Professional Documents

Culture Documents

VAT Homework

Uploaded by

Kloie SanoriaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VAT Homework

Uploaded by

Kloie SanoriaCopyright:

Available Formats

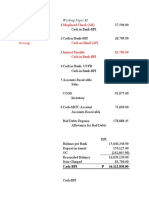

Given: Objective:

All are Vat Reg 1. JE

Amount Vat INCLUSIVE 2. Compute BT - Vat pay / Ex input

3. Taxable Income

(Importer) Mr. O Mr. P

Purchase (Import) 40,000.00 Purchase from Mr. O 90,000.00

Sell to Mr. P 90,000.00 Sell to Mr. Q 170,000.00

Dr Cr Dr Cr

(1) JE (1) JE

Purchases 35,714.29 Purchases 80,357.14

Input Vat 4,285.71 Input Vat 9,642.86

Cash / AP 40,000.00 Cash / AP 90,000.00

Cash / AR 90,000.00 Cash / AR 170,000.00

Sales 80,357.14 Sales 151,785.71

Output Vat 9,642.86 Output Vat 18,214.29

(2)BT (2)BT

Output Vat 9,642.86 Output Vat 18,214.29

Input Vat 4,285.71 Input Vat 9,642.86

Vat Payable 5,357.14 Vat Payable 8,571.43

(3) Taxable Income (3) Taxable Income

Sales 80,357.14 Sales 151,785.71

AD: (Purchases) 35,714.29 AD: (Purchases) 80,357.14

Taxable Income 44,642.86 Taxable Income 71,428.57

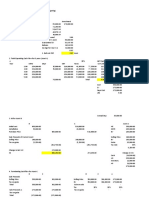

Mr. Q

Purchase from Mr. P 170,000.00

Purchase from Mr. R 50,000.00 Sell to Mr. Q

Sell to Customers (Non Vat) 400,000.00

Dr Cr Dr

(1) JE (1) JE

Purchases (Mr. P) 151,785.71 Purchases -

Input Vat 18,214.29 Input Vat -

Cash / AP 170,000.00 Cash / AP

Purchases (Mr. R) 44,642.86 Cash / AR 50,000.00

Input Vat 5,357.14 Sales

Cash / AP 50,000.00 Output Vat

COMPOUND ENTRY

Purchases (Mr. P & R) 196,428.57 (2)BT

Input Vat 23,571.43 Output Vat

Cash / AP 220,000.00 Input Vat

Vat Payable

Cash / AR 400,000.00

Sales 357,142.86 (3) Taxable Income

Output Vat 42,857.14 Sales

AD: (Purchases)

(2)BT Taxable Income

Output Vat 42,857.14

Input Vat 23,571.43

Vat Payable 19,285.71

(3) Taxable Income

Sales 357,142.86

AD: (Purchases) 196,428.57

Taxable Income 160,714.29

Mr. R

50,000.00

Final customers

Cr Dr Cr

If Vat Reg

Purchases 357,142.86

Input Vat 42,857.14

- Cash / AP 400,000.00

Not Vat Reg

Purchases 400,000.00

44,642.86 Cash / AP 400,000.00

5,357.14

5,357.14

-

5,357.14

44,642.86

-

44,642.86

You might also like

- Solution Problem 1Document6 pagesSolution Problem 1Michelle Joy Nuyad-PantinopleNo ratings yet

- Profit and LossDocument1 pageProfit and LossphotolabjsdNo ratings yet

- SummaryDocument1 pageSummarynovitaNo ratings yet

- 1 Dio, RC, Tax Due. WorldDocument14 pages1 Dio, RC, Tax Due. WorldAngelou J. Delos ReyesNo ratings yet

- CASE 1 - 20 PtsDocument6 pagesCASE 1 - 20 PtsCendimee PosadasNo ratings yet

- m3 Answer KeyDocument8 pagesm3 Answer KeyLara Camille CelestialNo ratings yet

- Test Ii: Misplaced Check (AR)Document10 pagesTest Ii: Misplaced Check (AR)Hannaniah PabicoNo ratings yet

- VatDocument23 pagesVatMichole chin MallariNo ratings yet

- Kashato-Shirts MerchandisingDocument3 pagesKashato-Shirts MerchandisingFred Wilson100% (1)

- Module 2 AnswersDocument39 pagesModule 2 AnswersEy GuanlaoNo ratings yet

- Solutions Midterms VATDocument1 pageSolutions Midterms VATReginald ValenciaNo ratings yet

- AE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBDocument7 pagesAE 315 FM Sum2021 Week 3 Capital Budgeting Quiz Anserki B FOR DISTRIBArly Kurt TorresNo ratings yet

- Chapter 15Document8 pagesChapter 15Mychie Lynne MayugaNo ratings yet

- Unicon Infra PVT LTD (2018) : 1-Jan-2020 To 31-Dec-2020 Particulars Closing Balance Credit DebitDocument3 pagesUnicon Infra PVT LTD (2018) : 1-Jan-2020 To 31-Dec-2020 Particulars Closing Balance Credit DebitOjhal RaiNo ratings yet

- Sum No 21Document3 pagesSum No 21Om MansattaNo ratings yet

- MadindigwaDocument7 pagesMadindigwaRay MondNo ratings yet

- ACTIVITY 1 BSA4A AutosavedDocument6 pagesACTIVITY 1 BSA4A AutosavedJonathan BausingNo ratings yet

- Taxation ProblemsDocument11 pagesTaxation ProblemsKai Son-MyoiNo ratings yet

- Practice Set 1Document6 pagesPractice Set 1moreNo ratings yet

- Multiple Choice-Problem 1: September 15 - Chapter 7-Introduction To Regular Income Taxation (Assignment)Document4 pagesMultiple Choice-Problem 1: September 15 - Chapter 7-Introduction To Regular Income Taxation (Assignment)anitaNo ratings yet

- Unrealized Mark-Up: Best CoDocument4 pagesUnrealized Mark-Up: Best CoPalos DoseNo ratings yet

- Allowable DeductionsDocument9 pagesAllowable DeductionsLyka RoguelNo ratings yet

- Interest Rate and FOREX Risk Management.Document17 pagesInterest Rate and FOREX Risk Management.Kathleen MonesNo ratings yet

- 6-Fac 4 ADocument5 pages6-Fac 4 Anachofr2704No ratings yet

- AUDPROB CHPT 5 and 61Document30 pagesAUDPROB CHPT 5 and 61Jem ValmonteNo ratings yet

- Income Statement For The Year Ended, December, 31, 2016: Pt. ZaliaDocument4 pagesIncome Statement For The Year Ended, December, 31, 2016: Pt. ZaliaNofi Nurlaila0% (1)

- 115,200.00 Two 100,200.00 TwoDocument19 pages115,200.00 Two 100,200.00 TwoAlexandra Nicole IsaacNo ratings yet

- Cash Flow Statement: Cash Flow Before SSF Cash Flow After SSF 1 Cash Flow After SSF 2Document1 pageCash Flow Statement: Cash Flow Before SSF Cash Flow After SSF 1 Cash Flow After SSF 2JHOMAENo ratings yet

- SO008864 - WO11608 - 2012469883 - 04-03-2024 - Commercial InvoiceDocument2 pagesSO008864 - WO11608 - 2012469883 - 04-03-2024 - Commercial InvoicebhuvaneszwarNo ratings yet

- Profit & Loss A - CDocument1 pageProfit & Loss A - Cbhoomika.shah0624No ratings yet

- October 5,2018 E-Dbs GomezDocument2 pagesOctober 5,2018 E-Dbs GomezJescilyn Kate MaggayNo ratings yet

- Q - Add or Drop A SegmentDocument1 pageQ - Add or Drop A SegmentIrahq Yarte TorrejosNo ratings yet

- HOBA Notes 2Document4 pagesHOBA Notes 2Hana GNo ratings yet

- Nice Spring Icee Delight (Bohol) : For The Month Ended December 31, 2020Document2 pagesNice Spring Icee Delight (Bohol) : For The Month Ended December 31, 2020ARISNo ratings yet

- WP - Forex Practice SetDocument8 pagesWP - Forex Practice SetJester LimNo ratings yet

- Modul 7 - Konsinyasi (Laba Dipisah)Document7 pagesModul 7 - Konsinyasi (Laba Dipisah)Natalia ErvinaNo ratings yet

- Best Friends Co. Statement of Profit or Loss and Other Comprehensive Income For The Year Ended December 31, 20x1Document3 pagesBest Friends Co. Statement of Profit or Loss and Other Comprehensive Income For The Year Ended December 31, 20x1Luis AlcalaNo ratings yet

- REPORT February 2023Document36 pagesREPORT February 2023leniemirandaNo ratings yet

- University of Makati J.P. Rizal Ext. West Rembo, City of Makati College of Business and Financial ScienceDocument16 pagesUniversity of Makati J.P. Rizal Ext. West Rembo, City of Makati College of Business and Financial ScienceKarla OñasNo ratings yet

- Acco 17 Midterm SolutionDocument5 pagesAcco 17 Midterm SolutionTonz KieNo ratings yet

- Cta 1D CV 06790 A 2015mar25 RefDocument50 pagesCta 1D CV 06790 A 2015mar25 RefSharon AgapuyanNo ratings yet

- 2021 Annual Budget Report - Luna, ApayaoDocument40 pages2021 Annual Budget Report - Luna, ApayaoMarvin OlidNo ratings yet

- Cash Flow ExampleDocument2 pagesCash Flow ExampleLealyn CuestaNo ratings yet

- Capital Budgeting Seatwork 1 MWF SolutionDocument2 pagesCapital Budgeting Seatwork 1 MWF SolutionTrizia Bermudo TibesNo ratings yet

- Franchise Discussion ProblemDocument8 pagesFranchise Discussion ProblemMeleen TadenaNo ratings yet

- Profit and Loss AccountDocument1 pageProfit and Loss Account169 Vishal DabiNo ratings yet

- Beg. Balance Sales Journal Voucher Registry Check Register Cash Receipt Account TitleDocument12 pagesBeg. Balance Sales Journal Voucher Registry Check Register Cash Receipt Account TitleFred WilsonNo ratings yet

- Beg. Balance Sales Journal Voucher Registry Check Register Cash ReceiptDocument4 pagesBeg. Balance Sales Journal Voucher Registry Check Register Cash ReceiptFred WilsonNo ratings yet

- Financial Accounting hw1Document5 pagesFinancial Accounting hw1Jermaine M. SantoyoNo ratings yet

- Pand LDocument1 pagePand Lvihanjangid223No ratings yet

- 3 Exam Part IDocument6 pages3 Exam Part IRJ DAVE DURUHANo ratings yet

- Problem Solving 1-4Document11 pagesProblem Solving 1-4Romina LopezNo ratings yet

- Chpater 4 SolutionsDocument13 pagesChpater 4 SolutionsTamar PkhakadzeNo ratings yet

- Midterm Exam IntaxDocument20 pagesMidterm Exam IntaxJane TuazonNo ratings yet

- AC - IntAcctg1 Quiz 2 Solution GuideDocument6 pagesAC - IntAcctg1 Quiz 2 Solution Guidejohn hellNo ratings yet

- Answer: B.: Review Question 1: Traditional Jo PetmaluDocument20 pagesAnswer: B.: Review Question 1: Traditional Jo PetmaluFranchNo ratings yet

- Activity 1 (A01) - Overview of InventoriesDocument2 pagesActivity 1 (A01) - Overview of InventoriesJoebin Corporal LopezNo ratings yet

- Lesson 2 - VAT May 05, 2022Document8 pagesLesson 2 - VAT May 05, 2022Kloie SanoriaNo ratings yet

- Problem 1 Process CostingDocument1 pageProblem 1 Process CostingKloie SanoriaNo ratings yet

- Problem 2 Process Costing UlitDocument4 pagesProblem 2 Process Costing UlitKloie SanoriaNo ratings yet

- Audit of Plant, Property, and EquipmentDocument36 pagesAudit of Plant, Property, and EquipmentKloie SanoriaNo ratings yet

- (ACC124) Investment QuizDocument6 pages(ACC124) Investment QuizKloie SanoriaNo ratings yet

- Chap 12 - Inventory (Prob 24-32)Document10 pagesChap 12 - Inventory (Prob 24-32)Kloie SanoriaNo ratings yet

- X'Chapter I SECTION 1: Form of Negotiable InstrumentsDocument13 pagesX'Chapter I SECTION 1: Form of Negotiable InstrumentsKloie SanoriaNo ratings yet

- BSA 3A Students Maintaining CoVid GROUP 1Document68 pagesBSA 3A Students Maintaining CoVid GROUP 1Kloie SanoriaNo ratings yet

- GROUPED - Mean Median ModeDocument85 pagesGROUPED - Mean Median ModeKloie SanoriaNo ratings yet

- Chap 1 Ans To Ques (For Recit)Document5 pagesChap 1 Ans To Ques (For Recit)Kloie SanoriaNo ratings yet

- Measures of Variability 32729Document15 pagesMeasures of Variability 32729Kloie SanoriaNo ratings yet

- Terms Used in STATISTICS 32720Document20 pagesTerms Used in STATISTICS 32720Kloie SanoriaNo ratings yet

- Transcendental Meditaton ProgramDocument3 pagesTranscendental Meditaton Programacharyaprakash0% (3)

- 7TH Maths F.a-1Document1 page7TH Maths F.a-1Marrivada SuryanarayanaNo ratings yet

- EIC 3 Practice Exercises Unit 4Document3 pagesEIC 3 Practice Exercises Unit 4Trần ChâuNo ratings yet

- Manual G Ingles - V6Document68 pagesManual G Ingles - V6Phùng Thế Kiên50% (2)

- C3H Hawaii (Polynesian Islands) (Native Food in Hawaii)Document19 pagesC3H Hawaii (Polynesian Islands) (Native Food in Hawaii)Yoon Yati ShinNo ratings yet

- Determination of Iron in Water - SpectrophotometryDocument4 pagesDetermination of Iron in Water - Spectrophotometryhanif ahmadNo ratings yet

- Microtech Testing & Research Laboratory: Condition of Sample, When Received: SatisfactoryDocument1 pageMicrotech Testing & Research Laboratory: Condition of Sample, When Received: SatisfactoryKumar AbhishekNo ratings yet

- PURL Questions and AnswersDocument3 pagesPURL Questions and AnswersSHAHAN VS100% (5)

- Science 10 FINAL Review 2014Document49 pagesScience 10 FINAL Review 2014Zara Zalaal [Student]No ratings yet

- Checkpoints Before Transformer InstallationDocument3 pagesCheckpoints Before Transformer InstallationBeaBustosNo ratings yet

- Phil. Hist. SyllabusDocument7 pagesPhil. Hist. SyllabusCarl Angelo MartinNo ratings yet

- Prishusingh Blogspot Com 2024 03 Digital-Marketing-Course HTMLDocument12 pagesPrishusingh Blogspot Com 2024 03 Digital-Marketing-Course HTMLsudharaj86038No ratings yet

- TSAR-1 Reverb Quick GuideDocument1 pageTSAR-1 Reverb Quick GuidedraenkNo ratings yet

- Specification For Neoprene Coating On The Riser CasingDocument17 pagesSpecification For Neoprene Coating On The Riser CasingLambang AsmaraNo ratings yet

- Character AnalysisDocument3 pagesCharacter AnalysisjefncomoraNo ratings yet

- NTCC Project - Fake News and Its Impact On Indian Social Media UsersDocument41 pagesNTCC Project - Fake News and Its Impact On Indian Social Media UsersManan TrivediNo ratings yet

- Exercise On Coordination and ResponseDocument8 pagesExercise On Coordination and ResponseNorliyana AliNo ratings yet

- GSM Sniffing - Telegraph+Document9 pagesGSM Sniffing - Telegraph+Sridhar PNo ratings yet

- Cultures of The West A History, Volume 1 To 1750 3rd PDFDocument720 pagesCultures of The West A History, Volume 1 To 1750 3rd PDFtonnyNo ratings yet

- Particle FilterDocument16 pagesParticle Filterlevin696No ratings yet

- LeaP Math G7 Week 8 Q3Document10 pagesLeaP Math G7 Week 8 Q3Reymart PalaganasNo ratings yet

- Cyber Frauds, Scams and Their Victims - Mark Button, Cassandra CrossDocument253 pagesCyber Frauds, Scams and Their Victims - Mark Button, Cassandra CrossMitesh MehtaNo ratings yet

- Assignment 1 SolutionDocument11 pagesAssignment 1 SolutionKash TorabiNo ratings yet

- LGDocument36 pagesLGNanchavisNo ratings yet

- Nurse Education Today: Natalie M. Agius, Ann WilkinsonDocument8 pagesNurse Education Today: Natalie M. Agius, Ann WilkinsonSobiaNo ratings yet

- Chapter - 1 - Digital - Systems - and - Binary - Numbers EE228 15-16Document81 pagesChapter - 1 - Digital - Systems - and - Binary - Numbers EE228 15-16mohamed hemdanNo ratings yet

- Network Tools and Protocols Lab 2: Introduction To Iperf3Document17 pagesNetwork Tools and Protocols Lab 2: Introduction To Iperf3Fabio MenesesNo ratings yet

- Antibiotics and Their Types, Uses, Side EffectsDocument4 pagesAntibiotics and Their Types, Uses, Side EffectsSpislgal PhilipNo ratings yet

- Technical Sheet Vacuum Tube Collectors CVTDocument2 pagesTechnical Sheet Vacuum Tube Collectors CVTgonzalez2678No ratings yet

- Prelims Reviewer Biochem LabDocument4 pagesPrelims Reviewer Biochem LabRiah Mae MertoNo ratings yet