Professional Documents

Culture Documents

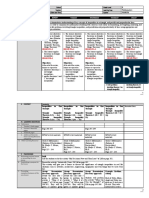

Class Course Code Course

Uploaded by

shraddha shukla0 ratings0% found this document useful (0 votes)

11 views7 pagesThe document contains details of courses offered for different classes (FYBAF, SYBAF, TYBAF) including course codes, course names, compulsory or optional status, credits, and assessment details. It lists 27 courses for FYBAF (first year Bachelors in Financial Accounting), 15 courses for SYBAF (second year), and 11 courses for TYBAF (third year). Each course is assigned credits and assessment is based on internal and semester end examinations, with minimum and maximum marks defined for each.

Original Description:

subject list

Original Title

BAF

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains details of courses offered for different classes (FYBAF, SYBAF, TYBAF) including course codes, course names, compulsory or optional status, credits, and assessment details. It lists 27 courses for FYBAF (first year Bachelors in Financial Accounting), 15 courses for SYBAF (second year), and 11 courses for TYBAF (third year). Each course is assigned credits and assessment is based on internal and semester end examinations, with minimum and maximum marks defined for each.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views7 pagesClass Course Code Course

Uploaded by

shraddha shuklaThe document contains details of courses offered for different classes (FYBAF, SYBAF, TYBAF) including course codes, course names, compulsory or optional status, credits, and assessment details. It lists 27 courses for FYBAF (first year Bachelors in Financial Accounting), 15 courses for SYBAF (second year), and 11 courses for TYBAF (third year). Each course is assigned credits and assessment is based on internal and semester end examinations, with minimum and maximum marks defined for each.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 7

Class Course Code Course

FYBAF UA_FFSI.1 FINANCIAL ACCOUNTING (ELEMENTS OF FINANCIAL ACCOUNTING) I

FYBAF UA_FFSI.1 FINANCIAL ACCOUNTING (ELEMENTS OF FINANCIAL ACCOUNTING) I

FYBAF UA_FFSI.2 COST ACCOUNTING (INTRODUCTION AND ELEMENT OF COST) I

FYBAF UA_FFSI.2 COST ACCOUNTING (INTRODUCTION AND ELEMENT OF COST) I

FYBAF UA_FFSI.3 FINANCIAL MANAGEMENT (INTRODUCTION TO FINANCIAL MANAGEMENT) I

FYBAF UA_FFSI.3 FINANCIAL MANAGEMENT (INTRODUCTION TO FINANCIAL MANAGEMENT) I

FYBAF UA_FFSI.4 BUSINESS COMMUNICATION-I

FYBAF UA_FFSI.4 BUSINESS COMMUNICATION-I

FYBAF UA_FFSI.5.1 FOUNDATION COURSE-I

FYBAF UA_FFSI.5.1 FOUNDATION COURSE-I

FYBAF UA_FFSI.6 COMMERCE ( BUSINESS ENVIRONMENT) I

FYBAF UA_FFSI.6 COMMERCE ( BUSINESS ENVIRONMENT) I

FYBAF UA_FFSI.7 BUSINESS ECONOMICS I

FYBAF UA_FFSI.7 BUSINESS ECONOMICS I

SYBAF UA_FFSIII.1 FINANCIAL ACCOUNTING( SPECIAL ACCOUNTING AREAS)III

SYBAF UA_FFSIII.1 FINANCIAL ACCOUNTING( SPECIAL ACCOUNTING AREAS)III

SYBAF UA_FFSIII.2 COST ACCOUNTING (INTRODUCTION AND ELEMENT OF COST) II

SYBAF UA_FFSIII.2 COST ACCOUNTING (INTRODUCTION AND ELEMENT OF COST) II

SYBAF UA_FFSIII.4 TAXATION II (DIRECT TAXES PAPER I)

SYBAF UA_FFSIII.4 TAXATION II (DIRECT TAXES PAPER I)

SYBAF UA_FFSIII.6 INFORMATION TECHNOLOGY IN ACCOUNTANCY I

SYBAF UA_FFSIII.6 INFORMATION TECHNOLOGY IN ACCOUNTANCY I

SYBAF UA_FFSIII.7.1 FOUNDATION COURSE IN COMMERCE ( FINANCIAL MARKET OPERATIONS)- III

SYBAF UA_FFSIII.7.1 FOUNDATION COURSE IN COMMERCE ( FINANCIAL MARKET OPERATIONS)- III

SYBAF UA_FFSIII.8 BUSINESS LAW (BUSINESS REGULATORY FRAMEWORK) II

SYBAF UA_FFSIII.8 BUSINESS LAW (BUSINESS REGULATORY FRAMEWORK) II

SYBAF UA_FFSIII.9 BUSINESS ECONOMICS II

SYBAF UA_FFSIII.9 BUSINESS ECONOMICS II

TYBAF 44801 FINANCIAL ACCOUNTING V

TYBAF 44801 FINANCIAL ACCOUNTING V

TYBAF 44802 FINANCIAL ACCOUNTING VI

TYBAF 44802 FINANCIAL ACCOUNTING VI

TYBAF 44803 COST ACCOUNTING III

TYBAF 44803 COST ACCOUNTING III

TYBAF 44804 FINANCIAL MANAGEMENT II

TYBAF 44804 FINANCIAL MANAGEMENT II

TYBAF 44806 TAXATION IV (INDIRECT TAXEX II)

TYBAF 44806 TAXATION IV (INDIRECT TAXEX II)

TYBAF 44807 INTERNATIONAL FINANCE

TYBAF 44807 INTERNATIONAL FINANCE

Head Compulsory Credit Count Of Batches Required Include On Reportcard Include On Exam

THEORY Y 1Y Y

THEORY Y 3 1Y Y

THEORY Y 1Y Y

THEORY Y 3 1Y Y

THEORY Y 1Y Y

THEORY Y 3 1Y Y

THEORY Y 1Y Y

THEORY Y 3 1Y Y

THEORY Y 1Y Y

THEORY Y 2 1Y Y

THEORY Y 1Y Y

THEORY Y 3 1Y Y

THEORY Y 1Y Y

THEORY Y 3 1Y Y

THEORY Y 1Y Y

THEORY Y 3 1Y Y

THEORY Y 1Y Y

THEORY Y 3 1Y Y

THEORY Y 1Y Y

THEORY Y 3 1Y Y

THEORY Y 1Y Y

THEORY Y 3 1Y Y

THEORY Y 1Y Y

THEORY Y 2 1Y Y

THEORY Y 1Y Y

THEORY Y 3 1Y Y

THEORY Y 1Y Y

THEORY Y 3 1Y Y

THEORY Y 1Y Y

THEORY Y 3 1Y Y

THEORY Y 1Y Y

THEORY Y 3 1Y Y

THEORY Y 1Y Y

THEORY Y 3 1Y Y

THEORY Y 1Y Y

THEORY Y 3 1Y Y

THEORY Y 1Y Y

THEORY Y 3 1Y Y

THEORY Y 1Y Y

THEORY Y 3 1Y Y

Assessment details Min marks Maximum marks

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

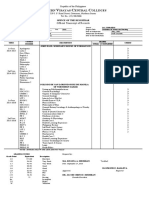

Class Course Code

FYBAF UA_FFSII.1

FYBAF UA_FFSII.1

FYBAF UA_FFSII.2

FYBAF UA_FFSII.2

FYBAF UA_FFSII.3

FYBAF UA_FFSII.3

FYBAF UA_FFSII.4

FYBAF UA_FFSII.4

FYBAF UA_FFSII.5.1

FYBAF UA_FFSII.5.1

FYBAF UA_FFSII.6

FYBAF UA_FFSII.6

FYBAF UA_FFSII.7

FYBAF UA_FFSII.7

SYBAF UA_FFSIV.1

SYBAF UA_FFSIV.1

SYBAF UA_FFSIV.2

SYBAF UA_FFSIV.2

SYBAF UA_FFSIV.4

SYBAF UA_FFSIV.4

SYBAF UA_FFSIV.6

SYBAF UA_FFSIV.6

SYBAF UA_FFSIV.7.1

SYBAF UA_FFSIV.7.1

SYBAF UA_FFSIV.8

SYBAF UA_FFSIV.8

SYBAF UA_FFSIV.9

SYBAF UA_FFSIV.9

TYBAF 85601

TYBAF 85601

TYBAF 85602

TYBAF 85602

TYBAF 85603

TYBAF 85603

TYBAF 85604

TYBAF 85604

TYBAF 85605

TYBAF 85605

TYBAF UA_FFSVI.8

TYBAF UA_FFSVI.8

Course Head

FINANCIAL ACCOUNTING( SPECIAL ACCOUNTING AREAS)II THEORY

FINANCIAL ACCOUNTING( SPECIAL ACCOUNTING AREAS)II THEORY

AUDITING (INTRODUCTION AND PLANNING) I THEORY

AUDITING (INTRODUCTION AND PLANNING) I THEORY

INNOVATIVE FINANCIAL SERVICES THEORY

INNOVATIVE FINANCIAL SERVICES THEORY

BUSINESS COMMUNICATION II THEORY

BUSINESS COMMUNICATION II THEORY

FOUNDATION COURSE II THEORY

FOUNDATION COURSE II THEORY

BUSINESS LAW (BUSINESS REGULATORY FRAMEWORK) I THEORY

BUSINESS LAW (BUSINESS REGULATORY FRAMEWORK) I THEORY

BUSINESS MATHEMATICS THEORY

BUSINESS MATHEMATICS THEORY

FINANCIAL ACCOUNTING( SPECIAL ACCOUNTING AREAS)IV THEORY

FINANCIAL ACCOUNTING( SPECIAL ACCOUNTING AREAS)IV THEORY

MANAGEMENT ACCOUNTING ( INTRODUCTION TO MANAGEMENT ACCOUNTING) THEORY

MANAGEMENT ACCOUNTING ( INTRODUCTION TO MANAGEMENT ACCOUNTING) THEORY

TAXATION III (DIRECT TAXES II) THEORY

TAXATION III (DIRECT TAXES II) THEORY

INFORMATION TECHNOLOGY IN ACCOUNTANCY II THEORY

INFORMATION TECHNOLOGY IN ACCOUNTANCY II THEORY

FOUNDATION COURSE IN MANAGEMENT (INTRODUCTION TO MANAGEMENT)-IV THEORY

FOUNDATION COURSE IN MANAGEMENT (INTRODUCTION TO MANAGEMENT)-IV THEORY

BUSINESS LAW (COMPANY LAW) III THEORY

BUSINESS LAW (COMPANY LAW) III THEORY

RESEARCH METHODOLOGY IN ACCOUNTING AND FINANCE THEORY

RESEARCH METHODOLOGY IN ACCOUNTING AND FINANCE THEORY

FINANCIAL ACCOUNTING VII THEORY

FINANCIAL ACCOUNTING VII THEORY

COST ACCOUNTING IV THEORY

COST ACCOUNTING IV THEORY

FINANCIAL MANAGEMENT III THEORY

FINANCIAL MANAGEMENT III THEORY

TAXATION V (INDIRECT TAXES III) THEORY

TAXATION V (INDIRECT TAXES III) THEORY

SECURITY ANALYSIS & PORTFOLIO MANAGEMENT THEORY

SECURITY ANALYSIS & PORTFOLIO MANAGEMENT THEORY

PROJECT WORK II THEORY

PROJECT WORK II THEORY

Compulsory Credit Count Of Batches Required Include On Reportcard Include On Exam

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 2 1Y Y

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 3 1Y Y

Y 1Y Y

Y 3 1Y Y

Assessment details Min marks Maximum marks

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

Semester End Examination 30 75

Internal Assessment 10 25

You might also like

- DLL Mathematics Grade8 Quarter4-IVa (Palawan Division)Document7 pagesDLL Mathematics Grade8 Quarter4-IVa (Palawan Division)Mark Kiven MartinezNo ratings yet

- Entrep Lesson 3Document5 pagesEntrep Lesson 3Claire CabactulanNo ratings yet

- Fields of PhilosophyDocument5 pagesFields of Philosophyroy_dubouzetNo ratings yet

- Math PBL SlidesDocument27 pagesMath PBL SlidesAiman IbhrahimNo ratings yet

- Pengantar Ekonomi - Case and Fair - CompressedDocument1,644 pagesPengantar Ekonomi - Case and Fair - CompressedYose At The KahyanganNo ratings yet

- Slide MGT101 Slide01Document32 pagesSlide MGT101 Slide01Putcha JagannadhamNo ratings yet

- The Scope and Method of Economics: © 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and FairDocument36 pagesThe Scope and Method of Economics: © 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and FairLukas PrawiraNo ratings yet

- Economics 101Document36 pagesEconomics 101Sai PrabhuNo ratings yet

- 9DS MA MSC PI S20a21Document3 pages9DS MA MSC PI S20a21Suleman RaufNo ratings yet

- Pertemuan 1 Pengantar EkonomiDocument36 pagesPertemuan 1 Pengantar Ekonomirusmi.tutiNo ratings yet

- Powerpoint Lectures For Principles of Macroeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterDocument36 pagesPowerpoint Lectures For Principles of Macroeconomics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterfamytyasNo ratings yet

- Thyroid HormonesDocument27 pagesThyroid Hormones2023ph17No ratings yet

- 04 Revised Macro Economics Theory and Policy 2022 24 31-01-2023Document3 pages04 Revised Macro Economics Theory and Policy 2022 24 31-01-2023Aakash AgrawalNo ratings yet

- The Scope and Method of Economics: © 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and FairDocument52 pagesThe Scope and Method of Economics: © 2007 Prentice Hall Business Publishing Principles of Economics 8e by Case and FairMohammad Ehsanul HoqueNo ratings yet

- The Thyroid Gland: Triiodothyronine (T) Tetraiodothyronine Thyroxine (T) Calcitonin TyrosineDocument1 pageThe Thyroid Gland: Triiodothyronine (T) Tetraiodothyronine Thyroxine (T) Calcitonin TyrosineLarasNo ratings yet

- Adobe Scan 02 Jun 2021.Document11 pagesAdobe Scan 02 Jun 2021.Pavana PNo ratings yet

- Powerpoint Lectures For Principles of Economics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterDocument36 pagesPowerpoint Lectures For Principles of Economics, 9E by Karl E. Case, Ray C. Fair & Sharon M. OsterKyleNo ratings yet

- Robert J. Sternberg: Professor of Human Development Cornell UniversityDocument3 pagesRobert J. Sternberg: Professor of Human Development Cornell UniversityEricka RicaldeNo ratings yet

- Principles of Microeconomics: Session 2Document34 pagesPrinciples of Microeconomics: Session 2Vamsi PeketiNo ratings yet

- PRS MicroCH01 9eDocument52 pagesPRS MicroCH01 9eYash PandeyNo ratings yet

- EET1 Task 1Document1 pageEET1 Task 1cynthia_kirchnerNo ratings yet

- Mathematics Grade 8 Fourth Week 1Document5 pagesMathematics Grade 8 Fourth Week 1Lorenzo Cohen100% (2)

- Materi 1Document14 pagesMateri 1Muhammad Rafah Rizki FadillahNo ratings yet

- Discussion Topics, Chapter 37, Thyroid and Parathyroid AgentsDocument1 pageDiscussion Topics, Chapter 37, Thyroid and Parathyroid AgentsGene LiongNo ratings yet

- Discussion Topics, Chapter 37, Thyroid and Parathyroid AgentsDocument1 pageDiscussion Topics, Chapter 37, Thyroid and Parathyroid AgentsGene LiongNo ratings yet

- Discussion Topics, Chapter 37, Thyroid and Parathyroid AgentsDocument1 pageDiscussion Topics, Chapter 37, Thyroid and Parathyroid AgentsGene LiongNo ratings yet

- Discussion Topics, Chapter 37, Thyroid and Parathyroid AgentsDocument1 pageDiscussion Topics, Chapter 37, Thyroid and Parathyroid AgentsGene LiongNo ratings yet

- Information Retrieval Solutions ManualDocument17 pagesInformation Retrieval Solutions ManualDovoza Mamba84% (57)

- Introduction To DebateDocument31 pagesIntroduction To DebateAlbert RoseteNo ratings yet

- Harris D., Bertolucci M. - Symmetry and Spectroscopy (1978, Dover) PDFDocument284 pagesHarris D., Bertolucci M. - Symmetry and Spectroscopy (1978, Dover) PDFKuNdAn DeOrE100% (1)

- Career Path Survey QuestionnaireDocument3 pagesCareer Path Survey QuestionnaireAbhishek KhandalNo ratings yet

- Pengantar Manajemen MotivationDocument7 pagesPengantar Manajemen MotivationDhita HafizhaNo ratings yet

- Engleza Manual KinetoDocument125 pagesEngleza Manual KinetoFlorin DinuNo ratings yet

- 05.11.02 Thyroid and ParathyroidDocument10 pages05.11.02 Thyroid and Parathyroidbo gum parkNo ratings yet

- This Study Resource Was: Exploring Euler's TheoremDocument9 pagesThis Study Resource Was: Exploring Euler's TheoremJesryl Remerata OrtegaNo ratings yet

- Epistemologi All Baru Sept 2019Document70 pagesEpistemologi All Baru Sept 2019WinardiNo ratings yet

- Book 1Document2 pagesBook 1Amaan KhatibNo ratings yet

- CH 01Document12 pagesCH 01hafiza fadilaNo ratings yet

- Instant Download Ebook PDF Economic Methodology 2nd by Marcel Boumans PDF ScribdDocument47 pagesInstant Download Ebook PDF Economic Methodology 2nd by Marcel Boumans PDF Scribdlyn.pound175100% (47)

- Motivation and RewardsDocument46 pagesMotivation and RewardsKriss Kringle JordanNo ratings yet

- IPE1617 Intro IDocument12 pagesIPE1617 Intro IAngelika May Santos Magtibay-VillapandoNo ratings yet

- Thyroid GlandDocument9 pagesThyroid GlandZach ReyesNo ratings yet

- 04 Logika (CB. Kusmaryanto)Document39 pages04 Logika (CB. Kusmaryanto)Zuzu FinusNo ratings yet

- Rebisyon Sa PananaliksikDocument2 pagesRebisyon Sa PananaliksikCabanlas staffNo ratings yet

- Asuncion, Dennis M. Copy 1Document4 pagesAsuncion, Dennis M. Copy 1Allan IgbuhayNo ratings yet

- (Treatise On Basic Philosophy 6) M. Bunge (Auth.) - Epistemology & Methodology II - Understanding The World-Springer Netherlands (1983) PDFDocument307 pages(Treatise On Basic Philosophy 6) M. Bunge (Auth.) - Epistemology & Methodology II - Understanding The World-Springer Netherlands (1983) PDFRoberto Inguanzo100% (2)

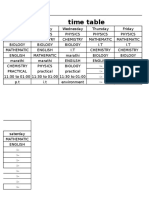

- TimetableDocument1 pageTimetableLoga GuruNo ratings yet

- Branches of PhilosophyDocument18 pagesBranches of PhilosophyDerelyn De VillaNo ratings yet

- SAPM TYBBI Internal Exam - Google FormsDocument6 pagesSAPM TYBBI Internal Exam - Google Formsshraddha shuklaNo ratings yet

- 2k23-S.Y.B.B.I-Cost Accountng (Sem.-IV) 1st PageDocument1 page2k23-S.Y.B.B.I-Cost Accountng (Sem.-IV) 1st Pageshraddha shuklaNo ratings yet

- Letter For Vehicle International ConferenceDocument1 pageLetter For Vehicle International Conferenceshraddha shuklaNo ratings yet

- Unit FourDocument9 pagesUnit Fourshraddha shuklaNo ratings yet

- Unit ThreeDocument7 pagesUnit Threeshraddha shuklaNo ratings yet

- M.comDocument7 pagesM.comshraddha shuklaNo ratings yet

- TimetableDocument1 pageTimetableshraddha shuklaNo ratings yet

- 2.A Study On The Impact of FDI in Life Insurance Sector in IndiaDocument88 pages2.A Study On The Impact of FDI in Life Insurance Sector in Indiashraddha shuklaNo ratings yet

- (Accounting & Finance ProposalDocument7 pages(Accounting & Finance Proposalshraddha shuklaNo ratings yet

- 5.analysis of Banking SectorDocument92 pages5.analysis of Banking Sectorshraddha shuklaNo ratings yet

- 4.amrin Ramzan Ali KHOJA M.com Accountancy Part 2 Roll No.49Document89 pages4.amrin Ramzan Ali KHOJA M.com Accountancy Part 2 Roll No.49shraddha shuklaNo ratings yet

- 3.advance Accountancy Project - 41 Word 6Document103 pages3.advance Accountancy Project - 41 Word 6shraddha shuklaNo ratings yet

- CH 16Document12 pagesCH 16Islani AbdessamadNo ratings yet

- Laying & Testing of Fire Detection Cable Methods StatementDocument23 pagesLaying & Testing of Fire Detection Cable Methods StatementJanaka Kavinda100% (1)

- Bbe Lo2Document25 pagesBbe Lo2Dhushmitha ManoharNo ratings yet

- Himanshu Rawat Industrial Cluster Plastic ProductsDocument10 pagesHimanshu Rawat Industrial Cluster Plastic ProductsHIMANSHU RAWATNo ratings yet

- Srisaila Devasthanam Ticket 7Document2 pagesSrisaila Devasthanam Ticket 7Kalyan KotraNo ratings yet

- 2018 Siswantoro Accounting For SukukDocument16 pages2018 Siswantoro Accounting For SukukyuwonliloNo ratings yet

- ABC Healthcare Corporation 2Document7 pagesABC Healthcare Corporation 2NAUGHTYNo ratings yet

- MHR 520 Note (Aiden)Document18 pagesMHR 520 Note (Aiden)hanhvy04No ratings yet

- TAX2 - ReportDocument6 pagesTAX2 - ReportJollibee Bida BidaNo ratings yet

- Russia Ukraine ConflictDocument3 pagesRussia Ukraine ConflictSimon DruryNo ratings yet

- Corporate Governance - Christine Mallin - Role of Institutional Investors in Corporate GovernanceDocument3 pagesCorporate Governance - Christine Mallin - Role of Institutional Investors in Corporate GovernanceUzzal Sarker - উজ্জ্বল সরকারNo ratings yet

- BMA4106 Investment and Asset Management Lecture 2Document21 pagesBMA4106 Investment and Asset Management Lecture 2Dickson OgendiNo ratings yet

- Case GalanzDocument7 pagesCase GalanzLeonard LiNo ratings yet

- Semi-Periphery Countries: Sociological TheoryDocument11 pagesSemi-Periphery Countries: Sociological TheoryLebogangNo ratings yet

- Graham Uldrich - Unit 5 ReviewDocument4 pagesGraham Uldrich - Unit 5 ReviewGraham UldrichNo ratings yet

- SK Z3 2022 BudgetDocument2 pagesSK Z3 2022 Budgetgenesis tolibasNo ratings yet

- TestDocument2 pagesTestralucaNo ratings yet

- Test Statistics 2022 Accounting CFABDocument21 pagesTest Statistics 2022 Accounting CFABShirah ShahrilNo ratings yet

- Pb23eco02 QPDocument7 pagesPb23eco02 QPAfiya NazimNo ratings yet

- Chapter 4 FinalDocument139 pagesChapter 4 FinaltomyidosaNo ratings yet

- SamplereportsDocument5 pagesSamplereportsMehul MittalNo ratings yet

- DCB Bank Annual Report 2019 20Document163 pagesDCB Bank Annual Report 2019 20Anitha PeyyalaNo ratings yet

- DeVry MATH 533 Final Exam 100% Correct AnswerDocument6 pagesDeVry MATH 533 Final Exam 100% Correct AnswerDeVryHelp100% (1)

- Financial Statement Analysis Discussion MaterialDocument3 pagesFinancial Statement Analysis Discussion MaterialMargin Pason RanjoNo ratings yet

- IFM 02 Exchange Rate SystemsDocument53 pagesIFM 02 Exchange Rate SystemsTanu GuptaNo ratings yet

- Metals - July 20 2018Document1 pageMetals - July 20 2018Tiso Blackstar GroupNo ratings yet

- GSIS TEMPLATE Fire Insurance Application Form (TRAD)Document3 pagesGSIS TEMPLATE Fire Insurance Application Form (TRAD)Ronan MaquidatoNo ratings yet

- Release Order Notification (Inward Processing) and Bonded TransportationDocument10 pagesRelease Order Notification (Inward Processing) and Bonded TransportationAung LattNo ratings yet

- Annual: Kathmandu Holdings LimitedDocument50 pagesAnnual: Kathmandu Holdings Limitedmartino chongasisNo ratings yet

- Ns 01 2013 PDFDocument136 pagesNs 01 2013 PDFchunochunoNo ratings yet