Professional Documents

Culture Documents

TFFE Math 7

Uploaded by

Shamima AkterOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TFFE Math 7

Uploaded by

Shamima AkterCopyright:

Available Formats

S. M.

Mahruf Billah

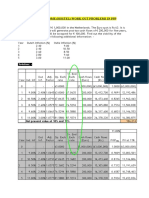

Your exporter wants to sell a 120-day usance bill of EUR 65,000.00 to your bank, calculate the

buying exchange rate of your bank. How much does your bank have to pay to the exporter?

Please use the following information:

(96th AIBB May-June 2023)

a) Interbank Exchange rate

EUR 1= USD 1.0715 – 1.0820

USD 1 = BDT 106.1010 – 107.7590

b) Transit period 10 days

c) Profit margin BDT 0.10 per EUR

d) Your bank’s overhead charge 0.0625%

e) Interest rate 6% per annum

(Assume 360 days in a year. Please show your rough calculation)

Solution: The usance of the bill and transit period comes to (120+10=) 130 days.

1 𝐸𝑈𝑅 = 𝐵𝐷𝑇 1.0715 × 106.1010 − 1.0820 × 107.7590

= 𝐵𝐷𝑇 113.6872 − 116.5952

6 × 130 × 113.6872

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑝𝑒𝑟 𝐸𝑢𝑟𝑜 = = 𝐵𝐷𝑇 2.4632

100 × 360

113.6872 × 0.0625

𝑂𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝐶ℎ𝑎𝑟𝑔𝑒 𝑝𝑒𝑟 𝐸𝑢𝑟𝑜 = 𝐵𝐷𝑇 ( ) = 0.0710

100

𝑻𝒉𝒆 𝒃𝒖𝒚𝒊𝒏𝒈 𝒆𝒙𝒄𝒉𝒂𝒏𝒈𝒆 𝒓𝒂𝒕𝒆 =

𝑺𝒑𝒐𝒕 𝒃𝒖𝒚𝒊𝒏𝒈 𝒓𝒂𝒕𝒆 − 𝑷𝒓𝒐𝒇𝒊𝒕 𝒎𝒂𝒓𝒈𝒊𝒏 − 𝑶𝒗𝒆𝒓𝒉𝒆𝒂𝒅 𝒄𝒉𝒂𝒓𝒈𝒆 − 𝑰𝒏𝒕𝒆𝒓𝒆𝒔𝒕

∴ 𝑇ℎ𝑒 𝑏𝑢𝑦𝑖𝑛𝑔 𝐸𝑥𝑐ℎ𝑎𝑛𝑔𝑒 𝑟𝑎𝑡𝑒 𝑝𝑒𝑟 𝐸𝑢𝑟𝑜 = 𝐵𝐷𝑇(113.6872 − 0.10 − 0.0710 − 2.4632)

= 𝐵𝐷𝑇 111.053

𝑆𝑜, 𝑇ℎ𝑒 𝑏𝑎𝑛𝑘 ℎ𝑎𝑠 𝑡𝑜 𝑝𝑎𝑦 𝑡𝑜 𝑡ℎ𝑒 𝑒𝑥𝑝𝑜𝑟𝑡𝑒𝑟 = 𝐵𝐷𝑇 (65,000 × 111.053) = 𝐵𝐷𝑇 72,18,445

You might also like

- פרוייקט סיום קורס מכשירי מדידה וחיישנים1Document21 pagesפרוייקט סיום קורס מכשירי מדידה וחיישנים1Omer WassermanNo ratings yet

- Solution Manual For Investment Science by David LuenbergerDocument94 pagesSolution Manual For Investment Science by David Luenbergerkoenajax96% (28)

- Sanjay Saraf SFM Volume 2 Portfolio ManagementDocument131 pagesSanjay Saraf SFM Volume 2 Portfolio ManagementShubham AgrawalNo ratings yet

- Diseñar Una Zapata Combinada Rectangular Datos Columnas 50x50 CMDocument12 pagesDiseñar Una Zapata Combinada Rectangular Datos Columnas 50x50 CMJefferson Potosí ToledoNo ratings yet

- Preterm 2014 Test v2Document5 pagesPreterm 2014 Test v2prasant goel100% (2)

- SolutionDocument16 pagesSolutionAli MahmoudNo ratings yet

- Decimal Fractions: Fractions in Which Denominators Are Powers of 10 Are Known As Decimal FractionsDocument7 pagesDecimal Fractions: Fractions in Which Denominators Are Powers of 10 Are Known As Decimal FractionsArunachalam NarayananNo ratings yet

- INV3703 Past Paper 3Document28 pagesINV3703 Past Paper 3SilenceNo ratings yet

- Final POM Arrangement 2Document5 pagesFinal POM Arrangement 2Samuel kwateiNo ratings yet

- INV3703 Past Paper 4Document23 pagesINV3703 Past Paper 4SilenceNo ratings yet

- Regression AnalysisDocument3 pagesRegression AnalysisPhaneendranath Yellapragada100% (1)

- Cálculos de ConvecciónDocument1 pageCálculos de ConvecciónolveraNo ratings yet

- Examinations: Subject 102 - Financial MathematicsDocument11 pagesExaminations: Subject 102 - Financial MathematicsClerry SamuelNo ratings yet

- Operations ManagementDocument8 pagesOperations ManagementLheam C VilogNo ratings yet

- Business Statistics Communicating With Numbers 1st Edition Jaggia Solutions Manual 1Document60 pagesBusiness Statistics Communicating With Numbers 1st Edition Jaggia Solutions Manual 1fred100% (30)

- Steel Frame Analysis & DesignDocument22 pagesSteel Frame Analysis & DesignjoynaldxNo ratings yet

- Problem Set 1 SolutionsDocument32 pagesProblem Set 1 Solutionsale.ili.pauNo ratings yet

- PROBLEM SET-4 Continuous Probability - SolutionsDocument8 pagesPROBLEM SET-4 Continuous Probability - Solutionsmaxentiuss71% (7)

- SQM Assignment Semester 1Document20 pagesSQM Assignment Semester 1Maruf NafiNo ratings yet

- SFE1.6.2 - UDJ - (SOL) MBA March 2021 UDJ Final Exam Solutions - UpdatedDocument5 pagesSFE1.6.2 - UDJ - (SOL) MBA March 2021 UDJ Final Exam Solutions - UpdatedGonçalo RibeiroNo ratings yet

- Foreign Exchange MathDocument6 pagesForeign Exchange MathJoyanta Sarkar100% (1)

- BS Assignment #2Document6 pagesBS Assignment #2Darya Khan BughioNo ratings yet

- PNL and Risk Analysis For Credit DerivativesDocument36 pagesPNL and Risk Analysis For Credit DerivativesTheodor MunteanuNo ratings yet

- Problems: Log (Q) VS TDocument8 pagesProblems: Log (Q) VS TDianita ZuamaNo ratings yet

- Tugas 4 Statek BaruDocument20 pagesTugas 4 Statek BaruMardhiyyah AadilahNo ratings yet

- CAT 2 ECE SchemeDocument2 pagesCAT 2 ECE SchemeLaaria ChrisNo ratings yet

- Ejercicio 3 Zapata CombinadaDocument12 pagesEjercicio 3 Zapata CombinadaROBERTO DAVID RIOS MOSQUERANo ratings yet

- FEX Math Solution-1Document13 pagesFEX Math Solution-1Salauddin AhmedNo ratings yet

- Gen Est Aki Via-SDocument3 pagesGen Est Aki Via-Spromotora construonNo ratings yet

- BondsDocument22 pagesBondsSuchit Backup1No ratings yet

- Statically Indeterminate StructureDocument19 pagesStatically Indeterminate StructureNoor Ul Amin AwanNo ratings yet

- Suggested Solution Test-5Document14 pagesSuggested Solution Test-5Yogesh NeupaneNo ratings yet

- Wawan Aris - PTE-TTE-7 - Tugas 2 Simulink - PPKDSTLDocument7 pagesWawan Aris - PTE-TTE-7 - Tugas 2 Simulink - PPKDSTLWAWAN ARISNo ratings yet

- Ifm AssignmentDocument4 pagesIfm AssignmentPriya VardhanNo ratings yet

- Assingnment: Ch#4 (Options Market and Contracts)Document10 pagesAssingnment: Ch#4 (Options Market and Contracts)Mahnoor ShahbazNo ratings yet

- RegresionDocument5 pagesRegresionoscar80% (5)

- The Project of Machines DesignDocument30 pagesThe Project of Machines Designn1f2No ratings yet

- Solución Parcial II Modelos 11Document3 pagesSolución Parcial II Modelos 11JUANNo ratings yet

- Baf2103 Quantitative Techniques CatDocument12 pagesBaf2103 Quantitative Techniques CatcyrusNo ratings yet

- Simulation: Intro To Management ScienceDocument29 pagesSimulation: Intro To Management ScienceWaleed AhmadNo ratings yet

- 2022 Stat6089 Lgda TP2-W3-S3-R0 2401967132Document5 pages2022 Stat6089 Lgda TP2-W3-S3-R0 2401967132Oki AdityaNo ratings yet

- Solution Manual For Shigleys Mechanical Engineering Design 10th Edition by Budynas Chapters 18 and 19 Not IncludedDocument12 pagesSolution Manual For Shigleys Mechanical Engineering Design 10th Edition by Budynas Chapters 18 and 19 Not Includeda1650150860% (4)

- Gen - Est - Aki - Paseo EraltoDocument3 pagesGen - Est - Aki - Paseo Eraltopromotora construonNo ratings yet

- Test - 2 Paper - 2 Vsmart Academy Examprep Strategic Financial Management Suggested AnswersDocument10 pagesTest - 2 Paper - 2 Vsmart Academy Examprep Strategic Financial Management Suggested AnswerswinNo ratings yet

- Compound Interest Quiz 5-1 PDFDocument10 pagesCompound Interest Quiz 5-1 PDFSurayyaNo ratings yet

- Managerial Finance Tutorial 7: To Be Submitted Within 3 JuneDocument7 pagesManagerial Finance Tutorial 7: To Be Submitted Within 3 JuneaskdgasNo ratings yet

- Tutorial 7 SolutionDocument3 pagesTutorial 7 SolutionSitla Reddy75% (4)

- Balok Khusus Penumpu AtapDocument50 pagesBalok Khusus Penumpu AtapNan NdaNo ratings yet

- Wireless Communication and Networks Sheet 1Document4 pagesWireless Communication and Networks Sheet 1Ahmed El SayedNo ratings yet

- Fix CostDocument5 pagesFix CostIrdian Devi SaputriNo ratings yet

- Business Report ANDocument39 pagesBusiness Report ANKrishnaveni RajNo ratings yet

- Bisection: Literasi Ke x1 x2 x3 F (x1) F (x2)Document9 pagesBisection: Literasi Ke x1 x2 x3 F (x1) F (x2)Arafa ZahiraNo ratings yet

- Nilesh Coaching Class, LOGARITHM AND CALCULATION, NagpurDocument14 pagesNilesh Coaching Class, LOGARITHM AND CALCULATION, Nagpurzhenith gaurNo ratings yet

- Thick Cylinder Lab ReportDocument12 pagesThick Cylinder Lab ReportTshepo Moloto100% (2)

- Decision ScienceDocument8 pagesDecision ScienceHimanshi YadavNo ratings yet

- Assn1 Solution Sept2022Document7 pagesAssn1 Solution Sept2022Yuqin LuNo ratings yet

- 96th AIBB TMFI SolvedDocument26 pages96th AIBB TMFI SolvedShamima AkterNo ratings yet

- COM 96th AIBB Solved-FBDocument29 pagesCOM 96th AIBB Solved-FBShamima AkterNo ratings yet

- 96th AIBB RMFI Solved-2-1Document20 pages96th AIBB RMFI Solved-2-1Shamima Akter100% (1)

- TFFE Math 5Document1 pageTFFE Math 5Shamima AkterNo ratings yet

- Com 5 CDocument2 pagesCom 5 CShamima AkterNo ratings yet

- COM 6 (B) of 96th AIBBDocument2 pagesCOM 6 (B) of 96th AIBBShamima AkterNo ratings yet

- TFFE Math 2Document9 pagesTFFE Math 2Shamima AkterNo ratings yet

- COM 4 (C)Document1 pageCOM 4 (C)Shamima AkterNo ratings yet