Professional Documents

Culture Documents

Notice PDF

Uploaded by

sachme1998Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notice PDF

Uploaded by

sachme1998Copyright:

Available Formats

Confidential

Annexure B

Reasons for uploading of information on VRW/CRIU:

1. During FY 2022-23, the PCCIT (AP &TS) charge witnessed

a n unprecedented increase in personal income tax refunds, mostly

out of the ITRs processed by the CPC. Preliminary analysi s

show ed that some assessees having salary income were claiming

excessive and ineligible deductions and exemptions leading to huge

refunds. On further analysis of the data obtained from

DGIT(Systems),it was found that 6,23,918 returns filed in ITR-1 & 2

for AY 2022-23 by the assessee of AP&TS charge, refund of more than

Rs.25,000/- was claimed and the refund amount was more than

25% of prepaid taxes in each case and in some cases, the refund

claim was exceeding 75% to 90% of the prepaid taxes.

2. Deeper study of some sample cases revealed that the refund of

prepaid

taxes was because of the claim of certain exemptions

U / S 10(13A),10(14),10(15), and deductions u/s 24(b), 80CCD(1B),

80D, 80DD, 80DDB, 80E, 80EEA, 80EEB, 80GGC etc. In some cases,

it was also found that the total spending/investment supposedly

made to become eligible for the exemptions claimed in the return

far exceeded the salary income itself. It was also noticed that none

of these claims were made by the employees before the respective

DDOs and no details/proof for claim of deduction/exemption was

submitted with the ROI.

3. It is found that eight intermediaries have filed ITRs of more

than 3000

taxpayers, whose refund claims exceeded 25% of their prepaid taxes.

DGIT(Inv) Hyderabad conducted survey operations on these

intermediaries, during which the intermediaries admitted on oath

that they have neither verified nor have any proof of the

deduction/exemption claims of their clients and that wrongful

refunds were claimed in the returns filed by them for their clients

based on ineligible deduction/exemption. As per their admission,

they have cumulatively

Confidential

Annexure B

filed 20,891 ITRs across various A.Y's, with a total wrongful refund claim of

Rs. 1 3 9 . 3 0 Cr (approx.). Their clientele included employees from

C e n t r a l a n d State Governments, Banks, reputed tech Companies, etc.

Subsequently, some of their clients were summoned by the Investigation

Wing and they admitted on oath that the deduction/exemption claim ed

by t hem w as unsubstantiated and they agreed to update their returns.

4.D a t a r e g a r d i n g c a s e s o f r e f u n d s > R s . 2 5 0 0 0 / - a n d r e f u n d a m o u n t s

exceeding 25% of prepaid taxes, covering a total refund of Rs. 4631.36 Cr

was segregated and forwarded to the jurisdictional PCslT which identified

cases with red flags such as substantially higher deductions and directed

the JAOs to issue notices u/s 133(6) of the Act, calling for information

and proof regarding the e x e m p t i o n s / d e d u c t i o n s c l a i m e d i n t h e r e t u r n .

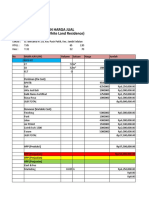

T h e d e t a i l s o f t h e n u m b e r o f notices issued, number of responses

received, number of persons who did not respond/ responded

p a r t i a l l y , a n d n u m b e r o f u p d a t e d r e t u r n s f i l e d withdrawing the

claim of refunds are tabulated as under:

PCIT CHARGE Cumulative Cumulative Cumulative Cumulative Cumulative Cumulative Cumulative Cumulative

(1) number of number of number of number of number of cases number of number of taxes

Notices No response cases where Final where final updated updated paid (in ELL

issued cases sent for adjournment responses Response is returns return Lakhs)

u/s 133(6) E-verification Sought/ Received till satisfactory/ no required to filed (9)

till date (3) PartialReply date updated return be (8)

(2) received/other (5) required/ case filed

till 01.01.2024 dropped (7)

(4) (6)

PCIT-1, 1716 679 406 731 42 560 432 132155

Hyderabad

PCIT-2 4843 1926 1082 1934 265 1731 1297 2343.8

Hyderabad

PCIT-4 4006 1765 642 1104 101 597 556 1483.17

Hyderabad

PCIT, Tirupati 16506 5320 5037 8433 99 8334 7351 12833.05

POT, Vizag 7789 2552 1640 3961 517 3509 2712 4177.01

PCIT, 9028 2181 1761 5249 595 4654 2732 3795.17

Vijayawada

TOTAL 43888 14418 10568 21412 1619 19385 15080 25954.75

Confidential

Annexure B

5. From the above table it is seen that in response to the notices

issued, 15,080 assessees admitted that they made wrong claims, filed

updated returns, and withdrew their claims for refunds. However, as can

be seen from the above d a t a , n o t a l l t h e a s s e s s e e s r e s p o n d e d t o t h e

n o t i c e s . D e s p i t e n o t i c e s a n d reminders being served, almost 33% of the

assessors chose not to respond. The D e p a r t m e n t a l s o c o n d u c t e d 1 8 5

o u t r e a c h p r o g r a m s w i t h D D O / Z A O s o f Multinational organizations.

The public sector organizations were also covered in these outreach

programs with wide publicity. The Department also issued approx.

63,474of advisories for taking remedial action where the claims of

deductions are suspicious in nature. Accordingly, a total of 14418

nonresponsive cases have been sent to the DG System for taking these

cases in the Risk Management System (RMS) module for e-verification.

6. S o m e of the assessees partially

responded by seeking a d j o u r n m e n t s / r e q u e s t i n g f u r t h e r

t i m e t o f u r n i s h p r o o f / d e t a i l s o f t h e exemptions/deductions claimed

but chose not to respond thereafter. From the data, it can be seen that

some of the assessees have not been responding to the n o t i c e s i s s u e d /

p o s t p o n i n g t h e p r o c e e d i n g s b e c a u s e t h e y d o n o t h a v e a n y evidence in

support of their wrong claims. The Department was contemplating

launching prosecution u/s 276C(1) or u/s 277 of the Income Tax Act

on the a s s e s s e e w h o i s c l a i m i n g w r o n g d e d u c t i o n s / e x e m p t i o n s .

A d d i t i o n a l l y , Department was considering launching prosecution on the

individuals working a s I n c o m e - t a x c o n s u l t a n t s u / s 2 7 8 o f t h e

I n c o m e - t a x A c t a s a b e t t o r s (abatement of false returns).

7. However, the offence of abetment/ inducement to file false returns

against t h e c o n s u l t a n t s c a n o n l y b e e s t a b l i s h e d i f t h e o f f e n s e b y t h e

individual assessees u/s.276C(1) or Sec.277 is proved. Further,

Sec.278 specifies the a m o u n t o f t a x e v a d e d b a s e d o n w h i c h t h e

quantum of punishment is to be

Confidential

Annexure B

decided. Hence, the prerequisites for launching prosecution

u/s.278 against the consultants for abetting/inducing the filing of

false returns are:

i.Prosecution against the individual assessees u/s.277 or

269C(1) are launched and the offences are proved

ii.Arriving at the amount of tax evaded to decide the

quantum of punishment.

7. T o i n i t i a t e p r o s e c u t i o n p r o c e e d i n g s o n u / s 2 7 6 C ( 1 ) o r u / s

277, the

quantum of tax evasion is necessary and that can be done only

a f t e r t h e Assessment proceedings are initiated on these assessees.

As mentioned earlier, a total of 14418 cases have been sent to the

DO System for taking these cases in the Risk Management System

(RMS) module. Additionally, it is imperative that the cases in which

assessees have submitted partial responses and are not submitting

complete details, those cases need to be uploaded in VRU/CRIU for

their inclusion in the RMS module. Once the quantum of tax

e v a s i o n i s established, the consequent prosecution proceedings

can be initiated by the competent Authority. Hence, this case is

uploaded in the CRIU/NTRU module of Insight.

You might also like

- A.M. No. P-17-3746Document6 pagesA.M. No. P-17-3746Sheraina GonzalesNo ratings yet

- Revised Methodology 23.12.2015Document38 pagesRevised Methodology 23.12.2015ykbharti101No ratings yet

- 2020 Annual Audit Report For Local Government AcademyDocument25 pages2020 Annual Audit Report For Local Government AcademyRapplerNo ratings yet

- Ts 389 Itat 2011 (Del) at KearneyDocument9 pagesTs 389 Itat 2011 (Del) at KearneyNeeta Punjabi BhatiaNo ratings yet

- GR No. 172231 CIR V Isabela Cultural CorporationDocument9 pagesGR No. 172231 CIR V Isabela Cultural CorporationRene ValentosNo ratings yet

- Before Hon'Ble Joint Commissioner (Appeals) : Central Goods and Service Tax: Delhi IndexDocument11 pagesBefore Hon'Ble Joint Commissioner (Appeals) : Central Goods and Service Tax: Delhi IndexUtkarsh KhandelwalNo ratings yet

- GST Book 6th Edition CDocument438 pagesGST Book 6th Edition CUtkarsh100% (1)

- Tax Cases April 28Document52 pagesTax Cases April 28Treborian TreborNo ratings yet

- QUIZ in Government Accounting Disbursements: (Group 3)Document6 pagesQUIZ in Government Accounting Disbursements: (Group 3)TokkiNo ratings yet

- CIR v. Isabela Cultural Corporation, G.R. No. 172231, 2007Document5 pagesCIR v. Isabela Cultural Corporation, G.R. No. 172231, 2007JMae MagatNo ratings yet

- GST 7th Edition PDFDocument366 pagesGST 7th Edition PDFUtkarshNo ratings yet

- CIR vs Isabela Cultural CorpDocument13 pagesCIR vs Isabela Cultural CorpmifajNo ratings yet

- Controller General of Defence AccountsDocument28 pagesController General of Defence AccountsadhityaNo ratings yet

- Issues Related To Taxation of NPOsDocument17 pagesIssues Related To Taxation of NPOsCA Poonam GuptaNo ratings yet

- CIR v. Isabela Cultural CorporationDocument1 pageCIR v. Isabela Cultural Corporationthirdy demaisipNo ratings yet

- Republic of Philippines Court of Tax Appeals Quezon: THE CityDocument23 pagesRepublic of Philippines Court of Tax Appeals Quezon: THE CityAemie JordanNo ratings yet

- 50 - (G.R. NO. 172231. February 12, 2007)Document7 pages50 - (G.R. NO. 172231. February 12, 2007)alda hobisNo ratings yet

- Frequent objections and issues in treasury bills, pensions, deposits and maintenanceDocument8 pagesFrequent objections and issues in treasury bills, pensions, deposits and maintenanceExecutive Engineer R&BNo ratings yet

- RMC No 102-2019Document3 pagesRMC No 102-2019AJ SantosNo ratings yet

- 57-CIR v. Isabela Cultural Corp. G.R. No. 172231 February 12, 2007Document5 pages57-CIR v. Isabela Cultural Corp. G.R. No. 172231 February 12, 2007Jopan SJNo ratings yet

- Income Certificate Latest GO 484Document5 pagesIncome Certificate Latest GO 484Kiranmai NallapuNo ratings yet

- SC Tax Decision2Document45 pagesSC Tax Decision2Jasreel DomasingNo ratings yet

- 09-PA2018 Part2-Observations and RecommendationsDocument29 pages09-PA2018 Part2-Observations and RecommendationsVERA FilesNo ratings yet

- CIR v ICC Tax Dispute Decision ReviewDocument21 pagesCIR v ICC Tax Dispute Decision ReviewVida MarieNo ratings yet

- CA Final DT Q MTP 1 May 23Document10 pagesCA Final DT Q MTP 1 May 23Mayur JoshiNo ratings yet

- CTA Case No. 9074 - Subic Water vs. CIRDocument83 pagesCTA Case No. 9074 - Subic Water vs. CIRJeffrey JosolNo ratings yet

- Master Circular 19.01.2022-Recovery of ArrearsDocument16 pagesMaster Circular 19.01.2022-Recovery of ArrearsShiv Swarup PandeyNo ratings yet

- Gross Income CasesDocument80 pagesGross Income CasesapperdapperNo ratings yet

- Cta 1D CV 08854 D 2017aug04 Ass PDFDocument39 pagesCta 1D CV 08854 D 2017aug04 Ass PDFYna YnaNo ratings yet

- AGNPO Midterms ReviewerDocument79 pagesAGNPO Midterms ReviewerKurt Morin Cantor100% (2)

- Hari Software Training FormatDocument30 pagesHari Software Training Formatvijayvadranam654No ratings yet

- ITR 4 Validation RulesDocument16 pagesITR 4 Validation RulesKuldeep JatNo ratings yet

- 17th SLC Minutes Held On 08-11-2017Document62 pages17th SLC Minutes Held On 08-11-2017Pramod PindipoluNo ratings yet

- Tax Updates by Atty. Riza LumberaDocument75 pagesTax Updates by Atty. Riza Lumberadmad_shayne50% (2)

- RTI Quarterly Reports 2021Document30 pagesRTI Quarterly Reports 2021rahul4u88No ratings yet

- GST Appeal Dispute Over Tax Invoice Date MismatchDocument12 pagesGST Appeal Dispute Over Tax Invoice Date MismatchUtkarsh KhandelwalNo ratings yet

- Peace Corps OST Task Analysis - CashierDocument10 pagesPeace Corps OST Task Analysis - CashierAccessible Journal Media: Peace Corps DocumentsNo ratings yet

- Supreme Court: Today Is Wednesday, February 27, 2019Document8 pagesSupreme Court: Today Is Wednesday, February 27, 2019Emiaj Francinne MendozaNo ratings yet

- Coon or Tax Appeals: Third DnisiikDocument31 pagesCoon or Tax Appeals: Third DnisiikAemie JordanNo ratings yet

- Incometax 29 09 2022Document3 pagesIncometax 29 09 2022nitishbhaskaran4No ratings yet

- GST Update28092019Document28 pagesGST Update28092019Akhil KashyapNo ratings yet

- GST 9th Edition BookDocument542 pagesGST 9th Edition BookLalli DeviNo ratings yet

- Cir vs. Isabela Cultural Corporation (Icc) : 1 Taxation Case Digest by Rena Joy C. CastigadorDocument2 pagesCir vs. Isabela Cultural Corporation (Icc) : 1 Taxation Case Digest by Rena Joy C. CastigadorsakuraNo ratings yet

- CIR v. Isabela CulturalDocument4 pagesCIR v. Isabela CulturalDiwata de LeonNo ratings yet

- Green Valley Marketing Corp. v. Commissioner of Internal Revenue, C.T.A. Case No. 8988, (November 3, 2017) PDFDocument42 pagesGreen Valley Marketing Corp. v. Commissioner of Internal Revenue, C.T.A. Case No. 8988, (November 3, 2017) PDFKriszan ManiponNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon CityDocument12 pagesRepublic of The Philippines Court of Tax Appeals Quezon CityCzar Ian AgbayaniNo ratings yet

- Accept Affects The Sample Size Required. The Lower The Risk The Auditor Is Willing To Accept, The Greater The Sample Size Will Need To BeDocument11 pagesAccept Affects The Sample Size Required. The Lower The Risk The Auditor Is Willing To Accept, The Greater The Sample Size Will Need To BeGao YungNo ratings yet

- Indian ADRCDocument21 pagesIndian ADRCSyed Tahir HussainNo ratings yet

- CBDT - E-Filing - ITR 1 - Validation RulesDocument15 pagesCBDT - E-Filing - ITR 1 - Validation Rulesshadab qureshiNo ratings yet

- Court Upholds Tax Deductions But Limits Professional FeesDocument3 pagesCourt Upholds Tax Deductions But Limits Professional Feesjleo1No ratings yet

- Tendering CVCC GuidelinesDocument2 pagesTendering CVCC GuidelinesSARATH KRISHNAKUMARNo ratings yet

- Petitioner Respondent: Bpi Capital Corporation, Commissioner of Internal RevenueDocument16 pagesPetitioner Respondent: Bpi Capital Corporation, Commissioner of Internal Revenuerian.lee.b.tiangcoNo ratings yet

- Monthly Operating Report: MOR (O47)Document11 pagesMonthly Operating Report: MOR (O47)Chapter 11 DocketsNo ratings yet

- Tax - CIR Vs Isabela Cultural CorpDocument11 pagesTax - CIR Vs Isabela Cultural CorpLudica OjaNo ratings yet

- Rahul Patil Audit Misrepresentations SuppressionsDocument4 pagesRahul Patil Audit Misrepresentations SuppressionsA PanickarNo ratings yet

- Ca Education: 8 EditionDocument478 pagesCa Education: 8 Editionankit singhNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Cash Flow and Capital Investment in Textile IndustryDocument76 pagesCash Flow and Capital Investment in Textile IndustryMuktadir BillahNo ratings yet

- BZUNPresentation March 2019-官网-editDocument21 pagesBZUNPresentation March 2019-官网-editPT Henza Global SinergiNo ratings yet

- Mathematical Literacy p1 Sep 2022 Eastern CapeDocument15 pagesMathematical Literacy p1 Sep 2022 Eastern CapeRexNo ratings yet

- Parkin Econ SM CH06Document21 pagesParkin Econ SM CH06Quang VinhNo ratings yet

- Bcom Fa - 20230121013946Document9 pagesBcom Fa - 20230121013946Swayam AgarwalNo ratings yet

- Part 2 - Investment ManagementDocument30 pagesPart 2 - Investment ManagementChethan BkNo ratings yet

- Setti Andrea-2014-Export PricingDocument123 pagesSetti Andrea-2014-Export PricingNguyễn HàNo ratings yet

- Economics of Strategy - Summary: Hubrecht Soline - 2020Document51 pagesEconomics of Strategy - Summary: Hubrecht Soline - 2020afaf kissamiNo ratings yet

- Web Order Acknowledgement: Adjusted Tax and Freight Will Appear On Invoice Based On Items ShippedDocument1 pageWeb Order Acknowledgement: Adjusted Tax and Freight Will Appear On Invoice Based On Items ShippedJackNo ratings yet

- Pre-Mediation ApplicationDocument2 pagesPre-Mediation ApplicationHarshitha MNo ratings yet

- Estimasi Perhitungan Harga Jual Perumahan WLR 2Document25 pagesEstimasi Perhitungan Harga Jual Perumahan WLR 2Next LevelManagementNo ratings yet

- A Systems Engineering Approach For Implementation of A CorporateDocument106 pagesA Systems Engineering Approach For Implementation of A CorporateMASOUDNo ratings yet

- Chapter - 4 MineDocument23 pagesChapter - 4 MineBereket MinaleNo ratings yet

- Basic Financial Statements Chapter Number 2Document2 pagesBasic Financial Statements Chapter Number 2Muhammad UsamaNo ratings yet

- Project On Online e PayDocument49 pagesProject On Online e PayAmaan RazviNo ratings yet

- The Professional CPA Review School - Auditing Problems First Preboard ExamDocument18 pagesThe Professional CPA Review School - Auditing Problems First Preboard ExamRodmae VersonNo ratings yet

- Lecture-Documentary Stamp TaxDocument13 pagesLecture-Documentary Stamp TaxJaiselle EscobedoNo ratings yet

- CORPORATE FINANCE - Chap 11Document4 pagesCORPORATE FINANCE - Chap 11Nguyễn T. Anh Minh100% (1)

- Catalogo Guarda OrdumeDocument11 pagesCatalogo Guarda OrdumeJúlio Cézar CastroNo ratings yet

- Nöz Social & Search Strategy: (Mehraael Sawers) (08/05/2023)Document22 pagesNöz Social & Search Strategy: (Mehraael Sawers) (08/05/2023)api-704773576No ratings yet

- Accounting AssignmentDocument17 pagesAccounting AssignmentStrom spiritNo ratings yet

- Financial Ratios Analysis: Dialog Axiata PLCDocument34 pagesFinancial Ratios Analysis: Dialog Axiata PLCjey456No ratings yet

- Economics WordsearchDocument1 pageEconomics WordsearchSandy SaddlerNo ratings yet

- Marketing To The Bottom of The Pyramid: CASE 3-3Document2 pagesMarketing To The Bottom of The Pyramid: CASE 3-3Nazmul Hasan NahidNo ratings yet

- Evaluating a New Sugarcane Peeling Machine PrototypeDocument10 pagesEvaluating a New Sugarcane Peeling Machine PrototypeOdior EmmanuelNo ratings yet

- Asc Coc Certificate: Controun ODocument3 pagesAsc Coc Certificate: Controun Oaktaruzzaman bethuNo ratings yet

- Mercurial Lite Paper v1Document9 pagesMercurial Lite Paper v1ivan chenNo ratings yet

- The Greatest Options Strategy Ever MadeDocument14 pagesThe Greatest Options Strategy Ever MadeAnkur DasNo ratings yet

- Inventory Mgt: Concepts, Motives & ObjectivesDocument5 pagesInventory Mgt: Concepts, Motives & ObjectivesEKANSH DANGAYACH 20212619No ratings yet

- National Webinar on Entrepreneurship Opportunities in EV IndustryDocument14 pagesNational Webinar on Entrepreneurship Opportunities in EV IndustryRajashekar VadlaNo ratings yet