Professional Documents

Culture Documents

Syllabus

Uploaded by

richanangiaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Syllabus

Uploaded by

richanangiaCopyright:

Available Formats

COMMERCIAL KNOWLEDGE & ETHICS

Course Code: 21BCP-0CK22T Credits: 04

COURSE OBJECTIVE: To familiarize the students with the understanding of issues and

practices of corporate governance and Corporate Social Responsibility in Indian and Global

context.

COURSE OUTCOMES:

The learning outcomes that students are expected to achieve in this course include

CO 1-To Distinguish between ethical and other types of values

CO 2-To recognize ethical considerations and values relevant to business activity

CO 3-To evaluate common beliefs about ethics—especially common beliefs about the role

of ethics in business

CO 4-To evaluate the ethics of particular business decisions and general practices in business

COURSE CONTENTS: Total Lecture Hours (40 Hours)

MODULE 1:

Introduction to Business Ethics The nature, purpose of ethics and morals for organizational

interests; Ethics and Conflicts of Interests; Ethical and Social Implications of business

policies and decisions; Corporate Social Responsibility; Ethical issues in Corporate

Governance

MODULE 2:

Environment issues Protecting the Natural Environment – Prevention of Pollution and

Depletion of Natural Resources; Conservation of Natural Resources

MODULE 3:

Ethics in Workplace Individual in the organization, discrimination, harassment, gender

equality. ; Ethics in Marketing and Consumer Protection Healthy competition and protecting

consumer’s interest

MODULE 4:

Ethics in Accounting and Finance Importance, issues and common problems

PEDAGOGY:

Primarily class lectures followed by question-answer sessions/ class tests/ assignments/

interactive sessions, reading of texts, compositions, case study would be used as an important

pedagogy.

TEXT & REFERENCES:

Text:

Bhanu Murthy, K. V. and Usha Krishna, Politics Ethics and Social Responsibilities of

Business, Pearson Education, New Delhi.

J. P. Sharma Corporate Governance, Business Ethics & CSR, Anne Books Pvt. Ltd., New

Delhi.

Christine A Mallin, Corporate Governance (Indian Edition), Oxford University Press, New

Delhi.

J.P. Sharma, Corporate Governance and Social Responsibility, Taxman, New Delhi

References:

Bob Tricker, Corporate Governance-Principles, Policies, and Practice (Indian Edition),

Oxford University Press, New Delhi.

Andrew Crane Dirk Matten, Business Ethics (Indian Edition), Oxford University Press,

New Delhi.

Daniel Albuquerque, Business Ethics, Principles and Practices (Indian Edition), Oxford

University Press, New Delhi.

Michael Blowfield, Alan Murray, Corporate Responsibility-A Critical Introduction,

Oxford University Press, New Delhi.

Francesco Perrini, Stefano, Antonio Tencati, Developing Corporate Social Responsibility-

A European Perspective, Edward Elgar

Readings:

Sir Adrian Cadbury Committee (UK), 1992, OECD principles of Corporate Governance,

1999 and Sarbanes-Oxley (SOX) Act, 2002 USA.

Corporate Scandal: Maxwell Communication Corporation and Mirror Group

Newspapers (UK), Enron (USA), World.Com (USA), Andersen Worldwide (USA) and

Vivendi (France).

Statutory Committees of Board -Remuneration Committee, Nomination Committee,

Compliance Committee, Shareholders Grievance Committee, Investors Relation

Committee, Investment Committee, Risk Management Committee, and Audit

Committee.

TOTAL MARKS: 100

II Course Assessment Components

This course is of 100 marks and will have the following assessment components. Final

Grades will be based on the relative performance of a student in the class

Mid Semester Quiz(s)/ Presentation Assignment(s

Attendance Total

Examination (s) )

15 15 5 5 40

End Semester Examination 60

100

Course Outcomes to Program Outcomes Mapping Matrix

PO’s (Program Outcomes)- At the end of the program the students will be able to:

Apply the knowledge of mathematics, accounting and finance for solving

PO-1

complex accounting and management problems.

PO-2 Demonstrate ethical and socially responsible behavior.

Create relevant, complete and accurate financial statements and information

PO-3 reports using the appropriate accounting principles to provide information to

measure the entity’s performance.

Interpret financial statement and organizational results to enhance the entity’s

PO-4

decision-making performance.

Showcase the knowledge of financial, managerial, tax, auditing, and

PO-5

international accounting principles and practices.

PO-6 Demonstrate an appreciation of the broad environment in which business

operates.

Develop critical thinking, quantitative reasoning, written, and oral

PO-7

communication.

Course

Programme Outcomes POs

Outcomes(COs)

PO PO

PO1 PO3 PO4 PO5 PO7

2 6

CO1 M M H H M H H

CO2 M M H H H H M

CO3 H H H H H H H

CO4 H M H H H H H

Where H= High relationship (covers up to 75-95% of the desired outcome); M=Medium

(covers up to 50 to 75%); L=Low (covers up to 10-50% of the desired outcome)

You might also like

- Making Sustainability Work: Best Practices in Managing and Measuring Corporate Social, Environmental, and Economic ImpactsFrom EverandMaking Sustainability Work: Best Practices in Managing and Measuring Corporate Social, Environmental, and Economic ImpactsRating: 3 out of 5 stars3/5 (2)

- BAIN Case Interview GuideDocument9 pagesBAIN Case Interview GuideNabihah Kara100% (2)

- Bitstream Case Solution and Analysis, HBR Case Study Solution & Analysis of Harvard Case StudiesDocument6 pagesBitstream Case Solution and Analysis, HBR Case Study Solution & Analysis of Harvard Case StudiesDeepesh Shenoy50% (2)

- Tutorial Chapter 6Document5 pagesTutorial Chapter 6onaNo ratings yet

- Errors - Discussion ProblemsDocument2 pagesErrors - Discussion ProblemsHaidee Flavier SabidoNo ratings yet

- FEU Quiz 2 Conso SYDocument6 pagesFEU Quiz 2 Conso SYclarissa paragas50% (2)

- Course Outline CBB by Prof. Deepa ReleDocument4 pagesCourse Outline CBB by Prof. Deepa ReleHIDDEN Life OF 【शैलेष】No ratings yet

- Semester I No TableDocument19 pagesSemester I No Tableanupriya3771No ratings yet

- BBA Final 27-12-12 UpdatedDocument48 pagesBBA Final 27-12-12 UpdatedsogatNo ratings yet

- MBA Syll 28-05-19Document242 pagesMBA Syll 28-05-19Sonu yaarNo ratings yet

- Unit Guide: Fin201 Corporate FinanceDocument11 pagesUnit Guide: Fin201 Corporate FinanceRuby NguyenNo ratings yet

- Saintgits Institute of Management: Name of The Faculty: Jinomol P Email-Id: Mobile No. 9895142914Document7 pagesSaintgits Institute of Management: Name of The Faculty: Jinomol P Email-Id: Mobile No. 9895142914SNEHA MARIYAM VARGHESE SIM 16-18No ratings yet

- IRLL Course File 2023Document14 pagesIRLL Course File 2023Hema LathaNo ratings yet

- IAM - Risk MathematicsDocument7 pagesIAM - Risk MathematicswirdinaNo ratings yet

- Fundamentals of MarketingDocument6 pagesFundamentals of MarketingAbdul HereNo ratings yet

- International MarketingDocument6 pagesInternational MarketingHafiz NomanNo ratings yet

- Business Ethics AssignmentDocument10 pagesBusiness Ethics AssignmentYee Sin MeiNo ratings yet

- Mathematics II OUTLINEDocument5 pagesMathematics II OUTLINEMuzammil ShabbirNo ratings yet

- SyllabusDocument18 pagesSyllabusBhavesh Kumar 1019No ratings yet

- Standard For HSM UMT (Corporate Finance)Document6 pagesStandard For HSM UMT (Corporate Finance)Ali ANo ratings yet

- B368F Course Info 2016Document7 pagesB368F Course Info 2016Kenny SzeNo ratings yet

- Screenshot 2024-03-01 at 9.39.09 AMDocument55 pagesScreenshot 2024-03-01 at 9.39.09 AMRiya JasNo ratings yet

- Syllabus of MBA 4th SemesterDocument51 pagesSyllabus of MBA 4th SemesterTanu Singh 1584No ratings yet

- Sample Ethics Outline 2Document5 pagesSample Ethics Outline 2Tammy GyaNo ratings yet

- Compensation and Benefit ManagementDocument37 pagesCompensation and Benefit ManagementWHO AM INo ratings yet

- BUS 201 Business and The Business EnvironmentDocument6 pagesBUS 201 Business and The Business EnvironmentNazirah HussinNo ratings yet

- FAR 635 - Lesson PlanDocument11 pagesFAR 635 - Lesson PlanAmirah HananiNo ratings yet

- Semester-I: Scheme of Examination andDocument63 pagesSemester-I: Scheme of Examination andBhavna MuthyalaNo ratings yet

- Syllabi Semester-I PDFDocument39 pagesSyllabi Semester-I PDFPuneet VermaNo ratings yet

- New SyllabusDocument5 pagesNew SyllabusJames BondNo ratings yet

- School of Economics, Finance and Banking Uum College of BusinessDocument9 pagesSchool of Economics, Finance and Banking Uum College of BusinessSofia ArissaNo ratings yet

- Economics CourseOutlineDocument10 pagesEconomics CourseOutlinenorman spenceNo ratings yet

- IMP-DH44ISB-1 Integrated Business Project K44 FINALDocument12 pagesIMP-DH44ISB-1 Integrated Business Project K44 FINALThu Hiền KhươngNo ratings yet

- New SyllabusDocument5 pagesNew SyllabusRajasingh BhumiharNo ratings yet

- BUS 231 Business LawDocument6 pagesBUS 231 Business LawNazirah HussinNo ratings yet

- Silabus Matrikulasi Audit Maksi 2019Document5 pagesSilabus Matrikulasi Audit Maksi 2019Fahmi Nur AlfiyanNo ratings yet

- Professional Ethics and Social Responsibility For SustainabilityDocument5 pagesProfessional Ethics and Social Responsibility For SustainabilityyeahNo ratings yet

- AudtheosyllabusDocument12 pagesAudtheosyllabusMichelle de GuzmanNo ratings yet

- FA22 Fundamentals of Management and OrganizationDocument8 pagesFA22 Fundamentals of Management and Organizationymaham YousafNo ratings yet

- A171 BEEEB 1013 Syllabus - 23 Ogos 2017Document10 pagesA171 BEEEB 1013 Syllabus - 23 Ogos 2017Aina ZalinaNo ratings yet

- A192 - BEEB 1013 SyllabusDocument9 pagesA192 - BEEB 1013 SyllabusJasmine TehNo ratings yet

- 2 Learning Outcomes and Learning DomainsDocument30 pages2 Learning Outcomes and Learning DomainsAzreen Bin JafaarNo ratings yet

- Module 0Document10 pagesModule 0SHIENNA MAE ALVISNo ratings yet

- MKT260 Internal OutlineDocument17 pagesMKT260 Internal OutlineLala PopNo ratings yet

- Programme: Bachelor of Business Management (Hons)Document10 pagesProgramme: Bachelor of Business Management (Hons)Shahed MohsenNo ratings yet

- Hbo SyllabusDocument13 pagesHbo SyllabusEarl Russell S PaulicanNo ratings yet

- Course Outline of ECSRDocument4 pagesCourse Outline of ECSRJaatooNo ratings yet

- Accounting For Managerial Decisions (B205201) Total Credits-5 L T P Semester 2 4 1 0 Course OutcomesDocument9 pagesAccounting For Managerial Decisions (B205201) Total Credits-5 L T P Semester 2 4 1 0 Course Outcomesmani singhNo ratings yet

- f0185ETHICS & CORPORATE GOVERNANCEDocument2 pagesf0185ETHICS & CORPORATE GOVERNANCEShashwat AnandNo ratings yet

- Advanced Financial Reporting Module OutlineDocument4 pagesAdvanced Financial Reporting Module Outlineevans muteeraNo ratings yet

- BA 501 - Social Responsibility and Good GovernanceDocument8 pagesBA 501 - Social Responsibility and Good GovernanceVal PinedaNo ratings yet

- Syllabus Aku 3302 - Auditing 2Document6 pagesSyllabus Aku 3302 - Auditing 2alfianaNo ratings yet

- JOM-Session 1 Conducted Together by Both FacultiesDocument14 pagesJOM-Session 1 Conducted Together by Both FacultiesPromil KumarNo ratings yet

- Principles of FinanceDocument9 pagesPrinciples of FinanceOmar FarukNo ratings yet

- Final - Assessment Brief (IHRM) 2021Document10 pagesFinal - Assessment Brief (IHRM) 2021Taqi TazwarNo ratings yet

- Agw610 Course Outline Sem 1 2013-14 PDFDocument12 pagesAgw610 Course Outline Sem 1 2013-14 PDFsamhensemNo ratings yet

- Modern Muslim World BAHU3073Document4 pagesModern Muslim World BAHU3073Usman AkhtarNo ratings yet

- AF432 Course Outline TII 2019Document12 pagesAF432 Course Outline TII 2019Alaric DallasNo ratings yet

- AF Course Outline 2020 FINAL PGDMSec BDocument13 pagesAF Course Outline 2020 FINAL PGDMSec BAditya SinghNo ratings yet

- Course Code: ECO 501 Level: MBA Semester: Semester I Credit Hours: 4 Course ObjectiveDocument5 pagesCourse Code: ECO 501 Level: MBA Semester: Semester I Credit Hours: 4 Course Objectivesatyendra_upreti2011No ratings yet

- FINN 400 - Applied Corporate Finance-Fazal Jawad Seyyed PDFDocument7 pagesFINN 400 - Applied Corporate Finance-Fazal Jawad Seyyed PDFAhmed RazaNo ratings yet

- Course Outline - Marketing ManagementDocument4 pagesCourse Outline - Marketing ManagementBhavesh KaushikNo ratings yet

- Om2 PDFDocument5 pagesOm2 PDFAliNo ratings yet

- Course OutlineDocument5 pagesCourse OutlinesafdarnazeerNo ratings yet

- Department of Management Birla Institute of Technology, Mesra, Ranchi - 835215 (India)Document227 pagesDepartment of Management Birla Institute of Technology, Mesra, Ranchi - 835215 (India)MohitAhujaNo ratings yet

- ADMAS UNIVERSITY Bakery PlanDocument17 pagesADMAS UNIVERSITY Bakery Planeyerusalem tesfaye100% (2)

- Sweden India Business Guide 2017Document62 pagesSweden India Business Guide 2017kijekaNo ratings yet

- From Potato Chips To Computer Chips: Features of Korea's Economic DevelopmentDocument41 pagesFrom Potato Chips To Computer Chips: Features of Korea's Economic DevelopmentBUINo ratings yet

- Taller de Comprensión LectoraDocument4 pagesTaller de Comprensión Lectorasandra zambranoNo ratings yet

- Mas1 BoardworkDocument1 pageMas1 BoardworkAshy LeeNo ratings yet

- Annexure - III Process Flow ChartDocument1 pageAnnexure - III Process Flow ChartIbrahim AhmedNo ratings yet

- ApindoDocument3 pagesApindoqoer udinNo ratings yet

- Consumers of Lotus Footwear Company Chap 3 & 4Document37 pagesConsumers of Lotus Footwear Company Chap 3 & 4ginish12No ratings yet

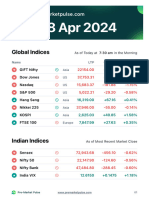

- Pre-Market Pulse-63Document7 pagesPre-Market Pulse-63dhruvika guptaNo ratings yet

- Topic VII Capital Budgeting TechniquesDocument16 pagesTopic VII Capital Budgeting TechniquesSeph AgetroNo ratings yet

- Bizniz Plan Pt. Hilal Angkasa Indonesia 090922Document100 pagesBizniz Plan Pt. Hilal Angkasa Indonesia 090922indra lukmanNo ratings yet

- London Stock Exchange Etfs - Highlights of Ten Years of TradingDocument5 pagesLondon Stock Exchange Etfs - Highlights of Ten Years of Tradingjini02No ratings yet

- NIBCO's "Big Bang": An SAP Implementation: Novi Yuningsih Prawistri PuspitasariDocument25 pagesNIBCO's "Big Bang": An SAP Implementation: Novi Yuningsih Prawistri PuspitasarinovijoenNo ratings yet

- 2013 IA COAG Report National Infrastructure Plan LR PDFDocument140 pages2013 IA COAG Report National Infrastructure Plan LR PDFLauren FrazierNo ratings yet

- A Detailed Research Report On Motilal Oswal Financial Services LTDDocument19 pagesA Detailed Research Report On Motilal Oswal Financial Services LTDKushagra KejriwalNo ratings yet

- 076 Mscom 017Document25 pages076 Mscom 017Rukesh GhimireNo ratings yet

- World Trade Organization: Kushal KatariaDocument12 pagesWorld Trade Organization: Kushal KatariaSurbhi JainNo ratings yet

- Land Acquisition in India-Past and Present: Prof. Kahkashan Y. DanyalDocument3 pagesLand Acquisition in India-Past and Present: Prof. Kahkashan Y. DanyalANANo ratings yet

- Name of The Subject: Human Resource Management Course Code and Subject Code: CC 204, HRM Course Credit: Full (50 Sessions of 60 Minutes Each)Document2 pagesName of The Subject: Human Resource Management Course Code and Subject Code: CC 204, HRM Course Credit: Full (50 Sessions of 60 Minutes Each)pranab_nandaNo ratings yet

- DLCPM00312970000023340 NewDocument6 pagesDLCPM00312970000023340 NewAnshul KatiyarNo ratings yet

- Banco de Oro or BDO Unibank, Inc. Is The Largest Bank Based in Makati CityDocument7 pagesBanco de Oro or BDO Unibank, Inc. Is The Largest Bank Based in Makati CityErfan TanhaeiNo ratings yet

- Bank Financial Institution Checking Account Certificates of DepositDocument10 pagesBank Financial Institution Checking Account Certificates of DepositPriyanshu BalaniNo ratings yet

- APTC Form - 58-Fully Vouched Contingent Bill FormDocument2 pagesAPTC Form - 58-Fully Vouched Contingent Bill Formvijay_dilse33% (3)

- Agent Scripts To Find Cash Buyers 073120Document3 pagesAgent Scripts To Find Cash Buyers 073120Azim Mohammed100% (1)

- TD Salkia TAXDocument20 pagesTD Salkia TAXocbtaxjpNo ratings yet