Professional Documents

Culture Documents

IFRIC 1 - Class Notes

Uploaded by

Ummar Farooq0 ratings0% found this document useful (0 votes)

30 views1 pageThis document provides guidance on accounting for changes in estimates of decommissioning, restoration, and similar liabilities. It states that such changes should be accounted for by taking the present value of the new estimate and subtracting the present value of the old estimate. If the related asset is measured using the cost model, any increase in the liability is added to the asset cost, while any decrease offsets the asset carrying amount. If the asset uses the revaluation model, changes are treated as revaluation increases or decreases, potentially impacting profit or loss. The document also notes that changes in estimates may trigger revaluation of the related asset.

Original Description:

Original Title

IFRIC 1 - Class notes

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides guidance on accounting for changes in estimates of decommissioning, restoration, and similar liabilities. It states that such changes should be accounted for by taking the present value of the new estimate and subtracting the present value of the old estimate. If the related asset is measured using the cost model, any increase in the liability is added to the asset cost, while any decrease offsets the asset carrying amount. If the asset uses the revaluation model, changes are treated as revaluation increases or decreases, potentially impacting profit or loss. The document also notes that changes in estimates may trigger revaluation of the related asset.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views1 pageIFRIC 1 - Class Notes

Uploaded by

Ummar FarooqThis document provides guidance on accounting for changes in estimates of decommissioning, restoration, and similar liabilities. It states that such changes should be accounted for by taking the present value of the new estimate and subtracting the present value of the old estimate. If the related asset is measured using the cost model, any increase in the liability is added to the asset cost, while any decrease offsets the asset carrying amount. If the asset uses the revaluation model, changes are treated as revaluation increases or decreases, potentially impacting profit or loss. The document also notes that changes in estimates may trigger revaluation of the related asset.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

IFRIC 1 – Class notes

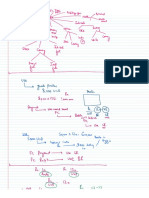

Changes in the measurement of an existing decommissioning, restoration and similar liability that results

from changes in estimates shall be accounted for as follows:

At the date of estimate change:

Change in the amount of obligation = PV of obligation (using new estimates) – PV of obligation (using old

estimates)

If the related asset is measured using the cost model

Increase in obligation Decrease in obligation

Change in obligation is Added to the cost of Change in obligation is Deducted from the

asset. cost of asset.

Dr. Asset Dr. Provision for dismantling

Cr. Provision for dismantling Cr. Asset

The entity shall consider whether there is a The amount of change shall not exceed its

need for impairment testing as per IAS 36. carrying amount. If the amount of change is

higher than carrying amount, then the excess

shall be recognized immediately in P&L.

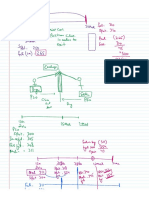

If the related asset is measured using the revaluation model

Increase in obligation Decrease in obligation

Change in obligation is treated as revaluation Change in obligation is treated as revaluation

decrease increase.

Dr. Revaluation surplus Dr. Provision for dismantling

Dr. P&L Cr. P&L (reversal of previous loss)

Cr. Provision for dismantling Cr. Revaluation surplus

If the amount of change is higher than carrying

amount that would have been determined as

per cost model, then the excess shall be

recognized immediately in P&L.

- A change in obligation is an indication that asset may have to be revalued. If so, then revaluation

and estimate change are handled in compound entry.

- If revalued amount (i.e. fair value) is provided by valuer as net of dismantling cost, then for

revaluation accounting, revalued amount will be the sum of (i) net value determined by valuer and

(ii) present value of new dismantling obligation amount.

Nasir Abbas FCA Page 1 | 1

You might also like

- 24 Fischer10e SM Ch21 FinalDocument29 pages24 Fischer10e SM Ch21 Finalvivi anggiNo ratings yet

- Dokumen - Tips - Labor Law Review Atty V Duano PDFDocument75 pagesDokumen - Tips - Labor Law Review Atty V Duano PDFGlenz LagunaNo ratings yet

- Pas 36 - Impairment of AssetsDocument20 pagesPas 36 - Impairment of AssetsMa. Franceska Loiz T. RiveraNo ratings yet

- Historical Background of Indian Constitution NotesDocument9 pagesHistorical Background of Indian Constitution NotesSri Krishna Bharadwaj GodavariNo ratings yet

- Tangible and Intangible Non Current Assets Lecture NotesDocument20 pagesTangible and Intangible Non Current Assets Lecture NotesDivya NandiniNo ratings yet

- Accountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsDocument5 pagesAccountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsRNo ratings yet

- First Division: Nicolas Robert Martin Egger, Complainant, vs. Atty. Francisco P. DURAN, RespondentDocument5 pagesFirst Division: Nicolas Robert Martin Egger, Complainant, vs. Atty. Francisco P. DURAN, RespondentJovy Norriete dela CruzNo ratings yet

- Mega Project Assurance: Volume One - The Terminological DictionaryFrom EverandMega Project Assurance: Volume One - The Terminological DictionaryNo ratings yet

- 7 - IAS 37 - Provisions, Contingent SVDocument32 pages7 - IAS 37 - Provisions, Contingent SVHồ Đan ThụcNo ratings yet

- Ias 37 Provisions Contingent Liabilities and Contingent Assets SummaryDocument5 pagesIas 37 Provisions Contingent Liabilities and Contingent Assets SummaryChristian Dela Pena67% (3)

- ASME 889.4.1 b-2001Document101 pagesASME 889.4.1 b-2001Alaeddine Abid100% (1)

- EPP 5 HE Module 2Document12 pagesEPP 5 HE Module 2ronald100% (1)

- AS 10 - Property Plant and Equipment: Recognition CriteriaDocument5 pagesAS 10 - Property Plant and Equipment: Recognition CriteriaAshutosh shriwasNo ratings yet

- FAR 006 Summary Notes - Property, Plant & EquipmentDocument9 pagesFAR 006 Summary Notes - Property, Plant & EquipmentMarynelle Labrador SevillaNo ratings yet

- U.S. GAAP vs. IFRS: Impairment of Long-Lived Assets: Prepared byDocument8 pagesU.S. GAAP vs. IFRS: Impairment of Long-Lived Assets: Prepared byChoi TeumeNo ratings yet

- Tudy Buddy: Ias 36 - Impairment of AssetsDocument2 pagesTudy Buddy: Ias 36 - Impairment of AssetsAbdullah Al Amin MubinNo ratings yet

- Impairment of Long-Lived Assets: Balance SheetDocument2 pagesImpairment of Long-Lived Assets: Balance SheetJuan MatiasNo ratings yet

- Topic 1 - MFRS116 - PpeDocument38 pagesTopic 1 - MFRS116 - PpeAmir DanialNo ratings yet

- Revaluation of Assets and LiabilitiesDocument6 pagesRevaluation of Assets and LiabilitiesTushar sahuNo ratings yet

- ICAIEKM Material 180116Document57 pagesICAIEKM Material 180116INTER SMARTIANSNo ratings yet

- Ifrs at A Glance: IAS 16 Property Plant and EquipmentDocument4 pagesIfrs at A Glance: IAS 16 Property Plant and EquipmentDimitris PapadopoulosNo ratings yet

- Ifric 1Document11 pagesIfric 1Hammad TariqNo ratings yet

- Assignment Financial Account Sem 1Document4 pagesAssignment Financial Account Sem 1alysanajla04No ratings yet

- IAS 36 ImpairmentDocument9 pagesIAS 36 ImpairmentDaniyal AhmedNo ratings yet

- Accounting Standard 28 Impairment 2Document15 pagesAccounting Standard 28 Impairment 2sosteniblebusinessNo ratings yet

- IFRS 02 (Self Notes - MI)Document4 pagesIFRS 02 (Self Notes - MI)Mujahid IqbalNo ratings yet

- Issues in Financial Accounting 15th Edition Henderson Solutions ManualDocument40 pagesIssues in Financial Accounting 15th Edition Henderson Solutions Manualurimp.ricedi1933100% (18)

- Presentation of Financial StatementDocument14 pagesPresentation of Financial StatementSrabon BaruaNo ratings yet

- Notes Payable With Debt RestructuringDocument3 pagesNotes Payable With Debt RestructuringZehra LeeNo ratings yet

- Subsequent Measurement of Property, Plant and Equipment: Cost ModelDocument6 pagesSubsequent Measurement of Property, Plant and Equipment: Cost ModelLorraine Dela CruzNo ratings yet

- Ias 37Document44 pagesIas 37James MutarauswaNo ratings yet

- Group Five DisposalDocument10 pagesGroup Five Disposalelvis page kamunanwireNo ratings yet

- Tangible NCA V7Document18 pagesTangible NCA V7David JosephNo ratings yet

- Aud Application 2 - Handout 6 Revaluation (UST)Document5 pagesAud Application 2 - Handout 6 Revaluation (UST)RNo ratings yet

- Ifrs at A Glance: IAS 16 Property Plant and EquipmentDocument4 pagesIfrs at A Glance: IAS 16 Property Plant and EquipmentRjan LGNo ratings yet

- Property Plant and EquipmentDocument14 pagesProperty Plant and EquipmentsathyaeziNo ratings yet

- Ifric-1 Changes in Existing Decommissioning, Restoration (Prior Knowledge)Document16 pagesIfric-1 Changes in Existing Decommissioning, Restoration (Prior Knowledge)Aounaiza AhmedNo ratings yet

- Notes For L2Document9 pagesNotes For L2yuyin.gohyyNo ratings yet

- CFAS - Lec. 6 PAS 12, 16Document29 pagesCFAS - Lec. 6 PAS 12, 16latte aeriNo ratings yet

- SBR宝典Document22 pagesSBR宝典Ziping ZhaoNo ratings yet

- Ifrs 2021 - IfricsDocument136 pagesIfrs 2021 - IfricsAamir IkramNo ratings yet

- Ifrs Debt Modifications Ifrs 9Document8 pagesIfrs Debt Modifications Ifrs 9Paul DoroinNo ratings yet

- Changes in Existing Decommissioning, Restoration and Similar LiabilitiesDocument8 pagesChanges in Existing Decommissioning, Restoration and Similar LiabilitiesJames BarzoNo ratings yet

- IAS 37 - SummaryDocument5 pagesIAS 37 - Summarysitoulamanish100No ratings yet

- Changes in Existing Decommissioning, Restoration and Similar LiabilitiesDocument3 pagesChanges in Existing Decommissioning, Restoration and Similar LiabilitiesTess De LeonNo ratings yet

- 3204ifric 01Document4 pages3204ifric 01Progga MehnazNo ratings yet

- Fixed AssetDocument20 pagesFixed AssetMohamed Ahmed RammadanNo ratings yet

- Research & Case AnalysisDocument1 pageResearch & Case AnalysisMichael LeibaNo ratings yet

- AP03-04-Audit of PPE-as Annotated by Sir Allan (Theories) - EncryptedDocument5 pagesAP03-04-Audit of PPE-as Annotated by Sir Allan (Theories) - Encryptedkisheal kimNo ratings yet

- Property Plant and Equipment - RevaluationDocument4 pagesProperty Plant and Equipment - RevaluationpolxrixNo ratings yet

- Fixed Assets IAS 16Document25 pagesFixed Assets IAS 16zulfi100% (2)

- #22 Revaluation & Impairment (Notes For 6206)Document5 pages#22 Revaluation & Impairment (Notes For 6206)Claudine DuhapaNo ratings yet

- Impairment Testing of Assets - March 2019Document6 pagesImpairment Testing of Assets - March 2019Anand ShahNo ratings yet

- Provision Contingent LiabilityDocument12 pagesProvision Contingent LiabilityGinamae CayangcangNo ratings yet

- Tetelsor ContabilitateDocument5 pagesTetelsor ContabilitateMarcela Adriana StefNo ratings yet

- Subsequent Measurement of AssetsDocument4 pagesSubsequent Measurement of AssetsTKTGNo ratings yet

- Financial Accounting IIDocument27 pagesFinancial Accounting IIsalman siddiquiNo ratings yet

- Nas 16Document33 pagesNas 16bhattag283No ratings yet

- Pas 37 Provisions Contingent Liab Contingent AssetsDocument15 pagesPas 37 Provisions Contingent Liab Contingent Assetswendy alcosebaNo ratings yet

- PAS 37 Provision Contingent Liability and AssetDocument25 pagesPAS 37 Provision Contingent Liability and AssetCurly Spaghetti 88No ratings yet

- Assets PrintingDocument7 pagesAssets PrintingIrtiza AbbasNo ratings yet

- Major Differences in Revised Accounting Standards 10, 11Document4 pagesMajor Differences in Revised Accounting Standards 10, 11Neha GuptaNo ratings yet

- Executive's Guide to Fair Value: Profiting from the New Valuation RulesFrom EverandExecutive's Guide to Fair Value: Profiting from the New Valuation RulesNo ratings yet

- IFRS Short Requiremnts Diagram PDFDocument62 pagesIFRS Short Requiremnts Diagram PDFTamirat Eshetu WoldeNo ratings yet

- IAASB Public Interest Table Exposure Draft ISA 204 Mapping Key ChangesDocument28 pagesIAASB Public Interest Table Exposure Draft ISA 204 Mapping Key ChangesUmmar FarooqNo ratings yet

- Global Protocol Community Scale GHG Inventories GuidanceDocument136 pagesGlobal Protocol Community Scale GHG Inventories GuidanceUmmar FarooqNo ratings yet

- ICAP Comments Proposed ISSA 5000 Sustainability Assurance (Final)Document10 pagesICAP Comments Proposed ISSA 5000 Sustainability Assurance (Final)Ummar FarooqNo ratings yet

- IAS 36 CA Final Solution Class WorkDocument14 pagesIAS 36 CA Final Solution Class WorkUmmar FarooqNo ratings yet

- Eps Ias 33 2019-1Document26 pagesEps Ias 33 2019-1Ummar FarooqNo ratings yet

- 18 Sept Forex ForwardDocument6 pages18 Sept Forex ForwardUmmar FarooqNo ratings yet

- 19 September MPV and FOH VariancesDocument3 pages19 September MPV and FOH VariancesUmmar FarooqNo ratings yet

- 20 Sept Futures Stock FutureDocument9 pages20 Sept Futures Stock FutureUmmar FarooqNo ratings yet

- 19 Sept 2020 Money Market HedgeDocument5 pages19 Sept 2020 Money Market HedgeUmmar FarooqNo ratings yet

- 18 Sept Standard CostingDocument3 pages18 Sept Standard CostingUmmar FarooqNo ratings yet

- Hindi Essay On Mother TeresaDocument8 pagesHindi Essay On Mother Teresaezksennx100% (2)

- Acctg16a Midterm ExamDocument6 pagesAcctg16a Midterm ExamRannah Raymundo100% (1)

- Official Ielts Reading TestDocument15 pagesOfficial Ielts Reading Testaereo CNo ratings yet

- 01 Corpo 1A 2022Document60 pages01 Corpo 1A 2022Jamil Jammy AngNo ratings yet

- Campos DigestDocument2 pagesCampos DigestDeannara JillNo ratings yet

- Government of Punjab Department of Technical Education and Industrial Training (Technical Education Branch-Ii) NotificationDocument2 pagesGovernment of Punjab Department of Technical Education and Industrial Training (Technical Education Branch-Ii) Notificationharpal_abhNo ratings yet

- Part 1 Sale of GoodsDocument24 pagesPart 1 Sale of GoodsChen HongNo ratings yet

- Nupur Chowdhury (Auth.) - European Regulation of Medical Devices and Pharmaceuticals - Regulatee Expectations of Legal Certainty-Springer International Publishing (2014)Document190 pagesNupur Chowdhury (Auth.) - European Regulation of Medical Devices and Pharmaceuticals - Regulatee Expectations of Legal Certainty-Springer International Publishing (2014)Anil SharmaNo ratings yet

- 1.longa Vs Longa, G.R. No. 203923, October 08, 2018Document28 pages1.longa Vs Longa, G.R. No. 203923, October 08, 2018Maryland AlajasNo ratings yet

- Balemo Comments To FoeDocument2 pagesBalemo Comments To FoeGervin ArquizalNo ratings yet

- Internal and External Aid To InterpretationDocument4 pagesInternal and External Aid To InterpretationMuhammad fahadNo ratings yet

- Police Operations Theory and Practice 6th Edition Hess Test BankDocument25 pagesPolice Operations Theory and Practice 6th Edition Hess Test BankBrianWillisdbrx100% (46)

- 194 - Tamayo V CalejoDocument1 page194 - Tamayo V CalejojrvyeeNo ratings yet

- Loc Psda Mathangi and Vedanshi Puri 1-lDocument4 pagesLoc Psda Mathangi and Vedanshi Puri 1-lmathangiNo ratings yet

- Perwira Affin Bank BHD (Formerly Known As Perwira Habib Bank Malaysia BHD) V Selangor Properties SDN BHD & OrsDocument11 pagesPerwira Affin Bank BHD (Formerly Known As Perwira Habib Bank Malaysia BHD) V Selangor Properties SDN BHD & OrsCold DurianNo ratings yet

- Kieso18e - ch01 - Testbank Test Bank For Intermediate Accounting 18E Donald E. Kieso ISBN 9781119778899Document40 pagesKieso18e - ch01 - Testbank Test Bank For Intermediate Accounting 18E Donald E. Kieso ISBN 9781119778899fullgradestore2023No ratings yet

- Nicaragua Canal Law 800Document6 pagesNicaragua Canal Law 800NicaraguaTourismNo ratings yet

- Gelito v. Heirs of Tirol, G.R. No. 196367, February 5, 2020Document3 pagesGelito v. Heirs of Tirol, G.R. No. 196367, February 5, 2020Robert EspinaNo ratings yet

- Tyquane Williams CiDocument13 pagesTyquane Williams CiAnonymous PbHV4HNo ratings yet

- Prohibition Against Torture 2Document15 pagesProhibition Against Torture 2elementrixbotswanaNo ratings yet

- 390F L Excavator ADJUSTER BUCKETDocument2 pages390F L Excavator ADJUSTER BUCKETisaac989No ratings yet

- Written DigestsDocument3 pagesWritten DigestsMaria Angelica LucesNo ratings yet

- SECTION 01 10 00 Summary of The Work GeneralDocument4 pagesSECTION 01 10 00 Summary of The Work GeneralJeremy ProffittNo ratings yet

- Inz 1202Document20 pagesInz 1202nad.liveNo ratings yet

- The Impact of Vavilov - Reasonableness and VulnerabilityDocument14 pagesThe Impact of Vavilov - Reasonableness and VulnerabilityMayank AryaNo ratings yet