Professional Documents

Culture Documents

Standard Costing

Uploaded by

Aleah MarieOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standard Costing

Uploaded by

Aleah MarieCopyright:

Available Formats

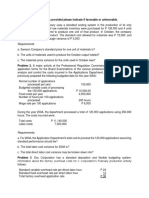

STANDARD COSTING

Gem Company uses a standard cost system. Information for raw materials for Product G for the

month of November is as follows:

Standard unit price P1.60

Actual purchase price per unit P1.55

Actual quantity purchased 2,000 units

Standard quantity allowed for actual production 1,800 units

What is the materials purchase variance?

P90 favorable P90 unfavorable

P100 favorable P100 unfavorable

Nice, Inc. uses a standard cost system. Overhead cost information for Product A for the month

of May is as follows:

Total actual overhead incurred P12,600

Fixed overhead budgeted P 3,300

Total standard overhead rate per direct labor P 4.00

Variable overhead rate per direct labor hour P 3.00

Standard hours allocated for actual production 3,500

What is the overall (or net) overhead variance?

P1,400 favorable P1,200 favorable

P1,200 unfavorable P1,400 unfavorable

Egay Corporation uses a standard cost system. Direct labor information for Product E for the

month of October is as follows:

Standard unit price P6.10 per hour

Actual rate paid P6.00 per hour

Standard quantity allowed for actual production 1,500 hours

Labor efficiency variance P600 favorable

What is the actual hours worked?

1,600 1,598

1,402 1,400

Edil company’s budgeted fixed factory overhead cost is P50,000 per month plus a variable

factory overhead rate of P4 per direct labor hour. The standard direct labor hours allowed for

October production was 18,000. An analysis of the factory overhead indicates that in October,

Edil had an unfavorable budget (controllable) variance of P1,000 and a favorable volume

variance of P500. Edil uses two-way analysis of overhead variance.

The actual factory overhead measured in October is:

P121,000 P122,000

P123,000 P122,300

The applied factory overhead in October is:

P122,500 P123,000

P122,000 P121,000

The data below relate to the month of April for Tim, Inc. which uses a standard cost system:

Actual direct labor cost P43,400

Actual hours used 14,000

Standard hours allowed for good output 15,000

Direct labor rate variance-debit 1,400

Actual total overhead 32,000

Budgeted fixed cost 9,000

Normal activity in hours 12,000

Total application rate per standard direct-labor hour 2.25

Tim uses a two-way analysis of overhead variance (controllable and volume)

What was Tim’s direct labor usage (efficiency) variance for April?

P3,000 favorable P3,200 unfavorable

P3,200 favorable P3,000 unfavorable

What was Tim’s budget (controllable) variance for April?

P2,250 unfavorable P500 favorable

P2,250 favorable P500 unfavorable

What was Tim’s volume variance for April?

P500 unfavorable P500 favorable

P2,250 unfavorable P2,250 favorable

Roy Corporation’s direct-labor costs for the month of March were as follows:

Standard direct-labor hours 42,000

Actual direct-labor hours 40,000

Direct-labor rate variance, favorable P8,400

Standard direct-labor rate per hour P6.50

What was Roy’s direct-labor payroll for the month of March?

P251,600 P244,000

P260,000 P243,000

Information on Aicel Company’s direct-material costs is as follows:

Actual units of direct material used 20,000

Actual direct-material costs 40,000

Standard price per unit of direct-materials P2.10

Direct material efficiency variance, favorable 3,000

What was Aicel’s direct-material price variance?

P1,000 favorable P2,000 unfavorable

P2,000 favorable P1,000 unfavorable

Which one of the following terms best describes the rate of output which qualified workers can

achieve as an average over the working day or shift, without overexertion, provided they adhere

to the specified method of working and are well motivated in their work?

Standard hours Standard performance

Standard time Standard unit

Standard costs are used for all the following except:

Controlling costs Forming a basis for price setting

Measuring efficiencies Income determination

The type of standard that is intended to represent challenging yet attainable result is:

*Controllable cost standard

*Normal standard

*Flexible budget standard

*Expected actual standard

*Theoretical standard

Which of the following is true concerning standard costs?

*Standard costs are estimates of costs attainable only under the most ideal conditions, but

rarely practicable

*If properly used, standards can help motivate employees

*Standard costs are difficult to use with a process-costing system

*Unfavorable variances, when material in amount, should be investigated, but large variance

need not be investigated

A manager prepared the following table by which to analyze labor costs for the month:

Actual hours at actual rate P10,000

Actual hours at standard rate P9,800

Standard hours at standard rate P8,820

Which variance was P980?

Labor rate variance Labor efficiency variance

Volume variance Labor spending variance

You might also like

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Standard Cost ActivityDocument1 pageStandard Cost ActivityIrahq Yarte TorrejosNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- ACT23 - 12 - Standard Costs and Variance AnalysisDocument4 pagesACT23 - 12 - Standard Costs and Variance AnalysisLim JugyeongNo ratings yet

- Finals Quiz 1 CostDocument6 pagesFinals Quiz 1 CostChloe Oberlin100% (1)

- Chapter 13 - Standard Costing - PROBLEMSDocument4 pagesChapter 13 - Standard Costing - PROBLEMSKristina De GuzmanNo ratings yet

- Standard CostingDocument7 pagesStandard CostingsarahbeeNo ratings yet

- Standard CostingDocument3 pagesStandard CostingElijah MontefalcoNo ratings yet

- MS 14 Variance AnalysisDocument3 pagesMS 14 Variance AnalysisDianneGarcia0% (1)

- Midterm ExaminationDocument20 pagesMidterm ExaminationEmmanuel VillafuerteNo ratings yet

- FAS1 - STD CostDocument9 pagesFAS1 - STD CostMica Moreen GuillermoNo ratings yet

- Factory overhead variance analysis & standard costing quizDocument3 pagesFactory overhead variance analysis & standard costing quizno oneNo ratings yet

- Standard Costing Problems 3 1Document2 pagesStandard Costing Problems 3 1Nikki Garcia0% (2)

- Name: Score: Prof. Mark Lester T. Balasa, Cpa, Mba Date:: Standard CostingDocument3 pagesName: Score: Prof. Mark Lester T. Balasa, Cpa, Mba Date:: Standard CostingCherrylane EdicaNo ratings yet

- Midterm Examination Review - Strategic Cost ManagementDocument67 pagesMidterm Examination Review - Strategic Cost ManagementEmmanuel VillafuerteNo ratings yet

- Standard CostingDocument3 pagesStandard CostingSergio, JesharelleNo ratings yet

- SCM - Pre-Test Questionnaire (Computational)Document7 pagesSCM - Pre-Test Questionnaire (Computational)Angel BrutasNo ratings yet

- AFAR Finals Dec 2017Document47 pagesAFAR Finals Dec 2017Dale Ponce0% (1)

- Cost Variance AnalysisDocument3 pagesCost Variance AnalysisJp CombisNo ratings yet

- 314 Chap 7&8Document9 pages314 Chap 7&8Jonah Marie TaghoyNo ratings yet

- Chapter 7 The Master Budget and Flexible BudgetingDocument14 pagesChapter 7 The Master Budget and Flexible BudgetingJuana LyricsNo ratings yet

- Computation and Cost Variances in Standard Costing SystemsDocument5 pagesComputation and Cost Variances in Standard Costing SystemsEricka Hazel Osorio0% (1)

- Problem Solving Standard Costing and Variance AnalysisDocument6 pagesProblem Solving Standard Costing and Variance AnalysisFranklin Galope100% (5)

- 314 Chap 8Document5 pages314 Chap 8Jonah Marie TaghoyNo ratings yet

- ACCTBA3 QuizzerDocument2 pagesACCTBA3 QuizzerTherese ChiuNo ratings yet

- Standard Costing - Materials and LaborDocument4 pagesStandard Costing - Materials and LaborTupe LeiNo ratings yet

- WDocument9 pagesWSamantha CabugonNo ratings yet

- Standard Costing and Variance AnalysisDocument5 pagesStandard Costing and Variance AnalysisMalesia AlmojuelaNo ratings yet

- Part 1 Problems (Difficulty Level: Easy 2 Points Each) Problem 1Document6 pagesPart 1 Problems (Difficulty Level: Easy 2 Points Each) Problem 1Roldan Hiano ManganipNo ratings yet

- Orca Share Media1539914027782Document4 pagesOrca Share Media1539914027782Gem Alcos NicdaoNo ratings yet

- COST ACCOUNTING QUIZ - LONGDocument5 pagesCOST ACCOUNTING QUIZ - LONGretchiel love calinogNo ratings yet

- DRAFTLevel 2Document37 pagesDRAFTLevel 2Mark Paul RamosNo ratings yet

- 3 - Discussion - Standard Costing and Variance AnalysisDocument1 page3 - Discussion - Standard Costing and Variance AnalysisCharles Tuazon0% (1)

- Backflush Costing1Document3 pagesBackflush Costing1Mitzi EstelleroNo ratings yet

- True or False Costing QuizDocument5 pagesTrue or False Costing Quizretchiel love calinogNo ratings yet

- Mas 3232Document3 pagesMas 3232Ana Morillo100% (1)

- (Mas) 04 - Standard Costing and Variance AnalysisDocument7 pages(Mas) 04 - Standard Costing and Variance AnalysisCykee Hanna Quizo Lumongsod0% (1)

- MASDocument7 pagesMASHelen IlaganNo ratings yet

- MasDocument13 pagesMasHiroshi Wakato50% (2)

- Cost Accounting Midterm ExamDocument37 pagesCost Accounting Midterm Examshynebright.phNo ratings yet

- MAS 1 Standard CostingDocument1 pageMAS 1 Standard CostingFídely Pierré100% (1)

- Standard CostingDocument6 pagesStandard CostingNurul FaizahNo ratings yet

- Service Cost AllocationDocument2 pagesService Cost AllocationdamdamNo ratings yet

- Quiz 2 - Cost AccountingDocument4 pagesQuiz 2 - Cost AccountingDong WestNo ratings yet

- CPV Highlow ABC Costing Key To CorrectionDocument3 pagesCPV Highlow ABC Costing Key To CorrectionlairadianaramosNo ratings yet

- 4 - Sample Problems - Standard Costing and Variance AnalysisDocument8 pages4 - Sample Problems - Standard Costing and Variance AnalysisJustin AciertoNo ratings yet

- Answer Key - Quiz - Chapter 12 - MC - All VariancesDocument3 pagesAnswer Key - Quiz - Chapter 12 - MC - All VariancesJeanelle Angeles60% (5)

- Standard Costing Material, Labor & Factory Overhead VariancesDocument3 pagesStandard Costing Material, Labor & Factory Overhead VariancesNikka Nicole ArupatNo ratings yet

- Standard Costing QuestionsDocument6 pagesStandard Costing QuestionsAlbert MuzitiNo ratings yet

- Cost Acctg. - HO#9Document5 pagesCost Acctg. - HO#9JOSE COTONER0% (1)

- Mock Board 2014Document11 pagesMock Board 2014Jade TanNo ratings yet

- Costing ProblemsDocument7 pagesCosting ProblemsJoanne Pauline OcheaNo ratings yet

- Activity 3 and 4Document5 pagesActivity 3 and 4Lovely Anne Dela CruzNo ratings yet

- Crc-Ace Review School, Inc.: Management Accounting Services (1-40)Document8 pagesCrc-Ace Review School, Inc.: Management Accounting Services (1-40)LuisitoNo ratings yet

- Variance AnalysisDocument4 pagesVariance AnalysisAlaine Milka GosycoNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingBella0% (1)

- University of Saint Louis Tuguegarao Integrated Managerial Accounting Prelims PretestDocument4 pagesUniversity of Saint Louis Tuguegarao Integrated Managerial Accounting Prelims PretestGraal GasparNo ratings yet

- Samson Co standard costing problemDocument5 pagesSamson Co standard costing problemRaine PiliinNo ratings yet

- University of Saint Louis School of Accountancy, Business and Hospitality Strategic Cost Management Finals Departmental Quiz 1 Short Term 2019Document3 pagesUniversity of Saint Louis School of Accountancy, Business and Hospitality Strategic Cost Management Finals Departmental Quiz 1 Short Term 2019Jed AbadNo ratings yet

- Financial Statements British English Student Ver2Document4 pagesFinancial Statements British English Student Ver2Paulo AbrantesNo ratings yet

- FSA Guide 20Document16 pagesFSA Guide 20David DangNo ratings yet

- The Air Rules 1982Document20 pagesThe Air Rules 1982visutsiNo ratings yet

- 30 Free Leed Ap BD+C Sample QuestionsDocument23 pages30 Free Leed Ap BD+C Sample QuestionsSubhranshu PandaNo ratings yet

- Nabanita Das - Senior Integration (Software AG Webmethods) Consultant 03242023Document12 pagesNabanita Das - Senior Integration (Software AG Webmethods) Consultant 03242023vipul tiwariNo ratings yet

- CHAPTER 1.1 Basic Concepts of ManagementsDocument15 pagesCHAPTER 1.1 Basic Concepts of ManagementsRay John DulapNo ratings yet

- CARGO Establishment ListDocument3 pagesCARGO Establishment ListRanjith PNo ratings yet

- Se/Omc/Nalgonda - Pay Unit Code: 5112: Pay Slip For The Month of August - 2020Document1 pageSe/Omc/Nalgonda - Pay Unit Code: 5112: Pay Slip For The Month of August - 2020babu xeroxNo ratings yet

- BioPharma Case StudyDocument4 pagesBioPharma Case StudyNaman Chhaya100% (3)

- Final Ruckus ProposalDocument29 pagesFinal Ruckus Proposalapi-609740598No ratings yet

- Becoming an Operations Consultant in 40 StepsDocument2 pagesBecoming an Operations Consultant in 40 StepsNicolae NistorNo ratings yet

- The Shadow Money Lenders - Significance of Fed's Zirp PolicyDocument8 pagesThe Shadow Money Lenders - Significance of Fed's Zirp Policyasksigma6No ratings yet

- Technical Appraisal: Unit 5Document16 pagesTechnical Appraisal: Unit 5DIPAKNo ratings yet

- Exponential Growth Decay Extra Practice W - AnswersDocument3 pagesExponential Growth Decay Extra Practice W - AnswersEdal SantosNo ratings yet

- CV Example (Dubal Avinash)Document3 pagesCV Example (Dubal Avinash)Rajkumar KhaseraoNo ratings yet

- Jurnal Penelitian Dosen Fikom (UNDA) Vol.10 No.2, November 2019, ISSNDocument8 pagesJurnal Penelitian Dosen Fikom (UNDA) Vol.10 No.2, November 2019, ISSNkiki rifkiNo ratings yet

- Tax Invoice DetailsDocument2 pagesTax Invoice Detailsquality fluconNo ratings yet

- Designing The Perfect Procurement Operating Model: OperationsDocument9 pagesDesigning The Perfect Procurement Operating Model: Operationspulsar77No ratings yet

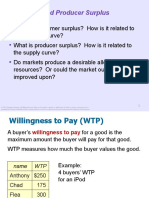

- CS, PS and EfficiencyDocument45 pagesCS, PS and EfficiencySubodh MohapatroNo ratings yet

- IBS Selection Process GuideDocument24 pagesIBS Selection Process GuideApna time aayegaNo ratings yet

- Masinde Muliro University of Science & Technology: School of Computing & InformaticsDocument2 pagesMasinde Muliro University of Science & Technology: School of Computing & InformaticsBrandon JaphetNo ratings yet

- Pre ProductionDocument2 pagesPre ProductionRajrupa SahaNo ratings yet

- Authority To Sell ExtensionDocument1 pageAuthority To Sell ExtensionPaul BaesNo ratings yet

- Notice: Combined Graduate Level Examination, 2020Document63 pagesNotice: Combined Graduate Level Examination, 2020Abhay Pratap SharmaNo ratings yet

- Cbse Cost Accounting NotesDocument154 pagesCbse Cost Accounting NotesMANDHAPALLY MANISHANo ratings yet

- Barangay transparency monitoring form titleDocument1 pageBarangay transparency monitoring form titleOmar Dizon100% (1)

- Chapter 2. Historical and Current ThinkingDocument5 pagesChapter 2. Historical and Current Thinkingnguyetanhtata0207k495No ratings yet

- Accounting Information System: Midterm ExamDocument35 pagesAccounting Information System: Midterm ExamHeidi OpadaNo ratings yet

- NIC Asia Bank Brand PositioningDocument29 pagesNIC Asia Bank Brand PositioningRaushan ChaudharyNo ratings yet

- Marketing Plan Guidelines:: Bus314 Marketing Management (Ncy)Document2 pagesMarketing Plan Guidelines:: Bus314 Marketing Management (Ncy)Murgi kun :3No ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Business Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsFrom EverandBusiness Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- NLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsFrom EverandNLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (4)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Emprender un Negocio: Paso a Paso Para PrincipiantesFrom EverandEmprender un Negocio: Paso a Paso Para PrincipiantesRating: 3 out of 5 stars3/5 (1)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyRating: 4 out of 5 stars4/5 (4)

- The CEO X factor: Secrets for Success from South Africa's Top Money MakersFrom EverandThe CEO X factor: Secrets for Success from South Africa's Top Money MakersNo ratings yet