Professional Documents

Culture Documents

Finance vs. Accounting Cheat Sheet - Oana Labes, MBA, CPA

Finance vs. Accounting Cheat Sheet - Oana Labes, MBA, CPA

Uploaded by

Dennis CklCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance vs. Accounting Cheat Sheet - Oana Labes, MBA, CPA

Finance vs. Accounting Cheat Sheet - Oana Labes, MBA, CPA

Uploaded by

Dennis CklCopyright:

Available Formats

ACCOUNTING VS.

FINANCE CHEAT SHEET

by

Oana

Labes

Accounting KPIs Accounting vs. Finance Finance KPIs

CASH CONVERSION CYCLE ECONOMIC VALUE ADDED (EVA)

= DSO + DIO - DPO SCOPE = EBIT (1-tax) - ((Long Term Debt + Equity) x WACC)

Accounting involves recording, analyzing, Finance involves managing and allocating

DAYS SALES OUTSTANDING (DSO) financial resources for businesses EARNINGS PER SHARE (EPS)

and reporting financial transactions

= Average Accounts Receivable / = (Net Income - Pref. Dividends) /

Net Credit Sales x 365 FOCUS Weighted Average Shares Outstanding

Accounting is drive to ensure the accuracy Finance is driven to create value through

DAYS PAYABLE OUTSTANDING (DPO) PRICE TO EARNINGS RATIO (P/E RATIO)

and compliance of financial data strategic capital allocation

= Average Accounts Payable / Purchases x 365 = Market Price per Share / Earnings per Share

TIMEFRAME (EPS)

DAYS INVENTORY OUTSTANDING (DIO)

= Average Inventory / COGS x 365 Accounting deals with the day-to-day Finance focuses on the long-term financial FREE CASH FLOW (FCF)

recording and reporting of financial health and growth of a business = Operating Cash Flow - Capital Expenditures

TOTAL ASSET TURNOVER transactions

= Net Sales / Average Total Assets

REGULATIONS WGT. AVG. COST OF CAPITAL (WACC)

Accounting adheres to regulatory Finance deals with capital structure, = (E/V x Re) + ((D/V x Rd) x (1 - Tax Rate))

RETURN ON ASSETS frameworks such as GAAP, IFRS, and tax investments, and risk management

= Net Income/ Average Total Assets regulations RETURN ON INVESTED CAPITAL (ROIC)

TOOLS OF THE TRADE = EBIT (1-tax) / (Long Term Debt + Equity - Cash)

GROSS PROFIT MARGIN

= (Net Sales - Cost of Goods Sold) / Net Sales Accounting involves recording, analyzing, Finance works with financial modeling,

DIVIDEND PAYOUT RATIO

and reporting financial transactions forecasting, and investment appraisal

= Dividends / Net Income

NET PROFIT MARGIN techniques

= Net Income / Net Sales

RETURN ON EQUITY (ROE)

DEBT TO EQUITY RATIO

= Total Debt / Total Equity

Accounting vs. Finance Designations = Net Income / Average Shareholder's Equity

RETURN ON ASSETS (ROA)

CURRENT RATIO = Net Income / Average Total Assets

=Current Assets/ Current Liabilities ACCOUNTING FINANCE OPERATING CASH FLOW RATIO

NET WORKING CAPITAL = Operating Cash Flow / Current Liabilities

= Current Assets - Current Liabilities

CPA US (Certified Public CFA (Chartered Financial Analyst)

Accountant) FRM (Financial Risk Manager) 10 Finance Skills

CPA Canada (Chartered CAIA (Chartered Alternative Inv.

The Master Budget Professional Accountant Analyst) For Managers

CMA (Certified Management CFP (Certified Financial Planner)

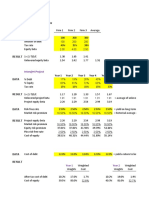

FINANCIAL FINANCIAL RATIO

Accountant) CTP (Certified Treasury

ANALYSIS ANALYSIS

OPERATING BUDGET CIA (Certified Internal Auditor) Professional)

ACCA (Association of Chartered CBV (Chartered Business Valuator) BUDGETING AND PERFORMANCE

Sales Forecast MANAGEMENT

Certified Accountants) CRM (Certified Risk Manager) FORECASTING

Revenue Budget FP&A (Certified Corporate

CGMA (Chartered Global BREAK-EVEN RISK

Financial Planning & Analysis MANAGEMENT

Management Accountant) ANALYSIS

Professional)

Cost of Sales (COS)

Production Budget

Selling and COST-VOLUME- CASH FLOW

Direct PROFIT ANALYSIS ANALYSIS

Materials

Direct

Labour

Manufacturing

Overhead Administration

Budget Budget Budget

(SG&A) PERFORMANCE

CAPITAL

Cost of Goods Manufactured

(COGM) and Cost of Goods Sold

(COGS) Budgets

Budget

Accounting vs. Finance Careers BUDGETING METRICS

WORKING CAPITAL BUSINESS/

Operating Cash Budget ASSET VALUATION

CAREER PROGRESSION MANAGEMENT

FINANCIAL BUDGETS

Staff Accountant → Senior Accountant →

Accounting Manager → Controller →

Financial Analyst → Senior Financial

Analyst → Financial Manager → CFO or Financial Analysis

Scorecard

Transition to Investment Banking,

CAPEX Cash Financing CFO

Private Equity, or Venture Capital Horizontal Analysis (Trend Analysis)

Budget Budget Budget

WORK TYPE Horizontal Analysis

(Trend Analysis)

Budgeted Financial Statements

Detail-oriented, technical, compliance- Strategic, forward-looking, analytical,

Adapted from CPA Ontario

focused, process-driven decision-making-focused

(Common Size Analysis)

Investment Banking, Private Equity, Profitability

20 Confusing

Efficiency

Vertical Analysis

Audit, Tax, Consulting, Risk Ratios

Venture Capital, Corporate Strategy, Ratios

Management, Forensic Accounting

Treasury, Risk Management

Accounting Topics

ACCRUAL VS. CASH FIXED ASSETS VS

Liquidity Solvency

ACCOUNTING CURRENT ASSETS

Ratios Ratios

DEPRECIATION VS. ACCUMULATED

AMORTIZATION DEPRECIATION VS

DEPRECIATION EXPENSE Ratio, Sensitivity & Scenario Analysis

GROSS PROFIT VS.

CONTINGENT Cash Flow Analysis

NET PROFIT

LIABILITIES VS

GROSS PROFIT VS. CONTINGENT ASSETS

GROSS PROFIT

MARGIN

DEFERRED REVENUE VS.

UNBILLED (ACCRUED)

EBITDA RATIOS

GAAP VS REVENUE EBITDA MARGIN

IFRS

DEFERRED TAXES VS

CURRENT TAXES EBITDA / Revenue x 100

FAIR VALUE VS.

Cash Flow Analysis

HISTORICAL COST PROVISION VS INterest COverage

RESERVE

ALLOWANCE FOR

EBITDA / Interest Expene

DOUBTFUL ACCOUNTS VS CAPITAL STOCK VS

BAD DEBT EXPENSE RETAINED EARNINGS DEBT SERVICE COVERAGE

GOODWILL VS LEASE VS

EBITDA / (principal + interest)

INTANGIBLE ASSETS LOAN

FIXED CHARGE COVERAGE

CAPITAL EXPENDITURES VS USEFUL LIFE VS.

REVENUE EXPENDITURES ECONOMIC LIFE EBITDA + Fixed Charges - Cash Taxes -

Unfunded CAPEX - Shareholder Distributions) /

ACCOUNTING POLICY

FAIR VALUE VS. (P+I+Fixed Charges

VS. ACCOUNTING

CARRYING VALUE ESTIMATE

FUNDED DEBT TO EBITDA

Total Financed Debt / EBITDA

Follow @Oana Labes for more Finance, Business and Cash Flow Insights

You might also like

- The CFO's Cheat Sheet - Oana Labes, MBA, CPADocument1 pageThe CFO's Cheat Sheet - Oana Labes, MBA, CPATamer ŞenerNo ratings yet

- The CEO's First Year Checklist - WIP - Oana Labes, MBA, CPADocument1 pageThe CEO's First Year Checklist - WIP - Oana Labes, MBA, CPAKh Health100% (2)

- Click File - Download - The Corporate Finance Cheat Sheet - Oana Labes, MBA, CPADocument9 pagesClick File - Download - The Corporate Finance Cheat Sheet - Oana Labes, MBA, CPAMessias MorettoNo ratings yet

- Finance Is Not Accounting Oana Labes MBA CPA 1692546499Document16 pagesFinance Is Not Accounting Oana Labes MBA CPA 1692546499Jota PoyoNo ratings yet

- xFP&A How To Get ThereDocument21 pagesxFP&A How To Get Therekevin ostos julca100% (1)

- FP&A IntroDocument13 pagesFP&A Introruchirvatsal7731No ratings yet

- AFP GUIDE TO FP&A Organizational Structure - Trends and Best Practices. FP&A Guide Series. Sponsored By. Issue 5 PDFDocument19 pagesAFP GUIDE TO FP&A Organizational Structure - Trends and Best Practices. FP&A Guide Series. Sponsored By. Issue 5 PDFDave100% (1)

- Management Information SystemDocument25 pagesManagement Information SystemVaibhav GoyalNo ratings yet

- The EBITDA Vs Cash Flow Cheat Sheet - Oana Labes, MBA, CPADocument1 pageThe EBITDA Vs Cash Flow Cheat Sheet - Oana Labes, MBA, CPATadeu Andrade100% (1)

- 31 Top Finance Cheat Sheets 1693854197Document33 pages31 Top Finance Cheat Sheets 1693854197AyaNo ratings yet

- Discount Factor TemplateDocument5 pagesDiscount Factor TemplateRashan Jida Reshan100% (1)

- Accounting Fact SheetDocument1 pageAccounting Fact SheetSergio OlarteNo ratings yet

- Statement of Change in Financial Position-5Document32 pagesStatement of Change in Financial Position-5Amit SinghNo ratings yet

- Accounting FM NotesDocument2 pagesAccounting FM NotessapbuwaNo ratings yet

- Month End Close ChecklistDocument10 pagesMonth End Close ChecklistKv kNo ratings yet

- CFI AccountingfactsheetDocument1 pageCFI AccountingfactsheetHue PhamNo ratings yet

- Data MonetizationDocument3 pagesData MonetizationmohnishNo ratings yet

- 10 Skills For Your Finance Career: SwipeDocument48 pages10 Skills For Your Finance Career: SwipeJunias Folly100% (1)

- Company AnalysisDocument11 pagesCompany AnalysisRamesh Chandra DasNo ratings yet

- CFI Interview QuestionsDocument5 pagesCFI Interview QuestionsSagar KansalNo ratings yet

- Blackline: The Financial Close Is Critical, and Can Easily Be ImprovedDocument16 pagesBlackline: The Financial Close Is Critical, and Can Easily Be Improvedvishy100% (1)

- BEC NotesDocument17 pagesBEC NotescsugroupNo ratings yet

- CFO VP Finance Administration in Pittsburgh PA Resume Matthew BurlandoDocument2 pagesCFO VP Finance Administration in Pittsburgh PA Resume Matthew BurlandoMatthew BurlandoNo ratings yet

- Atlassian Pty LTD - 3-Statement Projection ModelDocument27 pagesAtlassian Pty LTD - 3-Statement Projection Modelmzhao8No ratings yet

- Comparable Companies: Inter@rt ProjectDocument9 pagesComparable Companies: Inter@rt ProjectVincenzo AlterioNo ratings yet

- Course Pledge - App Brewery 100 Days of PythonDocument1 pageCourse Pledge - App Brewery 100 Days of Python43A Nitanshu ShahaneNo ratings yet

- Process Phases of Asset Under Construction in SAP: Asset Module Optimization & Accuracy in Costing / Depreciation RunDocument2 pagesProcess Phases of Asset Under Construction in SAP: Asset Module Optimization & Accuracy in Costing / Depreciation RunUppiliappan GopalanNo ratings yet

- CPA Study Plan and Tips Simandhar EducationDocument6 pagesCPA Study Plan and Tips Simandhar Educationdaljeet singhNo ratings yet

- Executive Reporting PackageDocument50 pagesExecutive Reporting PackageArthsNo ratings yet

- FinQuiz - UsgaapvsifrsDocument12 pagesFinQuiz - UsgaapvsifrsĐạt BùiNo ratings yet

- Accounting vs. Finance - Oana Labes, MBA, CPADocument14 pagesAccounting vs. Finance - Oana Labes, MBA, CPAMAHADI HASANNo ratings yet

- Adam Uchman: SAP FI/CO, Lead Consultant - ContractDocument10 pagesAdam Uchman: SAP FI/CO, Lead Consultant - ContractManojManivannanNo ratings yet

- Cfa Level I - Us Gaap Vs IfrsDocument4 pagesCfa Level I - Us Gaap Vs IfrsSanjay RathiNo ratings yet

- Cheat Sheet For Financial Accounting PDF FreeDocument1 pageCheat Sheet For Financial Accounting PDF FreeNahom endNo ratings yet

- Cfo RoleDocument4 pagesCfo RoleTor AgaNo ratings yet

- 3 Statement Model: Strictly ConfidentialDocument9 pages3 Statement Model: Strictly ConfidentialAshokNo ratings yet

- DCF ModellDocument7 pagesDCF ModellziuziNo ratings yet

- Net Present Value TemplateDocument3 pagesNet Present Value TemplatedanielmugaboNo ratings yet

- Record To Report: Quality Close and ReportingDocument4 pagesRecord To Report: Quality Close and ReportingAnupam DasNo ratings yet

- Accenture Rethinking Risk Financial Institutions CFO CRODocument40 pagesAccenture Rethinking Risk Financial Institutions CFO CROkumarch2012No ratings yet

- Categories Business Management FinanceDocument35 pagesCategories Business Management FinancegeetmannNo ratings yet

- 2024 IFRS Diploma Study TextDocument26 pages2024 IFRS Diploma Study TextcraigsappletreeNo ratings yet

- Consolidation IIIDocument36 pagesConsolidation IIIMuhammad Asad100% (1)

- Financial PL Anning & Analysis Technical Mastery Program: Where Strategy and Analysis MeetDocument3 pagesFinancial PL Anning & Analysis Technical Mastery Program: Where Strategy and Analysis MeetAarnaaNo ratings yet

- Financial Modeling For Entrepreneurs - Foresight - Taylor DavidsonDocument36 pagesFinancial Modeling For Entrepreneurs - Foresight - Taylor DavidsonAhmed Furkan GulNo ratings yet

- Midterm Cheat SheetDocument3 pagesMidterm Cheat SheetHiếuNo ratings yet

- REG Study Guide 4-21-2013Document213 pagesREG Study Guide 4-21-2013Valerie ReadhimerNo ratings yet

- Answers To QuestionsDocument8 pagesAnswers To QuestionsElie YabroudiNo ratings yet

- Complete P&L Statement TemplateDocument4 pagesComplete P&L Statement TemplateGolamMostafaNo ratings yet

- PDF Cost Accounting Fundamentals Essential Concepts and Examples Steven M Bragg Ebook Full ChapterDocument53 pagesPDF Cost Accounting Fundamentals Essential Concepts and Examples Steven M Bragg Ebook Full Chapterwayne.neff749100% (3)

- Absorption Costing: - Kyambadde EdwardDocument22 pagesAbsorption Costing: - Kyambadde EdwardKamauWafulaWanyamaNo ratings yet

- Asset Under ConstructionDocument2 pagesAsset Under ConstructionmohammedraulmadridNo ratings yet

- Synergy ValuationDocument2 pagesSynergy ValuationrobinkapoorNo ratings yet

- CFI 3 Statement Model CompleteDocument9 pagesCFI 3 Statement Model Completehelmy muktiNo ratings yet

- Segment AnalysisDocument53 pagesSegment AnalysisamanNo ratings yet

- Strategic CFO Management Consultant in San Francisco Bay CA Resume Reynold SamoranosDocument3 pagesStrategic CFO Management Consultant in San Francisco Bay CA Resume Reynold SamoranosReynoldSamoranosNo ratings yet

- Consolidation ModelDocument19 pagesConsolidation ModelTran Anh VanNo ratings yet

- Expressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDocument3 pagesExpressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDGNo ratings yet

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet