Professional Documents

Culture Documents

10-04-2023 (Updates)

Uploaded by

For Purpose0 ratings0% found this document useful (0 votes)

8 views3 pagesThe document summarizes the sale of land for $350,000, with $100,000 received in cash and $250,000 received via a 5-year, 12% interest note. It provides the journal entries to record the initial sale on Jan 1, 2023 and updates to accrued interest and interest income through 2025. It also calculates the present value of the $250,000 note using annual discount rates of 12% to determine the proper amount of unearned interest income to initially record.

Original Description:

Original Title

10-04-2023 (UPDATES)

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes the sale of land for $350,000, with $100,000 received in cash and $250,000 received via a 5-year, 12% interest note. It provides the journal entries to record the initial sale on Jan 1, 2023 and updates to accrued interest and interest income through 2025. It also calculates the present value of the $250,000 note using annual discount rates of 12% to determine the proper amount of unearned interest income to initially record.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views3 pages10-04-2023 (Updates)

Uploaded by

For PurposeThe document summarizes the sale of land for $350,000, with $100,000 received in cash and $250,000 received via a 5-year, 12% interest note. It provides the journal entries to record the initial sale on Jan 1, 2023 and updates to accrued interest and interest income through 2025. It also calculates the present value of the $250,000 note using annual discount rates of 12% to determine the proper amount of unearned interest income to initially record.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

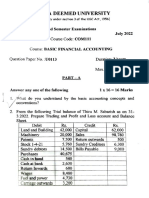

Jan 1 2023

land cost 200,000

fv 300000

sales retail 350,000

cash 100,000

note 250,000

terms: 5 years

% = 12% annually

entries

jan 1 2023 cash 100,000

notes recei 250,000

land 200,000

gain 150,000

dec. 31 2023

accrued int 30,000

interest i 30,000

2024 balance of AiR in 2024 = 60,000

AIR 30,000

Interest I 30,000 balance of Interest Income in 2025 = 27,500 ( beacause na zero out na s

nov 31 2025

cash 337,500 250k + 60K + 27,500

notes Rece 250,000 250,000 x 11% (kase each month is 1%)

AIR 60,000

Interest I 27,500

Non interest bearing

repayment 1.12//presPresent value market prevailing rate

2023 50,000 0.8929, 44645 12%

2024 50,000 0.7972, 39860

2025 100,000 0.7118, 71180 pag walang given schedule of payment directly yung 250k multply sa 0.5

2026 30,000 0.6355 19065

2027 20,000 0.5674, 11348

250,000 186098 total present value of note

ginagawa lang kapag iba iba ang payment

present value of an ordinary annuity

1.10 // tatlong =, -1, /0.1

JOURNAL ENTRY (noninterest bearing)

cash 100,000 balance of unearned interest income

notes rece 250,000 5,355

land 200,000 10,140

unearned i 63,902 250k - 186, 098 28,820

gain on sal 86,098 -63,902

19,587

2023

unearned i5, 355 (50k - 44, 645)

interest i 5,355

( beacause na zero out na sya by the year 2025)

tly yung 250k multply sa 0.5674

You might also like

- Interest Bearing Note Problems Day 2 NotesDocument5 pagesInterest Bearing Note Problems Day 2 NotesPATRICIA ALVAREZNo ratings yet

- IA 1 - Chapter 6 Notes Receivable Problems Part 1Document6 pagesIA 1 - Chapter 6 Notes Receivable Problems Part 1John CentinoNo ratings yet

- Intacc2A Assignment 2.13.1keyDocument10 pagesIntacc2A Assignment 2.13.1keyRosette SANTOSNo ratings yet

- Ae 211 Problem 1-4 SolutionDocument3 pagesAe 211 Problem 1-4 SolutionNhel AlvaroNo ratings yet

- 02 FAR02-answersDocument18 pages02 FAR02-answersBea GarciaNo ratings yet

- Ass.2 Ans On CalculationDocument5 pagesAss.2 Ans On CalculationRiza FabreNo ratings yet

- Internal Test - 2 - FSA - QuestionDocument3 pagesInternal Test - 2 - FSA - Questionsalil naik100% (1)

- Assignment 1Document7 pagesAssignment 1REJAY89No ratings yet

- 21 05 2023Document4 pages21 05 2023Aimen ImranNo ratings yet

- Chapter 20 CompilationDocument41 pagesChapter 20 CompilationMaria Licuanan0% (1)

- Npo BTSDocument6 pagesNpo BTSdipakpunjabi18No ratings yet

- FAA Tutorial 1Document1 pageFAA Tutorial 1kyals414No ratings yet

- Jawaban Lat Debt & Equity InvestmentDocument10 pagesJawaban Lat Debt & Equity InvestmentYOPIE CHANDRANo ratings yet

- T8 - Exam Revision 2 - SDocument4 pagesT8 - Exam Revision 2 - Skst-26024No ratings yet

- Essay TestDocument8 pagesEssay TestBich NgocNo ratings yet

- FAR Handout Depreciation Part 2Document7 pagesFAR Handout Depreciation Part 2Chesca Marie Arenal Peñaranda100% (1)

- Note Receivable Problem 6 1 To 6 5Document11 pagesNote Receivable Problem 6 1 To 6 5Jewel Mercano PabalinasNo ratings yet

- Ia PPT 6Document20 pagesIa PPT 6lorriejaneNo ratings yet

- Father Saturnino Urios University Accountancy Program San Francisco St. Butuan CityDocument9 pagesFather Saturnino Urios University Accountancy Program San Francisco St. Butuan CityHanna Niña MabrasNo ratings yet

- Chapter 4 SpreadsheetDocument5 pagesChapter 4 SpreadsheetChâu Trần Dương MinhNo ratings yet

- Es - Group 8Document4 pagesEs - Group 8Papa NketsiahNo ratings yet

- September 18Document16 pagesSeptember 18Danica JaneNo ratings yet

- Assignment 1Document6 pagesAssignment 1Nichole TumulakNo ratings yet

- AnswerDocument23 pagesAnswerYousaf BhuttaNo ratings yet

- Lapkeu GTGDocument3 pagesLapkeu GTGIndira GabriellaNo ratings yet

- False 2. False 3. False 4. False 5. True 6. True 7. False 8. TrueDocument4 pagesFalse 2. False 3. False 4. False 5. True 6. True 7. False 8. TrueRegina Mae CatamponganNo ratings yet

- Tugas AkuntansiDocument12 pagesTugas AkuntansiLia RahmawatiNo ratings yet

- 4.3 Solution To Income From Salary - Class Work & Home Assignment QuestionsDocument39 pages4.3 Solution To Income From Salary - Class Work & Home Assignment QuestionsKASHISH GUPTANo ratings yet

- IntAcc GroupingsDocument4 pagesIntAcc GroupingsNikka BigtasNo ratings yet

- Problems On DepreciationDocument7 pagesProblems On DepreciationHarsha HarshaNo ratings yet

- Corporate Finance Assignment 1Document23 pagesCorporate Finance Assignment 1fiza akhterNo ratings yet

- EA6Document54 pagesEA6Chris TVNo ratings yet

- Module 6 Notes ReceivableDocument5 pagesModule 6 Notes ReceivableAbegail RafolsNo ratings yet

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Document5 pagesLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainNo ratings yet

- MIS207 FinanceDocument9 pagesMIS207 FinanceRafid ChyNo ratings yet

- Problems On Individual Taxation AY 2020-21 StudentsDocument9 pagesProblems On Individual Taxation AY 2020-21 StudentsAminul Islam RubelNo ratings yet

- AE 16 Solutions To Chapter 5 2 1Document10 pagesAE 16 Solutions To Chapter 5 2 1Miles CastilloNo ratings yet

- Sem 2 - End Sem PapersDocument23 pagesSem 2 - End Sem Paperslalith sasankaNo ratings yet

- Special Trans Activity 2Document15 pagesSpecial Trans Activity 2Rachelle JoseNo ratings yet

- Problem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueDocument11 pagesProblem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueJane Carla GarbidaNo ratings yet

- Lobrigas Unit3 Topic1 AssessmentDocument9 pagesLobrigas Unit3 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Horizonatal & Vertical Analysis and RatiosDocument6 pagesHorizonatal & Vertical Analysis and RatiosNicole AlexandraNo ratings yet

- Internal Test - 2 - FSA - QuestionDocument3 pagesInternal Test - 2 - FSA - QuestionSandeep Choudhary40% (5)

- Cash BudgetDocument1 pageCash BudgetatenNo ratings yet

- MIS207 FinanceDocument7 pagesMIS207 FinanceRafid ChyNo ratings yet

- Note Receivable Part 2Document7 pagesNote Receivable Part 2Carlo VillanNo ratings yet

- Note Receivable Part 2Document7 pagesNote Receivable Part 2Carlo VillanNo ratings yet

- Group 2 Cash Budget N4ba2503Document3 pagesGroup 2 Cash Budget N4ba2503nuraz3169No ratings yet

- Estate ExercisesDocument12 pagesEstate ExercisesAmira SyahiraNo ratings yet

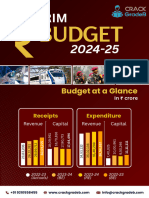

- Budget 2024-25 HighlightsDocument63 pagesBudget 2024-25 Highlightsvaishu8101996No ratings yet

- Probs 22Document3 pagesProbs 22kyle GNo ratings yet

- FinanceDocument4 pagesFinancethantoolwin2002No ratings yet

- Assignment - Current Liabilities - Notes PayableDocument24 pagesAssignment - Current Liabilities - Notes PayableBEA CATANEONo ratings yet

- Babar LifafaDocument4 pagesBabar LifafaRaheel HafeezNo ratings yet

- Case No. 1: Gain (Loss) On Sale of Investment (136,262.50)Document10 pagesCase No. 1: Gain (Loss) On Sale of Investment (136,262.50)Melanie SamsonaNo ratings yet

- Chapter6 BuenaventuraDocument11 pagesChapter6 BuenaventuraAnonnNo ratings yet

- Cash Flow QuestionsDocument6 pagesCash Flow QuestionsBhakti GhodkeNo ratings yet

- Jawaban Exercise Cash BudgetingDocument2 pagesJawaban Exercise Cash BudgetingThania ParameswariNo ratings yet

- Tutor Statement Cash FlowDocument3 pagesTutor Statement Cash Flowlavie nroseNo ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet