance on quantity = real quantity ( real price –pre- established price)

Variance on price = pre- established (real price – pre-established quantity)

Total variance = variance on quantity + variance on price

Variance on raw materrials

Variance on quantity = 35000 (33.125- 34) = -30625(favourable)

Variance on price = 34 ( 35000 – 32147) = 97002(unfavourable)

Total variance = -30625+ 97002 = 66377 (unfavourable)

variance on direct labour

variance on quantity = 4800 (70 – 68) = 9600 ( unfavourable)

variance on price = 68 ( 4800 – 4443.8) = 24221.6 ( unfavourable)

total variance = 9600 + 24221.6 = 33821.6 (unfavourable)

variance on intermediate product

variance on quantity = 20000 (66.11875 – 65.125) = 19875 (unfavourable)

variance o price = 65.125 (20000 – 18910) = 70986.25 (unfavourable)

total variance = 19875 + 70986.25 = 90861.25 ( unfavourable)

You might also like

- 06 Tcheutsoua Marie Christelle Exercise 06Document6 pages06 Tcheutsoua Marie Christelle Exercise 06rita tamohNo ratings yet

- 03 Tadzoa Francis EXO 03 COSTDocument4 pages03 Tadzoa Francis EXO 03 COSTrita tamohNo ratings yet

- 03 Tazoah Francis Exercise 03 CostDocument4 pages03 Tazoah Francis Exercise 03 Costrita tamohNo ratings yet

- Hello SirDocument8 pagesHello Sir2022-24 ANKIT KUMAR GUPTANo ratings yet

- Particulars P1 P2Document4 pagesParticulars P1 P2sanket pareekNo ratings yet

- Case SolutionsDocument11 pagesCase SolutionsMohit AgrawalNo ratings yet

- Account Excel Class 1Document14 pagesAccount Excel Class 1Flora bhandariNo ratings yet

- Cost Sheet Analysis: Aparna Parmar Damini Baijal Shambhawi SinhaDocument7 pagesCost Sheet Analysis: Aparna Parmar Damini Baijal Shambhawi SinhaShambhawi SinhaNo ratings yet

- Chap 8Document7 pagesChap 8minhndn21405No ratings yet

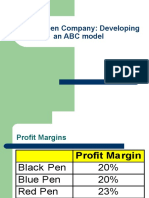

- Classic Pen Working HandoutsDocument1 pageClassic Pen Working HandoutsTushar DuaNo ratings yet

- Units of Fixed Goods To Be ProducedDocument8 pagesUnits of Fixed Goods To Be Producedbada donNo ratings yet

- Act 202 FinalDocument6 pagesAct 202 FinalMahiNo ratings yet

- Group 2: Dakshayani Biscuits (: Cost Sheet)Document6 pagesGroup 2: Dakshayani Biscuits (: Cost Sheet)Vinu DNo ratings yet

- Classic Pen HandoutsDocument1 pageClassic Pen HandoutsSuraj KumarNo ratings yet

- Chapter 2: Cost Management Concepts: Jayadevm@iimb - Ernet.inDocument20 pagesChapter 2: Cost Management Concepts: Jayadevm@iimb - Ernet.inPratyush GoelNo ratings yet

- Acc Assign Sem 2Document7 pagesAcc Assign Sem 2xuanylimNo ratings yet

- Yr1 Yr2 Yr3 Sales/year: (Expected To Continue)Document7 pagesYr1 Yr2 Yr3 Sales/year: (Expected To Continue)Samiksha MittalNo ratings yet

- 05 Wilkerson Company Solution - StudentsDocument9 pages05 Wilkerson Company Solution - StudentsVinyabhooshan Bajpai PGP 2022-24 Batch100% (1)

- Income StatementDocument11 pagesIncome StatementBianca Camille CabaliNo ratings yet

- Cost Sheet AnalysisDocument7 pagesCost Sheet AnalysisShambhawi SinhaNo ratings yet

- Answers:: Cost of Goods Manufactured Schedule For The Year EndedDocument5 pagesAnswers:: Cost of Goods Manufactured Schedule For The Year EndedAsim boidyaNo ratings yet

- Hassan Exame 21 AugustrDocument4 pagesHassan Exame 21 Augustrsardar hussainNo ratings yet

- Job Costing ADMDocument18 pagesJob Costing ADMSiddhanta MishraNo ratings yet

- Process CostingDocument4 pagesProcess Costingsus meetaNo ratings yet

- Classic PenDocument12 pagesClassic PenSamiksha MittalNo ratings yet

- Shri WCMDocument9 pagesShri WCMIrfan ShaikhNo ratings yet

- Classic Pen Company: Developing An ABC ModelDocument22 pagesClassic Pen Company: Developing An ABC Modeljk kumarNo ratings yet

- Make or Buy Decisions: (B) Limiting FactorDocument2 pagesMake or Buy Decisions: (B) Limiting FactorFarman ShaikhNo ratings yet

- Cost Sheet TemplatesDocument26 pagesCost Sheet TemplatessukeshNo ratings yet

- Classic Pen Co HandoutDocument1 pageClassic Pen Co HandoutbharathtgNo ratings yet

- Assignment-1 Classic Pen Company: Developing An Abc Model: Case BackgroundDocument5 pagesAssignment-1 Classic Pen Company: Developing An Abc Model: Case BackgroundRitika Sharma0% (1)

- 04 Akone Joseph Exercise 04 CostDocument4 pages04 Akone Joseph Exercise 04 Costrita tamohNo ratings yet

- Wilkerson ABC at CapacityDocument1 pageWilkerson ABC at CapacityTushar DuaNo ratings yet

- Budgetary ControlDocument14 pagesBudgetary ControlCool BuddyNo ratings yet

- Traditional Costing Method Ice-Mint Paan ElaichiDocument11 pagesTraditional Costing Method Ice-Mint Paan ElaichiI.E. Business SchoolNo ratings yet

- II Mor Chap 9 12.11.2020Document5 pagesII Mor Chap 9 12.11.2020Al BastiNo ratings yet

- Management Accounting and Control Systems Report On: Cost Sheet and Break Even AnalysisDocument9 pagesManagement Accounting and Control Systems Report On: Cost Sheet and Break Even AnalysisHavish P D SulliaNo ratings yet

- 9 200314-260314-Cost Effectiveness AnalysisDocument31 pages9 200314-260314-Cost Effectiveness AnalysisTewodros TadesseNo ratings yet

- MA Group1 SectionDDocument6 pagesMA Group1 SectionDananyaverma695No ratings yet

- Budgetary Control SolutionDocument9 pagesBudgetary Control SolutionAnkita VaswaniNo ratings yet

- MA - CASE - With GraphDocument13 pagesMA - CASE - With Graphanup akasheNo ratings yet

- Trout Inc. Prepared The Following Production Report-Weighted AverageDocument4 pagesTrout Inc. Prepared The Following Production Report-Weighted AverageJalaj GuptaNo ratings yet

- MA MathDocument16 pagesMA MathAvijit SahaNo ratings yet

- Danshui Plant 2 SolutionsDocument12 pagesDanshui Plant 2 SolutionsShashank AgarwalaNo ratings yet

- Correction Economic AnalysisDocument18 pagesCorrection Economic AnalysislucasNo ratings yet

- Classic Pen IIM RohtakDocument12 pagesClassic Pen IIM RohtakHEM BANSALNo ratings yet

- s15 16 (AutoRecovered)Document14 pagess15 16 (AutoRecovered)R GNo ratings yet

- Danshui CaseDocument9 pagesDanshui CaseNIKHIL CHAVANNo ratings yet

- Ex Tema 4Document4 pagesEx Tema 4Nuria VanesaNo ratings yet

- Destin Brass Products Co Case WorksheetDocument2 pagesDestin Brass Products Co Case WorksheetManishNo ratings yet

- Feasibility Report 2Document2 pagesFeasibility Report 2Jawad ahmadNo ratings yet

- MA - ExcelDocument7 pagesMA - ExcelKushal KaushikNo ratings yet

- K S Oils LTD.: Unsecured LoanDocument51 pagesK S Oils LTD.: Unsecured Loanshilpatiwari1989No ratings yet

- Nepa Projection AmitDocument43 pagesNepa Projection AmitDaya SharmaNo ratings yet

- LM (For 6.0m Length) : Item Ga 24 Stainless Steel Gutter UnitDocument40 pagesLM (For 6.0m Length) : Item Ga 24 Stainless Steel Gutter UnitCristina Dangla CruzNo ratings yet

- Unit 8 - BudgetingDocument8 pagesUnit 8 - Budgetingkevin75108No ratings yet

- Traditional Costing Method Vs ABC Costing Ice-Mint Paan ElaichiDocument11 pagesTraditional Costing Method Vs ABC Costing Ice-Mint Paan ElaichiI.E. Business SchoolNo ratings yet

- Activity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing ApproachDocument4 pagesActivity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing ApproachJay BrockNo ratings yet

- Manufacturing Surface Technology: Surface Integrity and Functional PerformanceFrom EverandManufacturing Surface Technology: Surface Integrity and Functional PerformanceRating: 5 out of 5 stars5/5 (1)

- Lukong Blessing Exercise 08 FormationDocument7 pagesLukong Blessing Exercise 08 Formationrita tamohNo ratings yet

- TEMATIO SANDRINE'S DATA - New1Document49 pagesTEMATIO SANDRINE'S DATA - New1rita tamohNo ratings yet

- Introduction To Law and Fundamental RightsDocument55 pagesIntroduction To Law and Fundamental Rightsrita tamohNo ratings yet

- PBG208 TC+CorrDocument25 pagesPBG208 TC+Corrrita tamohNo ratings yet

- PBG207 TC+CorrDocument20 pagesPBG207 TC+Corrrita tamohNo ratings yet

- Esg Budget Management Final VersionDocument66 pagesEsg Budget Management Final Versionrita tamohNo ratings yet

- OHADA Uniform Act 2000 Harmonization Accounts of Enterprises1Document13 pagesOHADA Uniform Act 2000 Harmonization Accounts of Enterprises1rita tamohNo ratings yet

- Sample Life Exam QuestionsDocument10 pagesSample Life Exam Questionsrita tamohNo ratings yet

- Raheel Ahmad Mechanical Engineer Cover Letter For Saudi AramcoDocument1 pageRaheel Ahmad Mechanical Engineer Cover Letter For Saudi AramcoRaheel Neo AhmadNo ratings yet

- Idea Vodafone Project FileDocument36 pagesIdea Vodafone Project FilePranjal jain100% (1)

- Maruti Suzuki Project PDF FreeDocument67 pagesMaruti Suzuki Project PDF FreeLGNo ratings yet

- Group 5 - Pharmaceutical IndustryDocument16 pagesGroup 5 - Pharmaceutical Industryanubhav deoNo ratings yet

- Hortatory Tugas PengayaanDocument4 pagesHortatory Tugas PengayaanaidaNo ratings yet

- IRT06101 Operation and Maintenance of Irrigation Systems 9: 1.0 Module Code: 2.0 Module Name: 3.0 CreditsDocument33 pagesIRT06101 Operation and Maintenance of Irrigation Systems 9: 1.0 Module Code: 2.0 Module Name: 3.0 CreditsRhoda AbdulNo ratings yet

- Global Nylon Feedstock and Fibers Market: Trend Analysis and Forecast To 2022Document2 pagesGlobal Nylon Feedstock and Fibers Market: Trend Analysis and Forecast To 2022JUAN SEBASTIAN BUSTOS GARNICANo ratings yet

- Tea Garden Process Flow - SAPDocument3 pagesTea Garden Process Flow - SAPMahmoodNo ratings yet

- Indian Footwear IndustryDocument6 pagesIndian Footwear IndustryVishal DesaiNo ratings yet

- Cargo Documents - CH1Document5 pagesCargo Documents - CH1Daniel FigueroaNo ratings yet

- MSCDocument34 pagesMSCdwieandreyNo ratings yet

- Solving Challenges in Agriculture With Blockchain - WOWTRACEDocument6 pagesSolving Challenges in Agriculture With Blockchain - WOWTRACEjunemrsNo ratings yet

- Supply Chain Management FunctionsDocument1 pageSupply Chain Management FunctionsRockyNo ratings yet

- DIPS Surat 01.06.2016 FINAL PDFDocument93 pagesDIPS Surat 01.06.2016 FINAL PDFmaitry tejaniNo ratings yet

- Ppap Check List: Lear Automotive India Pvt. Ltd.,NasikDocument73 pagesPpap Check List: Lear Automotive India Pvt. Ltd.,Nasikrajesh sharma100% (1)

- Chayote Production PlannDocument1 pageChayote Production PlannAntonio Jr TanNo ratings yet

- Manufacturing Finance With SAP ERP Financials: Subbu RamakrishnanDocument33 pagesManufacturing Finance With SAP ERP Financials: Subbu RamakrishnanKhalifa Hassan100% (1)

- Preliminary Pages CBLMDocument4 pagesPreliminary Pages CBLMAkim SabanganNo ratings yet

- International Business Strategy: Submitted To: Dr. Rojers P Joseph Submitted By: Group 4 - Section BDocument21 pagesInternational Business Strategy: Submitted To: Dr. Rojers P Joseph Submitted By: Group 4 - Section BDeepali GuptaNo ratings yet

- 1ZBF000261 Product Life Cycle Management - 2020-06-26Document2 pages1ZBF000261 Product Life Cycle Management - 2020-06-26Hossam AlzubairyNo ratings yet

- SFO Principles of REACH - Airport PDFDocument125 pagesSFO Principles of REACH - Airport PDFEladio YoveraNo ratings yet

- UMW Niugini Limited Are Looking For New TalentDocument1 pageUMW Niugini Limited Are Looking For New TalentJoe Ireeuw100% (1)

- Indian Dairy IndustryDocument11 pagesIndian Dairy IndustryRibhanshu RajNo ratings yet

- WPD Quiz 7 On 09-Nov-2021Document10 pagesWPD Quiz 7 On 09-Nov-2021Qasim KhokharNo ratings yet

- Total Amount Processed $167,731.48: Our Card Processing StatementDocument8 pagesTotal Amount Processed $167,731.48: Our Card Processing StatementJuan Pablo Marin100% (1)

- 11 BST Chap 01Document10 pages11 BST Chap 01Anuj YadavNo ratings yet

- Chapter 2 Resume AMP Strategic Cost Managemen - Adri Istambul LGDocument7 pagesChapter 2 Resume AMP Strategic Cost Managemen - Adri Istambul LGAdri Istambul Lingga GayoNo ratings yet

- On March 20 2016 Finetouch Corporation Purchased Two Machines at PDFDocument1 pageOn March 20 2016 Finetouch Corporation Purchased Two Machines at PDFhassan taimourNo ratings yet

- TEST 7 - Phung Chi KienDocument5 pagesTEST 7 - Phung Chi KienTăng Như ÝNo ratings yet

- Unit 1 Introduction & Forms of Business OrganizationDocument33 pagesUnit 1 Introduction & Forms of Business OrganizationDr. Nuzhath KhatoonNo ratings yet