Professional Documents

Culture Documents

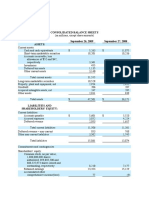

Consolidated Balance Sheet: December 31, 2020 2019 (In Millions, Except Per Share Data)

Consolidated Balance Sheet: December 31, 2020 2019 (In Millions, Except Per Share Data)

Uploaded by

Maanvee Jaiswal0 ratings0% found this document useful (0 votes)

5 views2 pagesOriginal Title

BS & CF

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesConsolidated Balance Sheet: December 31, 2020 2019 (In Millions, Except Per Share Data)

Consolidated Balance Sheet: December 31, 2020 2019 (In Millions, Except Per Share Data)

Uploaded by

Maanvee JaiswalCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

PART II

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Consolidated Balance Sheet

December 31,

2020 2019

(in millions, except per share data)

Assets

Current assets:

Cash and cash equivalents $ 10,113 $ 6,988

Restricted cash for litigation settlement 586 584

Investments 483 688

Accounts receivable 2,646 2,514

Settlement due from customers 1,706 2,995

Restricted security deposits held for customers 1,696 1,370

Prepaid expenses and other current assets 1,883 1,763

Total current assets 19,113 16,902

Property, equipment and right-of-use assets, net 1,902 1,828

Deferred income taxes 491 543

Goodwill 4,960 4,021

Other intangible assets, net 1,753 1,417

Other assets 5,365 4,525

Total Assets $ 33,584 $ 29,236

Liabilities, Redeemable Non-controlling Interests and Equity

Current liabilities:

Accounts payable $ 527 $ 489

Settlement due to customers 1,475 2,714

Restricted security deposits held for customers 1,696 1,370

Accrued litigation 842 914

Accrued expenses 5,430 5,489

Current portion of long-term debt 649 —

Other current liabilities 1,228 928

Total current liabilities 11,847 11,904

Long-term debt 12,023 8,527

Deferred income taxes 86 85

Other liabilities 3,111 2,729

Total Liabilities 27,067 23,245

Commitments and Contingencies

Redeemable Non-controlling Interests 29 74

Stockholders’ Equity

Class A common stock, $0.0001 par value; authorized 3,000 shares, 1,396 and 1,391 shares

issued and 987 and 996 shares outstanding, respectively — —

Class B common stock, $0.0001 par value; authorized 1,200 shares, 8 and 11 shares issued

and outstanding, respectively — —

Additional paid-in-capital 4,982 4,787

Class A treasury stock, at cost, 409 and 395 shares, respectively (36,658) (32,205)

Retained earnings 38,747 33,984

Accumulated other comprehensive income (loss) (680) (673)

Mastercard Incorporated Stockholders' Equity 6,391 5,893

Non-controlling interests 97 24

Total Equity 6,488 5,917

Total Liabilities, Redeemable Non-controlling Interests and Equity $ 33,584 $ 29,236

The accompanying notes are an integral part of these consolidated financial statements.

62 MASTERCARD 2020 FORM 10-K

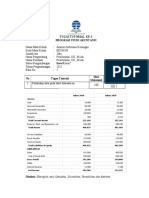

PART II

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Consolidated Statement of Cash Flows

For the Years Ended December 31,

2020 2019 2018

(in millions)

Operating Activities

Net income $ 6,411 $ 8,118 $ 5,859

Adjustments to reconcile net income to net cash provided by operating activities:

Amortization of customer and merchant incentives 1,072 1,141 1,235

Depreciation and amortization 580 522 459

(Gains) losses on equity investments, net (30) (167) —

Share-based compensation 254 250 196

Deferred income taxes 73 (7) (244)

Other 14 24 31

Changes in operating assets and liabilities:

Accounts receivable (86) (246) (317)

Income taxes receivable (2) (202) (120)

Settlement due from customers 1,288 (444) (1,078)

Prepaid expenses (1,552) (1,661) (1,769)

Accrued litigation and legal settlements (73) (662) 869

Restricted security deposits held for customers 326 290 (6)

Accounts payable 26 (42) 101

Settlement due to customers (1,242) 477 849

Accrued expenses (114) 657 439

Long-term taxes payable (37) 2 (20)

Net change in other assets and liabilities 316 133 (261)

Net cash provided by operating activities 7,224 8,183 6,223

Investing Activities

Purchases of investment securities available-for-sale (220) (643) (1,300)

Purchases of investments held-to-maturity (198) (215) (509)

Proceeds from sales of investment securities available-for-sale 361 1,098 604

Proceeds from maturities of investment securities available-for-sale 140 376 379

Proceeds from maturities of investments held-to-maturity 121 383 929

Purchases of property and equipment (339) (422) (330)

Capitalized software (369) (306) (174)

Purchases of equity investments (214) (467) (91)

Acquisition of businesses, net of cash acquired (989) (1,440) —

Settlement of interest rate derivative contracts (175) — —

Other investing activities 3 (4) (14)

Net cash used in investing activities (1,879) (1,640) (506)

Financing Activities

Purchases of treasury stock (4,473) (6,497) (4,933)

Dividends paid (1,605) (1,345) (1,044)

Proceeds from debt, net 3,959 2,724 991

Payment of debt — (500) —

Acquisition of redeemable non-controlling interests (49) — —

Contingent consideration paid — (199) —

Tax withholdings related to share-based payments (150) (161) (80)

Cash proceeds from exercise of stock options 97 126 104

Other financing activities 69 (15) (4)

Net cash used in financing activities (2,152) (5,867) (4,966)

Effect of exchange rate changes on cash, cash equivalents, restricted cash and restricted cash equivalents 257 (44) (6)

Net increase in cash, cash equivalents, restricted cash and restricted cash equivalents 3,450 632 745

Cash, cash equivalents, restricted cash and restricted cash equivalents - beginning of period 8,969 8,337 7,592

Cash, cash equivalents, restricted cash and restricted cash equivalents - end of period $ 12,419 $ 8,969 $ 8,337

The accompanying notes are an integral part of these consolidated financial statements.

MASTERCARD 2020 FORM 10-K 65

You might also like

- BS 2018Document1 pageBS 2018Maanvee JaiswalNo ratings yet

- Dell FY 2012 10 K Financial StatementsDocument4 pagesDell FY 2012 10 K Financial StatementsJuan Diego Vasquez BeraunNo ratings yet

- Appendix PfizerDocument2 pagesAppendix PfizerelatobouloNo ratings yet

- Pepsico Inc 2019 Annual ReportDocument1 pagePepsico Inc 2019 Annual ReportToodley DooNo ratings yet

- Financial Analysis Hewlett Packard Corporation 2007Document24 pagesFinancial Analysis Hewlett Packard Corporation 2007SAMNo ratings yet

- Tesla Inc Financial Statements (Extract)Document10 pagesTesla Inc Financial Statements (Extract)Abhishek BatraNo ratings yet

- Nicole Irvin - ProjectDocument4 pagesNicole Irvin - Projectapi-581024555No ratings yet

- Assets: PAYNET, Inc. Consolidated Balance SheetsDocument3 pagesAssets: PAYNET, Inc. Consolidated Balance Sheetschemicalchouhan9303No ratings yet

- Kroger Financial Statement ExcerptsDocument9 pagesKroger Financial Statement ExcerptsAlexa WilcoxNo ratings yet

- Whirlpool Annual ReportDocument1 pageWhirlpool Annual ReportFakhre AlamNo ratings yet

- Ibex 2019 Financial Statements and Auditors ReportDocument70 pagesIbex 2019 Financial Statements and Auditors ReportElsa malikNo ratings yet

- Balance SheetDocument25 pagesBalance SheetImran AhmedNo ratings yet

- 2022 Q4 Earnings Release (Ex-99.1) - Full Release Coca-ColaDocument1 page2022 Q4 Earnings Release (Ex-99.1) - Full Release Coca-ColakusshhalNo ratings yet

- DASH Q3 23 Earnings FinancialsDocument6 pagesDASH Q3 23 Earnings Financialsalpha.square.betaNo ratings yet

- Chapter 3 108-117Document10 pagesChapter 3 108-117Leony SantikaNo ratings yet

- Consolidated Balance Sheet As at June 30, 2021: AssetsDocument2 pagesConsolidated Balance Sheet As at June 30, 2021: Assetsshannia dcostaNo ratings yet

- Five Below 2018 Financial StatementsDocument4 pagesFive Below 2018 Financial StatementsElie GergesNo ratings yet

- Consolidated Balance Sheet: in Millions, Except Per Share Amounts, at December 31Document1 pageConsolidated Balance Sheet: in Millions, Except Per Share Amounts, at December 31Juan Jeronimo Marin ArevaloNo ratings yet

- Adani Ports & Special Economic Zone Ltd. (India) : SourceDocument9 pagesAdani Ports & Special Economic Zone Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Consolidated Balance Sheet Metapower International, IncDocument12 pagesConsolidated Balance Sheet Metapower International, IncJha YaNo ratings yet

- 2022 - Consolidated Financial StatementsDocument7 pages2022 - Consolidated Financial StatementscaarunjiNo ratings yet

- Zynga 2019 Annual Report - Excerpts - FinalDocument7 pagesZynga 2019 Annual Report - Excerpts - FinalAlexa WilcoxNo ratings yet

- KRR FS Q1 2023 15-May-2023Document19 pagesKRR FS Q1 2023 15-May-2023prenges prengesNo ratings yet

- 106 08 STLD Financial StatementsDocument3 pages106 08 STLD Financial StatementsRadit AdiNo ratings yet

- 3M - 2019 Annual Report ExcerptDocument7 pages3M - 2019 Annual Report ExcerptKumar AbhishekNo ratings yet

- Book 2Document3 pagesBook 2Tichaona NgomaNo ratings yet

- Unaudited Condensed Consolidated Financial ReportsDocument33 pagesUnaudited Condensed Consolidated Financial ReportsinforumdocsNo ratings yet

- Cosco Example PDFDocument4 pagesCosco Example PDFBeatrice BallabioNo ratings yet

- 2023 Half Year Balance SheetDocument2 pages2023 Half Year Balance SheetsrishtiladdhaNo ratings yet

- Marsh MC Lennan 2021-79-83-1-4Document4 pagesMarsh MC Lennan 2021-79-83-1-4socialsim07No ratings yet

- Marsh MC Lennan 2021-79-83Document5 pagesMarsh MC Lennan 2021-79-83socialsim07No ratings yet

- Ultratech Cement Ltd. (India) : SourceDocument6 pagesUltratech Cement Ltd. (India) : SourceDivyagarapatiNo ratings yet

- American Airlines Group IncDocument5 pagesAmerican Airlines Group IncMyka Mabs MagbanuaNo ratings yet

- 2014 AR Excel Financials For AR Web Site FINALDocument6 pages2014 AR Excel Financials For AR Web Site FINALPranjal SharmaNo ratings yet

- CHK 4Q 2023 FinancialsDocument10 pagesCHK 4Q 2023 FinancialsRanjan SaxenaNo ratings yet

- Consolidated Balance SheetsDocument3 pagesConsolidated Balance SheetsAninda RestikaNo ratings yet

- Financial Statement AnalysisDocument29 pagesFinancial Statement AnalysisasifNo ratings yet

- Samorita Hospital (Last 6 Month Financial Report)Document11 pagesSamorita Hospital (Last 6 Month Financial Report)Stalwart sheikhNo ratings yet

- Compilation of Raw Data - LBOBGDT Group 9Document165 pagesCompilation of Raw Data - LBOBGDT Group 9Romm SamsonNo ratings yet

- Sample 10KDocument29 pagesSample 10KabhishekNo ratings yet

- Financial Statements and Supplementary Data: (In Millions, Except Per Share Amounts) Year Ended June 30, 2018 2017 2016Document5 pagesFinancial Statements and Supplementary Data: (In Millions, Except Per Share Amounts) Year Ended June 30, 2018 2017 2016SSDNo ratings yet

- Star ReportsDocument38 pagesStar ReportsAnnisa DewiNo ratings yet

- (In Millions, Except Par Values) Assets: The Kroger Co. C B SDocument1 page(In Millions, Except Par Values) Assets: The Kroger Co. C B ShashaamNo ratings yet

- Goodwill HandoutDocument14 pagesGoodwill HandoutCharudatta MundeNo ratings yet

- Bharat Petroleum Corporation Ltd. (India) : SourceDocument6 pagesBharat Petroleum Corporation Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Espresso Software Financial Statements and Supplementary DataDocument38 pagesEspresso Software Financial Statements and Supplementary DataAnwar AshrafNo ratings yet

- Financial Report 30 09 2019 ENDocument38 pagesFinancial Report 30 09 2019 ENVenture ConsultancyNo ratings yet

- Transportation Report Pfm4Document7 pagesTransportation Report Pfm4Lex Jeofrey SadsadNo ratings yet

- Review of Financial Statements: Professor Brian BusheeDocument13 pagesReview of Financial Statements: Professor Brian Busheeadan fadhilNo ratings yet

- Assignment 2 - Suggested AnswersDocument3 pagesAssignment 2 - Suggested AnswersMark James GarzonNo ratings yet

- DTCC Annual Financial Statements 2020 and 2019Document51 pagesDTCC Annual Financial Statements 2020 and 2019EvgeniyNo ratings yet

- Restatements Due To PPA of The Monsanto Acquisition PDFDocument8 pagesRestatements Due To PPA of The Monsanto Acquisition PDFAlvin LaquiNo ratings yet

- FA AssignmentDocument21 pagesFA AssignmentMuzammil khanNo ratings yet

- Particulars 2Document2 pagesParticulars 2AshwinNo ratings yet

- 2019 Cerner - Excerpts - FinalDocument10 pages2019 Cerner - Excerpts - FinalAlexa WilcoxNo ratings yet

- Divi's Laboratories Ltd. (India) : SourceDocument5 pagesDivi's Laboratories Ltd. (India) : SourceDivyagarapatiNo ratings yet

- Chapter 7 Problem 7Document3 pagesChapter 7 Problem 7Pamela PerezNo ratings yet

- FINC600 Week 4 DQ. Balance SheetDocument4 pagesFINC600 Week 4 DQ. Balance SheetashibhallauNo ratings yet

- Maxbank FilesDocument6 pagesMaxbank FilesD Del SalNo ratings yet

- Trading Volume On Stock PriceDocument11 pagesTrading Volume On Stock PriceShinta KarinaNo ratings yet

- Affidavit of Self AdjudicationDocument4 pagesAffidavit of Self AdjudicationCPMMNo ratings yet

- GAURAV Valuation Content Edited RevisedDocument17 pagesGAURAV Valuation Content Edited Revisedgauravbansall567No ratings yet

- Exam 1 For Posting S18Document8 pagesExam 1 For Posting S18Muhammad Waqar ZahidNo ratings yet

- By Laws Stock CorporationDocument35 pagesBy Laws Stock CorporationAngelica Sanchez100% (4)

- 43 Indian - Capital - MarketDocument40 pages43 Indian - Capital - MarketNiladri MondalNo ratings yet

- FM CH 07 PDFDocument72 pagesFM CH 07 PDFLayatmika SahooNo ratings yet

- The Family Business Model (Credit Suisse)Document54 pagesThe Family Business Model (Credit Suisse)Artan MyftiuNo ratings yet

- Merchant Banking (Cir. 17.10.2023)Document26 pagesMerchant Banking (Cir. 17.10.2023)Akshaya SwaminathanNo ratings yet

- Examiners' Commentaries 2016: FN1024 Principles of Banking and FinanceDocument25 pagesExaminers' Commentaries 2016: FN1024 Principles of Banking and FinancekashmiraNo ratings yet

- Tugas 2 Eksi 4204 - Dini Nur Lathifah - 030995277Document4 pagesTugas 2 Eksi 4204 - Dini Nur Lathifah - 030995277Doni Jogja0% (1)

- IG Client Sentiment Report 2020-12-03 12 - 00 PDFDocument36 pagesIG Client Sentiment Report 2020-12-03 12 - 00 PDFEno Ronaldfrank OguriNo ratings yet

- Bus 316 - Week2Document40 pagesBus 316 - Week2winblacklist1507No ratings yet

- 9-The Option Greeks (Delta) Part 1Document6 pages9-The Option Greeks (Delta) Part 1Zahid GolandazNo ratings yet

- Impact of Inflation On The Financial StatementsDocument22 pagesImpact of Inflation On The Financial StatementsabbyplexxNo ratings yet

- A Study On Credit Risk Management at Canara BankDocument10 pagesA Study On Credit Risk Management at Canara BankBhaswani33% (6)

- TOA ReviewerDocument9 pagesTOA ReviewerMichelle de GuzmanNo ratings yet

- Commercial Law - Sale and Supply of Goods Detailed Module Outline 2013-2014Document34 pagesCommercial Law - Sale and Supply of Goods Detailed Module Outline 2013-2014manjeet kumarNo ratings yet

- 2012Document21 pages2012Mohammad Salim HossainNo ratings yet

- Forex Trading Tutorial PDFDocument75 pagesForex Trading Tutorial PDFneeds tripathiNo ratings yet

- Kuawaiti CMA GlossaryDocument52 pagesKuawaiti CMA Glossaryammokhtar100No ratings yet

- OutputDocument6 pagesOutputSylvia MorenoNo ratings yet

- DuPont RatioDocument6 pagesDuPont RatioOmer007No ratings yet

- Pre Webinar Presentation-13th OctoberDocument11 pagesPre Webinar Presentation-13th OctoberVinod100% (3)

- CAIE O Level Firms, Cost, Revenue & Objectives PDFDocument28 pagesCAIE O Level Firms, Cost, Revenue & Objectives PDFDayaan Ameen100% (1)

- 18 06 26 Jadhav ComplaintDocument24 pages18 06 26 Jadhav ComplaintFlorian MuellerNo ratings yet

- Quarterly and Monthly Mutual Fund ReportDocument17 pagesQuarterly and Monthly Mutual Fund ReportDhuraivel GunasekaranNo ratings yet

- Central Bank V CA ObliCon Case DIGESTDocument1 pageCentral Bank V CA ObliCon Case DIGESTCharlyn ReyesNo ratings yet